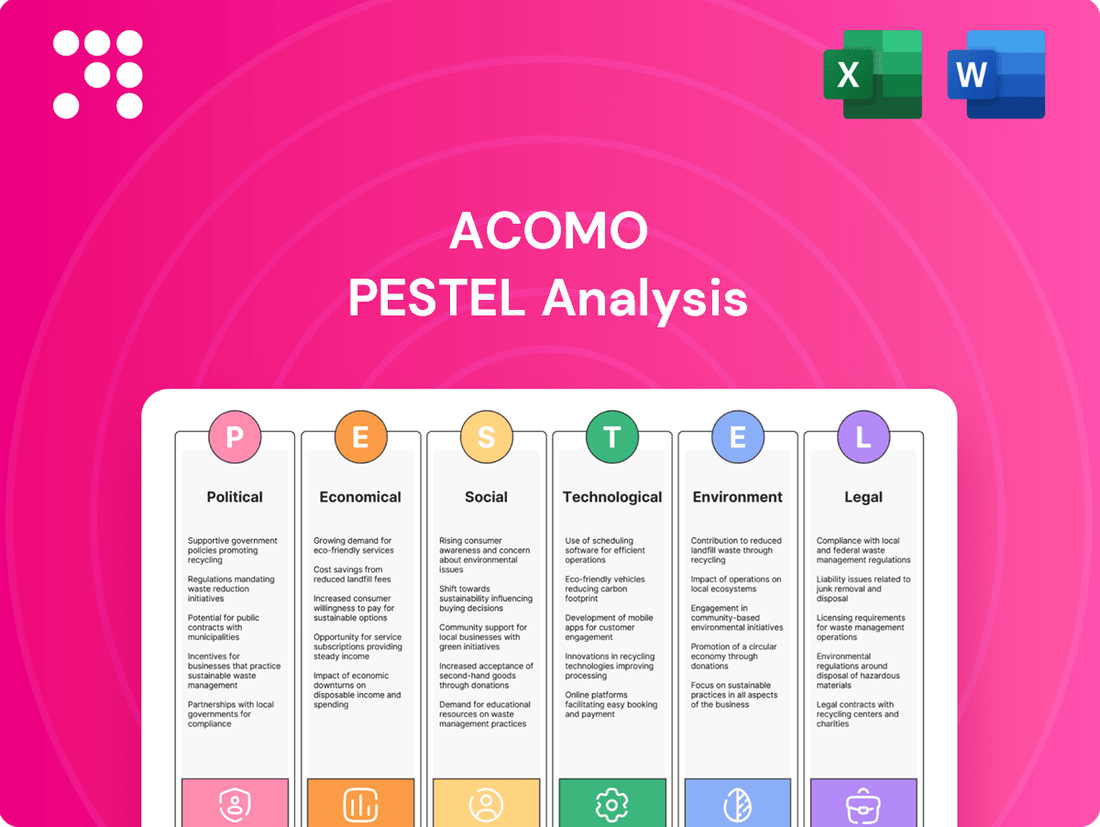

Acomo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Acomo's trajectory. Our PESTLE analysis provides a comprehensive overview, equipping you with the foresight to anticipate challenges and capitalize on opportunities. Download the full report to gain actionable intelligence for strategic decision-making.

Political factors

Geopolitical tensions, particularly ongoing US-China trade dynamics and disruptions in vital shipping routes like the Red Sea, directly influence global agricultural trade. These conflicts can trigger tariffs, raising commodity costs and impacting supply chains. For a global player like Acomo, this translates to direct exposure to trade volatility, underscoring the need for agile risk management to adapt to evolving trade flows.

Government policies significantly shape Acomo's operational landscape. For instance, trade restrictions can directly impact the flow of agricultural commodities, influencing Acomo's sourcing and sales. Biofuel mandates, like those in place across many European countries, can boost demand for certain crops, while agricultural subsidies can alter competitive dynamics.

The European Union's ambitious Green Deal, particularly the Farm to Fork strategy, is a key regulatory driver. This initiative aims to create a more sustainable food system by 2030, introducing stricter rules on pesticide use, fertilizer application, and land management. For Acomo, this means adapting to new compliance requirements for products sold within or exported to the EU, potentially affecting production costs and market access.

In 2024, the EU continued to refine its sustainability targets, with ongoing discussions around the Common Agricultural Policy (CAP) reforms. These reforms are expected to further integrate environmental and climate objectives into agricultural practices, impacting Acomo's supply chain partners. For example, the CAP 2023-2027 allocates substantial funding towards eco-schemes, incentivizing farmers to adopt greener methods, which Acomo will need to factor into its procurement strategies.

