Acomo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acomo Bundle

Acomo's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the looming threat of new entrants. Understanding these dynamics is crucial for any business looking to thrive in its market.

The complete report reveals the real forces shaping Acomo’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Commodity price volatility significantly bolsters supplier bargaining power. Agricultural markets, including those for cocoa, coffee, spices, and nuts, experience sharp price swings influenced by weather, global politics, and demand fluctuations. This instability directly affects Acomo's expenses, especially when suppliers can leverage heightened demand for specific products.

For example, the first half of 2025 saw cocoa prices nearly double, a trend mirrored by substantial increases in coconut, spice, and nut prices. This surge in raw material costs directly translates to higher procurement expenses for Acomo, impacting its working capital and overall profitability.

In agricultural markets, a few dominant producers or regions can control the supply of specific commodities. If Acomo depends significantly on these concentrated sources, these suppliers gain substantial leverage over pricing and availability.

This concentration restricts Acomo's sourcing alternatives, making it more reliant on a few key suppliers. For instance, in 2024, the global cocoa market saw significant price increases driven by supply disruptions in West Africa, where production is highly concentrated.

Farmers, the bedrock of agricultural supply chains, are grappling with escalating costs for essential inputs. Fuel prices, crucial for machinery and transportation, have seen significant volatility. Similarly, the cost of fertilizers, vital for crop yields, and labor, increasingly scarce and expensive, are on the rise. These combined pressures directly impact the profitability of farming operations.

This surge in production expenses naturally leads farmers to seek higher prices for their raw commodities. For companies like Acomo, which rely on these agricultural products, this translates into increased procurement costs. This situation amplifies the bargaining power of farmers, as they have a stronger justification for demanding better terms.

The financial implications for buyers like Acomo can be substantial. If these higher commodity prices cannot be effectively passed on to end consumers or absorbed through operational efficiencies, it can lead to a compression of profit margins. For instance, in 2024, global fertilizer prices, while showing some moderation from 2022 peaks, remained elevated compared to pre-pandemic levels, impacting agricultural production costs worldwide.

Supply Chain Disruptions and Logistics

Global supply chain disruptions, such as port congestion and transportation delays, significantly bolster the bargaining power of suppliers. These issues can create scarcity and extend lead times, enabling suppliers to command higher prices and more favorable contract terms from companies like Acomo. For instance, in 2023, the cost of shipping a 40-foot container from Asia to Europe saw substantial fluctuations, impacting the landed cost of raw materials for many agribusinesses.

These disruptions directly affect agribusinesses, including Acomo, by potentially straining working capital. When goods are delayed or become more expensive to procure due to logistical hurdles, companies may need to hold more inventory or face increased financing costs. This situation can limit Acomo's ability to negotiate from a position of strength.

- Increased Lead Times: Extended delivery periods due to port backlogs can force Acomo to place orders further in advance.

- Higher Procurement Costs: Supply chain inefficiencies translate to increased transportation and handling expenses, passed on by suppliers.

- Working Capital Strain: Delays and price hikes can tie up more of Acomo's capital in inventory and receivables.

Differentiation of Organic and Specialty Ingredients

Acomo's focus on organic and specialty ingredients significantly influences supplier bargaining power. When suppliers provide highly differentiated or certified organic products, requiring specialized farming and rigorous certifications, their leverage increases.

This specialization allows these suppliers to command premium prices, particularly as consumer demand for natural and sustainable options surged. For instance, by mid-2024, the global organic food market was projected to reach over $350 billion, highlighting the substantial value placed on such ingredients.

- Supplier Leverage: Suppliers of unique, certified organic, or specialty ingredients possess higher bargaining power due to the specialized nature and higher value of their products.

- Premium Pricing: This differentiation enables suppliers to negotiate better terms and charge premium prices, especially given the increasing consumer preference for natural and sustainable food options.

- Market Growth: The expanding market for organic and specialty foods, estimated to grow at a compound annual growth rate of around 10-12% through 2025, further strengthens the position of suppliers in these niches.

Suppliers of specialized or organic ingredients hold significant leverage due to the unique nature and premium pricing of their products. This is amplified by growing consumer demand for natural and sustainable options, a trend projected to see the global organic food market exceed $350 billion by mid-2024.

