Alliant Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliant Energy Bundle

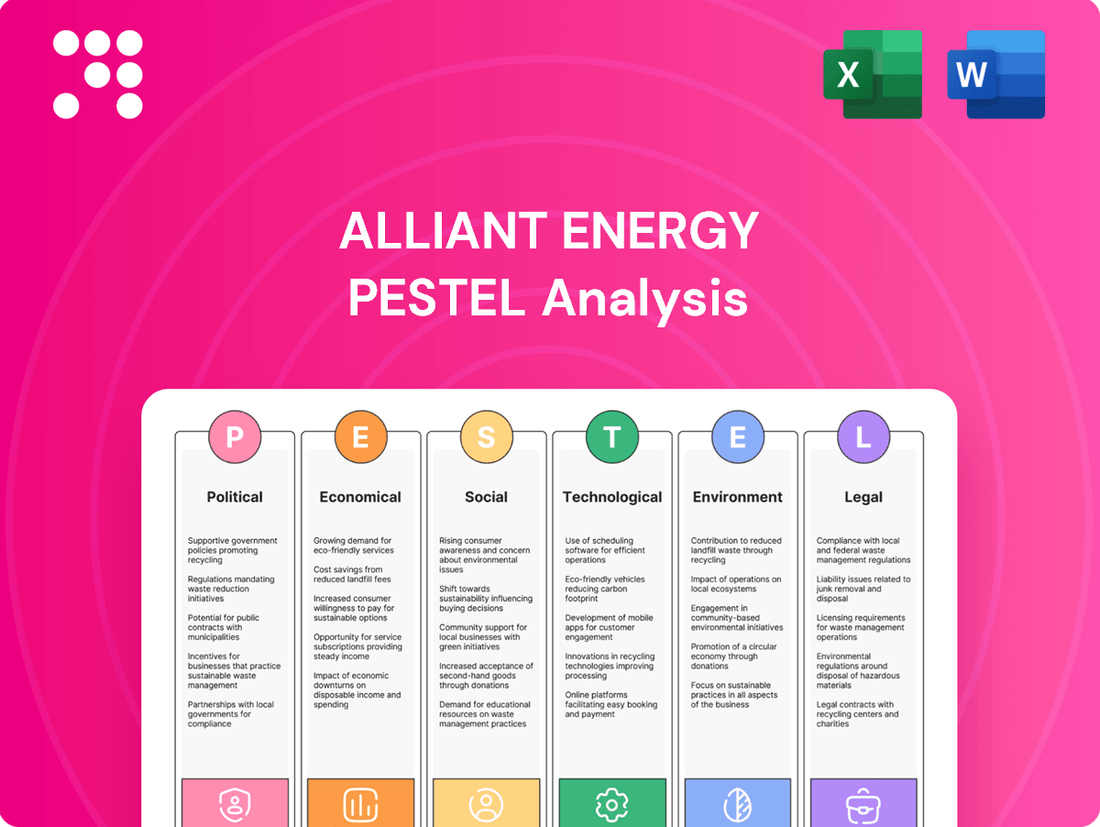

Navigate the complex external forces shaping Alliant Energy's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements create both challenges and opportunities for the company.

Our expert-crafted analysis delves into social trends, environmental regulations, and legal frameworks impacting Alliant Energy's operations and strategic planning. Gain a competitive edge by leveraging these crucial insights.

Don't get left behind in a rapidly evolving energy landscape. Download the full PESTLE analysis of Alliant Energy now to unlock actionable intelligence and make informed decisions for your business or investments.

Political factors

Alliant Energy operates under the watchful eye of state utility commissions in Iowa and Wisconsin, which hold the power to set electricity and natural gas rates. These regulatory bodies are key to Alliant's financial health, directly impacting its revenue streams and its capacity to invest in necessary infrastructure upgrades and new projects.

For instance, Alliant filed for rate increases in late 2023, with decisions expected to influence its earnings throughout 2024 and into 2025. The outcomes of these rate cases are critical; a favorable decision can unlock the capital needed for ambitious spending plans, while an unfavorable one could constrain growth and profitability.

Government policies, both federal and state, are a major driver for Alliant Energy's strategic direction in renewable energy. These policies often include tax credits, grants, and renewable portfolio standards that encourage the adoption of clean energy sources.