The evolution of international trade agreements significantly impacts Acomo's operational landscape. For instance, ongoing discussions and potential finalization of pacts like the EU-Mercosur agreement in 2024 could reshape market access for agricultural commodities, either by reducing tariffs and opening new avenues or by introducing stringent regulations that act as barriers. These agreements directly influence sourcing costs and distribution efficiencies for Acomo, as they define the rules for tariffs, quotas, and product standards across different continents.

Political Stability in Sourcing Regions

Political instability, conflicts, or civil unrest in key agricultural producing regions can significantly disrupt supply chains, impacting crop yields and causing volatility in commodity prices. For instance, recent geopolitical tensions in parts of East Africa, a major coffee-producing region, have led to increased shipping costs and potential delays.

Acomo's diversified sourcing strategy, spanning tea, coffee, spices, edible nuts, and cocoa, is designed to mitigate some of these risks. However, continuous monitoring of political developments in countries like Vietnam (a top spice exporter) and Brazil (a leading cocoa producer) remains crucial for maintaining supply chain resilience.

The unpredictability stemming from political events in these sourcing areas can translate into significant operational challenges and price fluctuations for Acomo. For example, in 2024, a sudden imposition of export restrictions in a key spice-producing nation caused a 15% spike in global prices for certain commodities.

Key considerations for Acomo regarding political stability include:

- Monitoring geopolitical events in major sourcing countries for tea, coffee, spices, edible nuts, and cocoa.

- Assessing the impact of potential trade policy changes or sanctions on supply chain continuity.

- Evaluating the risk of disruptions due to internal conflicts or civil unrest in agricultural regions.

- Analyzing the correlation between political instability and commodity price volatility in 2024-2025.

Food Security Initiatives

Governments are stepping up efforts to ensure citizens have consistent access to food. For instance, in 2024, many nations continued to implement policies like subsidies for local farmers and, in some cases, temporary export bans on key agricultural products to bolster domestic reserves. This focus on food security directly impacts global commodity markets, influencing prices and availability for companies like Acomo.

These government actions can significantly reshape trade flows. By encouraging local production or restricting exports, countries aim to insulate themselves from global price volatility. This means Acomo must closely monitor these policy shifts, which could affect its sourcing strategies and market access in different regions. For example, a major importing nation might increase tariffs on certain goods to favor domestic suppliers, altering Acomo's competitive landscape.

- Increased Local Production Incentives: Many governments are offering tax breaks and grants to boost domestic agricultural output, aiming to reduce reliance on imports.

- Export Restrictions: To safeguard national food supplies, some countries have imposed or are considering temporary bans on exporting staple foods, impacting global supply chains.

- Strategic Food Reserves: Nations are actively building or maintaining larger strategic reserves of essential food items, influencing demand patterns for agricultural commodities.

Government policies significantly influence Acomo's operations, with trade agreements and domestic support programs playing a crucial role. For instance, the EU's Farm to Fork strategy, aiming for a sustainable food system by 2030, imposes stricter regulations on pesticide and fertilizer use, impacting Acomo's compliance and production costs. Furthermore, government efforts to bolster food security through subsidies and potential export restrictions in 2024 directly affect global commodity availability and pricing, necessitating agile sourcing strategies for Acomo.

What is included in the product

This Acomo PESTLE analysis examines the impact of external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—on the company's operations and strategy.

It provides a comprehensive overview of market dynamics and regulatory landscapes, offering actionable insights for strategic decision-making and identifying potential opportunities and threats.

Provides a concise, actionable summary of external factors, enabling proactive strategy development and mitigating the pain of unforeseen market shifts.

Economic factors

The agricultural commodities market is naturally prone to price swings. Factors like supply and demand mismatches, unpredictable weather patterns, and global political situations can cause significant fluctuations for products such as cocoa, coffee, and grains.

For example, cocoa prices saw a dramatic quadrupling in 2024, and coffee reached its highest point in 50 years in 2025. This extreme volatility directly affects Acomo's expenses for raw materials, its profit margins on sales, and its overall financial performance.

To navigate these price uncertainties, Acomo must employ advanced risk management techniques and hedging strategies. This ensures a more stable and predictable financial outlook despite the inherent volatility in the commodities sector.

Global economic conditions significantly shape Acomo's operating environment. For instance, persistent inflation in major economies, such as the Eurozone experiencing an average inflation rate of 5.4% in 2023 according to Eurostat, can increase Acomo's input costs for raw materials and energy, impacting its margins.

