Amadeus IT Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amadeus IT Group Bundle

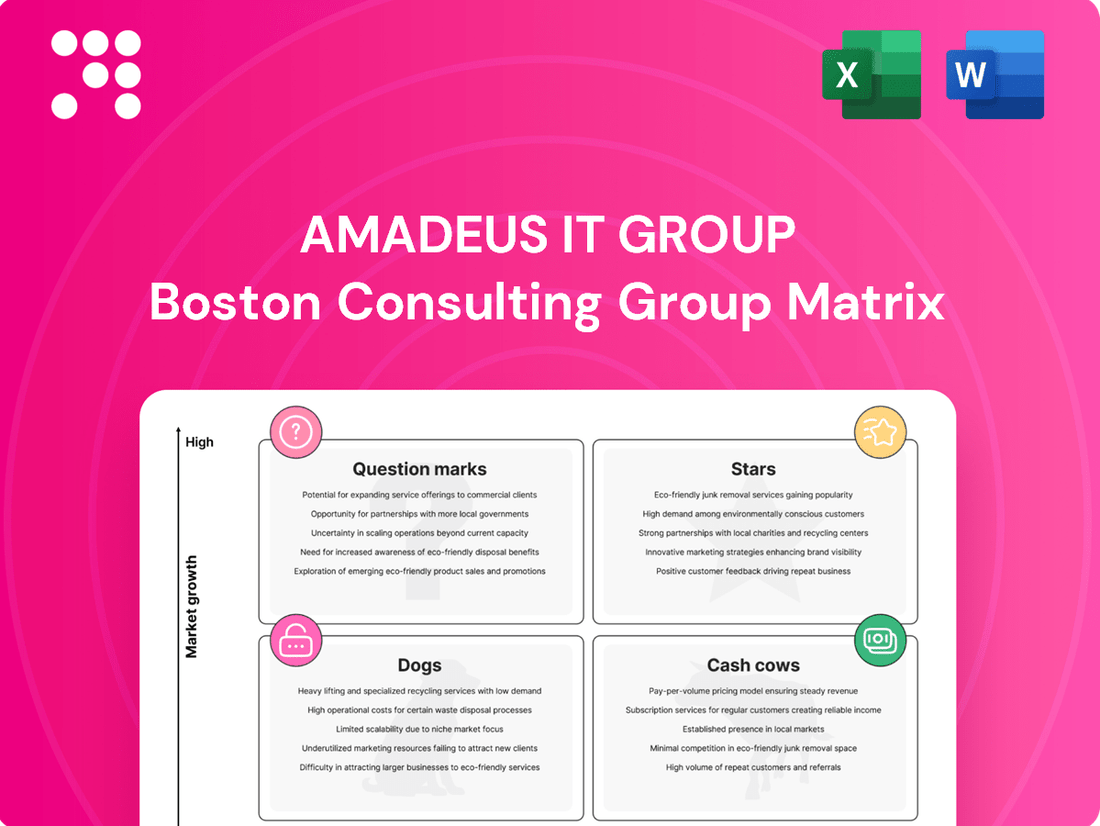

Curious about Amadeus IT Group's product portfolio performance? Our BCG Matrix preview offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. To truly unlock strategic advantage and make informed decisions about resource allocation and future investments, dive deeper with the full BCG Matrix report.

Gain a comprehensive understanding of Amadeus IT Group's competitive landscape by purchasing the complete BCG Matrix. This detailed analysis provides quadrant-by-quadrant insights and actionable recommendations, empowering you to navigate the complexities of the travel technology market with confidence.

Don't miss out on the critical insights the full Amadeus IT Group BCG Matrix offers. It's your shortcut to understanding which products are driving growth, which require careful management, and where future opportunities lie. Invest in clarity and strategic foresight today.

Stars

Amadeus is positioning itself as the primary hub for New Distribution Capability (NDC) transactions, a move driven by significant investment and a clear strategy. This focus taps into a burgeoning market where airlines are upgrading their retail operations to offer more customized and dynamic travel content. By 2024, the travel industry's embrace of NDC is expected to accelerate, with projections indicating a substantial increase in NDC-enabled bookings.