The increasing costs of agricultural inputs such as fuel, fertilizers, and labor directly translate to higher commodity prices. For instance, while fertilizer prices have moderated from 2022 peaks, they remained elevated in 2024 compared to pre-pandemic levels, impacting farmer profitability and their pricing power with buyers like Acomo.

Concentrated supply markets, where a few producers dominate, grant suppliers substantial bargaining power. This was evident in the 2024 cocoa market, where supply disruptions in West Africa, a highly concentrated production region, led to significant price increases.

| Factor | Impact on Supplier Bargaining Power | 2024/2025 Data Point |

|---|---|---|

| Commodity Price Volatility | Increases power due to price swings | Cocoa prices nearly doubled in H1 2025 |

| Input Cost Increases (Farmers) | Strengthens justification for higher prices | Elevated fertilizer prices in 2024 vs. pre-pandemic |

| Supply Chain Disruptions | Creates scarcity and extends lead times | Fluctuating container shipping costs from Asia to Europe in 2023 |

| Product Specialization (Organic/Specialty) | Enables premium pricing and better terms | Organic food market projected >$350 billion by mid-2024 |

What is included in the product

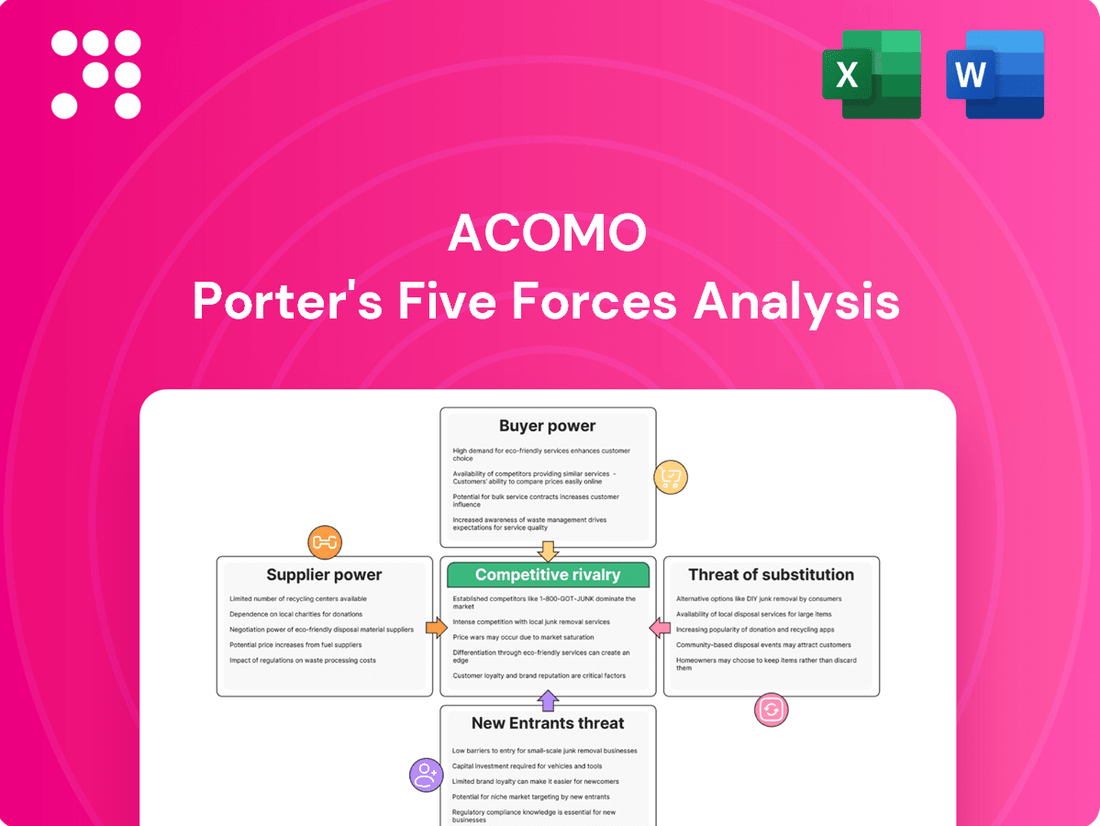

Acomo's Porter's Five Forces analysis dissects the competitive intensity within its operating environment, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Instantly identify and address competitive threats with a visual breakdown of each force, simplifying complex market dynamics.