For instance, the Inflation Reduction Act of 2022 continues to provide significant tax credits for renewable energy projects, which Alliant Energy can leverage. In 2023, Alliant Energy announced plans to invest billions in expanding its wind and solar generation capacity, directly responding to these supportive governmental frameworks and clean energy mandates.

Shifting energy policies, driven by political mandates for decarbonization and energy security, are a significant factor for Alliant Energy. The company is actively responding to these changes, notably by planning to retire its coal-fired generation facilities by 2040. This strategic move is directly influenced by governmental pressures and evolving legislative landscapes concerning environmental impact and energy independence.

Economic Development Initiatives

Political efforts to spur economic development in Iowa and Wisconsin are a significant tailwind for Alliant Energy, directly translating into higher energy demand. For instance, a substantial economic development investment confirmed for Cedar Rapids in 2024 is projected to boost electric sales, showcasing the tangible impact of these government-led initiatives. These collaborations often necessitate and facilitate considerable infrastructure upgrades by the utility to meet the anticipated load growth.

These economic development programs frequently involve partnerships between utilities and governmental bodies to attract new businesses and expand existing ones. Alliant Energy actively engages with state and local authorities to support these efforts, which can lead to increased industrial and commercial energy consumption. This strategic alignment ensures that the company is well-positioned to capitalize on growth opportunities driven by public policy.

- Increased Demand: Political focus on economic development in Iowa and Wisconsin directly boosts Alliant Energy's energy sales.

- Cedar Rapids Investment: A major 2024 economic development investment in Cedar Rapids is expected to drive electric sales growth.

- Infrastructure Investment: Government-backed development initiatives often require and support significant utility infrastructure enhancements.

Interstate Regulatory Cooperation (MISO)

Alliant Energy's strategic planning is significantly shaped by its engagement with the Midcontinent Independent System Operator (MISO). MISO's evolving resource adequacy frameworks, such as those implemented in 2024, directly influence how Alliant must ensure reliable power supply, potentially affecting its generation mix and investment in new capacity.

Changes in MISO's long-range transmission planning, including the progress and cost of Tranche 1 and Tranche 2 projects approved in 2023 and 2024, have a direct bearing on Alliant's capital expenditure for grid modernization. These projects aim to enhance transmission infrastructure, and Alliant's participation necessitates significant investment in grid upgrades and expansion to meet future demand and integrate renewable resources effectively.

- MISO Resource Adequacy: Updates to MISO's requirements for ensuring sufficient generation capacity, as seen in recent planning cycles, can necessitate Alliant adjusting its generation portfolio or securing additional power resources.

- Transmission Planning: MISO's approved transmission expansion plans, like the multi-year Tranche 1 and Tranche 2 initiatives, represent billions in investment, impacting Alliant's capital allocation for grid enhancements.

- Grid Modernization: The need to connect new renewable energy sources and improve grid resilience, driven by MISO's planning, requires Alliant to invest in advanced technologies and infrastructure upgrades.

Governmental policies and regulatory oversight are paramount for Alliant Energy, directly influencing its operational costs and strategic investments. State utility commissions in Iowa and Wisconsin hold significant sway over rate adjustments, impacting Alliant's revenue streams, as evidenced by rate increase filings in late 2023 with decisions affecting 2024 and 2025 earnings.

Federal and state mandates, particularly those supporting renewable energy adoption like the Inflation Reduction Act of 2022, are driving Alliant's substantial investments in wind and solar capacity, aiming for billions in expansion by 2025. Furthermore, political momentum towards decarbonization is pushing Alliant to retire its coal-fired plants by 2040, a direct response to evolving environmental legislation.

Economic development initiatives in its service territories are a key driver of increased energy demand for Alliant. For example, a significant economic development project confirmed for Cedar Rapids in 2024 is anticipated to boost electric sales, underscoring the direct link between public policy and utility growth. These initiatives often necessitate and support utility investments in grid modernization and expansion to meet projected load increases.

Alliant's engagement with the Midcontinent Independent System Operator (MISO) is also heavily influenced by political and regulatory frameworks. MISO's resource adequacy requirements and multi-year transmission expansion plans, such as Tranche 1 and Tranche 2 projects approved through 2024, represent billions in potential capital expenditures for grid enhancements and integration of renewable resources.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Alliant Energy across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify both emerging threats and opportunities.

A concise, actionable summary of Alliant Energy's PESTLE factors, designed to quickly identify and address potential external threats and opportunities, thereby alleviating strategic planning pain points.

