111 PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

111 Bundle

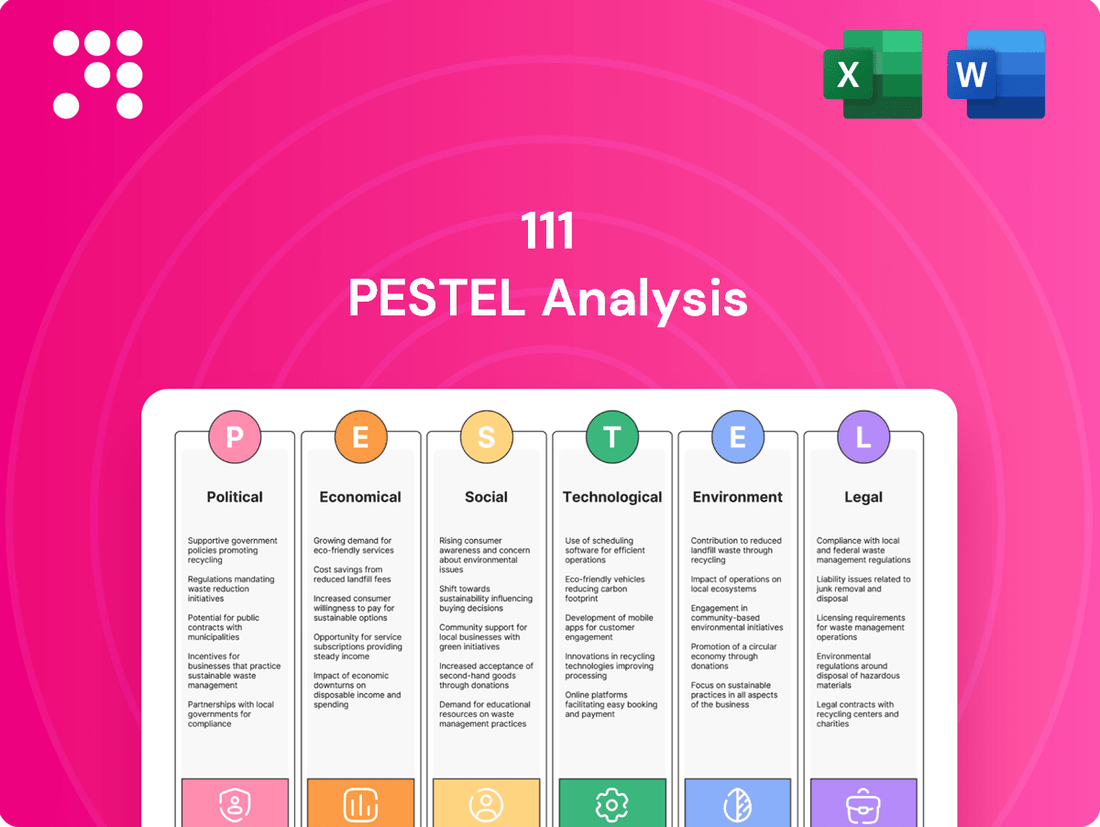

Unlock the critical external factors shaping 111's trajectory with our meticulously researched PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges. Equip yourself with this vital intelligence to refine your strategies and anticipate market shifts. Purchase the full PESTLE analysis now for actionable insights.

Political factors

China's government is actively pursuing healthcare reforms, emphasizing fairer distribution of medical resources and broadening the scope of clinical services. This initiative aims to improve healthcare access and the overall quality of care nationwide.

Key policies are being implemented to foster a shift towards a high-quality, value-based healthcare system, with primary care serving as its fundamental pillar. For instance, by the end of 2023, China had established over 1.7 million primary healthcare institutions, a 4.8% increase from the previous year, illustrating the commitment to strengthening this foundational level of care.

China's commitment to fostering innovation in the pharmaceutical sector has intensified since mid-2024, with significant policy shifts aimed at accelerating the development and approval of novel drugs and medical devices. This includes substantial fiscal subsidies and a streamlined approach to clinical trial reviews, directly impacting the landscape for new therapies.

A key development is the National Medical Products Administration's (NMPA) introduction of the Pilot Work Plan for Optimizing Review and Approval of Clinical Trials for Innovative Drugs in July 2024. This initiative is designed to expedite the journey of groundbreaking treatments from laboratory to market, creating a more fertile ground for companies involved in pharmaceutical distribution and patient access platforms.

