Warner Music Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Warner Music Group Bundle

Warner Music Group navigates a dynamic landscape shaped by intense rivalry and the evolving power of buyers. Understanding the threat of new entrants and the leverage of suppliers is crucial for strategic success in this competitive industry.

The complete report reveals the real forces shaping Warner Music Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Artists and songwriters wield considerable bargaining power, particularly those with established careers and significant fan bases, as their creative output is the core asset for Warner Music Group (WMG). Their ability to select which label to partner with, or even to distribute their music independently, directly influences WMG's access to valuable content and, consequently, its revenue streams. For instance, in 2023, WMG's recorded music revenue reached $4.2 billion, underscoring the direct link between artist appeal and financial performance.

The increasing success of independent artists, who can bypass traditional label structures altogether, further amplifies this supplier power. These artists can negotiate more favorable terms or retain greater control over their intellectual property, presenting a competitive alternative to major labels like WMG. This trend means WMG must continually offer attractive deals and support to secure and retain top talent, directly impacting their operational costs and profitability.

Major music publishing houses wield considerable bargaining power over Warner Music Group (WMG) concerning synchronization and licensing. Even though Warner Chappell Music is a significant publisher, WMG frequently needs to license content from other major publishing entities for use in film, television, advertising, and video games. These publishers control vast libraries of popular and back-catalog music, enabling them to negotiate higher licensing fees and impose stricter usage terms. This can directly affect WMG's profitability and its capacity to fulfill diverse client requests for music in various media projects.

Streaming platforms like Spotify, Apple Music, and Amazon Music hold significant sway as they are essential for Warner Music Group's (WMG) recorded music distribution. Their vast subscriber numbers and control over how artists and labels are paid give them considerable leverage.

These digital service providers (DSPs) possess substantial bargaining power, directly impacting WMG's digital revenue. For instance, in 2023, Spotify reported over 602 million monthly active users, demonstrating the sheer scale these platforms command. Negotiations with these giants are critical for WMG's financial health.

Music Production and Technology Providers

The bargaining power of suppliers in music production and technology, such as recording studios, sound engineers, and software developers, can be significant, especially for specialized, high-end services. For instance, renowned studios or highly sought-after engineers can leverage their expertise and unique capabilities to command premium pricing. This is particularly true for complex projects requiring specialized equipment or advanced technical skills.

However, this power is somewhat counterbalanced by the growing accessibility of sophisticated home studio technology. This trend allows more artists to handle aspects of production independently, reducing reliance on external, high-cost providers for mainstream projects. In 2024, the market continues to see a bifurcation, with top-tier specialized services maintaining strong pricing power while more commoditized services face increased competition from accessible technology.

- Specialized Expertise: High-end studios and engineers with unique skills or reputations can charge higher rates, influencing production costs.

- Technological Advancements: The proliferation of affordable, high-quality home studio equipment lessens the dependence on traditional, expensive production facilities for many artists.

- Market Fragmentation: While some segments are dominated by a few key players, many technology and service providers are fragmented, which can dilute individual supplier power.

- Impact on WMG: Warner Music Group, like other major labels, must strategically manage relationships with these suppliers to control production budgets and maintain creative quality.

Talent Management and Agencies

Artist management companies and booking agencies hold significant sway in the music industry, acting as gatekeepers for talent. Their ability to negotiate favorable terms for artists directly affects Warner Music Group's (WMG) capacity to acquire and retain sought-after musicians. For instance, in 2023, major artist management firms reported managing portfolios that generated hundreds of millions in revenue, underscoring their financial leverage.

The consolidated power of these agencies, particularly those representing A-list artists, can create substantial bargaining power. These entities often control the touring schedules and overall career direction of their clients, making them indispensable partners for labels like WMG. Without strong relationships with these agencies, WMG might struggle to secure exclusive recording contracts or advantageous distribution deals for its most profitable acts.

- Consolidated Influence: Management and booking agencies represent multiple artists, amplifying their collective bargaining power with record labels.

- Access Control: Agencies often dictate which labels artists work with and on what terms, giving them considerable leverage.

- Negotiation Expertise: These firms employ skilled negotiators who understand the market value of talent, ensuring artists receive top compensation and favorable contract conditions.