Economic factors

Alliant Energy has outlined substantial capital expenditure programs, with plans to invest around $11.5 billion between 2025 and 2028, and an expanded estimate of $15.6 billion for the 2025-2029 period. These significant outlays are strategically directed towards upgrading aging electric and gas infrastructure and building out renewable energy sources like solar, wind, and battery storage.

The successful execution of these ambitious capital expenditure plans is directly linked to Alliant Energy's future earnings trajectory and its ability to meet evolving energy demands. The company's commitment to modernizing its systems and expanding clean energy capacity positions it to capitalize on the ongoing energy transition.

As a capital-intensive utility, Alliant Energy's financial performance is closely tied to interest rates and its ability to access capital. Higher interest rates directly translate to increased financing costs on the company's substantial debt, which can squeeze profitability and make its dividend less appealing to investors.

In 2024, Alliant Energy projected capital expenditures of approximately $2.1 billion, with plans to fund this through a mix of debt and equity. For instance, in March 2024, the company issued $500 million in senior notes with a coupon rate of 5.125%. This demonstrates the direct impact of prevailing market rates on its borrowing expenses.

Rising electricity demand, especially from burgeoning data centers in Iowa and Wisconsin, creates a substantial growth avenue for Alliant Energy. This trend is a key economic factor influencing the company's future.

Alliant Energy projects a robust 3%-5% annual growth in electric sales between 2024 and 2032. Data centers are a major contributor, expected to fuel 9%-10% sales growth from 2025 to 2030 alone.

This escalating demand necessitates significant investment in new generation capacity and critical infrastructure upgrades to meet the increased load reliably.

Inflationary Pressures and Cost Control

Inflationary pressures directly affect Alliant Energy's operational costs, including fuel, materials, and labor, and also influence the expense of undertaking new capital projects. For instance, the Consumer Price Index (CPI) in the U.S. saw a notable increase, with annual inflation rates hovering around 3.1% in early 2024, impacting the cost of goods and services the company procures.

Alliant Energy is actively working to manage these rising costs. Their success in implementing effective cost control measures is paramount for preserving profitability and achieving the authorized rates of return on investments, particularly in light of recent rate adjustments designed to offset these economic challenges.

- Rising Input Costs: Fuel prices, a significant component of utility operating expenses, experienced volatility in 2023 and early 2024, directly impacting Alliant Energy's cost structure.

- Capital Expenditure Inflation: The cost of materials like steel and equipment for grid modernization and renewable energy projects has also seen upward price movements, increasing the overall investment required for these initiatives.

- Rate Case Implications: Alliant Energy's ability to recover these increased costs through regulatory rate cases is critical. For example, their recent rate filings aim to reflect these higher expenses, but the approval process and authorized returns are key determinants of financial health.

Economic Conditions in Service Territories

The economic well-being of Iowa and Wisconsin is paramount for Alliant Energy, directly impacting its customer base and, consequently, energy sales. A robust and stable economic environment ensures consistent utility demand, enabling the company to meet its financial projections. For instance, Iowa's GDP grew by an estimated 2.1% in 2023, and Wisconsin's by 1.8%, indicating a generally supportive economic climate for utility services.

Economic development initiatives play a crucial role in bolstering the resilience and growth of Alliant Energy's service territories. These efforts can lead to increased industrial and commercial activity, which in turn drives higher energy consumption.

- Iowa's unemployment rate averaged 3.0% in 2023, and Wisconsin's was 3.1%, reflecting a healthy labor market.

- Both states have seen continued investment in manufacturing and technology sectors, which are significant energy users.

- Alliant Energy's service areas benefit from these economic trends, supporting stable revenue streams.

Economic factors significantly influence Alliant Energy's performance, particularly through rising demand from sectors like data centers, projected to drive 9%-10% electric sales growth in its service territories between 2025 and 2030. This escalating demand necessitates substantial capital investments, with the company planning approximately $11.5 billion to $15.6 billion between 2025 and 2029 for infrastructure upgrades and renewable energy expansion. However, inflationary pressures, evidenced by a 3.1% CPI in early 2024, increase operational and capital project costs, requiring careful management and regulatory approval for cost recovery.

