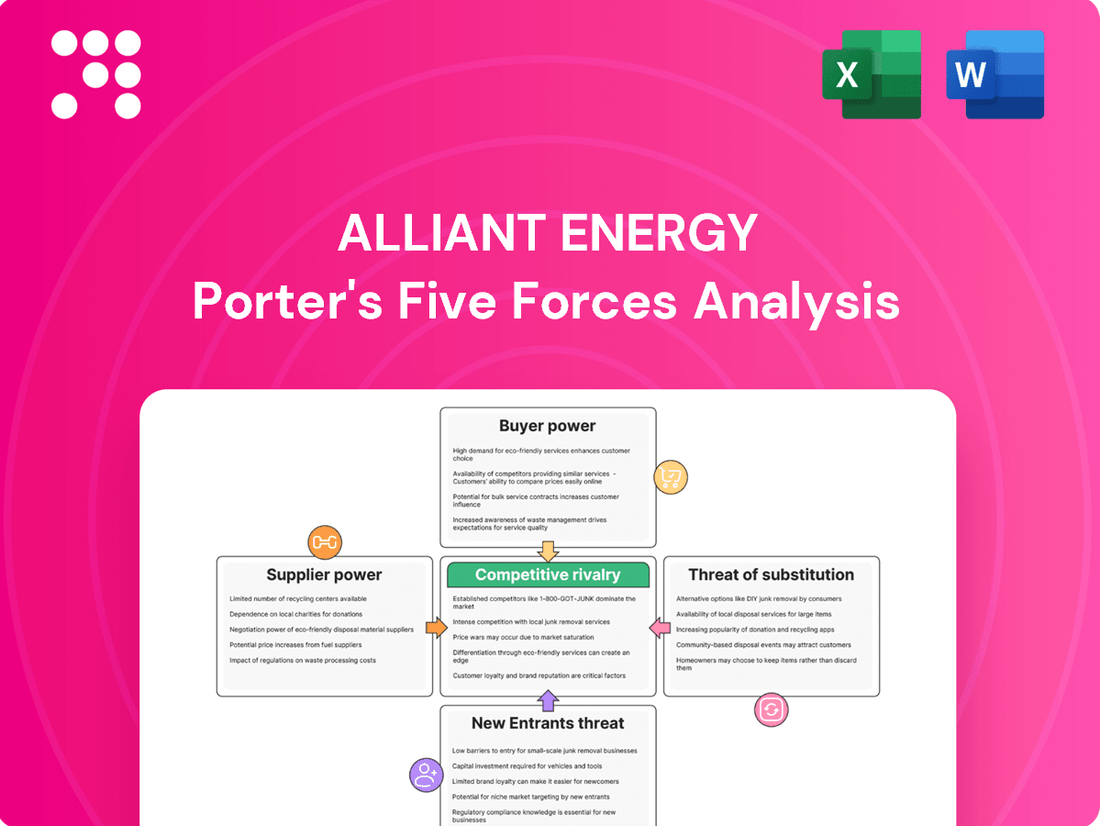

Alliant Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliant Energy Bundle

Alliant Energy operates within a dynamic energy sector, facing significant pressures from rivals, the bargaining power of customers, and the influence of suppliers. Understanding these forces is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping Alliant Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The utility sector, which includes companies like Alliant Energy, often deals with a limited number of suppliers for crucial, specialized equipment. Think about large transformers, turbines, and sophisticated grid components; these aren't items you can just pick up anywhere.

This concentration gives suppliers more leverage. For example, in 2024, the lead times for procuring large power transformers have stretched significantly, sometimes exceeding 18-24 months. This extended waiting period directly translates to increased bargaining power for the few companies that manufacture these essential parts.

Alliant Energy's reliance on a diverse energy portfolio, encompassing natural gas, coal, wind, and solar, helps mitigate the bargaining power of any single fuel supplier. This diversification broadens their supplier base, reducing dependence on any one source.

Despite this diversification, the natural gas market presents a notable exception. Fluctuations in natural gas prices, often driven by global demand such as liquefied natural gas (LNG) exports, can significantly influence Alliant Energy's generation costs. This volatility grants natural gas suppliers a degree of leverage in price negotiations.

