Alliant Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliant Energy Bundle

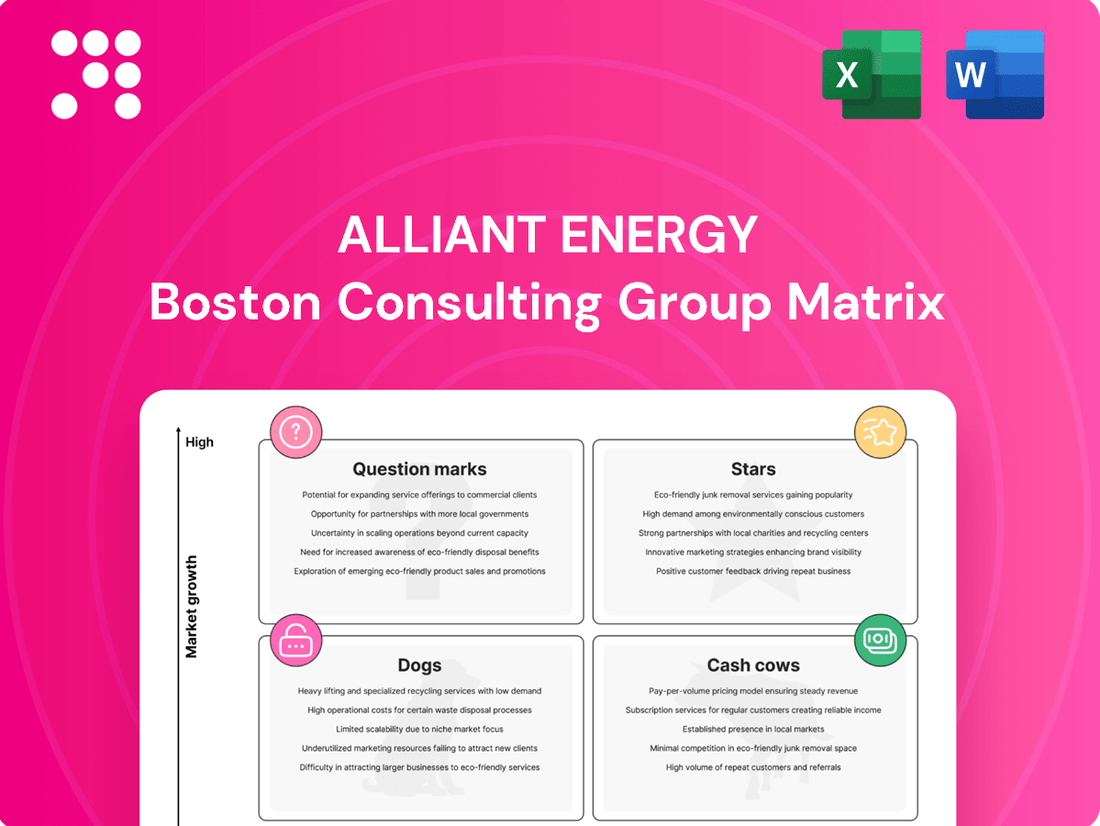

Curious about Alliant Energy's product portfolio performance? Our BCG Matrix analysis offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their energy lies and where strategic adjustments might be needed.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Alliant Energy.

Stars

Alliant Energy is heavily investing in large-scale renewable energy projects, a key component of its strategic growth. In 2024 alone, the company completed 1,500 megawatts of new solar generation, building upon its existing 1,800 megawatts of wind capacity.

These significant investments in zero-emission, zero-fuel cost assets highlight Alliant's commitment to the energy transition. This aggressive expansion in a high-growth market is designed to solidify its leadership position and capture increasing market share within its service territories.

The company's strategic focus on renewables is projected to fuel future earnings growth. This buildout is crucial for strengthening its generation portfolio, ensuring long-term stability and profitability.