The economic health of Iowa and Wisconsin, with GDP growth of 2.1% and 1.8% respectively in 2023, directly supports Alliant Energy's customer base and energy sales. A stable labor market, with unemployment rates around 3.0% in both states during 2023, further bolsters industrial and commercial activity, key drivers of energy consumption. The company's ability to secure capital at favorable rates is also critical; for example, in March 2024, it issued $500 million in senior notes at a 5.125% coupon rate, highlighting the impact of interest rates on financing costs.

| Economic Factor | Metric/Data Point | Impact on Alliant Energy |

| Demand Growth (Data Centers) | 9%-10% projected electric sales growth (2025-2030) | Drives revenue and necessitates infrastructure investment |

| Capital Expenditure | $11.5B - $15.6B (2025-2029) | Investments in modernization and renewables, impacting future earnings |

| Inflation (CPI) | 3.1% (early 2024) | Increases operating and capital costs, affecting profitability |

| State GDP Growth (2023) | Iowa: 2.1%, Wisconsin: 1.8% | Supports customer base and energy sales stability |

| Unemployment Rate (2023) | Iowa: 3.0%, Wisconsin: 3.1% | Indicates healthy economic activity and consistent energy demand |

| Interest Rates (Senior Notes, March 2024) | 5.125% coupon rate | Affects cost of capital and debt servicing |

Same Document Delivered

Alliant Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Alliant Energy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a thorough understanding of the external forces shaping its strategy and operations.

Sociological factors

Customers and stakeholders are increasingly demanding that utilities like Alliant Energy reduce their greenhouse gas emissions and shift towards cleaner energy. This societal pressure is a significant driver for change in the energy sector.

Alliant Energy is actively responding to this demand by making substantial investments in renewable energy generation. For instance, in 2023, the company announced plans to invest approximately $1.7 billion in clean energy projects, aiming to retire its remaining coal-fired generation by 2040. This strategic move directly addresses evolving customer preferences and broader societal values favoring sustainability.

Alliant Energy places a strong emphasis on community engagement, demonstrating this through initiatives like safety grants and environmental programs such as the One Million Trees project. In 2023, the company contributed over $3.5 million in grants and sponsorships to support local communities, reinforcing its commitment to social well-being and sustainable practices.

These proactive efforts in workforce readiness and addressing critical needs like hunger and housing foster positive public perception and build crucial trust with stakeholders. For a regulated utility like Alliant Energy, this strong community backing is vital for operational stability and future growth, especially as they navigate the evolving energy landscape.

Alliant Energy understands that a skilled workforce is crucial, particularly as the energy sector evolves. They actively invest in workforce readiness and development, recognizing human capital as a key asset for their modernization initiatives.

In 2024, Alliant Energy continued its commitment to nurturing future talent through various scholarship programs, aiming to attract and retain individuals with the necessary skills for the transitioning energy landscape. This focus on development is vital for ensuring operational efficiency and driving innovation.

Public Perception and Trust

Public perception and trust are paramount for Alliant Energy's social license to operate. Maintaining a reputation for reliability, affordability, and sustainability is key, especially as consumer expectations around environmental responsibility grow. Negative publicity, perhaps stemming from service disruptions or environmental concerns, could trigger increased regulatory scrutiny and impact community support, directly affecting operational freedom and investor confidence.

Alliant Energy actively works to build trust through transparent communication and community engagement. For instance, in 2023, the company invested $33 million in local communities across its service territories, supporting economic development and charitable initiatives. This focus on social responsibility aims to mitigate the risks associated with public backlash, which could manifest as protests or organized opposition to projects, potentially leading to costly delays or cancellations.

- Reputation Management: Alliant Energy prioritizes a strong public image, emphasizing reliable service delivery and competitive pricing.

- Sustainability Focus: Investments in renewable energy, such as their 2024 plans to add 400 MW of solar power, aim to align with public demand for greener energy solutions.

- Community Investment: Significant financial contributions to local communities demonstrate corporate citizenship and foster goodwill.

- Risk Mitigation: Proactive engagement and transparency are crucial to prevent negative public sentiment that could lead to regulatory intervention or legal challenges.

Demographic Shifts and Urbanization

Demographic shifts in Iowa and Wisconsin directly impact Alliant Energy's operational landscape. For instance, Iowa's population is projected to grow modestly, with an increasing proportion of older adults, which can alter overall energy consumption patterns. Wisconsin, while experiencing slower growth, sees pockets of urbanization, particularly around major metropolitan areas like Milwaukee and Madison, driving localized demand increases.

