Treace Medical Concepts Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Treace Medical Concepts Bundle

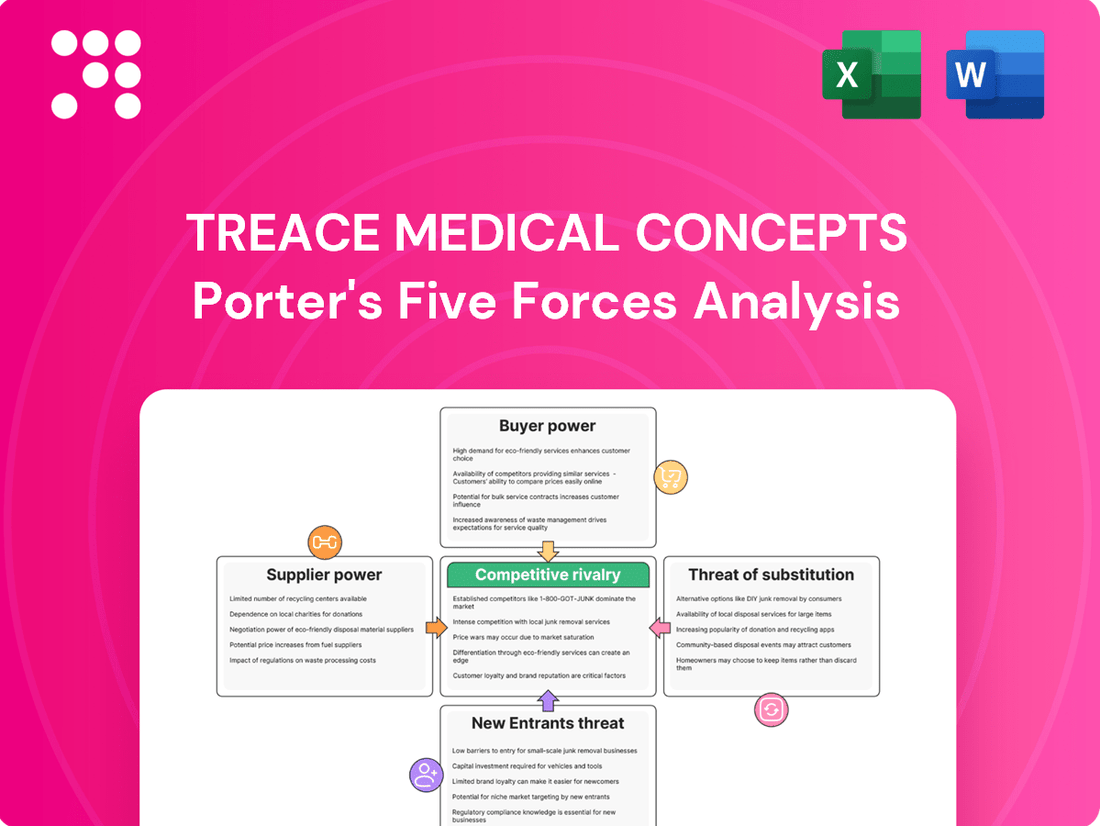

Treace Medical Concepts operates in a dynamic market, facing moderate threats from new entrants and substitutes due to the specialized nature of its orthopedic solutions. The company's ability to innovate and differentiate its product offerings is crucial in navigating these pressures.

The full analysis reveals the strength and intensity of each market force affecting Treace Medical Concepts, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Treace Medical Concepts' reliance on specialized components for its Lapiplasty system and other surgical offerings means suppliers of these unique parts hold considerable bargaining power. If few other manufacturers can produce these critical materials, Treace faces higher costs or potential supply shortages. The medical device sector has experienced supply chain volatility, with reports in 2023 and early 2024 highlighting challenges in sourcing specific raw materials and components, directly impacting manufacturers like Treace.

Suppliers possessing critical intellectual property or patents for specialized materials or manufacturing techniques can wield significant bargaining power over Treace Medical Concepts. This situation necessitates Treace potentially licensing these essential technologies, a move that directly impacts cost structures and operational flexibility. For instance, in the medical device sector, exclusive patents on biocompatible materials or advanced surgical instrument designs can create substantial barriers to entry for competitors and grant considerable leverage to the patent holder.