Alliant Energy is a significant player in fostering economic development across Iowa and Wisconsin. The company has been instrumental in attracting substantial new capital investments and creating numerous jobs in these regions.

A key driver of this growth is the company's success in securing approximately 2.1 gigawatts of contracted peak demand from data centers. This figure highlights a major expansion in Alliant's customer base, specifically targeting high-growth industrial sectors.

This strategic focus on data centers, with plans for further expansion, presents a considerable opportunity for increased electric sales. Alliant Energy's proactive approach is not only generating tangible economic outcomes but also justifying essential infrastructure investments for sustained future growth.

Alliant Energy is heavily investing in modernizing its electric and gas distribution systems, a strategic move to build a more resilient and adaptable energy infrastructure. These significant capital expenditures are vital for improving grid reliability and accommodating new energy technologies.

The company anticipates deploying approximately $9.1 billion in capital expenditures between 2024 and 2027, with a substantial allocation dedicated to these critical system upgrades. This focus on modernization positions Alliant Energy to effectively manage rising energy demand and integrate emerging energy sources.

Ambitious Capital Expenditure Plan (2025-2028)

Alliant Energy has laid out a significant capital expenditure plan, projecting $11.5 billion in investments between 2025 and 2028. This substantial financial commitment is primarily directed towards expanding its renewable energy portfolio, enhancing battery storage capabilities, and modernizing its electric distribution infrastructure.

This aggressive investment strategy is a cornerstone of Alliant Energy's growth plan, aiming to bolster its rate base and construction work in progress. These initiatives are designed to create a predictable and sustained trajectory for earnings growth, reflecting the company's forward-looking approach to energy infrastructure and service improvement.

- Projected Capital Expenditure: $11.5 billion (2025-2028)

- Key Investment Areas: Renewables, battery storage, electric distribution

- Strategic Objectives: Drive rate base growth, increase construction work in progress

- Financial Implication: Supports sustained earnings growth

Execution of Clean Energy Blueprint

Alliant Energy is making significant strides in executing its Clean Energy Blueprint, a comprehensive strategy aimed at transforming its energy portfolio. This plan focuses on retiring coal-fired generation and investing heavily in renewable sources like solar and wind power. For instance, as of early 2024, the company has committed to retiring all its remaining coal-fired plants by 2040, a key milestone in its decarbonization efforts.

The blueprint's execution involves substantial capital investments in new clean energy projects. Alliant Energy is targeting the addition of approximately 4,000 megawatts of new renewable energy capacity over the next few years. This aggressive expansion of clean energy resources is designed to reduce greenhouse gas emissions by an estimated 50% from 2005 levels by 2030.

- Accelerated Renewable Deployment: Alliant Energy's Clean Energy Blueprint is driving the addition of substantial renewable energy capacity, with plans to add around 4,000 MW of solar and wind power.

- Coal Plant Retirements: A critical component of the blueprint involves the planned retirement of all coal-fired generation by 2040.

- Emission Reduction Targets: The strategy is projected to achieve a 50% reduction in greenhouse gas emissions by 2030 compared to 2005 levels.

- Market Positioning: Successful implementation reinforces Alliant's leadership in the clean energy transition, positioning it to capitalize on the growing demand for sustainable energy solutions.

Alliant Energy's significant investments in renewable energy projects, such as the 1,500 megawatts of new solar generation completed in 2024, position these as Stars in the BCG matrix. These zero-fuel cost assets are in a high-growth market, solidifying the company's leadership and capturing market share.

The company's aggressive expansion in renewables, coupled with its focus on attracting high-growth sectors like data centers, indicates strong potential for future earnings growth. This strategic buildout is key to strengthening its generation portfolio.

Alliant Energy's commitment to modernizing its infrastructure, with projected capital expenditures of $9.1 billion between 2024 and 2027, also supports its Star status. These upgrades enhance grid reliability and accommodate new energy technologies, driving rate base growth.