Customers Bargaining Power

Acomo's customer base is incredibly diverse, ranging from large multinational food corporations to smaller, specialized food producers across the globe. This broad reach means that no single customer or even a small group of customers typically accounts for a significant portion of Acomo's total sales.

In 2024, Acomo continued to serve thousands of customers across various food and beverage sectors, including dairy, bakery, and beverages. This wide distribution of sales across numerous clients significantly limits the ability of any individual customer to exert substantial pricing pressure on Acomo.

The fragmentation of Acomo's customer base across different industries and geographic regions further dilutes the bargaining power of any particular customer segment. For instance, while a large beverage company might have considerable purchasing volume, its influence is counterbalanced by Acomo's relationships with numerous clients in the dairy or confectionery sectors.

Customers in the food and beverage sector are increasingly focused on ingredient quality and knowing where their food comes from. This demand for transparency and traceability is a significant factor influencing supplier relationships.

This heightened consumer awareness, coupled with evolving regulations, pushes Acomo's clients to insist on higher standards from their ingredient providers. For instance, a 2024 report indicated that over 70% of consumers are willing to pay more for food with clear origin information.

Consequently, customers are empowered to negotiate for premium quality and detailed provenance data. This can translate into Acomo facing pressure to enhance its sourcing and production processes, potentially affecting its operational expenses and the variety of products it can offer.

Acomo's customers operate in end markets, particularly food and beverages, where consumers are highly attuned to price. This means that even though Acomo provides essential processing and logistics, the ultimate cost of their ingredients directly impacts the affordability of finished consumer goods. For instance, in 2024, the global food and beverage market experienced continued pressure from inflation, making consumers more selective about pricing, which in turn pushes ingredient suppliers like Acomo to maintain competitive cost structures.

Shift Towards Healthier and Functional Ingredients

The growing consumer demand for healthier, functional, and plant-based food options significantly amplifies the bargaining power of Acomo's customers. As consumers increasingly prioritize specific nutritional benefits and ingredient profiles, buyers are empowered to seek out suppliers who can consistently deliver these tailored ingredients. This trend means customers at the cutting edge of dietary innovation can exert greater influence, pushing Acomo to offer more specialized and adaptable sourcing solutions.

This shift is evidenced by market growth in key areas:

- Plant-based food market projected to reach $162 billion by 2030, up from $74 billion in 2023.

- The global functional foods market was valued at approximately $270 billion in 2023 and is expected to grow.

- Personalized nutrition market is anticipated to expand, driven by advancements in genetic testing and health tracking.

Customer's Ability to Substitute or Vertically Integrate

Large food and beverage manufacturers, Acomo's key customers, possess the potential to bypass Acomo by sourcing ingredients directly from agricultural producers or by developing their own processing and distribution infrastructure. This vertical integration, while demanding substantial capital and specialized knowledge, grants these customers significant bargaining power. For instance, a major beverage company could invest in its own cocoa bean processing facilities, reducing reliance on Acomo's services.

While the threat of customers vertically integrating is real, Acomo mitigates this by offering value-added services. These include specialized processing, quality control, and risk management solutions that are often complex and costly for individual customers to replicate. Acomo's expertise in navigating global supply chains and managing price volatility for commodities like cocoa and vanilla provides a compelling reason for customers to continue partnering with them.

- Customer Substitution/Vertical Integration Threat: Large food and beverage manufacturers can potentially source directly from producers or invest in their own processing and distribution.

- Leverage in Negotiations: The mere possibility of vertical integration gives customers leverage when negotiating terms with Acomo.

- Mitigation through Value-Added Services: Acomo counters this threat by providing essential services like specialized processing and risk mitigation.

- Market Context: In 2024, the global food processing market is valued at over $1.5 trillion, indicating the scale of potential investment by large players.

Acomo's customers, particularly large food and beverage manufacturers, possess significant bargaining power due to their substantial purchasing volumes and the price sensitivity of the end consumer market. In 2024, continued inflation in the food sector meant that even slight price increases from ingredient suppliers like Acomo could impact the affordability of final products, pushing customers to negotiate harder.

The growing consumer demand for transparency, traceability, and specialized ingredients, such as plant-based or functional options, further empowers Acomo's clients. For example, the plant-based food market's projected growth to $162 billion by 2030 highlights how customers catering to these trends can demand more tailored solutions from their suppliers.

While Acomo offers value-added services to mitigate this, the potential for large customers to vertically integrate by sourcing directly from producers or developing their own processing capabilities remains a key factor in their bargaining leverage. This threat is amplified in a market valued at over $1.5 trillion in 2024 for global food processing.

| Customer Characteristic | Impact on Bargaining Power | Supporting Data (2024 Context) |

|---|---|---|

| Purchasing Volume | High | Large food manufacturers represent significant sales volume. |

| Price Sensitivity of End Market | High | Inflation pressures in 2024 made consumers more price-conscious. |

| Demand for Specialized Ingredients | High | Plant-based market growth ($162B by 2030) drives demand for tailored sourcing. |

| Threat of Vertical Integration | Moderate to High | Potential for large players to bypass intermediaries in a $1.5T+ market. |

Preview the Actual Deliverable

Acomo Porter's Five Forces Analysis

This preview showcases the complete Acomo Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you'll receive immediately after purchase, ensuring no discrepancies or missing information. You're looking at the actual, professionally formatted analysis, ready for immediate download and application to your strategic planning.

Rivalry Among Competitors

Acomo navigates a fiercely competitive global arena for agricultural commodities and food ingredients. It contends with a wide array of competitors, from massive multinational corporations to niche regional specialists, all vying for market share in a sector valued in the trillions of dollars.

The sheer scale and complexity of the agricultural supply chain, encompassing sourcing, processing, trading, and distribution, contribute to a highly fragmented competitive environment. This broad spectrum of players necessitates continuous innovation and operational efficiency for Acomo to maintain its edge.

The agricultural sector, where Acomo operates, is inherently prone to significant price swings. Factors like unpredictable weather patterns, global geopolitical shifts, and evolving trade policies directly impact the cost of raw materials, creating an environment of heightened competitive rivalry. For instance, in 2024, major commodity markets like coffee and cocoa experienced notable volatility due to supply chain disruptions and climate events, forcing companies to adapt quickly.

This price volatility compels competitors to adopt aggressive strategies, such as engaging in price wars to secure market share or utilizing hedging instruments to mitigate financial risks. Such actions can directly squeeze profit margins for all players, including Acomo, making efficient risk management a critical differentiator for sustained competitive advantage.

Competitive rivalry in the agricultural commodity sector, including for companies like Acomo, goes far beyond simply trading raw goods. It increasingly centers on providing sophisticated value-added services. These can include everything from specialized processing and intricate logistics management to robust risk mitigation strategies, all of which command higher margins and customer loyalty.

Acomo actively pursues differentiation by offering a broad spectrum of products and services designed to inject value at multiple points within the supply chain. This strategy aims to create a more integrated and beneficial experience for their clients, moving beyond basic transactional relationships.

Companies that excel in offering specialized ingredients, demonstrating a commitment to sustainable sourcing practices, or providing highly efficient and reliable supply chain solutions are carving out significant competitive advantages. For instance, in 2024, the demand for traceable and sustainably sourced agricultural products continued to rise, with reports indicating that over 60% of consumers are willing to pay a premium for such goods.

Geographic Reach and Network Strength

Acomo's extensive global footprint, serving over 100 countries across multiple continents, highlights its robust network strength. This broad reach is a significant competitive advantage, facilitating efficient sourcing and distribution channels.

Rivalry intensifies when competitors possess similar or superior geographic reach and established relationships with both agricultural producers and end-consumers. Companies with well-developed global networks can leverage economies of scale and offer more competitive pricing.

The ongoing effort to maintain and expand this network is crucial for Acomo. For instance, in 2024, Acomo continued to invest in strengthening its supply chain infrastructure, aiming to onboard new regional suppliers and enhance logistics in emerging markets.

- Global Presence: Acomo operates in over 100 countries, demonstrating a wide geographic reach.

- Network Strength: Established relationships with producers and consumers are vital for competitive advantage.

- Competitive Challenge: Competitors with similar global networks can exert significant pressure.

- Strategic Importance: Network expansion and maintenance are key to efficient operations and market share.

Sustainability and Transparency Demands

Growing consumer and investor demand for sustainability and transparency is intensifying competitive rivalry in the food sector. Companies demonstrating robust Environmental, Social, and Governance (ESG) performance are increasingly favored, creating pressure for all players, including Acomo, to enhance their own practices. For instance, in 2024, a significant portion of global consumers indicated a willingness to pay a premium for sustainably sourced products, according to various market research reports. This trend is compelling competitors to invest heavily in areas like organic farming, ethical labor practices, and carbon footprint reduction.

Competitors are actively showcasing their commitment to these principles, which in turn necessitates continuous improvement in Acomo's sustainability framework to maintain its market position. This includes investing in supply chain traceability and reducing waste. For example, several major food companies announced in early 2024 ambitious targets for reducing plastic packaging and achieving net-zero emissions by 2040, setting a benchmark for the industry.

- ESG Performance as a Differentiator: Companies with strong ESG credentials are gaining market share and investor confidence.

- Investment in Sustainable Practices: Competitors are channeling resources into organic farming, ethical sourcing, and carbon footprint reduction initiatives.

- Supply Chain Transparency: Enhanced visibility into sourcing and production processes is becoming a key competitive factor.

- Consumer Willingness to Pay: A growing segment of consumers are prioritizing sustainability, influencing purchasing decisions and driving industry standards.

Competitive rivalry within Acomo's operating environment is intense, driven by a fragmented market and significant price volatility in agricultural commodities. Companies differentiate themselves not just on raw goods but on value-added services like specialized processing and logistics. For example, in 2024, coffee and cocoa markets saw considerable price swings due to supply chain issues and climate events, forcing rapid adaptation.

The drive for market share often leads to aggressive pricing strategies and the use of hedging, which can compress profit margins across the board. Companies excelling in sustainability and supply chain transparency are gaining an edge, with consumer demand for these attributes rising. In 2024, over 60% of consumers expressed willingness to pay more for sustainably sourced products, pushing competitors to invest in areas like ethical labor and carbon reduction.

Acomo's global presence in over 100 countries is a key asset, but competitors with similar reach can exert considerable pressure. Continuous network expansion and maintenance are therefore crucial for Acomo to leverage economies of scale and maintain competitive pricing. The company's 2024 investments in supply chain infrastructure aimed to bolster its position in emerging markets.

| Key Competitive Factor | Impact on Rivalry | 2024 Relevance |

|---|---|---|

| Price Volatility | Intensifies competition, drives aggressive strategies | Major commodity markets experienced significant swings |

| Value-Added Services | Key differentiator beyond raw goods | Growing demand for specialized processing and logistics |

| Sustainability & Transparency | Consumer preference, investor confidence | Over 60% of consumers willing to pay premium for sustainable goods |

| Global Network Strength | Leverages economies of scale, competitive pricing | Acomo invested in infrastructure to expand reach in emerging markets |

SSubstitutes Threaten

Large food and beverage manufacturers, like Nestlé and Unilever, increasingly explore direct sourcing from agricultural producers, bypassing traditional traders such as Acomo. This trend is driven by a desire for greater control over supply chains and potentially lower costs for high-volume commodities. For instance, in 2024, major food companies continued to invest in supply chain digitization to facilitate these direct relationships, aiming to improve traceability and efficiency.

This direct sourcing presents a significant threat of substitution for Acomo's core trading and distribution services. When manufacturers can secure ingredients directly, they reduce their reliance on intermediaries. However, the logistical intricacies and quality assurance demands of global agricultural sourcing remain substantial hurdles. Acomo's established network, risk management capabilities, and expertise in navigating complex international trade regulations continue to offer value, mitigating the full impact of this substitution threat.

Emerging food technologies like lab-grown meats, precision fermentation, and novel plant-based proteins pose a potential threat by offering alternatives to traditional agricultural commodities. For instance, the global plant-based food market was valued at approximately $22.6 billion in 2023 and is projected to reach $106.1 billion by 2030, indicating substantial growth that could divert demand from conventional ingredients.

A growing consumer interest in locally sourced, seasonal, and minimally processed foods presents a potential threat of substitutes for Acomo. This shift could lead consumers to favor regional supply chains, potentially reducing demand for Acomo's international distribution of certain globally traded commodities. For instance, in 2024, the global market for organic foods, a segment often associated with local sourcing, was valued at over $250 billion and is projected to continue its strong growth trajectory.

Synthetic or Bio-Engineered Ingredients

The rise of synthetic or bio-engineered ingredients poses a significant threat of substitution for traditional agricultural commodities. These innovations can replicate the functional properties of natural ingredients, potentially offering a more predictable and cost-effective supply chain. For instance, advancements in precision fermentation and cellular agriculture are enabling the production of proteins and fats that directly compete with those derived from crops like soybeans or dairy. This technological shift could fundamentally alter sourcing strategies across various industries, including food and beverage, where Acomo operates.

This substitution dynamic could reduce Acomo's reliance on its existing agricultural input base. As these engineered alternatives mature and achieve economies of scale, they may present a compelling value proposition to Acomo's customers. For example, lab-grown meat or plant-based dairy alternatives are gaining market share, directly impacting the demand for conventional agricultural products. The global alternative protein market, projected to reach over $150 billion by 2030, underscores this growing trend.

- Technological Advancements: Innovations in biotechnology, such as CRISPR gene editing and synthetic biology, are accelerating the development of bio-engineered ingredients.

- Cost and Stability: These alternatives can offer greater price stability and a more controlled supply chain compared to agricultural commodities, which are subject to weather, disease, and geopolitical factors.

- Market Impact: The increasing consumer acceptance and investment in alternative ingredients, like precision-fermented dairy proteins, directly challenge the market position of traditional agricultural products.

- Acomo's Adaptation: Acomo may need to strategically invest in or partner with companies developing these synthetic alternatives to remain competitive and offer a diversified portfolio.

Changes in Dietary Habits and Nutritional Trends

Broad shifts in global dietary habits, such as a decline in consumption of specific commodities or a rise in entirely new nutritional trends, can lead to the substitution of one food ingredient for another. For instance, the growing awareness of functional nutrition and specialized dietary needs is driving demand for alternative ingredient profiles.

Acomo's diversified portfolio, which includes a wide array of products, helps mitigate this risk by offering flexibility and reducing reliance on any single commodity.

- Functional Foods Growth: The global functional foods market was valued at approximately $280 billion in 2023 and is projected to grow significantly, indicating a strong trend towards ingredients that offer health benefits beyond basic nutrition.

- Plant-Based Alternatives: The plant-based food market, a major driver of ingredient substitution, reached over $50 billion globally in 2023, showcasing a clear shift away from traditional animal-based products.

- Acomo's Diversification: Acomo's strategy to offer a broad spectrum of ingredients, from traditional to novel, positions it to adapt to these changing consumer preferences and ingredient demands.

The threat of substitutes for Acomo arises from alternative sourcing methods and innovative food technologies. Direct sourcing by large manufacturers, as seen in 2024 with increased supply chain digitization, bypasses intermediaries like Acomo. Emerging food tech, such as lab-grown meats and plant-based proteins, offers direct competition to traditional agricultural commodities, with the plant-based food market projected to reach $106.1 billion by 2030.

Consumer preferences for locally sourced and functional foods also present substitution risks, potentially reducing demand for globally traded commodities. For example, the organic food market exceeded $250 billion in 2024. Furthermore, synthetic or bio-engineered ingredients, driven by advancements in biotechnology, can replicate natural ingredient functions, offering cost-effectiveness and supply chain stability.

| Threat Category | Description | Key Data Point (2023/2024 Estimates) | Potential Impact on Acomo |

| Direct Sourcing by Manufacturers | Large food companies increasingly source directly from producers. | Continued investment in supply chain digitization in 2024. | Reduced reliance on Acomo's trading services. |

| Emerging Food Technologies | Lab-grown meats, precision fermentation, plant-based proteins. | Plant-based food market valued at $22.6 billion (2023). | Direct competition for traditional agricultural inputs. |

| Consumer Preferences | Shift towards local, seasonal, and functional foods. | Organic food market over $250 billion (2024). | Potential decrease in demand for globally traded commodities. |

| Synthetic/Bio-engineered Ingredients | Lab-produced ingredients mimicking natural ones. | Alternative protein market projected over $150 billion by 2030. | Disruption of traditional agricultural supply chains. |

Entrants Threaten

The global agricultural commodities and food ingredients market demands significant upfront capital. New entrants must invest heavily in sourcing networks, processing plants, sophisticated logistics, and robust risk management systems. For instance, establishing a global supply chain comparable to Acomo's, which operates in over 100 countries, requires billions in investment, making it a formidable hurdle.

Acomo's extensive global sourcing and distribution networks, cultivated over decades, present a significant barrier to new entrants. These deeply entrenched relationships with producers and consumers worldwide, coupled with sophisticated logistics and quality control infrastructure, are incredibly difficult and costly to replicate.

For instance, in 2024, Acomo continued to leverage its established network, facilitating the movement of millions of tons of agricultural commodities. New players would face immense hurdles in building comparable reach and reliability, requiring substantial capital investment and years to develop the trust and operational efficiency that Acomo already commands.

The agricultural commodity sector presents a formidable barrier to new entrants due to its inherent volatility. Factors like unpredictable weather patterns, shifting geopolitical landscapes, and significant price fluctuations demand robust risk mitigation expertise. New players would require substantial capabilities in hedging and sophisticated financial management to even begin navigating these turbulent waters.

Acomo's extensive experience in effectively managing these complex risks, demonstrated by its consistent performance through various market cycles, offers a significant competitive advantage. This deep-seated expertise in navigating market volatility is not easily replicated by newcomers, thus acting as a deterrent.

Regulatory Compliance and Traceability Demands

The food and agricultural industries face escalating regulatory hurdles concerning food safety, quality, and traceability. Newcomers must navigate complex supply chains and secure essential certifications in numerous global markets, a significant challenge. For instance, in 2024, the EU's Farm to Fork strategy continued to emphasize enhanced traceability, requiring more sophisticated data management systems for all players.

This intricate regulatory landscape serves as a substantial barrier to entry. Companies must invest heavily in compliance infrastructure and expertise to meet standards, which can be prohibitive for smaller or less established entities. The increasing demand for transparency from consumers and regulators alike further amplifies these requirements, making it harder for new entrants to establish a foothold without substantial upfront investment.

- Stricter Food Safety Standards: Growing emphasis on preventing contamination and ensuring product integrity.

- Enhanced Traceability Requirements: Mandates for tracking products from farm to fork, often leveraging digital solutions.

- International Certification Complexities: Meeting diverse national and regional food regulations and standards.

- Investment in Compliance Technology: Need for advanced systems to manage and report on traceability data.

Brand Reputation and Customer Trust

In the food ingredients and agricultural commodities sector, brand reputation and customer trust are incredibly important. Acomo, having been around for a while and built a solid presence, enjoys a strong reputation for being reliable. Newcomers would have to spend a significant amount of time and money to earn that same level of trust and recognition.

Building customer loyalty in this industry often relies on consistent quality and dependable supply chains. For instance, in 2023, major food manufacturers continued to prioritize suppliers with proven track records, as evidenced by the continued consolidation of supply agreements among established players. Acomo's established relationships mean new entrants face a high barrier to entry in securing comparable customer commitments.

- Established brand loyalty: Existing customers often stick with suppliers they trust, making it difficult for new entrants to gain market share.

- High switching costs: For buyers, changing suppliers can involve significant effort in qualifying new sources and reconfiguring processes.

- Reputational risk: Food companies are highly sensitive to any disruption or quality issues, making them hesitant to switch from trusted partners.

The threat of new entrants in the agricultural commodities and food ingredients market is significantly mitigated by the immense capital requirements. Establishing global sourcing, processing, and logistics networks, similar to Acomo's operations spanning over 100 countries, necessitates billions in investment. For example, in 2024, the ongoing need for advanced digital infrastructure for traceability and sustainability reporting further increases these upfront costs, making it a substantial barrier for newcomers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from financial reports, industry-specific market research, and publicly available company disclosures. This multi-faceted approach ensures a comprehensive understanding of competitive pressures.