China's evolving regulatory framework significantly impacts online pharmacies like 111, Inc. Amendments to the Drug Administration Law in 2019 allowed for the online sale of prescription drugs, a crucial development for the company's business model.

More recent regulations, such as the Administrative Measures for Supervision of Internet Pharmacy effective December 2022, further clarify operational requirements for online pharmacy businesses. These measures emphasize safety and prescription authenticity, directly influencing how 111, Inc. conducts its core online pharmacy and consultation services.

Anti-Corruption Campaigns

China's intensified anti-corruption efforts, particularly within the healthcare sector, began in mid-2023 and are expected to continue through 2024 and into 2025. This crackdown aims to foster a more equitable and transparent marketplace. For companies like 111, Inc., this could translate to a reduction in unfair competitive practices and an overall improvement in industry integrity.

The State Administration for Market Regulation (SAMR) introduced new compliance directives in January 2025, specifically targeting commercial bribery risks. These measures are designed to curb illicit practices and promote ethical business conduct across various industries, including pharmaceuticals and medical devices. Such regulatory shifts can influence operational costs and market access for businesses operating within China.

- Increased Compliance Burden: Companies must adapt to stricter regulations, potentially increasing legal and administrative expenses.

- Level Playing Field: Reduced corruption can create a more competitive environment, benefiting companies with strong ethical practices.

- Market Transparency: Enhanced oversight can lead to greater clarity in pricing and distribution, aiding strategic planning.

National Reimbursement Drug List Expansion

The National Healthcare Security Administration (NHSA) expanded the National Reimbursement Drug List (NRDL) in late 2024, adding 90 new pharmaceutical products effective January 1, 2025. This move significantly broadens patient access to a range of medications, including many innovative and recently launched treatments.

For companies like 111, Inc., having their drugs included on the NRDL is a critical factor for growth. Such inclusion can directly translate to increased patient uptake and higher sales volumes, even if it involves negotiating potential price concessions.

- NRDL Expansion: 90 new drugs added in late 2024, effective January 1, 2025.

- Impact on Access: Enhances patient access to innovative and new treatments.

- 111, Inc. Benefit: NRDL inclusion can boost drug uptake and sales volume.

- Pricing Consideration: Potential for price concessions alongside increased sales.

China's government is actively reforming its healthcare system, focusing on equitable resource distribution and expanding clinical services. This push aims to improve healthcare accessibility and quality, with a strong emphasis on strengthening primary care. By the close of 2023, over 1.7 million primary healthcare institutions were operational, reflecting a 4.8% year-on-year increase.

Since mid-2024, there's been a heightened focus on pharmaceutical innovation, supported by fiscal subsidies and streamlined clinical trial approvals. The National Medical Products Administration's (NMPA) July 2024 pilot plan for optimizing innovative drug clinical trial reviews is a key initiative to speed up market entry for new treatments.

Regulatory changes continue to shape the online pharmacy landscape. Amendments to the Drug Administration Law in 2019 permitted online sales of prescription drugs, a critical step for companies like 111, Inc. More recent measures, like the December 2022 Administrative Measures for Supervision of Internet Pharmacy, reinforce safety and prescription verification.

Intensified anti-corruption efforts within healthcare, ongoing since mid-2023 and projected through 2025, aim to create a more transparent market. New compliance directives from the State Administration for Market Regulation (SAMR) in January 2025 target commercial bribery, promoting ethical conduct and potentially leveling the playing field.

The National Healthcare Security Administration (NHSA) expanded the National Reimbursement Drug List (NRDL) in late 2024, adding 90 new products effective January 1, 2025. This expansion significantly boosts patient access to a wider array of medications, including innovative treatments, which can drive sales for companies with NRDL-listed products.

| Policy Area | Key Development | Impact on 111, Inc. | Data Point |

| Healthcare Reform | Strengthening primary care, improving access | Broader patient base, increased demand for services | 1.7M+ primary care institutions (end of 2023) |

| Pharmaceutical Innovation | Accelerated drug approval, fiscal subsidies | Faster market entry for new products, potential for partnerships | NMPA Pilot Work Plan (July 2024) |

| Online Pharmacy Regulation | Online prescription drug sales, safety measures | Operational framework for e-commerce, compliance requirements | Internet Pharmacy Supervision Measures (Dec 2022) |

| Anti-Corruption Drive | Increased transparency, reduced illicit practices | Fairer competition, improved market integrity | SAMR compliance directives (Jan 2025) |

| Drug Reimbursement | NRDL expansion | Increased drug uptake and sales volume | 90 new drugs added to NRDL (Jan 1, 2025) |

What is included in the product

This comprehensive PESTLE analysis of the 111 meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations and strategic direction.