The company's Clean Energy Blueprint, targeting 4,000 MW of new renewable capacity and the retirement of coal plants by 2040, further reinforces its Star classification. This strategy aims for a 50% reduction in greenhouse gas emissions by 2030.

| Category | Key Initiatives | Investment (2024-2028 Est.) | Market Growth | Strategic Impact |

| Stars | Renewable Energy Projects (Solar, Wind) | $11.5 billion (2025-2028) | High | Market Leadership, Earnings Growth |

| Stars | Data Center Customer Acquisition | N/A (Contracted Demand) | High | Increased Electric Sales, Economic Development |

| Stars | Grid Modernization & Resilience | $9.1 billion (2024-2027) | Moderate to High | Rate Base Growth, Infrastructure Adaptation |

What is included in the product

The Alliant Energy BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Alliant Energy BCG Matrix provides a clear, one-page overview, instantly relieving the pain of strategic uncertainty.

Cash Cows

Alliant Energy's regulated electric and natural gas operations serve roughly 1 million electric and 430,000 natural gas customers, mainly in Iowa and Wisconsin. This core business benefits from the stability and predictability inherent in rate-regulated environments, ensuring consistent revenue. The company holds a substantial market share in these mature, essential utility markets.

Alliant Energy's utility operations in Iowa and Wisconsin are positioned as cash cows, thanks to favorable regulatory decisions. Approved rate increases for 2024 and 2025 in both states are crucial, allowing the company to recover its operating expenses and achieve a reasonable return on its substantial infrastructure investments.

These regulatory approvals translate into predictable and stable revenue streams, supporting high profit margins from its core business. For instance, the Iowa Utilities Board approved a $100 million rate increase for Alliant Energy in late 2023, which will be implemented in stages through 2025, contributing directly to this cash cow status.

Alliant Energy's consistent dividend payout, targeting 60%-70% of consolidated ongoing earnings, underscores its position as a Cash Cow. This commitment reflects the robust cash generation capabilities inherent in its mature, high-market-share business segments.

The company's impressive streak of increasing its dividend for 21 consecutive years is a testament to the reliability and stability of its cash flow, further solidifying its Cash Cow status within the BCG Matrix.

Strong Market Position in Service Territories

Alliant Energy's position as the primary regulated utility provider in Iowa and Wisconsin signifies a strong market position, characteristic of a Cash Cow in the BCG matrix. This dominance translates into a consistent and reliable revenue stream, as electricity and natural gas are essential services with inelastic demand. For instance, in 2024, Alliant Energy reported significant revenue from its regulated utility operations, underscoring the stability of these core businesses. The company's deep roots and established customer base in these territories further reinforce its market leadership, ensuring continued patronage and predictable financial performance.

The company's established presence in its service territories is a key driver of its Cash Cow status.

- Dominant Market Share: Alliant Energy is the sole regulated utility provider in significant portions of Iowa and Wisconsin.

- Essential Service Demand: Electricity and natural gas are fundamental needs, ensuring a constant customer base.

- Stable Operational Performance: The regulated nature of its business allows for predictable revenue and operational planning.

- Customer Loyalty: Long-standing relationships foster customer retention and reduce acquisition costs.

Operational Efficiency and Cost Management

Alliant Energy prioritizes operational efficiency and stringent cost management within its established utility segments, which function as its Cash Cows. This focus is crucial for maintaining profitability in these mature, low-growth areas of the business.

Despite securing necessary base rate increases, Alliant Energy demonstrated a commitment to cost control by keeping its average retail electric rates below the U.S. rate of inflation throughout 2024. This strategic approach helps protect customers while bolstering the company's financial stability.

The company's dedication to efficiency directly translates into optimized profit margins and robust cash flow generation from these high-market-share, yet low-growth, business units.

- Cost-Effective Operations: Alliant Energy actively manages expenses within its core utility businesses.

- Rate Management: In 2024, average retail electric rates remained below the U.S. inflation rate.

- Profit Margin Optimization: Efficiency measures directly contribute to healthier profit margins.

- Cash Flow Sustainability: Strong cash flow is generated from these stable, high-market-share segments.

Alliant Energy's regulated utility operations in Iowa and Wisconsin are firmly established as Cash Cows. These segments benefit from a dominant market share in essential services, ensuring consistent demand and predictable revenue streams. Favorable regulatory environments, including approved rate increases for 2024 and 2025, further solidify their cash-generating capabilities and support healthy profit margins.

| Metric | Value (2024 Data) | Significance |

|---|---|---|

| Regulated Utility Revenue | Significant portion of total revenue (specific figures often reported quarterly/annually) | Demonstrates stability and scale of core operations |

| Dividend Payout Ratio Target | 60%-70% of consolidated ongoing earnings | Reflects robust cash generation from mature businesses |

| Dividend Increase Streak | 21 consecutive years | Testament to consistent and reliable cash flow |

| Average Retail Electric Rate vs. Inflation | Below U.S. inflation rate | Indicates cost management and customer affordability |

Preview = Final Product

Alliant Energy BCG Matrix

The Alliant Energy BCG Matrix preview you are viewing is the complete, unedited document you will receive upon purchase. This means the strategic insights and visual representation of Alliant Energy's business units are exactly as they will be delivered, ready for immediate integration into your planning processes.

Dogs

Alliant Energy is actively retiring its coal-fired generating facilities, demonstrating a commitment to cleaner energy. For instance, the company retired its Lansing Generating Station in Iowa in 2023. This strategic move aligns with its broader clean energy transition goals.

These older coal plants are classified as 'dogs' in the BCG matrix. They incur significant maintenance expenses and face increasing environmental scrutiny. Furthermore, their long-term operational viability is diminishing as the energy sector shifts towards more sustainable sources.

The divestment from these 'dog' assets allows Alliant Energy to reallocate capital. This freed-up capital can then be directed towards more promising investments, such as renewable energy projects and grid modernization efforts, supporting future growth and profitability.

Portions of Alliant Energy's legacy electric and gas distribution infrastructure, particularly those predating significant modernization initiatives, can be viewed as 'dogs' in a BCG matrix context. These older assets often exhibit lower operational efficiency and demand higher ongoing maintenance expenditures. For instance, in 2023, Alliant Energy reported capital expenditures of $1.8 billion, with a substantial portion allocated to infrastructure modernization, highlighting the ongoing need to address these less efficient components.

Alliant Energy's non-utility and parent operations have presented a challenge, contributing negatively to GAAP EPS in 2024 and the first quarter of 2025. This underperformance is largely attributed to increased financing expenses within these segments.

These operations are currently consuming cash rather than generating positive earnings, signaling a position within the BCG matrix characterized by low market share and low growth. This cash drain, while the core utility business remains robust, suggests these non-core or overhead functions could be acting as a drag on overall financial performance.

Assets with High Depreciation and Financing Expenses

Alliant Energy's assets that carry significant depreciation and financing expenses without corresponding revenue growth can be categorized as potential 'dogs' in a BCG Matrix. These are assets where the financial strain of their upkeep and funding is not being offset by their contribution to the company's earnings.

The impact of these costs is evident in financial reporting, where increases in depreciation and financing expenses have been noted as factors affecting overall GAAP EPS. For instance, in 2024, Alliant Energy reported that certain capital expenditures, while necessary for future growth, initially increase depreciation and financing costs before generating substantial returns. This dynamic highlights the challenge of managing these specific asset categories.

- High Depreciation: Assets with accelerated depreciation schedules or those that are aging rapidly incur higher non-cash expenses.

- Financing Costs: Investments requiring substantial new debt or equity financing add to interest or dividend expenses, impacting profitability.

- Low Revenue Growth: When these high-cost assets do not generate proportional increases in revenue, their net contribution diminishes.

- Impact on EPS: The combined effect of these factors can drag down overall earnings per share, signaling a potential 'dog' status if not managed effectively.

Customer Segments with Declining Demand

While Alliant Energy is strategically investing in high-growth areas such as data centers, certain customer segments might be facing a sustained decrease in energy demand. These could be specific industrial sectors or geographically concentrated customer groups whose energy needs are diminishing over time.

These declining segments, if they represent a small portion of Alliant's overall customer base, could be considered 'dogs' within the BCG matrix framework. They would be characterized by low growth potential and a limited capacity to drive future revenue increases for the company.

Alliant Energy's commitment to economic development initiatives is designed to counteract these potential downturns. For instance, in 2023, Alliant Energy announced plans to invest approximately $6 billion in capital projects over the next four years, with a significant portion dedicated to expanding renewable energy and modernizing infrastructure, aiming to attract new, energy-intensive businesses.

- Declining Sectors: Identify specific industries within Alliant's service territory that show a consistent trend of reduced energy consumption, potentially due to automation, efficiency improvements, or industry consolidation.

- Localized Impact: Pinpoint any geographic areas or smaller communities where industrial or commercial activity has significantly decreased, leading to a lower overall energy demand from those specific customer bases.

- Revenue Contribution: Assess the current and projected revenue contribution from these potentially declining segments to understand their impact on overall financial performance.

- Growth Offset Strategy: Detail how Alliant's broader growth strategies, such as attracting new businesses or expanding into new energy services, are intended to compensate for any revenue shortfalls from these 'dog' customer segments.

Alliant Energy's legacy coal-fired generating stations, like the Lansing Generating Station retired in 2023, are prime examples of 'dogs' in the BCG matrix. These assets require substantial capital for maintenance and face increasing regulatory pressure, making their long-term viability questionable as the company transitions to cleaner energy sources.

The company's non-utility and parent operations, which negatively impacted GAAP EPS in 2024 and Q1 2025 due to higher financing costs, also fit the 'dog' profile. These segments consume cash without generating sufficient returns, indicating a low market share and low growth scenario.

Certain segments of Alliant's older infrastructure, especially those predating recent modernization efforts, can be considered 'dogs'. These assets often exhibit lower efficiency and higher maintenance costs, as evidenced by the $1.8 billion in capital expenditures in 2023, a significant portion of which was directed towards upgrading such infrastructure.

Declining customer segments, such as specific industrial sectors with reduced energy demand, also represent potential 'dogs'. These areas offer limited future revenue growth, necessitating strategies like the $6 billion capital investment plan announced in 2023 to attract new, energy-intensive businesses and offset these downturns.

Question Marks

Alliant Energy is actively investing in emerging battery energy storage systems, with plans for significant deployments like 100 MW and 75 MW systems at solar facilities. They are also exploring cutting-edge technologies such as compressed carbon dioxide storage.

These advanced storage solutions operate within a rapidly expanding market, offering substantial future promise for enhancing grid stability and integrating renewable energy sources more effectively. For instance, the global battery energy storage market was valued at approximately $12.5 billion in 2023 and is projected to grow considerably.

Despite the high growth potential, these technologies are still in their nascent stages of deployment. Consequently, they currently represent a small market share and necessitate considerable capital investment and ongoing development to fully establish their economic feasibility and achieve widespread market penetration.

Pilot projects for advanced grid technologies, such as those exploring novel distributed energy resource management systems or cutting-edge grid cybersecurity, fit squarely into the question mark category of the Alliant Energy BCG Matrix. These initiatives represent emerging frontiers with substantial potential to revolutionize grid efficiency and resilience, mirroring the high growth potential characteristic of a star.

However, their current market penetration is minimal, reflecting the nascent stage of these technologies. Significant research and development investment is a prerequisite for their successful scaling, a hallmark of question mark assets. The ultimate market share and viability of these pilot projects remain uncertain, necessitating careful evaluation and strategic decision-making.

