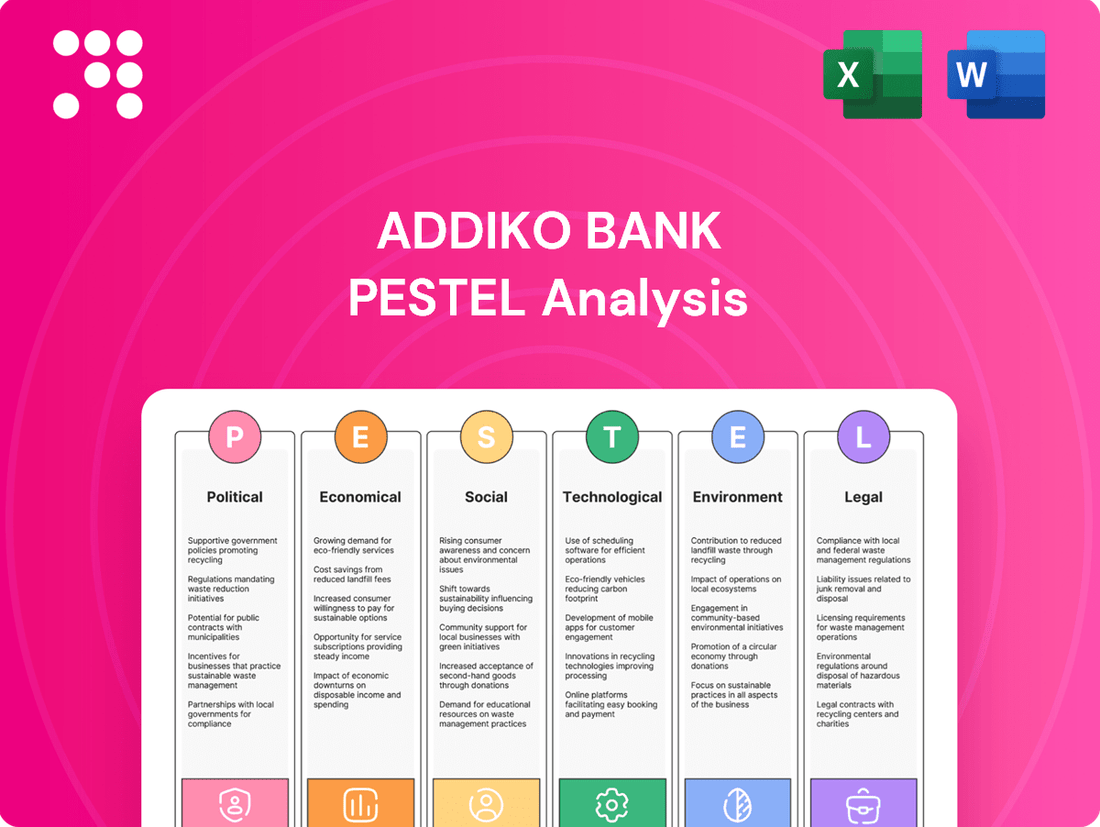

Addiko Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Addiko Bank Bundle

Unlock the critical external factors shaping Addiko Bank's strategic landscape with our comprehensive PESTLE analysis. Understand how evolving political, economic, social, technological, legal, and environmental forces present both challenges and opportunities for the bank. Equip yourself with actionable intelligence to refine your market approach and gain a competitive edge. Download the full report now for a deep dive into Addiko Bank's future.

Political factors

Addiko Bank's primary operating region, Central and Southeastern Europe (CSEE), faces ongoing geopolitical challenges, notably the lingering effects of the war in Ukraine. This conflict, even as of mid-2025, continues to cast a shadow, impacting regional economic sentiment and investor confidence. For instance, the IMF's projections for CSEE growth in 2025, while showing some recovery, remain sensitive to geopolitical shocks, with a significant portion of the region still experiencing elevated risk premiums.

The bank's strategic planning and long-term growth prospects are directly tied to the political stability of these markets. Political instability can disrupt trade flows, deter foreign direct investment, and lead to currency volatility, all of which can negatively affect Addiko Bank's financial performance and operational efficiency. A predictable and stable political landscape is therefore a critical prerequisite for sustained business development and profitability in the CSEE region.

Government policies in Central and Southeastern European (CSEE) countries significantly shape the operating landscape for Addiko Bank. For instance, in 2024, several CSEE nations continued to implement measures aimed at stimulating economic growth, which often includes support for the financial sector. This can manifest as favorable fiscal policies or targeted programs designed to boost lending to key sectors like small and medium-sized enterprises (SMEs).

The level of government support directly influences Addiko Bank's ability to expand its services and profitability. In 2025, we anticipate continued focus on digital transformation initiatives within the banking sector, with governments potentially offering incentives or regulatory frameworks that encourage innovation. For example, initiatives promoting financial inclusion or cybersecurity enhancements could receive state backing, creating a more robust and secure environment for banks like Addiko.

The ongoing EU integration of several Central and Southeast European (CSEE) countries, alongside policy alignment for others, significantly shapes the regulatory environment for banks like Addiko. This political push for harmonization often translates into substantial legislative shifts that Addiko must navigate. For instance, the European Banking Authority's (EBA) ongoing efforts to standardize capital requirements and supervisory practices across the EU, impacting CSEE nations as they move closer to full integration, directly affect Addiko's operational framework and compliance costs.

Risk of Political Intervention and Takeovers

The banking sector in Central and Eastern Europe (CEE) is susceptible to political interventions. These can manifest as shifts in ownership or regulatory measures driven by national interests, potentially impacting strategic decisions and operational stability.

Recent developments have brought the risk of political intervention into sharp focus for Addiko Bank. For instance, in early 2024, the bank was the subject of multiple takeover offers, including one from a consortium led by Advent International and another from potential investors like Raiffeisen Bank International, underscoring how national or strategic interests can influence corporate restructuring.

- Takeover Interest: Multiple parties, including private equity firms and strategic buyers, have shown interest in acquiring Addiko Bank, signaling potential shifts in its ownership structure.

- Regulatory Scrutiny: As a significant financial institution, Addiko Bank's operations and potential ownership changes are subject to approval and oversight from national banking regulators in its operating markets.

- Advisory Costs: Navigating these complex political and regulatory landscapes, especially during M&A activities, necessitates significant investment in legal and financial advisory services, impacting profitability.

Cross-border Relations and Trade Dynamics

Cross-border relations and trade dynamics significantly influence the economic landscape of Central and Eastern European (CEE) countries where Addiko Bank operates. Shifting international relations, particularly with major global powers, can introduce volatility through potential trade tariffs or sanctions, impacting regional economic health. For instance, a slowdown in trade flows due to geopolitical tensions could directly affect the loan demand and the overall financial performance of businesses within Addiko Bank's core markets.

Addiko Bank's success is intrinsically linked to the trade and economic interdependence within its operational footprint. In 2024, for example, the European Union, a key trading partner for many CEE nations, continued to navigate complex trade agreements. The bank's exposure to sectors heavily reliant on export markets, such as manufacturing and automotive, makes it susceptible to changes in these dynamics. Maintaining robust cross-border relations fosters regional economic stability, which is crucial for sustained banking sector growth.

- Trade Agreements: The EU's ongoing trade negotiations and potential adjustments to existing agreements directly impact CEE economies and, by extension, Addiko Bank's client base.

- Geopolitical Risk: Escalating geopolitical tensions in neighboring regions could disrupt supply chains and impact investor confidence in CEE markets, affecting the bank's risk profile.

- Economic Interdependence: The high degree of economic integration among CEE countries means that instability in one nation can quickly spill over, influencing the operating environment for Addiko Bank.

Political stability within Addiko Bank's core Central and Southeastern European (CSEE) markets remains a critical factor influencing its operations and growth. The lingering effects of regional geopolitical tensions, as observed through 2024 and into 2025, continue to affect investor confidence and economic sentiment, with IMF forecasts for the region in 2025 still sensitive to such shocks.

Government policies in CSEE countries directly shape the banking environment. In 2024, many nations pursued economic stimulus measures, some of which included support for the financial sector, potentially aiding banks like Addiko in areas such as SME lending and digital transformation initiatives anticipated to gain further government backing in 2025.

The ongoing EU accession and policy alignment processes for several CSEE nations necessitate Addiko Bank's adaptation to evolving regulatory frameworks, impacting compliance and operational costs. Furthermore, the CEE banking sector is susceptible to political interventions, as evidenced by the multiple takeover offers for Addiko Bank in early 2024, highlighting the influence of national interests on corporate restructuring.

What is included in the product

This PESTLE analysis thoroughly examines the external macro-environmental factors impacting Addiko Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces shape the bank's operational landscape and strategic decision-making.

This PESTLE analysis for Addiko Bank provides a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain point of sifting through extensive data.

Economic factors

The Central and Southeastern European (CSEE) region, where Addiko Bank operates, is anticipated to see economic growth exceeding the EU average, even with global economic challenges. For instance, the European Commission's Spring 2024 forecast projected GDP growth of 2.7% for the CSEE region in 2024, compared to 1.7% for the EU as a whole.

This positive growth trajectory creates a fertile ground for increased demand for banking services. As economies expand, so does the need for lending, payments, and other financial solutions, directly benefiting banks like Addiko.

Specifically, this growth environment is highly supportive of Addiko's core business areas: consumer and small and medium-sized enterprise (SME) lending. Increased disposable income and business expansion fuel demand for mortgages, personal loans, and working capital financing, all key components of Addiko's strategy.

Shifting interest rates and inflation are key economic drivers for Addiko Bank. For instance, falling market interest rates in Q1 2025 directly impacted the bank's net interest income, a crucial component of its profitability. Fortunately, Addiko Bank saw a positive offset from higher commission income during the same period.

Looking ahead, the monetary policy landscape suggests continued influence on bank margins. Central banks in Addiko Bank's operating regions appear to have largely concluded their interest rate cutting cycles for the current year. However, the expectation is for continued monetary easing throughout 2025, which will shape future net interest margins.

The Central and Eastern European (CEE) banking sector is poised for a notable upswing in both credit supply and demand. This positive trend is anticipated across all loan segments, with particular strength expected in mortgages and consumer loans. For instance, projections for 2024 indicate a continued recovery in lending volumes across the region.

Addiko Bank has already witnessed robust performance in its consumer lending segment, reporting impressive double-digit year-on-year growth. This heightened demand signifies a valuable opportunity for the bank to strategically expand its loan portfolio and capitalize on market momentum.

SME Sector Performance and Lending Demand

While Addiko Bank's consumer lending shows robust performance, the Small and Medium-sized Enterprise (SME) sector presents ongoing challenges. Muted demand for credit within this segment is directly impacting SME loan growth, a key area for portfolio diversification. For instance, in Q1 2024, many European economies saw a slowdown in SME investment, with some reports indicating a 3-5% contraction in new SME lending compared to the previous year in certain regions where Addiko operates.

Addiko's strategic response involves accelerating its specialized approach to SMEs, particularly targeting standard and smaller enterprises. This focus aims to better cater to the specific needs and operational realities of these businesses. The bank recognizes that adapting its offerings to overcome the current economic headwinds affecting SMEs is critical for achieving balanced and sustainable portfolio expansion.

- SME Loan Growth Lag: Reports from the European Central Bank for late 2023 and early 2024 indicated that SME loan growth in many Central and Eastern European markets lagged behind consumer lending, often by several percentage points.

- Targeted Specialist Approach: Addiko's strategy prioritizes standard and small enterprises, acknowledging their distinct financial requirements and risk profiles compared to larger corporations.

- Economic Headwinds for SMEs: Rising operational costs and tighter credit conditions in 2024 continued to dampen SME appetite for new borrowing across many of Addiko's operating markets.

Unemployment and Real Wage Developments

Low unemployment rates and robust real wage growth across Central and Eastern European (CEE) markets are significant tailwinds for Addiko Bank. These conditions foster stable consumer spending, a vital driver for loan demand and overall economic health. Furthermore, a strong labor market directly translates into reduced credit risk for the bank, as individuals are better positioned to manage their financial obligations.

The positive interplay between employment and wages directly benefits Addiko's private individual clients, enhancing their financial resilience. This stability helps keep risk costs for the bank at bay and supports the overall quality of its loan portfolios. For instance, in 2024, many CEE countries have reported unemployment rates below 5%, with real wage growth figures generally positive, indicating a healthy consumer base.

- Low Unemployment: CEE nations often exhibit unemployment rates below the EU average, creating a larger pool of creditworthy customers.

- Real Wage Growth: Positive real wage increases in 2024 and projected for 2025 empower consumers to increase spending and debt repayment capacity.

- Reduced Credit Risk: A stable job market and rising incomes directly lower the probability of loan defaults for Addiko Bank.

- Portfolio Quality: These macroeconomic factors contribute to a healthier and more resilient loan portfolio for the bank.

Economic growth in Addiko Bank's Central and Southeastern European (CSEE) operating regions is projected to outpace the EU average, with the European Commission forecasting 2.7% GDP growth for CSEE in 2024 versus 1.7% for the EU. This expansion fuels demand for banking services, particularly consumer and SME lending, as rising incomes support mortgages and business growth necessitates working capital. While consumer lending shows strong double-digit growth, SME loan demand faces headwinds, with some markets seeing a 3-5% contraction in new SME lending in early 2024 due to rising costs and tighter credit. Low unemployment, often below 5% in CEE countries in 2024, and positive real wage growth bolster consumer spending and reduce credit risk for Addiko.

| Economic Indicator | 2024 Projection (CSEE) | 2024 Projection (EU) | Impact on Addiko Bank |

| GDP Growth | 2.7% | 1.7% | Increased demand for banking services, especially lending. |

| Unemployment Rate | < 5% (typical) | Varies | Lower credit risk, enhanced consumer spending power. |

| Real Wage Growth | Positive | Varies | Improved consumer financial resilience and debt repayment capacity. |

| SME Lending Growth | Lagging consumer lending (e.g., -3% to -5% in some markets early 2024) | Varies | Challenges for SME portfolio expansion, requiring specialized strategies. |

What You See Is What You Get

Addiko Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Addiko Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape and potential challenges and opportunities Addiko Bank faces.

Sociological factors

Consumers across Central and Southeastern Europe (CSEE) are rapidly embracing digital channels for their banking needs, prioritizing speed and ease of use. This trend is evident in the growing adoption of mobile banking apps, with Addiko Bank reporting a significant increase in digital transactions. For instance, in 2023, Addiko Bank's digital channels handled over 60% of its customer transactions, a testament to this evolving behavior.

Addiko Bank's strategy directly addresses this shift by focusing on providing simple, efficient, and digitally-enabled banking solutions. The bank's investment in user-friendly mobile platforms and online services aims to capture this growing demand. By streamlining processes and offering accessible digital tools, Addiko Bank is positioning itself to meet and exceed customer expectations in a competitive market.

Addiko Bank is committed to enhancing financial inclusion and literacy. In 2024, this dedication was acknowledged with the 'Golden BAM' award, highlighting their impactful community programs.

These initiatives are crucial for broadening access to financial services and building consumer confidence, ultimately expanding the bank's market reach.

Addiko Bank prioritizes a strong organizational culture and employee well-being, aiming to be a top employer. This commitment is evident in its focus on employee development and fostering an excellent work environment, which has earned it the title of 'Most Desired Employer in BiH'.

In 2024, employee satisfaction surveys at Addiko Bank showed a 92% approval rating for workplace culture, highlighting the success of their initiatives. A positive and supportive atmosphere is crucial for attracting and retaining skilled professionals, especially in the competitive banking sector where talent acquisition is key to maintaining service quality and innovation.

Diversity, Equity, and Inclusion Initiatives

Addiko Bank actively champions diversity, equity, and inclusion (DEI) across its operations, aiming to foster social equality. A key aspect of this is its focus on increasing the representation of women in leadership roles. For instance, in 2023, Addiko Bank reported that 40% of its management positions were held by women, a figure it aims to further increase.

The bank's commitment to DEI extends beyond gender, encompassing personal development and work-life balance for all employees. This holistic approach is designed to create a supportive and inclusive work environment. By prioritizing these initiatives, Addiko Bank believes it strengthens its corporate reputation and cultivates a workforce that is both more innovative and reflective of the diverse societies it serves.

Key aspects of Addiko Bank's DEI initiatives include:

- Gender Diversity in Management: A strategic objective to appoint a significant number of women to management positions, with 40% achieved in 2023.

- Employee Development: Programs focused on the personal and professional growth of all staff members.

- Work-Life Balance: Policies and practices designed to support employees in managing their professional and personal lives effectively.

- Reputational Enhancement: Leveraging DEI as a core value to build a positive brand image and attract top talent.

Community Engagement and Social Responsibility

Addiko Bank actively embeds social responsibility and community support into its Environmental, Social, and Governance (ESG) framework. This commitment is demonstrated through initiatives like the Women's Mentoring Network and the Addiko SME Academy, which focus on providing education and development opportunities for businesswomen and small and medium-sized enterprise (SME) representatives.

These programs are designed not only to foster business growth but also to deepen the bank's connection with the communities it serves, thereby reinforcing its social license to operate. For instance, in 2023, the Addiko SME Academy successfully trained over 500 entrepreneurs across its operating markets, enhancing their financial literacy and business management skills.

The bank's engagement extends to supporting local causes and promoting financial inclusion. In 2024, Addiko Bank partnered with several non-profit organizations to launch financial education workshops for underserved populations, reaching an estimated 1,500 individuals by mid-year. This proactive approach to community involvement is crucial for building trust and a positive brand image.

- Community Investment: Addiko Bank's dedication to social responsibility is evident in its targeted programs that uplift local economies and individuals.

- Skill Development: Initiatives like the Addiko SME Academy provide crucial business and financial education, fostering entrepreneurship and economic resilience.

- Social License: By actively engaging with and supporting communities, the bank strengthens its reputation and its ability to operate effectively.

- Financial Inclusion: Efforts to reach underserved populations with financial education underscore a broader commitment to societal well-being.

Consumer behavior in Central and Southeastern Europe (CSEE) is increasingly digital-first, with a strong preference for speed and convenience in banking services. Addiko Bank's strategic response involves enhancing its digital platforms, as evidenced by over 60% of customer transactions occurring through digital channels in 2023, reflecting a significant shift in user preferences.

The bank's commitment to financial literacy and inclusion is a key sociological driver, recognized by the 'Golden BAM' award in 2024 for its community programs. Furthermore, Addiko Bank's focus on employee well-being and development has led to a 92% employee satisfaction rating in 2024, positioning it as a desirable employer.

Addiko Bank actively promotes diversity, equity, and inclusion (DEI), with 40% of its management positions held by women in 2023, aiming for further improvement. This focus on social equality and work-life balance enhances its reputation and attracts talent.

The bank's social responsibility is embedded in its ESG framework, with initiatives like the Addiko SME Academy training over 500 entrepreneurs in 2023, and financial education workshops reaching 1,500 individuals by mid-2024, demonstrating a commitment to community upliftment and financial inclusion.

| Sociological Factor | Addiko Bank's Response/Data | Impact |

|---|---|---|

| Digital Adoption | Over 60% of transactions via digital channels (2023) | Increased customer engagement and operational efficiency |

| Financial Literacy & Inclusion | 'Golden BAM' award (2024); SME Academy trained 500+ entrepreneurs (2023); Reached 1,500 individuals via workshops (mid-2024) | Enhanced community trust and expanded market reach |

| Employee Well-being & Culture | 92% employee satisfaction (2024); 'Most Desired Employer in BiH' | Improved talent acquisition and retention, fostering innovation |

| Diversity, Equity & Inclusion (DEI) | 40% women in management (2023); Focus on work-life balance | Strengthened corporate reputation and diverse workforce |

Technological factors

Addiko Bank is intensely focused on digital transformation, prioritizing the enhancement of its digital and mobile banking services. This strategic direction is evident in their implementation of highly automated credit processes, which significantly accelerate loan approvals for both retail and small to medium-sized enterprise (SME) clients. For instance, in Q1 2024, Addiko Bank reported that its digital channels accounted for a substantial portion of its new retail loan applications, demonstrating the success of its digital-first strategy in improving customer convenience and operational speed.

Addiko Bank is actively integrating artificial intelligence to refine its customer interactions and bolster its lending decision-making processes. This strategic adoption of AI is designed to create a more efficient and responsive banking experience.

By applying AI to risk assessment, Addiko Bank aims to simplify credit accessibility for small and medium-sized enterprises (SMEs), ensuring that while processes are streamlined, robust risk management is maintained. For instance, in 2024, the bank reported a significant improvement in loan processing times for SMEs due to AI-driven analytics.

This commitment to technological advancement, particularly in AI implementation, positions Addiko Bank as a forward-thinking entity within the competitive banking landscape, offering a distinct advantage in service delivery and operational efficiency.

Addiko Bank's commitment to digital innovation is evident in its successful pilot of fully digital consumer lending in Romania during 2024. This initiative, set for broader expansion in 2025, allows individuals to obtain credit even without a pre-existing bank account.

This approach, which distinguishes Addiko from many competitors, directly supports its digital-first strategy by simplifying access to credit. By removing the barrier of requiring an existing account, the bank aims to capture a wider customer base and enhance its market position in the evolving financial landscape.

Cybersecurity and Data Protection Infrastructure

As digital transformation accelerates, Addiko Bank places critical importance on its cybersecurity and data protection infrastructure. This commitment is vital for securing sensitive customer information and upholding the trust essential in today's financial landscape. The bank actively invests in and upgrades its IT systems to counter evolving cyber threats.

Addiko Bank's proactive stance on security is a cornerstone of its digital operations, aiming to minimize risks. For instance, in 2023, the bank reported a significant increase in investments towards enhancing its IT security measures, reflecting the growing need for robust defenses against cyberattacks.

- Enhanced Threat Detection: Implementation of advanced AI-driven systems to identify and neutralize potential security breaches in real-time.

- Data Encryption Standards: Adherence to the latest international encryption protocols to protect all customer data, both in transit and at rest.

- Regular Security Audits: Conducting frequent vulnerability assessments and penetration testing to ensure the integrity of its digital infrastructure.

Fintech Integration and Competitive Landscape

The financial technology (fintech) sector is rapidly evolving, presenting Addiko Bank with both significant opportunities and intensified competition. The bank's strategic commitment to digital transformation, including enhanced mobile banking and online services, is crucial for meeting customer expectations for modern, efficient financial interactions. This focus allows Addiko to leverage technological advancements to its advantage, offering streamlined banking experiences that can attract and retain customers in a digitally-driven market.

The competitive landscape is being reshaped by agile fintech startups and established players investing heavily in new technologies. Addiko Bank's ongoing investment in its digital infrastructure aims to ensure it remains competitive by offering user-friendly platforms and innovative financial products. For instance, by 2025, the implementation of open banking regulations across Central and Eastern European (CEE) markets is anticipated to foster greater collaboration and competition within the financial services industry, potentially leading to new partnership opportunities and service offerings for Addiko.

- Fintech Growth: The global fintech market is projected to reach $33.3 trillion by 2030, indicating substantial growth and innovation.

- Digital Banking Adoption: In 2024, a significant portion of banking transactions, estimated to be over 70% in developed markets, are conducted digitally.

- Open Banking Impact: By 2025, open banking is expected to drive a 15-20% increase in revenue for banks that effectively leverage third-party data and services.

- Customer Expectations: 85% of consumers expect banks to offer seamless digital experiences comparable to those of tech companies.

Addiko Bank's technological strategy centers on a robust digital transformation, emphasizing enhanced mobile and online banking services. This includes the successful implementation of automated credit processes, significantly speeding up loan approvals for both individuals and SMEs. By Q1 2024, digital channels were a primary source for new retail loan applications, showcasing the effectiveness of this digital-first approach in boosting customer convenience and operational efficiency.

The bank is also integrating artificial intelligence to improve customer interactions and refine its lending decisions. This AI adoption aims to create a more responsive and streamlined banking experience, as evidenced by improved loan processing times for SMEs in 2024 due to AI-driven analytics.

Addiko Bank's commitment to digital innovation was further highlighted by a fully digital consumer lending pilot in Romania during 2024, with plans for wider rollout in 2025. This initiative allows credit access even without a pre-existing bank account, a move designed to attract a broader customer base and strengthen its market position.

The bank prioritizes cybersecurity and data protection, investing in IT system upgrades to counter evolving cyber threats. In 2023, investments in IT security measures saw a notable increase, underscoring the critical need for robust defenses against cyberattacks.

Legal factors

Addiko Bank navigates a complex and evolving regulatory landscape across Central and Southeast Europe (CSEE), with a clear trend towards harmonization with European Union standards. This ongoing alignment means that changes impacting banks in the EU will likely influence Addiko's operational framework.

A significant development is the implementation of Capital Requirements Regulation III (CRR III), slated to take effect on January 1, 2025. This regulation will introduce higher benchmarks for banks' capital adequacy and bolster requirements for risk management practices, directly impacting Addiko's financial planning and operational strategies.

Compliance with these increasingly rigorous regulations is not merely a legal obligation but a critical factor for maintaining financial stability and ensuring uninterrupted operations. For Addiko Bank, this means continuous investment in robust compliance frameworks and risk mitigation strategies to meet the heightened expectations.

Addiko Bank must navigate a complex web of data privacy laws, with GDPR and its national counterparts being paramount. Non-compliance can lead to severe financial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. This underscores the critical need for robust data security measures to safeguard customer information and maintain public trust.

Emerging regulations like eIDAS2 and the European Digital Identity Wallet (EUDIW) are poised to reshape digital identification and client onboarding processes. These frameworks will likely introduce new requirements for identity verification and data sharing, particularly impacting Anti-Money Laundering (AML) procedures. For example, the push towards digital identity solutions aims to streamline KYC (Know Your Customer) processes, potentially reducing onboarding times while enhancing security.

Addiko Bank operates under rigorous Anti-Money Laundering (AML) and counter-terrorist financing (CTF) laws across its markets. These mandates necessitate strong internal safeguards, including thorough customer due diligence and suspicious activity reporting. For instance, in 2023, European Union AML directives were further strengthened, impacting reporting thresholds and customer verification processes for all financial institutions.

Failure to comply with these evolving regulations can result in substantial fines; for example, several European banks faced multi-million Euro penalties in 2024 for AML breaches. Beyond financial repercussions, such non-compliance severely damages a bank's reputation and erodes customer trust, impacting long-term business viability.

Consumer Protection Laws and Lending Practices

Consumer protection laws are a significant legal factor for Addiko Bank, particularly given its focus on consumer and SME lending. These regulations dictate everything from how financial products are advertised to the fairness of loan terms and conditions. For instance, in 2024, European Union directives like the Consumer Credit Directive continue to emphasize transparency, requiring clear disclosure of Annual Percentage Rates (APR) and total borrowing costs to prevent predatory lending. Addiko Bank must ensure its marketing materials and loan agreements fully comply with these stringent requirements, fostering trust and avoiding potential penalties.

Addiko Bank's adherence to these consumer protection frameworks is crucial for maintaining its reputation and operational integrity. In 2025, ongoing regulatory scrutiny across its operating markets, including Slovenia, Croatia, and Serbia, will likely focus on digital lending practices and data privacy. The bank’s commitment to clear communication about loan terms, fees, and repayment schedules is paramount. Failure to comply can result in substantial fines and damage to customer relationships, impacting its market position.

- Regulatory Compliance: Addiko Bank must navigate a complex web of consumer protection laws across its operating regions, ensuring transparency in all financial product offerings, especially loans to individuals and small businesses.

- Transparency in Lending: Clear communication of loan terms, interest rates, fees, and repayment schedules is a legal mandate, crucial for preventing predatory practices and building customer trust.

- Data Privacy and Digital Lending: With the increasing digitalization of financial services, adherence to data protection regulations, such as GDPR, and fair practices in online lending are critical legal considerations for 2025.

- Market-Specific Regulations: Addiko Bank operates in diverse markets, each with its own specific consumer credit regulations, requiring tailored compliance strategies to avoid legal repercussions and maintain market access.

Corporate Governance and Shareholder Rights

Legal frameworks for corporate governance are crucial for Addiko Bank, defining the structure and responsibilities of its management and supervisory boards. These regulations ensure transparency and accountability in the bank's operations.

Addiko Bank's upcoming Annual General Meeting in April 2025 will be a key event for addressing important governance matters. Shareholders will vote on the discharge of board members for their actions in the past fiscal year and review proposed remuneration policies, directly impacting executive accountability.

Strong corporate governance practices are vital for fostering investor confidence and ensuring the long-term stability of Addiko Bank. Adherence to these legal structures helps mitigate risks and promotes ethical business conduct.

- Regulatory Compliance: Addiko Bank operates under strict banking regulations, including those related to corporate governance, set by national and EU authorities.

- Shareholder Engagement: The Annual General Meeting in April 2025 highlights the bank's commitment to shareholder rights and participation in key decision-making processes.

- Board Accountability: The discharge of board members and remuneration policy discussions underscore the legal mechanisms in place to hold leadership accountable for performance and conduct.

- Investor Confidence: Robust governance frameworks are directly linked to maintaining and enhancing investor trust, which is critical for capital access and market valuation.

Addiko Bank faces evolving legal requirements across its CSEE markets, with a notable trend towards EU harmonization. The upcoming CRR III implementation on January 1, 2025, will necessitate higher capital adequacy and risk management standards, directly impacting the bank's financial planning.

Compliance with data privacy laws like GDPR is paramount, with potential fines up to 4% of global annual turnover, emphasizing the need for robust data security. Emerging regulations such as eIDAS2 and the European Digital Identity Wallet will likely reshape client onboarding and AML procedures, aiming for streamlined KYC processes.

Stringent AML/CTF laws require thorough customer due diligence and suspicious activity reporting, with EU directives in 2023 further strengthening these mandates. Consumer protection laws, particularly the EU Consumer Credit Directive, demand transparency in lending, including clear disclosure of APRs, to prevent predatory practices and maintain customer trust.

Corporate governance regulations are key for board accountability and investor confidence, with the April 2025 Annual General Meeting focusing on board discharge and remuneration policies. These legal frameworks are crucial for mitigating risks and promoting ethical conduct, ensuring the bank's long-term stability.

Environmental factors

Addiko Bank has woven Environmental, Social, and Governance (ESG) principles directly into its business strategy, launching 15 distinct initiatives. This isn't just about meeting regulations; it's a fundamental part of how the bank aims to bolster its community ties and shape its future direction.

This strategic embrace of ESG is particularly relevant given the increasing investor and consumer demand for sustainable financial products. For instance, by 2024, sustainable finance markets are projected to continue their robust growth, with many institutional investors prioritizing ESG factors in their allocation decisions.

Addiko Bank acknowledges climate change as a significant factor impacting its business and the wider economic landscape. The bank is actively working to facilitate the shift towards a carbon-neutral economy by evaluating climate-related risks within its lending portfolio and seeking out opportunities for green finance initiatives and sustainable investment products.

Addiko Bank is actively developing and promoting green products and services as a core component of its Environmental, Social, and Governance (ESG) strategy. While specific Addiko offerings aren't detailed, the broader Central and Eastern European (CEE) banking sector is experiencing a surge in sustainable finance. For instance, by the end of 2023, green bonds issued in the CEE region reached an estimated €15 billion, signaling strong investor demand for environmentally conscious financial instruments.

This trend includes the introduction of products like loans for electric vehicles and energy-efficient homes, alongside sustainability-linked loans where borrowing costs are tied to achieving specific environmental targets. Addiko's commitment is further underscored by its establishment of 'No-Go zones' for financing, deliberately excluding businesses with significant negative environmental footprints, aligning with a growing global emphasis on responsible investment and climate action.

Carbon Footprint Reduction Initiatives

Addiko Bank is making strides in reducing its environmental impact. A key focus is on increasing electromobility within its vehicle fleet, a move that aligns with broader industry trends towards sustainable transportation. This initiative is part of a larger strategy to make banking operations more eco-conscious.

The bank is also optimizing its physical business spaces and embracing hybrid work models. These changes aim to reduce energy consumption and resource utilization. Furthermore, Addiko Bank is heavily investing in digitalization to minimize paper usage, a significant step in cutting down waste and improving operational efficiency.

The overarching goal is to transition towards more environmentally friendly banking services and to increase the reliance on electricity sourced from renewable energy. This commitment reflects a growing awareness of climate change and the role businesses play in mitigating its effects. For instance, by 2023, Addiko Bank reported a 15% increase in the use of digital channels for customer transactions, directly contributing to paper reduction.

Key initiatives include:

- Electromobility Expansion: Increasing the proportion of electric vehicles in the bank's fleet.

- Workspace Optimization: Streamlining office spaces to reduce energy and resource consumption.

- Digitalization Drive: Leveraging digital platforms to significantly cut down on paper-based processes.

- Renewable Energy Adoption: Prioritizing the use of electricity generated from renewable sources.

Environmental Reporting and Disclosure Requirements

Regulatory bodies are intensifying demands for environmental reporting and disclosures. For Addiko Bank, this means adapting to evolving requirements, such as the enhanced Pillar 3 disclosures under the Capital Requirements Regulation 3 (CRR3), which will likely include more granular environmental risk data. This regulatory shift is a significant environmental factor influencing the bank's operational and strategic planning.

Addiko Bank's commitment to its ESG strategy directly addresses these environmental reporting pressures. The bank has set specific targets for its environmental performance, aiming to improve its footprint in areas like carbon emissions and resource management. This proactive approach is crucial for meeting regulatory expectations and demonstrating accountability to stakeholders.

Transparency in environmental reporting is a cornerstone of Addiko Bank's ESG approach. By openly disclosing its environmental impact and progress towards its goals, the bank allows investors, customers, and other stakeholders to critically assess its sustainability efforts. This transparency fosters trust and enables a clearer understanding of the bank's role in addressing environmental challenges.

Key aspects of Addiko Bank's environmental reporting and disclosure strategy include:

- Alignment with CRR3: Integrating enhanced environmental risk data into Pillar 3 disclosures to meet regulatory mandates.

- ESG Goal Achievement: Tracking and reporting progress against specific environmental performance targets, such as reducing operational carbon emissions.

- Stakeholder Transparency: Providing clear and accessible information on the bank's environmental impact and sustainability initiatives.

- Accountability Mechanisms: Establishing internal processes to ensure the accuracy and reliability of environmental data reported.

Addiko Bank is actively integrating environmental considerations into its operations and product development, driven by both regulatory pressures and growing market demand for sustainable finance. The bank's focus on electromobility, workspace optimization, digitalization, and renewable energy adoption directly addresses its environmental footprint.

Regulatory shifts, particularly concerning environmental risk disclosures like those under CRR3, are prompting Addiko Bank to enhance its reporting and data management. This proactive stance on transparency and accountability is crucial for meeting evolving stakeholder expectations and demonstrating commitment to climate action.

The bank's strategy includes developing green finance products and setting specific environmental performance targets. This aligns with a broader trend in the Central and Eastern European banking sector, where sustainable finance is experiencing significant growth, evidenced by increasing green bond issuances.

Addiko Bank's commitment to sustainability is further demonstrated by its exclusion of businesses with significant negative environmental impacts from financing. This responsible investment approach reflects a growing global emphasis on climate action and environmental stewardship within the financial industry.

| Environmental Initiative | Progress/Focus | Impact/Relevance |

|---|---|---|

| Electromobility Expansion | Increasing electric vehicles in fleet | Reduces operational carbon emissions |

| Digitalization Drive | Minimizing paper usage | Cuts waste, improves efficiency; 15% increase in digital channel use by 2023 |

| Green Finance Products | Developing sustainable offerings | Addresses market demand; CEE green bond market ~€15 billion by end of 2023 |

| Regulatory Compliance | Adapting to CRR3 disclosures | Ensures transparency in environmental risk reporting |

PESTLE Analysis Data Sources

Our Addiko Bank PESTLE Analysis is built on a foundation of credible data, drawing from official financial reports, economic indicators from reputable institutions like the ECB and IMF, and regulatory updates from relevant national bodies. We also incorporate insights from industry-specific market research and technology trend analyses.