Amadeus IT Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amadeus IT Group Bundle

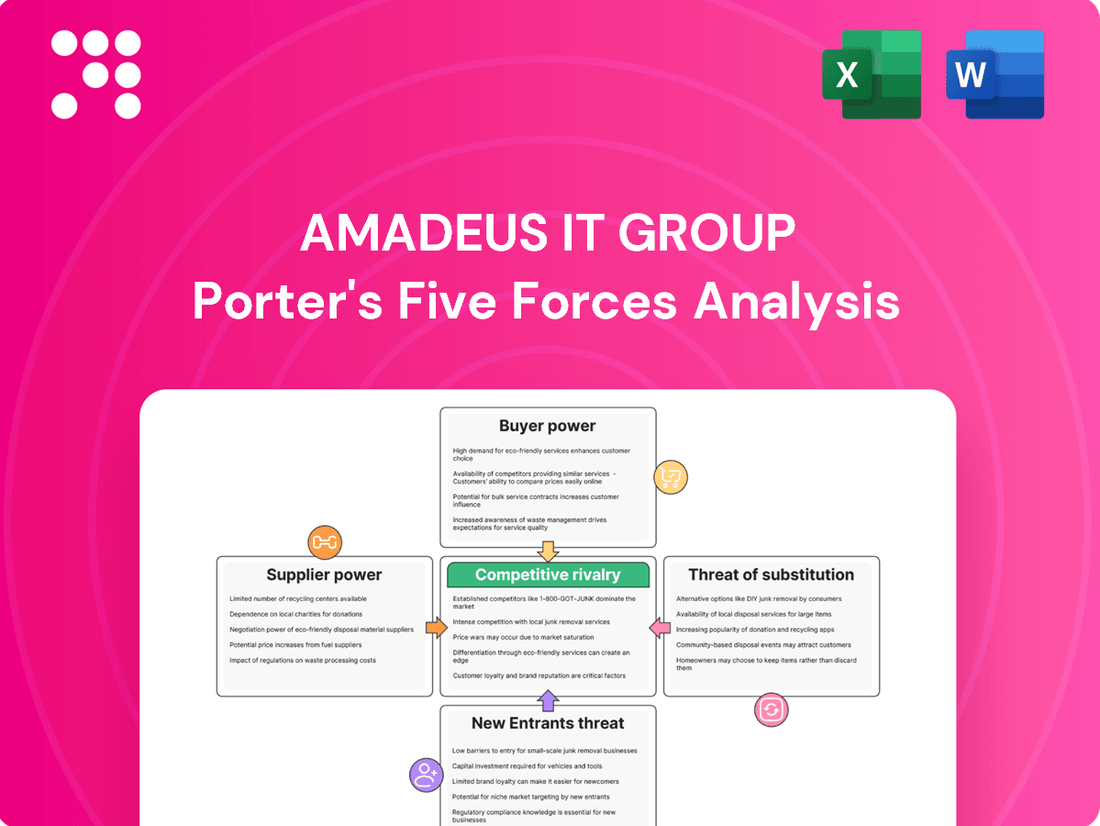

Amadeus IT Group operates in a dynamic travel technology landscape, facing significant competitive pressures. Understanding the interplay of buyer power, supplier leverage, the threat of new entrants, and the intensity of rivalry is crucial for strategic planning.

The complete report reveals the real forces shaping Amadeus IT Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Amadeus IT Group's reliance on specialized technology and cloud providers significantly influences its bargaining power. The company depends on firms like Microsoft and Google Cloud for critical infrastructure, especially with the rise of AI and cloud computing. These providers hold considerable sway due to their unique, essential services.

While Amadeus employs a multi-cloud approach to lessen dependency, the specialized nature of processing vast, secure travel transactions makes switching suppliers difficult and costly. This inherent lack of easy substitutes for these advanced technological capabilities grants these suppliers substantial bargaining power.

