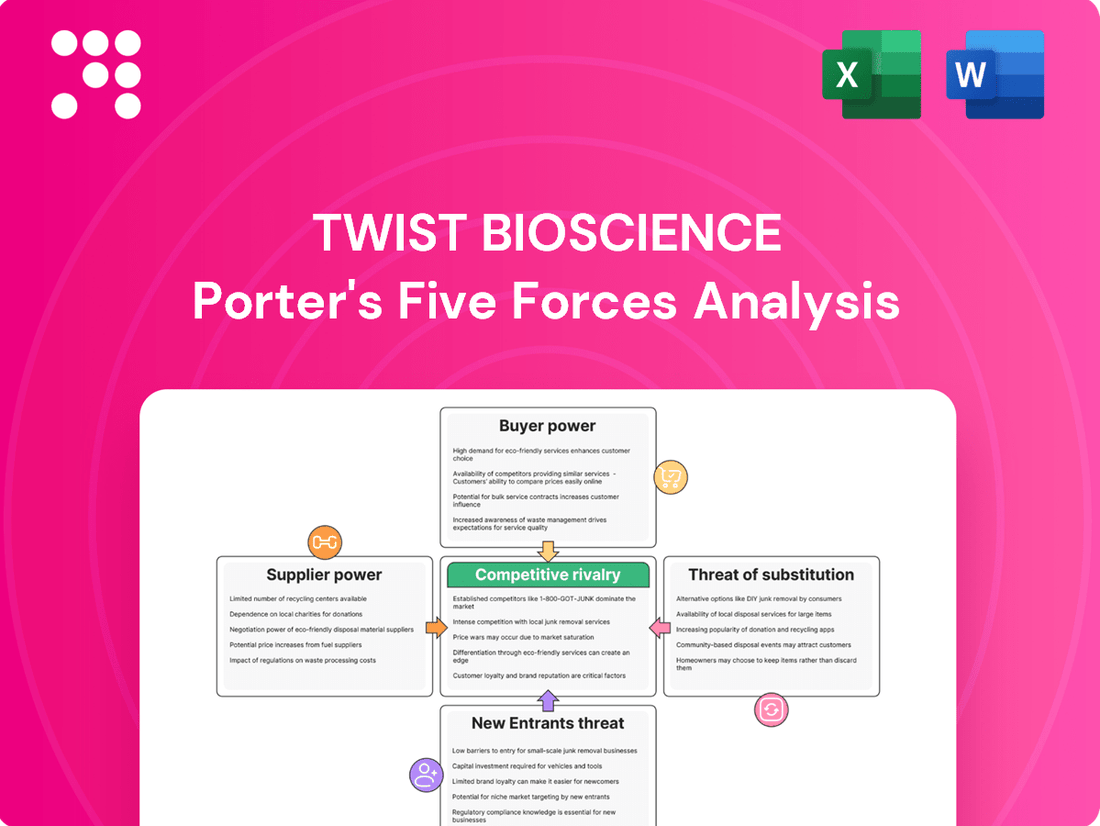

Twist Bioscience Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Twist Bioscience Bundle

Twist Bioscience operates in a dynamic biotech landscape, facing moderate threats from new entrants and substantial bargaining power from buyers due to the critical nature of DNA synthesis. The intensity of rivalry is significant, driven by technological advancements and the need for rapid innovation.

The complete report reveals the real forces shaping Twist Bioscience’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Twist Bioscience's reliance on its proprietary silicon-based DNA synthesis platform means it likely depends on specialized raw materials and components. These critical inputs may only be available from a select group of suppliers, granting them substantial leverage. For instance, if a key chemical or a highly precise component for their silicon wafers is only produced by a handful of companies, those suppliers can command higher prices or dictate terms.

The bargaining power of suppliers for Twist Bioscience is significantly influenced by the high switching costs associated with its silicon-based DNA synthesis platform. Shifting to alternative suppliers for critical components or raw materials would necessitate substantial investments for Twist Bioscience, potentially including redesigning manufacturing processes and re-validating materials. These considerable switching costs empower existing suppliers by limiting Twist's flexibility and leverage in price negotiations.

