Amkor Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amkor Technology Bundle

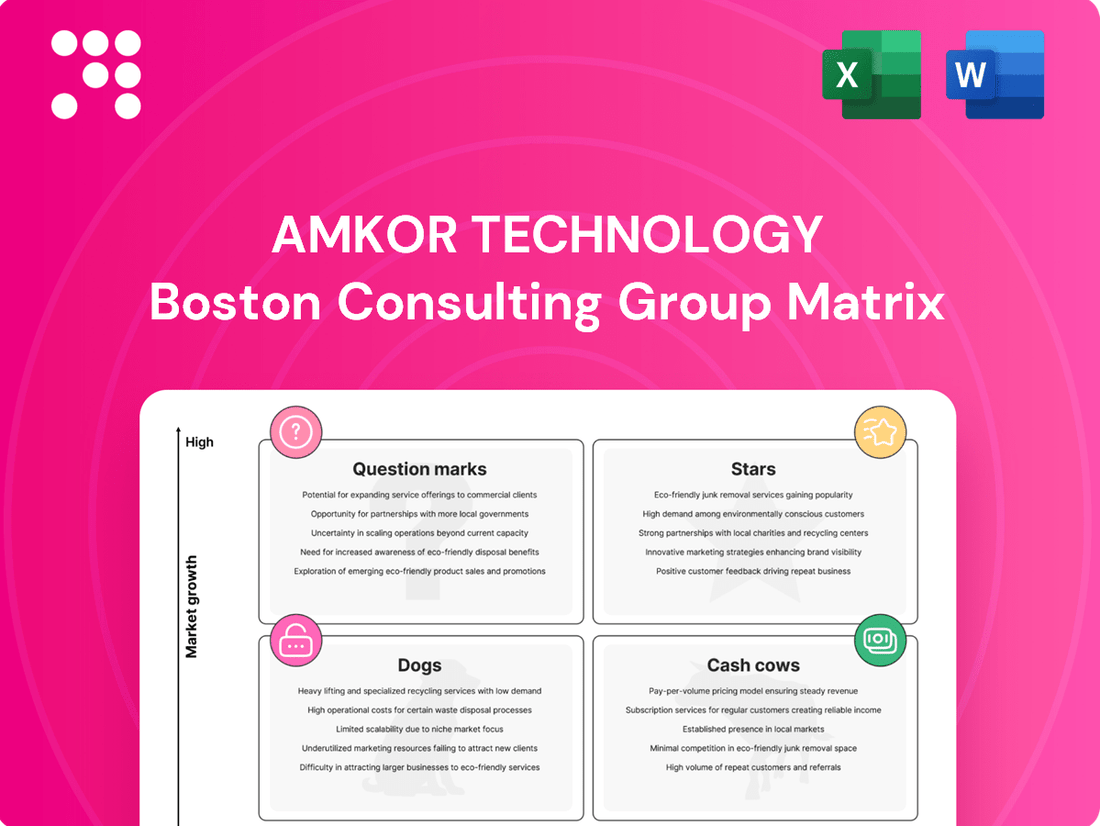

Amkor Technology's position within the BCG Matrix reveals a dynamic portfolio, highlighting areas ripe for growth and those requiring careful management. Understanding which of their offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic decision-making.

This preview offers a glimpse into Amkor's market standing, but for a comprehensive understanding and actionable strategies, the full BCG Matrix report is essential. Unlock the complete picture and gain a competitive edge.

Purchase the full Amkor Technology BCG Matrix today to receive detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing your investment and product strategies.

Stars

Amkor Technology's advanced packaging, especially 2.5D technology, is critical for AI and HPC. This segment is seeing massive demand growth, making it a vital area for Amkor's future. The company is investing heavily to keep up with the need for AI chips and GPUs.

Amkor Technology's communications segment, particularly its focus on 5G infrastructure and high-end smartphones, represents a significant growth engine. The continuous expansion of 5G networks worldwide and the increasing adoption of connected devices are driving substantial demand for Amkor's sophisticated packaging solutions. In 2024, Amkor reported a strong 22% year-over-year revenue increase in its communications division, underscoring the robust market traction.

Amkor Technology's new advanced packaging and test facility in Peoria, Arizona, is positioned as a future Star in the BCG Matrix. This facility, backed by CHIPS Act funding, signifies a major strategic move to bolster the U.S. semiconductor supply chain.

The Peoria site will offer comprehensive end-to-end advanced packaging solutions, targeting high-demand sectors such as artificial intelligence and autonomous driving. This investment is expected to capture significant market share in cutting-edge semiconductor technologies.

System-in-Package (SiP) Solutions

Amkor Technology is experiencing significant growth in its Advanced System-in-Package (SiP) solutions, reflecting its strong market standing in this rapidly expanding area of semiconductor packaging. This technology is key for creating smaller, more powerful electronic devices by combining various components into one unit.

The company reported record revenue for its SiP offerings, underscoring the increasing demand for these integrated solutions. This success is further bolstered by Amkor's strategic expansion, including a new facility in Vietnam that commenced operations in 2024, specifically geared towards producing advanced SiP and memory packages to meet this demand.

Key aspects of Amkor's SiP strategy include:

- Record Revenue Growth: Demonstrating strong market traction and demand for advanced packaging.

- Technological Advancement: SiP enables miniaturization and enhanced functionality in consumer electronics and other high-tech applications.

- Global Expansion: The 2024 opening of its Vietnam facility supports increased production capacity for SiP and memory products.

- Market Leadership: Amkor's focus on SiP positions it as a key player in a high-growth segment of the semiconductor industry.

Strategic Partnerships for Advanced Technologies

Amkor's strategic partnerships are crucial for its position in advanced technologies. For instance, their collaboration with TSMC on advanced packaging in Arizona highlights Amkor's focus on high-growth sectors.

These alliances are vital for developing cutting-edge technologies like Integrated Fan-Out (InFO) and Chip on Wafer on Substrate (CoWoS). Such collaborations enable Amkor to shorten product development cycles and contribute to advancements in mobile, AI, and High-Performance Computing (HPC).

By engaging in these key partnerships, Amkor Technology solidifies its role as an innovator in the rapidly expanding advanced packaging market.

- TSMC Collaboration: Amkor is working with TSMC on advanced packaging capabilities, particularly in Arizona.

- Key Technologies: Focus areas include Integrated Fan-Out (InFO) and Chip on Wafer on Substrate (CoWoS).

- Market Impact: These partnerships accelerate product cycles and support breakthroughs in mobile, AI, and HPC.

- Strategic Advantage: Alliances ensure Amkor remains at the forefront of technological innovation in a growing market.

Amkor's advanced packaging, particularly for AI and HPC, is a significant Star. The communications segment, driven by 5G and smartphones, also shines brightly, with a 22% revenue increase in 2024. The new Peoria, Arizona facility, backed by CHIPS Act funding, is strategically positioned to become a future Star, focusing on AI and autonomous driving sectors.

| Segment | BCG Category | Key Growth Drivers | 2024 Data/Outlook |

|---|---|---|---|

| Advanced Packaging (AI/HPC) | Star | High demand for AI chips, GPUs | Massive demand growth |

| Communications (5G/Smartphones) | Star | 5G network expansion, connected devices | 22% YoY revenue increase |

| New Arizona Facility (Peoria) | Potential Star | CHIPS Act funding, U.S. supply chain focus | Targeting AI, autonomous driving |

| Advanced System-in-Package (SiP) | Star | Miniaturization, enhanced functionality | Record revenue growth, Vietnam facility expansion |

What is included in the product

Amkor's BCG Matrix analyzes its business units, identifying Stars for growth, Cash Cows for funding, Question Marks for evaluation, and Dogs for divestment.

A clear BCG Matrix visualizes Amkor's portfolio, easing strategic decision-making by highlighting areas needing investment or divestment.

Cash Cows

Amkor Technology's global leadership in Outsourced Semiconductor Assembly and Test (OSAT) firmly places it in the Cash Cows quadrant of the BCG Matrix. As one of the largest OSAT providers worldwide, Amkor commands a substantial and stable market share, ensuring predictable revenue streams from a diverse clientele. This established position is bolstered by their expansive global operational footprint, strategically located in critical electronics manufacturing hubs.

Amkor's diversified customer base is a key strength, acting as a Cash Cow. In 2024, Amkor reported significant revenue contributions from key sectors like communications and automotive, demonstrating its broad market penetration. This wide reach across industries such as consumer electronics, computing, and networking provides a robust and stable foundation for its operations.

Amkor Technology's mainstream packaging services, largely based on wirebond interconnect technology, are a cornerstone of their business, contributing a significant and stable portion to net sales. These offerings operate within a mature market, meaning growth isn't explosive, but Amkor's established processes and economies of scale allow for strong competitive positioning and healthy profit margins.

These reliable cash generators are crucial for funding other strategic initiatives within Amkor. For instance, in 2023, Amkor reported total revenue of $5.7 billion, with their wirebond-based packages forming a substantial and predictable component of this figure, underscoring their role as a consistent cash cow.

Consistent Free Cash Flow Generation

Amkor Technology's position as a cash cow is strongly supported by its consistent generation of robust free cash flow. This indicates a mature business unit that generates more cash than it needs to reinvest for growth, a hallmark of a cash cow.

For the full year 2024, Amkor reported a significant free cash flow of $359 million. This substantial figure underscores the company's operational efficiency and its capacity to produce cash in excess of its operational and capital expenditure requirements.

- Consistent Free Cash Flow: Amkor Technology demonstrates a reliable ability to generate substantial free cash flow from its operations.

- 2024 Performance: The company reported $359 million in free cash flow for the full year 2024, highlighting strong cash-generating capabilities.

- Financial Flexibility: This consistent cash generation provides Amkor with significant financial flexibility to manage debt, distribute dividends, and pursue strategic investment opportunities.

Established Global Manufacturing Footprint

Amkor Technology's established global manufacturing footprint, encompassing production facilities, product development centers, and sales offices across Asia, Europe, and the USA, serves as a powerful cash cow. This extensive network allows for efficient global customer service and fosters strong client relationships, directly contributing to the company's profitability.

This broad geographic presence enables Amkor to tap into diverse markets and leverage regional manufacturing advantages, enhancing operational efficiency. The sheer scale and established nature of these operations are key drivers of consistent cash generation, underpinning the company's financial stability.

- Global Reach: Amkor operates in key manufacturing hubs, facilitating efficient supply chains and market access.

- Customer Proximity: Local presence allows for tailored solutions and responsive service to a worldwide clientele.

- Operational Scale: The extensive infrastructure supports high-volume production, driving economies of scale and cost efficiencies.

- Profitability Driver: Established, efficient operations are a significant source of consistent cash flow for Amkor.

Amkor's mature wirebond packaging services represent a significant cash cow, leveraging established technology and economies of scale in a stable market. These operations, a substantial contributor to Amkor's overall revenue, generate consistent profits due to efficient processes and strong market positioning.

The company's robust free cash flow generation is a testament to these cash cow activities. For the full year 2024, Amkor reported $359 million in free cash flow, demonstrating its ability to generate cash in excess of its operational needs and investments.

| Key Financial Metric | 2024 Value | Significance for Cash Cow Status |

| Free Cash Flow | $359 million | Indicates strong profitability and cash generation beyond operational needs. |

| Revenue Contribution (Wirebond) | Substantial & Predictable | Represents a stable, mature business segment with consistent cash inflow. |

| Market Share (OSAT) | Leading Global Position | Ensures stable demand and pricing power for mature product lines. |

What You See Is What You Get

Amkor Technology BCG Matrix

The preview of the Amkor Technology BCG Matrix you are currently viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic analysis ready for your immediate use. You can be confident that the insights and visualizations presented here represent the complete, professional-grade document you'll be downloading. This allows you to assess the quality and relevance of our BCG Matrix analysis firsthand before committing to your purchase. Rest assured, the file you see is the exact file you will own and utilize for your business planning.

Dogs

Amkor's Legacy Automotive & Industrial Packaging segment faced significant headwinds in 2024. Revenue from these sectors saw a full-year decline due to ongoing inventory corrections and broader market weakness. This underperformance suggests these areas are consuming resources without generating commensurate returns, a classic indicator of a Dog in the BCG matrix.

While Amkor possesses advanced automotive packaging solutions, older or less differentiated offerings within these markets are struggling. Sluggish demand and fierce competition for these legacy products are likely contributing to their classification as Dogs, characterized by low growth and potentially diminishing market share in specific sub-segments.

Highly commoditized standard packaging services, especially those facing significant price competition from regions like China and Southeast Asia, often find themselves in the Dogs quadrant of the BCG Matrix. These offerings, while essential for a complete service catalog, typically exhibit low growth potential and thinner profit margins. For instance, Amkor Technology might experience this with very basic lead frame packages where differentiation is minimal.

Amkor Technology's legacy products and older packaging technologies, such as certain leadframe-based packages, fall into the Dogs category. These are products where market demand is steadily decreasing as newer, more advanced solutions emerge. For instance, the demand for older, less power-efficient semiconductor packaging is declining sharply.

These offerings typically possess a low market share within a low-growth or shrinking market segment. Continued investment in these products would likely result in diminishing returns, tying up valuable capital that could be better allocated to Amkor's growth areas. By 2024, the semiconductor industry's shift towards advanced packaging solutions like fan-out and wafer-level packaging has significantly reduced the market for many traditional package types.

Segments with Persistent Inventory Corrections

Segments experiencing persistent inventory corrections, such as those observed in certain consumer electronics and automotive sub-sectors throughout 2024, are indicative of a company's potential 'Question Mark' or even 'Dog' classifications within a BCG matrix framework, depending on their market share and growth prospects. These ongoing adjustments highlight a persistent imbalance between the supply of products and actual market demand, directly impacting order volumes and revenue streams for Amkor Technology. For instance, the automotive sector in 2024 continued to navigate supply chain complexities and fluctuating consumer demand for certain vehicle types, leading to inventory recalibrations. Similarly, some consumer electronics categories faced significant inventory overhangs from previous periods, necessitating extended correction cycles.

These prolonged periods of market softness are a clear signal that these particular business segments are not currently acting as growth engines for the company. They are not contributing substantially to the overall expansion of Amkor Technology's business or its profitability. This stagnation can tie up capital and management attention that could otherwise be directed towards more promising areas. The persistence of these corrections suggests a deeper structural issue, possibly related to evolving consumer preferences, technological obsolescence, or intense competition, which requires careful strategic evaluation.

- Persistent Inventory Corrections: Segments like certain consumer electronics and automotive components in 2024 faced prolonged inventory adjustments, signaling demand-supply mismatches.

- Impact on Revenue: These ongoing corrections directly translate to reduced order volumes and consequently lower revenue generation for affected business units.

- Growth Stagnation: The inability of these segments to overcome inventory issues indicates they are not contributing positively to Amkor Technology's overall growth or profitability.

- Strategic Re-evaluation: Such persistent market softness necessitates a thorough review of these business segments' strategic positioning and future viability.