The bargaining power of suppliers, particularly artists and songwriters, remains a critical factor for Warner Music Group (WMG). Top-tier talent can demand higher royalty rates and more favorable contract terms, directly impacting WMG's profitability. For example, in 2023, WMG's recorded music revenue was $4.2 billion, highlighting the direct correlation between artist appeal and financial success.

Major music publishers also exert significant influence, especially in licensing content for film, TV, and advertising. Warner Chappell Music, while a part of WMG, still needs to license from other major publishers, who can command higher fees. This dynamic directly affects WMG's cost of content acquisition and its ability to serve diverse media needs.

The power of digital service providers (DSPs) like Spotify and Apple Music is undeniable, as they are the primary distribution channels. Their vast user bases and control over payment structures give them substantial leverage in negotiations, impacting WMG's digital revenue streams. Spotify's 602 million monthly active users in 2023 exemplifies this scale.

| Supplier Type | Bargaining Power Factors | Impact on WMG | 2023/2024 Data Points |

|---|---|---|---|

| Artists & Songwriters | Established careers, fan base, independent distribution options | Higher royalty demands, contract terms | WMG Recorded Music Revenue: $4.2 billion (2023) |

| Music Publishers | Vast content libraries, synchronization & licensing control | Increased licensing fees, stricter usage terms | N/A (Specific publisher data not publicly available for WMG licensing) |

| Digital Service Providers (DSPs) | Large subscriber bases, control over distribution and payment | Negotiation leverage on revenue share, royalty rates | Spotify MAU: 602 million (2023) |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Warner Music Group's position in the evolving music industry.

Instantly assess Warner Music Group's competitive landscape to identify and mitigate threats, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

Individual music consumers, often referred to as listeners, wield significant bargaining power. This is largely due to the sheer volume of music streaming services available today. For instance, in 2024, the global music streaming market was valued at over $30 billion, offering consumers a vast array of choices.

Switching between these platforms is remarkably easy and virtually cost-free for the consumer. This low barrier to entry means listeners can readily migrate to a different service if they find a better price point, a more extensive music catalog, or a superior user interface. This dynamic compels music companies, including Warner Music Group as it distributes content to these platforms, to continually offer compelling value propositions to retain their audience.

Digital Service Providers (DSPs) like Spotify and Apple Music are crucial intermediaries for Warner Music Group (WMG), holding significant bargaining power. These platforms negotiate licensing agreements that dictate royalty rates and terms, directly impacting WMG's revenue. For instance, in 2023, Spotify reported over 602 million monthly active users, demonstrating the immense reach and leverage these platforms possess in their dealings with music labels.

Broadcasters and media companies, including television networks, film studios, advertising agencies, and video game developers, hold significant bargaining power when licensing music from Warner Music Group (WMG). This power stems from their ability to choose alternative music sources or even forgo licensed music altogether. For instance, the demand for specific WMG tracks in a major film release can influence licensing fees, but if the budget for music is tight, these buyers can negotiate harder or seek less expensive options.

Concert Promoters and Venues

For Warner Music Group, concert promoters and venues represent crucial customers in the artist services and touring segment. Their bargaining power is directly tied to the popularity and drawing capacity of Warner's artists, as well as the availability of alternative venues and competing entertainment options. In 2024, the live music industry continued its robust recovery, with major tours generating significant revenue, potentially increasing the leverage of large promoters capable of booking top-tier Warner artists.

The ability of promoters and venues to negotiate favorable terms, such as revenue splits and marketing support, is a key consideration. Established promoters often wield more influence due to their experience and established relationships, allowing them to secure better deals for securing performances from Warner's roster.

- Artist Popularity: High-demand artists significantly reduce venue/promoter leverage.

- Venue Availability: A scarcity of suitable venues strengthens promoter bargaining power.

- Competition: Numerous competing events can dilute the drawing power of any single concert.

- Promoter Scale: Larger promoters can negotiate more favorable terms due to volume.