The company's commitment to NDC is evident in its aggressive pursuit of aggregation. This strategy is crucial as airlines increasingly adopt NDC to bypass traditional distribution channels and present richer, more personalized offers. Amadeus's ability to consolidate these diverse NDC streams makes it an indispensable partner for both airlines and travel agencies navigating this complex landscape.

Strategic collaborations are key to Amadeus's NDC dominance. Partnerships with major carriers such as British Airways and Thai Airways for NDC content distribution highlight their leading edge. These agreements are not just about volume; they signify Amadeus's role in shaping the future of travel retailing, ensuring access to a wider array of airline products and services for the end consumer.

Following its January 2024 acquisition of Vision-Box, Amadeus IT Group has significantly bolstered its biometric solutions for airports and border control. This strategic move positions Amadeus to capitalize on the burgeoning demand for enhanced security and streamlined passenger experiences. The integration of Vision-Box's advanced hardware and software is crucial in a market where passenger flow efficiency is paramount.

The biometric solutions segment for airports and border control is a high-growth area, fueled by global initiatives to improve airport security and operational efficiency. Amadeus's expanded offering directly addresses this need, supporting a market where a remarkable 98% of airlines have already embarked on biometric implementation plans. This indicates a strong market readiness and a clear trend towards widespread adoption.

Amadeus is heavily invested in generative AI for the travel sector, aiming to enhance every stage of the traveler's journey. This includes everything from sparking initial travel ideas and detailed planning to providing real-time support during trips and analyzing customer feedback afterward.

For 2025, many travel businesses are prioritizing generative AI, and Amadeus is making substantial investments in research, development, and collaborations to harness AI's power. The goal is to create highly personalized travel experiences and boost operational efficiency.

Amadeus has pinpointed more than 100 potential applications for AI within the travel industry. This proactive approach positions them as a leader in adopting this game-changing technology.

Cloud-Based Travel Technology Platforms

Cloud-based travel technology platforms are a significant growth area for Amadeus, fitting into the Stars category of the BCG Matrix. The company's strategic shift to cloud architecture, with core systems migration targeted for completion by 2026, is designed to boost margins and scalability. This move aligns with the broader travel industry trend of leveraging cloud computing for flexible, demand-driven operations and enhanced customer experiences.

Amadeus's commitment to a multi-cloud strategy, including its partnership with Google Cloud, strengthens its position in this high-growth segment. This approach allows for the delivery of advanced, efficient, and dependable travel technology solutions. The travel tech market is projected for robust expansion, with cloud adoption being a key driver for innovation and competitive advantage.

- Market Growth: The global travel technology market is expected to reach approximately $11.3 billion by 2027, growing at a CAGR of 7.8% from 2020 to 2027.

- Cloud Adoption: A significant portion of travel companies are investing in cloud solutions to improve operational efficiency and customer engagement.

- Amadeus's Investment: Amadeus continues to invest heavily in its cloud infrastructure and offerings, aiming to capture a larger share of this expanding market.

- Strategic Partnerships: Collaborations with major cloud providers like Google Cloud are crucial for Amadeus to deliver cutting-edge solutions and maintain its market leadership.

Advanced Digital Payment Solutions (Outpayce, Xchange Payment Platform)

Amadeus's advanced digital payment solutions, including Outpayce and the Xchange Payment Platform, are positioned as strong contenders in the BCG Matrix, likely in the 'Stars' category. The company's strategic acquisitions in 2024, such as Voxel and Shift4, underscore a significant commitment to enhancing its capabilities in digital payments and e-invoicing specifically for the travel sector. This focus aligns with a market experiencing heightened demand for seamless payment experiences across diverse travel segments.

The growth trajectory for these solutions is further supported by recent developments. Amadeus secured an e-money license, a crucial step in expanding its payment services, and has entered into new agreements, signaling growing adoption and market confidence. These achievements point to a high-growth potential, driven by the modernization of travel payment processes, making Outpayce and the Xchange Payment Platform key drivers of Amadeus's future revenue and market share.

