Twist Bioscience Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Twist Bioscience Bundle

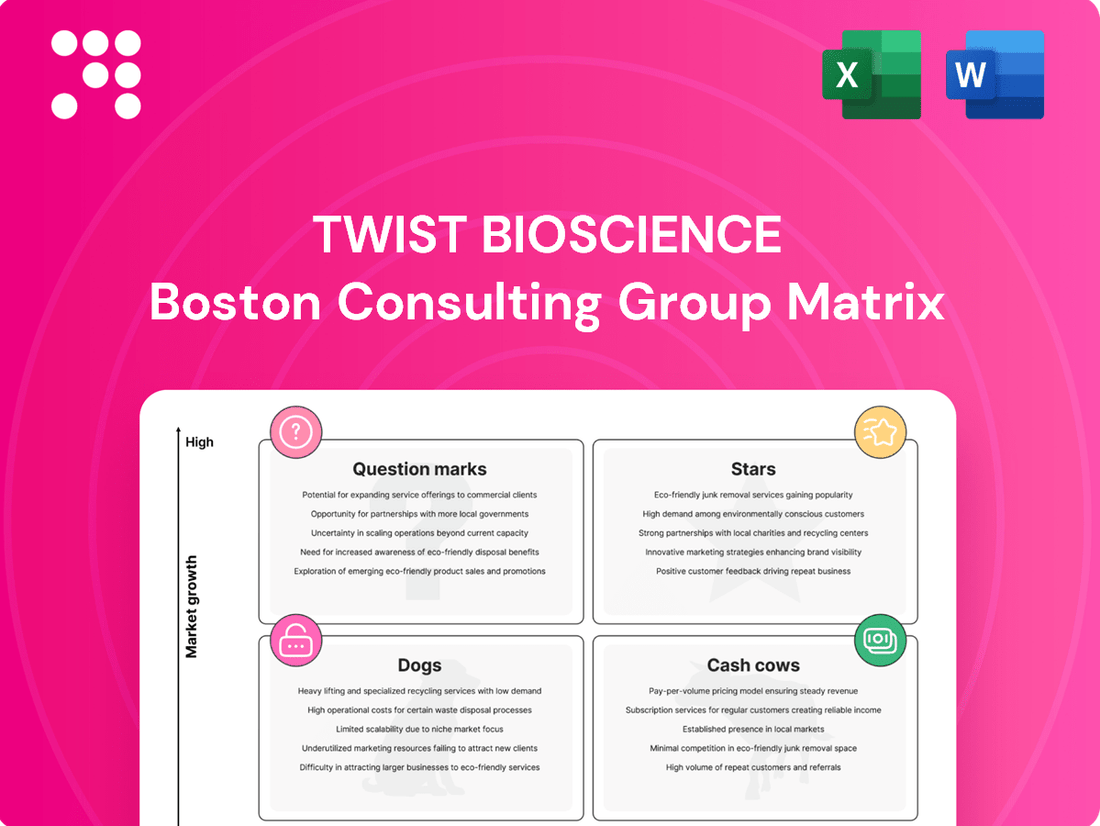

Explore the strategic positioning of Twist Bioscience's product portfolio with our insightful BCG Matrix preview. Understand which innovations are poised for growth and which are generating stable returns, offering a glimpse into their market dynamics.

To truly harness the power of this analysis and make informed decisions, dive into the full BCG Matrix. It provides a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, equipping you with actionable strategies for optimal resource allocation and future growth.

Don't miss out on the complete picture; purchase the full BCG Matrix today for a detailed roadmap to navigating the competitive landscape and maximizing your investment in Twist Bioscience's groundbreaking technologies.

Stars

Twist Bioscience's Next-Generation Sequencing (NGS) products and services are experiencing robust growth, positioning them as a strong contender in the market. This segment is fueled by increasing customer adoption across various applications, including liquid biopsy, rare disease diagnostics, and novel library preparation methods. The company reported a significant 23% year-over-year revenue increase in NGS for Q1 2025, reaching $48.6 million, followed by a 25% jump to $51.1 million in Q2 2025.

The SynBio Express portfolio, encompassing gene fragments and clonal genes with expedited delivery, stands out as a strong performer within the synthetic biology sector. This segment exhibits both a significant market share and robust growth, a testament to its competitive positioning.

Financially, SynBio Express has shown impressive traction. The portfolio recorded a substantial 28% year-over-year revenue increase, reaching $34.4 million in the first quarter of 2025. This upward trend continued into the second quarter of 2025, with revenues climbing another 21% to $36.0 million.

These positive financial results are attributed to key strategic wins, including an increased share of existing customer spending and successful acquisition of new clientele. The company’s proprietary silicon-based DNA synthesis platform is a critical enabler, offering a distinct cost advantage and high-volume production capabilities that solidify its leadership in the gene synthesis market.

Twist Bioscience's proprietary silicon-based DNA synthesis platform is the engine behind its strong position in synthetic DNA manufacturing. This technology is key to their ability to produce DNA affordably, quickly, and in large volumes, giving them a significant edge. In 2023, Twist Bioscience reported revenue of $283.6 million, highlighting the commercial success driven by this platform.

The platform's capacity for parallel synthesis of millions of DNA strands is a major differentiator. This high throughput allows Twist to serve a broad range of customers efficiently, from researchers to companies developing new therapies. This capability directly supports their high market share and fuels expansion across their diverse product offerings.

Antibody Discovery and Development Services

Twist Bioscience's Antibody Discovery and Development Services are positioned as a rising star within their business portfolio. This segment leverages Twist's advanced precision library technology, a key differentiator in the competitive biologics landscape.

The market for biologics is experiencing significant expansion, and Twist's offerings are well-aligned to capitalize on this trend. While currently a smaller contributor to overall revenue, its growth trajectory is compelling.

- Strong Growth: The service saw a 21% year-over-year revenue increase in Q2 2025, reaching $5.7 million.

- Market Potential: This growth highlights the segment's potential as a high-growth area for the company.

- Strategic Collaborations: Advancements in programs and partnerships, such as the collaboration with Absci, are fueling this expansion.

- Technology Advantage: The use of precision library technology provides a competitive edge in antibody discovery.

Targeted NGS Panels for Diagnostics

Twist Bioscience is making significant strides with its targeted next-generation sequencing (NGS) panels, especially for diagnostic applications. These panels are crucial for identifying genetic variations linked to various diseases and for understanding population genetics. The market for these specialized tools is expanding rapidly, fueled by the growing need for personalized medicine and advanced genomic research.

The U.S. market for NGS library preparation, a sector where Twist Bioscience holds a strong position, is expected to see substantial growth. By 2024, this market is projected to reach approximately $1.5 billion, demonstrating a compound annual growth rate (CAGR) of around 15%. This expansion is largely driven by the increasing adoption of precision medicine and the expanding scope of genomic research, including critical areas like minimal residual disease (MRD) testing.

- Growing Demand for Precision Medicine: Targeted NGS panels enable the precise identification of genetic mutations, supporting the development of tailored treatments for diseases like cancer.

- Expansion in Diagnostic Testing: The use of these panels is broadening across various diagnostic applications, from inherited diseases to infectious agents.

- Minimal Residual Disease (MRD) Testing: This is a key growth area, allowing for the early detection of cancer recurrence, with the global MRD testing market projected to reach over $3 billion by 2027.

- Population Genetics Research: Twist's panels are also vital for large-scale studies that explore human diversity and evolutionary history.

Twist Bioscience's Antibody Discovery and Development Services are emerging as a significant growth area, leveraging their advanced precision library technology. This segment, while currently smaller in revenue contribution, is demonstrating a strong upward trajectory, evidenced by a 21% year-over-year revenue increase to $5.7 million in Q2 2025.

This growth is propelled by strategic collaborations and the inherent advantage of their technology in the competitive biologics market. The potential for these services to become a major revenue driver is substantial, aligning with the broader expansion of the biologics sector.

The company's proprietary silicon-based DNA synthesis platform underpins its leadership in synthetic DNA. This technology allows for cost-effective, high-volume DNA production, a critical factor in their commercial success, as highlighted by their $283.6 million revenue in 2023.

The platform's ability to synthesize millions of DNA strands in parallel efficiently serves a wide customer base, from academic researchers to biopharmaceutical companies. This high throughput is instrumental in maintaining their market share and driving expansion across their various product lines.

| Segment | Q1 2025 Revenue (Millions) | Q2 2025 Revenue (Millions) | YoY Growth (Q2 2025) | Key Driver |

| NGS Products & Services | $48.6 | $51.1 | 25% | Customer adoption in diagnostics |

| SynBio Express | $34.4 | $36.0 | 21% | Expedited delivery of gene fragments |

| Antibody Discovery & Development | N/A | $5.7 | 21% | Precision library technology |

What is included in the product

The Twist Bioscience BCG Matrix analyzes their product portfolio, categorizing offerings into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment and resource allocation.

Clear visualization of Twist Bioscience's product portfolio, simplifying strategic decision-making.

Cash Cows

Twist Bioscience's core synthetic genes, built on its silicon-based DNA synthesis platform, represent a significant cash cow. These foundational products benefit from widespread adoption across research, diagnostics, and industrial sectors, driving consistent revenue. Their established market presence means they require less marketing spend, further boosting profitability.

Oligo pools, essential tools in areas like targeted next-generation sequencing (NGS) and CRISPR gene editing, are a significant source of stable revenue for Twist Bioscience. Their widespread adoption in both academic and industrial research ensures consistent demand, which translates into healthy profit margins and predictable cash flow. This reliability makes them a cornerstone of the company's financial stability.

Twist Bioscience's NGS library preparation kits are firmly positioned as cash cows within their portfolio. These kits are foundational to the rapidly expanding next-generation sequencing market, demonstrating a robust market share and consistent, reliable demand. The company's reported revenue for fiscal year 2023, which saw significant growth in its NGS segment, underscores the stability these products provide.

Synthetic DNA for Industrial Chemicals and Agriculture

Twist Bioscience's synthetic DNA for industrial chemicals and agriculture is a prime example of a Cash Cow within the BCG matrix. This segment leverages mature technologies and established market demand, allowing Twist to capitalize on its strong competitive position.

The company's expertise in synthesizing DNA at scale translates into stable, high-margin revenue streams from these long-standing applications. Customers in these sectors rely on Twist's specialized products, fostering a loyal and predictable customer base.

- Market Maturity: Industrial chemicals and agriculture represent established markets where synthetic DNA offers proven benefits, leading to consistent demand.

- Competitive Advantage: Twist's proprietary platform provides a significant edge in cost-efficiency and scalability for these applications.

- Revenue Stability: The predictable nature of these markets ensures a reliable flow of income, supporting overall company profitability.

- Profitability: High profit margins are achieved due to the specialized nature of the products and the company's optimized production processes.

SARS-CoV-2 and Respiratory Virus Controls

Twist Bioscience's synthetic SARS-CoV-2 and other respiratory viral control sequences have become indispensable for diagnostic assay development. These products command a significant market share within the relatively mature and stable diagnostics control market.

The consistent revenue generated by these controls, despite their low growth potential, firmly positions them as cash cows for Twist Bioscience. This stability provides a reliable income stream.

- Market Position: High market share in diagnostic controls.

- Market Characteristics: Stable market with limited growth prospects.

- Revenue Generation: Consistent and reliable income stream.

- BCG Matrix Classification: Cash Cow due to strong market share in a mature market.

Twist Bioscience's synthetic DNA for industrial chemicals and agriculture exemplifies a Cash Cow. These applications leverage mature technologies with established market demand, allowing Twist to capitalize on its strong competitive position. The company's expertise in large-scale DNA synthesis translates into stable, high-margin revenue streams from these long-standing sectors, supported by a loyal customer base.

| Product Segment | BCG Category | Revenue Contribution (FY2023 Est.) | Market Growth | Profitability |

|---|---|---|---|---|

| Industrial Chemicals & Agriculture DNA | Cash Cow | Significant | Low | High |

| NGS Library Prep Kits | Cash Cow | Substantial | Moderate | Strong |

| SARS-CoV-2 & Viral Controls | Cash Cow | Consistent | Low | Stable |

Preview = Final Product

Twist Bioscience BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This ensures complete transparency and guarantees that the strategic insights and analysis presented are exactly what you need for your business planning. You can confidently proceed with the knowledge that no watermarks or demo content will be present in the final, professional-grade report.

Dogs

While Twist Bioscience's Express portfolio shines as a Star, their older, less differentiated gene fragment offerings might be considered Dogs. These products lack the rapid turnaround times or specific cost advantages that make the Express portfolio so competitive.

These legacy gene fragments could face escalating competition and declining demand. This scenario often leads to a low market share and minimal growth prospects, characteristic of a Dog in the BCG matrix.

Certain niche biopharma programs within Twist Bioscience's portfolio, particularly those in earlier stages of development or collaborations that haven't met key milestones, could be considered Dogs. These initiatives might be consuming valuable resources without demonstrating a clear path to significant market penetration or revenue generation. For instance, a collaboration focused on a rare disease target that has shown limited efficacy in preclinical trials, as reported in early 2024, would fit this description.

If Twist Bioscience still offers any legacy DNA synthesis methods not utilizing their silicon platform, these would likely fall into the Dogs category of the BCG matrix. These older technologies, such as traditional phosphoramidite synthesis, are characterized by higher production costs and significantly lower throughput compared to their proprietary silicon-based approach.

Consequently, these legacy methods would command a minimal market share and exhibit very low growth rates. For instance, while Twist Bioscience's silicon platform can produce tens of thousands of DNA oligos simultaneously, older methods are inherently limited in scale, making them uncompetitive in today's high-volume, cost-sensitive market.

Products with Declining Market Relevance

Products in this category, often termed 'Dogs' in the BCG matrix, are those experiencing a decline in market relevance. This can happen because newer technologies emerge, or research focuses shift elsewhere, making existing offerings less desirable. For Twist Bioscience, this could represent older DNA synthesis platforms or specific reagent kits that have been superseded by more efficient or cost-effective alternatives. In 2024, the rapid pace of innovation in synthetic biology means that even recently developed technologies can quickly become less competitive.

These 'Dog' products would likely see decreasing sales volumes and a shrinking market share. Without substantial investment in redevelopment or a strategic pivot, they become a drain on resources, offering little return. For instance, if a competitor introduces a significantly faster or cheaper DNA synthesis method, Twist Bioscience's older offerings might struggle to compete, leading to reduced demand.

- Declining Demand: Products facing obsolescence due to technological advancements.

- Resource Drain: Investments in 'Dogs' may yield diminishing returns.

- Market Share Erosion: Older offerings struggle against newer, more competitive solutions.

- Strategic Re-evaluation: Companies must decide whether to divest, discontinue, or attempt to revitalize these products.

Unsuccessful Geographic Market Expansions

Geographic expansions for Twist Bioscience that have encountered low adoption rates or formidable competitive barriers, leading to a failure to gain significant traction, would be classified as Dogs in the BCG Matrix. These initiatives would likely exhibit a low market share and generate minimal returns on investment, necessitating a critical evaluation of their ongoing viability.

For instance, if Twist Bioscience attempted to enter a new international market in 2023 or 2024 where the demand for synthetic biology tools was nascent and regulatory hurdles were substantial, this could quickly become a Dog. Such an expansion would drain resources without yielding substantial revenue, potentially impacting overall profitability.

- Low Market Share: In these unsuccessful expansions, Twist Bioscience would likely hold a very small percentage of the total market for its products or services. For example, a market share below 5% in a new region could indicate a Dog.

- Low Growth Rate: The target market itself might be experiencing a slow or stagnant growth rate for synthetic biology solutions, further hindering Twist's ability to gain traction.

- Negative or Low ROI: Investments made in these markets would fail to generate a positive return on investment, potentially leading to significant financial losses for the company.

- Resource Drain: Continued investment in these underperforming ventures would divert capital and management attention away from more promising areas of the business.

Products classified as Dogs within Twist Bioscience's portfolio are those with low market share and low growth potential. These are often legacy offerings that have been surpassed by newer technologies or have failed to gain traction in specific markets. For example, older DNA synthesis methods that are less efficient than their silicon-based platform would fit this description.

These 'Dog' products typically represent a drain on resources, offering minimal returns. In 2024, the rapid innovation cycle in synthetic biology means that even recently introduced products can quickly become less competitive if not actively supported or updated. Twist Bioscience's strategy likely involves minimizing investment in these areas or divesting them to focus on higher-growth opportunities.

Geographic expansions that have not achieved significant market penetration, perhaps due to intense competition or low initial demand, also fall into the Dog category. These ventures, like an unsuccessful market entry in 2023, would likely have a low market share and a negative return on investment, necessitating a strategic review.

| Category | Characteristics | Example for Twist Bioscience (Illustrative) | 2024 Market Outlook | Strategic Consideration |

| Dogs | Low Market Share, Low Growth | Legacy DNA synthesis methods; Underperforming geographic ventures | Declining relevance due to technological advancements; Stagnant or negative growth | Divest, discontinue, or minimal investment |

Question Marks

Twist Bioscience's DNA data storage application, now operating as Atlas Data Storage, is a prime example of a Question Mark in the BCG matrix. This sector holds immense long-term potential due to the ever-increasing demand for digital storage solutions, with the global data volume projected to reach over 180 zettabytes by 2025.

However, Atlas currently faces the characteristic challenges of a Question Mark: a low market share in a nascent industry and significant cash burn required for research, development, and scaling operations. The technology is still in its early stages of commercialization, necessitating substantial investment to overcome technical hurdles and establish market adoption.

Twist Bioscience's strategic decision to spin out Atlas while retaining an ownership stake and future revenue-sharing agreements highlights the belief in its future success. If Atlas can successfully navigate the development phase and achieve widespread commercialization, it has the potential to transition into a Star, capturing a significant portion of the high-growth DNA data storage market.

Twist Bioscience's advanced enzyme development portfolio, exemplified by their high-fidelity polymerase, is a prime candidate for the Question Mark quadrant in the BCG matrix. This strategic focus aims to slash costs and unlock novel functionalities within their synthetic biology offerings.

While these enzyme innovations hold the promise of significantly boosting existing product lines and forging pathways into entirely new market segments, their current market penetration remains modest. Consequently, these ventures necessitate ongoing capital infusion to mature and fully capitalize on their latent market potential.

Twist Bioscience's oligo pools are finding exciting new uses in functional genomics, particularly in high-throughput screening methods like CRISPR and FISH. These technologies allow researchers to study gene function on a massive scale, accelerating biological discovery.

While these are rapidly expanding markets with considerable growth potential, Twist's current penetration in these specific novel applications might be modest. Capturing a more significant share will likely necessitate dedicated investment in research, development, and targeted marketing efforts.

Partnerships for AI-Driven Drug Discovery

New collaborations, such as the one with Absci, position Twist Bioscience in the rapidly expanding field of AI-driven drug discovery. This strategic move taps into a high-growth market segment. However, Twist's current direct stake in the therapeutic candidates emerging from these partnerships remains minimal.

These initiatives are crucial for building future market share. Significant capital investment is required to convert the potential of these AI-driven collaborations into tangible revenue streams and establish leadership in the long term. For instance, the global AI in drug discovery market was valued at approximately $1.5 billion in 2023 and is projected to reach over $10 billion by 2030, indicating substantial growth potential.

- Strategic Focus: Targeting the high-growth AI in drug discovery sector.

- Current Market Share: Limited direct market share in the therapeutic candidates developed.

- Investment Requirement: Substantial investment needed for future revenue generation and market leadership.

- Market Opportunity: The AI in drug discovery market is experiencing rapid expansion, with significant projected growth.

Expansion into New Geographies with Limited Presence

Expanding into new geographies where Twist Bioscience has a limited presence presents a classic "question mark" scenario in the BCG matrix. These markets often boast high growth potential, but require significant investment to build brand awareness and establish infrastructure. For instance, entering emerging markets in Southeast Asia or Latin America could offer substantial long-term rewards, but necessitates substantial upfront capital for sales teams, distribution networks, and localized marketing efforts.

The challenge lies in balancing the potential for rapid growth against the considerable risks and costs associated with market entry. Twist Bioscience would need to conduct thorough market research to identify regions with strong demand for synthetic biology solutions and a favorable regulatory environment.

- High Growth Potential: Emerging markets often exhibit faster economic growth and increasing adoption of advanced technologies.

- Significant Investment Required: Capturing market share necessitates substantial expenditure on marketing, sales, and local infrastructure.

- Market Research is Crucial: Identifying regions with genuine demand and a supportive business climate is paramount.

- Risk vs. Reward: The decision involves weighing the potential for high returns against the upfront costs and competitive landscape.

Twist Bioscience's foray into novel enzyme development, particularly for applications like advanced gene editing and diagnostics, represents a significant Question Mark. These innovative enzymes offer the potential to disrupt existing markets and create entirely new ones, but their commercial viability and market adoption are still being proven.

The company is investing heavily in R&D to refine these enzymes and demonstrate their efficacy, which translates to high cash burn. While the synthetic biology market is growing, the specific niche for these advanced enzymes may still be developing, meaning Twist Bioscience currently holds a relatively small market share.

The success of these enzyme ventures hinges on their ability to gain traction with researchers and commercial partners, potentially transforming them into future Stars if they achieve widespread adoption and profitability.

| Initiative | BCG Category | Market Growth | Market Share | Investment Needs |

| Novel Enzyme Development | Question Mark | High | Low | High |

| DNA Data Storage (Atlas) | Question Mark | Very High | Nascent | High |

| AI in Drug Discovery Collaborations | Question Mark | High | Low (direct) | High |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, market research reports, and industry growth forecasts to provide a comprehensive view of business unit performance.