Addiko Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addiko Bank Bundle

Addiko Bank demonstrates solid strengths in its digital transformation and customer-centric approach, but also faces challenges related to market competition and regulatory changes. Understanding these dynamics is crucial for anyone looking to invest or strategize within the European banking sector.

Want the full story behind Addiko Bank’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Addiko Bank AG showcased impressive financial results in 2024, with net profit climbing 10% to €45.4 million. This marks the third year in a row the bank has seen its profits grow, signaling strong operational efficiency and a consistent ability to generate earnings.

The bank's financial strength is further evidenced by its Common Equity Tier 1 (CET1) ratio, which stood at a healthy 22.0% by the end of 2024. This robust capital position indicates a solid foundation and resilience against potential financial challenges.

Addiko Bank's strategic repositioning as a specialist in Consumer and SME banking across Central and South-Eastern Europe (CSEE) is a significant strength. This targeted approach enables the development of highly relevant products and efficient solutions for its core customer base.

The bank's commitment to consumer lending has yielded impressive results, with new business growing by 20% year-on-year in 2024. This momentum continued into the first quarter of 2025, showing a further 9.8% increase, underscoring the effectiveness of their specialized strategy.

Addiko Bank is making significant strides in digital transformation, focusing heavily on digital products and mobile banking. This commitment is evident in their pilot of fully digital consumer lending in Romania, scheduled for a Q1 2025 launch.

The bank's strategy includes integrating artificial intelligence to boost operational efficiency and improve customer interactions. This digital-first approach positions Addiko as a competitive challenger bank, highlighting speed and a contemporary service offering as key advantages.

Resilient Asset Quality

Addiko Bank demonstrates robust asset quality, a key strength. The bank's impaired loans ratio held steady at around 3.7% by the close of 2024. Furthermore, its non-performing exposure (NPE) ratio remained stable at 3.0% in the first quarter of 2025.

This resilience is underpinned by several factors. Effective risk management processes are in place, leading to low new inflows of impaired loans. Continued successful recoveries also contribute to maintaining this stable asset quality.

- Impaired Loans Ratio: Approximately 3.7% (End of 2024)

- Non-Performing Exposure (NPE) Ratio: Stable at 3.0% (Q1 2025)

- NPE Coverage Ratio: Strong at 80.9%

Established Regional Presence and Expertise

Addiko Bank boasts a robust network of branches across Central and South-Eastern Europe, giving it a significant advantage. This extensive physical footprint, coupled with a deep understanding of local market dynamics, allows the bank to effectively serve its diverse customer base. For instance, as of the end of 2024, Addiko Bank operated over 150 branches in its key markets, demonstrating its commitment to regional accessibility.

This established regional presence translates into a competitive edge by enabling Addiko Bank to tailor its offerings to the unique needs of each market. The bank's deep local expertise is crucial for executing its business plan and strategy, particularly in segments like retail and SME banking. In 2024, Addiko Bank reported a customer deposit growth of 5% in its core markets, reflecting the success of its localized approach.

- Well-dispersed branch network: Over 150 branches across Central and South-Eastern Europe as of year-end 2024.

- Deep local market knowledge: Enabling tailored customer service and product development.

- Competitive advantage: Understanding and catering to diverse customer needs within specific regions.

- Strategic execution: Leveraging local expertise to drive growth in key banking segments, evidenced by a 5% customer deposit growth in 2024.

Addiko Bank's focused strategy on consumer and SME banking in CSEE is a significant strength, driving growth. This specialization is paying off, with new consumer lending business up 20% in 2024 and continuing at 9.8% in Q1 2025. The bank's commitment to digital transformation, including AI integration and a pilot for fully digital consumer lending in Romania in Q1 2025, positions it as a modern and efficient competitor.

The bank's financial performance is robust, with net profit rising 10% to €45.4 million in 2024, marking the third consecutive year of profit growth. This is supported by a strong CET1 ratio of 22.0% at the end of 2024, indicating solid capital adequacy.