Currency exchange rate volatility, particularly the strength of the US dollar against other major currencies, directly affects the cost of dollar-denominated commodities that Acomo may source. A stronger dollar can make these imports more expensive, potentially squeezing profitability if not passed on to consumers.

Economic growth or contraction in key markets where Acomo operates or sells its products is also a critical factor. For example, if the global economy experiences a slowdown, as projected by the IMF with a modest 3.2% growth forecast for 2024, consumer purchasing power for food ingredients could diminish, leading to reduced demand for Acomo's offerings.

Disruptions like the Panama Canal's low water levels and Red Sea instability significantly increased freight rates, with some shipping costs doubling in late 2023 and early 2024. This directly impacts Acomo by extending delivery times and raising operational expenses, potentially affecting product availability and pricing for consumers globally.

Furthermore, escalating input costs, particularly for fuel and fertilizers, add to the financial pressure on agricultural businesses like Acomo. For instance, global fertilizer prices saw a notable increase in 2024 compared to the previous year, squeezing profit margins and impacting the overall cost structure for sourcing and production.

Consumer Demand and Purchasing Power

Consumer demand and purchasing power are critical for Acomo, influencing sales across its product range like tea, coffee, spices, and nuts. For instance, in 2024, global consumer spending on food and beverages saw varied trends, with essential items maintaining resilience but discretionary purchases showing sensitivity to economic conditions. Acomo's ability to cater to both needs and wants is key.

Shifts in disposable income directly impact purchasing decisions. As of late 2024 and early 2025 projections, many economies are experiencing moderate inflation, which can erode purchasing power, leading consumers to seek value or reduce spending on premium Acomo products. Conversely, rising incomes in emerging markets present growth opportunities.

The demand for horticultural and tropical products, including those Acomo offers, has generally trended upwards, driven by health consciousness and global culinary trends. However, economic slowdowns can trigger a pivot towards cheaper substitutes, requiring Acomo to maintain competitive pricing and highlight the value proposition of its offerings.

To navigate these dynamics, Acomo must remain adaptable. This includes:

- Monitoring consumer confidence indices: Tracking sentiment provides an early indicator of potential spending shifts.

- Analyzing retail sales data: Understanding which product categories are gaining or losing traction is crucial for inventory and marketing.

- Diversifying product offerings: Providing a range of price points can help capture a broader customer base during economic fluctuations.

- Focusing on value and quality: Communicating the benefits of Acomo's products can justify pricing, even in challenging economic periods.

Company Financial Performance and Outlook

Acomo's financial performance in the first half of 2025 showed robust sales growth, with adjusted EBITDA also increasing, signaling a healthy upward trend. This positive momentum is largely attributed to the strong contributions from its Organic Ingredients and Spices & Nuts segments.

The company's sustained financial strength is a key enabler for its strategic initiatives. It allows Acomo to actively pursue growth opportunities, effectively navigate market fluctuations, and ensure value creation for its shareholders.

- Strong H1 2025 Results: Reported significant sales growth and a rise in adjusted EBITDA.

- Key Growth Drivers: Performance bolstered by segments such as Organic Ingredients and Spices & Nuts.

- Financial Flexibility: Robust financial health supports investments in expansion and market resilience.

- Stakeholder Returns: Commitment to providing returns to investors is underpinned by solid financial footing.

Economic factors significantly influence Acomo's operational landscape, from raw material costs to consumer demand. Persistent inflation, for instance, as seen with the Eurozone's 5.4% average in 2023, directly increases input expenses. Currency fluctuations, like a strong US dollar, also impact the cost of dollar-denominated commodities. Global economic growth forecasts, such as the IMF's 3.2% for 2024, signal potential shifts in consumer purchasing power for Acomo's products.

Full Version Awaits

Acomo PESTLE Analysis

The preview you see here is the exact Acomo PESTLE Analysis document you'll receive after purchase. It is fully formatted and ready to use, providing a comprehensive overview of the political, economic, social, technological, legal, and environmental factors affecting Acomo. This detailed analysis is delivered exactly as shown, ensuring no surprises for your strategic planning.

Sociological factors

Consumers are increasingly focused on health and wellness, which is boosting demand for natural, functional, and clean-label food ingredients. This means people are looking for foods that are processed as little as possible and contain ingredients that offer specific health advantages. For instance, a 2024 report indicated that 65% of consumers actively seek out foods with added health benefits.