Amadeus, as a critical intermediary for travel content, relies heavily on airlines, hotels, and other service providers for up-to-date inventory and pricing. While Amadeus is a dominant Global Distribution System, the increasing adoption of airline-led New Distribution Capability (NDC) standards could shift some power back to suppliers, allowing them greater control over how their content is presented and priced. Despite this, Amadeus's extensive network and transaction volume continue to make it a vital partner for many travel providers, limiting the suppliers' ability to exert excessive pressure.

The bargaining power of suppliers for Amadeus IT Group, particularly concerning human capital and talent, is substantial. Developing and maintaining sophisticated travel technology demands expertise in software engineering, data science, and cybersecurity. The limited availability of specialized talent, especially in cutting-edge areas like AI and machine learning, significantly enhances employees' leverage.

Amadeus's reliance on these skilled professionals means they hold considerable sway. This necessitates significant investment in research and development, alongside robust talent acquisition strategies, to secure and retain the workforce needed to maintain its competitive position in the market.

Payment Processing and Fintech Partners

Amadeus relies on payment processing and fintech partners to offer seamless transactions, a critical component in the travel sector. The acquisition of payments specialist Voxel in 2024 underscores the strategic value Amadeus places on these services. This move also points to the significant influence these specialized financial technology firms wield.

The bargaining power of these suppliers stems from the increasing demand for secure, efficient, and varied payment methods. Their ability to innovate and provide these solutions gives them leverage in negotiations with companies like Amadeus. This is particularly true as the travel industry continues to digitize and customer expectations for payment flexibility rise.

- Strategic Acquisitions: Amadeus's 2024 acquisition of Voxel demonstrates a commitment to strengthening its payment capabilities, acknowledging the importance of these partners.

- Industry Demand: The travel industry's need for secure and diverse payment options empowers fintech providers.

- Technological Advancement: The specialized expertise and innovative solutions offered by fintech companies grant them considerable bargaining power.

Hardware and Network Infrastructure Vendors

Amadeus IT Group relies heavily on hardware and network infrastructure vendors to maintain its extensive global network and data centers. While the market for standard IT hardware is competitive, specialized components and critical network solutions often originate from a smaller pool of suppliers with significant market influence. For instance, in 2024, the demand for high-performance computing and specialized networking gear, crucial for Amadeus's real-time transaction processing, continued to be dominated by a few key players.

The bargaining power of these suppliers can be substantial, particularly for custom-engineered solutions or proprietary technologies that Amadeus needs for its unique operational requirements. If these key vendors were to increase prices or experience supply chain disruptions, it could directly impact Amadeus's operational efficiency and cost structure. This was evident in early 2024 when certain semiconductor shortages led to extended lead times and increased costs for specialized hardware, affecting IT infrastructure investments across various industries, including travel technology.

- Supplier Concentration: The market for specialized network equipment and data center hardware, essential for Amadeus's global operations, is often concentrated among a few dominant vendors.

- Technological Dependence: Amadeus's reliance on specific, high-performance hardware and network solutions can increase supplier leverage, especially when these are proprietary or require specialized integration.

- Impact of Disruptions: In 2024, global supply chain issues, particularly for advanced semiconductors, highlighted the potential for vendor-induced disruptions and cost increases that could affect Amadeus's operational continuity and capital expenditure plans.

The bargaining power of suppliers for Amadeus IT Group is notably influenced by specialized technology providers, particularly in cloud infrastructure and AI. Companies like Microsoft and Google Cloud, essential for Amadeus's operations, possess significant leverage due to the unique and critical nature of their services. While Amadeus employs a multi-cloud strategy, the specialized requirements for processing vast travel data make switching providers complex and expensive, solidifying these suppliers' strong position.

In 2024, Amadeus's acquisition of payments specialist Voxel highlights the growing influence of fintech partners. The travel industry's increasing demand for secure, diverse, and seamless payment solutions empowers these financial technology firms, granting them considerable bargaining power due to their innovative capabilities and the critical nature of their services.

Human capital also represents a significant supplier power for Amadeus. The need for highly specialized talent in areas like AI, data science, and cybersecurity means that skilled professionals hold considerable sway, necessitating substantial investment in talent acquisition and retention to maintain Amadeus's competitive edge.

