Addiko Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addiko Bank Bundle

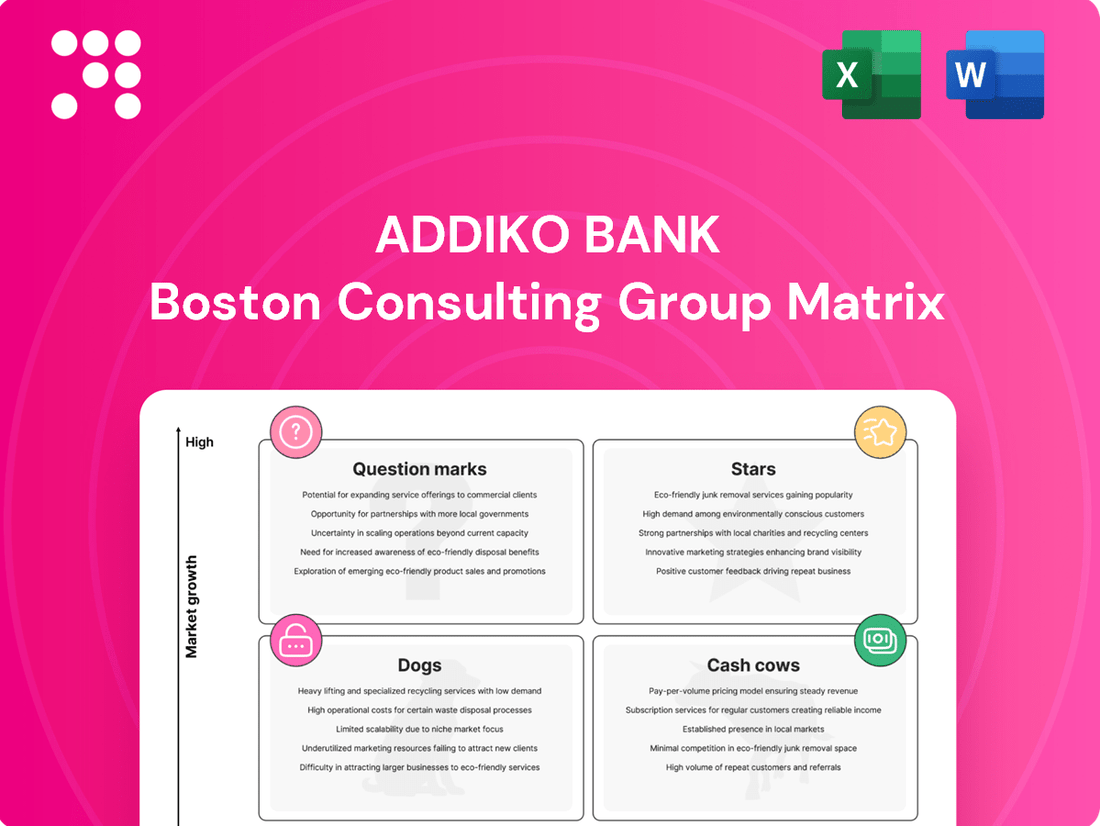

Curious about Addiko Bank's strategic positioning? This glimpse into their BCG Matrix reveals how their offerings stack up in the market, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on the detailed insights and actionable strategies that await. Secure your copy of the full Addiko Bank BCG Matrix today and chart a course for optimized performance.

Stars

Addiko Bank's consumer lending segment is a standout performer, exhibiting impressive double-digit growth. New business in this area surged by 16% year-over-year in the first quarter of 2025. This robust expansion, coupled with a 10% loan growth in 2024, significantly surpassed the bank's own projections and highlights its strong momentum in the Central and South-Eastern European markets.

Addiko Bank's commitment to fully digital consumer lending, exemplified by its Romania launch in Q1 2025, places it at the forefront of a rapidly expanding sector. This digital-first strategy is designed to significantly improve customer interactions and operational efficiency, eliminating the need for traditional branch visits during loan applications.

The bank anticipates that these advancements in digital channels will not only boost its market share but also solidify its reputation as a digitally innovative financial institution. This focus is crucial for capturing a larger segment of the growing digital lending market.

Addiko Bank has demonstrated robust growth in its net fee and commission income, a key indicator of its diversified revenue generation capabilities. In the first quarter of 2025, this income stream saw an impressive 8.0% year-over-year increase, building on a strong performance in 2024 where it grew by 8.7%.

This upward trend is largely attributable to Addiko Bank's focused strategy on expanding its offerings in high-demand areas. Significant contributions come from the successful cross-selling of products such as accounts and packages, bancassurance, and credit cards, highlighting effective customer engagement and product penetration.

The consistent growth in net fee and commission income is crucial for Addiko Bank's overall profitability. It underscores the bank's strategic shift towards generating more income from non-interest-bearing activities, thereby enhancing its financial resilience and market competitiveness.

Strategic Focus on CSEE Specialist Banking

Addiko Group's strategic repositioning as a specialist Consumer and SME banking group across Central and Southeastern Europe (CSEE) is a key element of its business strategy. This focus allows for concentrated efforts and deep market expertise in segments with significant growth potential.

This regional specialization enables Addiko to effectively tailor its services and respond to local market dynamics, building a strong competitive advantage. The CSEE region is anticipated to grow faster than the EU average, offering a favorable environment for Addiko's focused approach.

- Specialist Focus: Addiko concentrates on Consumer and SME banking in CSEE, aiming for deep market penetration.

- Regional Growth: The CSEE region is projected to experience economic growth exceeding the EU average, supporting Addiko's strategy.

- Competitive Edge: Tailoring services to local CSEE market dynamics enhances Addiko's competitive positioning.

Strong Capital Position and Asset Quality

Addiko Bank demonstrates a strong capital position, crucial for its strategic positioning. Its CET1 ratio stood at a healthy 22.0% at the close of 2024, further strengthening to 21.7% by the first quarter of 2025. This robust capital base underscores the bank's financial stability and its capacity to absorb potential shocks.

This solid capital foundation directly supports Addiko Bank's ability to invest in growth initiatives and maintain asset quality. The bank's non-performing exposure (NPE) ratio remained stable at 3.0% in Q1 2025, reflecting prudent risk management. This combination of strong capital and quality assets provides the necessary resilience for continued expansion and strategic development.

- CET1 Ratio (Year-End 2024): 22.0%

- CET1 Ratio (Q1 2025): 21.7%

- NPE Ratio (Q1 2025): 3.0%

Addiko Bank's consumer lending segment is a clear star performer, showing significant growth. This segment experienced a 16% year-over-year increase in new business in Q1 2025, building on an 10% loan growth in 2024. The bank's strategic push into fully digital consumer lending, as seen with its Romania launch in Q1 2025, is positioning it to capture a larger share of this expanding market.

The bank's net fee and commission income also shines, growing 8.0% year-over-year in Q1 2025 and 8.7% in 2024. This growth is driven by successful cross-selling of products like accounts, bancassurance, and credit cards, indicating strong customer engagement and a move towards diversified, non-interest-bearing income streams.

Addiko's specialist focus on Consumer and SME banking in the CSEE region is a strategic advantage, as this area is expected to outpace EU average economic growth. This focused approach, combined with a robust capital position—evidenced by a CET1 ratio of 21.7% in Q1 2025 and a stable 3.0% NPE ratio—underpins its ability to invest in growth and maintain financial stability.

| Business Segment | Growth Metric | 2024 Performance | Q1 2025 Performance | Strategic Outlook |

|---|---|---|---|---|

| Consumer Lending | New Business Growth | 10% loan growth | 16% year-over-year increase | Digitalization focus, market share expansion |

| Fee & Commission Income | Net Fee & Commission Income Growth | 8.7% growth | 8.0% year-over-year increase | Diversified revenue, cross-selling success |

| Overall Strategy | Capital Strength (CET1) | 22.0% (Year-End 2024) | 21.7% (Q1 2025) | Specialist CSEE focus, stable asset quality (NPE 3.0%) |

What is included in the product

Addiko Bank's BCG Matrix offers a strategic overview of its business units, guiding investment and divestment decisions.

The Addiko Bank BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Addiko Bank's funding structure is notably robust due to its significant reliance on retail deposits. As of the first quarter of 2025, these deposits amounted to €5.3 billion, highlighting a stable and secure financial foundation.

This substantial base of low-cost retail deposits offers Addiko Bank a consistent and predictable source of liquidity and capital. It effectively reduces the bank's exposure to potentially more volatile funding sources found in the broader financial markets, thereby enhancing its operational resilience.

The steady, albeit sometimes modest, growth observed in these deposits underscores their reliability. This consistent expansion provides a dependable bedrock for Addiko Bank's ongoing operations, particularly within its established mature markets.

Addiko Bank's established transaction banking services are a prime example of a Cash Cow. These offerings, including payment solutions, are foundational to the bank's operations, consistently producing reliable fee income.

While not a high-growth area, these services are crucial for customer retention and provide a stable revenue base. In 2023, Addiko Bank reported a net fee and commission income of €131.8 million, demonstrating the significant and steady contribution from these mature business lines.

Addiko Bank maintains a network of approximately 155 branches across Central and Southeastern Europe. While this geographic footprint doesn't represent a high-growth market, it serves as a reliable foundation for customer engagement and essential banking services.

The bank's operational philosophy centers on efficiency and providing uncomplicated financial solutions. This approach implies that the branch network is fine-tuned to bolster core banking functions and client support, rather than focusing on rapid expansion.

This established branch infrastructure is a key factor in retaining existing customers and ensuring operational steadiness, thereby producing a predictable, albeit modest, stream of cash flow.

Prudent Risk Management Framework

Addiko Bank's commitment to prudent risk management positions its established operations as reliable cash cows. This is clearly demonstrated by their impressive financial metrics.

- Stable Asset Quality: Addiko Bank maintained a Non-Performing Exposure (NPE) ratio of 3.0% as of Q1 2025, showcasing strong control over credit risk in its mature banking segments.

- High Coverage: With an NPE coverage ratio of 80.9%, the bank has robust provisions in place, significantly mitigating potential losses from impaired loans.

- Profitability Protection: This diligent risk management directly translates to consistent profit generation by effectively minimizing unexpected credit losses.

- Low Cost of Risk: The low cost of risk recorded in Q1 2025 further underscores the efficiency of their risk mitigation strategies, safeguarding profitability.

Yield from Sovereign Bond Portfolio

Addiko Bank's sovereign bond portfolio functions as a cash cow within its business model. This segment contributes a stable yield to the bank's net interest income, even as it navigates fluctuating interest rate landscapes.

While not a high-growth area, these investments represent a prudent deployment of capital, consistently generating returns. For instance, Addiko Bank reported a net interest income of €235.5 million for the first nine months of 2023, with its investment portfolio playing a key role in this stability.

This portfolio acts as a dependable income stream in a mature financial market, bolstering the bank's overall profitability. The conservative nature of sovereign bonds offers a predictable revenue source.

- Stable Income Generation: Sovereign bonds provide a consistent yield, contributing to net interest income.

- Conservative Allocation: Represents a low-risk investment strategy within the bank's broader portfolio.

- Profitability Support: Acts as a reliable revenue generator, enhancing overall financial performance.

- Impacted by Interest Rates: Yields are sensitive to changes in the broader interest rate environment.

Addiko Bank's transaction banking services and its established branch network are key examples of its Cash Cows. These mature business lines generate consistent fee income and provide a stable revenue base, even if growth is modest. The bank's prudent risk management, evidenced by a low Non-Performing Exposure ratio of 3.0% as of Q1 2025 and a high coverage ratio of 80.9%, further solidifies these operations as reliable profit generators. Additionally, the sovereign bond portfolio contributes steadily to net interest income, acting as a dependable income stream.

| Business Area | BCG Category | Key Financial Contribution | Data Point (as of Q1 2025 unless stated) |

|---|---|---|---|

| Transaction Banking | Cash Cow | Stable Fee Income | Net Fee and Commission Income €131.8 million (2023) |

| Branch Network | Cash Cow | Customer Retention, Operational Steadiness | Approx. 155 Branches |

| Sovereign Bond Portfolio | Cash Cow | Stable Net Interest Income | Net Interest Income €235.5 million (first 9 months 2023) |

| Overall Risk Management | Supports Cash Cow Stability | Profitability Protection | NPE Ratio: 3.0%; NPE Coverage: 80.9% |

Full Transparency, Always

Addiko Bank BCG Matrix

The Addiko Bank BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you'll gain immediate access to a professionally formatted analysis, ready for strategic decision-making without any hidden surprises or additional work required. The comprehensive insights presented here are precisely what will be delivered, enabling you to effectively evaluate Addiko Bank's business units and plan future investments.

Dogs

Addiko Bank has clearly identified its mortgage lending as a non-focus area, actively pursuing an accelerated run-down of this portfolio. This strategic move signals a deliberate exit or a significant reduction in their exposure to this market.

The bank's decision suggests that its mortgage lending segment holds a low market share and does not align with its primary growth objectives. In 2023, Addiko Bank continued its strategy of reducing its mortgage exposure, with the portfolio size reflecting this ongoing divestment process.

Public and large corporate lending are categorized as non-focus areas within Addiko Bank's strategy, slated for an accelerated run-down. This indicates a deliberate move to exit or significantly reduce exposure in these segments due to a low market share and perceived limited growth potential.

The bank's decision to divest these portfolios stems from a strategic reallocation of resources. By shedding these less profitable segments, Addiko aims to concentrate its efforts and capital on expanding its presence and profitability in consumer and small and medium-sized enterprise (SME) lending, which are identified as key growth drivers.

Addiko Bank's Non-Strategic Legacy Assets represent a challenge, comprising remaining non-performing or low-yield assets from past strategic initiatives. These are assets that no longer align with the bank's current focus on consumers and small to medium-sized enterprises (SMEs).

While not a formally defined product, the bank's strategy includes an accelerated run-down of these non-focus areas. This indicates a deliberate effort to clean up portfolios that are not contributing meaningfully to the bank's future growth or profitability, freeing up capital and management attention.

For instance, as of the first quarter of 2024, Addiko Bank reported a Non-Performing Loans (NPL) ratio of 4.4%, a figure that includes these legacy assets. The ongoing efforts to reduce these non-strategic holdings are crucial for improving overall asset quality and financial performance.

Outdated or Inefficient Internal Processes

Before Addiko Bank's 'Acceleration Program' concluded in 2024, it's plausible that outdated internal processes were a drag on efficiency. These could have included manual data entry or paper-based workflows that slowed down operations and increased the risk of errors.

Even with the program's focus on modernization, any remaining manual tasks or legacy systems not yet fully integrated could represent 'dogs' within the bank's operational framework. For instance, if certain customer onboarding procedures still involve significant manual verification, this would consume more time and resources than a fully digitized alternative.

- Manual Reconciliation: Processes requiring manual reconciliation of accounts or transactions, potentially leading to delays and increased operational costs.

- Legacy IT Systems: Reliance on older IT infrastructure that is not fully compatible with newer, more efficient digital platforms, impacting speed and data flow.

- Paper-Based Workflows: Certain departments might still rely heavily on paper documentation, slowing down approvals and increasing storage costs.

- Siloed Information: Lack of seamless data sharing between departments due to disparate systems, hindering cross-functional efficiency and customer service.

Underperforming Medium SME Loans

While Addiko Bank identifies Small and Medium-sized Enterprises (SMEs) as a strategic focus, its medium SME loan portfolio experienced a decline. This segment, particularly medium-sized businesses, is showing characteristics of a 'dog' within the BCG matrix due to consistently underperforming against growth expectations. In 2024, overall SME loan growth was subdued, falling short of targets, a situation attributed to weak demand and intense market competition.

The bank's efforts to revitalize the SME market, including specific initiatives aimed at addressing its unique challenges, underscore the difficulties encountered in this sector. For instance, the continued decrease in the medium SME loan book suggests a lack of traction or a shrinking market share for this particular segment. This underperformance, coupled with the bank's strategic initiatives to improve its standing, points to a potential 'dog' status for medium SME loans if they fail to meet future growth objectives.

- Declining Loan Book: The medium SME loan portfolio has seen a continuous decrease, indicating a shrinking market presence.

- Subdued Growth in 2024: Overall SME loan growth in 2024 did not meet expectations, highlighting broader challenges.

- Competitive Environment: A highly competitive market and muted demand are key factors contributing to the underperformance.

- Strategic Initiatives: The bank's launch of targeted initiatives signals recognition of and attempts to address the difficulties within the SME lending space.

Within Addiko Bank's strategic analysis, certain segments are identified as 'dogs' due to their low market share and low growth prospects. These are areas where the bank is actively reducing its exposure, such as mortgage lending and public/large corporate lending, indicating a deliberate exit or significant run-down of these portfolios.

The medium SME loan portfolio also exhibits 'dog' characteristics, evidenced by a declining loan book and subdued growth in 2024, falling short of targets. This underperformance is attributed to weak demand and intense market competition, prompting strategic initiatives to address these challenges.

Operational inefficiencies, potentially stemming from manual processes or legacy IT systems not yet fully integrated, can also be considered 'dogs'. These areas consume resources without contributing significantly to future growth or profitability, impacting overall efficiency.

Addiko Bank's strategy involves divesting these underperforming segments to reallocate capital and focus on more promising areas like consumer and SME lending.

| Segment | Market Share | Growth Prospects | Addiko Bank Strategy |

|---|---|---|---|

| Mortgage Lending | Low | Low | Accelerated Run-down |

| Public & Large Corporate Lending | Low | Low | Accelerated Run-down |

| Medium SME Loans | Declining | Subdued (2024) | Strategic Revitalization Efforts |

| Legacy IT Systems/Manual Processes | N/A (Operational) | Low Efficiency | Modernization/Integration |

Question Marks

Addiko Bank views SME lending as a key growth driver in Central and Southeast Europe (CSEE), recognizing its substantial potential. However, the bank has experienced subdued demand, with performance falling short of targets in 2024 and only achieving 2% year-over-year growth in the first quarter of 2025.