Addiko Bank maintains high asset quality, with an impaired loans ratio of approximately 3.7% and an NPE ratio of 3.0% as of Q1 2025. This stability is attributed to effective risk management and successful loan recoveries, further bolstered by a strong NPE coverage ratio of 80.9%.

The bank benefits from an extensive branch network of over 150 locations across CSEE as of year-end 2024, coupled with deep local market knowledge. This allows for tailored customer service and product development, contributing to a 5% growth in customer deposits in core markets during 2024.

| Key Strength Metric | Value | Period | Significance |

| Net Profit Growth | 10% | 2024 | Demonstrates operational efficiency and earnings generation. |

| CET1 Ratio | 22.0% | End of 2024 | Indicates strong capital foundation and resilience. |

| New Consumer Lending | +20% | 2024 | Highlights success of specialized strategy. |

| Impaired Loans Ratio | ~3.7% | End of 2024 | Shows robust asset quality. |

| Branch Network | >150 | End of 2024 | Facilitates regional accessibility and market penetration. |

What is included in the product

Offers a full breakdown of Addiko Bank’s strategic business environment by detailing its internal capabilities and external market dynamics.

Identifies key vulnerabilities and competitive advantages, enabling Addiko Bank to proactively address weaknesses and leverage strengths for improved market performance.

Weaknesses

In 2024, Addiko Bank experienced considerable shareholder instability, marked by two unsolicited takeover bids. These events incurred substantial one-off advisory costs totaling €3 million. This period of flux also triggered shifts in the bank's ownership structure.

The instability prompted the European Central Bank (ECB) to recommend suspending dividend payments for the 2024 financial year. Such disruptions can foster investor uncertainty and negatively influence market sentiment towards the bank.

Addiko Bank's SME lending segment has experienced underperformance, with loan growth lagging behind expectations, a contrast to the strong performance in its consumer lending arm. This subdued growth is primarily due to muted demand from businesses and intense competition within the SME market. For instance, in the first quarter of 2024, while consumer loans saw a notable increase, SME loan origination remained sluggish, impacting the bank's overall loan portfolio expansion strategy.

Addiko Bank's business model, while focused on specific markets, shows a weakness in revenue diversification when compared to larger, universal banking competitors. This specialization, particularly in Central and Southeastern European (CSEE) markets, can leave the bank more vulnerable to economic slowdowns or sector-specific challenges within its core operating regions.

For instance, in 2023, Addiko Bank's net interest income, a primary driver of its revenue, represented a significant portion of its total income. While this focus has yielded positive results, a lack of broader revenue streams, such as extensive fee-based services or international operations, means that downturns in its primary markets, like the economic pressures experienced in some CSEE countries during 2024, can have a more pronounced impact on overall profitability.

Increasing Operating Expenses

Addiko Bank faces a challenge with rising operating expenses. General administrative costs have climbed due to inflationary pressures and the full impact of wage adjustments implemented in 2025. This trend is evident in the bank's cost-to-income ratio, which increased to 63.0% in the first quarter of 2025 from 60.7% in the same period of 2024. Effectively managing these escalating costs is vital for sustaining profitability.

- Increased administrative expenses due to inflation and wage adjustments.

- Higher cost-to-income ratio: 63.0% in Q1 2025 vs. 60.7% in Q1 2024.

- Pressure on profitability necessitates efficient cost management strategies.

Vulnerability to Interest Rate Fluctuations

Addiko Bank's profitability is susceptible to shifts in interest rates. For instance, falling market interest rates in the first quarter of 2025 directly impacted the bank's net interest income. While increased commission income provided some buffer, a sustained low or declining interest rate environment could continue to challenge Addiko's core earnings, underscoring its sensitivity to these market movements.