Urbanization trends are a key consideration. As more people move into urban centers, the demand for electricity and gas in those concentrated areas intensifies. This necessitates strategic investments in grid modernization and capacity expansion to ensure reliable service. For example, the growth of technology sectors in Wisconsin cities could lead to increased demand from data centers, a trend Alliant Energy must anticipate in its infrastructure planning.

- Iowa's population growth rate was approximately 0.2% annually between 2020 and 2023.

- Wisconsin's urban population share has been steadily increasing, with over 70% of residents living in urban areas as of recent estimates.

- The average age in Iowa is around 38.5 years, indicating a growing senior demographic.

- Concentrated development in areas like the Fox Valley in Wisconsin points to localized energy demand surges.

Societal expectations are pushing Alliant Energy towards greater environmental responsibility, with customers and stakeholders demanding reduced greenhouse gas emissions. This is driving significant investments in renewables; for instance, in 2023, the company committed around $1.7 billion to clean energy projects, aiming to phase out coal by 2040. Community engagement is also vital, as shown by over $3.5 million in grants and sponsorships provided in 2023 to support local initiatives, fostering goodwill and a positive public image.

| Sociological Factor | Alliant Energy Action/Impact | Data Point (2023/2024 Focus) |

|---|---|---|

| Environmental Consciousness | Investment in clean energy & retirement of coal assets | $1.7 billion planned investment in clean energy projects (2023); Coal retirement by 2040 |

| Community Relations | Local grants, sponsorships, and development support | Over $3.5 million in community grants/sponsorships (2023) |

| Workforce Development | Scholarships and training for evolving energy sector needs | Continued commitment to scholarship programs (2024) |

| Public Perception & Trust | Transparent communication and reliable service | $33 million invested in local communities (2023) to build trust |

Technological factors

Alliant Energy is actively investing in grid modernization, with plans to spend around $1.2 billion in 2024 on infrastructure upgrades, including smart grid technologies. These initiatives are designed to bolster the reliability and efficiency of its electric and gas distribution networks.

The company is implementing advanced distribution management systems and smart energy solutions to reduce the frequency and duration of power outages, a critical factor for customer satisfaction and operational continuity. For instance, smart meters and automated switching technologies are key components of this strategy.

These technological advancements are crucial for better integrating renewable energy sources, such as solar and wind power, into the existing grid infrastructure. By 2025, Alliant Energy aims to have 40% of its electricity generated from renewable sources, necessitating a more agile and responsive grid.

Alliant Energy is significantly investing in renewable energy, having brought 1,500 MW of solar online in 2024 alone. The company also boasts nearly 1,800 MW of regulated wind capacity, showcasing a strong commitment to diversifying its energy portfolio.

Ongoing progress in solar panel efficiency, wind turbine technology, and battery storage solutions is paramount for Alliant Energy's success in achieving its ambitious clean energy targets and reducing its carbon footprint.

Technological advancements in energy storage are critical for utilities like Alliant Energy. The company is making significant investments, planning to add 275 MW of battery storage capacity by the close of 2025. This move is not just about capacity; it's about modernizing the grid.

These energy storage solutions are fundamental to managing the inherent variability of renewable energy sources, such as solar and wind. By integrating more battery storage, Alliant Energy can ensure a more stable and reliable power supply, bolstering the overall resilience of its energy infrastructure. This is essential for meeting the demands of a modern, increasingly electrified economy.

Data Center Technology and Demand

The burgeoning demand for data centers, especially within Alliant Energy's operational regions, signifies a significant growth avenue. These facilities are power-hungry, requiring massive and consistent electricity supplies. For instance, by the end of 2024, projections indicated a substantial increase in data center power consumption across the US, with states like Iowa and Wisconsin, within Alliant's footprint, seeing notable development. This surge necessitates considerable capital outlay for upgrading and expanding generation and transmission capabilities to meet this escalating need.

This technological shift translates directly into infrastructure requirements. Alliant Energy must invest in advanced grid technologies and potentially new power generation sources to reliably serve these data-intensive clients. The company's 2024-2028 capital investment plan, for example, allocated billions towards grid modernization and new energy infrastructure, partly in anticipation of such demand growth.

- Data Center Growth: The global data center market is projected to see continued robust expansion through 2025, with significant investments in hyperscale and colocation facilities.

- Power Consumption: Data centers are among the largest and fastest-growing consumers of electricity, with their demand expected to rise significantly in the coming years.

- Infrastructure Investment: Meeting this demand requires substantial investment in grid upgrades, new generation capacity, and energy storage solutions.

- Alliant's Service Territory: Regions served by Alliant Energy are experiencing increased interest from data center developers, creating both opportunities and challenges for grid reliability.

Cybersecurity and Data Management

As energy infrastructure increasingly relies on digital systems, cybersecurity is paramount for Alliant Energy. Protecting operational technology and sensitive customer data from threats is a significant technological challenge. For instance, in 2023, the U.S. Department of Energy highlighted that the energy sector faces persistent cyber threats, underscoring the need for continuous investment in advanced security protocols.

Alliant Energy's focus on enterprise workforce and asset management systems demonstrates a commitment to efficient data handling. These integrated systems are crucial for optimizing operations and ensuring reliability. By leveraging data analytics, the company can improve decision-making across its vast network.

- Cybersecurity Investments: Alliant Energy must continue to invest in robust cybersecurity measures to safeguard its digitized infrastructure and customer information, a critical need given the escalating threat landscape.

- Data Management Systems: The implementation and ongoing enhancement of enterprise workforce and asset management systems are vital for operational efficiency and data-driven insights.

- Interconnected Infrastructure: The growing interconnectedness of energy grids necessitates sophisticated data management to ensure seamless and secure operations.

- Operational Excellence: Effective data management directly supports Alliant Energy's pursuit of operational excellence by enabling better resource allocation and predictive maintenance.

Technological advancements are reshaping Alliant Energy's operations, driving significant investments in grid modernization and renewable energy integration. The company is actively deploying smart grid technologies and energy storage solutions, such as battery capacity, to enhance reliability and manage the intermittency of clean energy sources. These upgrades are essential for meeting the increasing power demands of sectors like data centers, which are experiencing rapid growth within Alliant's service territories.

| Technology Area | 2024/2025 Focus | Impact |

|---|---|---|

| Grid Modernization | $1.2 billion planned for 2024; smart grid tech deployment | Improved reliability, efficiency, and integration of renewables |

| Renewable Energy Integration | 40% renewable generation target by 2025; 1,500 MW solar online in 2024 | Reduced carbon footprint, diversified energy portfolio |

| Energy Storage | 275 MW battery storage capacity by end of 2025 | Enhanced grid stability, management of renewable variability |

| Data Center Demand | Anticipating increased demand; infrastructure upgrades planned | Growth opportunity requiring significant capital investment |

| Cybersecurity | Continuous investment in advanced security protocols | Protection of operational technology and customer data |

Legal factors

Alliant Energy's financial health is heavily influenced by utility rate regulation, with the Iowa Utilities Board (IUB) and the Public Service Commission of Wisconsin (PSCW) acting as key decision-makers. These regulatory bodies determine the rates customers pay for electricity and natural gas, directly impacting Alliant's revenue and profitability.

The company secured crucial rate adjustments for 2024 and 2025. For instance, in December 2023, the IUB approved a $118 million electric rate increase for Alliant Energy's Iowa customers, effective January 2024, and a $45 million natural gas rate increase, effective February 2024. These approvals are vital for Alliant to recover its operational costs and achieve its authorized return on equity.

Alliant Energy must navigate a complex web of federal and state environmental laws, a crucial legal consideration. This includes stringent regulations on greenhouse gas emissions, air quality, and water usage, all of which directly impact its operations and strategic planning.

The company is dedicated to meeting standards established by the Environmental Protection Agency (EPA) and various state departments of natural resources. For instance, in 2023, Alliant Energy reported a 15% reduction in carbon emissions intensity from its 2005 baseline, demonstrating its commitment to compliance and sustainability goals.

Operational permits held by Alliant Energy necessitate strict adherence to environmental compliance. Failure to meet these requirements can result in significant fines and operational disruptions, underscoring the critical nature of these legal factors for the company's financial health and reputation.

Legal mandates like renewable portfolio standards (RPS) significantly shape Alliant Energy's strategic direction, pushing investments towards cleaner energy sources. For instance, Wisconsin's RPS requires utilities to generate 10% of their electricity from renewable sources by 2015 and 16% by 2030, a framework Alliant navigates. These regulations directly impact capital allocation and operational planning as the company adapts to decarbonization goals.

Consumer Protection and Service Quality Regulations

Utility companies like Alliant Energy operate under stringent legal frameworks designed to protect consumers and ensure dependable service. These regulations mandate specific standards for service reliability and safety, directly impacting how Alliant manages its operations and customer interactions.

A key legal obligation involves transparent communication with customers regarding any changes to their bills. For instance, following rate adjustments approved by regulatory bodies, Alliant Energy must provide clear notifications detailing the impact on customer charges. This commitment to transparency is crucial for maintaining customer trust and adherence to consumer protection laws.

- Consumer Protection Mandates: Laws require utilities to offer fair pricing and reliable service, with penalties for significant disruptions.

- Rate Change Notification: Alliant Energy must inform customers about rate adjustments, detailing how these changes affect their bills, often within a specific timeframe before implementation.

- Service Quality Standards: Regulatory bodies set performance benchmarks for service reliability, such as maximum allowable outage durations, which Alliant must meet.

- Safety Regulations: Strict legal requirements govern the safe operation of energy infrastructure, including regular inspections and maintenance protocols.

Corporate Governance and Compliance

Alliant Energy is legally bound to uphold stringent corporate governance standards, including ethical labor practices and the meticulous maintenance of financial records. Failure to comply can result in significant legal repercussions and damage to its public image.

The company's Code of Conduct explicitly mandates adherence to all federal, state, and local laws and regulations. This commitment necessitates the implementation of strong internal controls to prevent legal penalties and safeguard its reputation. For instance, in 2023, Alliant Energy reported total operating revenues of $7.1 billion, underscoring the scale of financial operations requiring robust oversight.

- Corporate Governance Adherence: Alliant Energy must comply with established governance frameworks to ensure accountability and transparency.

- Ethical Labor Practices: The company is legally obligated to maintain fair and ethical treatment of its workforce.

- Financial Record Accuracy: Maintaining precise financial records is a critical legal requirement, essential for regulatory compliance and investor confidence.

- Compliance with Laws: Adherence to all applicable federal, state, and local laws and regulations is paramount, as reinforced by their Code of Conduct.

Alliant Energy's operations are significantly shaped by legal frameworks governing utility rates and environmental protection. The company secured key rate increases in late 2023, with the Iowa Utilities Board approving an $118 million electric rate hike effective January 2024 and a $45 million natural gas increase effective February 2024. These decisions are critical for cost recovery and profitability, while stringent environmental laws, including those related to greenhouse gas emissions, necessitate ongoing compliance efforts, as evidenced by a 15% reduction in carbon emissions intensity from 2005 levels reported in 2023.

| Regulatory Body | Rate Action | Effective Date | Impact |

|---|---|---|---|

| Iowa Utilities Board (IUB) | $118 million electric rate increase | January 2024 | Increased electricity revenue for Alliant Energy |

| Iowa Utilities Board (IUB) | $45 million natural gas rate increase | February 2024 | Increased natural gas revenue for Alliant Energy |

| Environmental Protection Agency (EPA) & State DNRs | Emissions standards compliance | Ongoing | Requires investment in cleaner technologies and operational adjustments |

Environmental factors

Alliant Energy is actively pursuing ambitious environmental targets, aiming to slash greenhouse gas emissions from its utility operations by 50% compared to 2005 levels by the year 2030. This commitment is a cornerstone of their Clean Energy Vision.

Furthermore, the company plans to completely phase out coal from its electricity generation fleet by 2040, a significant move that necessitates substantial investments in renewable energy sources like wind and solar power.

Alliant Energy is making a significant pivot towards renewable energy. In 2024 alone, they completed 1,500 MW of solar generation, a substantial increase in their clean energy portfolio. This move is fundamental to their strategy of reducing carbon emissions and meeting evolving sustainability goals.

The company's commitment extends beyond solar, with plans for further solar installations and the crucial addition of battery storage. This integration of renewables and storage is key to ensuring grid reliability while transitioning away from traditional energy sources.

Alliant Energy is actively prioritizing water management and conservation, aiming to slash its electric utility water usage by a significant 75% compared to 2005 levels by the year 2030. This ambitious target underscores a broader industry trend that extends environmental stewardship beyond carbon reduction efforts.

This commitment to water conservation is crucial, especially for utilities that rely heavily on water for cooling and other operational processes. By 2023, Alliant Energy reported that its water withdrawal intensity had already decreased substantially, demonstrating tangible progress towards its conservation goals.

Land Use and Biodiversity

Alliant Energy's dedication to environmental stewardship is evident in its 'One Million Trees' initiative. This program actively promotes reforestation and enhances biodiversity across its service territories. Since its inception in 2021, the company has facilitated the planting of over 551,000 trees in Iowa and Wisconsin, directly contributing to carbon sequestration and the improvement of local habitats.

These efforts are crucial for mitigating climate change impacts and supporting ecological balance. The trees planted not only absorb carbon dioxide but also provide vital living spaces for various species. This aligns with broader environmental goals and demonstrates a proactive approach to land use management.

- Reforestation Goal: Planting one million trees.

- Trees Planted (as of recent data): Over 551,000 in Iowa and Wisconsin since 2021.

- Environmental Benefits: Carbon sequestration and habitat improvement.

- Geographic Focus: Iowa and Wisconsin.

Climate Change Impacts and Resilience

Alliant Energy, like other utilities, is increasingly focused on building a more resilient energy grid to withstand the growing impacts of climate change. This includes preparing for and adapting to extreme weather events such as severe storms, heatwaves, and flooding, which can disrupt service and damage infrastructure. For instance, in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, highlighting the escalating risks utilities face.

To counter these challenges, Alliant Energy is investing in modernizing its infrastructure. These investments aim to harden the grid against severe weather and improve its ability to recover quickly from any outages that do occur. A significant portion of these capital expenditures, projected to be substantial in the 2024-2025 period, is directed towards grid modernization efforts, including undergrounding power lines in vulnerable areas and upgrading transmission and distribution systems.

Diversifying energy sources also plays a crucial role in enhancing resilience. By integrating more renewable energy sources like solar and wind, which are less susceptible to certain climate-related disruptions compared to fossil fuels, Alliant Energy is working towards a more stable and sustainable energy future. The company has set ambitious goals for increasing its renewable energy portfolio, with a target of achieving 40% renewable energy by 2030, which contributes to both environmental stewardship and operational resilience.

- Grid Modernization Investments: Alliant Energy is allocating significant capital to upgrade its infrastructure, aiming to improve reliability and resilience against extreme weather.

- Extreme Weather Preparedness: The company is enhancing its systems to better withstand and recover from events like severe storms and heatwaves, which are becoming more frequent.

- Renewable Energy Integration: Expanding the use of solar and wind power helps diversify the energy mix, reducing reliance on sources vulnerable to climate impacts and enhancing overall grid stability.

- 2024-2025 Capital Expenditures: A substantial portion of planned spending in this period is earmarked for resilience and modernization projects.

Alliant Energy is aggressively pursuing environmental sustainability, targeting a 50% reduction in greenhouse gas emissions from its utility operations by 2030, using 2005 levels as a baseline. This aligns with their Clean Energy Vision and includes a complete phase-out of coal by 2040, necessitating significant investment in renewables.

The company is making substantial strides in renewable energy, with 1,500 MW of solar generation completed in 2024, bolstering their clean energy portfolio. Furthermore, Alliant Energy is committed to reducing water usage by 75% by 2030 compared to 2005, demonstrating a holistic approach to environmental stewardship beyond carbon reduction.

Alliant Energy's 'One Million Trees' initiative, which has already seen over 551,000 trees planted in Iowa and Wisconsin since 2021, actively contributes to carbon sequestration and biodiversity. This proactive approach to land management is crucial for mitigating climate change and enhancing ecological balance.

| Environmental Target | 2030 Goal | Progress/Status | Key Initiatives |

|---|---|---|---|

| Greenhouse Gas Emissions Reduction | 50% reduction from 2005 levels | Ongoing | Clean Energy Vision, Coal Phase-out by 2040 |

| Water Usage Reduction | 75% reduction from 2005 levels | Substantial decrease in water withdrawal intensity by 2023 | Water conservation efforts |

| Renewable Energy Integration | 40% renewable energy by 2030 | 1,500 MW solar generation completed in 2024 | Solar installations, battery storage integration |

| Reforestation | One Million Trees | Over 551,000 trees planted (Iowa & Wisconsin, since 2021) | 'One Million Trees' initiative |

PESTLE Analysis Data Sources

Our Alliant Energy PESTLE Analysis is grounded in comprehensive data from government regulatory bodies, industry associations, and reputable financial news outlets. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors impacting the energy sector.