If the raw materials or specialized chemicals Twist Bioscience needs for its synthetic DNA are highly unique and difficult for other companies to produce, those suppliers gain significant leverage. This could be due to proprietary manufacturing processes or specific purity standards that are essential for Twist's advanced applications.

For instance, if a key reagent is only available from a single source with patented technology, that supplier can command higher prices. In 2023, the global market for specialty chemicals, which would include such reagents, was valued at over $600 billion, indicating the importance of specialized inputs.

Potential for Forward Integration by Suppliers

The potential for suppliers to integrate forward into DNA synthesis presents a significant, albeit less common, threat to Twist Bioscience. If a supplier of a crucial component, such as specialized enzymes or reagents, possessed the technical expertise and market opportunity to begin manufacturing synthetic DNA themselves, their leverage would dramatically increase.

This looming threat of forward integration compels Twist Bioscience to cultivate strong, mutually beneficial relationships with its key suppliers. Maintaining competitive pricing and ensuring reliable supply chains are paramount to mitigating this risk. For instance, a supplier of high-purity nucleotides, a fundamental building block, could theoretically develop its own synthesis capabilities, directly competing with its customers.

- Supplier Forward Integration Threat: Suppliers of critical DNA synthesis inputs could enter the synthetic DNA market, increasing their bargaining power.

- Impact on Twist Bioscience: This potential competition pressures Twist to maintain favorable supplier relationships and pricing.

- Example Scenario: A provider of specialized enzymes or high-purity reagents might develop in-house DNA synthesis capabilities.

Impact of Supplier Concentration in Synthetic Biology Market

The synthetic biology market, though expanding, exhibits supplier concentration for crucial, specialized components. This means that if a few suppliers dominate the production of a particular gene synthesis technology or a unique enzyme, their ability to dictate terms to companies like Twist Bioscience is significantly amplified. For instance, while the overall synthetic biology market is projected to reach over $30 billion by 2025, the availability of highly specific reagents or advanced manufacturing equipment might be limited to a handful of providers.

When demand for these specialized offerings outstrips supply, suppliers gain considerable leverage. This situation can translate into higher prices for essential inputs, longer lead times, and less favorable contract terms for companies relying on these suppliers. In 2024, the increasing complexity of synthetic biology applications, such as the development of novel therapeutics and advanced materials, further heightens the demand for these niche products, thereby strengthening supplier bargaining power.

- Supplier Concentration: Certain critical components within the synthetic biology sector are provided by a limited number of specialized firms.

- Demand-Supply Imbalance: High demand coupled with restricted supply for specific synthetic biology inputs empowers suppliers.

- Impact on Twist Bioscience: Increased supplier bargaining power can lead to higher costs and less favorable terms for companies like Twist Bioscience.

- Market Dynamics: The growing sophistication of synthetic biology applications in 2024 intensifies the need for specialized inputs, bolstering supplier influence.

The bargaining power of suppliers for Twist Bioscience is substantial due to the specialized nature of its silicon-based DNA synthesis platform. This reliance on unique raw materials and components, often sourced from a limited number of providers, grants these suppliers significant leverage. For instance, if a critical chemical or a precise component for their silicon wafers is produced by only a few companies, those suppliers can dictate higher prices or more stringent terms.

The high switching costs associated with Twist Bioscience's proprietary technology further empower its suppliers. Shifting to alternative suppliers would require significant investment in process redesign and material re-validation, making it difficult for Twist to change providers. This lack of flexibility strengthens the hand of existing suppliers in price negotiations.

Supplier concentration within the synthetic biology market, particularly for specialized components, amplifies their bargaining power. When demand for these niche products exceeds supply, suppliers can command higher prices and impose less favorable contract terms. In 2024, the increasing complexity of synthetic biology applications, such as novel therapeutics, further intensifies the demand for these specialized inputs, thus bolstering supplier influence.

| Factor | Impact on Twist Bioscience | Example Data/Scenario |

|---|---|---|

| Supplier Concentration | Limited suppliers for critical components grant them significant leverage. | Few providers for specialized enzymes or advanced manufacturing equipment in synthetic biology. |

| Switching Costs | High costs to change suppliers limit Twist's flexibility and negotiation power. | Need for process redesign and material re-validation for silicon wafer components. |

| Demand-Supply Imbalance | High demand for specialized inputs strengthens supplier pricing power. | Increased demand for niche reagents due to complex synthetic biology applications in 2024. |

| Forward Integration Threat | Potential for suppliers to enter the synthetic DNA market increases their leverage. | A supplier of high-purity nucleotides could develop its own synthesis capabilities. |

What is included in the product

This Porter's Five Forces analysis for Twist Bioscience dissects the competitive landscape, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on the synthetic biology market.

Instantly visualize the competitive landscape and identify key leverage points with a dynamic, interactive dashboard.

Customers Bargaining Power

Twist Bioscience serves a wide array of sectors, including pharmaceuticals, diagnostics, agriculture, and technology. This diversification is key, as it means the company isn't overly dependent on any single industry or client.

The company's customer base is also expanding, showing healthy growth. In the second quarter of fiscal year 2025, Twist Bioscience shipped products to approximately 2,431 customers, a notable increase from the 2,253 customers served in the second quarter of fiscal year 2024. This expanding reach dilutes the influence any one customer can exert.

Customers integrating Twist Bioscience's synthetic DNA into their research face significant hurdles if they consider switching providers. These hurdles, often referred to as switching costs, can be substantial, directly impacting their leverage.

These costs can manifest in several ways, including the need for extensive re-validation of existing protocols and the re-optimization of experimental workflows. Imagine a biotech firm that has spent months perfecting a process using Twist's DNA; switching would mean repeating much of that foundational work.

The potential for project delays is another critical factor. If a company is on a tight deadline for drug discovery or diagnostic development, a disruption caused by switching DNA suppliers could have severe financial and strategic consequences. For instance, a delay in a clinical trial due to supplier change could cost millions.

These high switching costs effectively reduce the bargaining power of customers. Knowing that changing providers is costly and time-consuming, customers are less likely to demand significant price concessions or favorable terms, as the risk of disruption outweighs the potential benefits.

Twist Bioscience’s commitment to delivering high-quality, rapid, and precise DNA synthesis significantly impacts customer bargaining power. For companies in fast-paced sectors like drug discovery, where time-to-market is critical, the speed and accuracy offered by Twist Bioscience can outweigh minor price differences, thereby reducing customers’ price sensitivity.

Customer Concentration Risk

Customer concentration risk is a key factor in Twist Bioscience's bargaining power of customers. While Twist serves a broad market, a few major pharmaceutical or biotech firms could account for a substantial portion of its revenue. This concentration gives these key clients more leverage to negotiate better pricing or more favorable contract terms.

For instance, if a handful of large customers represent, say, 30% or more of Twist's total sales, their departure or demands could significantly impact the company's financial performance. This reliance on a few major players inherently increases their bargaining power.

- High Revenue Dependence: A significant percentage of revenue tied to a small number of clients increases their negotiation leverage.

- Price Pressure: Large customers can demand lower prices, impacting Twist's profit margins.

- Favorable Terms: These clients may push for more advantageous payment schedules or service level agreements.

- Switching Costs: While high for some, if switching costs are manageable for these large clients, their bargaining power is amplified.

Availability of Alternative Synthesis Providers

While Twist Bioscience operates a proprietary gene synthesis platform, the market still offers a range of alternative providers. Companies such as GenScript, Integrated DNA Technologies (IDT), and Eurofins Genomics provide customers with choices for their gene synthesis needs.

These competitors often present comparable pricing structures and delivery timelines, which naturally places some downward pressure on Twist Bioscience's ability to dictate prices. For instance, in 2023, the global gene synthesis market was valued at approximately $7.5 billion, with numerous players vying for market share, highlighting the competitive landscape.

- Alternative Providers: GenScript, IDT, and Eurofins Genomics offer competitive gene synthesis solutions.

- Pricing Pressure: The availability of alternatives limits Twist Bioscience's pricing power.

- Market Competition: The gene synthesis market, valued at roughly $7.5 billion in 2023, features multiple established competitors.

While Twist Bioscience's expanding customer base and high switching costs generally limit customer bargaining power, the presence of alternative providers and potential customer concentration introduce counterbalancing forces.

The availability of competitors like GenScript, IDT, and Eurofins Genomics, operating within a roughly $7.5 billion gene synthesis market in 2023, means customers have choices, which can exert price pressure.

However, the significant investment required for customers to switch, involving re-validation and workflow re-optimization, often makes sticking with Twist Bioscience the more practical option, thereby dampening customer leverage.

The balance is further influenced by whether a few large clients represent a disproportionate share of Twist's revenue, as this concentration would grant those key customers increased bargaining power.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Context |

| Switching Costs | Lowers Power | Re-validation of protocols, workflow re-optimization, potential project delays. |

| Customer Base Size | Lowers Power | ~2,431 customers in Q2 FY25, up from ~2,253 in Q2 FY24, diluting individual influence. |

| Alternative Providers | Increases Power | GenScript, IDT, Eurofins Genomics offer competitive solutions. |

| Market Competition | Increases Power | Gene synthesis market valued at ~$7.5 billion in 2023, with multiple players. |

| Customer Concentration | Potentially Increases Power | High revenue dependence on a few major clients grants them greater negotiation leverage. |

Preview the Actual Deliverable

Twist Bioscience Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Twist Bioscience, presenting the identical document you will receive immediately after purchase. You're looking at the actual, fully formatted analysis, detailing the competitive landscape, industry rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the threat of substitute products or services for Twist Bioscience. Once you complete your purchase, you’ll get instant access to this exact, ready-to-use file, allowing you to leverage its insights without delay.

Rivalry Among Competitors

The synthetic biology and DNA synthesis market is a crowded space, featuring formidable competitors. Companies like GenScript, Integrated DNA Technologies (IDT), and Thermo Fisher Scientific are major players, offering a broad spectrum of DNA synthesis services and products. This robust competition directly impacts pricing and innovation within the industry.

Twist Bioscience leverages its unique silicon-based DNA synthesis platform, enabling faster and more cost-effective production compared to traditional methods. This technological edge allows them to offer high-quality, custom DNA sequences with impressive precision.

However, the competitive landscape is fierce, with rivals like GenScript focusing on advanced error correction algorithms and Integrated DNA Technologies (IDT) emphasizing rapid delivery times. These ongoing investments in technological differentiation mean Twist Bioscience faces constant pressure to innovate and maintain its leadership position in the synthetic biology market.

The global synthetic biology market is booming, with projections indicating it could reach over $100 billion by 2028, demonstrating its significant attractiveness. This rapid expansion fuels intense competition among established players and new entrants alike, all vying for a larger piece of this lucrative pie.

This high growth environment naturally encourages substantial investment from existing companies. They are pouring resources into research, development, and scaling up production to maintain or expand their market share, leading to aggressive competitive strategies and a dynamic marketplace.

Pricing Strategies and Cost Advantages

Twist Bioscience targets cost-effectiveness, boasting a production cost advantage of $0.003 per base. This focus on efficiency allows them to compete aggressively on price, a critical factor in the synthetic biology market.

Competitors in this space also prioritize efficient production and competitive pricing. The ability to offer lower prices or faster turnaround times directly influences market share and overall competitive standing, often intensifying price-based rivalry.

- Cost Advantage: Twist Bioscience's $0.003 per base cost is a key differentiator.

- Price Sensitivity: Customers often choose suppliers based on price and delivery speed.

- Competitive Pressure: Rivals are driven to match or beat pricing and efficiency benchmarks.

- Market Dynamics: Lower prices and quicker service directly impact customer acquisition and retention.

Breadth of Product Offerings and Applications

Competitive rivalry intensifies as companies expand their product portfolios and the applications they serve. Twist Bioscience, for instance, offers a wide array of synthetic biology tools, including synthetic genes, oligo pools, and next-generation sequencing (NGS) target enrichment solutions. These products cater to a broad spectrum of industries, from pharmaceutical drug discovery to agricultural advancements and even novel data storage methods.

This breadth is a key battleground. Competitors are also actively broadening their offerings to capture a larger share of the market. For example, companies like Integrated DNA Technologies (IDT) and Agilent Technologies provide a range of gene synthesis and oligonucleotide services, directly competing with Twist Bioscience across various applications. The ability to serve multiple market segments with a comprehensive suite of products is crucial for maintaining a competitive edge.

- Product Diversification: Companies are expanding beyond basic gene synthesis to include more complex DNA constructs, libraries, and specialized reagents.

- Application Expansion: Competitors are developing solutions tailored for emerging fields like synthetic genomics, personalized medicine, and advanced biofuels.

- Market Penetration: A wider product range allows companies to address a broader customer base, from academic research labs to large industrial biotechnology firms.

- Technological Advancement: The drive to offer more sophisticated and application-specific products fuels innovation and increases the intensity of rivalry.

The synthetic biology market is characterized by intense rivalry, with companies like GenScript, IDT, and Thermo Fisher Scientific being significant competitors. Twist Bioscience differentiates itself through its silicon-based DNA synthesis platform, offering faster and more cost-effective production with high precision, aiming for a production cost advantage of $0.003 per base.

Competitors are also investing heavily in technology and expanding their product portfolios to capture market share in this rapidly growing sector, projected to exceed $100 billion by 2028. This includes offering a broad range of synthetic biology tools and catering to diverse applications from drug discovery to advanced biofuels.

The competitive landscape necessitates continuous innovation and aggressive pricing strategies, as customers often prioritize cost and delivery speed. Companies are driven to match or surpass efficiency benchmarks, leading to a dynamic marketplace where product diversification and application expansion are key battlegrounds.

| Key Competitor | Primary Differentiator | Key Product Area | Estimated Market Presence (Illustrative) |

| GenScript | Advanced error correction algorithms | Custom gene synthesis, peptide synthesis | Strong global presence, diverse customer base |

| Integrated DNA Technologies (IDT) | Rapid delivery times, broad oligo portfolio | Oligonucleotides, gene synthesis, NGS solutions | Leading provider in life science research tools |

| Thermo Fisher Scientific | Extensive product and service ecosystem | Broad range of life science reagents, instruments, and services | Dominant player across multiple scientific disciplines |

| Twist Bioscience | Silicon-based DNA synthesis platform | Synthetic genes, oligo pools, NGS target enrichment | Rapidly growing, focus on cost-efficiency and scale |

SSubstitutes Threaten

While Twist Bioscience's silicon-based platform is innovative, traditional gene synthesis methods remain a viable substitute. Companies offering services using established, albeit potentially slower, enzymatic or ligation-based approaches can fulfill less demanding or smaller-scale DNA synthesis needs.

These alternative providers, often with long-standing reputations, present a threat by offering competitive pricing or specialized services that may appeal to certain market segments. For instance, some academic labs or smaller biotech firms might opt for these traditional methods if throughput is not a primary concern and cost-effectiveness is paramount.

CRISPR-Cas9 and other gene editing technologies present a compelling substitute threat to the synthetic DNA market. These tools enable targeted modifications of existing genetic material, offering an alternative to creating new DNA sequences from scratch for applications such as gene therapy development and disease research. For instance, advancements in CRISPR have accelerated the creation of cell and animal models for disease study, potentially decreasing reliance on custom DNA synthesis for these specific research needs.

For certain research needs, direct cloning from natural sources or established molecular biology techniques can act as substitutes for purchasing synthetic DNA. While synthetic DNA provides rapid turnaround and tailored sequences, these older methods are still practical for specific scientific endeavors.

In-house DNA Synthesis Capabilities of Customers

Large pharmaceutical companies and major academic research institutions possess the resources to invest in and develop their own DNA synthesis capabilities. This internal development acts as a significant threat of substitution, as it directly reduces their need for external suppliers like Twist Bioscience.

The decision for these entities to synthesize DNA in-house hinges on a cost-benefit analysis. If internal operational costs and efficiency metrics become competitive with or surpass those offered by specialized providers, the allure of outsourcing diminishes considerably. For instance, a company might project savings of 15-20% on synthesis costs by bringing operations in-house, especially for high-volume, routine orders.

- In-house Investment: Major players can allocate significant capital towards advanced synthesis equipment and skilled personnel.

- Cost-Benefit Analysis: The 'make or buy' decision is driven by internal cost-efficiency compared to external provider pricing.

- Strategic Independence: Developing internal capabilities offers greater control over timelines and proprietary processes.

Evolving Bio-manufacturing Approaches

The synthetic biology landscape is a hotbed of innovation, with new bio-manufacturing methods constantly surfacing. These emerging techniques could potentially offer alternatives to traditional, large-scale synthetic DNA production. For instance, advancements in cell-free protein synthesis or direct microbial fermentation for producing complex molecules might reduce reliance on custom DNA sequences, presenting a long-term substitute threat to companies like Twist Bioscience.

Consider the rapid progress in areas like CRISPR-based gene editing and engineered cellular systems. These technologies allow for direct manipulation of biological processes or the creation of novel biological factories. By 2024, the synthetic biology market was valued at approximately $10.7 billion, with significant investment flowing into platform technologies that could redefine manufacturing pathways. This dynamic suggests a future where the need for extensive synthetic DNA libraries could be diminished by more integrated biological engineering solutions.

- Emerging Bio-manufacturing Techniques: Advancements in cell-free systems and direct microbial fermentation offer alternative routes to producing biological products.

- CRISPR and Gene Editing: These tools enable direct biological manipulation, potentially reducing the demand for custom synthetic DNA.

- Market Growth: The synthetic biology market, valued around $10.7 billion in 2024, sees substantial investment in disruptive platform technologies.

- Long-Term Substitute Threat: Integrated biological engineering could bypass the need for large-scale synthetic DNA production, impacting business models.

While Twist Bioscience offers advanced silicon-based DNA synthesis, traditional methods like enzymatic or ligation-based synthesis remain viable substitutes for less demanding applications. Companies leveraging these established techniques can provide cost-effective solutions for smaller-scale projects, appealing to academic labs or smaller biotech firms where speed is not the primary concern.

Emerging gene editing technologies such as CRISPR-Cas9 present a significant substitute threat. These tools allow for direct modification of existing genetic material, potentially reducing the need for entirely synthesized DNA sequences in areas like gene therapy development and disease modeling. By 2024, the synthetic biology market, valued at approximately $10.7 billion, saw substantial investment in such platform technologies, indicating a shift towards integrated biological engineering solutions that might bypass extensive custom DNA synthesis.

| Substitute Type | Description | Impact on Twist Bioscience |

|---|---|---|

| Traditional Synthesis | Enzymatic or ligation-based DNA synthesis | Appeals to cost-sensitive or low-throughput users. |

| Gene Editing (e.g., CRISPR) | Direct modification of existing DNA | Reduces demand for novel DNA sequences in specific research applications. |

| In-house Synthesis | Large organizations developing internal capabilities | Decreases reliance on external suppliers for high-volume needs. |

| Emerging Bio-manufacturing | Cell-free systems, microbial fermentation | Offers alternative pathways for producing biological products, potentially reducing reliance on custom DNA libraries. |

Entrants Threaten

Developing a DNA synthesis platform, particularly one as advanced as Twist Bioscience's silicon-based technology, demands immense upfront capital. This includes significant investment in research and development, cutting-edge specialized equipment, and robust manufacturing facilities. For instance, building out the necessary infrastructure for high-throughput DNA synthesis can easily run into tens or even hundreds of millions of dollars, presenting a formidable financial hurdle for potential new competitors.

Twist Bioscience's proprietary silicon-based DNA synthesis platform, protected by a robust portfolio of patents, significantly raises the barrier to entry for potential competitors. The intricate nature of synthetic biology manufacturing and the substantial investment required to replicate this technology make it exceedingly difficult for new players to establish a foothold. For instance, the company's ongoing patent filings and granted patents in areas like microfluidics and DNA sequencing demonstrate a commitment to maintaining its technological edge, a critical factor in deterring new entrants.

Twist Bioscience leverages significant economies of scale in its synthetic DNA production. Its advanced, automated manufacturing processes allow for a substantial reduction in cost per base as output increases, a key advantage that new entrants would find challenging to replicate quickly. For instance, in 2023, the company continued to scale its operations, aiming to produce billions of DNA bases annually, a volume that inherently lowers unit costs.

The experience curve also plays a crucial role. As Twist Bioscience has refined its proprietary silicon-based DNA synthesis platform over years, it has gained operational efficiencies and knowledge that further reduce production costs and improve quality. This accumulated expertise creates a barrier for newcomers who would need considerable time and investment to reach a similar level of process mastery and cost-effectiveness, making it difficult to compete on price from the outset.

Regulatory Hurdles and Safety Concerns

The synthetic biology sector, especially for areas like advanced therapeutics and diagnostics, faces a landscape of constantly changing regulations and safety standards. New companies entering this space must invest significant resources and time to understand and comply with these intricate requirements, making it a substantial barrier.

Navigating these regulatory pathways, such as those governed by the FDA for gene therapies or similar bodies globally, demands rigorous testing and validation. For instance, in 2024, the cost of bringing a new drug to market, including regulatory approval processes, can easily exceed billions of dollars, a significant hurdle for any new entrant.

- Complex Compliance: Adhering to diverse and evolving regulatory frameworks is a major challenge.

- High Development Costs: Significant investment is required for safety testing and regulatory submissions.

- Extended Timelines: Gaining approval can be a lengthy process, delaying market entry.

- Safety Scrutiny: Public and governmental concerns about safety in synthetic biology necessitate stringent oversight.

Access to Expertise and Talent

The specialized nature of synthetic biology and DNA synthesis demands a workforce with advanced skills in areas like molecular biology, genetic engineering, and bioinformatics. This creates a significant hurdle for new entrants who must invest heavily in recruiting and training such specialized talent. For instance, in 2024, the demand for bioinformaticians was projected to grow significantly, with some reports indicating a need for hundreds of thousands of such professionals globally to support advancements in genomics and synthetic biology.

Established companies like Twist Bioscience benefit from existing relationships with universities and research institutions, giving them a head start in identifying and securing top-tier scientific talent. This established talent pool acts as a competitive advantage, making it more difficult for newcomers to assemble the necessary expertise to compete effectively. The ability to attract and retain these highly sought-after individuals is a key determinant of success in this rapidly evolving field.

- Specialized Skill Requirements: Synthetic biology and DNA synthesis require expertise in molecular biology, genetic engineering, and bioinformatics.

- Talent Acquisition Challenges: New entrants face difficulties in attracting and retaining highly skilled scientists and engineers.

- Established Player Advantage: Companies like Twist Bioscience leverage existing talent networks and reputations to secure top talent.

- Barrier to Entry: The high cost and difficulty of acquiring specialized human capital present a substantial barrier for new companies entering the market.

The threat of new entrants into the synthetic DNA market, while present, is significantly mitigated by several factors, primarily related to the immense capital investment and proprietary technology required. Twist Bioscience's silicon-based platform, protected by patents, and the sheer scale of operations needed to achieve cost-competitiveness create substantial barriers.

The synthetic biology sector also faces stringent regulatory hurdles and a high demand for specialized talent, further deterring new players. For instance, the cost of regulatory compliance in biotech can run into millions, and the global shortage of bioinformaticians, projected to be in the hundreds of thousands by 2024, makes talent acquisition a critical challenge for newcomers.

| Barrier Factor | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | High costs for R&D, equipment, and facilities (tens to hundreds of millions of dollars). | Formidable financial hurdle. |

| Proprietary Technology & Patents | Twist Bioscience's silicon-based platform and patent portfolio. | Makes replication difficult and legally challenging. |

| Economies of Scale | Twist Bioscience's high-volume production (billions of bases annually in 2023). | New entrants struggle to match cost-effectiveness. |

| Regulatory Compliance | Complex and evolving regulations in synthetic biology. | Requires significant investment in time and resources for approval. |

| Specialized Talent | Need for highly skilled professionals in molecular biology, bioinformatics, etc. | Difficult and costly to recruit and retain. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Twist Bioscience leverages data from company annual reports, SEC filings, and industry-specific market research reports to assess competitive intensity and strategic positioning.