Addiko Bank's financial performance is hampered by rising operating costs, with the cost-to-income ratio climbing to 63.0% in Q1 2025 from 60.7% in Q1 2024, driven by inflation and wage adjustments. Furthermore, the bank's profitability is vulnerable to interest rate fluctuations, as seen in the Q1 2025 impact of falling rates on net interest income. The underperformance in SME lending, with loan growth lagging behind consumer lending, also presents a significant weakness, exacerbated by muted business demand and market competition.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Cost-to-Income Ratio | 60.7% | 63.0% | +2.3 pp |

| SME Loan Growth | [Data Unavailable] | [Data Unavailable] | Lagging |

| Net Interest Income Impact | [Data Unavailable] | Negative (due to falling rates) | Sensitive |

Preview the Actual Deliverable

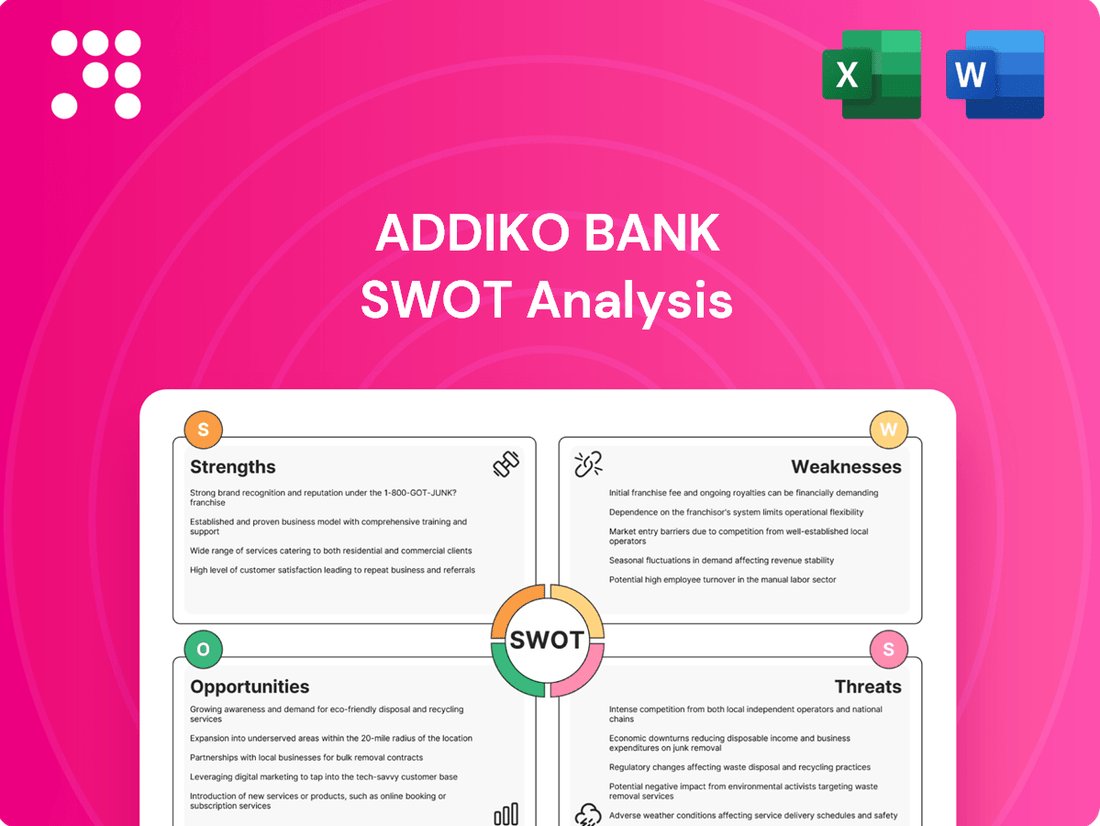

Addiko Bank SWOT Analysis

This is the actual Addiko Bank SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the bank's internal strengths and weaknesses, alongside external opportunities and threats. This detailed analysis is designed for strategic decision-making.

Opportunities

Addiko Bank is well-positioned to capitalize on the growing demand for digital and mobile banking. Building on its 2024 advancements in fully digital consumer lending, the bank can further enhance its digital offerings. This strategic focus is projected to attract a broader customer base and deepen engagement within its Central and Southeast European (CSEE) markets.