For instance, in 2023, natural gas prices saw considerable swings, impacting utility operating expenses. The EIA reported that the average spot price for natural gas at Henry Hub, a key benchmark, averaged $2.56 per million British thermal units (MMBtu) in 2023, down from $6.52 in 2022, illustrating the market's sensitivity to supply and demand dynamics.

Suppliers possessing cutting-edge research and development in renewable energy, like enhanced solar panel efficiency or sophisticated battery storage, wield considerable influence. Alliant Energy's substantial capital allocation towards solar and battery storage projects directly increases its reliance on these niche technology providers, thereby strengthening their negotiating position.

High Switching Costs for Infrastructure

The bargaining power of suppliers for Alliant Energy is significantly influenced by high switching costs associated with core infrastructure. Replacing components like transmission and distribution equipment isn't a simple swap; it often necessitates extensive redesign, retooling of manufacturing processes, and navigating complex regulatory approval pathways. These substantial upfront investments make it difficult and costly for Alliant Energy to change suppliers, thereby strengthening the hand of existing providers.

For instance, in 2023, the average cost for utility-scale solar projects in the US ranged from $1,000 to $1,500 per kilowatt, with significant portions dedicated to specialized equipment and installation. Any change in these critical components would likely incur additional engineering and integration expenses, further cementing supplier leverage.

- High Capital Investment: The initial outlay for specialized infrastructure components creates a barrier to entry for new suppliers and locks in existing relationships due to the sunk costs involved.

- Technical Integration Complexity: Ensuring seamless integration of new equipment with existing grid systems requires significant technical expertise and testing, adding to switching costs.

- Regulatory Hurdles: Utility infrastructure is heavily regulated, and changes to approved equipment often require lengthy and costly re-certification processes.

Labor and Specialized Services

The bargaining power of suppliers for Alliant Energy is significantly influenced by the availability of skilled labor for construction, maintenance, and specialized technical services. A scarcity of qualified personnel or niche contractors in the utility sector can empower these suppliers, potentially driving up labor costs and causing project timelines to stretch.

For instance, in 2024, the demand for specialized electrical engineers and skilled tradespeople remained robust across the energy infrastructure sector. This tight labor market means that companies like Alliant Energy may face increased costs for essential services, impacting project budgets and operational efficiency.

- Skilled Labor Shortage: A continued deficit in qualified technicians and engineers can elevate labor expenses for Alliant Energy.

- Specialized Contractor Leverage: Suppliers offering unique technical expertise or certifications can command higher prices.

- Project Delays: Limited availability of specialized services can lead to extended project schedules and increased overall costs.

- Wage Pressures: Competition for a finite pool of skilled workers in 2024 contributed to upward pressure on wages within the industry.

The bargaining power of suppliers for Alliant Energy is a key consideration, particularly concerning specialized equipment and raw materials. While diversification across energy sources helps, reliance on a limited number of manufacturers for critical components like transformers, or on volatile markets like natural gas, grants suppliers significant leverage. High switching costs for essential infrastructure further solidify this power, as demonstrated by the substantial investment required for utility-scale solar projects.

| Factor | Impact on Alliant Energy | 2024 Data/Trend |

| Supplier Concentration (Specialized Equipment) | Increases supplier leverage due to limited options. | 18-24 month lead times for large power transformers in 2024. |

| Natural Gas Market Volatility | Grants natural gas suppliers pricing influence. | Average spot price at Henry Hub was $2.56/MMBtu in 2023, down from $6.52 in 2022. |

| Renewable Technology Dependence | Strengthens negotiating position of niche technology providers. | Alliant Energy's capital allocation towards solar and battery storage projects. |

| High Switching Costs (Infrastructure) | Locks in existing supplier relationships. | US utility-scale solar projects averaged $1,000-$1,500/kW in 2023. |

| Skilled Labor Availability | Can drive up labor costs and cause project delays. | Robust demand for specialized electrical engineers and skilled trades in 2024. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Alliant Energy's utility sector, examining the threat of new entrants, buyer and supplier power, and the intensity of rivalry.

Instantly identify and address competitive threats with a visual breakdown of Alliant Energy's market landscape.

Gain clarity on supplier power and customer bargaining strength to optimize Alliant Energy's strategic positioning.

