Amadeus IT Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amadeus IT Group Bundle

Amadeus IT Group leverages its dominant position in travel technology, a significant strength, but faces intense competition, a key threat. Understanding these dynamics is crucial for navigating the evolving travel landscape. Want the full story behind Amadeus's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Amadeus IT Group boasts a dominant market position, particularly in global distribution systems (GDS), handling a substantial portion of worldwide travel bookings. This leadership is solidified by a powerful network effect, as more airlines and travel agencies join the platform, its value increases for all participants.

The company’s strength is evident in its extensive reach, serving over 180 airlines. This broad adoption, coupled with a high customer retention rate, underscores Amadeus's entrenched position and the critical role it plays in the travel ecosystem.

Amadeus boasts a comprehensive IT solutions portfolio that extends far beyond its traditional Global Distribution System (GDS) roots. This includes robust airline IT solutions, where its Passenger Service Systems hold a significant market share, serving over 50% of the global market outside of China. This breadth of offerings across airlines, hospitality, and airports creates diverse revenue streams, mitigating risks associated with over-reliance on any single segment.

The strategic integration of acquisitions further strengthens Amadeus's capabilities. For instance, the acquisition of Vision-Box bolstered its biometric solutions, while the addition of Voxel enhanced its payment processing services. These moves are designed to create a more integrated, end-to-end offering for travel industry clients, solidifying Amadeus's position as a key technology partner.

Amadeus IT Group consistently showcases impressive financial strength. In 2024, the company achieved robust double-digit growth across key metrics like revenue, EBITDA, and adjusted profit, with projections indicating continued positive momentum into 2025. This financial stability provides a solid foundation for its strategic initiatives.

A significant driver of Amadeus's competitive advantage is its substantial commitment to research and development. The company invested approximately €1.4 billion in R&D during 2024, a clear indication of its focus on innovation. This ongoing investment is crucial for Amadeus to maintain its technological leadership and adapt to the fast-paced changes within the travel technology sector.

Technological Innovation and Cloud Adoption

Amadeus is a leader in integrating cutting-edge technologies like cloud computing, machine learning, and Generative AI into its travel solutions. This technological prowess allows them to continuously enhance their offerings and stay ahead of the curve. For instance, their strategic shift to a cloud-native environment, as seen in their ongoing investments, significantly boosts scalability and fosters rapid innovation. This robust infrastructure is crucial for developing new products and services that meet evolving market demands.

The company's commitment to cloud adoption is not just about modernization; it's a strategic move to ensure stability and agility. By leveraging cloud systems, Amadeus can better manage vast amounts of data and deliver more efficient, personalized travel experiences. This approach positions them well for future growth, enabling them to adapt quickly to technological advancements and maintain a competitive edge in the dynamic travel technology sector.

Key technological advancements and their impact:

- Cloud-Native Architecture: Facilitates enhanced scalability and faster deployment of new features, supporting Amadeus's commitment to innovation.

- AI and Machine Learning Integration: Powers advanced data analytics and personalized customer solutions, improving efficiency and user experience.

- Generative AI Exploration: Amadeus is actively exploring Generative AI to create novel solutions and streamline complex processes within the travel industry.

- Data Analytics Capabilities: Advanced analytics are used to derive insights from travel data, enabling better decision-making for both Amadeus and its clients.

Extensive Global Reach and Partnerships

Amadeus boasts an impressive global presence, operating in over 190 countries and serving as a vital link between travelers and a vast array of travel content worldwide. This extensive reach is a significant strength, allowing the company to tap into diverse markets and customer bases.

The company actively cultivates and expands its network of partnerships, securing distribution agreements with key players across the travel industry. This includes major travel sellers, a wide spectrum of airlines from full-service carriers to low-cost providers, and numerous hospitality businesses. By fostering such a broad ecosystem, Amadeus solidifies its position as a central facilitator in the global travel landscape.

These strategic alliances are crucial for Amadeus's ability to offer comprehensive travel solutions and maintain its competitive edge. For instance, in 2024, Amadeus continued to deepen its relationships with airlines, enhancing its capabilities in areas like NDC (New Distribution Capability) content aggregation, which is vital for modern travel retailing.

The strength of its global network and partnerships is reflected in its market performance. Amadeus remains a dominant force in the travel technology sector, with its systems processing a significant volume of global bookings and passenger data, underscoring its indispensable role in the industry.

Amadeus IT Group's market dominance is a key strength, particularly in its Global Distribution System (GDS) business, where it handles a significant volume of global travel bookings. This leadership is reinforced by a strong network effect, making the platform more valuable as more users join.

The company's extensive reach is demonstrated by its partnerships with over 180 airlines, and a high customer retention rate highlights its deeply embedded role in the travel industry. Amadeus also offers a comprehensive suite of IT solutions beyond GDS, including Passenger Service Systems used by more than half of the global market outside China, diversifying its revenue streams.

Strategic acquisitions, such as Vision-Box for biometrics and Voxel for payments, enhance Amadeus's end-to-end offerings. Financially, the company showed robust double-digit growth in revenue and profits in 2024, with positive trends projected into 2025, supported by a substantial R&D investment of approximately €1.4 billion in 2024 to drive innovation.

Amadeus is a leader in adopting advanced technologies like cloud, AI, and Generative AI, with ongoing investments in cloud-native architecture enhancing scalability and innovation. Its global presence spans over 190 countries, facilitating vital connections across the travel ecosystem.

| Metric | 2024 (Approx.) | 2025 (Projected) |

|---|---|---|

| R&D Investment | €1.4 billion | Continued significant investment |

| Airlines Served | 180+ | Expanding |

| Passenger Service Systems Market Share (ex-China) | >50% | Maintaining leadership |

What is included in the product

Delivers a strategic overview of Amadeus IT Group’s internal and external business factors, identifying key strengths in its market leadership, weaknesses in its reliance on legacy systems, opportunities in digital transformation, and threats from emerging competitors.

Offers a clear breakdown of Amadeus IT Group's competitive landscape, highlighting areas for strategic advantage and risk mitigation.

Weaknesses

Amadeus IT Group's significant reliance on its Air Distribution segment presents a notable weakness. While the company has been diversifying, this core area has historically been the primary driver of its revenue and profits. For instance, in 2023, the Air Distribution segment continued to be a substantial contributor to Amadeus' overall financial performance, though specific percentages are subject to ongoing reporting.

A slowdown in global air travel, perhaps due to economic downturns or unforeseen events, could directly impact Amadeus' performance. Furthermore, shifts in how airlines distribute tickets, such as a greater push towards direct bookings, could challenge the established model of this segment. This dependency means that disruptions in the airline industry can have a disproportionate effect on Amadeus' financial health.

Amadeus's reliance on the travel sector makes it vulnerable to disruptions. For instance, the COVID-19 pandemic in 2020 caused a dramatic 70% drop in air travel bookings, directly impacting Amadeus's transaction-based revenue. This highlights the company's susceptibility to global events that curtail travel demand, such as economic downturns or geopolitical instability.

Amadeus faces significant hurdles in integrating cutting-edge technologies, such as Generative AI, with its extensive network of legacy systems used by a broad client base. This process is inherently complex and demands considerable time and resources to ensure smooth operation and compatibility across diverse environments.

A key challenge lies in the potential shortage of skilled personnel and the lack of specialized expertise needed for the efficient implementation and adoption of these advanced technologies. Furthermore, issues related to data quality within legacy systems can impede the effectiveness of new integrations, requiring substantial effort in data cleansing and standardization.

Intense Competition and Pricing Pressures

Amadeus faces significant rivalry from established global distribution system (GDS) providers such as Sabre and Travelport, alongside a growing number of niche technology suppliers and emerging players in the travel tech space. This intense competition often translates into considerable pricing pressures, compelling Amadeus to dedicate substantial resources to ongoing innovation to safeguard its market position, which can, in turn, affect its profit margins.

The need for continuous technological advancement to stay ahead of competitors and meet evolving customer demands presents a constant challenge. For instance, the rapid development of AI-powered travel solutions and direct booking channels by airlines and hotels can erode the traditional GDS model, forcing Amadeus to adapt its strategies and offerings. This dynamic environment necessitates agile responses to market shifts and a proactive approach to product development.

- Intense Competition: Operates in a market with major rivals like Sabre and Travelport.

- Pricing Pressures: Competition leads to challenges in maintaining pricing power.

- Innovation Investment: Requires continuous spending on R&D to stay competitive.

- Market Share Defense: Constant effort needed to retain and grow its share against new entrants.

Regulatory and Data Privacy Challenges

Amadeus operates in a complex global environment, facing a patchwork of evolving regulations, particularly concerning data privacy. Stricter rules like the EU's General Data Protection Regulation (GDPR) necessitate robust compliance measures, impacting how they handle sensitive customer information. Failure to adhere can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

The sheer volume of travel data processed by Amadeus presents significant cybersecurity challenges. Maintaining the integrity and confidentiality of this information requires continuous investment in advanced security protocols and constant vigilance against sophisticated cyber threats. This ongoing effort is crucial to prevent data breaches, which could severely damage customer trust and incur significant financial and reputational costs.

- Regulatory Scrutiny: Amadeus must navigate diverse and often conflicting international data privacy laws, including GDPR and similar frameworks enacted in other regions.

- Data Security Investment: Significant capital is allocated annually to cybersecurity infrastructure and personnel to protect vast datasets from breaches and unauthorized access.

- Compliance Costs: Ensuring adherence to a multitude of global regulations incurs substantial operational costs, including legal counsel, audits, and technology upgrades.

- Evolving Threat Landscape: The company must constantly adapt its security measures to counter increasingly sophisticated cyberattack methods targeting sensitive travel and personal information.

Amadeus's substantial reliance on its Air Distribution segment, while historically a strength, represents a significant weakness. This segment, a major revenue driver, is highly susceptible to fluctuations in global air travel, as demonstrated by the 70% booking drop during the COVID-19 pandemic in 2020. Any future downturns in the airline industry, whether economic or event-driven, could disproportionately impact Amadeus's financial performance.

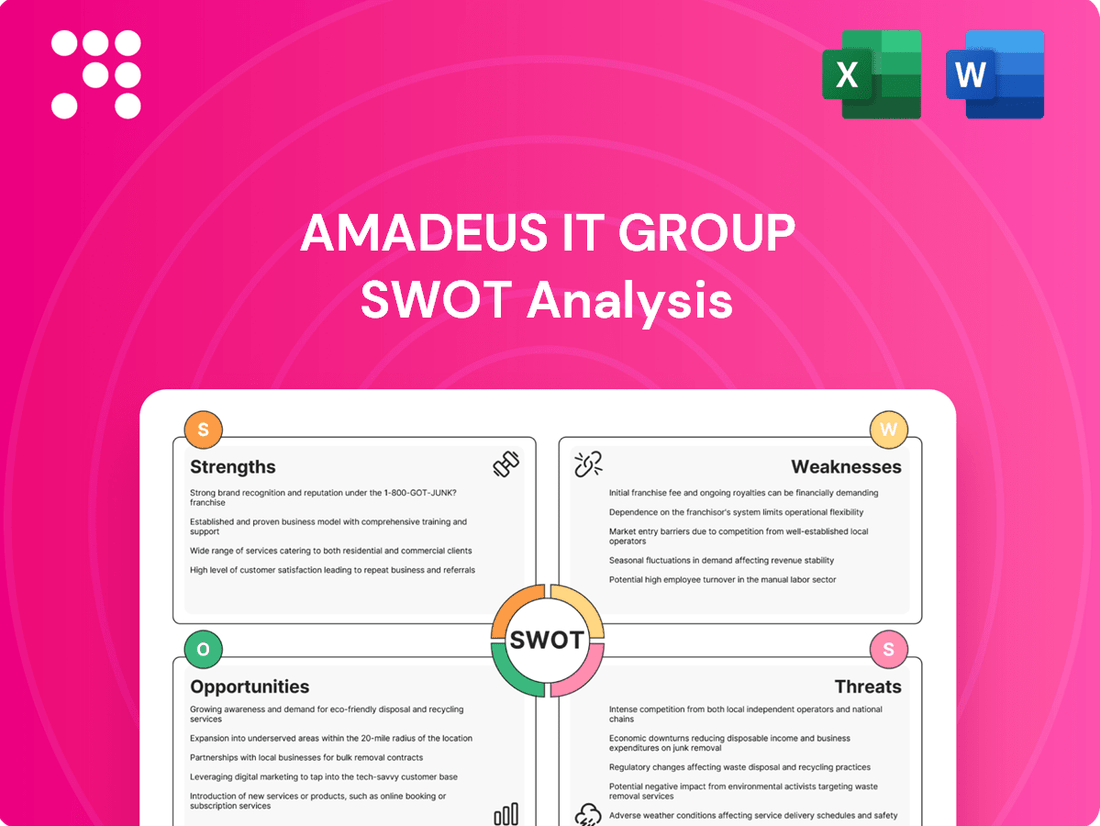

Preview Before You Purchase

Amadeus IT Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Amadeus IT Group's Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into Amadeus's competitive landscape and future prospects.

Opportunities

Amadeus sees significant growth potential in the hospitality sector, with major hotel chains increasingly adopting its technology platforms. Hoteliers are signaling substantial investments in technology upgrades, creating a fertile ground for Amadeus's solutions. For instance, by the end of 2024, many leading hotel groups are expected to have completed or be in the process of implementing new property management systems and guest-facing technologies, areas where Amadeus excels.

The company's strategic push into payments and fintech is another key opportunity. Recent acquisitions and the attainment of e-money licenses position Amadeus to offer more comprehensive financial services throughout the travel journey. This expansion allows them to capture a larger share of transaction value, moving beyond just booking systems to facilitate payments for a wider range of travel-related services, a trend that gained significant momentum in early 2025 with increased cross-border travel spending.

Amadeus is making significant strides in New Distribution Capability (NDC) adoption, positioning itself as a key aggregator for this modern XML-based standard. This strategic investment allows them to provide travel sellers and airlines with more detailed and personalized content, a crucial step in modernizing air travel retailing. By facilitating this shift, Amadeus is not only driving industry transformation but also unlocking new avenues for revenue generation as the sector embraces advanced distribution methods.

The resurgence of business travel, particularly with corporate travel managers boosting their technology investments, offers a substantial growth avenue for Amadeus. This trend was evident in early 2024 as companies resumed in-person meetings and events.

Amadeus is well-positioned to capitalize on this by further developing its corporate travel and expense management offerings. Innovations like AI-driven personal assistants and streamlined digital expense reporting are key to meeting the changing demands of both business travelers and their employers.

Advancements in AI and Biometric Technologies

The rapid integration of Generative AI and biometric technologies presents significant opportunities for Amadeus to redefine travel. By harnessing AI, Amadeus can develop smarter search functionalities and deliver hyper-personalized travel recommendations, directly addressing traveler needs. This AI-driven personalization is crucial as consumer expectations for tailored experiences continue to rise across all sectors.

Biometrics offer a pathway to streamline passenger journeys, from check-in to boarding, enhancing both security and convenience. For instance, the global biometrics market is projected to reach USD 134.2 billion by 2030, indicating strong demand for these solutions. Amadeus can integrate these technologies to create seamless, secure, and efficient travel processes, thereby boosting customer satisfaction and operational efficiency for its clients.

- AI-Powered Personalization: Amadeus can leverage AI to analyze vast datasets, enabling highly personalized travel offers and itinerary planning, improving customer engagement.

- Biometric Integration: Implementing biometric solutions for identity verification can significantly speed up passenger processing at airports and border control points, reducing wait times.

- Operational Efficiency Gains: AI can optimize airline operations, such as flight scheduling and resource management, leading to cost savings and improved service delivery.

- Enhanced Security: Biometrics provide a robust layer of security, ensuring traveler identity and mitigating risks throughout the travel ecosystem.

Sustainability-Driven Technology Solutions

The increasing emphasis on environmental, social, and governance (ESG) factors presents a significant opportunity for Amadeus. The company can leverage its technological expertise to create and market solutions that enable travel businesses to meet their sustainability targets, like cutting carbon footprints and boosting efficiency.

This strategic focus aligns with global trends. For instance, the International Air Transport Association (IATA) has set a goal for net-zero carbon emissions from aviation by 2050. Amadeus can develop technologies that support this transition, such as advanced route optimization software or platforms for managing sustainable aviation fuels.

- Develop AI-powered tools for optimizing flight paths to reduce fuel consumption.

- Offer solutions that facilitate the tracking and reporting of carbon emissions across the travel value chain.

- Integrate features that promote and enable sustainable travel choices for consumers.

Amadeus is capitalizing on the growing demand for advanced technology in the hospitality sector, with major hotel chains actively investing in upgrades. The company's expansion into fintech and payments, bolstered by strategic acquisitions and licenses, allows it to capture more value from travel transactions, particularly as cross-border spending increased in early 2025. Furthermore, Amadeus is a key player in the adoption of New Distribution Capability (NDC), enabling richer content and personalized offers for travel retailing, a critical modernization effort for the industry.

Threats

Rapid technological shifts, especially in blockchain and direct-to-consumer approaches where airlines might bypass Global Distribution Systems (GDS), present a significant threat to Amadeus's established distribution channels. For instance, the increasing adoption of NDC (New Distribution Capability) by airlines, which allows them to offer richer content and personalized offers directly, could reduce reliance on traditional GDS platforms. Amadeus reported a 14.5% increase in revenue in Q1 2024 compared to Q1 2023, reaching €2.9 billion, indicating continued strength, but this disruption could challenge future growth if not effectively managed.

While Amadeus is actively investing in NDC and artificial intelligence (AI) to stay ahead, the speed and magnitude of these technological disruptions pose a risk. If the company's adaptation pace falters or if entirely new, unanticipated technologies emerge and gain rapid traction, Amadeus could find its market position challenged. The travel technology sector is highly dynamic, and staying competitive requires continuous innovation and strategic agility to counter these evolving threats.

Large tech players like Google and Amazon, with their extensive cloud infrastructure and data analytics capabilities, are increasingly eyeing the travel technology sector. This presents a significant threat to Amadeus as these companies can leverage their existing user bases and technological prowess to offer integrated travel solutions, potentially disrupting traditional distribution models. For instance, Google's continued expansion of its travel search and booking functionalities directly competes with Amadeus's core business.

Amadeus, as a critical hub for travel data, is a prime target for sophisticated cyberattacks. The company's extensive processing of sensitive passenger information means a successful breach could have devastating consequences. For instance, the travel industry, in general, saw a significant increase in ransomware attacks, with some reports indicating a 70% rise in the first half of 2024 compared to the same period in 2023, highlighting the escalating threat landscape Amadeus navigates.

A major cybersecurity incident for Amadeus could result in substantial financial penalties, potentially running into hundreds of millions of dollars, especially with stricter data protection regulations like GDPR. Beyond fines, the damage to its reputation and the erosion of trust among its vast network of airlines, travel agencies, and passengers could be irreparable, severely impacting its operational capabilities and market position.

Economic Slowdowns and Geopolitical Instability

Global economic slowdowns and persistent high inflation present a significant threat to Amadeus IT Group. These conditions can curb consumer and business spending on travel, directly impacting the transaction volumes that form the core of Amadeus' revenue streams. For instance, if disposable income shrinks due to inflation, fewer people will opt for leisure travel, affecting airline bookings and hotel stays processed through Amadeus platforms.

Furthermore, geopolitical instability, including regional conflicts or trade disputes, can disrupt travel patterns and create uncertainty. This uncertainty often leads to reduced travel demand and can also impact the operational stability of airlines and other travel providers that rely on Amadeus' systems. In 2023, while the travel industry saw recovery, ongoing global economic headwinds and geopolitical tensions, such as those in Eastern Europe, continued to pose risks to sustained growth.

- Reduced Travel Demand: Economic downturns and inflation directly decrease discretionary spending on travel, leading to fewer bookings.

- Transaction Volume Impact: A drop in travel bookings directly translates to lower transaction volumes for Amadeus, affecting revenue.

- Geopolitical Disruptions: Conflicts and instability can alter travel routes and overall demand, creating unpredictable market conditions.

- External Control: These macro-economic and geopolitical factors are largely outside Amadeus' direct control, making them difficult to mitigate internally.

Evolving Regulatory Landscape and Compliance Costs

The global regulatory environment is becoming more intricate and demanding, especially concerning data privacy, fair competition, and the rollout of new digital services. This evolving landscape presents a significant threat to Amadeus IT Group, potentially leading to increased compliance burdens and operational limitations. For instance, stricter data protection laws like GDPR and similar regulations worldwide necessitate substantial investments in security and data handling protocols.

Furthermore, Amadeus's prominent market share in areas like global distribution systems (GDS) could attract anti-trust scrutiny from regulatory bodies in key markets. Such investigations might result in mandated changes to business practices or even penalties, impacting revenue streams and market flexibility. The company must remain agile and invest in robust compliance frameworks to navigate these challenges effectively.

- Increased Compliance Costs: Amadeus faces rising expenses for adhering to diverse global regulations on data privacy and digital services.

- Operational Restrictions: New regulations may limit how Amadeus operates, particularly concerning data handling and market access.

- Anti-trust Scrutiny: The company's dominant position could lead to investigations and potential sanctions, affecting its competitive strategy.

The increasing adoption of airline-specific technologies like NDC poses a threat as it allows carriers to bypass traditional Global Distribution Systems (GDS). This shift could reduce Amadeus's reliance on its core distribution business. Furthermore, large tech giants entering the travel space, leveraging their existing infrastructure and user bases, present a competitive challenge by offering integrated travel solutions that could disrupt Amadeus's market position.

Cybersecurity risks are paramount for Amadeus due to the sensitive data it handles. A successful breach could lead to significant financial penalties and reputational damage, impacting trust across its network. In the first half of 2024, the travel industry saw a notable rise in ransomware attacks, underscoring the escalating threat landscape Amadeus must navigate.

Economic slowdowns and inflation can significantly curb travel spending, directly impacting Amadeus's transaction-based revenue. Geopolitical instability further exacerbates this by disrupting travel patterns and creating market uncertainty, as seen with ongoing global tensions impacting travel demand in 2023.

Amadeus faces increasing compliance costs and potential operational restrictions due to evolving global regulations on data privacy and digital services. Its dominant market share also invites anti-trust scrutiny, which could lead to mandated business practice changes or penalties, affecting market flexibility.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating Amadeus's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.