The integration of artificial intelligence presents a significant opportunity to refine operational efficiency and improve the overall customer journey. By making financial solutions more accessible and streamlined through AI, Addiko Bank can differentiate itself in a competitive landscape. This digital-first approach is key to unlocking new customer segments and fostering loyalty.

Addiko Bank operates primarily in Central and Southeastern Europe (CSEE), a region anticipated to see economic growth exceeding the EU average. For instance, projections for 2024 and 2025 indicate robust GDP expansion in key CSEE markets where Addiko has a strong presence. This positive macroeconomic outlook creates a fertile ground for the bank to increase its consumer and small and medium-sized enterprise (SME) lending portfolios.

By concentrating on these core markets, Addiko is well-positioned to leverage the region's ongoing development. The increasing demand for financial products and services, driven by economic uplift, offers a significant opportunity for the bank to capture market share and enhance its profitability.

Addiko Bank's focus on straightforward banking presents a prime opportunity to sharpen its value proposition. By consistently delivering on its promise of speed and simplicity, the bank can solidify its unique selling points in a crowded financial landscape. This clear positioning can attract clients who prioritize ease and efficiency in their banking interactions.

The bank's commitment to client-focused solutions allows it to differentiate itself further. For instance, in 2023, Addiko Bank reported a significant improvement in its cost-to-income ratio, reaching 57.8%, down from 63.8% in 2022, reflecting operational efficiencies that can be directly translated into client benefits and a more compelling offering.

Leveraging Strong Capital for Strategic Growth

Addiko Bank's strong capital position, evidenced by a Common Equity Tier 1 (CET1) ratio of 22.0% as of the close of 2024, presents a significant opportunity for strategic growth. This robust capital buffer equips the bank with the financial flexibility to pursue various growth avenues.

This solid capital foundation allows Addiko Bank to:

- Fund future business expansion initiatives.

- Invest strategically in technological advancements and digital transformation.

- Explore potential mergers, acquisitions, or targeted market entries.

- Maintain financial stability and resilience in dynamic market conditions.

By responsibly deploying this capital, Addiko Bank can effectively drive sustainable growth, enhance its competitive positioning, and ultimately boost shareholder value.

Optimizing SME Segment Performance

Addiko Bank can seize the opportunity to revitalize its Small and Medium-sized Enterprise (SME) segment, even with current subdued lending demand. By strategically refining its approach, the bank can unlock growth potential.

The bank can implement tailored initiatives, such as specialized loan products for specific industries or flexible repayment schedules, to address unmet SME needs. Adjusting pricing strategies to offer competitive rates and introducing value-added services, like digital onboarding or advisory support, are also key. For instance, in 2024, many European banks are focusing on digital transformation to streamline SME lending processes, aiming to reduce operational costs and improve customer experience.

- Targeted Product Development: Launching new loan products designed for specific SME sectors, potentially leveraging insights from market analysis of 2024 SME investment trends.

- Dynamic Repricing Strategies: Implementing flexible pricing models that adapt to market conditions and client risk profiles, aiming to attract more borrowers.

- Enhanced Digital Offerings: Improving online application and servicing platforms to make accessing credit simpler and faster for SMEs.

- Portfolio Diversification: A stronger SME focus can lead to a more balanced loan book, reducing reliance on other, potentially more volatile, lending areas.

Addiko Bank's strong digital transformation efforts, particularly in fully digital consumer lending as seen in 2024, position it well to capture growing market demand. Further enhancements in its digital and mobile banking platforms can attract a wider customer base across its Central and Southeast European (CSEE) markets.

The bank can leverage AI to streamline operations and improve customer experience, making financial solutions more accessible and efficient. This focus on a digital-first approach is crucial for differentiating Addiko Bank in a competitive environment and attracting new customer segments.

The economic growth anticipated in CSEE markets, projected to outpace the EU average in 2024-2025, presents a significant opportunity for Addiko Bank. This positive macroeconomic trend supports an expansion of its consumer and SME lending portfolios.

Addiko Bank's commitment to simplicity and speed in its banking services offers a clear competitive advantage. By consistently delivering on this promise, the bank can solidify its unique selling proposition and attract clients who value ease and efficiency.