Customers Bargaining Power

As a regulated utility, Alliant Energy's pricing for electricity and natural gas is determined by state utility commissions in Iowa and Wisconsin. This regulatory oversight significantly curtails the bargaining power of individual customers, as they cannot directly negotiate rates. For instance, in 2024, Alliant Energy's electric rates are set by these commissions, limiting customer influence on pricing.

Furthermore, customers within Alliant Energy's service territories typically face a lack of alternative providers for their essential energy services. This limited choice effectively reduces their ability to switch suppliers and leverage that option as a bargaining tool, further concentrating power with the utility.

Even with regulatory oversight, customers, particularly residential users, are quite attuned to fluctuations in energy expenses. For instance, average residential electricity bills saw an uptick in 2024, highlighting this sensitivity.

This heightened awareness of costs can translate into significant pressure on regulatory bodies to scrutinize and potentially limit proposed rate hikes. Consequently, this dynamic indirectly impacts Alliant Energy's ability to freely adjust its pricing structures.

Large industrial and commercial customers, especially those in burgeoning sectors like data centers, are key drivers of load growth for Alliant Energy. Their substantial energy consumption grants them a degree of negotiation power, potentially leading to more favorable rates or tailored service agreements. For instance, in 2023, Alliant Energy reported significant customer growth, with industrial customers playing a vital role in this expansion, highlighting their importance in the company's revenue streams.

Distributed Energy Resources (DERs)

The growing adoption of distributed energy resources (DERs) by Alliant Energy's customers significantly influences their bargaining power. As more customers install rooftop solar and battery storage, they gain a measure of energy independence, which can lessen their dependence on the utility's grid. This self-sufficiency provides a tangible lever for negotiation, as customers can potentially reduce their consumption from traditional sources. For instance, in 2024, the U.S. solar market continued its robust growth, with residential solar installations projected to remain strong, indicating a sustained trend of customer-sited generation.

Furthermore, enhanced energy efficiency measures adopted by consumers also contribute to this increased bargaining power. By reducing their overall energy demand through smart home technology and improved insulation, customers can effectively lower their utility bills and become less sensitive to price increases. This trend is supported by ongoing advancements in energy-saving technologies, making efficiency a more accessible and attractive option for a wider range of households.

- Customer Self-Sufficiency: Rooftop solar and battery storage installations empower customers to generate and store their own power, reducing reliance on Alliant Energy's grid.

- Reduced Demand: Increased energy efficiency measures translate to lower overall electricity consumption, giving customers more control over their energy costs.

- Market Trends: The U.S. residential solar market, a key indicator of DER adoption, has shown consistent growth, with projections indicating continued expansion in 2024.

- Technological Advancements: Innovations in smart home technology and energy-saving appliances further enhance customer ability to manage and reduce their energy usage.

Customer Satisfaction and Regulatory Scrutiny

Customer satisfaction is a significant factor in utility rate cases, directly impacting how regulators approve pricing. If customers express dissatisfaction due to poor service or reliability problems, it can result in regulatory bodies disallowing certain costs or imposing stricter oversight on Alliant Energy. This pressure forces the company to carefully consider how to invest in infrastructure upgrades while keeping rates affordable for its customer base.

For instance, in 2023, Alliant Energy faced various customer service challenges that were closely monitored by state utility commissions. These challenges, often related to extended outage restoration times or billing inquiries, can influence the outcomes of rate increase requests. The company's ability to demonstrate improved customer satisfaction metrics is therefore crucial for favorable regulatory decisions. In 2024, ongoing investments in grid modernization are aimed at enhancing reliability, which in turn is expected to bolster customer satisfaction and support future rate case filings.

- Customer Satisfaction Metrics: Alliant Energy tracks key performance indicators such as customer complaint rates and net promoter scores.

- Regulatory Impact: Poor customer satisfaction can lead to disallowances in rate cases, impacting profitability.

- Infrastructure Investment Balance: The company must balance the need for infrastructure upgrades with customer affordability concerns.

- 2024 Focus: Enhancing grid reliability and customer service are priorities to mitigate regulatory scrutiny.