Non-Strategic, Low-Volume Offerings

Non-Strategic, Low-Volume Offerings in Amkor Technology's BCG Matrix represent product lines or services that Amkor doesn't actively prioritize. These are typically niche areas with limited market impact and don't fit Amkor's core strategy of advanced packaging. For instance, if Amkor had a small line of older, less sophisticated packaging solutions, it might fall into this category. These segments often have minimal revenue contribution and low growth potential.

These offerings usually possess a small market share and contribute very little to Amkor's total revenue. For example, in 2023, Amkor's total revenue was approximately $5.7 billion. If these low-volume offerings accounted for less than 1% of that, they would be considered insignificant financially. The focus here is on identifying areas that do not align with Amkor's push into high-performance computing or 5G applications.

- Low Market Share: These offerings typically hold a negligible portion of their respective markets.

- Minimal Revenue Contribution: They contribute very little to Amkor's overall financial performance.

- Lack of Strategic Alignment: They do not support Amkor's focus on advanced and high-performance packaging.

- Potential for Divestiture: Amkor might consider selling or phasing out these operations to reallocate resources.

Amkor Technology's legacy automotive and industrial packaging segments, particularly those with older, less differentiated offerings, are considered Dogs. These areas experienced revenue declines in 2024 due to inventory corrections and market weakness, indicating low growth and potentially diminishing returns. For instance, highly commoditized standard packaging services facing intense price competition often fall into this category.

These "Dog" products or services typically exhibit low market share within slow-growing or shrinking markets. Continued investment in them is unlikely to yield significant returns, and they can tie up capital that could be better used in Amkor's high-growth areas. The semiconductor industry's shift towards advanced packaging in 2024 has further reduced the demand for many traditional package types.

Segments that faced persistent inventory corrections in 2024, such as certain consumer electronics and automotive sub-sectors, also indicate potential Dog classifications. These ongoing adjustments highlight a persistent imbalance between supply and demand, directly impacting order volumes and revenue streams for Amkor Technology.

These underperforming segments are not growth engines and do not contribute substantially to Amkor's overall expansion or profitability. This stagnation can consume capital and management focus that could be better directed toward more promising areas, necessitating careful strategic evaluation.

| Amkor Technology Segment | BCG Classification | Key Characteristics | 2024 Performance Indicator |

| Legacy Automotive Packaging | Dog | Low market share, low growth, declining demand for older solutions. | Revenue decline due to inventory corrections and market weakness. |

| Legacy Industrial Packaging | Dog | Commoditized offerings, high price competition, minimal differentiation. | Revenue decline due to inventory corrections and market weakness. |

| Older Leadframe Packages | Dog | Obsolescence due to newer technologies, shrinking market. | Declining demand as advanced packaging solutions gain traction. |

| Highly Commoditized Standard Services | Dog | Low profit margins, intense price pressure from competitors. | Struggling to compete on price and differentiation. |

Question Marks

Amkor Technology's S-Connect™ and S-SWIFT™ represent cutting-edge advancements in semiconductor packaging, focusing on interposer solutions and chiplet/memory integration. These technologies are positioned to capitalize on the burgeoning demand for enhanced performance and miniaturization in high-growth sectors like AI and high-performance computing. For instance, the advanced packaging market, which these technologies serve, was projected to reach over $30 billion in 2024, demonstrating a significant growth trajectory.

While these innovative solutions are entering markets with substantial potential, their current market penetration is still in its early stages. Amkor is making considerable investments in research and development, alongside marketing efforts, to foster wider adoption and establish a stronger market presence. This strategic focus aims to position S-Connect™ and S-SWIFT™ as future market leaders, akin to 'Stars' in the BCG matrix, by capturing a significant share of the rapidly expanding advanced packaging segment.

Amkor Technology's new Vietnam facility, which commenced operations in 2024, is currently positioned as a Question Mark. While it operates within the robust OSAT market, projected to grow at a 7.9% CAGR, its full market penetration and optimization for advanced SiP and memory packages are still underway, meaning its current market share contribution is nascent.

