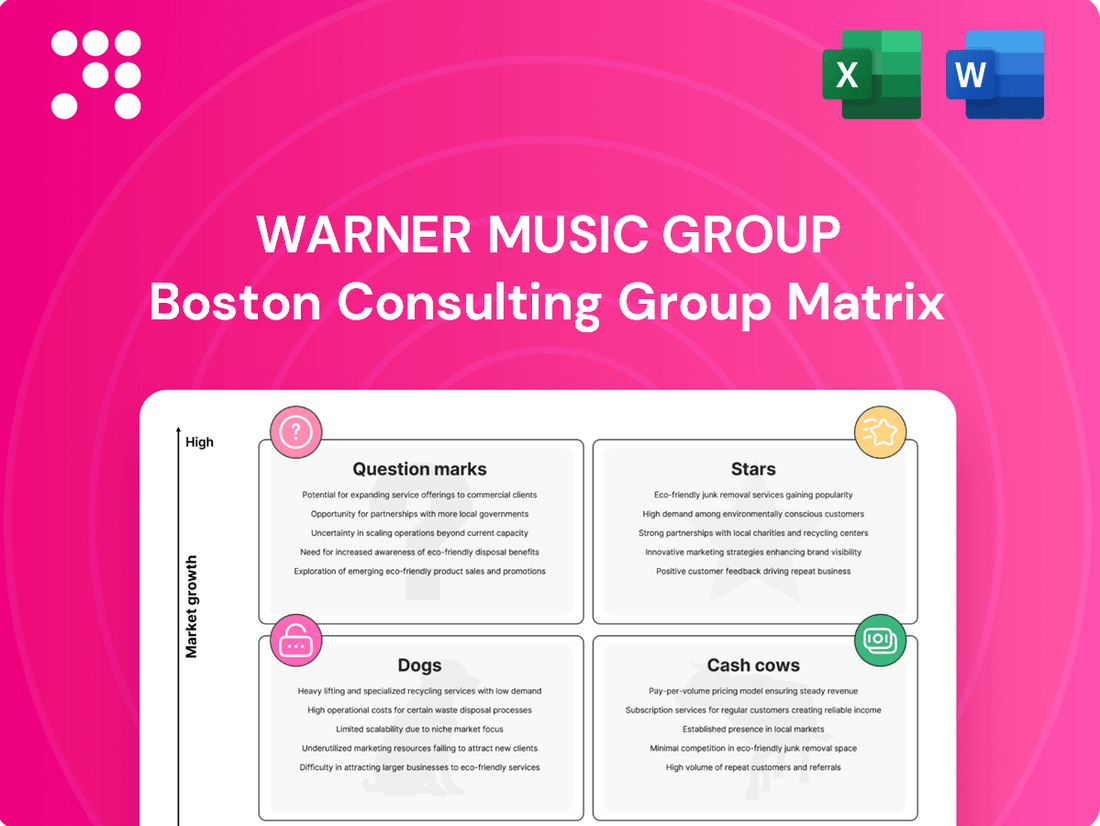

Warner Music Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Warner Music Group Bundle

Curious about Warner Music Group's strategic positioning? Our BCG Matrix analysis reveals how their diverse portfolio of artists, labels, and music rights stack up as Stars, Cash Cows, Dogs, or Question Marks. Understand where their revenue streams are strongest and where future growth lies.

Don't miss out on the full picture! Purchase the complete Warner Music Group BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for this music industry giant.

Stars

Warner Music Group's subscription streaming segment for recorded music is a definite star in their portfolio. It's not just growing; it's showing robust and consistent expansion. This is a key driver for the company, reflecting the ongoing shift in how people consume music.

Looking at the numbers, subscription streaming revenues saw a solid 3.2% increase year-over-year in calendar Q1 2025, when adjusted for currency fluctuations. Even more impressively, the prior quarter, fiscal Q1 2025 (which corresponds to calendar Q4 2024), experienced a 7% growth. This sustained momentum, building on double-digit growth throughout fiscal year 2024, underscores its significant market share in a digital music market that continues to expand.

Warner Chappell Music, WMG's global music publishing arm, is a strong performer within the music industry's publishing sector, which is experiencing steady growth. Its consistent revenue increases, such as the 3% rise in calendar Q1 2025 and 6.3% in Q4 2024 (fiscal Q1 2025), highlight its dominant market position.