While individual customers have limited direct bargaining power due to regulation, large commercial and industrial clients, particularly those with significant energy needs like data centers, can negotiate more favorable terms. Their substantial consumption in 2023 made them vital to Alliant Energy's growth, giving them leverage.

The rise of distributed energy resources, like rooftop solar, is also shifting power. In 2024, strong residential solar growth in the U.S. means more customers can reduce their reliance on the utility, increasing their negotiation ability.

Customer satisfaction is a critical indirect factor. In 2023, Alliant Energy faced scrutiny over service issues, impacting its ability to secure rate increases. For 2024, investments in grid reliability aim to improve customer sentiment and support future pricing.

Preview Before You Purchase

Alliant Energy Porter's Five Forces Analysis

This preview shows the exact, comprehensive Alliant Energy Porter's Five Forces Analysis you'll receive immediately after purchase, detailing industry competitiveness and profitability. You're looking at the actual document, fully formatted and ready for your strategic planning needs, ensuring no surprises or placeholders. Once you complete your purchase, you’ll get instant access to this exact file, providing valuable insights into Alliant Energy's competitive landscape.

Rivalry Among Competitors

Alliant Energy benefits from significant geographic monopolies and duopolies in its core service territories of Iowa and Wisconsin. This structure inherently limits direct competition for essential services like electricity and natural gas distribution within its designated areas.

In 2024, Alliant Energy's regulated operations, which form the bulk of its business, are characterized by this limited competitive landscape. For instance, in its Wisconsin service areas, it is often the sole provider of electricity and natural gas, a situation that greatly reduces the intensity of rivalry for customer acquisition and retention.

While not a complete monopoly, the regulated nature of these utilities means that new entrants face substantial regulatory hurdles, effectively creating a duopoly or near-monopoly situation. This stability in its primary markets shields Alliant Energy from the intense competitive pressures often seen in less regulated industries.

While direct competition among electric and gas utilities is often constrained by regulation, Alliant Energy faces significant rivalry from alternative energy sources. Customers can choose to heat their homes or power their businesses using options like propane, fuel oil, or by generating their own renewable energy, such as rooftop solar. This inter-fuel competition pressures utilities to remain competitive in pricing and service offerings.

Alliant Energy faces significant rivalry in securing large industrial customers, such as the substantial investments seen in data centers. Utility companies actively compete by offering attractive electricity rates, ensuring dependable service, and supporting infrastructure expansion to win these lucrative accounts. This dynamic fuels competition for economic development initiatives across their service territories.

Regulatory Framework and Performance-Based Regulation

Alliant Energy operates within a highly regulated utility sector, where state public utility commissions, such as the Wisconsin Public Service Commission and the Iowa Utilities Board, set the rules of engagement. This regulatory framework, particularly performance-based regulation (PBR), directly influences competitive rivalry.

PBR mechanisms incentivize utilities to meet specific performance targets, fostering a form of competition focused on operational efficiency and customer service. Utilities that excel in these areas, for example, by reducing costs or improving reliability, can earn higher authorized rates of return. This creates a dynamic where Alliant Energy competes with other utilities to demonstrate superior performance and secure favorable regulatory outcomes.

- Regulatory Oversight: State Public Utility Commissions (PUCs) are the primary regulators, influencing operational strategies and investment decisions.

- Performance-Based Regulation (PBR): This regulatory model encourages utilities to achieve efficiency targets and invest in infrastructure by linking their authorized rates of return to performance metrics.

- Incentives for Efficiency: PBR creates a competitive environment where utilities strive to outperform peers in cost management and service delivery to earn higher returns.

- Infrastructure Investment: The ability to earn returns on approved infrastructure investments, often tied to PBR, drives rivalry in undertaking modernization and expansion projects.

Investment in Clean Energy and Grid Modernization

Alliant Energy faces intense competition from other utilities vying for environmentally conscious customers and investors through their commitment to clean energy and grid modernization. This rivalry is a significant factor in the industry's landscape, pushing companies to innovate and invest heavily in sustainable practices.

Alliant Energy's substantial investments, such as its approximately $1.4 billion commitment to renewable energy projects in Iowa by 2025, directly address this competitive pressure. These investments in solar and wind power are crucial for attracting and retaining customers who prioritize sustainability and for appealing to investors focused on ESG (Environmental, Social, and Governance) factors.