Hardware and network infrastructure vendors also wield substantial bargaining power, especially for specialized components and critical network solutions. In 2024, global semiconductor shortages demonstrated how disruptions and price increases from a concentrated supplier base can directly impact Amadeus's operational efficiency and capital expenditure plans.

| Supplier Type | Key Dependencies | Bargaining Power Factors | 2024 Relevance |

| Cloud Providers (e.g., Microsoft Azure, Google Cloud) | Critical infrastructure, AI/ML services | Specialized services, high switching costs | Essential for advanced data processing and AI integration |

| Fintech/Payment Processors (e.g., Voxel) | Secure and diverse payment transactions | Industry demand for digital payments, innovation | Strategic acquisitions underscore importance and leverage |

| Specialized IT Talent | Software engineering, data science, cybersecurity expertise | Limited availability of niche skills, high demand | Crucial for R&D and maintaining technological advantage |

| Hardware/Network Vendors | High-performance computing, specialized networking equipment | Supplier concentration, proprietary technology, supply chain sensitivity | Impacted by 2024 semiconductor shortages and lead times |

What is included in the product

This analysis unpacks the competitive forces impacting Amadeus IT Group, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Amadeus IT Group's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures, perfect for quick strategic decision-making and identifying key pain points within the travel technology landscape.

Customers Bargaining Power

Major airlines and large travel providers form a concentrated customer base for Amadeus, wielding significant bargaining power. These entities, including global hotel chains, often demand tailored solutions and competitive pricing. For instance, the industry-wide push for New Distribution Capability (NDC) showcases how these powerful customers can influence product development roadmaps.

Online Travel Agencies (OTAs) like Booking.com and Expedia hold significant bargaining power. While they depend on Global Distribution Systems (GDS) like Amadeus for flight and hotel content, their direct access to millions of consumers and substantial marketing budgets allow them to negotiate favorable terms. In 2024, these OTAs continued to exert pressure on GDS providers, seeking better commission rates and more direct integration options with suppliers.

This power dynamic means OTAs can increasingly bypass traditional GDS channels by establishing direct connections with airlines and hotels. This strategy aims to reduce distribution costs and gain greater control over the booking experience. Amadeus, therefore, faces the ongoing challenge of proving its indispensable value through innovative offerings, such as advanced data analytics and personalized customer experiences, to maintain its relationships with these key OTA partners.

Small to medium travel agencies possess limited individual bargaining power with GDS providers like Amadeus, as they rely heavily on the extensive content and technology offered. However, their collective purchasing volume represents a significant market segment, driving Amadeus to offer accessible platforms and broad content. The primary leverage these agencies hold stems from the existence of alternative Global Distribution Systems or the option for direct bookings with suppliers.

Corporate Travel Managers

Corporate travel managers wield considerable power due to the substantial travel spend they oversee. In 2024, businesses continue to prioritize digital efficiency, personalized travel experiences, and cost optimization, placing significant leverage in the hands of these managers. Their ability to select providers that offer seamless integration with expense management systems and leverage AI-powered tools for booking and itinerary management is a key factor.

This segment is highly attuned to service quality and technological innovation. For instance, a 2024 survey indicated that over 70% of corporate travel managers consider advanced booking technology a primary driver in vendor selection, directly impacting their bargaining power with travel management companies and technology providers like Amadeus.

- Demand for Digital Efficiency: Corporate clients expect intuitive, user-friendly platforms for booking, managing, and reporting travel expenses.

- Personalized Experiences: Tailored travel options and loyalty programs are increasingly important for employee satisfaction and retention.

- Cost-Effectiveness: Strong negotiation power on rates, fees, and ancillary services remains a critical consideration.

- Integration Capabilities: Seamless connection with existing enterprise resource planning (ERP) and expense management software is a non-negotiable requirement for many.

Airports and Border Authorities

Amadeus IT Group's bargaining power of customers within the airports and border authorities segment is notably strong. This is due to the highly specialized and mission-critical nature of the IT solutions provided, leading to substantial switching costs for these clients. For instance, the integration of Amadeus's systems with existing airport infrastructure and government databases is complex and time-consuming, making a change a significant undertaking.

While this segment represents a smaller customer base compared to airlines, the long-term nature of their contracts and the essential services Amadeus delivers grant these clients considerable leverage. They often demand highly customized solutions to meet unique operational requirements and expect continuous, reliable support. This reliance means airports and border authorities can exert significant influence over pricing and service level agreements, particularly given the high stakes involved in managing air travel and security.

For example, in 2024, many airports globally continued to invest heavily in digital transformation initiatives, seeking more efficient passenger processing and enhanced security. This creates opportunities for Amadeus, but also amplifies the bargaining power of these authorities who are looking for best-in-class, integrated solutions that minimize disruption and maximize operational flow.

- High Switching Costs: The complexity and mission-critical nature of IT systems for airports and border authorities create significant barriers to changing providers.

- Long-Term Contracts: Established relationships and lengthy agreements give these customers sustained influence over Amadeus.

- Essential Services: The vital role of Amadeus's solutions in airport operations and border control underscores the customers' leverage.

- Demand for Tailored Solutions: Airports and border authorities often require bespoke IT systems, giving them negotiation power.

The bargaining power of customers for Amadeus IT Group is substantial, driven by a concentrated client base and industry dynamics. Major airlines and large travel providers, including hotel chains, represent a significant portion of Amadeus's revenue. These entities often demand customized solutions and competitive pricing, influencing Amadeus's product development. For instance, the industry's adoption of New Distribution Capability (NDC) highlights how powerful customers can shape technological roadmaps.

Online Travel Agencies (OTAs) like Booking.com and Expedia possess considerable leverage. Despite their reliance on Global Distribution Systems (GDS) for content, their direct access to consumers and substantial marketing budgets enable them to negotiate favorable terms. In 2024, OTAs continued to pressure GDS providers for better commissions and direct integration, sometimes bypassing traditional channels to reduce costs.

Corporate travel managers also wield significant power due to the large travel volumes they manage. In 2024, businesses prioritized digital efficiency and cost optimization, giving these managers leverage. Their preference for seamless integration with expense management systems and AI-powered booking tools influences vendor selection. A 2024 survey showed over 70% of corporate travel managers consider advanced booking technology a primary factor in choosing vendors.

Airports and border authorities, while a smaller segment, have strong bargaining power due to the mission-critical nature of Amadeus's IT solutions and high switching costs. Their long-term contracts and need for tailored, reliable systems give them influence over pricing and service agreements. In 2024, these authorities' digital transformation efforts amplified their demand for integrated, efficient solutions.

| Customer Segment | Bargaining Power | Key Drivers of Power | Examples of Influence |

| Major Airlines & Large Travel Providers | High | Concentrated customer base, demand for tailored solutions, influence on product roadmaps (e.g., NDC adoption) | Negotiating pricing, demanding specific features, influencing technology standards |

| Online Travel Agencies (OTAs) | High | Direct consumer access, substantial marketing budgets, ability to bypass GDS, negotiation for favorable terms | Seeking better commission rates, demanding direct integrations, influencing platform fees |

| Corporate Travel Managers | High | Significant travel spend, focus on digital efficiency and cost optimization, preference for integrated solutions | Prioritizing AI-powered tools, demanding seamless expense management integration, influencing vendor selection based on technology |

| Airports & Border Authorities | High | Mission-critical IT solutions, high switching costs, long-term contracts, need for customized systems | Demanding bespoke IT systems, influencing service level agreements, dictating integration requirements |

Preview Before You Purchase

Amadeus IT Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details how Amadeus IT Group's competitive landscape is shaped by the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes, providing a comprehensive strategic overview.

Rivalry Among Competitors

The Global Distribution System (GDS) market is a tight race, largely controlled by just three giants: Amadeus, Sabre, and Travelport. These players, as of early 2024, command a substantial portion of the global market, creating an oligopoly where competition is fierce. They battle for dominance through cutting-edge technology, aggressive pricing, and securing lengthy partnerships with airlines and travel agencies.