This expansion is fueled by robust digital, performance, and synchronization revenues, underscoring Warner Chappell Music's ability to capitalize on evolving revenue streams and maintain its competitive edge in a dynamic market.

Warner Music Group's commitment to Artist & Repertoire (A&R) is a key driver of its success with new artists. This investment allows WMG to identify and nurture emerging talent, leading to a robust pipeline of popular music. For instance, in Q2 2025, WMG saw an expansion of its new release market share in the US, a testament to its effective talent development.

The company highlights its "engine" as strong, fueled by both breakthrough new stars and established global superstars. This dual approach ensures consistent chart presence and a growing market share for new music releases. The focus on new releases positions them as high-growth products with significant potential to shape market trends and capture consumer attention.

Growth in Emerging International Markets

Warner Music Group is making significant strides in emerging international markets, particularly in India and Latin America. These regions represent key growth opportunities for the company.

The company's strategic expansion into these areas is yielding impressive results. For example, WMG's revenue growth in India surpassed 100% in fiscal year 2024. This remarkable performance highlights WMG's successful market penetration in rapidly expanding music economies.

- India's Revenue Growth: Exceeded 100% in fiscal 2024.

- Strategic Focus: Targeting high-growth emerging markets like India and Latin America.

- Global Rebalancing: Positioning these regions as crucial drivers of future growth.

Strategic Digital Service Provider (DSP) Partnerships

Strategic Digital Service Provider (DSP) partnerships are a cornerstone for Warner Music Group's (WMG) position in the BCG matrix, particularly for its digital music segment, which often acts as a cash cow. Securing new, multi-year agreements with major streaming platforms like Spotify is paramount. These deals ensure WMG’s continued access to a vast and growing global audience, a critical factor in maintaining its significant market share within the digital distribution landscape.

These vital partnerships directly contribute to stabilizing subscription streaming revenue, a predictable income stream for WMG. They also enhance WMG's capacity to effectively monetize its extensive music catalog. This strategic alignment solidifies WMG's strong market presence and fuels further growth within the broader music ecosystem.

- Spotify Partnership Value: In 2023, Spotify reported over 600 million monthly active users, highlighting the immense reach DSPs offer.

- Revenue Stability: Multi-year deals with platforms like Spotify provide predictable revenue streams, crucial for cash cow business units.

- Market Share Defense: Maintaining strong relationships with major DSPs is essential for WMG to defend its substantial market share in digital music.

- Monetization Enhancement: DSP agreements allow WMG to leverage its catalog effectively, driving revenue growth and profitability.

Warner Music Group's subscription streaming segment for recorded music is a definite star in their portfolio. It's not just growing; it's showing robust and consistent expansion, reflecting the ongoing shift in how people consume music.

Subscription streaming revenues saw a solid 3.2% increase year-over-year in calendar Q1 2025, with the prior quarter experiencing a 7% growth. This sustained momentum, building on double-digit growth throughout fiscal year 2024, underscores its significant market share in a digital music market that continues to expand.

Warner Chappell Music, WMG's global music publishing arm, is a strong performer within the music industry's publishing sector, which is experiencing steady growth. Its consistent revenue increases, such as the 3% rise in calendar Q1 2025 and 6.3% in Q4 2024, highlight its dominant market position.

This expansion is fueled by robust digital, performance, and synchronization revenues, underscoring Warner Chappell Music's ability to capitalize on evolving revenue streams and maintain its competitive edge.

| Segment | Growth (YoY Calendar Q1 2025) | Growth (YoY Calendar Q4 2024) | Key Driver |

|---|---|---|---|

| Subscription Streaming | 3.2% | 7.0% | Digital consumption shift, DSP partnerships |

| Warner Chappell Music | 3.0% | 6.3% | Digital, performance, and synchronization revenues |

What is included in the product

The Warner Music Group BCG Matrix categorizes its business units, identifying which segments require investment (Stars/Question Marks) and which generate cash (Cash Cows) or should be divested (Dogs).

A clear BCG Matrix visualizes Warner Music Group's portfolio, easing the pain of resource allocation by highlighting Stars and Cash Cows for investment and Dogs for divestment.

Cash Cows

Warner Music Group's established recorded music catalog is a prime example of a Cash Cow. This treasure trove of iconic music consistently delivers significant, high-margin revenue streams, demonstrating its mature and stable market position.

The strategic importance of these assets is highlighted by the $1.2 billion joint venture with Bain Capital, specifically aimed at investing in music catalogs. This move underscores the enduring cash-generating potential of these well-established music rights.

