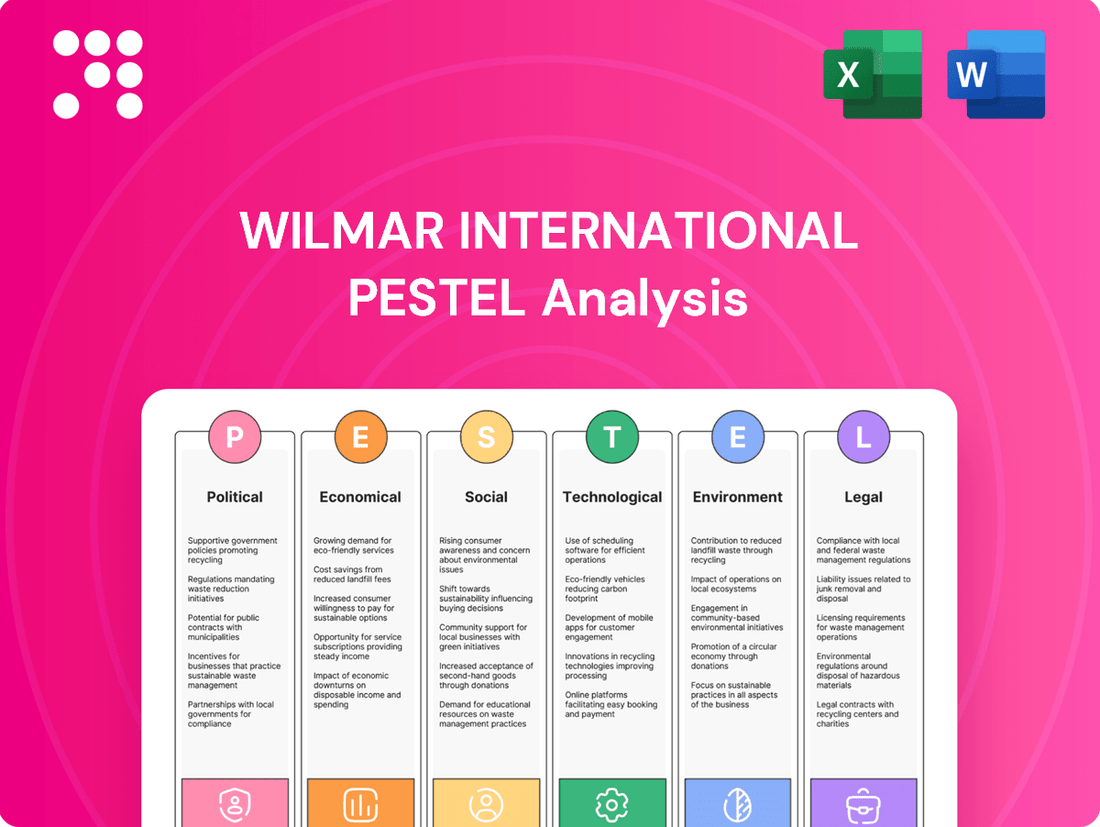

Wilmar International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wilmar International Bundle

Navigate the complex external forces shaping Wilmar International's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting their operations and market position. Equip yourself with the strategic foresight needed to thrive in this dynamic industry.

Gain a competitive advantage by leveraging our expert-crafted PESTLE analysis for Wilmar International. Uncover crucial insights into social trends, environmental regulations, and legal frameworks that influence their success. Download the full version now to unlock actionable intelligence and refine your market strategy.

Political factors

Government policies and regulations are a major influence on Wilmar International's operations as a global agribusiness leader. For instance, changes in trade agreements, like those impacting palm oil exports from Southeast Asia, can directly alter market access and pricing. In 2024, many nations are reviewing agricultural import tariffs, with some considering increases on processed food products, which could raise Wilmar's input costs and affect its competitive edge in key markets.

Geopolitical tensions and trade disputes significantly impact Wilmar International's operations, given its prominent role in the global agricultural commodity market. For instance, ongoing trade friction between major economies can lead to sudden tariff impositions, disrupting established trade flows and increasing costs for Wilmar's merchandising and distribution segments. The volatility in commodity prices stemming from these tensions directly affects Wilmar's profit margins and supply chain stability.

Wilmar International's extensive manufacturing footprint spans over 20 countries, with a significant concentration in Asia and Africa, making political stability in these regions paramount. For instance, in 2024, Wilmar's operations in Southeast Asia, a key growth engine, continued to navigate varying degrees of political landscapes. Unforeseen political shifts or unrest in these areas directly impact supply chain continuity, potentially leading to production halts and increased logistical expenses, as witnessed in certain markets experiencing localized instability.