Suppliers in the medical device sector, including those serving Treace Medical Concepts, operate under rigorous quality and regulatory mandates like ISO 13485 and FDA regulations. Treace's reliance on these suppliers to consistently meet these high standards grants compliant suppliers significant leverage. Any lapse in quality or compliance by a supplier can directly jeopardize Treace's product integrity, brand image, and ability to reach the market.

Concentration of Suppliers

The concentration of suppliers significantly impacts Treace Medical Concepts' bargaining power. If the market for specialized, high-tech components essential for their orthopedic implants is dominated by a small number of manufacturers, these suppliers gain considerable leverage. This can translate into less favorable pricing, stricter contract terms, and limited negotiation flexibility for Treace, potentially increasing their cost of goods sold.

For instance, in industries reliant on niche materials or advanced manufacturing processes, supplier consolidation can create dependencies. If Treace sources a critical component from just two or three highly specialized firms, those suppliers can dictate terms more effectively. This concentration limits Treace's ability to switch suppliers without incurring substantial costs or facing production delays.

- Supplier Concentration: A market with few dominant suppliers for key components grants those suppliers increased bargaining power.

- Impact on Treace: Treace may face higher input costs and less favorable contract terms due to limited sourcing options.

- Risk of Dependency: Reliance on a small supplier base can create vulnerabilities if those suppliers face production issues or decide to increase prices.

- Strategic Sourcing: Treace must actively manage supplier relationships and explore diversification where possible to mitigate this risk.

Switching Costs for Treace

Switching suppliers for Treace Medical Concepts' specialized orthopedic implants and instruments can be a significant hurdle. The costs associated with re-qualifying new suppliers, obtaining necessary regulatory approvals for modified components, and potentially redesigning existing products are substantial. For instance, in 2024, the medical device industry saw increased scrutiny on supply chain integrity, making such transitions even more complex and costly.

These high switching costs directly empower Treace's incumbent suppliers. They create a lock-in effect, as Treace would incur considerable expense and time delays to move to an alternative provider. This situation grants suppliers leverage in price negotiations and other contract terms, as Treace faces a substantial deterrent to seeking new partnerships.

- High Re-qualification Expenses: Medical device components require rigorous testing and validation, leading to significant costs for each new supplier.

- Regulatory Hurdles: Changes in suppliers often necessitate new regulatory submissions and approvals, adding time and expense.

- Potential Redesign Costs: Even minor component variations can require product redesigns and further testing.

- Supplier Leverage: These factors increase the bargaining power of existing suppliers, potentially impacting Treace's cost structure.

The bargaining power of suppliers for Treace Medical Concepts is significantly influenced by the uniqueness of their offerings and the concentration within the supplier market. For specialized components essential to Treace's Lapiplasty system, a limited number of suppliers can dictate terms, leading to potential cost increases. In 2024, the medical device sector continued to grapple with supply chain disruptions, making supplier relationships critical for Treace.

Suppliers holding patents for proprietary materials or manufacturing processes possess considerable leverage, potentially forcing Treace into licensing agreements that impact profitability. This dependency is amplified by the rigorous quality and regulatory standards, such as ISO 13485, that suppliers must meet, giving compliant providers significant negotiating power. Failure to meet these standards by a supplier directly risks Treace's product integrity and market access.

The high costs and regulatory complexities associated with switching suppliers for specialized medical devices create a strong lock-in effect for Treace. This makes it challenging and expensive to move to alternative providers, thereby strengthening the bargaining position of incumbent suppliers. For example, the need for extensive re-qualification and potential product redesigns in 2024 added significant barriers to supplier diversification.

| Factor | Impact on Treace | Example Data/Trend (2023-2024) |

|---|---|---|

| Supplier Concentration | Increased input costs, less favorable terms | Dominance of a few firms for specialized orthopedic components |

| Switching Costs | Supplier lock-in, higher negotiation leverage | Significant expenses for re-qualification and regulatory approvals |

| Uniqueness of Inputs | Dependency on proprietary materials/processes | Patented biocompatible materials or advanced surgical designs |

| Regulatory Compliance | Leverage for compliant suppliers | Adherence to ISO 13485 and FDA regulations |

What is included in the product

This analysis of Treace Medical Concepts' competitive environment reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Instantly assess competitive pressures and identify strategic vulnerabilities with a dynamic Porter's Five Forces analysis tailored for Treace Medical Concepts.