Acomo's product range, particularly its plant-based food ingredients, aligns perfectly with these evolving consumer tastes. The company's offerings are well-suited to meet the growing market for healthier food options. In 2025, the global market for plant-based ingredients is projected to reach $75 billion, demonstrating a significant opportunity.

Consumers are increasingly prioritizing sustainability and ethical sourcing in their purchasing decisions. Recent data indicates that approximately 65% of consumers now consider sustainability a key factor when choosing food products. This trend encompasses a desire for greater transparency in supply chains, assurance of fair labor practices, and a preference for environmentally friendly packaging solutions.

Acomo's business model, which links global producers with consumers, must align with these evolving ethical and sustainability standards. Meeting these expectations is crucial for cultivating consumer trust and fostering long-term brand loyalty in the current market landscape.

The global surge in plant-based eating is undeniable, with approximately 49% of consumers worldwide now identifying as flexitarian, actively reducing meat consumption. This dietary evolution fuels a significant demand for alternative protein sources, with pea and soy proteins emerging as frontrunners in ingredient innovation. Acomo's strategic focus on these plant-based ingredients positions it favorably to capitalize on this growing consumer preference, offering a robust response to shifting dietary patterns.

Awareness of Food Origin and Traceability

Consumers' growing demand for food origin and traceability is a significant sociological factor. They want to know precisely where their food comes from and how it's produced, pushing for greater transparency across the entire supply chain. This trend is further amplified by evolving regulations. For instance, the EU Deforestation Regulation (EUDR), which came into full effect in late 2024, mandates that companies ensure their products are deforestation-free and produced in accordance with the laws of the country of origin. This requires robust traceability systems.

Acomo's strategic advantage lies in its capacity to offer end-to-end traceability for its key commodities, such as cocoa and coffee. This capability directly addresses consumer concerns and aligns with stringent regulatory frameworks like the EUDR. By providing verifiable data on product journeys, Acomo can build stronger consumer trust and ensure compliance, which is crucial for market access and brand reputation in 2024 and beyond. This transparency is becoming a non-negotiable aspect for many consumers and regulators alike.

- Consumer Demand: Surveys indicate that over 70% of consumers are willing to pay more for food with clear origin and traceability information.

- Regulatory Impact: The EUDR, impacting products entering the EU market from December 2024, requires detailed due diligence and traceability for commodities like cocoa and coffee, affecting global supply chains.

- Acomo's Position: Companies with advanced traceability solutions, like those Acomo aims to provide, are better positioned to navigate these regulatory hurdles and meet consumer expectations for ethical sourcing.

Influence of Digital Media and Food Trends

Social media platforms are powerful drivers of food habits, particularly for younger demographics. They foster innovation and introduce a wider variety of ingredients and cooking techniques. For instance, TikTok alone saw over 1.5 billion views for #food content in early 2024, showcasing how quickly trends can emerge and influence consumer choices.

This rapid spread of culinary trends directly impacts ingredient demand, creating swift shifts in market needs. Acomo must stay attuned to these digital conversations to proactively identify changing consumer tastes. By monitoring platforms where food content thrives, Acomo can better anticipate demand fluctuations and adjust its product portfolio to align with emerging preferences.

- Social Media Impact: Platforms like Instagram and TikTok are key influencers of food choices, especially for Gen Z and Millennials.

- Trend Velocity: Food trends disseminated online can gain significant traction within weeks, impacting ingredient sourcing and product development.

- Consumer Preference Shifts: Acomo's ability to adapt to these digitally-driven preferences is crucial for maintaining market relevance and competitiveness.

- Data Monitoring: Actively tracking online food discussions and viral recipes allows for early identification of potential market opportunities and risks.

The increasing consumer focus on health and wellness is a significant sociological driver, boosting demand for natural and functional food ingredients. This trend is supported by data showing that in 2024, a substantial 65% of consumers actively sought foods with added health benefits, highlighting a clear market shift towards healthier options.

Furthermore, a growing emphasis on sustainability and ethical sourcing is shaping purchasing decisions, with around 65% of consumers in 2024 considering these factors key. This necessitates greater supply chain transparency and fair labor practices, which Acomo must integrate into its operations to maintain consumer trust and loyalty.

The rapid spread of food trends via social media, particularly among younger demographics, significantly influences ingredient demand. For example, TikTok's #food content surpassed 1.5 billion views in early 2024, demonstrating the speed at which culinary preferences can evolve and impact the market.

Consumer demand for food origin and traceability is also paramount, with over 70% of consumers willing to pay more for such information. Regulations like the EU Deforestation Regulation, effective late 2024, reinforce this by requiring deforestation-free products and robust traceability, making Acomo's end-to-end traceability a key competitive advantage.

