Amkor Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amkor Technology Bundle

Amkor Technology operates in a dynamic semiconductor packaging and testing industry, where intense rivalry and the threat of substitutes significantly shape its competitive landscape. Understanding the nuances of buyer power and the influence of suppliers is crucial for navigating this market effectively.

The complete report reveals the real forces shaping Amkor Technology’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration in the semiconductor manufacturing equipment sector significantly impacts Amkor Technology. This market features a few dominant players, meaning OSAT providers like Amkor have limited alternatives for essential tools.

The top five front-end equipment vendors captured 74% of all IC equipment sales in the first half of 2024. This high degree of concentration grants these suppliers substantial bargaining power, allowing them to potentially dictate terms and pricing to their customers.

Suppliers of advanced packaging equipment and specialized materials possess significant bargaining power due to the unique and often proprietary nature of their technologies. These inputs are critical for Amkor Technology to deliver cutting-edge semiconductor assembly and testing services, particularly for high-demand sectors like AI and high-performance computing (HPC). For example, specialized equipment for 2.5D/3D packaging and hybrid bonding, essential for these advanced applications, is sourced from a very limited pool of vendors.

Switching suppliers for specialized equipment and materials in the OSAT (Outsourced Semiconductor Assembly and Test) industry, where Amkor Technology operates, presents significant hurdles. These include the intricate integration of new components, rigorous qualification processes that can take months, and the very real risk of production delays. These complexities translate into substantial costs and potential disruptions for companies like Amkor, effectively increasing the bargaining power of their existing suppliers.

Threat of Forward Integration

The threat of forward integration by suppliers, while theoretically possible, presents a low risk for Amkor Technology. For a supplier to integrate forward into OSAT services, it would require significant capital investment and specialized knowledge in semiconductor packaging and testing. For instance, a supplier of advanced leadframes or molding compounds would need to acquire complex manufacturing equipment, invest in cleanroom facilities, and build expertise in process control and quality assurance, mirroring the substantial investments already made by established OSAT players like Amkor.

The sheer scale and established infrastructure of current OSAT leaders create formidable barriers to entry for potential supplier integrators. Amkor, for example, operates numerous advanced manufacturing facilities globally, supported by a vast network of R&D and customer support. This existing competitive landscape, characterized by high operational efficiency and technological advancement, makes it economically unfeasible for most suppliers to effectively compete by moving into OSAT services.

Consider the capital intensity: building a new OSAT facility capable of competing with Amkor's offerings could easily cost hundreds of millions of dollars. In 2024, the average capital expenditure for a new advanced packaging line can range from $50 million to over $150 million, depending on the technology. Suppliers typically operate with much leaner capital structures, making such a leap impractical.

- Low Likelihood: Suppliers integrating forward into OSAT is uncommon due to the high capital and expertise requirements.

- High Barrier to Entry: The substantial investments already made by established OSAT players like Amkor create a significant hurdle.

- Capital Intensity: New OSAT facilities can cost hundreds of millions of dollars, a prohibitive investment for most suppliers.

- Expertise Gap: Suppliers would need to acquire specialized knowledge in semiconductor packaging and testing processes.

Importance of Supplier's Input to Amkor's Business

Amkor Technology's reliance on specialized equipment and high-quality materials from its suppliers is substantial, directly impacting its ability to serve critical, high-growth markets. The semiconductor assembly and test services Amkor provides are fundamentally dependent on these inputs. Without access to cutting-edge packaging equipment and premium materials, Amkor would be unable to meet the demanding specifications of sectors like artificial intelligence (AI) and the automotive industry, which require advanced and reliable components.

The bargaining power of suppliers is a critical consideration for Amkor. Key suppliers of advanced packaging equipment and specialized materials, particularly those with proprietary technology or limited competition, can exert significant influence. For instance, a sole provider of a crucial piece of assembly machinery or a unique chemical compound used in testing could command higher prices or dictate terms, impacting Amkor's cost structure and operational flexibility. This is especially relevant as Amkor aims to expand its offerings in rapidly evolving technological landscapes.

- Dependence on Specialized Equipment: Amkor's core operations require sophisticated machinery for wafer processing, assembly, and testing, sourced from a limited number of specialized manufacturers.

- Criticality of High-Quality Materials: The performance and reliability of semiconductors are directly tied to the quality of materials used, such as lead frames, substrates, and molding compounds, often supplied by a select group of providers.

- Impact of Supply Chain Disruptions: In 2024, the semiconductor industry continued to navigate supply chain complexities, where disruptions from key material or equipment suppliers could significantly impede Amkor's production capacity and ability to fulfill customer orders, particularly for high-demand AI chips.

Amkor Technology faces considerable bargaining power from its suppliers, particularly for specialized equipment and critical materials. This is driven by supplier concentration, the unique nature of their technologies, and the high costs associated with switching. For example, the top five front-end equipment vendors accounted for 74% of IC equipment sales in the first half of 2024, highlighting a concentrated market where Amkor has limited alternatives.

The necessity of advanced packaging equipment for high-growth sectors like AI and HPC further amplifies supplier leverage. These specialized inputs, often proprietary, are crucial for Amkor's competitive edge. Switching suppliers involves complex integration, lengthy qualification processes, and the risk of production delays, making Amkor's reliance on existing vendors significant.

| Key Supplier Characteristics | Impact on Amkor Technology | 2024 Data/Context |

| Supplier Concentration | Limited alternatives, increased pricing power for suppliers | Top 5 IC equipment vendors held 74% of H1 2024 sales |

| Technological Uniqueness | Critical dependence on specialized, often proprietary, tech | Advanced packaging equipment for AI/HPC is sourced from few vendors |

| Switching Costs | High integration, qualification, and disruption risks | Switching can take months and incur substantial costs |

| Forward Integration Threat | Low due to high capital and expertise requirements for OSAT | New advanced packaging lines cost $50M-$150M+ |

What is included in the product

This analysis of Amkor Technology's competitive landscape reveals how supplier power, buyer bargaining, and the threat of new entrants shape its market position.