Customers Bargaining Power

Treace Medical Concepts' primary customers are surgeons and hospitals. While individual surgeons might favor specific technologies like the Lapiplasty system, larger entities such as major hospital networks and ambulatory surgery centers (ASCs) wield considerable bargaining power. This strength stems from their substantial purchasing volumes and their capacity to negotiate favorable pricing and contract terms for medical devices.

Surgeons and hospitals are primarily concerned with achieving the best possible patient outcomes and ensuring the clinical effectiveness of treatments. Treace Medical Concepts' Lapiplasty system is designed to directly address the underlying causes of bunions, potentially leading to quicker recovery periods for patients.

The presence of robust clinical data and documented positive patient results significantly bolsters Treace's standing, thereby diminishing the bargaining power of customers who might otherwise focus solely on price competition.

Treace Medical Concepts' strong product differentiation significantly curtails the bargaining power of customers. Their proprietary systems, such as the Lapiplasty 3D Bunion Correction, offer patented features and reported superior results over conventional methods. This distinctiveness makes it difficult for customers, primarily surgeons and hospitals, to switch to alternatives without sacrificing perceived quality or efficacy. For instance, in 2023, Treace reported a 35% increase in revenue, driven in part by the adoption of its differentiated technologies, indicating customer willingness to pay for these unique solutions.

Reimbursement Policies

Reimbursement policies from insurers significantly impact customer decisions regarding medical procedures and devices. Favorable reimbursement for Treace Medical Concepts' offerings makes them more appealing to hospitals and surgeons. This can lessen price sensitivity among these customers, thereby enhancing Treace's bargaining power.

- Impact of Reimbursement: Insurer policies directly influence the adoption and affordability of Treace's products and procedures.

- Reduced Price Sensitivity: When reimbursement is robust, hospitals and surgeons are less likely to prioritize cost alone, favoring effective solutions.

- Strengthening Bargaining Position: Positive reimbursement coverage for Treace's innovative technologies strengthens their negotiation leverage with healthcare providers.

Surgeon Training and Adoption

The significant investment surgeons make in training and mastering specific surgical systems, like Treace Medical Concepts' Lapiplasty system, directly impacts their willingness to switch. This specialized knowledge creates a form of customer lock-in, as retraining on a competitor's platform represents a considerable time and resource commitment.

For instance, a surgeon dedicating weeks or months to achieve proficiency with the Lapiplasty system is naturally disinclined to abandon that expertise for a new, unproven system. This reluctance to switch significantly diminishes the bargaining power of these surgeon customers, as their continued use of Treace's technology is less contingent on price concessions or customized terms.

- Surgeon Training Investment: The time and resources surgeons dedicate to learning and becoming proficient with specialized systems like Lapiplasty create a barrier to switching.

- Reduced Switching Costs: Once proficient, surgeons are less likely to incur the costs and effort associated with training on and adopting alternative technologies.

- Lowered Customer Bargaining Power: This established expertise and reduced incentive to switch directly translate into diminished bargaining power for surgeon customers when negotiating with Treace Medical Concepts.

Treace Medical Concepts' customers, primarily surgeons and hospitals, possess moderate bargaining power. While large hospital systems can leverage their volume for better pricing, the unique clinical benefits and surgeon training associated with Treace's Lapiplasty system mitigate this power. The company's strong product differentiation and the investment surgeons make in mastering its technology create switching barriers, reducing customer leverage.

| Factor | Impact on Bargaining Power | Treace's Position |

|---|---|---|

| Customer Volume | High volume purchasers (hospitals) can negotiate better prices. | Moderate, as volume is concentrated among fewer entities. |

| Product Differentiation | Unique features and superior outcomes reduce price sensitivity. | Strong, due to patented Lapiplasty system and clinical data. |

| Switching Costs (Surgeon Training) | Significant investment in training creates reluctance to switch. | High, as surgeons invest considerable time in Lapiplasty proficiency. |

| Clinical Effectiveness & Outcomes | Focus on patient results can override price considerations. | Strong, with documented positive patient outcomes. |

Preview Before You Purchase

Treace Medical Concepts Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Treace Medical Concepts, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products. The document you see here is precisely the same professionally written and formatted analysis you'll receive instantly after purchase. You can confidently expect to download this exact file, ready for immediate use and strategic planning.