For instance, in 2024, utilities are increasingly exploring AI-driven predictive maintenance for grid infrastructure, a technology with high growth prospects but currently low adoption rates. Investments in these pilot programs are crucial for understanding their efficacy and potential return on investment before wider deployment.

Alliant Energy is prioritizing investments in flexible, dispatchable generation technologies to address increasing energy demand and bolster grid reliability. This strategic focus acknowledges the need for adaptable power sources that can respond quickly to changing grid conditions.

These emerging technologies, while promising for future energy needs, currently occupy a small market share. They represent a high-growth potential but necessitate significant upfront capital and extensive operational learning to achieve widespread adoption and prove their long-term viability.

Untapped Niche Markets or Geographical Expansion Studies

Exploring untapped niche markets or geographical expansion for Alliant Energy would place these initiatives squarely in the "Question Mark" category of the BCG Matrix. These are nascent ventures with high growth potential but currently minimal market share, demanding substantial initial investment and rigorous market validation. For instance, developing hydrogen infrastructure for specialized industrial clients or establishing microgrids for isolated communities represent such opportunities.

- Hydrogen Infrastructure: A nascent market with significant growth projections, especially as decarbonization efforts accelerate. Alliant Energy's investment in this area would be a strategic bet on future energy demands.

- Microgrids for Remote Communities: These offer a solution for energy resilience and access in underserved areas, presenting a social and economic growth opportunity.

- Geographical Expansion Studies: Preliminary research into new states or regions with favorable regulatory environments and growing energy needs would also fall under this classification.

- Investment Needs: Such ventures require significant capital for research, development, pilot projects, and market entry, mirroring the characteristics of Question Marks needing careful management.

Projects Contingent on Future Regulatory & Grant Approvals

Alliant Energy's strategic positioning of certain capital-intensive projects, especially those embracing novel and expensive technologies, often hinges on gaining future regulatory approvals for cost recovery. This dependency, coupled with the need to secure substantial government grants, such as conditional DOE loan guarantees, places these initiatives in a 'questionable' category within a BCG matrix framework.

These projects, while offering considerable growth prospects, face uncertainty regarding their current market share and overall financial viability until these critical external approvals are confirmed. For instance, advancements in renewable energy infrastructure or grid modernization technologies might require significant upfront investment and await regulatory sign-off before their full economic potential can be realized.

- Regulatory Hurdles: Projects requiring cost recovery through rate adjustments are subject to Public Service Commission approvals, which can be lengthy and uncertain.

- Grant Dependency: Securing federal or state grants, like those from the Department of Energy, is crucial for offsetting the high initial costs of innovative technologies.

- Market Uncertainty: Until regulatory and grant approvals are finalized, the market share and profitability of these nascent projects remain speculative.

- Strategic Risk: The company must balance the potential high rewards of these projects with the inherent risks associated with external approval processes.

Alliant Energy's investments in emerging technologies like compressed carbon dioxide storage and advanced grid cybersecurity represent classic "Question Marks." These ventures are characterized by high growth potential in rapidly evolving markets, such as the expanding battery energy storage sector, which was valued around $12.5 billion in 2023.

However, they currently hold minimal market share due to their nascent stage, requiring substantial capital and ongoing development for economic viability. For example, AI-driven predictive maintenance for grid infrastructure, a high-growth area in 2024, still has low adoption rates.

These initiatives, including potential ventures into hydrogen infrastructure or microgrids for remote communities, demand significant upfront investment and rigorous market validation. Their success hinges on navigating regulatory hurdles, securing grants, and proving market share, making their future uncertain.

Alliant Energy's strategic bets on these areas, like exploring new geographical markets or developing niche technologies, are crucial for future growth but carry inherent risks due to their unproven market position and reliance on external approvals.

BCG Matrix Data Sources

Our Alliant Energy BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.