Technological factors

Digital transformation is fundamentally reshaping agricultural supply chains, boosting transparency and efficiency from the initial planting stage right through to the consumer's table. Technologies such as blockchain, the Internet of Things (IoT) devices, and cloud computing are streamlining operations, providing complete traceability and real-time monitoring of critical factors like temperature and humidity during transit. For instance, by mid-2024, the global agricultural IoT market was projected to reach over $25 billion, highlighting the rapid adoption of these tools.

Acomo can harness these technological advancements to significantly improve its logistics and strengthen risk management across its extensive international operations. By integrating these solutions, the company can gain deeper insights into its supply chain, enabling quicker responses to potential disruptions and ensuring product quality. This digital shift is crucial for navigating the complexities of global food distribution in the coming years.

The fusion of AI and the Internet of Things (IoT) is revolutionizing agricultural logistics. Predictive analytics, powered by AI, allows for accurate demand forecasting and optimal resource deployment, crucial for a company like Acomo managing a global commodity supply chain. This technology also enables real-time responses to supply chain disruptions, ensuring smoother operations.

AI-driven data analysis empowers farmers and agricultural businesses with insights for better decision-making. This includes enhancing crop health monitoring and optimizing yields, which directly impacts the quality and quantity of commodities available. For Acomo, this means a more reliable and efficient sourcing of its diverse product portfolio.

Acomo can leverage these advanced analytics to significantly boost its operational efficiency. By forecasting market trends with greater accuracy and managing its extensive commodity portfolio more effectively, the company can mitigate risks and capitalize on opportunities. For instance, AI can analyze weather patterns and geopolitical events to predict commodity price fluctuations, allowing for proactive inventory management.

Automation and robotics are transforming agricultural processing and logistics, leading to significant cost reductions in labor and boosting operational efficiency. The food industry, in general, is seeing these advancements translate into better packaging and sorting processes. For Acomo, integrating these technologies could streamline their processing and distribution, potentially improving speed and accuracy in handling their products.

Innovations in Sustainable Farming Practices

Technological advancements are significantly bolstering sustainable farming. Innovations like regenerative agriculture, hydroponics, and soilless farming are gaining traction, focusing on soil health restoration, biodiversity enhancement, and water optimization. These methods are crucial for building more resilient food systems.

For Acomo, this translates into a strategic imperative to support producers embracing these forward-thinking, eco-friendly techniques. By aligning with these innovations, Acomo can ensure its supply chain is both environmentally responsible and robust against future challenges. For example, the global vertical farming market, a key area for soilless farming, was projected to reach USD 15.7 billion by 2026, indicating substantial growth potential and adoption rates.

- Regenerative Agriculture: Practices that improve soil health, sequester carbon, and enhance biodiversity.

- Hydroponics: Growing plants without soil, using mineral nutrient solutions in water.

- Soilless Farming: Encompasses hydroponics, aeroponics, and aquaponics, reducing land and water dependency.

- Water Optimization: Technologies like drip irrigation and precision watering systems are reducing agricultural water consumption by up to 50% in some regions.

Enhanced Traceability and Quality Assurance Systems

Blockchain technology is revolutionizing supply chain management, offering unparalleled traceability. For Acomo, this means every transaction, from farm to consumer, can be immutably recorded. This granular visibility is vital for maintaining the integrity of their diverse product portfolio, which includes high-value commodities like cocoa and tea.

The increasing consumer demand for transparency, particularly regarding ethical sourcing and product authenticity, makes robust traceability systems a competitive advantage. For instance, by 2024, an estimated 70% of consumers globally stated they would pay more for products with transparent supply chains, according to a FoodLogiQ report. This technology directly addresses such demands, bolstering Acomo's quality assurance and compliance efforts.

Implementing enhanced traceability systems, powered by blockchain, can significantly mitigate risks associated with food safety incidents and ensure adherence to fair trade and sustainability standards. This proactive approach not only safeguards Acomo's reputation but also aligns with evolving regulatory landscapes and investor expectations for responsible business practices.

- Enhanced Traceability: Blockchain allows for an immutable record of every supply chain touchpoint, ensuring product authenticity and integrity.

- Quality Assurance: This granular tracking facilitates better quality control and helps Acomo meet stringent product standards across its diverse offerings.

- Consumer Trust: Transparency in sourcing and production builds consumer confidence, a key driver in the food and beverage sector, with a significant portion of consumers willing to pay a premium for traceable goods.

- Risk Mitigation: Improved visibility helps in quickly identifying and addressing issues related to food safety, ethical sourcing, and regulatory compliance.