Rivalry Among Competitors

The foot and ankle orthopedic device market is indeed a crowded space, featuring formidable competitors. Giants like Stryker, Smith & Nephew, Arthrex, Johnson & Johnson's DePuy Synthes, and Zimmer Biomet are all actively participating. These established companies bring significant advantages to the table, including vast financial resources, comprehensive product offerings that extend beyond just foot and ankle solutions, and deeply entrenched distribution networks that reach healthcare providers efficiently.

The bunion correction systems market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of 6.2% from 2025 to 2033. This upward trend signals a highly attractive landscape, drawing in both established companies and new entrants eager to capture market share.

This significant market expansion acts as a powerful magnet for competitors, encouraging substantial investment in research and development and aggressive marketing strategies. Consequently, the drive to gain and maintain market dominance intensifies the competitive rivalry within the bunion correction sector.

Competitive rivalry in the orthopedic surgical market is intensely fueled by product innovation. Companies are continuously developing novel surgical techniques, such as minimally invasive procedures, and creating advanced implants and accessories to gain an edge. Treace Medical Concepts' Lapiplasty system stands out as a significant differentiator in this landscape.

However, this innovation-driven competition means rivals are also launching new technologies and enhancements. For instance, in 2023, competitor Smith+Nephew introduced its NAVIO P.F. system for total knee arthroplasty, showcasing ongoing advancements. This necessitates substantial and continuous research and development investment from Treace to maintain its competitive position and introduce further improvements to its offerings.

Pricing Pressure and Value Proposition

While Treace Medical Concepts' Lapiplasty system is positioned as a premium offering due to its innovative approach to bunion correction, the competitive landscape can indeed exert pricing pressure. Rival companies may introduce bundled service packages or adopt more aggressive pricing strategies to capture market share, compelling Treace to consistently highlight the superior clinical outcomes and long-term value proposition of its technology.

This competitive dynamic means Treace must continually invest in demonstrating the economic benefits and improved patient satisfaction associated with the Lapiplasty procedure. For instance, by showcasing reduced revision rates or faster patient recovery times, Treace can justify its pricing and differentiate itself from competitors offering less advanced or less effective solutions.

- Premium Pricing Justification: Treace's Lapiplasty system's unique approach allows for premium pricing, but competition necessitates demonstrating superior value.

- Competitive Strategies: Rivals may use bundled offerings or aggressive pricing, forcing Treace to prove its product's enhanced outcomes.

- Value Demonstration: Continuous emphasis on reduced revision rates and faster recovery supports Treace's pricing against competitors.

Market Share Dynamics

Treace Medical Concepts is actively working to gain a larger foothold in the bunion surgery market. This push for increased market share naturally intensifies competition, as established players will likely defend their existing customer base and market positions.

The bunion market is characterized by several established competitors, and Treace's strategy to grow means it's directly challenging these incumbents. This dynamic creates a more aggressive competitive environment where pricing, product innovation, and sales force effectiveness become critical differentiators.

- Market Penetration Focus: Treace's stated goal of expanding its presence in the bunion market indicates a direct engagement with competitors' existing market share.

- Increased Rivalry: As Treace aims to capture more of the bunion market, competitors are compelled to respond, leading to heightened rivalry.

- Competitive Response: Established companies in the bunion space are likely to react to Treace's growth efforts through various strategies, potentially including price adjustments or enhanced marketing campaigns.

The competitive rivalry in the foot and ankle orthopedic device market, particularly within bunion correction, is intense due to the presence of major players like Stryker, Smith & Nephew, Arthrex, Johnson & Johnson, and Zimmer Biomet. These companies leverage substantial financial resources, broad product portfolios, and established distribution networks, creating a challenging environment for Treace Medical Concepts.