Retailers (for physical music sales)

While physical music sales represent a smaller segment of Warner Music Group's (WMG) overall revenue, traditional retailers still exert some bargaining power. In 2023, the global recorded music market generated an estimated $28.6 billion, with physical formats accounting for approximately 12% of that. Retailers control crucial shelf space and can influence promotional opportunities, particularly for niche genres or artists where physical media remains a significant driver.

This influence is more pronounced in the resurgence of vinyl. Vinyl sales in the US, for instance, continued their upward trend in 2023, reaching over $1.2 billion. This growth gives retailers leverage in negotiating terms with labels like WMG, as they are essential partners in reaching dedicated collectors and audiophiles who prefer physical purchases.

- Shelf Space Control: Retailers decide which physical music products are prominently displayed, impacting WMG's ability to move inventory.

- Promotional Opportunities: The extent to which retailers feature WMG releases in their marketing efforts, both in-store and online, can be a point of negotiation.

- Niche Market Influence: The continued strength of vinyl sales empowers retailers who specialize in this format, giving them greater bargaining power for these specific product lines.

Individual music consumers, often referred to as listeners, wield significant bargaining power due to the vast number of music streaming services available. In 2024, the global music streaming market exceeded $30 billion, offering consumers abundant choices and making switching between platforms effortless and cost-free.

Digital Service Providers (DSPs) like Spotify and Apple Music are crucial intermediaries for Warner Music Group (WMG), possessing substantial bargaining power. These platforms negotiate licensing agreements that directly influence WMG's revenue through royalty rates. With Spotify alone reporting over 602 million monthly active users in 2023, their negotiating leverage is immense.

Broadcasters and media companies also hold considerable power when licensing music from WMG. Their ability to select alternative music sources or even forgo licensed tracks means they can negotiate harder, especially when music budgets are constrained. This is particularly relevant for major film releases or advertising campaigns where music is a key component.

Concert promoters and venues are key customers for WMG's artist services. Their bargaining power is influenced by artist popularity and the availability of alternative venues. The live music industry's strong recovery in 2024, with major tours generating significant revenue, likely amplified the leverage of large promoters booking top Warner artists.

| Customer Segment | Bargaining Power Factors | Impact on WMG |

|---|---|---|

| Individual Consumers | Abundance of streaming services, low switching costs | Pressure on pricing and value proposition |

| Digital Service Providers (DSPs) | Large user bases, negotiation of licensing terms | Direct impact on royalty rates and revenue |

| Broadcasters & Media Companies | Ability to source alternative music, budget constraints | Negotiation leverage on licensing fees |

| Concert Promoters & Venues | Artist popularity, venue availability, competition | Influence on booking fees and revenue splits |

Same Document Delivered

Warner Music Group Porter's Five Forces Analysis

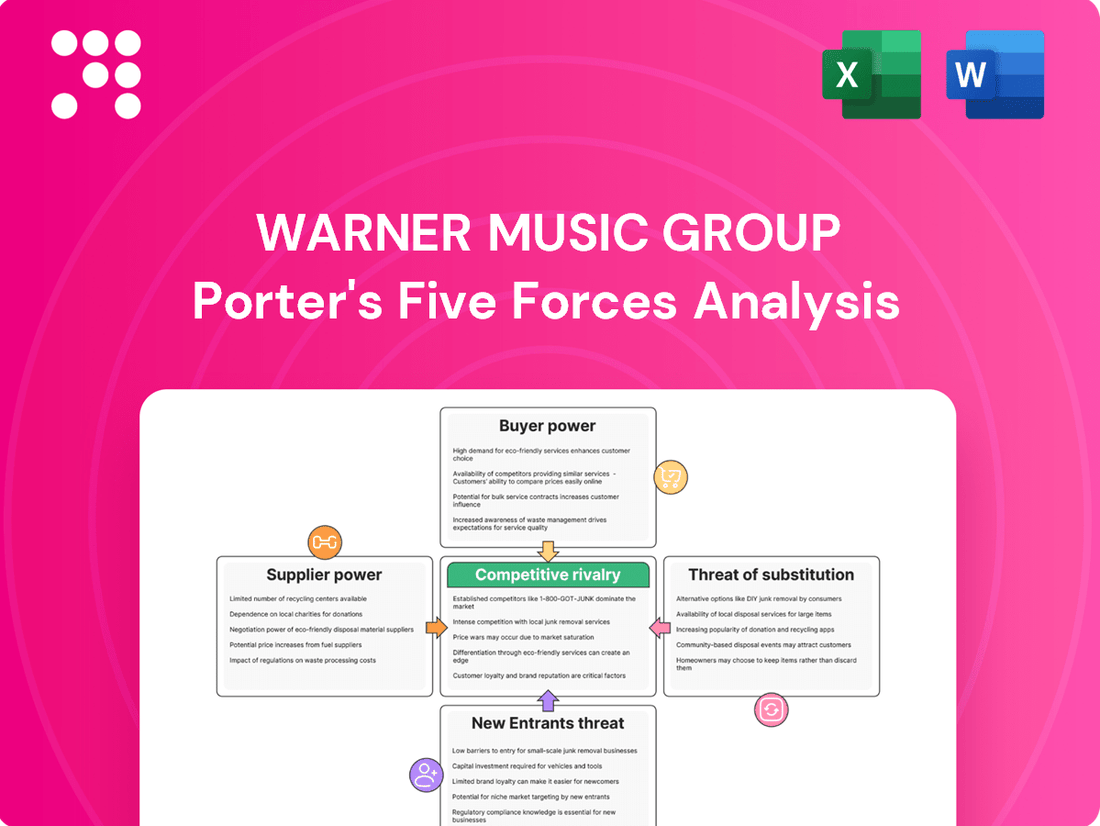

This preview provides the complete Warner Music Group Porter's Five Forces Analysis, detailing the competitive landscape within the music industry, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors. The document you see here is exactly what you’ll be able to download after payment, offering a comprehensive understanding of WMG's strategic positioning.

Rivalry Among Competitors

The competitive rivalry among major record labels like Universal Music Group, Sony Music Entertainment, and Warner Music Group is fierce. This oligopoly is characterized by intense competition for emerging artists, lucrative partnerships with digital service providers (DSPs), and the acquisition of established music catalogs.

In 2023, Universal Music Group reported revenue of €10.3 billion, while Sony Music Entertainment's recorded music segment generated ¥1,407.7 billion (approximately $9.5 billion USD at the time). Warner Music Group's fiscal year 2023 revenue reached $6.03 billion. These figures highlight the substantial financial power and market share controlled by these dominant players.

The increasing prominence of independent labels and self-releasing artists is a significant competitive challenge for Warner Music Group. Lowered barriers to entry, fueled by digital distribution and production tools, empower these independent players to capture market share. For instance, in 2023, independent artists and labels accounted for a substantial portion of music streaming revenue, demonstrating their growing influence and ability to offer competitive alternatives to major label deals.

Warner Music Group faces intense rivalry from other major publishers like Universal Music Publishing Group and Sony Music Publishing, as well as numerous independent entities. This competition is particularly sharp for securing exclusive rights to popular songwriters and lucrative music catalogs that promise substantial royalty streams from diverse revenue sources such as streaming, sync licenses, and public performances.

Streaming Platforms and Tech Giants

Major streaming platforms like Spotify, Apple Music, and Amazon Music are escalating their competitive stance against traditional music labels such as Warner Music Group. These tech giants are not merely distributors but are actively investing in exclusive content and directly engaging artists, creating their own music services that can potentially circumvent established label structures for specific talent and releases.

This shift means platforms are increasingly acting as rivals, not just partners. By signing artists directly and producing exclusive content, they gain leverage and can control a larger share of the value chain. For instance, Spotify's investment in podcasts and original audio content, alongside its artist promotion tools, demonstrates a move towards becoming a more comprehensive entertainment provider.

- Direct Artist Engagement: Platforms are signing artists directly, reducing reliance on labels for distribution and promotion.

- Exclusive Content Investment: Significant capital is being allocated to exclusive music releases and artist partnerships, creating unique offerings.

- In-House Music Services: The development of proprietary music services by tech giants poses a direct challenge to the traditional label model.

- Market Share Dynamics: In 2024, the top three streaming platforms continued to dominate, with Spotify holding a significant global market share, intensifying competition for artist attention and catalog rights.

Live Music and Artist Services Companies

Warner Music Group's (WMG) artist services division faces significant competitive rivalry from specialized firms focusing on touring, merchandising, and brand partnerships. These companies often possess deep expertise in niche areas of artist development beyond recorded music.

Competition intensifies due to the need for robust artist relationships and proficiency in monetizing diverse revenue streams. This dynamic drives intense bidding for artist loyalty and service agreements, impacting WMG's ability to secure exclusive deals.

- Specialized Competitors: Companies like Wasserman Music, CAA, and Live Nation Entertainment offer comprehensive artist management and live event services, directly competing with WMG's offerings.

- Artist Loyalty: Securing and retaining top-tier artists is paramount, with competitors actively vying for exclusive contracts by offering superior ancillary services.

- Non-Recorded Revenue Focus: The growing importance of touring, merchandise, and brand deals means WMG must compete with entities solely dedicated to maximizing these revenue streams.

- Market Share: While specific market share data for WMG's artist services segment isn't always granularly reported, the broader live music and artist services market is highly fragmented, with major players holding significant sway. For instance, Live Nation Entertainment's revenue in 2023 reached approximately $22.7 billion, highlighting the scale of competition in the live entertainment sector.

Warner Music Group operates in a highly competitive landscape, facing intense rivalry from major players like Universal Music Group and Sony Music Entertainment, as well as a growing number of independent labels and self-releasing artists. This competition extends to securing talent, striking deals with streaming platforms, and acquiring valuable music catalogs. The increasing power of tech giants like Spotify and Apple Music, who are investing in exclusive content and direct artist engagement, further intensifies this rivalry, forcing traditional labels to adapt their strategies.

| Competitor | 2023 Revenue (Approx. USD) | Key Competitive Area |

| Universal Music Group | $11.1 billion | Emerging artists, DSP partnerships, catalog acquisition |

| Sony Music Entertainment | $9.5 billion | Emerging artists, DSP partnerships, catalog acquisition |

| Independent Labels/Artists | Significant but fragmented | Lower barriers to entry, direct-to-fan engagement |

| Spotify | $14.3 billion (total company) | Exclusive content, direct artist deals, promotion tools |

| Apple Music | Not separately disclosed, part of Services | Exclusive content, integration with ecosystem |

SSubstitutes Threaten

User-generated content platforms like TikTok and YouTube present a significant threat of substitutes for Warner Music Group (WMG). These platforms empower users to create and distribute music-related content, often featuring existing WMG tracks or entirely new compositions. For instance, TikTok's viral challenges and YouTube's music videos offer alternative avenues for music discovery and consumption, potentially diverting audience attention from WMG's core recorded music business.

While WMG benefits from licensing agreements with these platforms, the sheer volume and rapid evolution of user-generated content can dilute the impact of professionally produced music. In 2024, platforms like TikTok continued to see explosive growth in music-driven content, with billions of videos created monthly, many featuring snippets of popular songs. This widespread accessibility and user creativity can act as a substitute for traditional music purchases or streams, impacting WMG's revenue streams.

The burgeoning popularity of podcasts and audiobooks presents a significant threat of substitutes for Warner Music Group. These platforms offer alternative audio content that directly competes for consumers' limited leisure time and discretionary spending on entertainment subscriptions. As of early 2024, the audiobook market alone was projected to reach over $20 billion globally, demonstrating a substantial diversion of consumer attention and budget away from traditional music consumption.

Concerts, festivals, and other live performances offer a unique, immersive experience that recorded music simply cannot replicate. While Warner Music Group (WMG) certainly profits from artist touring, the direct enjoyment of live music can indeed act as a substitute for purchasing or streaming recorded tracks.

For instance, in 2024, the global live music industry was projected to reach over $40 billion, demonstrating a significant consumer appetite for these experiences. This robust market indicates that a substantial portion of music consumption is fulfilled through live events, potentially diverting spending and attention away from WMG's recorded music catalog.

Video Content (Gaming, Film, TV)

The rise of video content, encompassing gaming, films, and TV shows, presents a significant threat of substitution for dedicated music listening. While Warner Music Group (WMG) benefits from licensing its music for these platforms, consumers increasingly allocate their leisure time and attention to visual entertainment.

This shift means that music might be relegated to a secondary role, complementing visual experiences rather than being the primary focus of consumption. For instance, in 2024, global spending on video games alone was projected to reach over $200 billion, indicating a substantial portion of entertainment budgets and time dedicated to interactive visual media.

- Increased time spent on visual media: Consumers are dedicating more hours to streaming services and gaming, potentially reducing the time available for active music listening.

- Music as a secondary element: In many video games and films, music serves as background or enhances the visual narrative, rather than being the central attraction.

- Competition for discretionary spending: Entertainment budgets are finite, and a significant portion allocated to video content means less might be available for music-related purchases or subscriptions.

- Shifting consumer preferences: The younger demographic, in particular, often engages with music through visual platforms like TikTok or YouTube, where music is integrated with video content.

Radio and Terrestrial Broadcasts

Traditional radio, while facing competition from digital platforms, still presents a threat of substitution for Warner Music Group. Its accessibility and cost-free nature make it an appealing option for many listeners, particularly for casual or background music consumption. In 2024, radio continued to hold a significant share of music listening, especially in vehicles and in regions with less robust internet infrastructure.

While digital streaming services offer vast libraries and on-demand listening, radio provides a curated experience that can introduce listeners to new artists and genres without requiring active selection. This passive discovery aspect can serve as a substitute for actively seeking out music on streaming platforms. For instance, many commuters still rely on radio for their daily dose of music and news.

The threat is amplified in markets where internet penetration is lower or where data costs are a significant barrier. In these areas, terrestrial radio remains a primary, if not the only, source of music for a substantial portion of the population. This enduring reach ensures that radio continues to function as a viable substitute for paid or data-intensive music consumption methods.

- Free Accessibility: Radio remains a zero-cost option for music discovery and listening.

- Curated Experience: Offers a passive listening and discovery channel, unlike on-demand streaming.

- Geographic Reach: Continues to be a dominant music source in areas with limited internet access or high data costs.

- In-Car Listening: Remains a primary source of music for many drivers, often integrated into vehicle dashboards.

User-generated content platforms like TikTok and YouTube, alongside podcasts and audiobooks, represent significant substitutes for Warner Music Group's (WMG) core offerings. These platforms compete for consumer attention and time, offering alternative audio and entertainment experiences that can divert listeners from WMG's catalog. In 2024, TikTok's viral music trends and the growing audiobook market, projected to exceed $20 billion globally, highlight this diversion.

Live music events, with a projected global market of over $40 billion in 2024, offer an immersive experience that recorded music cannot match, acting as a substitute for WMG's recorded music sales. Similarly, the massive video content industry, with gaming alone exceeding $200 billion in 2024, draws significant consumer time and spending away from dedicated music listening.

| Substitute | Impact on WMG | 2024 Market Data/Trend |

| User-Generated Content (TikTok, YouTube) | Dilutes impact of professional music, alternative discovery | Billions of music-driven videos created monthly |

| Podcasts & Audiobooks | Competes for leisure time and discretionary spending | Audiobook market projected over $20 billion |

| Live Music Events | Offers unique experience, diverts spending from recorded music | Global live music industry projected over $40 billion |

| Video Content (Gaming, Films, TV) | Allocates leisure time and budgets away from music | Global video game spending projected over $200 billion |

Entrants Threaten

The rise of digital distribution platforms has dramatically reduced the cost and complexity for new artists to enter the music market. This democratization of distribution means aspiring musicians can bypass traditional gatekeepers like record labels, reaching fans directly through services like Spotify, Apple Music, and Bandcamp.

In 2024, the independent music sector continued its strong growth, with digital sales and streaming accounting for the vast majority of revenue. This trend empowers new entrants, as the upfront investment required to distribute music globally is minimal compared to the physical distribution models of the past. For Warner Music Group, this means a constant influx of new talent challenging established artists and potentially fragmenting market share.

Artist-centric models and direct-to-fan platforms pose a growing threat by enabling artists to bypass traditional gatekeepers. Platforms like Patreon and Bandcamp allow creators to build communities and generate revenue directly, reducing reliance on major labels. In 2023, Bandcamp Fridays, where they waived their revenue share, saw artists earn over $70 million directly from fans, highlighting the financial viability of these alternative models.

The rapid evolution of artificial intelligence in music creation presents a significant threat of new entrants for Warner Music Group. AI tools can now generate music with increasing sophistication, potentially lowering production costs and barriers to entry for independent artists and new ventures. For instance, platforms like Amper Music and Jukebox by OpenAI demonstrate the capability to produce royalty-free music for various uses, bypassing traditional studio costs and established labels.

Established Tech Companies Diversifying into Music

Large technology firms like Google (YouTube) and Amazon, with their immense capital and extensive customer networks, represent a significant threat. Their capacity to invest heavily in music streaming, artist development, and even direct licensing deals could disrupt the existing market structure.

For instance, Amazon Music reported over 55 million U.S. listeners in 2023, demonstrating its substantial reach. YouTube's dominance in music video consumption also positions it as a formidable player, with billions of monthly active users globally, many of whom engage with music content.

- Deep Pockets: Tech giants can absorb initial losses and outspend established music companies on talent and technology.

- Existing Infrastructure: They already possess the platforms, payment systems, and global distribution networks necessary for music services.

- User Data: Access to vast user data allows for highly targeted marketing and personalized music recommendations, a key competitive advantage.

- Diversification Strategy: Many of these companies view music as a complementary service to their core offerings, enhancing overall ecosystem value.

Challenges in Content Acquisition and Licensing

While it's easier for artists to distribute music independently, a new entrant would face immense challenges acquiring and licensing the extensive music catalogs that major labels like Warner Music Group (WMG) possess. These established relationships and vast libraries represent a significant barrier to entry, making it difficult for newcomers to compete on the same scale.

Securing the necessary rights for a comprehensive music catalog involves navigating complex and costly licensing agreements. For instance, in 2023, the global music publishing market was valued at approximately $12.7 billion, highlighting the significant financial investment required to gain access to valuable intellectual property.

- Catalog Depth: WMG's catalog includes millions of master recordings and publishing rights, built over decades.

- Licensing Complexity: Agreements cover various uses (streaming, sync, performance), each with intricate terms.

- Financial Investment: Acquiring rights for a competitive catalog would require billions in upfront investment.

- Artist Relationships: Major labels have long-standing, often exclusive, relationships with artists and songwriters.

The threat of new entrants for Warner Music Group is moderate, primarily driven by the digital revolution that has lowered barriers for artists. However, established players benefit from deep catalogs and complex licensing, creating significant hurdles for newcomers aiming for scale.

The continued growth of independent music in 2024, fueled by digital platforms, empowers new artists to bypass traditional labels. This means a constant flow of talent, but the sheer volume of content makes it difficult for any single new entrant to gain significant market share without substantial investment.

While AI music generation tools are emerging, their current output often lacks the creative depth and established artist appeal that major labels like Warner Music Group cultivate. Furthermore, the immense cost and complexity of acquiring rights to a vast, diverse music catalog remain a substantial deterrent for potential new competitors.

| Factor | Impact on Warner Music Group | Evidence/Data (2023-2024) |

|---|---|---|

| Digital Distribution | Lowers entry barriers for artists | Independent artists' share of music revenue grew significantly, with digital sales dominating. |

| Artist-Centric Platforms | Enables direct artist-fan engagement | Platforms like Bandcamp saw artists earn substantial direct revenue, reducing label dependence. |

| AI Music Generation | Potential for lower production costs | AI tools are advancing, but widespread adoption for commercially successful music is still developing. |

| Catalog Acquisition | High barrier to entry | Global music publishing market valued at ~$12.7 billion in 2023, requiring massive investment for comparable catalogs. |

| Tech Giants' Infrastructure | Potential for disruption | Amazon Music had over 55 million U.S. listeners in 2023; YouTube's user base is in the billions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Warner Music Group is built upon a comprehensive review of their annual reports, investor presentations, and SEC filings. We also incorporate data from reputable industry research firms and financial news outlets to capture market dynamics and competitive landscapes.