- Acquisitions in 2024: Voxel and Shift4 bolster Amadeus's digital payment and e-invoicing offerings for travel.

- Market Demand: Increased investment and demand for frictionless payment solutions across travel verticals.

- E-money License: Granting of an e-money license to Amadeus's payment division enhances service capabilities.

- Platform Traction: Outpayce and Xchange Payment Platform are gaining momentum with new agreements, indicating strong growth potential.

Amadeus's cloud-based travel technology platforms and its advanced digital payment solutions, including Outpayce and the Xchange Payment Platform, are positioned as Stars within the BCG Matrix. These segments represent high market growth and high relative market share for Amadeus. The company's significant investments, strategic acquisitions in 2024 like Voxel and Shift4, and partnerships, such as with Google Cloud, underscore their commitment to these areas. These initiatives are designed to capture substantial market share in a rapidly expanding travel technology and digital payments landscape.

| Amadeus IT Group BCG Matrix: Stars | Market Growth | Relative Market Share | Key Investments/Drivers | 2024/2025 Data Points |

|---|---|---|---|---|

| Cloud-Based Travel Technology | High (Global travel tech market projected to reach ~$11.3B by 2027, CAGR 7.8%) | High (Amadeus's strategic shift to cloud architecture) | Core systems migration (targeted completion by 2026), Google Cloud partnership | Cloud adoption is a key driver for innovation; 98% of airlines are investing in biometric plans, indicating a broader tech adoption trend. |

| Digital Payment Solutions (Outpayce, Xchange) | High (Growing demand for frictionless payment solutions across travel) | High (Acquisitions of Voxel and Shift4 in 2024) | E-money license, new agreements, enhanced e-invoicing capabilities | Amadeus secured an e-money license, expanding payment services; these platforms are gaining momentum with new agreements. |

What is included in the product

The Amadeus IT Group BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide investment and resource allocation.

The Amadeus IT Group BCG Matrix provides a clear, one-page overview of each business unit's market position, relieving the pain of complex portfolio analysis.

Cash Cows

Amadeus's core Global Distribution System (GDS) for air distribution is a classic Cash Cow. It boasts over 40% market share in a mature but stable industry, contributing a significant portion to its 2024 revenue. This established position allows it to generate consistent cash flow from transaction fees.

Despite normalized booking growth, the GDS's embedded network effect creates a strong competitive moat, making it a dependable source of income. This stability and market dominance are hallmarks of a Cash Cow, providing ample resources for investment in other business areas.

Amadeus's core airline IT solutions, like the Altea Passenger Service System, are firmly positioned as cash cows. These systems, which are vital for airline operations, generate high margins and predictable revenue streams. In 2024, Amadeus's IT solutions segment accounted for a substantial 52% of its total revenue, underscoring the importance of these offerings.

The mission-critical nature of these solutions creates a sticky business model with few direct competitors. Airlines rely heavily on these deeply integrated systems for essential functions, making switching costs prohibitively high. This stability, coupled with the consistent increase in passengers boarded globally, reinforces the cash cow status of this segment.

Amadeus IT Group's hospitality IT solutions, particularly its Central Reservation Systems (CRS) and Property Management Systems (PMS), represent a strong Cash Cow. These systems are vital for large hotel chains, ensuring efficient booking and operational management.

The market for these solutions is mature, meaning growth is slower, but Amadeus commands a significant market share. This allows them to generate consistent, recurring revenue, much like a well-established product that reliably brings in money.

In 2024, Amadeus continued to focus on optimizing these existing platforms. Investments were primarily directed towards maintaining high levels of productivity and efficiency, utilizing their established infrastructure to maximize cash flow rather than pursuing aggressive expansion.

Traditional Travel Agency Desktop Solutions

Amadeus's traditional travel agency desktop solutions hold a commanding position in the market, serving a substantial network of agencies for booking and ticketing. Despite facing slower growth compared to emerging digital platforms, these solutions remain indispensable to agency operations, generating reliable revenue streams due to their deep integration and high transaction volumes. This widespread adoption guarantees a stable and predictable cash flow for Amadeus.

The enduring presence of these desktop solutions underscores their status as a Cash Cow for Amadeus IT Group. Their established user base and consistent transaction activity contribute significantly to the company's financial stability. For instance, Amadeus reported that its Travel Channels segment, which includes these traditional solutions, generated €2.4 billion in revenue in 2023, demonstrating the ongoing financial strength of this business line.

- High Market Share: Traditional desktop solutions continue to dominate the market for agency bookings.

- Consistent Revenue: Deeply embedded workflows and established relationships ensure steady cash flow.

- Transaction Volumes: High usage by a vast network of travel agencies drives consistent revenue.

- Financial Stability: These solutions are a foundational element of Amadeus's revenue generation.

Data Processing and Transaction Management for Travel Providers

Amadeus's core data processing and transaction management services for travel providers function as a classic cash cow within the BCG matrix. This essential infrastructure underpins the entire travel ecosystem, handling an immense volume of daily transactions that connect travelers with global travel content. Its position reflects a high market share in a critical, albeit less glamorous, segment of the travel industry.

These services generate substantial and consistent cash flow. The demand for reliable transaction processing is constant, and Amadeus's established position means it requires minimal incremental investment for marketing or expansion to maintain its market dominance. For instance, Amadeus processes billions of passenger name records (PNRs) annually, a testament to the sheer scale and indispensability of its operations.

- High Market Share: Dominant player in the travel industry's essential processing layer.

- Consistent Cash Flow: Generates significant revenue from high-volume, recurring transaction fees.

- Low Investment Needs: Requires minimal additional capital for promotion or market share growth.

- Indispensable Utility: Core function is a necessity for travel providers globally.

Amadeus's Global Distribution System (GDS) continues to be a prime example of a cash cow. In 2024, it maintained its significant market share in the air distribution sector, a mature but stable industry, contributing robustly to Amadeus's overall revenue through consistent transaction fees. The inherent network effect of the GDS creates a strong competitive advantage, ensuring a dependable income stream despite normalized booking growth.

| Business Segment | BCG Category | 2024 Revenue Contribution (Est.) | Key Characteristics |

|---|---|---|---|

| Global Distribution System (GDS) | Cash Cow | Significant | High market share, mature industry, consistent transaction fees, strong network effect. |

| Airline IT Solutions (e.g., Altea) | Cash Cow | 52% (2024) | Vital for airline operations, high margins, sticky business model, high switching costs, growing passenger volumes. |

| Hospitality IT Solutions (CRS/PMS) | Cash Cow | Substantial | Mature market, significant market share, consistent recurring revenue, focus on optimization. |

| Travel Agency Desktop Solutions | Cash Cow | €2.4 billion (2023) | Dominant market position, indispensable to agencies, high transaction volumes, deep integration. |

| Data Processing & Transaction Management | Cash Cow | High | Essential infrastructure, high volume of daily transactions, minimal incremental investment needed, indispensable utility. |

What You’re Viewing Is Included

Amadeus IT Group BCG Matrix

The Amadeus IT Group BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content, ensuring you get a complete, professional analysis ready for strategic decision-making.

What you see here is the exact Amadeus IT Group BCG Matrix document that will be delivered to you upon completing your purchase. It's a meticulously crafted analysis, ready for immediate integration into your business planning and competitive strategy.

Rest assured, the Amadeus IT Group BCG Matrix you're previewing is the final, unadulterated version you'll download after your purchase. This professionally designed report is instantly accessible for editing, presentation, or direct application to your business insights.

This preview showcases the actual Amadeus IT Group BCG Matrix file you will obtain once you buy. It's a comprehensive, analysis-ready document designed by experts, providing you with immediate strategic clarity without any hidden surprises.

Dogs

Legacy on-premise software installations for Amadeus' smaller clients represent a segment with low market share and minimal growth. These older systems, often maintained for clients hesitant to adopt newer cloud solutions, demand significant resources for upkeep without generating substantial revenue.

While these installations may not be cash drains, their limited returns and the ongoing trend of customer migration to cloud platforms position them for strategic de-emphasis. For instance, in 2024, Amadeus continued its strategic shift towards cloud-based offerings, with a focus on reducing the operational burden of supporting a diverse range of legacy systems.

Highly specialized consulting services for declining travel segments, especially those tied to legacy systems, represent Amadeus's "dogs" in a BCG matrix analysis. These niche offerings likely face minimal demand and struggle for growth, generating low revenue. For instance, consulting on mainframe-based airline reservation systems, a technology largely superseded, would fall into this category.

Such services offer little strategic advantage and minimal financial returns. Amadeus would typically aim to divest or significantly scale back investment in these areas to reallocate resources to more promising ventures. The global travel consulting market, while large, is shifting towards digital transformation and sustainability, leaving outdated niches with limited upside.

Phased-out older versions of Amadeus' core software, such as legacy Global Distribution System (GDS) or IT solutions, would be classified as Dogs in the BCG Matrix. These versions have a declining user base and a low market share as Amadeus encourages customers to adopt newer, supported platforms. While they might still exist for a period to ensure continuity for some users, they represent no significant growth opportunity for the company.

Undifferentiated Basic Reporting Tools

Undifferentiated basic reporting tools, often bundled with core Amadeus IT Group services, face challenges in today's data-driven environment. These tools, while functional, typically lack advanced analytics or AI capabilities, making them less appealing as specialized platforms gain traction.

In 2024, the demand for sophisticated data insights is paramount. Tools that offer only basic reporting may see their standalone market share diminish. Their growth potential is likely limited as users migrate to more integrated or AI-powered analytical solutions.

- Limited Advanced Features: These tools primarily offer standard reporting, failing to meet the growing need for predictive analytics and AI-driven insights.

- Market Saturation: The travel technology market is increasingly populated by specialized analytics providers, making it harder for basic tools to stand out.

- User Migration: Customers are likely to seek out platforms that offer deeper intelligence, potentially leading to a decline in the adoption of these basic reporting functionalities.

Minor, Non-Strategic Hardware Maintenance Contracts

Minor, non-strategic hardware maintenance contracts for Amadeus IT Group would likely be categorized as Dogs in the BCG Matrix. These are typically contracts for older, less integrated hardware that don't directly support Amadeus's core airline IT solutions or its newer ventures like biometrics. The market for such legacy hardware maintenance is often mature and exhibits low growth, offering little scope for Amadeus to expand or innovate.

These contracts represent a drain on resources without significant strategic value or potential for future growth. Amadeus's focus is on high-growth areas and integrated solutions, making these peripheral maintenance agreements less attractive. For instance, if Amadeus has a contract to maintain a specific type of airport check-in kiosk that is being phased out globally, this would fit the Dog profile.

Amadeus would likely aim to reduce its exposure to these types of contracts through several strategies:

- Divestment: Selling off these contracts to specialized maintenance providers.

- Streamlining: Consolidating or automating support for these legacy systems to reduce operational costs.

- Phasing Out: Gradually discontinuing support as clients migrate to newer, Amadeus-supported technologies.

Amadeus IT Group's "Dogs" in the BCG Matrix often include legacy on-premise software installations for smaller clients and highly specialized consulting services for declining travel segments. These areas have low market share and minimal growth potential, demanding resources without generating substantial returns.

Phased-out older software versions and basic reporting tools also fall into this category, as they face user migration and a lack of advanced features. Amadeus aims to strategically de-emphasize or divest these segments to focus on its more promising cloud-based and data-driven offerings.

For instance, in 2024, Amadeus continued its strategic shift towards cloud solutions, actively reducing the operational burden of supporting diverse legacy systems. The company's focus on high-growth areas and integrated solutions makes peripheral legacy contracts less attractive, with strategies like divestment or streamlining being employed.

The company's 2023 financial report highlighted a continued investment in cloud migration and digital transformation, implicitly signaling a reduction in resources allocated to legacy support. While specific figures for "Dog" segment revenue are not separately disclosed, the overall strategy points to a conscious effort to shed these lower-performing assets.