The bunion correction systems market is projected to grow at a CAGR of 6.2% from 2025 to 2033, attracting significant investment in R&D and marketing, which escalates competitive pressures. Treace's innovative Lapiplasty system differentiates itself, but rivals are also advancing their technologies, as seen with Smith+Nephew's 2023 NAVIO P.F. system launch, necessitating continuous investment from Treace.

While Treace's premium pricing for Lapiplasty is justified by its unique approach, competitors may employ bundled services or aggressive pricing. Treace must consistently highlight superior clinical outcomes and long-term value, such as reduced revision rates and faster recovery, to maintain its market position and justify its pricing strategy against less advanced alternatives.

| Competitor | 2023 Revenue (approx. billions USD) | Key Foot & Ankle Offerings |

|---|---|---|

| Stryker | 19.4 | Total ankle arthroplasty, bunion correction systems |

| Smith & Nephew | 4.2 | Total knee arthroplasty (NAVIO P.F.), foot & ankle implants |

| Arthrex | 4.0 | Arthroscopic surgery, implants, minimally invasive techniques |

| Johnson & Johnson (DePuy Synthes) | 27.4 (MedTech Segment) | Hip, knee, trauma, spine, reconstructive surgery |

| Zimmer Biomet | 6.7 | Knee, hip, spine, trauma, extremities |

SSubstitutes Threaten

Traditional bunion surgery techniques, such as osteotomy and fusion, present a notable threat of substitution for Treace Medical Concepts. These established methods, while sometimes associated with longer recovery periods or a greater chance of bunion recurrence, are readily accessible and well-understood within the medical community.

For patients and surgeons, these conventional procedures serve as a significant alternative, particularly if Treace's innovative solutions are viewed as having a higher price point or increased procedural complexity. The widespread availability and familiarity of these older techniques mean they will continue to be a competitive force in the bunion treatment market.

For less severe bunions, non-surgical treatments like custom orthotics, wider footwear, physical therapy, pain relief medication, and lifestyle adjustments offer viable alternatives to surgical intervention. These conservative approaches can alleviate symptoms and manage the condition without the need for surgery.

A growing patient inclination towards conservative management, stemming from a desire to avoid surgical procedures, presents a significant threat to companies like Treace Medical Concepts that specialize in surgical solutions. This trend suggests a potential shift in demand away from their core offerings.

While Treace Medical Concepts has innovated with its minimally invasive surgical (MIS) systems like Nanoplasty and Percuplasty, the threat of substitutes remains significant. Other medical device companies are actively developing and marketing their own MIS bunion surgery techniques and instrumentation.

These competing MIS approaches, if they are perceived by surgeons and patients as offering comparable effectiveness and similar advantages, such as quicker recovery times, directly substitute Treace's proprietary MIS solutions. This competitive landscape necessitates continuous innovation and demonstration of superior clinical outcomes.

Emerging Technologies and Regenerative Medicine

Future advancements in regenerative medicine, biological treatments, or entirely novel approaches to correcting foot deformities could emerge as substitutes for Treace Medical Concepts' current offerings. While these are long-term threats, they have the potential to fundamentally alter the treatment landscape for conditions like bunions.

For instance, research into bio-integrated implants or advanced tissue engineering could offer less invasive alternatives to surgical procedures. The market for regenerative medicine treatments is projected to grow significantly, with some estimates suggesting it could reach hundreds of billions of dollars globally by the late 2020s and into the 2030s, indicating a growing appetite for these types of innovations.

- Regenerative Medicine Growth: The global regenerative medicine market was valued at approximately $15.5 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of over 25% through 2030.

- Biological Treatment Advancements: Innovations in growth factors and cellular therapies could reduce reliance on traditional orthopedic implants.

- Novel Foot Correction Methods: The development of non-surgical or minimally invasive techniques could disrupt the existing market for surgical correction.

- Long-Term Market Impact: While not an immediate threat, these emerging technologies represent a potential future substitute that could impact Treace's market share.