- Renewable Energy Investment: Alliant Energy is investing billions in solar and wind projects to enhance its clean energy portfolio.

- Grid Modernization Efforts: The company is also focused on upgrading its infrastructure to support a more resilient and efficient energy grid.

- Customer and Investor Attraction: These initiatives are key differentiators in attracting customers and investors who value environmental responsibility.

- Competitive Landscape: Utilities are increasingly competing on their sustainability commitments, making these investments a strategic imperative.

While Alliant Energy operates in largely regulated territories with limited direct utility competitors, rivalry emerges from alternative energy sources and the pursuit of large industrial clients. The company's significant investments in renewable energy, such as its approximately $1.4 billion commitment to Iowa's clean energy projects by 2025, highlight this competitive dynamic. This strategy aims to attract environmentally conscious customers and investors, differentiating Alliant from peers focused on traditional energy portfolios.

| Competitive Factor | Description | Alliant Energy's Position |

|---|---|---|

| Direct Utility Competition | Limited due to geographic monopolies and regulatory structures in Iowa and Wisconsin. | Primarily operates as a sole provider or part of a duopoly in core service areas. |

| Alternative Energy Sources | Competition from propane, fuel oil, and on-site generation like rooftop solar. | Pressures Alliant to maintain competitive pricing and service quality. |

| Industrial Customer Acquisition | Rivalry among utilities to secure large clients like data centers through attractive rates and infrastructure support. | Actively competes for economic development projects by offering tailored energy solutions. |

| Sustainability and ESG | Increasing competition based on clean energy commitments and grid modernization. | Investing heavily in renewables to appeal to customers and investors prioritizing environmental factors. |

SSubstitutes Threaten

The increasing affordability and accessibility of customer-owned renewable generation, particularly solar panels and battery storage, pose a growing threat to Alliant Energy. As more customers invest in these distributed energy resources, they reduce their dependence on traditional utility services, potentially impacting Alliant's revenue streams. For instance, residential solar installations in the US saw a significant increase, with over 4.5 gigawatts installed in 2023 alone, demonstrating a clear trend of customers seeking alternatives.

Investments in energy-efficient appliances and smart thermostats are increasingly offering consumers alternatives to traditional energy consumption, directly impacting Alliant Energy's customer base. For instance, in 2024, the U.S. Department of Energy continued to promote ENERGY STAR certified products, which can reduce household energy bills by an average of 10% annually, presenting a tangible substitute for the energy Alliant provides.

Demand-side management programs, often incentivized by utilities themselves, further empower customers to reduce their reliance on purchased energy. These programs, which can include load control or time-of-use pricing, encourage shifts in energy usage, effectively substituting peak demand with off-peak consumption or even self-generation, thereby lessening the need for Alliant's core service.

The threat of substitutes for traditional heating and cooling methods is growing, impacting utilities like Alliant Energy. Technologies such as geothermal systems and advanced heat pumps offer viable alternatives to natural gas and conventional electric heating. For example, the U.S. Department of Energy has highlighted significant efficiency gains in modern heat pump technology, which can reduce reliance on fossil fuels.

These alternative technologies can directly substitute for Alliant Energy's core offerings. Geothermal systems, while having a higher upfront cost, can drastically lower long-term energy bills by utilizing the earth's stable temperature. Similarly, the increasing efficiency of electric heat pumps, especially in milder climates, presents a challenge to natural gas demand for heating and can reshape electricity consumption patterns.

The market for these substitutes is expanding. In 2024, the global heat pump market is projected to continue its robust growth, driven by environmental concerns and government incentives for energy efficiency. This trend directly affects Alliant Energy's revenue streams from natural gas distribution and could influence the overall demand for electricity, necessitating strategic adaptation.

Fuel Switching by Industrial Consumers

Large industrial clients often possess the flexibility to switch between various energy sources, such as natural gas, coal, or even biomass, depending on prevailing market prices and supply reliability. This capability directly impacts Alliant Energy by potentially reducing their demand if alternative fuels become more economically attractive.