Corruption and Governance Risks

Wilmar International has encountered significant governance challenges, including investigations into alleged corruption, notably in Indonesia concerning palm oil export permits and rice quality. These legal hurdles underscore the inherent risks in operating within certain jurisdictions and can result in substantial financial penalties and damage to the company's reputation.

Navigating these complex legal and regulatory environments is paramount for Wilmar's sustained operations and investor confidence. The company's proactive management of these issues directly impacts its financial stability and market standing.

- Legal Investigations: Wilmar has been subject to probes regarding business practices, impacting its operational continuity.

- Reputational Impact: Allegations of corruption can erode trust among stakeholders, affecting brand value.

- Financial Penalties: Adverse legal outcomes can lead to significant fines and increased compliance costs.

- Operational Scrutiny: Governance issues often result in heightened regulatory oversight, potentially slowing down business processes.

International Relations and Diplomatic Pressure

International pressure, particularly from NGOs and consumer nations, regarding deforestation and labor conditions in palm oil production significantly impacts governments in producing countries. This diplomatic pressure can translate into stricter national policies and increased oversight for companies like Wilmar International.

For instance, in 2023, the European Union's Deforestation Regulation (EUDR) came into effect, requiring companies to prove their commodities, including palm oil, are deforestation-free. This regulation directly affects Wilmar's supply chain and necessitates robust traceability measures, impacting operational costs and market access within the EU, a key market for Wilmar.

- EUDR Compliance Costs: Wilmar faces increased costs for supply chain mapping and verification to meet EUDR standards.

- Reputational Risk: Continued international scrutiny over environmental and labor practices poses a significant reputational risk, potentially affecting consumer trust and investor confidence.

- Supply Chain Adjustments: Wilmar may need to adjust sourcing strategies to align with stricter international sustainability expectations, potentially impacting supplier relationships and raw material availability.

Government policies and international trade agreements significantly shape Wilmar International's global operations. For example, in 2024, ongoing discussions around palm oil sustainability and import regulations in key markets like the EU and China directly influence Wilmar's market access and compliance costs. The company's ability to adapt to evolving agricultural subsidies and food safety standards in countries such as India and Indonesia remains critical for its competitive positioning.

Geopolitical stability is a constant factor for Wilmar, with operations in over 20 countries. Political unrest or shifts in government in regions like Southeast Asia or Africa can disrupt supply chains and increase operational risks. For instance, any significant policy changes affecting agricultural exports or foreign investment in 2024 could impact Wilmar's production and distribution networks.

| Political Factor | Impact on Wilmar International | Example/Data (2024/2025 Focus) |

| Trade Policies & Tariffs | Affects market access, import/export costs, and commodity pricing. | Potential for increased tariffs on processed foods in some Asian markets in 2024. EUDR compliance adds complexity to palm oil trade. |

| Geopolitical Stability | Influences supply chain continuity and operational safety. | Navigating varying political landscapes in Southeast Asia and Africa, where Wilmar has significant manufacturing. |

| Regulatory Environment | Impacts compliance costs, product standards, and operational permits. | Ongoing scrutiny over sustainability practices and labor conditions, particularly for palm oil. |

| Government Subsidies & Support | Can influence agricultural production costs and market competitiveness. | Monitoring agricultural support programs in key sourcing and processing regions. |

What is included in the product

This PESTLE analysis of Wilmar International examines the influence of political, economic, social, technological, environmental, and legal factors on its global agribusiness operations, providing a comprehensive view of the external landscape.

A concise PESTLE analysis of Wilmar International, highlighting key external factors and their implications, serves as a pain point reliever by offering a clear roadmap for strategic decision-making.

Economic factors

Wilmar International's extensive operations in edible oils, oilseeds, and sugar make it particularly vulnerable to global commodity price volatility. These price swings, driven by factors like weather, geopolitical tensions, and supply-demand imbalances, directly impact the company's financial performance. For example, projections indicate continued weakness in palm oil and sugar prices throughout 2025, presenting a significant challenge.

Consumer demand is a critical driver for Wilmar International, especially for its extensive range of consumer-packaged goods. Economic conditions directly shape how much consumers are willing and able to spend. For instance, a general economic slowdown can significantly dampen demand for everyday food items, forcing companies like Wilmar to increase promotional activities to maintain sales volumes.

In 2024, many Asian economies, including key markets for Wilmar, are navigating inflationary pressures and potential shifts in consumer spending habits. For example, while specific Wilmar sales data for this period is proprietary, broader economic indicators suggest that discretionary spending on food products might see more price sensitivity. This can lead to lower margins for Wilmar's food product segment if they need to absorb cost increases or offer deeper discounts.

Wilmar International, as a global player, faces significant risks from fluctuating currency exchange rates. For instance, a stronger US dollar against Asian currencies could increase the cost of imported raw materials for Wilmar's operations in those regions. Conversely, a weaker ringgit might make Wilmar's Malaysian exports more competitive but reduce the translated value of its earnings from other markets.

These currency movements directly impact Wilmar's profitability. In 2023, for example, the volatility in currencies like the Indonesian rupiah and the Malaysian ringgit against the US dollar would have influenced the reported revenue and profit margins from its extensive agribusiness operations. Such fluctuations can create unpredictable swings in financial results, making forecasting more challenging.

Global Economic Growth and Recession Risks

Global economic growth is a key driver for Wilmar International, as it directly influences demand for agricultural commodities and processed food. A robust global economy typically translates to higher consumer spending on food and industrial products, benefiting Wilmar's diverse portfolio. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from 2023, indicating a generally supportive, albeit moderate, economic environment.

However, the risk of a recession remains a significant concern. A global economic slowdown or downturn would likely depress commodity demand, impacting Wilmar's sales across its various segments, from edible oils and oilseeds to sugar and fertilizers. Such a scenario could put pressure on pricing and volumes, affecting profitability.

- Global GDP Growth Forecast: The IMF's projection of 3.2% growth for 2024 suggests a cautiously optimistic outlook, but geopolitical tensions and inflation could still trigger a sharper slowdown.

- Commodity Price Volatility: Economic uncertainty often leads to increased volatility in agricultural commodity prices, directly impacting Wilmar's input costs and product margins.

- Consumer Spending Impact: Recessions typically reduce discretionary spending, which can affect demand for higher-value processed food products in Wilmar's consumer goods segment.

- Industrial Demand Sensitivity: Wilmar's industrial products, such as oleochemicals used in various manufacturing processes, are highly sensitive to the health of broader industrial production and economic activity.

Interest Rates and Access to Capital

Fluctuations in global interest rates directly impact Wilmar International's cost of capital. For instance, if central banks like the US Federal Reserve continue their tightening cycle into 2024, borrowing costs for Wilmar's significant capital expenditures, such as new plantation development or processing facilities, will likely rise. This makes securing affordable financing more challenging, potentially slowing expansion plans.

Access to readily available and cost-effective capital is fundamental for Wilmar's growth strategy. In 2024, many emerging markets, key to Wilmar's expansion, may experience higher borrowing costs due to global economic uncertainty. This can hinder strategic investments and the company's ability to maintain its competitive position against rivals who might have better access to cheaper funds.

- Rising Interest Rates: As of early 2024, many developed economies are still navigating higher interest rate environments, increasing Wilmar's potential debt servicing costs.

- Capital Expenditure Financing: Wilmar's ongoing investments in agribusiness infrastructure, estimated in the billions of dollars annually, are sensitive to changes in lending rates.

- Emerging Market Access: The cost of capital in key markets like Indonesia and Vietnam can be volatile, impacting the feasibility of new projects and acquisitions.

- Competitive Landscape: Companies with stronger balance sheets or access to lower-cost financing can gain a competitive advantage in market share and operational efficiency.

Economic growth significantly influences Wilmar's performance, as global demand for its commodities and processed foods is tied to consumer and industrial activity. The International Monetary Fund (IMF) projected global GDP growth to be around 3.2% in 2024, indicating a moderate but generally supportive economic climate for Wilmar's diverse operations. However, persistent inflation and the risk of economic slowdowns in key markets like Asia could dampen consumer spending, impacting sales volumes and potentially margins for its consumer goods segment.

Commodity price volatility remains a critical economic factor for Wilmar, directly affecting its profitability in edible oils, oilseeds, and sugar. Projections for 2025 suggest continued pressure on palm oil and sugar prices, posing a challenge to input costs and product pricing strategies. Additionally, currency exchange rate fluctuations, such as the strength of the US dollar against Asian currencies, can increase the cost of imported raw materials and impact the translated value of international earnings.

Interest rates also play a crucial role in Wilmar's financial health, influencing its cost of capital for expansion and ongoing investments in infrastructure. With many central banks maintaining higher interest rates in 2024, borrowing costs for Wilmar's significant capital expenditures are likely to rise, potentially slowing strategic growth initiatives. Access to affordable capital in emerging markets, vital for Wilmar's expansion, could also become more constrained.

| Economic Factor | 2024/2025 Outlook | Impact on Wilmar International |

| Global GDP Growth | Projected 3.2% in 2024 (IMF) | Supports demand for commodities and processed foods, but growth moderation poses risk. |

| Commodity Prices | Continued weakness in palm oil and sugar projected for 2025. | Affects input costs, product margins, and overall profitability. |

| Inflationary Pressures | Present in many Asian economies in 2024. | Can lead to price sensitivity in consumer spending and impact margins if costs are absorbed. |

| Interest Rates | Higher rates maintained by many central banks in 2024. | Increases cost of capital for expansion and debt servicing. |

| Currency Exchange Rates | Volatility observed in emerging market currencies (e.g., IDR, MYR). | Impacts cost of imported raw materials and translated value of foreign earnings. |

Preview Before You Purchase

Wilmar International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Wilmar International delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Wilmar International's business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of how these macro-environmental factors influence Wilmar International's strategic planning and competitive positioning.

Sociological factors

Consumer preferences are increasingly leaning towards healthier options, with a strong emphasis on products low in saturated fat. This trend directly impacts Wilmar International, pushing them to innovate and market products like their low-saturated fat cooking oils. For instance, the global market for plant-based oils, a key category for Wilmar, is projected to see robust growth, driven by these health-conscious shifts.

Sustainability is another major driver. Consumers are actively seeking out products with certifications demonstrating responsible sourcing, particularly for palm oil. Wilmar's commitment to RSPO (Roundtable on Sustainable Palm Oil) certification, for example, is crucial for maintaining market access and appealing to environmentally aware consumers, a segment that continues to expand.

Wilmar International's public image is significantly shaped by its environmental and social conduct, especially regarding palm oil production. Concerns about deforestation and labor practices can trigger consumer boycotts, tarnishing its brand and affecting sales. For example, in 2023, Wilmar faced scrutiny over supply chain transparency, leading some downstream customers to review their sourcing.

Wilmar International, as a major player in agribusiness, faces significant societal expectations concerning its labor practices and human rights. In 2024, reports from various NGOs continued to highlight concerns about working conditions and wages in some of its supply chains, particularly in palm oil plantations. Adherence to international labor standards, including the prohibition of child and forced labor, is paramount for the company's reputation and its ability to operate sustainably.

The company's commitment to employee well-being and community engagement is vital for maintaining its social license to operate. In 2023, Wilmar announced initiatives to improve worker welfare programs, including enhanced access to healthcare and education for plantation workers and their families. These efforts are critical in addressing public perception and ensuring ethical operations across its vast global footprint.

Community Engagement and Social Impact

Wilmar International's extensive agricultural operations, particularly in palm oil cultivation, necessitate deep engagement with local communities. These relationships are crucial for maintaining operational stability and social license to operate. For instance, in 2023, Wilmar reported investing significantly in community development programs across its operating regions, focusing on education and infrastructure improvements. This proactive approach aims to mitigate potential social unrest and foster goodwill.

Effective community engagement can directly translate into operational benefits. By supporting local economies and improving living standards, Wilmar can reduce the risk of land disputes and labor issues. For example, their commitment to local employment and sourcing from smallholder farmers in Southeast Asia, a key strategy in 2024, helps build trust. Such initiatives are vital for long-term sustainability and preventing disruptions.

- Community Investment: Wilmar's 2023 sustainability report highlighted community development expenditures exceeding $50 million globally, with a focus on education and health initiatives.

- Local Employment: In 2024, approximately 85% of Wilmar's workforce in its Indonesian operations comprised local hires, demonstrating a commitment to community integration.

- Smallholder Farmer Support: The company continued its programs in 2024 to provide training and resources to over 300,000 smallholder farmers, enhancing their yields and livelihoods.

Demographic Shifts and Urbanization

Global demographic shifts, including a projected population increase to 9.7 billion by 2050 and a continued surge in urbanization, are fundamentally reshaping food consumption. As more people move to cities, demand for convenient, processed, and diverse food products intensifies, directly impacting agricultural supply chains. Wilmar International is strategically positioned to capitalize on this by focusing on expanding its presence in high-growth emerging markets, anticipating and catering to these evolving consumer preferences.

Wilmar’s proactive approach to these demographic trends is evident in its investment strategies. For instance, the company has been actively increasing its production and distribution capabilities in Southeast Asia and Africa, regions experiencing significant population growth and urbanization. This expansion allows Wilmar to tap into burgeoning middle classes with rising disposable incomes and changing dietary habits, favoring packaged foods and edible oils, core product categories for the company.

- Population Growth: The world population is expected to reach approximately 8.5 billion by 2030, a significant driver of increased food demand.

- Urbanization Rate: By 2050, an estimated 68% of the world's population will reside in urban areas, concentrating consumer demand and altering traditional food sourcing patterns.

- Emerging Market Focus: Wilmar International's expansion into markets like India and Indonesia, which have substantial young and growing urban populations, directly addresses these demographic shifts.

- Consumer Demand Shifts: Urbanization often correlates with a greater demand for processed foods, ready-to-eat meals, and a wider variety of ingredients, aligning with Wilmar's product portfolio.

Societal expectations regarding ethical labor practices and human rights are paramount for Wilmar International. In 2024, ongoing scrutiny of working conditions and wages in its supply chains, particularly palm oil plantations, underscores the need for strict adherence to international labor standards. The company's 2023 initiatives to improve worker welfare, including enhanced healthcare and education access, are vital for maintaining its social license to operate and public trust.

Technological factors

Wilmar International's operations are significantly influenced by technological advancements in agriculture. Precision farming techniques, utilizing GPS and sensors, are boosting efficiency. For instance, in 2024, adoption of these technologies across the agricultural sector is projected to increase crop yields by an average of 10-15%.

The integration of AI-powered drones for crop monitoring and data analysis offers real-time insights into plant health and resource needs, leading to more targeted interventions. Genetic research is also playing a crucial role, with new seed varieties showing increased resistance to diseases and improved growth rates, potentially boosting Wilmar's output by 5-10% in the coming years.

Wilmar International is heavily invested in advancing its processing and refining technologies. Innovations here directly impact product quality, waste reduction, and operational efficiency across its edible oils, specialty fats, and oleochemicals businesses. For example, in 2024, the company highlighted its ongoing efforts in developing more sustainable refining processes, aiming to cut energy consumption by 15% by 2027.

These technological upgrades are crucial for Wilmar to meet increasing global demand for its products while adhering to stricter environmental standards. Investments in areas like advanced filtration and enzymatic refining, which were central to Wilmar's R&D in 2024, promise not only better product yields but also a significant reduction in greenhouse gas emissions, with a target of a 10% decrease in Scope 1 and 2 emissions by 2026.

Wilmar International leverages advanced technological solutions for supply chain management, including sophisticated traceability systems. These systems are vital for meeting increasing consumer and regulatory demands for transparency and sustainable sourcing, particularly concerning policies like No Deforestation, No Peat, No Exploitation (NDPE).

In 2023, Wilmar continued to invest in digitalizing its supply chain, aiming to enhance real-time monitoring and verification of its sourcing practices. For instance, their palm oil operations utilize these technologies to track products from plantation to processing, ensuring compliance with sustainability commitments and providing auditable data.

Renewable Energy Technologies

Wilmar International's operational efficiency and sustainability are significantly influenced by advancements in renewable energy technologies. The company's focus on integrating these technologies, especially within its palm oil and sugar processing facilities, is a key technological driver. For instance, by leveraging biomass derived from agricultural byproducts, Wilmar can decrease its dependence on traditional fossil fuels.

This shift not only contributes to a reduction in greenhouse gas emissions but also bolsters the company's overall commitment to sustainable practices. By 2024, Wilmar has been actively exploring and implementing biomass co-generation plants, aiming to power its mills with cleaner energy sources. This strategic adoption of renewable energy technologies is crucial for meeting evolving environmental regulations and consumer expectations.

Key technological factors impacting Wilmar include:

- Biomass Utilization: Employing agricultural waste, such as palm kernel shells and bagasse, to generate electricity and heat, thereby reducing reliance on fossil fuels.

- Co-generation Efficiency: Implementing advanced co-generation systems that maximize energy output from biomass, improving overall plant energy efficiency.

- Carbon Capture Technologies: Investigating and potentially adopting technologies to capture carbon emissions from its operations, further enhancing its environmental profile.

Research and Development (R&D) in Food Innovation

Wilmar International's dedication to research and development in food innovation is a cornerstone of its strategy, particularly in creating healthier options like specialized cooking oils and low-glycemic index (GI) food products. This focus directly addresses the growing consumer preference for wellness, a trend that accelerated significantly through 2024 and is projected to continue into 2025.

Technological advancements in food science empower Wilmar to diversify its product portfolio and explore new market segments. For instance, their work on reducing saturated fats and increasing nutritional value in staple products like cooking oils positions them favorably against competitors and appeals to health-conscious demographics.

Wilmar's investment in R&D is crucial for maintaining its competitive edge in the dynamic global food industry. By leveraging technology, the company can innovate rapidly, adapt to changing consumer tastes, and unlock new avenues for growth and market penetration.

- Innovation in Healthier Oils: Wilmar is actively developing cooking oils with improved nutritional profiles, targeting reduced saturated fat content and enhanced omega-3 fatty acids, responding to a significant consumer health trend observed throughout 2024.

- Low-GI Product Development: The company's commitment extends to creating low-GI food products, catering to the increasing demand for dietary solutions that help manage blood sugar levels, a market segment showing robust growth projections for 2025.

- Market Competitiveness: These technological R&D efforts are vital for Wilmar to differentiate its offerings and maintain a strong competitive position against both established players and emerging food technology companies.

- Product Diversification: Through innovation, Wilmar aims to broaden its product range, moving beyond traditional offerings to capture value in specialized and premium food categories.

Technological advancements in agriculture, such as precision farming, are enhancing crop yields and efficiency for Wilmar. AI and genetic research are further optimizing agricultural output, with projections of 10-15% yield increases in 2024 due to technology adoption.

Wilmar is also investing in advanced processing technologies to improve product quality and reduce waste. In 2024, the company aimed to cut energy consumption in refining by 15% by 2027 through sustainable process development.

Supply chain digitalization, including traceability systems, is crucial for Wilmar to meet transparency demands, with investments in 2023 enhancing real-time monitoring of sourcing practices.

The company is leveraging renewable energy technologies, like biomass co-generation, to reduce fossil fuel reliance and emissions, a key focus in 2024.

| Technological Area | Impact on Wilmar | Key Initiatives/Data (2024-2025 Focus) |

| Precision Agriculture | Increased crop yields, operational efficiency | Adoption projected to boost yields by 10-15% (2024) |

| Processing & Refining | Improved product quality, waste reduction | Aiming for 15% energy reduction in refining by 2027 |

| Supply Chain Management | Enhanced transparency and sustainability verification | Digitalization investments in 2023 for real-time monitoring |

| Renewable Energy | Reduced fossil fuel dependency, lower emissions | Exploration of biomass co-generation plants (2024) |

Legal factors

Wilmar International navigates a complex web of environmental regulations worldwide, impacting everything from land use to emissions. Key areas include deforestation, carbon footprint management, and waste disposal, all subject to stringent global and local laws.

Compliance with mandates like the EU Deforestation Regulation (EUDR), which came into full effect in late 2024, is paramount for market access in key regions like Europe. Failure to adhere can result in significant penalties and trade restrictions, impacting Wilmar's supply chain integrity.

Furthermore, adherence to national sustainable palm oil standards, such as Malaysia's MSPO and Indonesia's ISPO, is crucial. As of early 2025, these certifications remain vital for demonstrating commitment to responsible sourcing and maintaining consumer trust in a competitive market.

Wilmar International must strictly adhere to national and international labor laws, covering aspects like minimum wage, safe working conditions, and the absolute prohibition of forced labor. This includes compliance with International Labour Organization (ILO) conventions. For instance, in 2023, Wilmar reported on its efforts to strengthen grievance mechanisms, a key component of upholding human rights and labor standards across its diverse global workforce.

Wilmar International operates under stringent food safety and product quality regulations across its consumer product manufacturing. These rules are critical for maintaining brand reputation and consumer confidence, especially in markets like China where food safety scandals have led to severe penalties.

Failure to comply can result in costly product recalls, hefty fines, and significant damage to brand image. For instance, in 2023, regulatory bodies worldwide continued to enforce rigorous testing for contaminants and accurate labeling, impacting supply chain management and product development cycles for companies like Wilmar.

Anti-Corruption and Anti-Bribery Laws

Wilmar International operates in regions where anti-corruption and anti-bribery laws are strictly enforced, posing significant legal challenges. For instance, the company has faced scrutiny in Indonesia, a key market for its palm oil operations. Failure to adhere to these regulations can lead to severe consequences.

The potential for investigations and legal proceedings necessitates a strong commitment to compliance. These legal battles can result in substantial financial penalties, impacting profitability. Furthermore, such actions can inflict considerable damage on Wilmar's reputation, affecting stakeholder trust and market position.

- Legal Scrutiny: Wilmar has encountered legal challenges related to anti-corruption and anti-bribery regulations, particularly in its Indonesian operations.

- Financial Penalties: Non-compliance can lead to significant fines, impacting the company's bottom line. For example, similar cases in the agribusiness sector have seen penalties reaching tens of millions of dollars.

- Reputational Risk: Investigations and legal actions can severely damage Wilmar's brand image and public perception.

- Compliance Frameworks: The company must maintain robust internal controls and compliance programs to mitigate these legal risks effectively.

Land Rights and Customary Laws

Wilmar International's operations, particularly in agricultural sectors across Asia and Africa, necessitate a deep understanding of intricate land rights and customary laws. These legal frameworks often govern land ownership and usage for indigenous and local communities, requiring careful navigation to ensure compliance and prevent disputes.

Adherence to principles such as Free, Prior, and Informed Consent (FPIC) is paramount. For instance, in Indonesia, where Wilmar has significant palm oil operations, customary land rights are deeply embedded in the legal system. Failure to obtain FPIC from affected communities can lead to protracted legal battles, operational disruptions, and reputational damage. Wilmar's commitment to responsible sourcing in 2024 and 2025 continues to emphasize engagement with local stakeholders to secure land tenure rights transparently.

- Land Tenure Security: Wilmar's ability to secure long-term land access depends on navigating diverse national and customary land laws, which vary significantly across its operating regions.

- Community Relations: Respecting customary land rights and engaging through FPIC processes are critical for maintaining social license to operate and avoiding costly legal challenges, a focus reinforced in Wilmar's sustainability reports for 2024.

- Regulatory Compliance: Compliance with evolving land use regulations and international best practices concerning indigenous rights is essential to mitigate legal risks and ensure sustainable business practices.

Wilmar International faces stringent legal requirements concerning product safety and quality across its diverse consumer goods portfolio. Adherence to these regulations is vital for maintaining consumer trust and brand reputation, particularly in markets like China where food safety violations can lead to severe penalties and product recalls. For example, in 2023, global regulatory bodies continued to enforce rigorous testing for contaminants and accurate labeling, impacting supply chain and product development timelines.

The company must also navigate complex anti-corruption and anti-bribery laws, especially in key operational regions such as Indonesia. Failure to comply can result in significant financial penalties and reputational damage, necessitating robust internal compliance programs. Investigations into similar cases in the agribusiness sector have previously resulted in fines reaching tens of millions of dollars, underscoring the financial risks involved.

Furthermore, Wilmar's extensive agricultural operations require careful management of land rights and adherence to principles like Free, Prior, and Informed Consent (FPIC) for local communities. As of 2024, securing land tenure transparently and engaging with stakeholders remains a priority to avoid legal disputes and operational disruptions, a commitment reinforced in the company's sustainability reporting.

| Legal Area | Key Regulations/Principles | Impact on Wilmar | Example/Data (2023-2025) |

|---|---|---|---|

| Product Safety & Quality | National food safety standards, labeling laws | Brand reputation, consumer trust, potential recalls/fines | Continued rigorous testing for contaminants and accurate labeling enforced globally in 2023. |

| Anti-Corruption & Bribery | National anti-corruption laws (e.g., Indonesia) | Financial penalties, reputational damage, legal proceedings | Agribusiness sector cases have seen fines in the tens of millions of dollars. |

| Land Rights & Community Engagement | Customary land laws, FPIC principles | Social license to operate, avoidance of disputes/disruptions | Focus on transparent land tenure and stakeholder engagement in 2024. |

Environmental factors

Wilmar International's significant presence in palm oil cultivation directly links it to environmental concerns like deforestation and biodiversity loss. Historically, expansion of oil palm plantations has been a major driver of these issues globally.

To address this, Wilmar implemented a No Deforestation, No Peat, No Exploitation (NDPE) policy. This policy commits the company to protecting areas critical for conservation, known as High Conservation Value (HCV) areas, and forests with significant carbon reserves, referred to as High Carbon Stock (HCS) forests. For instance, by the end of 2023, Wilmar reported that its NDPE policy covered 99% of its total palm oil plantation area.

The agribusiness sector, including Wilmar International's operations, is a significant contributor to global greenhouse gas (GHG) emissions, impacting climate change. Wilmar is actively addressing this by setting ambitious science-based targets to reduce its Scope 1, 2, and 3 emissions. For instance, as of its 2023 sustainability report, the company aims to achieve a 33% reduction in absolute Scope 1 and 2 GHG emissions by 2030 against a 2020 baseline. This commitment extends to increasing the use of renewable energy sources across its facilities to mitigate its environmental footprint.

Wilmar International's agricultural operations, particularly its vast palm oil plantations and processing plants, are inherently water-intensive. For instance, in 2023, the company's sustainability reports highlighted ongoing initiatives to monitor and reduce water consumption across its facilities, acknowledging the significant water footprint of these activities.

Water scarcity is a growing environmental challenge that directly impacts Wilmar's supply chain. Regions where Wilmar operates, such as parts of Southeast Asia, are increasingly facing water stress, making efficient water management crucial for operational continuity and responsible resource stewardship.

The company is investing in and implementing advanced water management practices, including water recycling and wastewater treatment technologies. This focus aims to mitigate the environmental impact of its operations and ensure sustainable water use, a key aspect of its environmental, social, and governance (ESG) strategy for 2024 and beyond.

Peatland Management and Fire Prevention

Wilmar International’s operations, particularly its plantation development, face scrutiny regarding peatland management and fire prevention. Historically, developing plantations on peatlands has been linked to substantial carbon emissions, as peat soils store vast amounts of carbon. Furthermore, these areas are highly susceptible to fires, which release greenhouse gases and pose significant environmental risks.

In response to these challenges, Wilmar has committed to a policy of no new peat development. This policy is complemented by the implementation of best management practices for existing cultivated peatlands. These practices aim to maintain high water tables to reduce oxidation and subsidence, thereby mitigating carbon release and fire risk. For instance, by 2023, Wilmar reported managing over 270,000 hectares of oil palm plantations, with ongoing efforts to improve practices on these lands.

Wilmar also utilizes integrated fire-monitoring platforms, often leveraging satellite technology and on-the-ground surveillance. These systems allow for early detection of fires, enabling rapid response and minimizing their spread. Such proactive measures are vital for protecting both the environment and the company’s assets. For example, in 2023, Wilmar’s fire prevention efforts contributed to a reduction in fire incidents within its concession areas compared to previous years, although specific aggregated data for all managed peatlands is still being refined.

- Peatland Carbon Storage: Peatlands globally store an estimated 30% of the world's soil carbon, making their preservation critical for climate change mitigation.

- Wilmar's No Peat Policy: The company's commitment to not developing new plantations on peatlands is a key environmental safeguard.

- Best Management Practices: Efforts include maintaining optimal water levels in cultivated peatlands to reduce emissions and fire susceptibility.

- Fire Monitoring: Advanced platforms are employed for early fire detection and rapid response, a critical component of risk management in tropical regions.

Sustainable Sourcing and Supply Chain Traceability

The increasing consumer and regulatory demand for sustainably sourced agricultural commodities significantly impacts companies like Wilmar International. This trend necessitates robust supply chain management to ensure environmental compliance and meet market expectations.

Wilmar's commitment to achieving high traceability, from plantation to mill, across its global operations is a direct response to these pressures. For instance, as of late 2024, Wilmar reported that over 95% of its palm oil mills in Indonesia and Malaysia were traceable to the plantation level, a critical step in verifying sustainable practices.

- Growing Consumer Demand: Consumers are increasingly scrutinizing the origin and production methods of agricultural products, favoring those with verifiable sustainability credentials.

- Regulatory Scrutiny: Governments worldwide are implementing stricter regulations regarding deforestation, land use, and labor practices in agricultural supply chains.

- Supply Chain Transparency: Wilmar's focus on traceability allows it to demonstrate adherence to environmental standards and build trust with stakeholders.

- Market Access: High levels of traceability are becoming a prerequisite for accessing key international markets and securing premium pricing for sustainably produced goods.

Wilmar International faces significant environmental pressures, particularly concerning deforestation and peatland management in its palm oil operations. The company's No Deforestation, No Peat, No Exploitation (NDPE) policy, covering 99% of its plantation area by the end of 2023, aims to mitigate these impacts by protecting High Conservation Value and High Carbon Stock areas.

The company is also addressing its substantial greenhouse gas emissions, setting targets to reduce Scope 1 and 2 emissions by 33% by 2030 from a 2020 baseline, and increasing renewable energy usage. Water management is another key focus, with initiatives in 2023 to monitor and reduce water consumption across its operations, acknowledging the sector's water intensity and regional water scarcity challenges.

Wilmar's commitment to peatland preservation includes a policy against new peat development and implementing best practices on existing cultivated peatlands to reduce emissions and fire risks. Advanced fire-monitoring systems are also in place, contributing to reduced fire incidents in its concession areas in 2023.

Growing demand for sustainable commodities drives Wilmar's focus on supply chain transparency, with over 95% of its palm oil mills in Indonesia and Malaysia traceable to the plantation level by late 2024, ensuring adherence to environmental standards and market access.

| Environmental Factor | Wilmar's Action/Commitment | Key Data/Target (as of latest reports) |

|---|---|---|

| Deforestation & Biodiversity | NDPE Policy Implementation | Policy covers 99% of plantation area (end 2023) |

| Greenhouse Gas Emissions | Science-Based Target for Emission Reduction | 33% reduction in Scope 1 & 2 emissions by 2030 (vs. 2020 baseline) |

| Peatland Management | No New Peat Development; Best Practices on Existing Peatlands | Managing over 270,000 hectares of oil palm plantations (2023) |

| Water Usage | Water Monitoring & Reduction Initiatives | Ongoing focus on reducing water consumption (2023) |

| Supply Chain Transparency | Traceability to Plantation Level | Over 95% of mills traceable in Indonesia & Malaysia (late 2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Wilmar International is built on a robust foundation of data from official government publications, international economic bodies like the World Bank and IMF, and leading industry-specific market research reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Wilmar.