This segment presents a significant opportunity for expansion, but Addiko's current market share in SME lending is relatively modest compared to its consumer business. The bank needs to implement substantial investments and strategic initiatives to capitalize on this high-growth market.

Failure to effectively address the muted demand and increase market penetration could relegate SME lending to a 'Dog' category within the BCG matrix, despite its inherent potential.

Addiko Bank's strategic move into Romania with fully digital consumer lending in Q1 2025 positions it as a Question Mark within the BCG Matrix. This expansion targets a new, potentially lucrative market, reflecting a significant investment in future growth.

The bank's cautious outlook, anticipating no notable profit impact until 2026, underscores the inherent uncertainty and early stage of this venture. This aligns with the Question Mark profile, characterized by high investment requirements and an unproven market position, despite the market's growth potential.

Addiko Bank is heavily investing in AI and advanced data analytics to sharpen customer experiences and operational efficiency. For instance, in 2024, European banks collectively saw a significant uptick in AI adoption, with many reporting improved fraud detection rates by up to 20% through AI-powered systems.

However, Addiko's specific advanced AI integrations are likely in their nascent stages, placing them in the question mark quadrant of the BCG matrix. The global market for AI in banking is projected for substantial growth, with some estimates suggesting it could reach over $30 billion by 2026, indicating a high-potential but competitive arena where Addiko is still building its presence and market share.

Development of New Digital Products Beyond Lending

Addiko Bank’s strategic focus on digital innovation extends well beyond its core lending operations. The bank is actively developing new digital products and services designed to broaden its customer base and enhance overall digital engagement. These initiatives are crucial for capturing new market segments in an increasingly competitive financial landscape.

These nascent digital offerings, which are not yet established in the market, represent a significant investment opportunity. For instance, Addiko Bank’s commitment to improving its mobile banking platform, including the introduction of advanced budgeting tools and personalized financial advice features, falls into this category. Such developments aim to attract younger demographics and tech-savvy customers who prioritize seamless digital experiences.

- Mobile Banking Enhancements: Focus on user experience, new features like advanced budgeting, and personalized financial insights.

- New Digital Service Development: Exploration of services beyond traditional banking, potentially including integrated financial wellness platforms or specialized digital advisory services.

- Market Penetration Strategy: Significant investment in marketing and development is required to establish these new products and gain traction in target market segments.

- Customer Acquisition Focus: Aiming to attract new customer segments, particularly younger and digitally inclined individuals, by offering innovative and convenient digital solutions.

Bancassurance and Credit Card Product Push

Addiko Bank's focus on product push in accounts, packages, bancassurance, and credit cards is a strategic move aimed at boosting net fee income. This initiative suggests a proactive approach to capturing a larger share of these specific market segments.

If Addiko's current market share in these product areas is modest relative to the total market opportunity, these segments might be classified as Stars or Question Marks within the BCG framework. This classification hinges on their growth potential and current market standing, indicating a need for sustained investment to either maintain leadership or cultivate growth.

The ultimate success of these product pushes will be the deciding factor in their future classification, directly impacting Addiko Bank's overall strategic positioning and resource allocation. For instance, in 2024, Addiko Bank reported a notable increase in its fee and commission income, partly driven by cross-selling efforts across its product portfolio.

- Bancassurance Growth: Addiko is actively promoting bancassurance products to diversify revenue streams.

- Credit Card Expansion: Efforts are underway to increase the adoption and usage of Addiko's credit card offerings.

- Market Share Ambition: The bank aims to gain significant market share in these fee-generating product categories.

- Investment Justification: Continued investment is warranted if these products demonstrate strong market growth potential and Addiko's current share is low.

Addiko Bank's expansion into Romania with fully digital consumer lending in Q1 2025, alongside its investments in AI and new digital services, firmly places these initiatives in the Question Mark category of the BCG Matrix. These ventures require substantial investment due to their nascent stage and unproven market position, despite the high growth potential of the target markets.

The bank's cautious profit outlook for these areas, anticipating no significant impact until 2026, highlights the inherent uncertainty. This aligns with the characteristic high investment and uncertain returns of Question Marks, where strategic decisions on future investment are critical.

Addiko's strategic focus on product push in accounts, packages, bancassurance, and credit cards also falls into this category if current market share is modest relative to market opportunity. The success of these initiatives, as evidenced by a notable increase in fee and commission income in 2024, will determine their future classification.

These areas represent opportunities for growth, but they demand continued investment to build market share and solidify their position. For example, Addiko Bank's fee and commission income saw a positive trend in 2024, partly due to these cross-selling efforts.

BCG Matrix Data Sources

Our Addiko Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.