Threats

The Central and Southeastern European banking sector is a crowded space, with many institutions competing for customers and business. This means Addiko Bank faces significant pressure on its ability to earn money from loans and the costs associated with attracting new clients. For instance, in 2023, the average net interest margin across the CSEE region hovered around 2.5%, a figure that can be squeezed by aggressive pricing from competitors.

To stay ahead, Addiko Bank must constantly develop new products and services that stand out from the crowd. This is essential to compete effectively against both established local banks and larger international financial institutions entering the market. The drive for differentiation is key in a market where customer loyalty can be hard-won, especially as digital banking solutions become increasingly commoditized.

Ongoing macroeconomic uncertainties and geopolitical events, such as the war in Ukraine, continue to pose significant risks to the European economy and, by extension, the banking sector. For instance, the European Central Bank (ECB) has maintained a hawkish stance on interest rates throughout 2024 to combat persistent inflation, which can dampen lending activity.

Such instability can lead to volatile market conditions, impact consumer and business confidence, and potentially increase credit risks. In the CSEE region, where Addiko Bank primarily operates, economic growth forecasts for 2024 have been revised downwards by institutions like the IMF, reflecting these broader challenges.

Addiko's operations in Central and Southeastern Europe (CSEE) make it particularly sensitive to these regional dynamics. For example, countries like Serbia and Croatia, key markets for Addiko, have experienced fluctuating inflation rates and currency pressures in 2024, directly impacting the bank's operating environment and asset quality.

Interest rate volatility poses a significant threat to Addiko Bank. For instance, in the first quarter of 2025, unexpected fluctuations in rates directly impacted the bank's net interest income, squeezing profitability. This sensitivity means that even minor shifts can have a noticeable effect on the bottom line.

Furthermore, the financial landscape is constantly reshaped by regulatory changes. Addiko Bank must navigate evolving capital requirements, such as those stemming from Basel IV, and adhere to recommendations from supervisory bodies like the European Central Bank. Failure to adapt swiftly to these shifts could result in costly penalties or operational limitations, hindering growth.

Increased Fraud and Cybersecurity Risks

As Addiko Bank continues to expand its digital services, it confronts a growing threat from cyber fraud and other cybersecurity vulnerabilities. The evolving nature of these illicit activities necessitates ongoing, substantial investment in advanced security systems and stringent protocols to safeguard operations and customer data.

The potential consequences of a major security incident are severe. A significant breach could result in direct financial losses, substantial damage to the bank's reputation, and a critical erosion of customer confidence, impacting long-term business viability.

- Sophisticated Cyber Threats: Financial institutions globally reported an average of 12.5 cyberattacks per day in 2023, a trend expected to continue in 2024.

- Cost of Breaches: The average cost of a data breach in the financial sector reached $5.9 million in 2023, underscoring the financial impact of security failures.

- Customer Trust: A 2024 survey indicated that 70% of consumers would switch banks following a significant cybersecurity incident, highlighting the importance of trust.

- Regulatory Scrutiny: Increased regulatory focus on data protection, such as GDPR and similar frameworks, means non-compliance due to breaches can lead to hefty fines.

Shareholder Disputes and Dividend Policy Impact

The European Central Bank's (ECB) recommendation to suspend Addiko Bank's dividend payments for 2024, following unsuccessful takeover bids and shifts in its shareholder base, presents a significant threat. This move, especially if it extends beyond the current financial year, could alienate investors who prioritize regular income streams. For instance, in 2023, Addiko Bank paid a dividend of €0.75 per share, a figure that investors might now find uncertain.

The potential for continued shareholder instability or a prolonged dividend suspension directly impacts investor confidence. Such uncertainty can lead to a decline in the bank's share price performance as market participants reassess the risk profile. This is particularly relevant given that Addiko Bank's stock has experienced volatility in recent periods, making consistent shareholder returns a key factor for many.

- ECB Recommendation: Suspension of 2024 dividend payments due to takeover bid aftermath.

- Investor Deterrence: Potential alienation of income-focused investors reliant on consistent payouts.