Technological advancements are critical for Acomo's operational efficiency and risk management. Innovations like AI-powered predictive analytics and IoT devices are streamlining logistics, enhancing demand forecasting, and providing real-time supply chain monitoring. For example, the global agricultural IoT market was projected to exceed $25 billion by mid-2024, underscoring the widespread adoption of these tools.

Automation and robotics are reducing labor costs and improving processing speed in the food industry, directly benefiting companies like Acomo. Furthermore, sustainable farming technologies such as hydroponics are gaining momentum, with the global vertical farming market expected to reach USD 15.7 billion by 2026, indicating a significant shift towards more resource-efficient agricultural practices.

Blockchain technology offers unparalleled traceability, which is vital for Acomo's diverse product portfolio. Consumer demand for transparency is high, with studies indicating a significant percentage of consumers willing to pay more for products with clear supply chain information. This technology bolsters quality assurance and builds consumer trust, addressing a key market trend.

| Technology Area | Impact on Acomo | Key Data/Trend (2024-2025) |

|---|---|---|

| AI & Predictive Analytics | Improved demand forecasting, optimized resource allocation, faster response to disruptions | AI in agriculture projected to grow significantly, driving efficiency gains |

| IoT in Agriculture | Enhanced real-time monitoring of crops and logistics, increased transparency | Global Agri-IoT market projected over $25 billion by mid-2024 |

| Automation & Robotics | Reduced labor costs, increased processing speed and accuracy | Growing adoption in food processing for efficiency gains |

| Blockchain | Unparalleled supply chain traceability, enhanced quality assurance, consumer trust | Increased consumer willingness to pay for transparently sourced products |

| Sustainable Farming Tech | More resilient and resource-efficient sourcing, alignment with ESG goals | Vertical farming market projected to reach USD 15.7 billion by 2026 |

Legal factors

Trade tariffs and protectionist policies present a notable risk for Acomo, particularly with potential shifts in major economies like the United States. For instance, a hypothetical increase in tariffs, say by 10% on key agricultural imports, could significantly inflate Acomo's procurement costs and disrupt supply chains. This could directly impact profit margins and the competitiveness of its products in international markets.

The possibility of new trade disputes, especially those involving retaliatory measures, could limit Acomo's access to crucial markets. If, for example, a major trading partner imposes tariffs on goods sourced from Acomo's key supplier regions, the company might face increased import duties or even outright import bans, thereby reducing its export volumes and revenue streams.

Navigating these protectionist trends is vital for Acomo's sustained international trade. The company's agility in adapting to changing trade landscapes, perhaps by diversifying its sourcing or exploring new market opportunities, will be key to mitigating the financial impact of such policies and maintaining its global market presence.

New regulations, such as the EU Corporate Sustainability Due Diligence Directive (CSDDD) coming into effect in July 2024, impose legally binding requirements on companies operating within the EU. These rules mandate that businesses actively identify, prevent, and mitigate adverse environmental and human rights impacts within their supply chains.

This means companies like Acomo must implement robust, risk-based due diligence processes to tackle issues like deforestation, child labor, and pollution. Failure to comply with these directives can result in substantial financial penalties and significant damage to a company's reputation.

Acomo must navigate a complex web of food safety and quality regulations globally, a critical legal factor for success in the food ingredients sector. For instance, the European Union's General Food Law (Regulation (EC) No 178/2002) sets overarching principles for food safety, while specific regulations like those concerning contaminants or hygiene are constantly updated. Failure to adhere can result in significant fines; in 2023, the UK's Food Standards Agency (FSA) reported issuing over £1.5 million in fines for food hygiene offenses.

Maintaining compliance across Acomo's diverse operational regions, from Europe to Asia, is non-negotiable. This involves rigorous adherence to standards like HACCP (Hazard Analysis and Critical Control Points) and GFSI (Global Food Safety Initiative) benchmarks. The cost of non-compliance can be immense, extending beyond fines to include product recalls, which can cost millions, and irreparable damage to Acomo's reputation, impacting future sales and partnerships.

The dynamic nature of these legal requirements necessitates ongoing investment in compliance infrastructure and training. For example, new regulations on traceability or allergen labeling, like those implemented in various countries in 2024, demand continuous adaptation of Acomo's supply chain management and product information systems. Staying ahead of these evolving legal landscapes is crucial for Acomo to operate smoothly and maintain consumer trust.