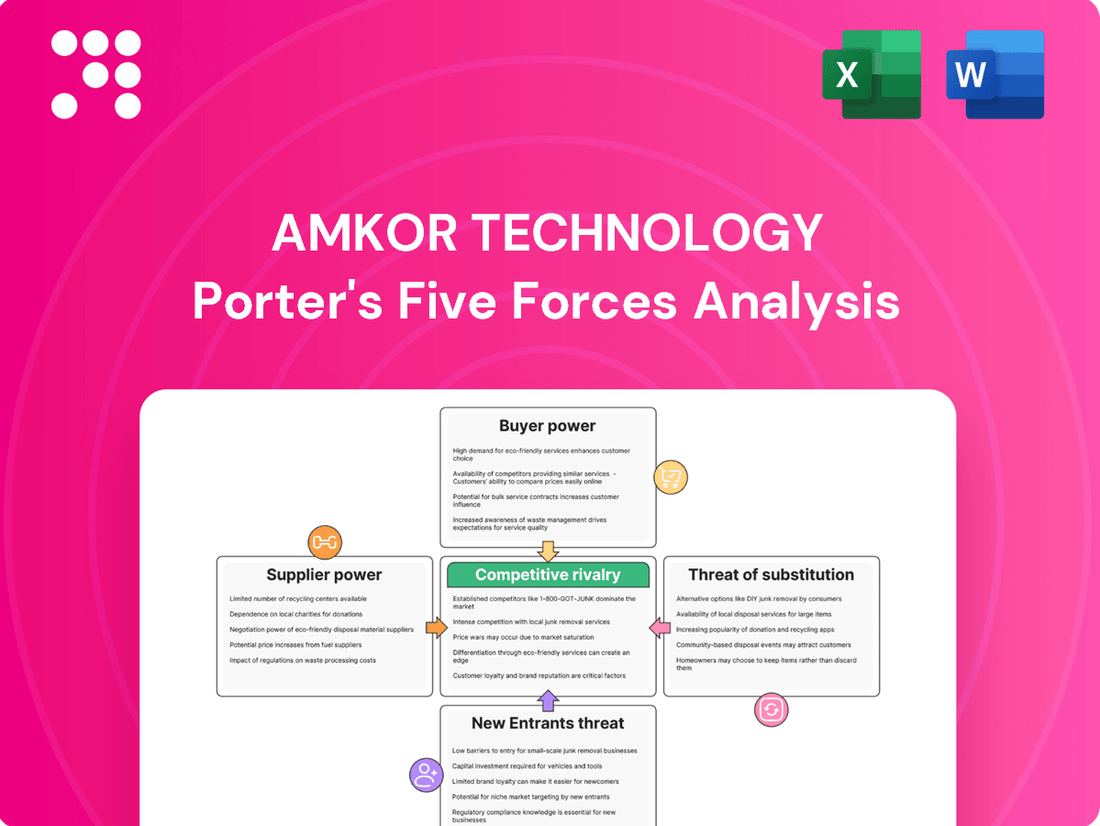

Instantly assess Amkor's competitive landscape with a visual breakdown of each force, simplifying complex strategic pressures for decisive action.

Customers Bargaining Power

Customer concentration is a key factor influencing Amkor Technology's bargaining power of customers. Amkor serves a global clientele, including many of the world's leading semiconductor firms.

In the first quarter of 2025, Amkor's top ten customers represented a substantial 67% of its net sales. This high degree of customer concentration means these major clients hold significant leverage when negotiating terms, pricing, and service levels with Amkor.

Large Integrated Device Manufacturers (IDMs) like Intel and Samsung possess significant in-house packaging capabilities, bolstering their bargaining power. These giants are actively investing in cutting-edge advanced packaging solutions, allowing them to perform assembly and testing internally. This vertical integration reduces their reliance on external OSAT providers, such as Amkor Technology, and strengthens their negotiating position.

The price sensitivity of customers in the semiconductor industry, including outsourced semiconductor assembly and test (OSAT) services like those offered by Amkor Technology, is a significant factor. This sensitivity often becomes more pronounced during economic downturns or periods of oversupply, leading customers to push for lower prices.

Amkor Technology, for instance, observed heightened pricing pressure in key markets like China and Southeast Asia throughout 2024. This trend reflects the cyclical nature of the semiconductor sector, where demand fluctuations directly impact the bargaining power of buyers, compelling OSAT providers to compete more aggressively on price to secure business.

Availability of Substitute Services

The availability of substitute services significantly impacts Amkor Technology's bargaining power with its customers. Customers aren't limited to Amkor; they can turn to other major Outsourced Semiconductor Assembly and Test (OSAT) providers worldwide. This means Amkor operates in a competitive landscape where alternatives are readily available.

While Amkor holds a strong position as the second-largest OSAT company, key competitors such as ASE Technology Holding, JCET, and Powertech Technology offer comparable services. These companies provide customers with viable alternatives, directly influencing Amkor's ability to dictate terms and pricing.

For instance, in 2023, the global OSAT market was valued at approximately $35 billion, with Amkor and its main competitors vying for market share. This competitive intensity means customers can often switch providers if Amkor’s offerings or pricing are not perceived as advantageous.

- Global OSAT Market Size: Valued around $35 billion in 2023, indicating a substantial market with multiple players.

- Key Competitors: ASE Technology Holding, JCET, and Powertech Technology offer direct substitutes for Amkor's services.

- Customer Choice: The presence of these alternatives empowers customers to negotiate better terms or switch suppliers if necessary.

- Market Share Dynamics: Amkor's position as the second-largest player highlights the intense competition and the availability of comparable services from rivals.

Volume of Purchases

Customers who purchase in large volumes, like major semiconductor manufacturers needing extensive assembly and testing for devices such as smartphones or AI processors, generally wield more influence. This allows them to negotiate better pricing and terms. For instance, Amkor Technology's strategic emphasis on high-growth sectors, including AI and automotive, means they are catering to clients with substantial volume requirements.

In 2023, Amkor Technology reported revenue of $5.3 billion, with a significant portion likely driven by these high-volume customers in key markets. The semiconductor industry, particularly the segments Amkor serves, often sees large players demanding economies of scale, which translates directly into their bargaining power.

- High-Volume Demand: Major clients in sectors like smartphones and AI require vast quantities of assembly and test services.

- Negotiating Leverage: Large purchase volumes empower these customers to secure more favorable pricing and contract conditions.

- Market Focus: Amkor's strategic alignment with high-growth areas like AI and automotive directly correlates with serving customers who represent significant volume opportunities.

- Industry Dynamics: The semiconductor supply chain inherently favors large-volume buyers who can leverage their scale to influence supplier terms.