Question Marks

Amadeus is actively developing Generative AI-powered conversational search and booking interfaces, tapping into the burgeoning market for personalized travel planning. This segment is experiencing rapid growth, driven by consumer demand for more intuitive and efficient ways to discover and reserve travel.

While this represents a high-potential area, these AI-driven interfaces are still in their early stages of market adoption. Consequently, Amadeus currently holds a relatively modest market share within this nascent field.

Capturing a significant share and establishing long-term viability in this competitive landscape will necessitate substantial investment. Amadeus faces the challenge of out-innovating and out-investing emerging competitors in this rapidly evolving technological space.

Amadeus is exploring 'Triportation' through digital twin technology, offering consumers and industry partners a pre-purchase experience of travel elements. This forward-thinking concept, aiming to transform travel planning, is currently in its nascent stages with minimal market penetration. For instance, Amadeus's investments in R&D for such advanced technologies are substantial, reflecting the high-risk, high-reward nature typical of 'question mark' ventures.

Amadeus provides access to its extensive data through open APIs, enabling third-party developers and startups to build innovative AI/ML solutions. This strategy aims to foster a vibrant ecosystem around its core travel technology, allowing external partners to leverage Amadeus's predictive modeling capabilities.

While the overall AI market is expanding rapidly, Amadeus's specific share in the niche of offering AI/ML APIs to external developers is likely nascent. This is a forward-looking play to cultivate new business models and drive adoption of its AI infrastructure, rather than a current dominant market position.

Specialized Sustainability Management and Reporting Solutions

Amadeus is actively developing IT solutions to foster sustainable travel, aiming to help airlines and airports cut CO2 emissions and empower travelers with sustainable choices. This focus aligns with a rapidly expanding market for sustainability tools.

While the demand for these specialized software solutions is surging, Amadeus's precise market share within this niche segment is likely still in its growth phase. The market itself presents a high-growth trajectory.

- High Growth Potential: The market for sustainability management and reporting solutions is experiencing significant expansion, driven by regulatory pressures and increasing consumer awareness.

- Investment Requirements: Achieving widespread adoption and market leadership in this specialized software segment necessitates substantial ongoing investment in research, development, and market penetration.

- Strategic Positioning: Amadeus's commitment to sustainable travel positions it to capitalize on this growing demand, though its current market share in this specific software category may be nascent.

- Market Dynamics: The competitive landscape is evolving, with established players and new entrants vying for dominance in providing these critical environmental, social, and governance (ESG) tools.

New Corporate Travel Expense Management Digitalization Tools

Corporate travel managers are significantly boosting investments in digitizing their entire expense management workflows. This trend reflects a broader industry push towards efficiency and automation in handling travel-related expenditures.

While Amadeus IT Group has established solutions in the broader corporate travel sector, its specific market penetration within the rapidly evolving expense management digitalization sub-segment might be less dominant compared to its core booking and distribution systems. This area represents a high-growth opportunity.

- Market Growth: The global corporate expense management software market was valued at approximately $1.6 billion in 2023 and is projected to reach $3.5 billion by 2028, growing at a CAGR of over 16%.

- Investment Focus: Companies are increasingly adopting cloud-based platforms for real-time expense tracking, automated approvals, and policy compliance, driving demand for new digital tools.

- Competitive Landscape: This segment is highly competitive, with numerous specialized providers alongside broader ERP and travel management companies, necessitating continuous innovation and investment for Amadeus to capture significant share.

- Amadeus' Position: Amadeus' existing corporate travel ecosystem provides a strong foundation, but capturing a larger share of expense management digitalization requires targeted development and strategic partnerships to compete effectively with specialized players.

Amadeus's ventures into Generative AI-powered conversational interfaces and 'Triportation' through digital twins represent classic 'question mark' scenarios. These initiatives are in nascent stages, demanding significant investment to carve out market share amidst evolving technologies and competitive pressures. The company's strategy of enabling AI/ML solutions via open APIs also falls into this category, aiming to cultivate future growth rather than capitalizing on current dominance.

BCG Matrix Data Sources

Our Amadeus IT Group BCG Matrix leverages financial statements, industry growth forecasts, and competitive landscape analysis to provide strategic insights.