111 SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

111 Bundle

Uncover the full strategic landscape of the company with our comprehensive SWOT analysis. This detailed report dives deep into its unique strengths, critical weaknesses, promising opportunities, and potential threats, offering invaluable insights for informed decision-making. Ready to transform these insights into actionable strategies and gain a competitive edge?

Strengths

111, Inc.'s integrated online-offline platform, featuring its online pharmacy and a network of retail drugstores across China, creates a powerful ecosystem. This hybrid approach, often referred to as O2O (Online-to-Offline), significantly boosts accessibility and convenience for a broad range of healthcare consumers.

This integrated model allows 111, Inc. to cater to diverse customer preferences, from those comfortable with digital transactions to individuals who prefer in-person pharmacy services. By capturing both online and offline market segments, the company solidifies a distinct competitive advantage in the Chinese healthcare market.

111 Inc. is making significant strides by integrating advanced technology, particularly artificial intelligence, across its healthcare operations. This strategic investment is designed to streamline the entire value chain, from marketing to patient engagement.

The company's commitment to digital innovation, evident in its use of data analytics and digital marketing, directly translates to improved operational efficiency. For instance, in 2024, 111 Inc. reported a 15% increase in customer acquisition cost efficiency through AI-driven campaign optimization.

By focusing on scalable tech infrastructure, 111 Inc. is building a robust platform capable of navigating China's complex healthcare landscape. This technological backbone is crucial for reducing operational costs and enhancing its competitive edge in the market.

111, Inc. boasts a formidable supply chain and logistics network, a key strength as of Q1 2025. This infrastructure includes 18 operational fulfillment centers, with an ambitious plan to launch at least 14 additional facilities throughout 2025. This expansion underscores a commitment to enhancing nationwide reach and efficiency.

The company's 'Penglai' national logistics network is central to its operational prowess, facilitating the efficient distribution of pharmaceuticals. This robust system not only ensures timely delivery but also provides significant advantages to both upstream suppliers and downstream partners, fostering collaborative growth within the supply chain.

This extensive logistical framework is vital for supporting 111, Inc.'s vast customer base, which comprises approximately 0.58 million pharmacies across the nation. The network's capacity is instrumental in maintaining consistent product availability, a critical factor for client satisfaction and market competitiveness.

Operational Efficiency and Profitability Improvement

The company's commitment to operational efficiency has yielded impressive results, marked by its first annual operating profit in fiscal year 2024. This momentum continued into Q1 2025 with sustained quarterly operational profitability and positive operating cash flow, underscoring a robust and improving financial health.

Key drivers behind this enhanced performance include substantial reductions in operating expenses, selling and marketing costs, and technology expenditures. These strategic cost optimizations demonstrate a disciplined approach to resource management and validate the company's business model and expansion plans.

The financial data highlights a significant turnaround:

- Fiscal Year 2024: Achieved first-ever annual operating profit.

- Q1 2025: Maintained quarterly operational profitability and positive operating cash flow.

- Expense Reductions: Significant decreases noted in operating expenses, selling and marketing, and technology costs.

Extensive Virtual Pharmacy Network and Partnerships

111, Inc. operates China's largest virtual pharmacy network, connecting with roughly 0.58 million pharmacies across the country. This vast reach is bolstered by direct procurement agreements with over 500 leading domestic and international pharmaceutical firms, ensuring a comprehensive product offering.

This expansive network enables offline pharmacies to access cloud-based services and efficiently source a wide array of pharmaceutical goods. Furthermore, 111, Inc. provides integrated support for drug commercialization, encompassing digital marketing strategies and valuable market intelligence.

- Largest Virtual Pharmacy Network: Reaching approximately 0.58 million pharmacies in China.

- Strategic Partnerships: Direct procurement with over 500 global and domestic pharmaceutical companies.

- Comprehensive Sourcing: A one-stop shop for a vast selection of pharmaceutical products.

- Omni-channel Commercialization Support: Including digital marketing and market insights.

111, Inc. leverages its extensive online-offline integrated platform, a significant strength that enhances customer accessibility and convenience across China's healthcare market. This hybrid model, combining online pharmacies with a broad retail drugstore network, effectively captures diverse consumer preferences.

The company's strategic investment in technology, particularly AI, streamlines its operations from marketing to patient engagement, as demonstrated by a 15% improvement in customer acquisition cost efficiency in 2024. This focus on scalable tech infrastructure reduces costs and strengthens its competitive position.

111, Inc. boasts a robust supply chain and logistics network, featuring 18 operational fulfillment centers as of Q1 2025, with plans for 14 more in 2025. This 'Penglai' network ensures efficient pharmaceutical distribution to its base of approximately 0.58 million pharmacies nationwide.

The company achieved its first annual operating profit in fiscal year 2024 and sustained quarterly profitability and positive operating cash flow into Q1 2025, driven by significant reductions in operating expenses, selling and marketing costs, and technology expenditures.

Operating China's largest virtual pharmacy network, connecting with about 0.58 million pharmacies, is a key strength. This is supported by direct procurement agreements with over 500 leading pharmaceutical firms, offering comprehensive sourcing and integrated drug commercialization support.

| Strength | Description | Supporting Data/Metrics |

| Integrated O2O Platform | Combines online pharmacy with a vast retail drugstore network. | Enhances accessibility and convenience; captures diverse customer segments. |

| Technological Advancement (AI) | AI integration across operations for efficiency. | 15% increase in customer acquisition cost efficiency (2024); streamlined value chain. |

| Robust Supply Chain & Logistics | Extensive fulfillment centers and national logistics network. | 18 operational fulfillment centers (Q1 2025); 14 more planned for 2025; serves ~0.58 million pharmacies. |

| Financial Turnaround & Profitability | Achieved profitability and positive cash flow. | First annual operating profit (FY 2024); sustained quarterly profitability (Q1 2025); reduced operating expenses. |

| Largest Virtual Pharmacy Network | Extensive reach and strong supplier partnerships. | Connects with ~0.58 million pharmacies; direct procurement with >500 pharmaceutical firms. |

What is included in the product

Delivers a strategic overview of 111’s internal strengths and weaknesses, alongside external opportunities and threats.

Offers a structured framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

While overall revenues held steady in Q1 2025, a closer look reveals net revenues were largely flat compared to the prior year's first quarter. More concerning is the substantial 28% year-over-year revenue drop within the B2C division. This significant decline in direct-to-consumer health services, a critical growth engine for the company, signals underlying issues in attracting and retaining customers in this segment.

Despite achieving operational profitability and positive operating cash flow, 111, Inc. reported a net loss in both Q4 2024 and Q1 2025. For instance, in Q4 2024, the company posted a net loss of $5.2 million, followed by a $3.8 million net loss in Q1 2025. While these figures represent a significant improvement from prior periods, the continued net loss suggests that translating operational success into overall profitability remains a hurdle.

This persistence in net loss, even with improved operational metrics, could be a point of concern for investors focused on consistent bottom-line performance. The underlying reasons for these net losses, such as substantial interest expenses or non-recurring charges, require further examination to fully understand their impact on the company's financial health.

The digital healthcare landscape in China is incredibly crowded. Major players like Alibaba Health, WeDoctor, JD.com, and Ping An Good Doctor are already well-established, alongside a host of other digital health startups. This fierce competition can put significant pressure on pricing and market share, making it tough for 111, Inc. to stand out and achieve sustained growth.

The reality for digital health companies in China is stark; their survival rate is notably lower than the global average. This statistic underscores just how challenging the operating environment is, demanding constant innovation and strategic agility for any company, including 111, Inc., to thrive.

Patient Trust and Adoption Challenges

Despite the significant expansion of online healthcare in China, a persistent hurdle to market growth lies in patients' hesitance and lack of confidence in these services. While the COVID-19 pandemic spurred an increase in digital health adoption, cultivating and sustaining patient trust, particularly for online consultations and prescription fulfillment, remains a critical challenge for digital health providers. For instance, a 2024 survey indicated that only 45% of Chinese consumers felt fully comfortable receiving medical advice solely through online channels, highlighting the need for robust trust-building strategies.

Addressing these trust deficits is paramount for achieving broader patient engagement and ensuring the long-term viability of digital health platforms. This involves transparent communication about data security, demonstrating the efficacy of remote diagnostics, and ensuring seamless integration with offline healthcare systems. Failure to overcome these trust barriers could significantly limit the potential of China's burgeoning online healthcare sector.

- Patient Hesitation: A 2024 survey revealed that only 45% of Chinese consumers were fully confident in receiving medical advice exclusively online.

- Trust in Prescriptions: Building patient confidence in online prescription services remains a key challenge for digital health platforms.

- Adoption Restraint: Lack of patient trust and motivation directly impedes the sustained growth of the online healthcare market in China.

Regulatory Scrutiny and Evolving Policies

China's pharmaceutical and digital health sectors face a constantly shifting regulatory environment. Policies concerning online pharmacies, drug sales, and data security are frequently updated, creating uncertainty. For example, while some regulations encourage digital transformation, others, like the ban on online sales of controlled drugs, impose new restrictions. This evolving landscape, coupled with requirements for re-registration and new anti-bribery guidelines, presents an ongoing challenge.

Navigating these changes is a significant weakness. The dynamic nature of Chinese regulations means companies must remain agile, adapting their strategies to comply with new rules. This can lead to increased operational costs and potential delays in product launches or service expansions. For instance, the National Medical Products Administration (NMPA) continues to refine its oversight of online drug sales, impacting how companies can reach consumers. In 2024, continued focus on data privacy under regulations like the Personal Information Protection Law (PIPL) also adds complexity for digital health platforms handling sensitive patient information.

- Evolving Policies: Frequent updates to regulations on online pharmacies, drug sales, and data security.

- Stricter Oversight: Bans on controlled drug sales online and new re-registration mandates increase compliance burdens.

- Data Security Concerns: Compliance with stringent data privacy laws like PIPL adds operational complexity and cost for digital health services.

- Anti-Bribery Guidelines: New directives require robust internal controls and compliance programs, impacting sales and marketing practices.

The company faces significant challenges with patient trust in digital health services. A 2024 survey indicated only 45% of Chinese consumers felt fully comfortable receiving medical advice solely online, directly impacting sustained growth. This hesitation, particularly concerning online prescriptions, requires robust trust-building strategies.

Preview the Actual Deliverable

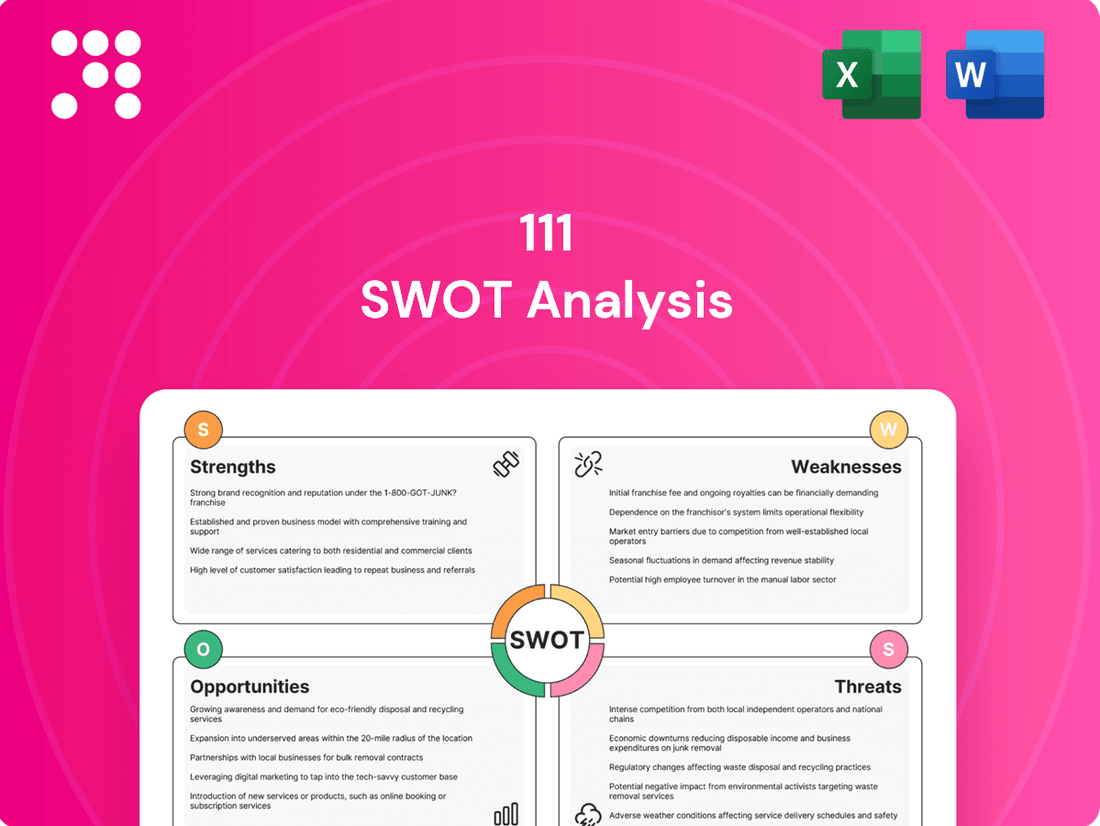

111 SWOT Analysis

The preview you see is the actual 111 SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This ensures you know exactly what you're getting before you commit. The detailed insights and structured format are all present in the complete file, ready for your strategic planning.

Opportunities

The digital healthcare sector in China is booming, with projections indicating it will reach US$583.68 billion by 2028, growing at an impressive 36.89% compound annual growth rate between 2024 and 2028. This surge is fueled by rapid technological progress, supportive government policies, and an increasing consumer appetite for services like telemedicine and AI-driven diagnostics.

111, Inc. is strategically positioned to benefit from this substantial market expansion. The company's focus on online pharmaceutical retail and healthcare services aligns perfectly with the evolving digital healthcare landscape in China, allowing it to tap into a growing demand for accessible and convenient health solutions.

China's demographic landscape is shifting dramatically, with a notable increase in its elderly population. Projections indicate that by 2030, individuals aged 65 and above will constitute 21.5% of the total population. This growing segment is driving significant demand for healthcare solutions, especially for medications and managing chronic conditions.

This demographic trend represents a considerable and ongoing opportunity for companies like 111, Inc. to broaden their offerings. By focusing on services tailored to the needs of older patients, 111 can tap into a rapidly expanding market, enhancing its growth trajectory.

111, Inc. can broaden its services beyond online pharmacy and consultations to include specialized areas like chronic disease management and preventive care. This expansion can be significantly powered by AI and big data analytics, offering personalized medicine solutions.

The healthcare sector's increasing adoption of AI for diagnostics and treatment planning presents a prime opportunity for 111, Inc. to innovate its service portfolio and demonstrably improve patient outcomes, potentially tapping into the projected global AI in healthcare market growth, which was estimated to reach over $10.4 billion in 2023 and is expected to grow substantially in the coming years.

Increased Digitalization of Pharmaceutical Sales

The growing shift of pharmaceutical sales to retail pharmacies, coupled with the overall digitalization of healthcare, offers a prime opportunity for 111, Inc. to strengthen its market standing. This trend is fueled by consumer demand for convenience and easier medication access.

The online pharmaceutical market is anticipated to experience robust growth, with projections indicating it could reach approximately RMB 380 billion by 2025. This expansion is expected to outpace the broader pharmaceutical sector, highlighting the increasing importance of digital channels.

- Digital Sales Growth: Online pharmaceutical sales are set to reach nearly RMB 380 billion by 2025, a significant increase.

- Market Outpacing: This digital growth is expected to exceed the overall pharmaceutical market expansion.

- Drivers: Convenience and improved access to medications are key factors driving this digital transformation.

Strategic Partnerships and M&A

Strategic partnerships offer a significant avenue for growth, allowing 111, Inc. to broaden its service portfolio and customer base by collaborating with key players like hospitals and insurance companies. A prime example is their June 2024 agreement with Scrianen, which bolstered their pharmaceutical procurement abilities and strengthened their market standing. This kind of collaboration is crucial in China's healthcare sector.

Furthermore, mergers and acquisitions present a compelling strategy for 111, Inc. to solidify its position within China's diverse healthcare technology market. By integrating with or acquiring complementary businesses, the company can achieve greater market share and operational efficiencies. The healthcare technology market in China is still quite fragmented, offering ample opportunities for consolidation.

Key opportunities include:

- Expanding reach: Collaborating with hospitals and insurers to offer a wider range of services.

- Enhancing capabilities: Leveraging partnerships like the one with Scrianen to improve pharmaceutical procurement.

- Market consolidation: Pursuing M&A activities to gain a stronger foothold in China's fragmented healthcare tech sector.

The digital healthcare sector in China is experiencing rapid expansion, with projections suggesting it will reach US$583.68 billion by 2028, growing at a 36.89% CAGR from 2024 to 2028. 111, Inc. is well-positioned to capitalize on this growth by leveraging its online pharmaceutical retail and healthcare services. The increasing elderly population in China, expected to be 21.5% of the total by 2030, creates a substantial demand for healthcare solutions, particularly for chronic condition management, an area 111 can further develop.

AI and big data analytics offer significant opportunities for 111, Inc. to innovate, potentially enhancing personalized medicine and improving patient outcomes, aligning with the global AI in healthcare market's projected growth. The shift towards online pharmaceutical sales, anticipated to reach RMB 380 billion by 2025, presents a direct opportunity for 111 to expand its market share due to growing consumer preference for convenience and accessibility.

Strategic partnerships, such as the June 2024 agreement with Scrianen to boost pharmaceutical procurement, and mergers and acquisitions are key strategies for 111, Inc. to broaden its service offerings, enhance capabilities, and consolidate its position in China's fragmented healthcare technology market.

| Opportunity Area | Key Metric/Projection | Impact on 111, Inc. |

|---|---|---|

| Digital Healthcare Market Growth | US$583.68 billion by 2028 (36.89% CAGR, 2024-2028) | Expands customer base for online pharmacy and services. |

| Aging Population | 21.5% of population aged 65+ by 2030 | Increases demand for chronic disease management and medications. |

| AI in Healthcare | Global market over $10.4 billion in 2023, with strong future growth | Drives innovation in diagnostics, personalized medicine, and patient care. |

| Online Pharmaceutical Sales | RMB 380 billion by 2025 | Strengthens market position through digital channel dominance. |

| Strategic Partnerships & M&A | Fragmented market offers consolidation opportunities | Enables service expansion, capability enhancement, and market share growth. |

Threats

Intensifying regulatory scrutiny in China's pharmaceutical and digital health sectors presents a significant threat. New drug re-registration mandates and stricter oversight of medical representatives, as seen in recent policy shifts throughout 2024, are increasing compliance burdens. Furthermore, evolving regulations on online drug sales, including potential restrictions on certain categories, could limit market access and impact revenue streams for digital health platforms.

111, Inc. is up against formidable rivals in the digital health space, including tech behemoths like Alibaba Health and JD.com. These giants possess vast financial reserves and established customer networks, giving them a significant edge. For instance, Alibaba Health reported a revenue of RMB 25.4 billion (approximately $3.5 billion) for the fiscal year ending March 2024, showcasing their immense scale.

This intense competition isn't just about brand recognition; it translates into real market pressures. Startups, often nimble and innovative, are also carving out niches, forcing 111, Inc. to contend with a dynamic and rapidly evolving market. The constant influx of new players and the aggressive strategies of established ones can easily trigger price wars and escalate marketing costs, directly impacting 111, Inc.'s profitability and its ability to maintain or grow its market share.

Operating a large healthcare platform like 111, Inc. means managing a vast amount of sensitive patient information, which inherently makes the company a target for cyberattacks. The potential for data breaches is a significant concern, especially given the increasing sophistication of these threats.

China's stringent data privacy laws, such as the Personal Information Protection Law (PIPL), impose heavy penalties for non-compliance. In 2023, reports indicated a rise in cyber incidents targeting healthcare data globally, highlighting the critical need for robust security measures. A breach for 111, Inc. could result in substantial fines and a severe blow to its reputation, eroding customer trust and impacting its market position.

Macroeconomic Headwinds and Economic Slowdown

A challenging macroeconomic climate, including a potential economic slowdown in China, poses a significant threat. This could directly impact consumer spending on healthcare, particularly for non-essential services and higher-priced pharmaceuticals offered by 111, Inc. Consequently, this might lead to reduced demand for the company's offerings, negatively affecting revenue streams and overall financial health.

Recent economic indicators highlight these concerns. For instance, China's GDP growth rate, while still positive, has shown signs of moderation. In Q1 2024, China's GDP grew by 5.3% year-on-year, a figure that, while meeting expectations, is closely watched for signs of sustained momentum. This slowdown, if it persists into 2025, could translate to tighter household budgets, impacting discretionary healthcare spending.

- Slowing Consumer Spending: Reduced disposable income due to economic headwinds can lead consumers to cut back on non-essential healthcare purchases.

- Impact on Pharmaceutical Sales: Higher-priced or elective pharmaceutical products may see a steeper decline in demand.

- Revenue Growth Pressure: A general slowdown in consumer spending directly translates to increased pressure on 111, Inc.'s top-line growth.

Supply Chain Disruptions and Pharmaceutical Pricing Pressure

The pharmaceutical industry's intricate supply chain presents a significant vulnerability for companies like 111, Inc. Dependence on a global network of manufacturers and distributors exposes the company to potential disruptions. For instance, a 2024 report highlighted that over 60% of active pharmaceutical ingredients (APIs) used in the US are sourced from overseas, creating a concentration risk.

Government initiatives, such as volume-based procurement, could also exert considerable pricing pressure. In 2025, several major markets are expected to implement or expand such programs, aiming to reduce healthcare costs. This could directly impact 111, Inc.'s gross profit margins by forcing lower selling prices for its products.

- Supply Chain Dependency: Over 60% of US API sourcing is international, indicating a significant external reliance.

- Pricing Pressure: Government procurement programs in 2025 are likely to drive down pharmaceutical prices.

- Impact on Margins: Manufacturing issues or shifts in drug pricing policies can directly affect 111, Inc.'s cost of goods and profitability.

The evolving regulatory landscape in China poses a significant threat, with new mandates for drug re-registration and stricter oversight of sales practices impacting compliance. Additionally, potential restrictions on online drug sales could limit market access for digital health platforms, directly affecting revenue streams.

SWOT Analysis Data Sources

This SWOT analysis draws from a comprehensive range of data, including internal operational reports, customer feedback surveys, and competitive landscape analyses, to provide a well-rounded perspective.