Amkor Technology faces significant customer bargaining power due to high customer concentration, with its top ten customers accounting for 67% of net sales in Q1 2025. Large Integrated Device Manufacturers (IDMs) like Intel and Samsung, with their own advanced packaging capabilities, further enhance this power by reducing their reliance on OSAT providers. The price sensitivity of these customers, especially during economic downturns, forces Amkor to compete aggressively on pricing, as seen with heightened price pressure in Asian markets throughout 2024.

| Factor | Impact on Amkor | Supporting Data/Observation |

|---|---|---|

| Customer Concentration | High leverage for major clients | Top 10 customers = 67% of net sales (Q1 2025) |

| Customer Capabilities | Reduced reliance on OSATs | IDMs like Intel/Samsung invest in in-house packaging |

| Price Sensitivity | Increased pricing pressure | Heightened pressure observed in China/SE Asia (2024) |

| Availability of Substitutes | Customers can switch providers | Global OSAT market ~ $35 billion (2023) with key competitors like ASE, JCET |

| Volume Purchases | Negotiating advantage for large clients | Amkor focuses on high-volume AI/automotive sectors |

Preview the Actual Deliverable

Amkor Technology Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Amkor Technology within this document details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the semiconductor packaging industry. This in-depth examination provides actionable insights for strategic decision-making.

Rivalry Among Competitors

The Outsourced Semiconductor Assembly and Test (OSAT) market is quite crowded, featuring many companies, but a few giants really lead the pack. This intense competition means players must constantly innovate and offer competitive pricing.

In 2024, ASE Technology Holding stood out as the dominant force, commanding a substantial 44.6% of the global OSAT market. Amkor Technology, while a significant player, held the second position with a 15.2% market share, illustrating the considerable gap between the top two and the rest of the field.

The global OSAT market is poised for robust expansion, with projections indicating an 8% growth rate by 2025. This surge is primarily fueled by the escalating demand for sophisticated packaging solutions, especially for AI accelerators, a key driver for Amkor Technology.

While the overall outlook is positive, it's important to note that specific market segments, such as automotive and industrial applications, have experienced periods of weakness. This uneven growth pattern can influence competitive dynamics within the OSAT industry.

While the core outsourced semiconductor assembly and test (OSAT) services can appear similar across competitors, Amkor Technology distinguishes itself through deep expertise in advanced packaging technologies. This includes areas like 2.5D/3D packaging, flip chip, and wafer-level packaging, which are critical for high-performance applications. For instance, Amkor's focus on advanced packaging for AI and automotive sectors highlights their commitment to innovation in these growing markets.

Exit Barriers

Amkor Technology, like other players in the Outsourced Semiconductor Assembly and Test (OSAT) sector, faces substantial exit barriers. The immense capital required for state-of-the-art manufacturing facilities and highly specialized equipment, often running into hundreds of millions of dollars, makes it incredibly difficult for companies to simply walk away. For instance, establishing a new advanced packaging facility can cost upwards of $500 million, a figure that discourages new entrants and makes exiting a costly proposition.

These high fixed costs mean that even when market conditions are unfavorable, OSAT companies are often compelled to continue operations to spread their overhead. This can lead to prolonged periods of intense competition as underutilized capacity puts downward pressure on prices, thereby intensifying the rivalry among existing players. In 2024, the OSAT market, while experiencing growth, also saw periods of price sensitivity due to global economic uncertainties, forcing companies to maintain production levels despite potential margin erosion.

- High Capital Investment: OSAT facilities require significant upfront investment in advanced machinery and cleanroom infrastructure.

- Specialized Equipment: The need for highly specific and expensive testing and assembly equipment creates a barrier to repurposing assets.

- Operational Continuity: High fixed costs incentivize companies to remain operational, even in downturns, to avoid underutilization penalties and maintain market presence.

- Market Dynamics: In 2024, the OSAT industry navigated fluctuating demand, with high exit barriers contributing to sustained competitive pressure.

Strategic Stakes

The Outsourced Semiconductor Assembly and Test (OSAT) industry is foundational to the semiconductor ecosystem, with Amkor Technology being a key player. Companies like Amkor are strategically vital, enabling semiconductor manufacturers to efficiently launch new products. This strategic importance is underscored by significant investments in advanced packaging technologies and new manufacturing sites, such as Amkor's facility in Arizona.

These substantial investments reflect the high stakes involved, as OSAT providers are critical partners in the semiconductor value chain. For instance, Amkor's commitment to advanced packaging solutions, like their fan-out wafer-level packaging (FOWLP), directly impacts the performance and miniaturization of advanced chips. The competitive landscape is intense, with players vying for market share by offering cutting-edge solutions and reliable production capacity.

Competitive rivalry in the OSAT sector is fierce, driven by a few dominant players and a crowded field of smaller competitors. Amkor Technology, while a significant entity, faces intense pressure from market leaders like ASE Technology Holding, which held a commanding 44.6% market share in 2024 compared to Amkor's 15.2%.

This intense competition is further fueled by the industry's high capital investment requirements and specialized equipment needs, creating substantial exit barriers that keep existing players engaged even during market fluctuations. Companies must continuously invest in advanced packaging technologies, such as those for AI accelerators, to remain competitive and capture market share in a sector projected for 8% growth by 2025.

The drive for innovation in areas like 2.5D/3D packaging and fan-out wafer-level packaging (FOWLP) is a direct response to this rivalry, as companies like Amkor Technology seek differentiation. This constant push for technological advancement and cost-effectiveness intensifies the competition among OSAT providers.

SSubstitutes Threaten

The primary threat of substitutes for outsourced semiconductor assembly and test (OSAT) services like Amkor Technology comes from Integrated Device Manufacturers (IDMs) performing these functions in-house. For instance, major players such as Intel have historically maintained significant internal packaging and testing operations, reducing their reliance on external OSAT providers.

Leading IDMs are continually investing in and enhancing their advanced packaging capabilities. TSMC, a foundry giant, has been aggressively expanding its own advanced packaging solutions, directly competing with OSAT companies by offering integrated services to its chip manufacturing clients. This internal capacity represents a substantial substitute, as it allows IDMs to control the entire production process.

The performance-price trade-off of substitutes is a critical factor for Amkor Technology. While companies can develop in-house manufacturing and testing capabilities, this route demands significant capital expenditure and specialized knowledge, often proving uneconomical, particularly for fabless semiconductor firms. For instance, building a state-of-the-art OSAT facility can cost hundreds of millions of dollars.

Outsourced Semiconductor Assembly and Test (OSAT) providers like Amkor offer a compelling alternative, delivering substantial cost savings and enhanced flexibility. These providers also grant access to cutting-edge technologies and processes, which can be challenging and expensive for individual companies to replicate. In 2024, the global OSAT market was valued at approximately $70 billion, highlighting the significant demand for these specialized services.

Customer propensity to substitute for Amkor Technology is influenced by their strategic priorities, financial capacity, and the intricacy of their chip designs. For highly advanced or specialized packaging needs, clients will likely seek out OSATs possessing specific, niche expertise, making direct substitution less feasible.

However, for more standardized product lines, the primary drivers for substitution become cost-effectiveness and the robustness of the supply chain. Amkor's ability to maintain competitive pricing and ensure reliable delivery directly impacts a customer's inclination to switch to an alternative provider.

Technological Advancements in Substitutes

The threat of substitutes for Amkor Technology is amplified by rapid technological advancements, particularly in advanced packaging solutions developed by Integrated Device Manufacturers (IDMs). For instance, Intel's Foveros and EMIB platforms, along with TSMC's CoWoS technology, represent significant in-house capabilities. These innovations allow major chipmakers to integrate more functionalities and achieve higher performance within their own operations, potentially decreasing their need for external Outsourced Semiconductor Assembly and Test (OSAT) providers like Amkor for certain high-end chip designs.

These internal advancements by IDMs directly challenge the market position of OSAT companies. As IDMs refine their proprietary packaging techniques, they can internalize more of the value chain. This trend is particularly relevant in 2024, as the demand for specialized, high-performance packaging continues to grow, driven by AI, high-performance computing, and advanced mobile devices. Companies that can leverage these internal capabilities may see reduced outsourcing opportunities.

The increasing sophistication of these in-house solutions means that OSATs must continuously innovate to remain competitive. The ability of IDMs to develop and implement cutting-edge packaging technologies internally poses a direct substitute threat, as it offers an alternative to relying on third-party OSAT services, especially for critical or proprietary designs.

Consider these key points regarding technological advancements in substitutes:

- IDM In-House Packaging: Intel's Foveros and EMIB, and TSMC's CoWoS, enhance internal capabilities, reducing reliance on OSATs for high-end applications.

- Value Chain Internalization: Advanced packaging allows IDMs to bring more of the semiconductor manufacturing process in-house, potentially decreasing outsourcing needs.

- Competitive Pressure: These internal advancements create competitive pressure on OSAT providers like Amkor to match or exceed these sophisticated packaging technologies.

- Market Shift: The ongoing development and adoption of these proprietary solutions could lead to a gradual shift in the market, with fewer opportunities for external OSAT services in certain segments.

Indirect Substitutes (e.g., alternative chip architectures)

While Amkor Technology primarily offers assembly and test services for semiconductors, the threat of indirect substitutes exists. Shifts in chip architectures or the rise of alternative computing paradigms that lessen the reliance on traditional, complex packaging could pose a challenge. For instance, if future computing needs could be met by less integrated or differently packaged components, the demand for Amkor's specialized services might decline.

However, current industry trends lean in Amkor's favor. The increasing adoption of chiplets and heterogeneous integration, where multiple smaller dies are combined into a single package, actually amplifies the need for advanced packaging solutions. Amkor's expertise in these areas positions them to benefit from this evolution, rather than be threatened by it. For example, the advanced packaging market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 8% in the coming years, reaching tens of billions of dollars by the late 2020s.

- Chiplet technology: This approach breaks down monolithic System-on-Chips (SoCs) into smaller, specialized dies, requiring sophisticated packaging to connect them.

- Heterogeneous integration: Combining different types of semiconductor technologies (e.g., logic, memory, RF) within a single package, increasing complexity and the need for advanced assembly.

- Market growth: The advanced packaging segment is a key growth driver for the semiconductor industry, with companies investing heavily in R&D and capacity.

The threat of substitutes for Amkor Technology is primarily driven by Integrated Device Manufacturers (IDMs) enhancing their in-house assembly and testing capabilities. Major players like Intel with its Foveros and EMIB technologies, and TSMC with its CoWoS, are developing advanced proprietary packaging solutions. These internal advancements allow IDMs to integrate more functions, potentially reducing their reliance on external OSAT providers for high-end chip designs.

The increasing sophistication of these in-house solutions creates competitive pressure on OSATs like Amkor to innovate continuously. As IDMs internalize more of the value chain, particularly in 2024 with high demand for AI and advanced computing, outsourcing opportunities in certain segments may decrease.

While indirect substitutes like shifts in chip architectures are a consideration, current trends like chiplets and heterogeneous integration actually boost demand for advanced packaging, benefiting Amkor. The advanced packaging market is a significant growth area, with projections indicating substantial expansion in the coming years.

| Substitute Type | Key Examples | Impact on Amkor |

| IDM In-house Packaging | Intel Foveros, EMIB; TSMC CoWoS | Reduced outsourcing for high-end, proprietary designs. |

| Alternative Computing Paradigms | Less integrated chip architectures | Potential long-term decline in demand for complex packaging. |

Entrants Threaten

The semiconductor packaging and testing (OSAT) industry demands significant upfront capital. Newcomers must invest heavily in advanced manufacturing plants, cutting-edge machinery, and ongoing research and development to compete. For instance, Amkor Technology anticipates capital expenditures of around $850 million for the full year 2025, illustrating the scale of investment required.

Established players in the Outsourced Semiconductor Assembly and Test (OSAT) sector, like Amkor Technology, benefit immensely from economies of scale. This means their per-unit production costs decrease as their output volume increases, allowing them to offer highly competitive pricing. In 2023, Amkor reported net sales of $5.3 billion, demonstrating their substantial production capacity and market presence.

For a new entrant, replicating this cost advantage would be a significant hurdle. Achieving similar cost efficiencies would require massive upfront investment in advanced manufacturing facilities and securing large-scale contracts, which is challenging without an established track record and customer base.

New entrants to the semiconductor packaging and test market face significant hurdles in gaining access to established distribution channels. Amkor Technology, for instance, has cultivated deep, long-standing relationships with many of its key customers, often involving intricate qualification processes that can take years to navigate. These existing partnerships represent a formidable barrier, as new players would struggle to displace Amkor's embedded position and secure the necessary volume commitments from leading semiconductor manufacturers.