Significant ongoing investment and strategic management are critical for this facility to navigate its development phase. The goal is to successfully transition it from a high-investment, low-return 'Question Mark' into a high-growth, high-market-share 'Star' within Amkor's portfolio.

Amkor Technology is actively pursuing expansion into new niche applications, a strategic move aligning with the characteristics of a Question Mark in the BCG matrix. These emerging areas, like specialized optical sensors and components for advanced technologies, represent significant growth opportunities but currently hold a minimal market share for Amkor.

The company's investment in these segments highlights a commitment to future growth, even though their current market penetration is low. For instance, Amkor's 2024 investor presentations have emphasized R&D spending focused on these nascent markets, aiming to establish a strong foothold before competitors.

Success in these niche applications hinges on Amkor's ability to drive early market adoption and maintain consistent investment. This approach is crucial for capturing substantial market share in these high-potential, yet currently underdeveloped, sectors.

Geographical Expansion in Less Established Markets

Amkor Technology's strategic expansion into less established markets, while not yet a primary focus, presents a significant opportunity. These regions, often characterized by rapid economic growth and increasing demand for electronics, could become future revenue drivers. For instance, Amkor's presence in Southeast Asia, a region experiencing substantial semiconductor market growth, demonstrates a potential pathway for such expansion.

- Capturing Emerging Demand: Less established markets often exhibit higher growth rates in electronics consumption, offering Amkor the chance to secure early market share.

- Diversification of Revenue Streams: Expanding into new geographical areas reduces reliance on mature markets and mitigates risks associated with economic downturns in those regions.

- Investment and Market Development: These initiatives require significant upfront capital for infrastructure, talent acquisition, and market education, posing a challenge but offering substantial long-term rewards.

- Competitive Advantage: Early movers in these markets can establish strong brand recognition and customer loyalty, creating a lasting competitive edge.

Advanced Packaging for Next-Gen Automotive/Industrial

Amkor Technology's advanced packaging for next-gen automotive and industrial markets represents a significant investment in future growth areas, even as some traditional segments face headwinds. This strategic focus targets high-growth sub-segments like electric vehicles and autonomous driving, where demand for sophisticated semiconductor packaging is rapidly increasing.

While Amkor may currently hold a smaller market share in these specific next-generation applications compared to its broader automotive offerings, the potential for substantial future gains is considerable. For instance, the automotive semiconductor market is projected to reach $110 billion by 2027, with advanced packaging playing a crucial role in enabling higher performance and reliability for critical automotive functions.

- High-Growth Potential: Targeting rapidly expanding segments within automotive (EVs, ADAS) and industrial IoT.

- Investment Focus: Significant capital expenditure is being directed towards developing and scaling these advanced packaging technologies.

- Market Share Dynamics: Current market share in these niche areas might be lower, but the long-term strategy aims for leadership.

- Technological Differentiation: Amkor is investing to create differentiated solutions that meet the stringent requirements of next-generation applications.

Amkor's Vietnam facility, operational since 2024, is a prime example of a Question Mark. While it benefits from the growing OSAT market, its current market share is minimal as it ramps up advanced SiP and memory package production.

The company's investment in emerging niche markets, such as specialized optical sensors, also places them in the Question Mark category. These areas offer high growth potential but require significant R&D and market development to gain traction.

Amkor's strategic focus on next-generation automotive and industrial applications, particularly for EVs and ADAS, represents another Question Mark. While these sectors are expanding rapidly, Amkor's current market share in these specialized packaging solutions is still developing.

These emerging ventures require substantial investment and strategic management to transition from low market share to high growth, aiming to become future Stars in Amkor's portfolio.

BCG Matrix Data Sources

Our Amkor Technology BCG Matrix leverages Amkor's official financial disclosures, industry growth forecasts, and market share data from reputable research firms to provide a comprehensive view of their product portfolio.