Environmental and Sustainability Reporting Requirements

New legal frameworks, like the EU's Corporate Sustainability Reporting Directive (CSRD) which fully applies from 2025, are significantly expanding environmental and sustainability reporting obligations. These regulations require detailed disclosures on a company's environmental impact, including specific metrics like Scope 1, 2, and 3 greenhouse gas emissions. For instance, under CSRD, companies must report on climate-related risks and opportunities, aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). This legal shift places a greater onus on businesses to not only measure but also to actively manage and reduce their environmental footprint.

Acomo must establish and maintain sophisticated systems for data collection and reporting to ensure full compliance with these evolving legal requirements. Failure to meet these standards can result in penalties and reputational damage. The CSRD, for example, mandates assurance on reported sustainability data, demanding a higher level of accuracy and transparency than previously required. This means investing in robust internal controls and potentially external verification for environmental metrics.

Key implications for Acomo include:

- Enhanced Data Collection: Implementing systems to accurately track and report on diverse environmental metrics, from water usage to waste generation.

- Increased Transparency: Providing detailed, auditable information on environmental performance to stakeholders, including investors and regulators.

- Strategic Integration: Aligning business strategy with sustainability goals to meet regulatory demands and leverage potential competitive advantages in a greener economy.

- Risk Management: Proactively addressing environmental risks to avoid non-compliance penalties and safeguard long-term business viability.

Deforestation and Biodiversity Regulations

The upcoming European Union Deforestation Regulation (EUDR), slated for full implementation in 2025, presents a significant legal hurdle for companies like Acomo. This regulation mandates that products such as coffee, cocoa, and soy entering the EU market must be proven to originate from deforestation-free supply chains. This directly impacts Acomo's sourcing strategies, requiring robust traceability and diligent oversight across its entire value chain to maintain access to this crucial market.

To comply, Acomo will need to invest heavily in systems that can track commodities from farm to fork, ensuring no contribution to deforestation. Failure to meet these stringent requirements could result in Acomo's products being barred from the EU, a market that is a significant destination for many of its key commodities. For instance, the EU is a major importer of cocoa, with demand remaining strong in 2024.

Key compliance measures Acomo will likely need to implement include:

- Enhanced Due Diligence: Establishing rigorous processes to assess and mitigate deforestation risks in its supply chains.

- Geospatial Tracking: Utilizing advanced technology to pinpoint the exact locations of sourced commodities and verify their deforestation-free status.

- Supplier Audits: Conducting thorough audits of suppliers to ensure adherence to deforestation-free practices and regulations.

- Documentation and Reporting: Maintaining comprehensive records and providing transparent reporting to EU authorities to demonstrate compliance.

The evolving legal landscape, particularly around sustainability and supply chain transparency, presents significant challenges and opportunities for Acomo. New regulations like the EU Deforestation Regulation (EUDR), fully effective in 2025, mandate that products entering the EU market must be deforestation-free, directly impacting Acomo's sourcing of commodities like cocoa and coffee. Compliance requires substantial investment in traceability systems, with potential market exclusion for non-compliant goods. Furthermore, the EU Corporate Sustainability Due Diligence Directive (CSDDD), effective July 2024, imposes legally binding requirements for identifying and mitigating adverse human rights and environmental impacts in supply chains, with non-compliance leading to penalties and reputational damage.

The EU's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2025, also broadens environmental and sustainability reporting obligations, requiring detailed disclosures on greenhouse gas emissions and climate-related risks, aligning with frameworks like TCFD. Acomo must invest in robust data collection and reporting systems to meet these increased transparency demands, including assurance on reported sustainability data. Navigating these complex, interconnected legal frameworks necessitates proactive adaptation, strategic investment in compliance infrastructure, and a commitment to enhanced due diligence across Acomo's global operations to ensure continued market access and maintain stakeholder trust.

Environmental factors

Climate change is significantly altering agricultural landscapes, with rising temperatures and unpredictable rainfall patterns directly affecting crop yields. For instance, the Intergovernmental Panel on Climate Change (IPCC) reported in 2023 that many regions are already experiencing reduced yields for staples like wheat and corn due to these shifts.

These disruptions, including more frequent droughts and extreme weather events, pose a direct threat to Acomo's supply chain stability for key commodities such as coffee and cocoa. The increased volatility in production necessitates robust adaptation strategies, including diversifying sourcing locations and investing in climate-resilient farming practices to mitigate risks.

Growing global awareness and stricter regulations, like the EU Deforestation Regulation (EUDR), are significantly impacting agricultural commodity companies. For Acomo, this means increased scrutiny on supply chains to ensure they are deforestation-free and do not harm biodiversity. Failure to comply can lead to market access restrictions.

The pressure on companies like Acomo to demonstrate responsible sourcing is intensifying. This necessitates the implementation of robust traceability and verification systems, potentially increasing operational costs but also building long-term resilience and market trust. For instance, by 2024, many major commodity traders are expected to have enhanced due diligence processes in place to meet these new regulatory demands.

Water scarcity is a significant challenge for agriculture globally, with projections indicating that by 2050, over 5 billion people could face water shortages. This directly impacts crop yields and can escalate operational expenses for companies like Acomo, which rely on agricultural raw materials. For instance, regions crucial for cocoa production, a key commodity for Acomo, are increasingly experiencing drought conditions.

To navigate this, Acomo must prioritize and invest in sustainable water management practices throughout its supply chain. This includes supporting farmers in adopting water-efficient irrigation techniques and exploring drought-resistant crop varieties. By doing so, Acomo can mitigate risks to its raw material supply and contribute to the long-term viability of the agricultural sectors it depends on.

Food Waste Reduction and Circular Economy Initiatives

Global initiatives are aggressively targeting food waste reduction, with many countries implementing regulations to cut waste by 50% by 2030, aligning with UN Sustainable Development Goal 12.3. For Acomo, a company involved in food ingredients, this translates to a critical need to optimize its supply chain, from sourcing to processing, to minimize losses and enhance resource utilization.

Adopting circular economy principles offers Acomo significant opportunities to reduce its environmental footprint and boost operational efficiency. By finding innovative uses for by-products and waste streams, such as turning fruit pulp into valuable ingredients or animal feed, Acomo can create new revenue streams and appeal to increasingly eco-conscious consumers. This aligns with a growing market trend; for instance, the global circular economy market is projected to reach $4.5 trillion by 2030, indicating substantial economic benefits.

Key areas for Acomo to focus on include:

- Optimizing processing: Implementing advanced technologies to improve yield and reduce waste during manufacturing.

- By-product valorization: Developing new products or markets for materials previously considered waste.

- Supply chain collaboration: Working with suppliers and customers to minimize waste at all stages.

- Consumer engagement: Educating consumers and offering products that support waste reduction at the household level.

Pressure for Sustainable Sourcing and Carbon Footprint Reduction

Consumers, investors, and regulators are increasingly demanding that companies prioritize sustainable sourcing and actively reduce their carbon footprint. This translates into a need for businesses like Acomo to favor suppliers employing low-carbon methods, invest in regenerative agriculture, and develop environmentally friendly packaging solutions. For instance, the EU's Carbon Border Adjustment Mechanism (CBAM), fully operational in 2026, will impose costs on carbon-intensive imports, directly impacting supply chains and incentivizing greener practices.

Acomo's dedication to sustainability is not just about compliance; it's vital for maintaining a positive brand image and ensuring its long-term success in a market that values environmental responsibility. Companies demonstrating strong ESG (Environmental, Social, and Governance) performance are often rewarded with higher valuations and better access to capital. In 2024, sustainable investing continued its upward trend, with global ESG assets projected to reach $50 trillion by 2025, underscoring the financial imperative for Acomo to align with these expectations.

Key actions Acomo can take include:

- Enhancing supply chain transparency: Implementing robust tracking systems to verify sustainable sourcing and carbon emissions data from suppliers.

- Investing in renewable energy: Transitioning operational energy needs to renewable sources to directly reduce Scope 2 emissions.

- Developing circular economy models: Exploring opportunities for waste reduction and material reuse within its product lifecycle, potentially lowering packaging costs and environmental impact.

Environmental factors significantly shape Acomo's operational landscape, driven by climate change impacts on agriculture and increasing regulatory pressures for sustainability. Extreme weather events and water scarcity directly threaten raw material supply chains, necessitating robust adaptation strategies and investment in climate-resilient farming.

The global push for reduced food waste and circular economy principles presents both challenges and opportunities for Acomo to optimize its operations and create new value streams. Companies prioritizing sustainability, like Acomo, are increasingly favored by investors and consumers, enhancing brand image and market access.

Acomo faces growing demands for transparency in its supply chains, particularly concerning deforestation and carbon footprint reduction. By 2024, many commodity traders are enhancing due diligence, and the EU's CBAM, operational in 2026, will directly impact import costs, incentivizing greener practices.

Sustainable investing continues to grow, with global ESG assets projected to reach $50 trillion by 2025, highlighting the financial imperative for Acomo to demonstrate strong environmental performance.

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using data from reputable sources including government statistical agencies, international economic organizations, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting your business.