Patient Acceptance of Deformity

For Treace Medical Concepts, the threat of substitutes for its surgical bunion correction procedures is influenced by patients' willingness to accept existing deformity or manage it non-surgically. Some individuals may find the pain or aesthetic issues of bunions manageable enough to avoid surgery altogether. This can involve using orthotic devices, specialized footwear, or pain-relief medications as alternatives to invasive treatment.

The decision to forgo surgery can be driven by factors such as the perceived risk of complications, recovery time, or the cost of procedures. For instance, while specific 2024 data on bunion treatment choices isn't readily available, general trends in elective surgery suggest that patient comfort with non-invasive management plays a significant role. A substantial portion of the population may opt for conservative treatments, especially if their symptoms are mild.

This patient acceptance of deformity directly impacts the demand for Treace's products. If a significant number of potential patients choose non-surgical routes, it limits the market size for their implantable devices and surgical systems. The effectiveness and accessibility of these non-surgical substitutes are therefore key considerations in assessing this competitive force.

- Patient Tolerance: Some patients tolerate bunion symptoms without seeking surgical correction, opting for lifestyle adjustments or non-invasive aids.

- Non-Surgical Alternatives: Orthotics, specialized shoes, physical therapy, and pain management are viable substitutes for surgical intervention.

- Cost and Risk Perception: The financial outlay and perceived risks associated with surgery can drive patients towards less invasive, albeit less definitive, solutions.

- Market Impact: The prevalence of non-surgical management directly reduces the addressable market for surgical bunion correction technologies like those offered by Treace.

The threat of substitutes for Treace Medical Concepts' bunion correction solutions is multifaceted, encompassing both established surgical alternatives and the growing appeal of non-surgical management. Traditional open bunionectomies, while less innovative, remain a benchmark against which Treace's minimally invasive techniques are compared. Furthermore, the increasing patient preference for conservative treatments, driven by a desire to avoid surgical risks and downtime, directly curtails the addressable market for surgical interventions.

For instance, while specific 2024 data on bunion treatment choices isn't readily available, general trends in elective orthopedic procedures indicate a sustained interest in less invasive options. However, the fundamental availability of non-surgical aids like orthotics and specialized footwear means that for many patients, particularly those with less severe conditions, these options serve as direct substitutes, mitigating the need for surgical correction altogether.

The emergence of new minimally invasive techniques from competitors also represents a significant substitute threat. If these alternative MIS approaches offer comparable or superior outcomes with similar or lower costs, they directly challenge Treace's market position. This underscores the importance of Treace's ongoing innovation and ability to demonstrate clear clinical advantages.

Looking ahead, advancements in regenerative medicine and biological treatments pose a longer-term threat. The global regenerative medicine market, projected to grow substantially, could eventually offer less invasive alternatives to current surgical implants, potentially reshaping the treatment landscape for foot deformities.

| Substitute Type | Description | Key Consideration for Treace |

| Traditional Bunion Surgery | Established open surgical techniques (e.g., osteotomy, fusion). | Accessibility, familiarity, and potentially lower perceived risk for some surgeons/patients. |

| Non-Surgical Management | Orthotics, wider footwear, physical therapy, pain medication, lifestyle changes. | Patient willingness to tolerate deformity, cost/risk aversion to surgery. |

| Competitor MIS Techniques | Other companies' minimally invasive bunion surgery systems. | Perceived effectiveness, recovery times, and procedural costs compared to Treace's offerings. |

| Regenerative Medicine/Biological Treatments | Future advancements in tissue engineering, bio-integrated implants, cellular therapies. | Long-term potential to offer less invasive alternatives, market growth projections. |

Entrants Threaten

Entering Treace Medical Concepts' specialized medical device market, particularly for innovative surgical systems, demands significant capital. For instance, developing and launching a new orthopedic implant or surgical robot can easily cost tens to hundreds of millions of dollars in research, development, and regulatory approval.

The high upfront investment for things like advanced manufacturing facilities, extensive clinical trials, and building a robust sales and distribution network creates a formidable barrier. Companies like Treace have already made these substantial investments, giving them a significant head start and making it difficult for newcomers to compete on a similar scale.

Stringent regulatory hurdles significantly deter new entrants in the medical device sector. The U.S. Food and Drug Administration (FDA), for example, mandates a rigorous pre-market approval process for new devices, which can take years and cost millions. In 2024, the FDA continued to emphasize robust data and clinical evidence for device clearance, making it a substantial barrier for startups lacking established regulatory expertise and capital.

Treace Medical Concepts' robust intellectual property, including a substantial number of granted patents and pending applications for its Lapiplasty system, significantly deters new entrants. This strong patent portfolio creates a formidable barrier, making it challenging for competitors to introduce similar innovative solutions without risking patent infringement or incurring substantial licensing costs.

Established Surgeon Relationships and Training

Established players like Treace Medical Concepts have cultivated deep-seated relationships with surgeons, often built over years of dedicated training and ongoing clinical support. This existing network is a significant barrier for newcomers.

New entrants face the considerable challenge of replicating this level of surgeon engagement. They must invest substantial resources in educating and training medical professionals on their novel technologies, a process that is both time-consuming and costly, thereby impeding swift market entry and adoption.

- Surgeon Loyalty: Existing relationships foster loyalty, making it difficult for new entrants to gain traction.

- Training Investment: New companies need to allocate significant capital to surgeon education and skill development.

- Clinical Validation: Building trust requires demonstrating efficacy through extensive clinical studies, a lengthy and expensive undertaking.

Brand Recognition and Clinical Reputation

Building a strong brand recognition and clinical reputation in the medical device industry is a significant hurdle for new entrants. Treace Medical Concepts has cultivated trust with its Lapiplasty system, a process that requires substantial investment in clinical trials and demonstrating consistent positive patient outcomes. For instance, by mid-2024, Treace reported continued strong adoption of its Lapiplasty system, with an increasing number of surgeons relying on its proven efficacy.

New companies entering the foot and ankle surgical market face the daunting task of establishing credibility with surgeons who prioritize established clinical results and surgeon satisfaction. This trust is not easily replicated; it is built over time through consistent product performance and positive word-of-mouth within the medical community. The financial commitment to achieve comparable brand recognition and clinical validation can be substantial, potentially running into millions of dollars for research, development, and marketing efforts.

- Brand loyalty: Surgeons often develop strong preferences for devices that have consistently delivered favorable outcomes.

- Clinical validation: Demonstrating superior efficacy and safety through rigorous clinical studies is essential.

- Time investment: Establishing a recognized and trusted brand in medical devices is a multi-year endeavor.

- Reputational risk: A new entrant must overcome the inherent risk aversion associated with adopting unproven technologies in patient care.

The threat of new entrants for Treace Medical Concepts is moderately low due to substantial capital requirements, stringent regulatory processes, and established brand loyalty. Developing and launching innovative medical devices like Treace's Lapiplasty system requires significant investment, often in the tens to hundreds of millions of dollars for R&D and FDA approval. In 2024, the FDA continued to emphasize robust clinical evidence, a high bar for startups.

Treace's strong intellectual property portfolio and established relationships with surgeons present further barriers. New companies must navigate patent landscapes and invest heavily in surgeon education and clinical validation to build trust, a process that takes years and considerable financial resources. By mid-2024, Treace's Lapiplasty system demonstrated continued strong adoption, underscoring the difficulty for new entrants to gain traction against proven efficacy and surgeon satisfaction.

| Barrier Type | Description | Impact on New Entrants | Example for Treace |

|---|---|---|---|

| Capital Requirements | High R&D, manufacturing, and marketing costs | Significant financial hurdle | Tens to hundreds of millions for device development |

| Regulatory Hurdles | Rigorous FDA approval process | Time-consuming and costly | Years and millions for pre-market approval |

| Intellectual Property | Patents and proprietary technology | Limits ability to replicate | Lapiplasty system patents |

| Surgeon Relationships & Brand Loyalty | Established trust and training | Difficult to overcome | Years of surgeon engagement and clinical support |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Treace Medical Concepts leverages data from SEC filings, investor presentations, and industry-specific market research reports to assess competitive dynamics.

We integrate insights from financial databases, news articles, and competitor websites to provide a comprehensive view of the forces shaping the medical device market.