- Share Price Impact: Risk of declining investor confidence and share price performance due to instability.

- Market Perception: Uncertainty surrounding dividend policy could negatively affect Addiko Bank's valuation.

Addiko Bank faces intense competition within the Central and Southeastern European banking sector, where many institutions vie for customers, potentially squeezing profit margins on loans. For example, in 2023, the average net interest margin in the CSEE region was around 2.5%, a figure vulnerable to aggressive pricing by rivals.

The bank must continuously innovate with new products and services to differentiate itself from established local banks and expanding international players. This is crucial in a market where customer loyalty is hard-earned, especially as digital banking offerings become increasingly standard.

Macroeconomic instability and geopolitical events, such as the ongoing conflict in Ukraine, present significant risks to the European economy and its banking sector. For instance, the European Central Bank's continued efforts to combat inflation through higher interest rates throughout 2024 could dampen lending activities.

Such uncertainties can lead to volatile markets, reduced consumer and business confidence, and increased credit risks. Economic growth forecasts for 2024 in the CSEE region, where Addiko Bank primarily operates, have been revised downward by institutions like the IMF, reflecting these broader challenges.

Addiko Bank's operational focus on Central and Southeastern Europe (CSEE) makes it particularly susceptible to regional economic fluctuations. Key markets for Addiko, such as Serbia and Croatia, have experienced fluctuating inflation and currency pressures in 2024, directly impacting the bank's operating environment and asset quality.

Interest rate volatility remains a significant threat, directly impacting Addiko Bank's net interest income and profitability. For example, unexpected rate shifts in early 2025 could negatively affect the bank's earnings, highlighting its sensitivity to even minor market movements.

The bank must also navigate evolving regulatory landscapes, including capital requirements like Basel IV and directives from supervisory bodies such as the European Central Bank. Non-compliance with these changes could result in financial penalties or operational constraints, impeding growth.

As Addiko Bank enhances its digital services, it faces growing threats from cyber fraud and other cybersecurity vulnerabilities. The evolving nature of these threats necessitates continuous, substantial investment in advanced security systems and protocols to protect operations and customer data.

A major security incident could lead to significant financial losses, reputational damage, and a critical erosion of customer trust, ultimately impacting the bank's long-term viability.

| Threat Category | Specific Threat | Impact on Addiko Bank | Supporting Data/Example |

|---|---|---|---|

| Competition | Intense Market Competition | Pressure on net interest margins, increased customer acquisition costs. | Average CSEE net interest margin ~2.5% in 2023. |

| Market Dynamics | Product/Service Differentiation | Difficulty in retaining customers and attracting new ones against established and new players. | Digital banking commoditization increases the challenge. |

| Economic Environment | Macroeconomic Uncertainty & Geopolitics | Dampened lending activity due to higher interest rates, reduced confidence. | ECB maintained hawkish stance on interest rates in 2024. IMF revised down CSEE growth forecasts for 2024. |

| Regional Exposure | Regional Economic Volatility | Impact on operating environment and asset quality in key markets. | Fluctuating inflation and currency pressures in Serbia and Croatia in 2024. |

| Financial Risk | Interest Rate Volatility | Direct impact on net interest income and profitability. | Unexpected rate shifts in Q1 2025 impacted net interest income. |

| Regulatory Compliance | Evolving Regulatory Landscape | Potential for penalties and operational limitations due to non-compliance. | Need to adapt to Basel IV capital requirements and ECB recommendations. |

| Cybersecurity | Cyber Threats & Data Breaches | Financial losses, reputational damage, erosion of customer trust. | Average cost of data breach in financial sector was $5.9 million in 2023. 70% of consumers would switch banks after a breach (2024 survey). |

| Shareholder Relations | Dividend Suspension & Shareholder Instability | Alienation of income-focused investors, potential decline in share price. | ECB recommended suspension of 2024 dividend payments. Addiko Bank paid €0.75/share in 2023. |

SWOT Analysis Data Sources

This Addiko Bank SWOT analysis is built upon a robust foundation of data, drawing from the bank's official financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment.