Wilmar International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wilmar International Bundle

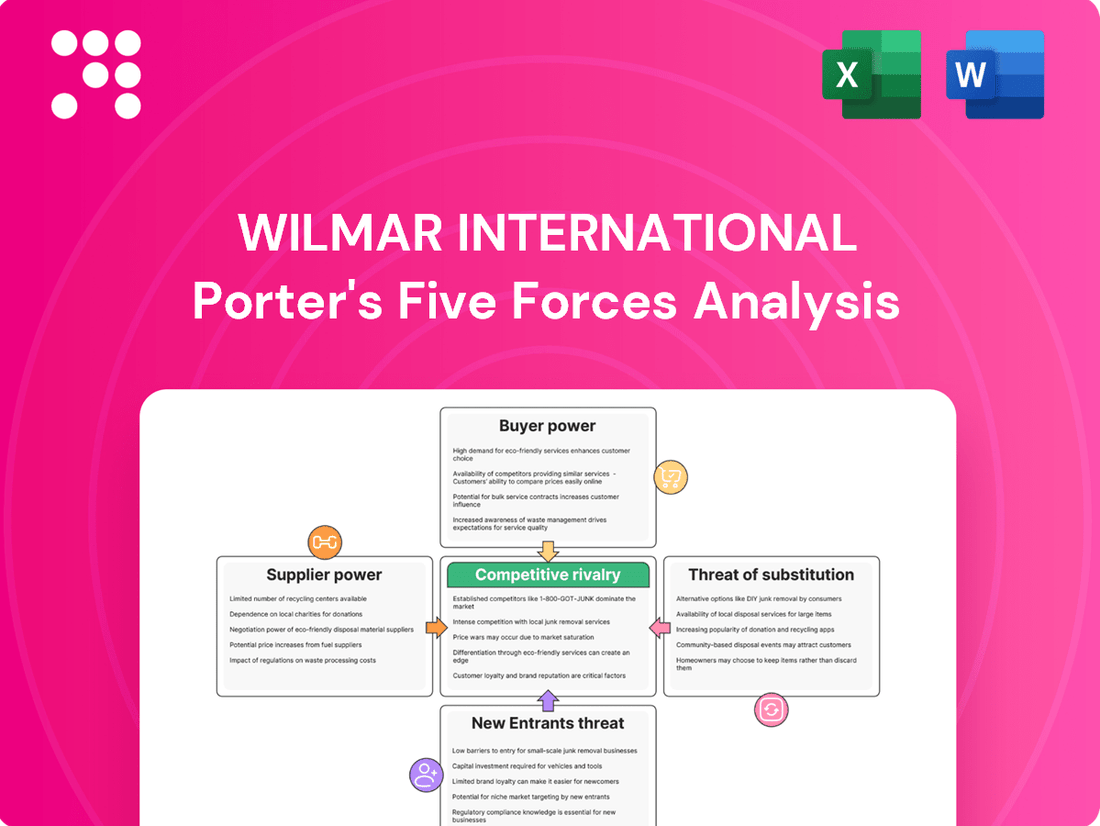

Wilmar International faces significant competitive pressures, particularly from the intense rivalry among existing players and the substantial bargaining power of its buyers in the agricultural commodities sector. Understanding these dynamics is crucial for navigating its complex market landscape.

The complete report reveals the real forces shaping Wilmar International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Wilmar International's reliance on a concentrated group of suppliers for key agricultural commodities such as palm oil, soybeans, and sugarcane significantly bolsters supplier bargaining power. Despite Wilmar's own cultivation and milling operations, substantial external procurement remains essential. For instance, in 2023, the global palm oil market saw significant price volatility, with benchmark prices fluctuating based on supply-demand dynamics, directly impacting Wilmar's procurement costs.

The bargaining power of suppliers for Wilmar International is largely influenced by the uniqueness and differentiation of their inputs. For most agricultural commodities, like palm oil or soybeans, differentiation is minimal, meaning suppliers have less leverage. However, when it comes to specialized inputs such as proprietary oleochemical formulations or advanced fertilizers, suppliers with unique technologies can indeed exert more influence and potentially command higher prices.

Switching costs for Wilmar can be substantial, especially for its integrated processing facilities. These plants are often highly specialized for particular raw materials, meaning a shift to a new supplier could necessitate costly retooling or significant logistical overhauls. For instance, a facility designed for a specific palm oil varietal might require extensive modifications to handle a different type or origin of oil, impacting operational efficiency and capital expenditure.

The complexity of establishing and vetting new suppliers across Wilmar's extensive global network also contributes to higher switching costs. Ensuring consistent quality and reliability from a new source, particularly for key commodities like palm oil or sugar, involves rigorous due diligence, pilot programs, and potential disruptions to production schedules. This inherent difficulty in onboarding new partners grants existing, reliable suppliers a degree of bargaining power.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while theoretically possible, is mitigated for Wilmar International. Large agricultural cooperatives or major commodity traders could potentially move into processing or finished goods, but Wilmar's sheer scale, an advantage evident in its 2024 revenue of over $60 billion, makes this a difficult proposition for any single supplier.

Wilmar's extensive vertical integration, covering everything from sourcing raw materials to distribution and manufacturing, acts as a significant deterrent. This comprehensive control over its value chain leaves fewer opportunities for suppliers to effectively integrate forward and compete.

- Limited Supplier Scale: Individual farmers lack the resources for significant forward integration into processing or consumer goods.

- Wilmar's Dominance: Wilmar's substantial market share and operational scale in agribusiness create high barriers to entry for integrating suppliers.

- Vertical Integration Advantage: Wilmar's control over its supply chain, from farm to fork, minimizes supplier leverage and potential for disruptive forward integration.

Impact of Regulatory and Geopolitical Factors

Regulatory actions, like Indonesia's ongoing investigations into palm oil export permits, directly influence the bargaining power of local suppliers by creating uncertainty and potentially restricting supply. These governmental interventions can disrupt established supply chains, forcing companies like Wilmar International to navigate complex compliance landscapes.

Geopolitical shifts and the resulting volatility in global commodity markets significantly bolster supplier leverage. Fluctuations in the prices of essential raw materials, driven by international relations and trade policies, mean suppliers can often command higher prices, impacting Wilmar's cost structure.

For instance, in 2024, the price of crude palm oil saw considerable swings due to factors like the conflict in Eastern Europe impacting vegetable oil availability and export restrictions from key producing nations. This environment grants suppliers a stronger hand in negotiations.

- Regulatory Uncertainty: Investigations into palm oil export permits in Indonesia, as seen in recent years, can lead to supply disruptions and increased costs for raw materials.

- Commodity Price Volatility: Global commodity market swings, influenced by geopolitical events in 2024, directly affect the cost and availability of key inputs for agribusinesses.

- Supplier Leverage: Increased input costs and supply chain risks empower suppliers to negotiate more favorable terms, potentially impacting profit margins for companies like Wilmar International.

The bargaining power of suppliers for Wilmar International is moderately high, driven by the essential nature of agricultural commodities and the limited number of large-scale producers for certain inputs. While Wilmar's scale offers some counter-leverage, factors like supply chain disruptions and geopolitical events in 2024, which caused significant price volatility for crude palm oil, empower suppliers to negotiate for better terms.

Switching costs are a key factor, as Wilmar's specialized processing facilities require significant investment to adapt to different raw material sources. This inertia benefits existing suppliers who can maintain consistent quality and reliability, thereby solidifying their negotiating position.

Wilmar's extensive vertical integration and market dominance do mitigate some supplier leverage, particularly against smaller entities. However, regulatory actions and global market dynamics that impact supply availability can still provide individual suppliers or cooperatives with considerable bargaining power.

| Factor | Impact on Wilmar | Supporting Data/Context |

| Supplier Concentration | Increases bargaining power | Reliance on key agricultural commodities like palm oil and soybeans. |

| Switching Costs | Strengthens supplier position | Specialized processing facilities require costly retooling for new suppliers. |

| Geopolitical/Regulatory Impact | Enhances supplier leverage | 2024 commodity price volatility and export regulations create supply uncertainty. |

| Wilmar's Scale & Integration | Reduces supplier leverage | Over $60 billion in 2024 revenue and extensive value chain control. |

What is included in the product

This analysis unpacks the competitive forces shaping Wilmar International's agribusiness and food processing sectors, detailing supplier and buyer power, threat of new entrants and substitutes, and the intensity of rivalry.

Quickly identify and mitigate competitive threats with a visual breakdown of Wilmar's industry landscape—empowering proactive strategic adjustments.

Customers Bargaining Power

Wilmar International’s customer base is a mix of large industrial buyers and millions of individual consumers. This broad reach, from major food manufacturers to everyday shoppers, means that while some large clients can negotiate for better terms due to their significant purchase volumes, the sheer number of smaller customers dilutes the overall bargaining power of any single group.

Customers for Wilmar International face significant bargaining power due to the wide availability of substitute products, particularly in the edible oils and food ingredients sectors. For instance, consumers can readily choose between soybean oil, sunflower oil, palm oil, or even alternatives like olive oil or coconut oil, depending on price, availability, and perceived health benefits.

This abundance of choices means that if Wilmar's pricing becomes uncompetitive or product quality falters, customers can easily switch to rival brands or entirely different product categories, such as butter or margarine for cooking. In 2024, the global edible oils market, valued at over $250 billion, is characterized by intense competition and fluctuating commodity prices, further amplifying customer leverage.

Customer switching costs for Wilmar International's consumer goods, such as branded edible oils and flour, are typically quite low. This means individual consumers can easily opt for a competitor's product if they find a better price or a more appealing brand, giving them significant bargaining power.

However, the situation changes for Wilmar's industrial clients. When businesses use Wilmar's specialty fats or oleochemicals as key ingredients in their manufacturing, the costs and complexities associated with switching suppliers can be substantial. These costs can include reformulating products, conducting extensive testing, and obtaining necessary regulatory approvals, all of which increase the switching burden and reduce the bargaining power of these industrial customers.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Wilmar International, especially in its commodity-driven segments. In markets where products are unbranded or sold in large volumes, buyers often prioritize cost. This is particularly evident in the feed and industrial products sectors, where price competition can directly impact Wilmar’s profitability.

The economic climate further amplifies this sensitivity. For instance, a slowdown in consumer spending, as observed in key markets like China during parts of 2023 and early 2024, pushes customers to seek lower prices. This trend intensifies competition and places downward pressure on Wilmar's profit margins.

- Price Sensitivity in Bulk Markets: Customers buying unbranded or bulk food and agricultural commodities are often highly attuned to price differences.

- Impact of Economic Slowdowns: Weak consumer spending in major economies, such as China, increases customer focus on affordability.

- Margin Pressure: Heightened price sensitivity directly translates to reduced margins for Wilmar, particularly in its feed and industrial product divisions.

Information Availability and Product Standardization

The bargaining power of customers is significantly influenced by the availability of information and the standardization of products, particularly in the agricultural and food ingredient sectors. Many of Wilmar International's core products, such as palm oil and sugar, are commodities. This means customers can readily access and compare pricing across various suppliers. For instance, in 2024, global benchmark prices for palm oil fluctuated, offering buyers ample opportunities to negotiate based on prevailing market rates.

This transparency inherently limits Wilmar's capacity to charge premium prices based on product differentiation alone. Customers can easily identify the lowest available prices for standardized goods. However, Wilmar leverages its strong brand equity, especially in its consumer goods division, to create perceived value. A reputation for quality and healthy food options allows Wilmar to stand out, even within a market characterized by commodity products, thereby mitigating some of the customer bargaining power.

- Commoditization: Many agricultural commodities and basic food ingredients are highly standardized, making price comparison easy for customers.

- Information Transparency: Increased market information availability empowers customers to negotiate effectively, reducing Wilmar's pricing power.

- Brand Differentiation: Wilmar's established brand reputation for quality and healthy food in its consumer segment helps to differentiate its offerings and counter customer pressure.

- Market Dynamics: In 2024, volatile commodity prices for products like palm oil provided customers with leverage to seek better deals from suppliers like Wilmar.

Wilmar International faces considerable customer bargaining power, largely due to the wide availability of substitutes and low switching costs for many of its products, especially in the edible oils and food ingredients sectors. While industrial clients may face higher switching burdens for specialty products, the overall market's price sensitivity and information transparency empower customers to negotiate favorable terms.

| Factor | Impact on Wilmar | 2024 Data/Context |

|---|---|---|

| Availability of Substitutes | High | Consumers can easily switch between various edible oils (palm, soy, sunflower) and fats. |

| Switching Costs (Consumer Goods) | Low | Individual consumers can readily choose competitor brands for products like flour and cooking oil. |

| Price Sensitivity | High (especially in bulk/unbranded) | Economic slowdowns, like those seen in China in early 2024, increase customer focus on affordability. |

| Information Transparency | High (for commodities) | Customers can compare prices easily for standardized products like palm oil, with global benchmark prices fluctuating. |

Same Document Delivered

Wilmar International Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Wilmar International, detailing the competitive landscape and strategic implications for the agribusiness giant. The document you see here is precisely what you'll receive, fully formatted and ready for immediate use after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

Wilmar International faces a highly competitive landscape, with major global agribusiness players like Archer Daniels Midland (ADM), Bunge, Golden Agri-Resources, and Olam Group vying for market share. These giants operate across the entire agricultural value chain, from growing crops to selling finished products, intensifying rivalry.

The sheer number of diversified competitors means Wilmar must constantly innovate and optimize its operations. For instance, in 2023, ADM reported revenues of $105 billion, highlighting the scale of its operations and competitive threat. Similarly, Bunge's agribusiness segment is a formidable force, with significant global reach.

Beyond these large, multinational corporations, the market is further fragmented by numerous strong regional players. These companies, while perhaps smaller individually, collectively exert considerable pressure on Wilmar, particularly in specific geographic markets, making market dominance a continuous challenge.

The growth rate within the agricultural commodity and food products sector, while generally stable in demand, shows significant variation across different segments. This uneven growth can create pockets of intense competition as companies vie for market share in expanding areas.

Wilmar International, for instance, has seen its performance influenced by slower retail consumption and heightened competition, particularly impacting its operations in China. This suggests that even in a stable overall market, specific regional or product segment growth rates can be modest, amplifying rivalry.

In mature markets, where growth is inherently slower, the struggle for market share becomes even more pronounced. Companies like Wilmar must navigate these environments carefully, as the limited expansion intensifies the competitive pressure among established players seeking to maintain or increase their positions.

Wilmar International faces intense competition, particularly in its bulk commodity sectors where products are largely undifferentiated, resulting in significant price-based rivalry. This means companies often compete primarily on cost efficiency to capture market share.

However, Wilmar actively pursues product differentiation in its consumer goods segment. By investing in brand building and emphasizing quality and health benefits, such as with its edible oils and packaged foods, the company aims to cultivate stronger customer loyalty and reduce direct price sensitivity. For instance, in 2024, Wilmar continued to expand its range of healthier oil alternatives, responding to growing consumer demand for wellness-focused products.

Exit Barriers

Wilmar International, like many in the agribusiness sector, faces substantial exit barriers. The sheer scale of investment required for plantations, processing facilities, and sophisticated distribution infrastructure represents significant sunk costs. These high initial outlays mean that exiting the market is not a simple decision; companies are often compelled to continue operations even when profitability is low, simply to recoup some of their invested capital.

This persistence in the face of adverse market conditions can exacerbate competitive intensity. For instance, in the palm oil industry, where Wilmar is a major player, substantial investments in refining capacity can lead to overcapacity during downturns. Companies are reluctant to shut down expensive plants, leading to continued supply and pressure on prices, a dynamic that impacts all participants, including Wilmar.

- High Capital Intensity: Agribusinesses require massive upfront investments in land, cultivation, processing, and logistics, making it costly to divest.

- Sunk Costs: Once invested, these costs are largely irrecoverable, encouraging continued operation even in unprofitable periods.

- Industry Overcapacity: Exit barriers can contribute to persistent oversupply in certain segments, like palm oil refining, intensifying competition.

- Operational Interdependence: Integrated supply chains mean that exiting one segment can disrupt others, further complicating divestment.

Strategic Acquisitions and Partnerships

Wilmar International's competitive rivalry is heightened by its proactive approach to strategic acquisitions and partnerships. For instance, its acquisition of a majority stake in AWL Agri Business in India and a joint venture in Nigeria demonstrate a clear strategy to bolster its global presence and competitive edge.

These moves by Wilmar, alongside similar aggressive expansion tactics from other major agribusiness players, directly intensify rivalry. Companies are actively competing for dominance in crucial markets and seeking to secure control over vital supply chains. This dynamic forces competitors to constantly innovate and adapt to maintain market share.

- Strategic Acquisitions: Wilmar's acquisition of a majority stake in AWL Agri Business in India, finalized in early 2024, signifies its commitment to expanding its footprint in key emerging markets.

- Joint Ventures: The company's establishment of a joint venture in Nigeria in late 2023 aims to tap into the growing West African agricultural sector.

- Intensified Competition: These strategic maneuvers by Wilmar and its peers lead to a more aggressive competitive landscape, with companies vying for market leadership and supply chain integration.

Wilmar International operates in a highly competitive environment, facing formidable rivals like ADM, Bunge, and Olam Group. These global players, with extensive value chain integration, intensify rivalry through scale and diversification. For example, ADM's 2023 revenue of $105 billion underscores the immense competitive pressure.

The market's fragmentation with numerous regional players further amplifies competition, particularly in specific geographies. Wilmar's strategy to differentiate in consumer goods, such as healthier oil alternatives in 2024, aims to mitigate price-based rivalry prevalent in its bulk commodity sectors.

High exit barriers, due to substantial capital investments in agribusiness infrastructure, compel companies to persist even in low-profitability periods, thereby sustaining competitive intensity. This is evident in sectors like palm oil, where overcapacity can lead to prolonged price pressures for all participants.

Wilmar's strategic acquisitions, like the majority stake in AWL Agri Business in India in early 2024, and joint ventures, such as in Nigeria in late 2023, actively escalate competition as firms vie for market dominance and supply chain control.

SSubstitutes Threaten

The threat of substitutes for Wilmar International, particularly in the edible oils sector, is substantial. Consumers and food manufacturers can readily switch between various oils like soybean, sunflower, and rapeseed oil, depending on price and perceived quality. This availability of alternatives directly impacts Wilmar's market position and pricing power.

In 2024, global edible oil markets experienced significant price volatility. For instance, soybean oil prices, a key substitute for palm oil, saw fluctuations driven by weather patterns in South America and demand from China. This dynamic means Wilmar must constantly monitor and adapt its strategies to remain competitive against these readily available and often price-sensitive alternatives.

Consumer preferences are shifting significantly, with a growing emphasis on healthier food options and specific dietary trends like plant-based eating. This evolution directly impacts demand for traditional ingredients, potentially driving consumers towards substitutes. For instance, the increasing consumer awareness around the environmental impact of palm oil has led to a rise in demand for alternative oils and fats, putting pressure on companies like Wilmar International.

In 2024, the global plant-based food market is projected to reach over $74 billion, highlighting a substantial shift away from animal-based products and potentially impacting demand for traditional agricultural commodities. Wilmar International, a major player in palm oil, is therefore increasingly focused on demonstrating its commitment to sustainability and responsible sourcing to mitigate the threat of substitution driven by these evolving consumer values.

Innovations in food science are introducing new substitute products that could challenge traditional agricultural commodities and processed foods. For instance, the plant-based protein market is experiencing significant growth, with global sales projected to reach $165 billion by 2030, according to Bloomberg Intelligence. This trend presents a potential long-term disruption to segments of Wilmar's food products business, as consumers increasingly seek novel alternatives to conventional ingredients.

Availability of Alternative Energy Sources

Wilmar International's biodiesel segment faces a significant threat from alternative energy sources. The economic viability of biodiesel is directly tied to crude oil prices; when oil prices are low, traditional fossil fuels become more attractive, diminishing the appeal of biofuels. For instance, in early 2024, crude oil prices fluctuated, impacting the cost competitiveness of biodiesel against petroleum diesel.

Government regulations and subsidies play a crucial role in shaping the substitute threat. Policies that favor renewable energy or impose carbon taxes can make biodiesel more competitive. Conversely, a rollback of such support can weaken its position. The development of more cost-effective or environmentally friendly alternatives, such as advanced biofuels derived from non-food sources or even emerging technologies like green hydrogen, also poses a growing substitution risk.

- Crude Oil Price Impact: Fluctuations in crude oil prices directly influence the cost-competitiveness of Wilmar's biodiesel against fossil fuels.

- Regulatory Influence: Government policies, including mandates and incentives for renewable fuels, significantly affect the demand for biodiesel.

- Emerging Alternatives: The continuous development of more efficient and sustainable alternative energy sources presents a persistent threat of substitution.

Switching Costs for Buyers to Substitutes

For many of Wilmar International's products, the costs for buyers to switch to substitutes are quite low. This is especially true when the alternative offers a similar value proposition in terms of price and performance. For instance, a food producer might readily shift between various vegetable oils depending on market prices and supply, thereby elevating the influence of substitute products.

The ease of switching can significantly impact Wilmar's pricing power and market share. In 2024, the global edible oils market saw significant price volatility, with palm oil, soybean oil, and sunflower oil prices fluctuating. This volatility encourages buyers to explore alternatives, making the threat of substitutes a constant consideration for Wilmar's product lines.

- Low Buyer Switching Costs: Many of Wilmar's core products, like edible oils and grains, face minimal switching costs for buyers.

- Price-Performance Ratio is Key: Buyers can easily opt for substitute products if they offer a comparable or better price-performance ratio.

- Example in Food Manufacturing: A food manufacturer can switch between different vegetable oils based on cost and availability, highlighting the power of substitutes.

- Market Volatility Enhances Threat: Price fluctuations in commodities like palm oil in 2024 incentivize buyers to explore and adopt alternative ingredients.

The threat of substitutes for Wilmar International is significant across its diverse product portfolio, particularly in edible oils and biodiesel. Low switching costs for buyers and the availability of comparable alternatives mean Wilmar must remain highly competitive on price and quality. For instance, in 2024, the fluctuating prices of soybean oil, a direct substitute for palm oil, underscored this pressure.

| Product Category | Key Substitutes | 2024 Market Dynamic Impact |

|---|---|---|

| Edible Oils | Soybean Oil, Sunflower Oil, Rapeseed Oil | Price volatility due to South American weather and Chinese demand influenced buyer switching. |

| Biodiesel | Fossil Fuels (Diesel) | Crude oil price fluctuations in early 2024 affected biodiesel's cost-competitiveness. |

| Plant-Based Foods | Alternative oils and fats, novel ingredients | Growing consumer preference for plant-based options ($74B market projected in 2024) pressures traditional ingredients. |

Entrants Threaten

The agribusiness sector, especially at Wilmar's immense scale covering cultivation, processing, and distribution, necessitates enormous capital outlays. For instance, establishing large-scale palm oil plantations alone can cost hundreds of millions of dollars, plus the expense of building refineries and logistics.

This high barrier to entry, requiring substantial financial backing for land acquisition, infrastructure development, and operational setup, significantly discourages new companies from entering the market. Wilmar's integrated model, from farm to fork, amplifies these capital demands, making it exceedingly difficult for smaller players to compete.

Wilmar International leverages significant economies of scale across its vast agribusiness operations, from palm oil plantations to global distribution networks. In 2024, its integrated model, encompassing cultivation, milling, refining, and logistics, allows for substantial cost efficiencies, making it challenging for new entrants to match its per-unit pricing power.

The company's deep-rooted experience in commodity trading and processing, built over decades, translates into an experience curve advantage. This accumulated knowledge in operational efficiency and market navigation in 2024 presents a formidable barrier, as newer players lack the same learning curve benefits and established market understanding.

Wilmar International's extensive global distribution network, reaching over 50 countries including major markets like China and India, presents a significant barrier. New entrants would need to invest heavily to replicate this reach, especially for consumer-packaged goods where shelf space and logistics are paramount.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants in the agribusiness sector where Wilmar International operates. The industry faces a complex web of rules regarding land use, environmental protection, and food safety. For instance, stringent 'No Deforestation, No Peat, No Exploitation' policies, particularly relevant for palm oil production, necessitate substantial upfront investment in sustainable practices and compliance infrastructure, creating a high barrier for newcomers.

Navigating these regulatory landscapes demands specialized knowledge and can involve considerable compliance costs. New entrants must invest in understanding and adhering to these diverse requirements, which can be prohibitive. For example, in 2024, the European Union's Deforestation Regulation (EUDR) places new obligations on companies importing commodities like palm oil, requiring due diligence to ensure products are deforestation-free, adding another layer of complexity and cost for potential new players.

The capital required to meet these standards acts as a deterrent. Companies must demonstrate not only operational efficiency but also robust environmental and social governance (ESG) compliance from the outset. This can involve significant investment in traceability systems, certification processes, and sustainable sourcing strategies, making it challenging for smaller or less capitalized entities to enter the market competitively.

- Stringent Environmental Policies: Regulations like the EUDR require extensive due diligence for commodities such as palm oil, increasing compliance costs and complexity for new entrants.

- Food Safety Standards: Adhering to evolving food safety regulations requires significant investment in quality control and supply chain management, acting as a barrier to entry.

- Land Use Regulations: Complex land use policies and permitting processes can be time-consuming and costly, deterring new companies from establishing operations.

Brand Loyalty and Established Relationships

Wilmar International benefits significantly from its deeply ingrained brand loyalty, particularly within its consumer food products division. Decades of delivering quality and promoting healthy eating have fostered strong consumer trust. For instance, in 2024, Wilmar's edible oils segment continued to see robust demand, reflecting this established preference.

New competitors face a formidable barrier in replicating this customer allegiance. They would need substantial capital investment in marketing and brand development to even begin challenging Wilmar's established market position. This is further compounded by the strong, long-standing relationships Wilmar maintains with industrial buyers, making market penetration a complex and costly endeavor.

- Brand Recognition: Wilmar's consumer food brands are household names, built over years of consistent quality.

- Consumer Loyalty: Established trust in healthy food offerings makes switching difficult for consumers.

- Industrial Relationships: Strong ties with business customers create a further hurdle for new entrants.

- Marketing Investment: New players require significant spending to build awareness and preference against Wilmar.

The threat of new entrants for Wilmar International is generally low due to substantial barriers. The agribusiness sector, particularly at Wilmar's scale, demands immense capital for land, infrastructure, and operations. For example, establishing large-scale palm oil plantations and processing facilities requires hundreds of millions of dollars, a significant hurdle for newcomers.

Wilmar's integrated business model, spanning cultivation to distribution, generates significant economies of scale and cost efficiencies that are difficult for new players to match. This, combined with decades of market experience and established brand loyalty in consumer goods, further deters potential entrants. Moreover, stringent government regulations and policies, such as the EUDR, add compliance costs and complexity, acting as another deterrent.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High initial investment for land, infrastructure, and operations. | Significant deterrent due to substantial financial needs. |

| Economies of Scale | Cost advantages from large-scale, integrated operations. | New entrants struggle to compete on price and efficiency. |

| Brand Loyalty & Relationships | Established consumer trust and strong industrial buyer ties. | Difficult for new players to gain market share and customer preference. |

| Government Regulations | Complex environmental, safety, and land use policies (e.g., EUDR). | Increases compliance costs and operational complexity, raising entry barriers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Wilmar International is built upon a foundation of verified data, including Wilmar's annual reports, industry-specific market research from firms like Euromonitor and IBISWorld, and relevant government and trade association publications.