For instance, fluctuations in natural gas prices, a key input for many industrial processes, can directly influence a company's decision to switch to a different fuel. In 2024, the U.S. Energy Information Administration (EIA) reported that industrial sector natural gas consumption can be sensitive to price changes, with significant shifts possible based on cost differentials.

This threat means Alliant Energy must remain competitive in its pricing and ensure consistent fuel availability to retain its large industrial customer base. The ability of these customers to adapt their energy consumption strategies poses a significant challenge to predictable revenue streams.

- Fuel Switching Capability: Industrial consumers can shift between natural gas, biomass, and other energy sources.

- Price Sensitivity: Decisions to switch are heavily influenced by the relative cost of different fuels.

- Impact on Demand: Switching can lead to reduced or intermittent demand for Alliant Energy's services.

- Competitive Pressure: Alliant Energy faces pressure to maintain competitive pricing and reliable supply to retain these customers.

Small Modular Reactors (SMRs) and Advanced Nuclear

Emerging technologies, particularly Small Modular Reactors (SMRs) and other advanced nuclear designs, present a potential long-term threat of substitution for traditional large-scale utility power generation. While still in early development stages, these technologies promise cleaner, more flexible, and potentially more cost-effective baseload power solutions.

The threat is currently low but growing. As of early 2024, SMRs are primarily in the design, licensing, and demonstration phases, with few operational projects. For instance, the U.S. Department of Energy's Advanced Reactor Demonstration Program (ARDP) has funded several SMR projects, aiming for deployment in the late 2020s or early 2030s. However, significant hurdles remain, including regulatory approval, supply chain development, and public acceptance.

- Nascent Threat: SMRs are not yet a widespread or cost-competitive alternative for utility-scale power in 2024.

- Long-Term Potential: These advanced reactors could offer a reliable, low-carbon baseload power source, directly competing with existing large fossil fuel or traditional nuclear plants.

- Developmental Stage: Significant investment and technological advancement are still required for SMRs to become a viable substitute.

- Cost Uncertainty: While proponents suggest long-term cost reductions, initial SMR deployment costs are expected to be high.

The threat of substitutes for Alliant Energy is multifaceted, encompassing distributed generation, energy efficiency, and alternative fuel sources. Customer-owned solar installations, for example, directly reduce reliance on utility-provided electricity. In 2023, U.S. residential solar saw over 4.5 gigawatts installed, a clear indicator of this trend.

Energy efficiency measures, such as ENERGY STAR appliances, also act as substitutes by lowering overall energy consumption. These products can reduce household energy bills by approximately 10% annually, as highlighted by the U.S. Department of Energy. Furthermore, industrial clients can switch fuels based on price, impacting Alliant's demand.

Emerging technologies like Small Modular Reactors (SMRs) represent a potential long-term substitute for utility-scale power generation, though they are still in developmental stages as of early 2024.

| Substitute Category | Example | Impact on Alliant Energy | 2023/2024 Data Point |

|---|---|---|---|

| Distributed Generation | Residential Solar Panels | Reduced electricity sales, lower revenue | 4.5 GW installed in U.S. residential solar (2023) |

| Energy Efficiency | ENERGY STAR Appliances | Lower overall energy demand | 10% average annual household energy bill reduction |

| Alternative Fuels | Industrial Fuel Switching (e.g., natural gas to biomass) | Fluctuating demand, competitive pricing pressure | Industrial natural gas consumption sensitive to price changes (EIA) |

| Advanced Generation | Small Modular Reactors (SMRs) | Potential long-term competition for baseload power | SMRs in design/licensing phases, limited operational projects (Early 2024) |

Entrants Threaten

The regulated utility industry, like the one Alliant Energy operates in, demands enormous upfront capital for building and maintaining essential infrastructure. Think power plants, vast transmission networks, and local distribution systems. These aren't small investments; they run into the billions of dollars, creating a formidable barrier for any newcomer looking to enter the market.

For instance, Alliant Energy's capital expenditure plans often involve multi-billion dollar investments to upgrade and expand its services. In 2024, the company projected capital expenditures of approximately $2.3 billion for the year, a significant sum that underscores the sheer financial muscle required to compete in this sector.