Amadeus, for instance, has consistently reinforced its leading position by channeling significant investment into research and development. This focus on innovation, coupled with a broad spectrum of integrated services, allows Amadeus to stay ahead in this concentrated competitive landscape. The drive for market share means constant evolution and adaptation to the needs of the travel ecosystem.

The travel technology sector is a hotbed of innovation, with artificial intelligence, machine learning, and cloud computing driving constant change. Competitors are fiercely vying to create more efficient and personalized travel experiences, making it essential to keep pace.

Amadeus is heavily investing in research and development, with a significant portion of its revenue dedicated to innovation. For instance, in 2023, Amadeus reported R&D expenses of €1.1 billion, underscoring its commitment to staying at the forefront of technological advancements and maintaining a competitive edge.

Strategic alliances, such as the one with Google Cloud for AI integration, are vital for Amadeus. These partnerships allow them to leverage cutting-edge technologies and accelerate the development of new solutions, ensuring they remain a leader in a rapidly evolving market.

The airline industry's drive towards New Distribution Capability (NDC) is a significant factor in competitive rivalry for Amadeus. NDC allows airlines to bypass traditional Global Distribution Systems (GDS) like Amadeus, selling their content directly to travel agents and other sellers. This direct connection empowers airlines, potentially reducing their reliance on GDS intermediaries and increasing competitive pressure on Amadeus to adapt its business model.

Amadeus is actively responding to this trend by positioning itself as a leading NDC aggregator. By integrating NDC content from various airlines into its platform, Amadeus aims to remain a central hub for travel distribution. This strategy is crucial for maintaining its market position, but it also means Amadeus must compete directly with airlines offering their own NDC channels, intensifying the rivalry.

As of early 2024, a substantial number of airlines, including major carriers like Lufthansa Group and American Airlines, have been actively developing and deploying their NDC capabilities. This widespread adoption means that the competitive landscape is rapidly evolving, with airlines increasingly able to control their distribution and offer personalized content, directly challenging the traditional GDS model.

Geographic Market Share and Focus

Amadeus IT Group holds a strong global position, especially within the European market. However, rivals like Sabre demonstrate a more significant footprint in North America, creating regional competitive dynamics.

Competitive intensity can escalate in particular geographic areas or specific market niches, necessitating localized strategic approaches. For instance, Amadeus's focus on expanding its offerings in the hospitality and payments sectors is a strategic move to counter these regional competitive pressures and diversify its income sources.

- Global Presence: Amadeus leads in Europe, while Sabre has a stronger North American presence.

- Regional Competition: Rivalry intensifies in specific geographic markets and segments.

- Strategic Diversification: Amadeus expands into hospitality and payments to reduce regional dependency.

Mergers, Acquisitions, and Partnerships

The competitive intensity within the travel technology sector is significantly influenced by strategic mergers, acquisitions, and partnerships. These moves are designed to bolster capabilities, expand market presence, and enhance technological portfolios. Amadeus's proactive engagement in this area, exemplified by its acquisitions of Vision-Box and Voxel in 2024, alongside its strategic alliances with major technology firms, underscores this dynamic. Such consolidation efforts can lead to a more concentrated market, fostering the emergence of more robust and diversified competitors.

These strategic maneuvers directly impact competitive rivalry by reshaping the market structure and competitive advantages. For instance, Amadeus's 2024 acquisitions aim to integrate advanced identity management and travel intelligence solutions, thereby strengthening its end-to-end offering. These integrations can create significant barriers to entry for smaller players and force established competitors to adapt their own strategies, either through similar M&A activity or by focusing on niche specialization.

- Strategic Acquisitions: Amadeus acquired Vision-Box and Voxel in 2024, enhancing its biometric and travel intelligence capabilities.

- Market Consolidation: These acquisitions contribute to market consolidation, potentially creating stronger, more diversified competitors.

- Partnership Ecosystem: Collaborations with tech giants expand Amadeus's reach and technological integration, influencing competitive dynamics.

