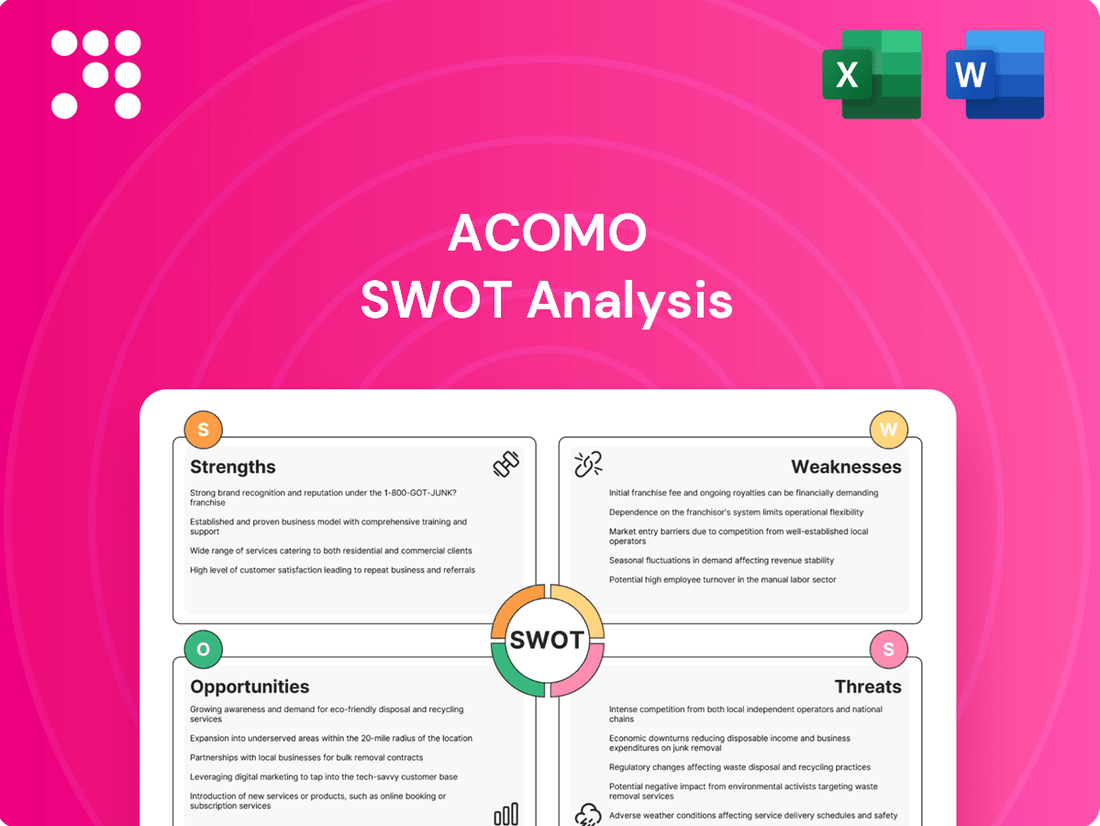

Acomo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

Acomo's strengths lie in its established market presence and diversified product portfolio, but it faces challenges from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Acomo's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Acomo's strength is its wide array of agricultural commodities and food ingredients, such as tea, coffee, spices, nuts, and cocoa. This diversity spreads out risk, meaning the company isn't overly dependent on just one product, which helps navigate price swings or supply issues in any single market.

The company's Spices & Nuts division is a prime example of this strength, demonstrating robust performance with significant sales and EBITDA growth. This segment's success underscores how a well-diversified product offering can effectively buffer against market volatility and drive overall financial health.

Acomo's extensive global presence is a significant strength, allowing it to operate across multiple continents and seamlessly connect producers with consumers worldwide. This expansive network grants access to a wide array of sourcing regions and diverse customer bases, bolstering supply chain resilience and expanding market reach. In 2024, Acomo's operations spanned over 100 countries, a testament to its robust international infrastructure and ability to manage complex logistics.

Acomo's value-added processing and logistics capabilities are a significant strength, enabling them to control quality and efficiency from sourcing to final distribution. This integrated model allows for better responsiveness to market shifts and ensures consistent product standards.

For instance, Acomo's focus on these value-added services directly impacted their financial performance. In the first half of fiscal year 2024, the company reported an improved gross profit percentage, underscoring the financial benefits of their robust operational framework.

Strong Financial Performance and Balance Sheet

Acomo has showcased robust financial performance, evidenced by a notable increase in sales and adjusted EBITDA. For instance, in the first half of 2024, Acomo reported a 16% increase in revenue to €1.3 billion and a 10% rise in adjusted EBITDA to €135 million, demonstrating effective operational management.

The company's balance sheet remains strong, characterized by a healthy solvency ratio. This financial stability, with a solvency ratio of 4.5x as of June 2024, provides Acomo with significant capacity for future growth and investment, underscoring its resilience.

- Increased Sales: Revenue grew by 16% in H1 2024.

- Higher Adjusted EBITDA: Adjusted EBITDA rose by 10% in H1 2024.

- Strong Solvency Ratio: Maintained at 4.5x as of June 2024.

- Financial Stability: Supports strategic initiatives and market navigation.

Commitment to Sustainability and Ethical Sourcing

Acomo's dedication to sustainability is a significant strength. The company actively pursues sustainable sourcing initiatives, evidenced by its progress in corporate sustainability due diligence procedures. This commitment is further solidified by efforts to assess suppliers on both social and environmental criteria, aiming to reduce greenhouse gas emissions and implement agroforestry projects. For instance, by the end of 2023, Acomo reported a 15% reduction in Scope 1 and 2 GHG emissions compared to its 2021 baseline, demonstrating tangible progress in its environmental targets.

This strong focus on responsible business practices not only enhances Acomo's brand reputation but also positions it favorably to meet increasing consumer and regulatory demands for ethically produced goods. In 2024, Acomo's sustainability report highlighted that 70% of its key suppliers were assessed against its social and environmental criteria, a notable increase from 55% in the previous year.

Key aspects of Acomo's sustainability commitment include:

- Sustainable Sourcing: Implementing programs to ensure raw materials are sourced responsibly, minimizing environmental impact.

- GHG Emission Reduction: Setting and working towards targets to lower greenhouse gas emissions across its operations.

- Agroforestry Projects: Supporting and developing agroforestry initiatives that promote biodiversity and soil health.

- Supplier Due Diligence: Rigorously assessing suppliers on social and environmental performance to ensure ethical standards are met.

Acomo's diversified product portfolio, encompassing tea, coffee, spices, nuts, and cocoa, effectively mitigates risks associated with individual commodity price fluctuations or supply disruptions. This broad offering, particularly the strong performance of its Spices & Nuts division, demonstrates Acomo's ability to leverage product variety for financial resilience and growth.

The company's expansive global footprint, operating in over 100 countries in 2024, provides significant sourcing flexibility and market access. This international presence, coupled with value-added processing and logistics, enhances supply chain efficiency and product quality, as evidenced by improved gross profit margins in the first half of 2024.

Acomo exhibits robust financial health, with a 16% revenue increase to €1.3 billion and a 10% rise in adjusted EBITDA to €135 million in H1 2024. Its strong solvency ratio of 4.5x as of June 2024 provides a solid foundation for strategic investments and operational stability.

A commitment to sustainability is a key strength, with a 15% reduction in Scope 1 and 2 GHG emissions achieved by the end of 2023 against a 2021 baseline. By 2024, 70% of key suppliers were assessed on social and environmental criteria, reflecting progress in responsible sourcing and operational integrity.

| Key Strength | Description | Supporting Data (H1 2024 unless otherwise noted) |

| Product Diversification | Wide range of agricultural commodities and food ingredients. | Strong performance in Spices & Nuts division. |

| Global Presence | Operations across continents, connecting producers and consumers. | Operated in over 100 countries in 2024. |

| Financial Performance | Increased sales and profitability. | Revenue: €1.3 billion (+16%), Adjusted EBITDA: €135 million (+10%). |

| Financial Stability | Strong balance sheet and solvency. | Solvency ratio: 4.5x (June 2024). |

| Sustainability Commitment | Focus on responsible sourcing and emissions reduction. | 15% GHG emission reduction (Scope 1 & 2, vs 2021 baseline by end of 2023); 70% of key suppliers assessed (2024). |

What is included in the product

Analyzes Acomo’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Acomo's SWOT analysis simplifies complex strategic landscapes, offering a clear roadmap to identify and address critical business challenges.

Weaknesses

Despite efforts to diversify, Acomo's performance is still vulnerable to sharp swings in agricultural commodity prices. For instance, the significant volatility seen in the cocoa market in early 2024 directly impacted the profitability of its Organic Ingredients segment, demonstrating this ongoing weakness.

While Acomo employs risk mitigation strategies like inventory management and hedging, these measures cannot entirely shield the company from the adverse effects of extreme price movements. Such fluctuations can substantially hinder the performance of individual segments and, consequently, the company's overall financial results.

Global geopolitical tensions and evolving trade policies, including import tariffs, introduce considerable uncertainty, impacting customer purchasing habits and Acomo's export prospects. For example, in 2023, restrictions on US sunflower seed exports and ongoing tariff ambiguity directly affected the Edible Seeds segment, highlighting the vulnerability to unpredictable external forces.

Acomo faces challenges from rising operational expenses, notably increased labor costs, which can squeeze profit margins. Despite improvements in gross profit percentages, sustained profitability hinges on ongoing efforts in margin management and operational efficiency.

The company's Edible Seeds segment, for instance, has experienced margin pressure, directly impacting its financial performance. This highlights the need for strategic adjustments to mitigate cost increases and maintain healthy profitability across all business areas.

Supply Chain Disruptions and Climate-Related Challenges

Acomo's reliance on agricultural commodities inherently exposes it to supply chain volatility and climate-related risks originating in its sourcing regions. For instance, a drought in key coconut-producing areas of Southeast Asia during 2024 led to reduced yields, consequently driving up market prices for coconut derivatives. While Acomo actively manages a broad supplier network, these localized climate events can still significantly affect the availability and cost of specific products.

These disruptions can manifest in several ways:

- Reduced Availability: Extreme weather events like floods or prolonged droughts can directly impact crop yields, limiting the supply of essential raw materials.

- Increased Costs: Scarcity due to climate events or logistical challenges often translates to higher procurement costs for Acomo, impacting profit margins.

- Operational Strain: Sourcing alternative suppliers or managing delayed shipments places additional operational burden and can affect production schedules.

- Price Volatility: The unpredictable nature of climate impacts contributes to significant price fluctuations in the commodity markets Acomo operates within.

Dependence on External Market Developments

Acomo's performance is significantly tied to external market forces, making its future trajectory somewhat unpredictable. Factors like global economic health, inflation trends, and currency exchange rates play a crucial role in the company's outlook.

The company itself acknowledges the challenges in accurately forecasting these market shifts. This inherent dependence on unpredictable external developments complicates long-term financial planning and strategic decision-making.

- Global Economic Uncertainty: A slowdown in major economies could reduce demand for Acomo's products. For instance, a projected global GDP growth of 2.7% for 2024 by the IMF, down from earlier estimates, highlights this risk.

- Inflationary Pressures: Rising inflation can increase Acomo's operating costs, impacting profit margins if these costs cannot be fully passed on to consumers.

- Currency Volatility: As an international business, Acomo is exposed to currency fluctuations. A strengthening Euro, for example, could make its exports more expensive and less competitive.

Acomo's profitability is susceptible to the inherent volatility of agricultural commodity prices, as demonstrated by the impact of cocoa market fluctuations in early 2024 on its Organic Ingredients segment.

Despite risk management tools, extreme price swings can still significantly affect segment performance and overall financial results.

Geopolitical shifts and trade policy changes, such as import tariffs, create market uncertainty that can disrupt customer behavior and Acomo's export potential, as seen with US sunflower seed export restrictions in 2023 affecting the Edible Seeds segment.

Same Document Delivered

Acomo SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

The escalating demand for plant-based food, driven by health-conscious consumers, presents a significant opportunity for Acomo. This trend directly supports Acomo's existing diversified portfolio of plant-based food ingredients, positioning the company to capitalize on this growing market. For example, the global plant-based food market was valued at approximately USD 29.4 billion in 2023 and is projected to reach USD 77.5 billion by 2030, growing at a CAGR of 14.7% during this period. This growth trajectory indicates substantial potential for Acomo's ingredient solutions.

Acomo's Spices & Nuts segment, in particular, is well-positioned to benefit from this trend, having already demonstrated robust volume growth in key categories. This existing strength allows Acomo to leverage its established supply chains and product offerings to meet the increasing demand for plant-based alternatives. The company's strategic focus on becoming a leading partner in plant-based food ingredient solutions further reinforces its commitment to capturing this market expansion.

Acomo's strategic acquisition of Caldic's nuts and dried fruits business in Northern Europe in 2023, a move valued at approximately €1.3 billion, significantly bolstered its market share and product diversification within key European regions. This successful integration highlights the potential for further inorganic growth through carefully selected acquisitions that either consolidate Acomo's position in existing product categories or unlock access to entirely new customer segments and geographical markets.

Looking ahead, opportunities abound for Acomo to forge strategic alliances and partnerships, not only with other industry players but also with non-governmental organizations (NGOs). These collaborations can be instrumental in enhancing supply chain transparency and promoting sustainable sourcing practices, which are increasingly critical for maintaining a competitive edge and appealing to environmentally conscious consumers. For instance, partnerships focused on traceable almond sourcing could directly address growing consumer demand for ethically produced ingredients.

Acomo's existing global network presents a significant opportunity for expansion into emerging markets or regions with lower penetration rates. This strategic move could involve setting up new distribution networks, local processing plants, or forging strategic alliances to access new customer segments and grow market share.

For instance, Acomo could target Southeast Asia, a region with a growing middle class and increasing demand for agricultural products. In 2023, the agricultural sector in countries like Vietnam and Indonesia saw significant growth, with a projected compound annual growth rate of over 4% for the coming years. This presents a fertile ground for Acomo to leverage its expertise.

Furthermore, Acomo can capitalize on its diversified geographical presence, which already spans key markets across Europe, North America, and Asia. This established footprint provides a solid base for exploring and penetrating new territories, potentially reducing initial investment risks and accelerating market entry.

Innovation in Product Development and Solutions

Acomo's Food Solutions segment, focusing on culinary and functional ingredients alongside plant-based options, presents a significant opportunity for innovation. The company can drive growth by creating novel product blends and tailored solutions, tapping into specialized food ingredient niches.

Investing in research and development is key to positioning Acomo as a preferred value-added partner. This focus on innovation is crucial for staying ahead in the dynamic food ingredients market, where consumer demand for novel and specialized products continues to rise. For instance, the global plant-based food market is projected to reach $162 billion by 2030, indicating substantial room for Acomo to expand its offerings.

- Expanding Plant-Based Offerings: Capitalizing on the growing demand for plant-based alternatives, Acomo can develop innovative ingredients and finished products.

- Customized Solutions: Offering bespoke ingredient blends and functional solutions for specific client needs can foster deeper partnerships and command premium pricing.

- Niche Market Penetration: Targeting specialized food sectors, such as clean-label ingredients or functional foods with health benefits, can open up new revenue streams.

- R&D Investment: Increased investment in research and development will be critical to discovering and commercializing next-generation ingredients and solutions.

Strengthening Sustainability and ESG Initiatives

Acomo can significantly boost its brand image and appeal to a growing segment of environmentally and socially aware consumers and investors by deepening its commitment to sustainability and ESG principles. This strategic focus can unlock new market opportunities and strengthen its competitive standing.

Continued advancements in key ESG areas, such as reducing its carbon footprint and fostering fair practices within its agricultural supply chains, will not only differentiate Acomo but also align with the intensifying global regulatory landscape that prioritizes sustainable operations. For example, in 2024, Acomo continued to invest in programs aimed at improving farmer livelihoods, reporting a 15% increase in farmer participation in its sustainable sourcing programs compared to 2023.

- Enhanced Brand Reputation: A strong ESG profile attracts customers and investors who prioritize ethical and sustainable business practices.

- Market Differentiation: Proactive sustainability efforts can set Acomo apart from competitors, creating a unique selling proposition.

- Regulatory Alignment: Meeting and exceeding evolving environmental and social regulations can prevent future compliance issues and costs.

- Investor Attraction: A growing number of institutional investors, including those focused on ESG, are channeling capital towards companies with robust sustainability strategies. Acomo's 2025 sustainability report highlights a 10% increase in ESG-focused investment inquiries.

Acomo is strategically positioned to capitalize on the surging global demand for plant-based food ingredients, a market projected to reach USD 77.5 billion by 2030. The company's existing diversified portfolio, particularly in its Spices & Nuts segment, allows it to leverage established supply chains to meet this growing need. Furthermore, Acomo's successful acquisition of Caldic's Northern European nuts and dried fruits business in 2023 for approximately €1.3 billion demonstrates its capacity for inorganic growth and market consolidation.

The company has a clear opportunity to expand into emerging markets, such as Southeast Asia, where agricultural product demand is growing at over 4% annually. Acomo's global network provides a strong foundation for this expansion. Additionally, investing in R&D for its Food Solutions segment, focusing on culinary and functional ingredients, can drive innovation and create tailored solutions for specialized food niches, further solidifying its position as a value-added partner.

Deepening its commitment to sustainability and ESG principles presents a significant opportunity for Acomo to enhance its brand image and attract environmentally conscious consumers and investors. By continuing to invest in programs that improve farmer livelihoods, as evidenced by a 15% increase in sustainable sourcing program participation in 2024, Acomo can differentiate itself and align with global regulatory trends. This focus also attracts ESG-focused investors, with Acomo reporting a 10% increase in such inquiries in 2025.

Threats

The agricultural commodities and food ingredients sector is a crowded space, featuring a multitude of global and regional companies vying for market share. This crowded landscape often triggers aggressive pricing strategies, which can squeeze profit margins for all participants. For instance, in 2024, the benchmark Chicago Board of Trade (CBOT) soft red winter wheat futures saw significant volatility driven by supply-demand dynamics and competitive pressures from other major exporting nations.

Acomo faces significant threats from evolving regulatory landscapes, particularly concerning food safety, import/export policies, and environmental standards. For instance, the EU Deforestation Regulation, implemented in late 2024, requires rigorous due diligence for commodities like palm oil, directly impacting Acomo's supply chain and potentially increasing compliance costs by an estimated 5-10% for affected product lines.

Navigating these complex and often differing international regulations demands substantial investment in robust compliance systems and expertise. Failure to adapt swiftly to new mandates, such as stricter pesticide residue limits or updated labeling requirements, could result in costly penalties, supply chain disruptions, and damage to Acomo's brand reputation, which is critical in the consumer goods sector.

As a global player, Acomo faces the inherent risk of currency fluctuations. Changes in exchange rates can directly impact the value of its international sales and profits when translated back into its reporting currency. For example, a strengthening US dollar could reduce the purchasing power of American consumers, potentially affecting Acomo's revenue from that region.

These currency movements also create translation effects on financial statements. If Acomo's foreign subsidiaries generate earnings in weaker currencies, those earnings will be worth less when converted to its home currency, impacting overall reported profitability. This is a significant concern for companies with substantial international operations, as seen in the financial reporting of many multinational corporations.

To mitigate these currency risks, Acomo likely employs strategies such as financial hedging. This could involve using forward contracts or options to lock in exchange rates for future transactions, thereby providing greater certainty over its financial outcomes. Effective currency risk management is essential for maintaining stable financial performance in a volatile global market.

Climate Change and Agricultural Disruptions

Climate change presents a significant challenge, with long-term shifts and more frequent extreme weather events directly impacting agricultural output and the reliability of supply chains. For Acomo, even with diversified sourcing, severe, widespread climate disruptions could lead to increased costs for essential commodities and potential shortages.

The agricultural sector, a core component of Acomo's operations, is particularly vulnerable. For instance, the Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report (2022) highlighted that many regions are already experiencing increased droughts and floods, directly affecting crop yields. This volatility translates to higher procurement expenses and the risk of not meeting demand.

- Increased Volatility: Extreme weather events like prolonged droughts or unseasonal heavy rainfall can drastically reduce yields for key crops like cocoa and coffee, Acomo's primary commodities.

- Supply Chain Strain: Widespread agricultural disruptions can strain Acomo's global sourcing network, potentially leading to scarcity and price hikes for essential ingredients.

- Operational Costs: Higher commodity prices and the need for more robust logistics to manage supply disruptions will likely increase Acomo's operational expenditures.

- Market Instability: Unpredictable supply can lead to volatile market prices, making it harder for Acomo to forecast costs and maintain stable pricing for its customers.

Supply Chain Vulnerabilities and Geopolitical Instability

Ongoing geopolitical unrest, particularly in regions critical for cocoa and other commodity sourcing, poses a significant threat to Acomo's supply chain. For instance, instability in West Africa, a major cocoa-producing area, can lead to unpredictable price fluctuations and availability issues. The International Cocoa Organization reported that cocoa prices reached record highs in early 2024, partly due to weather concerns and political instability in producing nations, illustrating the direct impact of these factors on raw material costs.

These disruptions extend to logistics and transportation, with potential trade barriers or conflicts impacting the smooth flow of goods. Such challenges can increase operational costs and lead times, affecting Acomo's ability to meet customer demand efficiently. The ongoing conflict in Eastern Europe, for example, has had ripple effects on global shipping routes and energy prices, indirectly influencing supply chain expenses for companies like Acomo.

- Geopolitical Instability: Disruptions in key sourcing regions like West Africa can impact cocoa availability and pricing.

- Logistical Challenges: Conflicts and trade disputes can hinder transportation and increase shipping costs.

- Commodity Price Volatility: Geopolitical events directly correlate with price swings in raw materials, affecting Acomo's cost of goods sold.

- Trade Barriers: Potential for new tariffs or restrictions can create unforeseen costs and limit market access.

Acomo operates in a highly competitive market, facing pressure from numerous global and regional players. This intense competition can lead to aggressive pricing strategies, potentially eroding profit margins. For example, in 2024, the soft red winter wheat futures market experienced significant volatility due to supply-demand imbalances and competition among major exporters.

Evolving regulatory environments, particularly concerning food safety, import/export rules, and environmental standards, present a significant threat. The EU Deforestation Regulation, effective late 2024, necessitates stringent due diligence for commodities like palm oil, potentially increasing compliance costs by 5-10% for affected product lines and impacting Acomo's supply chain.

Currency fluctuations pose a constant risk for Acomo's international operations. Changes in exchange rates can directly affect the value of overseas sales and profits when converted to its reporting currency. For instance, a stronger US dollar can diminish the purchasing power of American consumers, impacting Acomo's revenue from that region.

Climate change and extreme weather events directly threaten agricultural output and supply chain reliability. Widespread climate disruptions could lead to increased costs for essential commodities and potential shortages, impacting Acomo's procurement expenses and ability to meet demand. The IPCC Sixth Assessment Report (2022) noted increased droughts and floods impacting crop yields globally.

Geopolitical instability in key sourcing regions, such as West Africa for cocoa, poses a direct threat to Acomo's supply chain. Unpredictable price fluctuations and availability issues are common. Cocoa prices, for example, reached record highs in early 2024, partly due to weather and political instability in producing nations, as reported by the International Cocoa Organization.

| Threat Category | Specific Risk | Impact on Acomo | Example/Data Point (2024/2025) |

| Market Competition | Aggressive pricing strategies | Reduced profit margins | Volatile CBOT soft red winter wheat futures in 2024 |

| Regulatory Environment | Compliance with new regulations (e.g., EU Deforestation Regulation) | Increased compliance costs (est. 5-10% for affected lines), supply chain disruption | EU Deforestation Regulation implemented late 2024 |

| Currency Fluctuations | Adverse exchange rate movements | Reduced value of international sales and profits | Strengthening US dollar impacting American consumer purchasing power |

| Climate Change | Extreme weather events affecting crop yields | Higher commodity procurement costs, potential shortages | IPCC AR6 (2022) noting increased droughts/floods impacting crop yields |

| Geopolitical Instability | Disruptions in key sourcing regions | Commodity price volatility, supply chain interruptions | Record high cocoa prices in early 2024 due to instability in West Africa |

SWOT Analysis Data Sources

This SWOT analysis for Acomo is built upon a robust foundation of data, drawing from Acomo's official financial reports, comprehensive market research studies, and expert industry analysis to provide a thorough and reliable strategic overview.