These mature catalogs provide a predictable and reliable income, primarily through streaming, licensing agreements, and ongoing physical sales. Crucially, they require minimal additional promotional investment to maintain their revenue generation, further solidifying their Cash Cow status.

Global recorded music subscription streaming in mature markets is Warner Music Group's (WMG) prime Cash Cow. This segment, while experiencing some growth moderation following prior year price adjustments, continues to be WMG's largest revenue generator. For the fiscal year ending September 30, 2023, WMG reported total revenue of $6.17 billion, with digital revenue, largely driven by streaming, forming the bulk of this. This mature segment provides a stable, high-market share revenue stream, reliably generating significant cash flow that fuels other areas of the business.

Warner Chappell Music, Warner Music Group's publishing arm, functions as a prime Cash Cow. Its vast catalog, boasting over one million copyrights, consistently delivers high-margin revenue from performance, mechanical, and synchronization rights. This established asset base provides a predictable and robust cash flow, a critical advantage for WMG.

Licensing and Synchronization Revenue

Warner Music Group (WMG) effectively monetizes its extensive music catalog through licensing and synchronization revenue. This involves placing WMG's music in various media like films, TV shows, advertisements, and video games, generating a consistent and profitable income stream.

This segment acts as a strong cash cow for WMG due to the evergreen nature of its catalog. Established hits continue to find new audiences and applications, ensuring reliable cash flow with minimal incremental investment. For instance, in the fiscal year ending September 30, 2023, WMG's recorded music segment, which heavily includes licensing and synchronization, generated approximately $3.78 billion in revenue.

- Catalog Depth: WMG's vast library of iconic music provides a continuous source for licensing opportunities across diverse media.

- Consistent Cash Flow: Synchronization and licensing deals offer predictable revenue streams with lower operational costs compared to new releases.

- Enduring Appeal: Older, well-known tracks often command strong licensing fees due to their established popularity and cultural relevance.

- Fiscal Year 2023 Performance: WMG's recorded music division, a key beneficiary of these deals, saw significant revenue contributions, underscoring the segment's strength.

Physical Sales in Key Markets (US, Japan)

Physical sales in the U.S. and Japan remain a surprisingly resilient revenue stream for Warner Music Group. Despite the dominance of streaming, these markets show a stable, cash-generating performance.

For instance, in Warner Music Group's first fiscal quarter of 2025, physical revenue saw a modest increase of 0.9%, or 1.8% when adjusted for currency fluctuations. This growth was largely fueled by the success of new album releases.

- U.S. and Japan physical sales contribute steady cash flow.

- Q1 2025 saw a 0.9% increase in physical revenue.

- New releases were a key driver for this growth.

- This segment represents a mature but stable cash cow for WMG.

Warner Music Group's (WMG) digital revenue, primarily from streaming, is a significant Cash Cow. Despite growth moderation, it remains WMG's largest revenue source, contributing substantially to its overall financial health.

The company's publishing arm, Warner Chappell Music, also functions as a Cash Cow, leveraging its extensive catalog of over one million copyrights to generate consistent, high-margin revenue from various licensing rights.

Physical sales in key markets like the U.S. and Japan, while mature, continue to provide a stable and predictable cash flow, demonstrating their enduring Cash Cow status for WMG.

| Segment | Cash Cow Characteristics | Fiscal Year 2023 Revenue Contribution (Approx.) |

|---|---|---|

| Recorded Music (Streaming) | Dominant revenue driver, mature market, stable cash flow | $3.78 billion (Recorded Music Segment) |

| Warner Chappell Music (Publishing) | Vast catalog, high-margin licensing, consistent revenue | Not separately broken out in total revenue, but a significant contributor to overall profitability. |

| Physical Sales (U.S. & Japan) | Resilient, stable revenue stream, especially with new releases | Contributes to overall recorded music revenue, with Q1 2025 showing 0.9% growth. |

What You See Is What You Get

Warner Music Group BCG Matrix

The Warner Music Group BCG Matrix you are previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional-grade document ready for immediate use in your business planning.

Dogs

Warner Music Group's ad-supported streaming revenue is a clear indicator of a Dogs category within its BCG Matrix. This segment experienced a notable decline, dropping 2.9% year-over-year in calendar Q1 2025 and a more significant 7% in Q4 2024 (which aligns with WMG's fiscal Q1 2025).

These figures highlight a low-growth environment, further exacerbated by inherently lower profit margins compared to other revenue streams. The challenges are compounded by a generally soft advertising market and difficulties in securing favorable deal renewals, painting a picture of an underperforming business unit with limited future prospects.

Certain Artist Services and Expanded-Rights Revenue within Warner Music Group's BCG Matrix likely fall into the 'Dogs' category. For instance, concert promotion revenue, especially in markets like France, saw a decline. This segment, along with revenue from divested media properties, represents areas that are underperforming or no longer strategically prioritized for growth.

Underperforming legacy media properties within Warner Music Group's portfolio, such as its in-house ad sales function, are positioned as Dogs in the BCG Matrix. These assets are characterized by low market share and low growth prospects, often requiring significant investment to maintain operations without yielding substantial returns.

Warner Music Group's strategic decision to divest or wind down these non-core media properties reflects a clear understanding of their limited contribution to overall growth and profitability. For instance, in 2023, the broader media and entertainment sector saw increased scrutiny on profitability, with many traditional media outlets struggling to adapt to digital disruption, a trend likely impacting these specific WMG assets.

Terminated Digital Distribution Agreement with BMG

Warner Music Group's (WMG) decision to terminate its digital distribution agreement with BMG, effective in the first quarter of fiscal year 2024, placed this segment firmly in the 'Dog' category of the BCG Matrix. This move directly impacted WMG's recorded music digital revenue, leading to a decrease of $25 million in that quarter compared to the previous year.

- Termination Impact: The $25 million revenue shortfall in Q1 FY2024 highlights the negative contribution of the BMG digital distribution to WMG's overall performance.

- Strategic Divestment: This termination signifies WMG's strategic decision to exit a business relationship that was no longer fostering growth or expanding market share.

- 'Dog' Classification: The agreement's termination reflects a phasing out of a low-growth, low-market-share activity, characteristic of a 'Dog' in the BCG Matrix.

Smaller, Unsuccessful Niche Labels or Artists

Within Warner Music Group's vast catalog, there are smaller, niche labels or artists that may not have captured significant market traction. These ventures, even with initial investment, can become cash traps if they consistently fail to generate substantial revenue in the competitive music landscape.

For instance, while specific figures for underperforming niche artists within Warner Music Group are proprietary, the broader music industry often sees a high failure rate for new releases. In 2023, for example, only a fraction of the millions of songs uploaded to streaming platforms achieved significant listener numbers, highlighting the challenge for smaller acts.

- Niche Label Performance: Smaller labels often cater to very specific genres or fan bases, limiting their overall market reach.

- Artist Development Costs: Investing in artist development, marketing, and distribution for artists with limited commercial appeal can drain resources without commensurate returns.

- Market Saturation: The sheer volume of music available makes it difficult for emerging or niche artists to break through and gain visibility.

- Low Return on Investment: When these investments do not translate into increased streaming numbers, sales, or licensing deals, they represent a drain on capital.

Warner Music Group's ad-supported streaming revenue, particularly in Q4 2024, saw a notable 7% decline, signaling a low-growth, low-profitability segment. Similarly, certain Artist Services, like concert promotion in France, and divested media properties also indicate 'Dog' status due to underperformance and lack of strategic focus. These areas, including legacy media operations, are characterized by low market share and limited growth prospects, often requiring investment without substantial returns.

The termination of the digital distribution agreement with BMG in Q1 FY2024, resulting in a $25 million revenue shortfall, exemplifies WMG's exit from a low-growth, low-market-share activity. Furthermore, smaller, niche labels or artists that fail to gain market traction can become cash traps, draining resources without significant revenue generation, especially given the high failure rate of new music releases in a saturated market.

Question Marks

Warner Music Group's (WMG) investment in Web3 music accelerator initiatives, such as its partnership with Polygon Labs, signals a strategic move into a nascent but high-potential market. This venture focuses on startups like Mith, which targets superfans, and Muus Collective, integrating music with fashion-focused gaming, indicating a broad exploration of blockchain and metaverse applications in the music industry.

These initiatives are characteristic of a Stars or Question Marks category within the BCG Matrix. While current market share and direct revenue contributions from these Web3 ventures are likely minimal, the significant investment by WMG underscores the belief in future growth and disruption. The aim is to capture a leading position in emerging decentralized music ecosystems and associated digital assets.

Warner Music Group is actively investing in technology, exemplified by tools like the WMG Pulse app, to offer artists deep insights into their superfan base and foster stronger engagement. This focus on AI-driven analytics represents a significant technological advancement within the music industry, aiming to revolutionize how artists connect with and monetize their most dedicated followers.

While the potential for AI to transform artist-fan relationships and revenue streams is substantial, this specific area, as a distinct product or revenue driver for WMG, is still in its nascent stages of development and widespread adoption within the market. Its current market share as a standalone offering is yet to be fully established, indicating a growth opportunity.

Investing in artists within emerging genres like hyperpop or experimental electronic music is a classic question mark scenario for Warner Music Group. These artists have the potential for explosive growth, but their current market share is minimal, requiring substantial investment in promotion and artist development to gain traction in a crowded and unpredictable market. For example, while specific genre investment figures for 2024 are proprietary, the overall music industry saw continued growth in digital streaming revenue, with emerging genres often driving innovation and new listener engagement.

Experimental Monetization Models (e.g., Superfan Tiers)

Warner Music Group (WMG) is actively investigating new ways to increase revenue per user, looking at models like Spotify's superfan tiers. These initiatives aim to capture more value from their audience by offering exclusive benefits or premium access. For instance, Spotify's introduction of higher-priced subscription tiers in late 2023 and early 2024 is a direct example of this trend, with the company aiming to differentiate its offerings and potentially increase its average revenue per user (ARPU).

These experimental monetization strategies represent potential high-growth avenues for WMG. However, their success hinges on market acceptance and the ability to deliver compelling value propositions to fans. The long-term impact and widespread adoption of these superfan tiers are still uncertain, making them a classic 'Question Mark' in a BCG matrix context. WMG’s performance in this area will be closely watched as the music industry continues to innovate in how it monetizes content and fan engagement.

- Exploring Superfan Tiers: WMG is testing premium subscription models to enhance ARPU.

- High-Growth Potential: These new approaches offer significant opportunities for increased revenue.

- Market Uncertainty: Effectiveness and adoption rates for these models are still being evaluated.

- Strategic Importance: Success in this area could redefine WMG's revenue streams.

Early-Stage Global Expansions in Nascent Territories

Warner Music Group (WMG) is actively pursuing early-stage expansions in nascent territories, viewing these as potential future growth engines. While established markets like India show significant promise, WMG is also looking beyond these to regions with undeveloped music industries. These new frontiers represent a long-term play, demanding considerable investment before profitability is realized.

These nascent markets, characterized by low current market share for WMG, require a strategic build-out of infrastructure, talent acquisition, and localized marketing efforts. For instance, WMG's commitment to developing local artist rosters in emerging African markets, such as Nigeria and South Africa, exemplifies this strategy. By 2024, the global music streaming market in Africa was projected to reach over $1 billion, indicating substantial untapped potential.

- Emerging Markets Focus: WMG is investing in territories with nascent music industries, anticipating future growth.

- Low Current Share, High Potential: These regions currently represent a small fraction of WMG's revenue but hold significant upside.

- Infrastructure Investment: Substantial capital is allocated to building operational capacity and local market presence.

- Talent Development: WMG is focused on nurturing local artists and music ecosystems in these new territories.

WMG's ventures into Web3, emerging genres, and new monetization models like superfan tiers are all prime examples of Question Marks. These areas demand significant investment for uncertain future payoffs.

The company is betting on these nascent opportunities to become future market leaders, but their current market share and revenue contribution are minimal.

Success in these segments requires careful nurturing and strategic execution, as they face high competition and evolving consumer preferences.

WMG’s 2024 focus on these areas highlights a proactive approach to capturing future growth in a rapidly changing music landscape.

| Category | Description | WMG Example | Potential | Risk |

|---|---|---|---|---|

| Question Mark | Low market share, high growth potential | Web3 Music Initiatives, Emerging Genres, Superfan Tiers | Market leadership, new revenue streams | High investment, uncertain returns, market adoption |

| Investment Focus | Early-stage development, market penetration | Partnerships with Polygon Labs, hyperpop artists, Spotify tier experiments | Building brand presence and user base | Competition, technological shifts, regulatory changes |

| Financial Outlook (2024) | Significant R&D and marketing spend | Undisclosed specific figures, but overall industry investment in digital innovation is robust | Future revenue growth dependent on successful market entry | Potential for write-downs if ventures fail to gain traction |

BCG Matrix Data Sources

Our Warner Music Group BCG Matrix is built on comprehensive data, integrating financial disclosures, market growth metrics, and industry research to provide a clear strategic overview.