- Capability Expansion: Mergers and partnerships are key drivers for expanding service offerings and technological innovation in the travel tech industry.

The competitive landscape for Amadeus IT Group is dominated by a few major players, primarily Sabre and Travelport, creating an oligopolistic market structure. This intense rivalry is fueled by continuous innovation, aggressive pricing strategies, and the securing of long-term contracts with airlines and travel agencies. Amadeus's significant investment in R&D, amounting to €1.1 billion in 2023, highlights its commitment to maintaining a leading edge in this dynamic environment.

The rise of New Distribution Capability (NDC) presents a direct challenge, as airlines increasingly seek to distribute content directly, bypassing traditional GDS providers like Amadeus. Major carriers, including Lufthansa Group and American Airlines, have been actively adopting NDC, forcing Amadeus to adapt by becoming a leading NDC aggregator to retain its central role in travel distribution. This strategic pivot is crucial, as it positions Amadeus to compete directly with airlines' own NDC channels, intensifying the competitive pressure.

Regional market strengths also play a role, with Amadeus holding a strong position in Europe while Sabre has a more substantial presence in North America. To counter these regional dynamics and diversify its revenue streams, Amadeus is strategically expanding into sectors like hospitality and payments. Furthermore, strategic acquisitions, such as the 2024 purchases of Vision-Box and Voxel, are strengthening Amadeus's capabilities in areas like identity management and travel intelligence, contributing to market consolidation and creating more formidable competitors.

SSubstitutes Threaten

Airlines and hotels are bolstering their direct booking channels, creating a significant substitute threat for Amadeus. By investing in their own websites and apps, these providers can bypass Global Distribution Systems (GDS), aiming to cut distribution costs and foster direct customer loyalty. This trend saw continued momentum in 2024 as travel providers focused on enhancing their digital customer experience.

Online Travel Agencies (OTAs) present a nuanced threat to Amadeus. While many OTAs are Amadeus's clients, their growing ability to bypass Global Distribution Systems (GDS) by directly contracting with airlines and hotels, or by developing their own booking technology, positions them as potential substitutes. This direct approach allows OTAs to potentially capture more value and reduce their dependency on GDS providers like Amadeus.

Major OTAs, such as Expedia Group and Booking Holdings, have invested heavily in creating sophisticated platforms that offer end-to-end travel planning and booking services. These comprehensive offerings provide consumers with a compelling alternative to traditional travel agencies that rely on GDS. For instance, in 2023, Expedia Group reported gross bookings of $106.6 billion, showcasing the immense scale and direct consumer reach these platforms command, which can diminish the necessity of GDS for a significant portion of travel transactions.

New digital platforms are emerging, utilizing technologies like AI and blockchain to simplify travel booking and offer personalized experiences. These platforms, often with direct-to-consumer models, present a long-term substitute threat by potentially disrupting traditional Global Distribution System (GDS) functions. For instance, by mid-2024, several startups are expected to launch AI-powered travel assistants promising significantly more tailored itineraries than currently available.

These emerging technologies aim to provide more transparent pricing and a seamless user journey, directly challenging the value proposition of established GDS providers. Amadeus, recognizing this, is actively investing in these very technologies, aiming to integrate them into its existing ecosystem rather than being sidelined. This proactive approach is crucial, as the travel tech landscape continues to evolve rapidly, driven by consumer demand for greater efficiency and personalization.

Corporate Travel Management Software

The threat of substitutes for Amadeus IT Group's corporate travel management software is significant. Companies are increasingly looking for integrated solutions that bypass traditional Global Distribution System (GDS) channels. These alternatives often bundle direct booking capabilities with robust policy compliance and expense management features, offering a streamlined experience for business travel. For instance, many businesses are adopting platforms that consolidate travel services, reducing reliance on separate booking tools.

These substitute solutions aim to simplify the entire travel process, from booking to reimbursement. They often leverage technology to enforce corporate travel policies automatically, which can lead to substantial cost savings. In 2024, the corporate travel technology market saw continued growth in adoption of these integrated platforms, with many businesses prioritizing user experience and data analytics for better travel spend visibility. This trend puts pressure on traditional GDS providers to innovate.

- Direct Booking Platforms: Solutions allowing employees to book travel directly through company-approved channels, often integrated with HR and expense systems.

- Travel Management Companies (TMCs) with Proprietary Tech: TMCs offering their own technology platforms that may not heavily rely on GDS for all bookings.

- Expense Management Software with Travel Integration: Tools like SAP Concur or Expensify are expanding their travel booking functionalities, creating a consolidated solution.

Amadeus is actively responding to this threat by enhancing its own corporate travel solutions, such as Amadeus Cytric. This strategic move aims to provide a competitive offering that incorporates the desired functionalities of these substitutes, including improved policy adherence and expense management. The company recognizes the need to offer a comprehensive, user-friendly platform to retain and attract corporate clients in a rapidly evolving market landscape.

Alternative Distribution Models (e.g., Blockchain)

The emergence of blockchain-based distribution systems presents a significant threat of substitutes for Amadeus's traditional Global Distribution System (GDS) model. These decentralized platforms aim to disintermediate the travel booking process, potentially offering increased transparency and reduced fees for both suppliers and consumers.

While currently in early stages, the potential for blockchain to streamline transactions and create direct connections within the travel ecosystem could offer a compelling alternative. For instance, companies exploring decentralized travel marketplaces are targeting a reduction in intermediary costs, a key value proposition against established GDS providers.

Amadeus acknowledges this evolving landscape and actively invests in research and development related to blockchain and other decentralized technologies. This proactive approach is crucial to understanding and potentially integrating these nascent substitutes into their future strategy, ensuring continued relevance in a changing market.

- Blockchain's Potential: Promises greater transparency and lower transaction costs by removing intermediaries.

- Industry Exploration: Various startups are developing decentralized travel marketplaces, challenging the GDS model.

- Amadeus's Strategy: Monitoring and investing in these emerging technologies to adapt to potential shifts in distribution.

The threat of substitutes for Amadeus IT Group is multifaceted, encompassing direct booking channels, online travel agencies (OTAs) with advanced capabilities, and emerging digital platforms. Airlines and hotels are increasingly investing in their own direct booking systems, a trend that gained significant traction in 2024 as they sought to reduce distribution costs and cultivate customer loyalty.

OTAs like Expedia and Booking Holdings, with their extensive reach and proprietary technology, also pose a substitute threat. Their ability to bypass traditional Global Distribution Systems (GDS) by forming direct partnerships or developing their own booking infrastructure allows them to capture more value. In 2023, Expedia Group's $106.6 billion in gross bookings highlights the scale of these direct consumer channels.

Emerging digital platforms leveraging AI and blockchain offer further substitution potential by simplifying travel booking and providing personalized experiences. These new entrants aim for greater transparency and efficiency, directly challenging the established GDS model. By mid-2024, several startups are expected to launch AI-powered travel assistants promising enhanced personalization.

| Substitute Type | Key Characteristics | Impact on Amadeus | 2024 Trend Example |

|---|---|---|---|

| Direct Booking Channels | Bypass GDS, reduce costs, build loyalty | Reduced GDS transaction volume | Continued investment by airlines and hotels in proprietary platforms |

| Advanced OTAs | Direct contracting, proprietary tech, end-to-end services | Potential disintermediation, reduced reliance on GDS | Expedia Group's $106.6B gross bookings (2023) demonstrates scale |

| Emerging Digital Platforms | AI/Blockchain, personalization, transparency | Disruption of traditional GDS functions | Anticipated launch of AI travel assistants by mid-2024 |

Entrants Threaten

Entering the global distribution system (GDS) market demands immense capital for sophisticated IT infrastructure, data centers, and worldwide network links. Amadeus's commitment to cloud migration and research and development, with over €1.4 billion invested in R&D in 2024, highlights the significant financial commitment needed, effectively deterring potential new competitors.

Amadeus IT Group thrives on powerful network effects. The more airlines, hotels, and travel agencies that use its Global Distribution System (GDS), the more valuable the platform becomes for everyone involved. This creates a significant advantage, as a new entrant would struggle to replicate the sheer volume of connections and data Amadeus already possesses.

Establishing trust and deep relationships with thousands of global travel players is a process that takes decades. Amadeus has cultivated these partnerships over many years, making it incredibly difficult for a new competitor to gain the same level of access and credibility. For instance, Amadeus's platform connects around 190 countries and territories, a testament to its long-standing global reach.

The significant technological complexity and the deep expertise required to develop and maintain Amadeus's advanced travel technology solutions, such as its reservation and inventory management systems, act as a substantial barrier to new entrants. These systems handle millions of daily transactions in real-time, demanding continuous innovation in fields like AI and data analytics, which are challenging for newcomers to quickly match.

Regulatory Hurdles and Compliance

The global travel sector presents substantial regulatory challenges for potential newcomers. Compliance with diverse international and national laws, including data privacy mandates like GDPR and industry-specific standards such as IATA NDC, requires significant investment and expertise. For instance, in 2024, the ongoing evolution of data protection regulations continues to impose stringent requirements on how customer information is handled, making market entry a complex undertaking.

New entrants must also contend with the substantial costs and time associated with achieving and maintaining compliance across various jurisdictions. This intricate web of regulations acts as a significant barrier, deterring potential competitors by escalating the initial capital outlay and operational complexity.

Key regulatory considerations include:

- Data Privacy Laws: Adherence to regulations like GDPR, CCPA, and others governing the collection, storage, and processing of personal travel data.

- Industry Standards: Compliance with standards set by bodies like IATA, such as the New Distribution Capability (NDC), which impacts how travel content is distributed.

- National Aviation Authorities: Meeting the requirements of aviation regulators in different countries for ticketing, booking, and operational aspects.

- Consumer Protection: Ensuring adherence to consumer rights legislation related to refunds, cancellations, and service provision.

Brand Loyalty and Switching Costs for Customers

Existing customers of Amadeus, especially major airlines and travel agencies, experience significant switching costs. These costs are tied to the deep integration of Amadeus systems, the extensive training required for staff, and the established operational workflows that are difficult to replicate with a new provider.

This inherent stickiness fosters a strong degree of brand loyalty. For new entrants, gaining traction is a considerable hurdle. Even with cutting-edge technology, attracting a significant customer base requires overcoming the inertia and investment already made by Amadeus's established clients.

- High Switching Costs: Airlines and travel agencies invest heavily in integrating Amadeus solutions into their operations, making a change disruptive and expensive.

- Customer Retention: Amadeus reported a strong customer retention rate, with over 95% of its revenue coming from recurring contracts as of 2023, underscoring the loyalty factor.

- Barriers to Entry: The need to replicate Amadeus's comprehensive suite of services and achieve similar levels of integration presents a substantial barrier for new competitors.

The threat of new entrants in the Global Distribution System (GDS) market is significantly mitigated by Amadeus's substantial capital requirements, network effects, and established customer relationships. The sheer scale of investment in IT infrastructure, estimated in the billions for a comparable setup, alongside decades of cultivating trust with travel partners, creates formidable barriers.

Technological complexity and regulatory hurdles further deter newcomers. Amadeus's advanced systems, handling millions of real-time transactions, demand deep expertise, while navigating diverse global data privacy and industry standards like IATA NDC requires significant compliance investment. For example, Amadeus's extensive reach connecting approximately 190 countries underscores the difficulty for new players to achieve similar global penetration.

High customer switching costs, driven by deep system integration and staff training, alongside Amadeus's impressive customer retention rate of over 95% in 2023, solidify its market position. These factors make it exceptionally challenging for new entrants to disrupt Amadeus's established ecosystem and gain market share.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Amadeus IT Group is built upon a foundation of comprehensive data, including Amadeus's annual reports and investor presentations, alongside industry-specific reports from leading market research firms and analysis from financial institutions.

We leverage data from Amadeus's official filings and public disclosures, complemented by insights from reputable industry publications and economic databases, to provide a robust assessment of the competitive landscape.