Proprietary Technology and Expertise

The threat of new entrants in the Outsourced Semiconductor Assembly and Test (OSAT) industry, especially in advanced packaging, is significantly mitigated by the substantial barriers erected by proprietary technology and specialized expertise. Companies like Amkor Technology have cultivated deep engineering knowledge and secured numerous patents, creating a high hurdle for newcomers. This technological moat is crucial in a sector where innovation cycles are rapid and capital investment is immense.

Amkor's established leadership in advanced packaging technologies, such as its fan-out wafer-level packaging (FOWLP) and advanced substrate technologies, represents a formidable challenge for potential entrants. These capabilities require years of research and development, significant intellectual property protection, and a proven track record of reliability and performance. For instance, Amkor's investment in R&D, which often forms a substantial portion of its operational expenditure, directly contributes to its technological advantage.

- Proprietary Technology: OSATs leverage unique process technologies and material science innovations, often protected by patents, making replication difficult.

- Engineering Expertise: Decades of accumulated knowledge in semiconductor packaging, design, and manufacturing are essential and hard to acquire quickly.

- Amkor's Leadership: Amkor Technology is recognized for its innovation in areas like FOWLP and its advanced substrate offerings, demonstrating a clear technological edge.

- R&D Investment: Continuous and significant investment in research and development is vital to stay competitive, representing a substantial financial commitment for any new player.

Government Policy and Regulation

Government policies, like the U.S. CHIPS and Science Act of 2022, which allocated $52.7 billion for semiconductor manufacturing and research, can encourage new domestic players. This legislation aims to reshore critical industries, potentially lowering barriers to entry in certain geographic areas.

However, navigating existing regulatory landscapes, including stringent environmental compliance and import/export controls, presents significant hurdles. These requirements increase upfront costs and operational complexity for any new company seeking to enter the semiconductor packaging and testing market.

The semiconductor industry is also subject to evolving trade policies and national security regulations. For instance, export controls on advanced technology can impact supply chains and market access, creating an uncertain environment for new entrants.

- Government Support: Initiatives like the CHIPS Act provide financial incentives and research funding, potentially aiding new domestic semiconductor manufacturers.

- Regulatory Burden: Compliance with environmental, safety, and trade regulations adds substantial cost and complexity for new market entrants.

- Trade Policies: Evolving international trade agreements and national security concerns can create unpredictable market conditions for new players.

- Intellectual Property: Stringent intellectual property laws necessitate significant investment in R&D and legal protection, acting as a barrier to entry.

The threat of new entrants in the OSAT sector is considerably low due to immense capital requirements and established economies of scale. Amkor Technology's projected 2025 capital expenditures of approximately $850 million highlight the massive investment needed. Furthermore, Amkor's 2023 net sales of $5.3 billion underscore the scale advantage that new players would struggle to match, making it difficult to compete on cost.

Proprietary technology and deep engineering expertise create significant barriers to entry. Amkor's leadership in advanced packaging, like FOWLP, is built on years of R&D and intellectual property protection. New entrants would find it challenging to replicate this technological moat and the accumulated knowledge base essential for success in this rapidly evolving industry.

| Barrier Type | Description | Impact on New Entrants | Amkor's Position |

|---|---|---|---|

| Capital Requirements | High investment in advanced manufacturing facilities and R&D. | Significant hurdle due to upfront costs. | Established infrastructure and ongoing investment capacity. |

| Economies of Scale | Lower per-unit costs with higher production volumes. | Difficult to achieve competitive pricing without scale. | Large production capacity and market share. |

| Proprietary Technology & Expertise | Unique processes, patents, and accumulated knowledge. | Requires substantial R&D and talent acquisition. | Leader in advanced packaging with strong IP portfolio. |

| Customer Relationships | Long-standing partnerships and complex qualification processes. | Challenging to displace incumbents and secure volume. | Deep relationships with key semiconductor manufacturers. |

Porter's Five Forces Analysis Data Sources

Our Amkor Technology Porter's Five Forces analysis is built upon a foundation of verified data, including Amkor's own annual reports and SEC filings, alongside industry-specific market research reports and global economic trend data.