New entrants into the utility sector, like Alliant Energy operates within, encounter substantial barriers due to extensive regulatory hurdles and licensing requirements. These processes are often complex and time-consuming, demanding new companies to navigate intricate approval pathways. This includes securing necessary licenses, permits, and crucially, rate case approvals from state utility commissions, which can significantly impede market entry.

Alliant Energy benefits from an already established and extensive infrastructure, including generation, transmission, and distribution assets. This robust network provides significant economies of scale, allowing Alliant to spread fixed costs over a larger output, resulting in lower per-unit costs. For instance, in 2023, Alliant Energy reported capital expenditures of $2.5 billion, primarily focused on modernizing its existing infrastructure and building new, cleaner generation capacity, a substantial investment that new entrants would find challenging to match.

Access to Transmission and Distribution Networks

New entrants face a significant hurdle in accessing established transmission and distribution networks. These essential infrastructures are predominantly owned and operated by incumbent utilities, such as Alliant Energy, creating a substantial barrier to entry for potential competitors.

For instance, in 2024, the capital expenditure required to build new transmission lines can run into millions of dollars per mile, making it prohibitively expensive for new players to replicate existing infrastructure. This reliance on existing networks effectively limits the threat of new entrants, as gaining access often involves complex regulatory approvals and agreements with established entities.

- Infrastructure Control: Incumbents like Alliant Energy maintain control over critical transmission and distribution assets.

- High Capital Requirements: Building equivalent infrastructure demands massive investment, often exceeding $1 million per mile for transmission lines.

- Regulatory Hurdles: New entrants must navigate complex regulatory frameworks to gain access or rights-of-way.

- Limited Interconnection Opportunities: The availability and cost of interconnecting with existing grids can be a significant deterrent.

Strong Customer Relationships and Brand Loyalty

Alliant Energy benefits from deeply entrenched customer relationships and strong brand loyalty, cultivated over many years of reliable service and active community involvement. This history fosters a significant level of trust that new competitors would find challenging and time-consuming to replicate.

The company’s commitment to local communities, evident in its various engagement initiatives, further solidifies its position. For instance, in 2024, Alliant Energy continued its focus on community development projects and environmental stewardship programs, reinforcing its image as a responsible corporate citizen. This local embeddedness creates a barrier to entry by making it harder for newcomers to gain widespread acceptance and customer preference.

- Established Trust: Decades of service have built a strong foundation of trust with Alliant Energy's customer base.

- Community Engagement: Active participation in local initiatives in 2024 enhances brand loyalty and goodwill.

- High Switching Costs: For customers, the perceived effort and potential disruption of switching utility providers can be a deterrent.

- Brand Recognition: Alliant Energy enjoys high brand recognition within its service territories, making it the default choice for many consumers.

The threat of new entrants for Alliant Energy is significantly low due to the immense capital required to build and maintain utility infrastructure, coupled with stringent regulatory approvals. These barriers, including the need for extensive licensing and rate case approvals, make market entry exceptionally difficult and costly for potential competitors.

Newcomers face the challenge of replicating Alliant Energy's established infrastructure, which represents billions in investment. For example, Alliant's 2024 capital expenditure plan of approximately $2.3 billion highlights the scale of investment needed, a figure that new entrants would struggle to match, especially considering the high cost of new transmission lines, which can exceed $1 million per mile.

| Barrier Type | Description | Impact on New Entrants | Alliant Energy's Advantage |

|---|---|---|---|

| Capital Requirements | Building power plants, transmission, and distribution networks requires billions in investment. | Extremely high; prohibitive for most new players. | Established infrastructure and economies of scale. |

| Regulatory Hurdles | Complex licensing, permits, and rate case approvals from state commissions. | Significant; time-consuming and uncertain. | Expertise in navigating regulatory processes and existing approvals. |

| Infrastructure Control | Control over existing transmission and distribution networks. | High; limited access to essential infrastructure. | Exclusive ownership and operation of vital networks. |

| Customer Loyalty & Brand | Established trust and community engagement. | Difficult to overcome; requires significant time and investment. | Strong brand recognition and deep customer relationships. |

Porter's Five Forces Analysis Data Sources

Our Alliant Energy Porter's Five Forces analysis is built upon a foundation of publicly available data, including SEC filings, annual reports, and investor presentations. We also incorporate insights from industry-specific research reports and market intelligence platforms.