The 111 PESTLE Analysis offers a structured framework to identify and understand external factors, alleviating the pain of uncertainty and providing clarity for strategic decision-making.

Economic factors

China's healthcare expenditure is on a significant upward trajectory, with projections indicating it could reach RMB 20.5 trillion yuan by 2030. This substantial growth underscores a persistent and expanding demand for a wide array of healthcare services and products within the nation.

The healthcare sector in China is poised for continued expansion, with a positive outlook anticipated for 2025. This trend suggests that healthcare platforms can expect ongoing opportunities for development and increased market penetration.

The digital health market in China is booming, with forecasts suggesting it will hit USD 63,709.1 million by 2030, growing at a robust 23.6% annually between 2025 and 2030. Tele-healthcare led the market in 2024, showing strong consumer adoption.

This expansion provides a significant tailwind for companies like 111, Inc., particularly benefiting their online consultation and pharmacy offerings. The increasing demand for accessible virtual healthcare services directly aligns with 111's core business model.

Reforms in China's commercial medical insurance, including potential tax deductions, are poised to inject new funding into the healthcare sector. This influx of capital is expected to boost demand for innovative and high-quality drugs, thereby expanding the market for premium pharmaceutical products.

These changes are likely to improve patient affordability and broaden access to a wider array of treatments, benefiting platforms like 111, Inc. by increasing patient purchasing power and market opportunities for advanced medications.

Government Stimulus and Consumption Boost

Anticipated fiscal stimulus measures in 2025 are poised to directly target domestic consumption, a move that will likely provide a significant uplift to various healthcare subsectors. This includes areas like medical services and drug retailers, which are expected to see increased demand as consumers have more disposable income.

This boost in consumer spending power is a direct benefit for companies like 111, Inc., potentially translating into higher sales volumes for pharmaceutical products and a greater uptake of their online healthcare services. For instance, if stimulus checks or tax rebates are implemented, consumers might allocate more funds towards elective medical procedures or prescription medications.

- Stimulus Impact: Government fiscal stimulus in 2025 is projected to drive domestic consumption, benefiting healthcare providers and pharmacies.

- Sectoral Growth: Medical services and drug retailers are anticipated to experience increased demand due to enhanced consumer spending power.

- Company Benefits: 111, Inc. could see higher sales of pharmaceuticals and increased utilization of its online healthcare platforms as a result.

Pharmaceutical Market Dynamics

The pharmaceutical market is experiencing significant growth, particularly in emerging economies. China's pharmaceutical market is a prime example, with projections indicating it will reach USD 126,587.7 million by 2030, expanding at a compound annual growth rate of 7.8% between 2025 and 2030. This robust expansion presents a substantial opportunity for companies operating within the sector.

While traditional pharmaceuticals held the largest market share in 2024, the landscape is shifting. Biologics and biosimilars are emerging as the fastest-growing segments, signaling a move towards more advanced and specialized treatments. This trend suggests a growing demand for innovative drug development and distribution channels.

For 111, Inc., this dynamic market environment translates into a considerable addressable market for its online pharmacy and drug distribution services. The increasing demand for pharmaceuticals, coupled with the rise of biologics and biosimilars, creates a fertile ground for expanding its reach and services.

- China's pharmaceutical market is forecasted to reach $126.6 billion by 2030.

- The market is expected to grow at a CAGR of 7.8% from 2025 to 2030.

- Biologics and biosimilars are identified as the fastest-growing segments.

- This growth offers a significant opportunity for online pharmacy and drug distribution networks.

Economic factors are shaping China's healthcare landscape, with projected healthcare expenditure reaching RMB 20.5 trillion yuan by 2030, indicating sustained demand. The digital health market is expected to hit USD 63,709.1 million by 2030, driven by a 23.6% annual growth rate from 2025 to 2030, with tele-healthcare leading in 2024.

Anticipated fiscal stimulus in 2025 aims to boost domestic consumption, positively impacting medical services and drug retailers. China's pharmaceutical market is set to reach USD 126,587.7 million by 2030, growing at a CAGR of 7.8% from 2025 to 2030, with biologics and biosimilars showing the fastest growth.

| Economic Indicator | 2024 Status/Projection | 2025 Projection | 2030 Projection | Growth Driver |

|---|---|---|---|---|

| Healthcare Expenditure (China) | - | - | RMB 20.5 trillion yuan | Rising demand for services and products |

| Digital Health Market (China) | Tele-healthcare led | - | USD 63,709.1 million | 23.6% annual growth (2025-2030) |

| Pharmaceutical Market (China) | Traditional pharma dominant | - | USD 126,587.7 million | 7.8% CAGR (2025-2030), rise of biologics/biosimilars |

| Fiscal Stimulus | - | Targeted at domestic consumption | - | Increased consumer spending power |

Preview Before You Purchase

111 PESTLE Analysis

The preview you see here is the exact 111 PESTLE Analysis document you’ll receive after purchase. It's fully formatted and professionally structured, offering a comprehensive overview of the key external factors impacting your business. You'll be able to download this complete report immediately after completing your transaction.

Sociological factors

China's demographic landscape is rapidly evolving, with its elderly population exceeding 310 million individuals aged 60 and above as of early 2024. This substantial aging trend directly fuels a growing demand for specialized healthcare services, including geriatric care, effective chronic disease management, and easily accessible pharmaceutical solutions. 111, Inc.'s integrated online and offline service model is strategically positioned to cater to this expanding market segment.

Following the COVID-19 pandemic, Chinese consumers have shown a marked increase in health consciousness, prioritizing proactive health management and a comprehensive approach to well-being. This shift signifies a growing willingness to invest in products and services that support both physical and mental health.

This heightened awareness directly fuels demand for health-focused offerings, benefiting companies like 111, Inc. For instance, in 2024, the online health sector in China saw significant growth, with a substantial portion of consumers reporting increased spending on health-related products and services, underscoring the impact of this sociological trend.

Consumer preferences are increasingly leaning towards personalized and preventive healthcare. This shift is fueled by a burgeoning health-conscious middle class and rapid technological advancements, with a significant portion of the population actively seeking tailored wellness solutions. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for personalized health recommendations.

Younger, urban demographics are particularly embracing what's termed 'lazy health,' prioritizing convenient and digital health tools. This includes a preference for quick, accessible health choices, often delivered through apps and online platforms. This trend is evident in the projected 25% annual growth of the digital health market through 2025, highlighting a strong demand for on-the-go wellness solutions.

Prevalence of Chronic and Sub-Health Issues

The growing prevalence of chronic and sub-health issues presents a significant market opportunity. For instance, depression affects approximately 95 million people globally, and sleep disorders impact over 300 million individuals in China alone, creating a sustained demand for accessible healthcare solutions.

Consumers are increasingly turning to digital platforms for health management, actively seeking online consultations and purchasing a variety of health-related products to address these conditions. This trend highlights a shift towards proactive and convenient healthcare seeking behaviors.

111, Inc. is well-positioned to capitalize on these societal trends. Their platform directly caters to these widespread health concerns by offering convenient online consultations and a broad selection of pharmaceutical products and health services.

- Rising Health Concerns: Depression affecting 95 million and sleep disorders impacting over 300 million people globally indicate a substantial need for health services.

- Digital Health Adoption: Consumers are increasingly using online consultations and health products to manage chronic and sub-health issues.

- 111's Strategic Fit: The company's platform provides direct solutions through online consultations and a wide range of pharmaceutical offerings, aligning with consumer needs.

Trust in Online Healthcare Services

While the adoption of online healthcare services is growing, a significant hurdle remains the lack of patient trust and motivation to fully engage. This sociological factor can indeed act as a brake on market expansion for companies like 111, Inc. For instance, a 2024 survey indicated that only 45% of consumers felt completely comfortable sharing sensitive health information online, highlighting the trust deficit.

Building and sustaining consumer trust is therefore paramount. This involves demonstrating the reliability of services, ensuring that medical professionals are highly qualified and accessible, and implementing robust, secure data handling practices. Without this foundation of trust, maximizing market penetration and achieving widespread user adoption will be challenging.

Key elements for fostering trust in online healthcare include:

- Transparency: Clearly communicating data privacy policies and the qualifications of healthcare providers.

- Reliability: Ensuring consistent service availability and accurate medical advice.

- Security: Implementing state-of-the-art cybersecurity measures to protect patient data.

Societal shifts towards proactive health management and personalized wellness are significantly shaping the healthcare market. China's aging population, projected to exceed 310 million individuals aged 60+ by early 2024, is a key driver for increased demand in geriatric care and chronic disease management.

Consumers are increasingly prioritizing well-being, with a notable trend towards digital health solutions and convenient, accessible health choices, particularly among younger, urban demographics. This is reflected in the projected 25% annual growth of the digital health market through 2025.

Despite growing digital health adoption, building consumer trust remains a critical challenge, with only 45% of consumers in a 2024 survey expressing complete comfort sharing sensitive health information online. Transparency, reliability, and robust data security are essential for overcoming this trust deficit.

Technological factors

Artificial intelligence and digital health are fueling significant expansion in China's healthcare sector. 111, Inc. is strategically investing in these areas, utilizing advanced digital operations to boost efficiency. For instance, their AI-powered systems have dramatically streamlined pharmaceutical qualification reviews, improving processing times by an estimated 30% in recent trials.

Technology is the backbone of 111, Inc.'s service delivery, creating a seamless link between patients, healthcare providers, and pharmacies. This digital ecosystem facilitates online consultations, streamlines prescription management, and integrates with their retail pharmacy operations, enhancing patient convenience.

The company leverages advanced AI algorithms to dynamically manage shared inventory, leading to significant improvements in supply chain efficiency. In 2024, this AI-driven approach contributed to a 15% reduction in stockouts and a 10% increase in order fulfillment accuracy across their network.

Ultimately, 111, Inc.'s technological integration is designed to make healthcare services more accessible, user-friendly, and cost-effective for a broader population. This focus on digital transformation is key to their strategy for expanding reach and improving patient outcomes.

The digital health infrastructure is booming, with a significant increase in the home medical device and smart health monitoring markets. This technological evolution is transforming how healthcare is delivered and managed.

For instance, purchases of vision care devices and smart health monitoring equipment have seen a remarkable threefold increase on platforms like JD.com, showcasing strong consumer adoption and market growth. This trend highlights a clear shift towards proactive and accessible health management.

111, Inc. is well-positioned to capitalize on this development. By expanding its product catalog to include more home medical devices and smart health monitoring equipment, and by actively pursuing integration with existing smart health devices, the company can tap into this rapidly growing segment of the healthcare market.

Leveraging Big Data for Operations

111, Inc. is actively using big data analytics to enhance its operations across the healthcare value chain. This includes improving patient education, refining data analysis processes, and more accurately monitoring pricing. The company's investment in these technologies aims to streamline operations and inform strategic choices.

This data-driven strategy is fundamental to personalizing patient services and elevating the overall user experience. For instance, by analyzing patient data, 111, Inc. can tailor educational content, leading to better health outcomes. In 2024, the global healthcare analytics market was valued at over $30 billion, with significant growth projected, underscoring the importance of such technological adoption.

- Enhanced Operational Efficiency: Big data allows for the identification of bottlenecks and inefficiencies within the healthcare delivery system.

- Data-Driven Decision Making: Insights derived from data analytics support more informed strategic planning and resource allocation.

- Personalized Patient Engagement: Tailoring services based on individual patient data improves satisfaction and adherence to treatment plans.

- Market Trend Analysis: Continuous monitoring of pricing and service data enables competitive positioning and revenue optimization.

Logistics and Fulfillment Network Enhancement

Technological advancements are significantly reshaping 111, Inc.'s logistics and fulfillment network. The company's strategic expansion includes opening a new fulfillment center in Nanjing during the first quarter of 2025, with plans to establish at least 14 additional centers by the close of 2025. This aggressive build-out is designed to bolster efficiency and reach.

Leveraging its proprietary national logistics network, 'Penglai', 111, Inc. delivers professional and highly efficient pharmaceutical distribution services. This technological infrastructure is crucial for maintaining a competitive edge in the fast-paced online pharmacy market, ensuring timely and dependable delivery of medications to customers.

These enhancements directly translate to improved speed and reliability in drug delivery. For instance, by Q1 2025, the Nanjing facility will contribute to faster order processing times in that region. The ongoing network expansion aims to reduce last-mile delivery times across its service areas, a critical factor for customer satisfaction and retention in the e-pharmacy sector.

The investment in advanced logistics technology and infrastructure supports 111, Inc.'s growth trajectory. By Q4 2025, the expanded network is projected to handle a significantly higher volume of orders, supporting the company's market share objectives. Key benefits include:

- Increased delivery speed: Reduced transit times due to strategically located fulfillment centers.

- Enhanced reliability: Improved inventory management and order fulfillment processes.

- Greater geographic coverage: Expansion into new regions with the addition of new facilities.

- Cost efficiencies: Optimization of logistics routes and operational processes.

Technological advancements are central to 111, Inc.'s strategy, driving efficiency and expanding market reach. The company's investment in AI and big data analytics is transforming pharmaceutical reviews, supply chain management, and personalized patient services. By Q1 2025, their new Nanjing fulfillment center and an additional 14 centers by year-end will significantly enhance logistics, aiming for faster delivery and greater coverage.

| Key Technology Initiatives | Impact | 2024/2025 Data/Projections |

| AI-powered pharmaceutical review | Streamlined processing | 30% improvement in processing times (trials) |

| AI-driven inventory management | Reduced stockouts, improved fulfillment accuracy | 15% reduction in stockouts, 10% increase in fulfillment accuracy (2024) |

| Logistics Network Expansion (Penglai) | Increased delivery speed and geographic coverage | New Nanjing center (Q1 2025), 14+ additional centers by end of 2025 |

| Big Data Analytics | Enhanced patient education, pricing monitoring, operational efficiency | Global healthcare analytics market valued over $30 billion (2024) |

Legal factors

China's evolving legal landscape for online pharmacies, particularly the Administrative Measures for Supervision of Internet Pharmacy, permits the sale of both over-the-counter and prescription medications. These regulations, crucial for companies like 111, Inc., emphasize stringent requirements for verifying prescription authenticity and maintaining accurate customer identities to ensure patient safety and compliance.

In August 2024, China's National Medical Products Administration (NMPA) unveiled a draft Medical Device Administration Law. This proposed legislation aims to significantly bolster the regulatory framework for medical devices, fostering both innovation and improved product quality. The anticipated implementation in late 2025 means companies like 111, Inc., which operates a platform for medical device sales, must proactively adapt to these updated standards.

China's robust data privacy framework, encompassing the Personal Information Protection Law (PIPL), Data Security Law (DSL), and Cybersecurity Law (CSL), significantly impacts how healthcare big data is managed. These regulations mandate strict adherence to principles like informed consent for data processing and impose stringent controls on cross-border data transfers, alongside comprehensive data security measures.

For a platform like 111, Inc., navigating this complex legal landscape is paramount. Ensuring full compliance with these evolving data privacy obligations is critical to safeguarding sensitive patient information and maintaining trust. Failure to comply can result in substantial penalties, with PIPL fines potentially reaching up to 5% of annual turnover or 50 million yuan, whichever is higher, as of recent enforcement trends.

Cross-Border Data Transfer Rules

New regulations, like the Network Data Security Management Regulation effective January 1, 2025, are set to bring more clarity to data compliance and cross-border data transfers. Companies dealing with 'important data' will need to designate a network data security officer and set up a dedicated management department. This development is particularly relevant for 111, Inc. if its operations involve moving patient data internationally, necessitating strict adherence to these evolving legal frameworks.

These changes could significantly affect how 111, Inc. manages its data flows, especially concerning patient privacy and security across different jurisdictions. For instance, if 111, Inc. operates in regions with stringent data localization laws, transferring patient health information might require specific consent or anonymization protocols. The company's 2024 financial reports might already reflect increased investment in data governance tools to prepare for such regulatory shifts.

- Data Localization Requirements: Many countries are implementing or strengthening laws that require certain types of data, particularly personal and sensitive data, to be stored and processed within their borders.

- Consent and Privacy Frameworks: Regulations like GDPR (General Data Protection Regulation) in Europe and similar frameworks globally mandate explicit consent for data processing and transfer, impacting how patient data can be shared.

- Security Standards for Transfer: Cross-border data transfers often require adherence to specific security standards, such as encryption or anonymization, to protect data integrity and confidentiality.

Anti-Bribery and Compliance Guidelines

The State Administration for Market Regulation (SAMR) released new 'Compliance Guidelines for Healthcare Companies to Prevent Commercial Bribery Risks' in January 2025. This signals a significant increase in regulatory oversight concerning ethical conduct within the healthcare sector.

Consequently, 111, Inc. must ensure its compliance programs are exceptionally strong to effectively manage the risks tied to commercial bribery and safeguard its corporate image.

- Increased Scrutiny: The SAMR guidelines highlight a heightened focus on preventing commercial bribery in healthcare.

- Risk Mitigation: Robust internal compliance is crucial for 111, Inc. to avoid penalties and reputational damage.

- Ethical Standards: Adherence to these guidelines reinforces 111, Inc.'s commitment to ethical business practices.

China's legal framework for online pharmacies, including the Administrative Measures for Supervision of Internet Pharmacy, allows for the sale of both OTC and prescription drugs, with strict verification requirements for prescriptions and customer identities. The draft Medical Device Administration Law, expected to be implemented by late 2025, will further refine regulations for medical devices, impacting platforms like 111, Inc. by demanding adaptation to higher quality and innovation standards.

Stringent data privacy laws such as PIPL, DSL, and CSL govern the management of healthcare big data, mandating informed consent and imposing controls on cross-border data transfers, with PIPL fines potentially reaching 5% of annual turnover. New regulations effective January 1, 2025, like the Network Data Security Management Regulation, will require companies handling 'important data' to appoint dedicated security officers and departments, affecting data flow management and cross-border transfers for entities like 111, Inc.

The State Administration for Market Regulation's January 2025 'Compliance Guidelines for Healthcare Companies to Prevent Commercial Bribery Risks' underscore increased regulatory oversight and the critical need for robust compliance programs to mitigate risks and protect corporate reputation for companies such as 111, Inc.

Environmental factors

111, Inc. can champion sustainability in its pharmaceutical supply chain by optimizing logistics, aiming to cut down on emissions. For instance, in 2024, the global logistics industry contributed significantly to greenhouse gas emissions, and by adopting more efficient routes and modes of transport, 111 can make a tangible difference.

Encouraging suppliers to adopt greener manufacturing processes is another key area. Many pharmaceutical companies are already investing in renewable energy sources for their facilities. A 2025 report indicated that companies with strong ESG (Environmental, Social, and Governance) practices often see improved financial performance, suggesting a business case for these initiatives.

Focusing on sustainable sourcing and distribution not only appeals to the growing segment of environmentally conscious consumers but also builds a stronger brand image. Studies from late 2024 revealed that a majority of consumers are willing to pay more for products from companies demonstrating a commitment to sustainability, directly impacting market share and brand loyalty.

The surge in online pharmaceutical sales, a trend amplified in recent years, presents a significant challenge for medical product waste management. Consider that in 2024, the global online pharmacy market was valued at over $100 billion, with projections indicating continued robust growth. This expansion directly translates to increased volumes of packaging materials and expired medications requiring responsible disposal.

Companies like 111, Inc. are increasingly expected to implement robust waste management strategies for these products. Exploring partnerships for pharmaceutical waste recycling or developing internal programs for the responsible disposal of expired medications are crucial steps. Such initiatives not only address environmental concerns but also bolster a company's commitment to corporate social responsibility.

Operating an integrated online platform and managing data centers, like those likely used by 111, Inc., demands substantial energy. Global data center energy consumption is projected to rise significantly, potentially reaching 8% of total electricity demand by 2026, up from around 1-1.5% in recent years. This highlights the critical need for energy efficiency.

111, Inc. can mitigate its environmental impact by adopting energy-efficient technologies and investing in renewable energy sources for its digital infrastructure. For instance, companies are increasingly exploring AI-driven tools to optimize cooling systems in data centers, which can reduce energy usage by up to 30%. This strategic shift not only lowers the company's carbon footprint but also offers long-term operational cost savings.

Green Packaging and Delivery Solutions

111, Inc. can leverage its widespread retail pharmacy and online delivery infrastructure to implement green packaging for its products. This includes exploring biodegradable or recycled materials for medication and healthcare item packaging, aligning with growing consumer demand for sustainable options. For instance, by 2025, the global sustainable packaging market is projected to reach over $400 billion, indicating a significant opportunity for companies like 111, Inc. to adopt these practices.

Optimizing delivery routes and incorporating eco-friendly transportation methods are also key environmental considerations for 111, Inc. Reducing mileage and emissions through efficient logistics, potentially using electric vehicles or hybrid models for last-mile delivery, can significantly improve the company's environmental footprint. Studies in 2024 suggest that route optimization software can reduce fuel consumption by up to 15% for logistics companies.

These initiatives directly contribute to enhancing 111, Inc.'s sustainability profile, which is increasingly important for brand reputation and customer loyalty. Companies demonstrating strong environmental responsibility often see improved market perception and investor confidence. For example, a 2023 survey found that over 70% of consumers consider a company's environmental practices when making purchasing decisions.

Key areas for 111, Inc. to focus on include:

- Material Sourcing: Prioritizing packaging made from recycled content or biodegradable materials.

- Logistics Optimization: Implementing advanced route planning to minimize fuel usage and emissions.

- Fleet Modernization: Transitioning towards electric or low-emission vehicles for delivery services.

- Consumer Education: Informing customers about the company's sustainability efforts and how they can participate.

Contribution to Public Health and Prevention

By enhancing healthcare accessibility, 111, Inc. plays a role in public health and disease prevention, which can lead to positive environmental outcomes. A healthier populace generally exerts less pressure on environmental resources tied to acute medical care.

Focusing on preventive health strategies can alleviate the overall strain on healthcare infrastructure and its associated environmental footprint. For instance, in 2024, the healthcare sector globally accounted for approximately 4.4% of net global greenhouse gas emissions, highlighting the potential environmental benefits of preventative care.

- Reduced Resource Strain: A healthier population requires fewer hospitalizations and treatments, potentially lowering energy consumption and waste generation in healthcare facilities.

- Lower Healthcare System Burden: Preventive measures can decrease the demand for intensive medical services, thereby reducing the environmental impact of these resource-heavy operations.

- Environmental Externalities of Health: Improved public health can indirectly lead to more sustainable lifestyles and reduced consumption of environmentally impactful goods and services.

Environmental factors significantly influence 111, Inc.'s operations, from supply chain emissions to waste management. The company's commitment to sustainability, evident in its adoption of green packaging and optimized logistics, directly addresses these concerns. By embracing renewable energy for its digital infrastructure and promoting eco-friendly practices among suppliers, 111, Inc. can enhance its brand reputation and appeal to environmentally conscious consumers.

The growing online pharmaceutical market, valued at over $100 billion in 2024, necessitates robust waste management strategies. 111, Inc. can mitigate its environmental footprint by investing in energy-efficient technologies, such as AI-driven data center cooling, and transitioning to electric vehicles for deliveries. These efforts not only reduce operational costs but also align with increasing consumer demand for sustainable products.

Focusing on preventive health strategies can also yield environmental benefits by reducing the strain on healthcare resources. The healthcare sector’s global greenhouse gas emissions, around 4.4% in 2024, underscore the importance of public health initiatives in lowering the overall environmental impact of medical care.

| Environmental Focus Area | 2024/2025 Data Point | Impact on 111, Inc. |

|---|---|---|

| Logistics Emissions | Global logistics contributed significantly to GHG emissions in 2024. | Route optimization and eco-friendly transport can reduce fuel consumption by up to 15%. |

| Sustainable Packaging | Global sustainable packaging market projected to exceed $400 billion by 2025. | Adoption of biodegradable/recycled materials appeals to consumers willing to pay more for sustainable products. |

| Data Center Energy Use | Data centers could reach 8% of global electricity demand by 2026. | Energy-efficient tech and renewables can cut data center energy usage by up to 30%. |

| Healthcare Sector Emissions | Healthcare sector accounted for ~4.4% of global GHG emissions in 2024. | Preventive health strategies can lower demand for resource-intensive medical services. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable sources including governmental economic reports, international financial institutions, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors.