Treace Medical Concepts Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Treace Medical Concepts Bundle

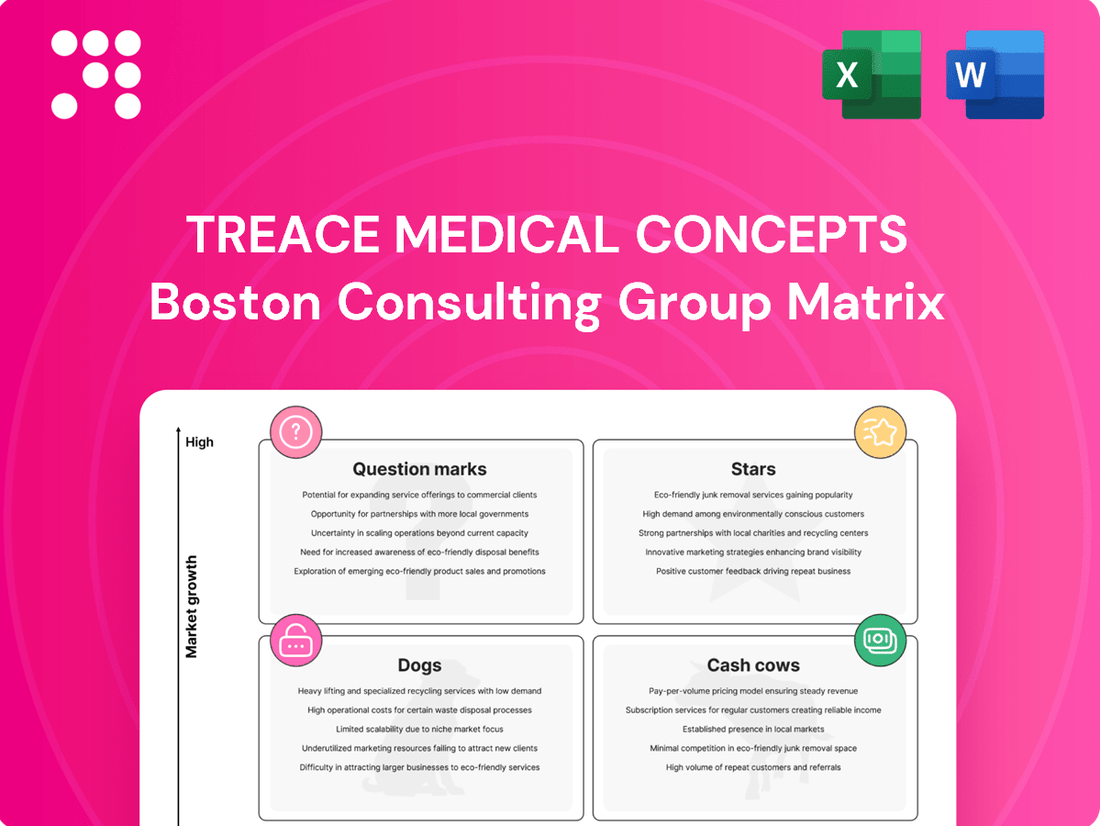

Curious about Treace Medical Concepts' product portfolio? Our BCG Matrix preview offers a glimpse into their Stars, Cash Cows, Dogs, and Question Marks. Understand their current market standing and identify growth opportunities.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain access to detailed quadrant placements, data-backed recommendations, and a clear roadmap for strategic investment and product development decisions.

Don't miss out on actionable insights. The full Treace Medical Concepts BCG Matrix is your essential tool for navigating the competitive landscape and driving future success.

Stars

The Lapiplasty 3D Bunion Correction System is Treace Medical Concepts' star product, directly addressing the underlying cause of bunions by correcting the three-dimensional deformity and stabilizing the affected joint. This system has established itself as a leader in its specialized market, demonstrated by widespread surgeon adoption and its substantial contribution to the company's revenue.

In 2024, the Lapiplasty system continued its strong growth trajectory, fueled by an expanding base of adopting surgeons and consistently positive clinical results. This sustained performance solidifies its position as a primary revenue generator and a key growth engine for Treace Medical Concepts.

The Adductoplasty Midfoot Correction System significantly expands Treace Medical Concepts' reach, moving beyond bunion corrections to address a wider array of midfoot deformities. This strategic move broadens the company's addressable market, tapping into a new segment of foot and ankle surgical needs.

This system acts as a complementary offering to the well-established Lapiplasty system, showcasing Treace's commitment to providing comprehensive solutions for foot and ankle surgeons. This integrated approach aims to solidify their position as a go-to provider for a variety of orthopedic foot and ankle procedures.

With recent positive clinical data supporting its efficacy and continued expansion into this related market, the Adductoplasty system demonstrates high growth potential. Treace's strategy here suggests an increasing market share capture in the midfoot correction space, building on their existing success.

Treace Medical Concepts saw its 2024 revenue climb, bolstered by the growing acceptance of its newer technologies and a strategic shift in its product offerings. This demonstrates the company's effectiveness in bringing innovative, advanced solutions to market that are rapidly being adopted.

While specific newer technologies aren't categorized individually as stars in the BCG matrix, their combined impact highlights a high-growth, high-market share segment for Treace. This evolving product mix is a key driver of the company's positive financial performance.

Minimally Invasive 3D Bunion Systems (Nanoplasty and Percuplasty)

Treace Medical Concepts' minimally invasive 3D bunion systems, including Nanoplasty and Percuplasty, introduced in late 2024 and early 2025, are poised to become stars within its BCG portfolio. These innovative offerings directly address the high-volume osteotomy market, employing less invasive surgical techniques. This strategic move is designed to counter competitive pressures and aggressively capture market share in a rapidly expanding surgical segment.

The novelty of these 3D bunion systems, coupled with their alignment with current surgical trends favoring minimally invasive procedures, positions them for swift adoption by surgeons. This strong market reception is a key indicator of their potential to achieve star status, signifying high growth and high market share for Treace Medical Concepts.

- Market Entry: Late 2024 / Early 2025

- Target Market: High-volume osteotomy

- Strategic Goal: Capture market share, address competition

- Growth Potential: High due to minimally invasive trend

Expanded Bunion Portfolio and R&D Pipeline

Treace Medical Concepts is actively expanding its bunion product offerings, with a commitment to a strong research and development pipeline. This strategy includes additional product launches anticipated through 2025, indicating a consistent flow of new opportunities.

The company's focus on developing unique technologies is designed to capture a larger share of the bunion market and reinforce its leading position. This proactive approach ensures a steady stream of products with the potential for high growth and significant market share.

- Expanded Bunion Portfolio: Treace aims to broaden its range of bunion correction solutions.

- R&D Pipeline: Ongoing investment in innovation to develop differentiated technologies.

- Future Launches: Additional product introductions are planned through 2025.

- Market Penetration: Strategy focused on increasing share within the bunion market.

Treace Medical Concepts' Lapiplasty 3D Bunion Correction System is a clear star in their BCG portfolio. Its strong revenue contribution and surgeon adoption in 2024 highlight its high market share and growth potential. This product directly addresses a significant market need with a differentiated, three-dimensional approach.

The company's newer minimally invasive 3D bunion systems, like Nanoplasty and Percuplasty, are positioned to become future stars. Launched in late 2024 and early 2025, these products target the high-volume osteotomy market, aligning with trends favoring less invasive procedures.

This strategic expansion into minimally invasive techniques aims to capture significant market share and counter competitive pressures. Their potential for rapid adoption by surgeons indicates a strong growth trajectory, solidifying Treace's innovative product strategy.

| Product | BCG Category | 2024 Performance Highlight | Strategic Importance | Future Outlook |

|---|---|---|---|---|

| Lapiplasty 3D Bunion Correction System | Star | Strong revenue growth, widespread surgeon adoption | Market leader in bunion correction | Continued dominance and expansion |

| Nanoplasty / Percuplasty (Newer 3D Bunion Systems) | Potential Star | Launched late 2024/early 2025, targeting high-volume osteotomy | Minimally invasive trend alignment, market share capture | High growth potential, future revenue driver |

| Adductoplasty Midfoot Correction System | Question Mark / Emerging Star | Expanding addressable market, positive clinical data | Complementary to Lapiplasty, broader foot & ankle solutions | Increasing market share in midfoot correction |

What is included in the product

The Treace Medical Concepts BCG Matrix analyzes its product portfolio by market share and growth potential.

It provides strategic direction for investing in Stars, managing Cash Cows, developing Question Marks, and divesting Dogs.

A clear visual of Treace Medical Concepts' BCG Matrix, showing each product's position, alleviates strategic confusion.

The BCG Matrix offers Treace Medical Concepts a simplified roadmap for resource allocation, easing the burden of complex portfolio decisions.

Cash Cows

Established Lapiplasty Procedures represent a significant Cash Cow for Treace Medical Concepts. While its rapid growth qualifies it as a Star, its established market presence and widespread adoption contribute to a stable and consistent revenue stream. This reliable cash flow is crucial for funding the company's ongoing innovation and strategic expansion efforts.

With over 120,000 patients treated since its introduction and a growing base of active surgeons, Lapiplasty consistently generates substantial and dependable cash. This financial stability allows Treace Medical Concepts to reinvest in its product pipeline and pursue new market opportunities without relying heavily on external financing.

Treace Medical Concepts' core implants and surgical kits for Lapiplasty and Adductoplasty are clear cash cows. These are the consumable items needed for every procedure, generating a reliable and recurring revenue. As of the first quarter of 2024, Treace reported a net sales increase of 19% year-over-year to $47.2 million, highlighting the consistent demand for these essential components.

The predictable nature of these sales, driven by the ongoing use of their established procedures, means less need for aggressive marketing spend once a surgeon is onboard. This translates to high-margin revenue with a stable foundation, allowing Treace to allocate resources to other areas of their business.

The Adductoplasty Midfoot Correction System, a key component in Treace Medical Concepts' portfolio, is showing characteristics of a maturing product. As surgical adoption increases, this segment is poised to become a stable cash generator for the company. For instance, in the first quarter of 2024, Treace reported a 16% increase in total revenue to $57.5 million, with their Adductoplasty system contributing significantly to this growth through established clinical efficacy and expanding use cases.

Broadened Global Patent Portfolio

Treace Medical Concepts leverages its significantly broadened global patent portfolio as a key Cash Cow. This extensive intellectual property, comprising 97 granted patents and 88 pending applications as of recent disclosures, forms a formidable competitive moat around its core technologies.

These patents are crucial for maintaining market exclusivity, which directly translates into sustained high profit margins for Treace's innovative systems. The intellectual property acts as a long-term, revenue-generating asset.

- Intellectual Property Strength: 97 granted patents and 88 pending applications protect Treace's core technologies.

- Market Exclusivity: Patents ensure sustained market exclusivity, a driver of profitability.

- Revenue Generation: The IP portfolio generates consistent revenue with minimal ongoing marketing spend.

- Competitive Advantage: This robust patent protection provides a significant competitive moat.

Surgeon Training and Education Programs

Treace Medical Concepts' surgeon training and education programs function as a Cash Cow within its BCG Matrix. The company boasts an established network of 3,135 active surgeons, a figure that saw a 10% increase in 2024. This growth underscores a deeply embedded and loyal customer base that consistently relies on Treace's innovative systems.

Investing in these comprehensive training initiatives, though an upfront expenditure, cultivates highly committed users. These trained surgeons are more likely to continue adopting and utilizing Treace's offerings for their procedures. This commitment translates into a stable and predictable revenue stream, requiring minimal ongoing marketing effort.

- Established Network: 3,135 active surgeons, up 10% in 2024.

- Loyalty Driver: Training fosters deep user commitment to Treace systems.

- Predictable Revenue: Creates a low-maintenance, consistent income source.

- High Retention: Trained surgeons are less likely to switch to competitors.

Treace Medical Concepts' core implant systems and surgical kits for Lapiplasty and Adductoplasty are prime examples of Cash Cows. These consumables are essential for every procedure, generating consistent, recurring revenue. In the first quarter of 2024, Treace reported net sales of $47.2 million, a 19% increase year-over-year, demonstrating the enduring demand for these critical components.

The established nature of these procedures means that once a surgeon is trained, the need for extensive marketing diminishes, leading to high-margin revenue. This stable financial foundation allows Treace to strategically allocate resources to other growth areas within the company.

| Product/Service | BCG Category | Revenue Driver | Key Metric |

|---|---|---|---|

| Lapiplasty & Adductoplasty Implants/Kits | Cash Cow | Consumable sales per procedure | 19% YoY Net Sales Growth (Q1 2024) |

| Intellectual Property (Patents) | Cash Cow | Market exclusivity, licensing potential | 97 granted patents, 88 pending applications |

| Surgeon Training Programs | Cash Cow | Customer loyalty, repeat business | 3,135 active surgeons (10% growth in 2024) |

What You’re Viewing Is Included

Treace Medical Concepts BCG Matrix

The BCG Matrix analysis you are currently previewing is the identical, fully comprehensive document you will receive immediately after completing your purchase. This means you'll get the exact same strategic insights and formatted report, ready for immediate application in your business planning or presentations, without any alterations or watermarks.

Dogs

Older, less differentiated products within Treace Medical Concepts' portfolio, like legacy instrumentation for traditional bunionectomies, would likely be classified as Dogs in a BCG Matrix. These products have been largely superseded by their flagship Lapiplasty System, leading to a diminished market share.

These legacy offerings probably contribute very little to Treace's overall revenue, especially as surgeons increasingly adopt the Lapiplasty procedure and newer minimally invasive surgery (MIS) systems. The focus has shifted, making these older products less of a priority for sales and marketing efforts.

While they might still incur some maintenance costs, the return on investment for these outdated products is minimal. Treace's strategic direction is clearly towards innovation and growth with their advanced solutions, rather than trying to revitalize older technologies.

Niche products with limited market adoption, like highly specialized orthopedic implants for rare foot deformities, would fall into the Dogs category of the BCG Matrix. For instance, a new implant designed for a condition affecting fewer than 1,000 people annually in the US might struggle to gain traction.

These products often require significant investment in research, development, and specialized marketing to reach their small target audience. If surgeon adoption remains low, perhaps below 5% of eligible procedures in 2024, and patient awareness is minimal, these offerings become resource drains.

The market growth for such specific niches can be negligible, meaning even successful penetration yields minimal revenue. Treace Medical Concepts, like other medical device companies, must carefully assess if the potential future payoff justifies the ongoing expenditure for these niche offerings.

Unsuccessful pilot programs or early-stage technologies within Treace Medical Concepts' portfolio would fall into the Dogs quadrant of the BCG Matrix. These are innovations that, despite initial investment and testing, did not gain traction. For instance, a new surgical technique that showed promise in early trials but failed to demonstrate superior clinical outcomes compared to existing methods in wider pilot studies would be categorized here.

Such ventures represent a drain on resources, having consumed research and development funds without generating significant market share or showing potential for future growth. In the competitive medical device landscape, failing to achieve desired clinical efficacy or market acceptance during these critical early stages often seals a technology's fate, leading to a low or negligible return on investment.

Products Facing Intense Commoditization

Treace Medical Concepts may face challenges in highly commoditized segments of the orthopedic device market. In these areas, pricing pressure is often intense, and differentiation between products can be minimal. This makes it difficult to capture or maintain a significant market share, leading to typically low profit margins. Such segments can become cash traps if the company lacks proprietary technology to stand out.

For instance, if Treace offers standard surgical instruments or implants that are widely available from multiple manufacturers, they could be vulnerable. In 2024, the orthopedic device market continued to see consolidation and intense competition, particularly in areas like trauma and general orthopedic implants. Companies often compete on price rather than innovation in these segments. Treace's focus on its proprietary Amaze® bone graft substitute and its minimally invasive surgical systems are designed to counter this commoditization trend, aiming for higher value and differentiation.

- Low Differentiation: Products in commoditized markets often lack unique features, making them interchangeable.

- Intense Pricing Pressure: Competitors frequently engage in price wars, eroding profit margins.

- Difficulty in Market Share Growth: Without significant differentiation, expanding market share becomes an uphill battle.

- Cash Trap Potential: Low margins and high competition can trap capital, hindering investment in growth areas.

Ineffective Direct-to-Consumer Campaigns

Ineffective direct-to-consumer campaigns for certain Treace Medical Concepts products can significantly impact their position within the BCG matrix. If marketing investments, even substantial ones, fail to translate into meaningful patient demand or surgeon referrals, these products may be classified as dogs. This scenario highlights a poor return on investment, indicating a lack of market resonance.

For instance, if a direct-to-consumer campaign aimed at increasing awareness for a specific implant system generated minimal patient inquiries or surgeon adoption, despite a considerable marketing budget, it would point towards an ineffective strategy. Such underperformance suggests that the product, or the way it's being marketed, isn't connecting with the target audience.

- Low Conversion Rates: High marketing spend with low patient acquisition or surgeon referral rates is a key indicator of an ineffective direct-to-consumer campaign.

- Poor ROI: When marketing efforts do not generate sufficient demand to justify the expenditure, the return on investment is negative, characteristic of a dog.

- Market Resonance: A failure to resonate with patients or surgeons implies that the product's value proposition or the campaign's message is not effectively communicated or perceived.

Products in the Dogs quadrant of Treace Medical Concepts' BCG Matrix represent offerings with low market share and low market growth. These are typically older, less innovative products that are no longer a strategic focus. For example, legacy instrumentation for traditional bunionectomies, which has been largely surpassed by the Lapiplasty System, would fit this category. These products often require continued investment for maintenance but yield minimal returns, making them candidates for divestment or discontinuation.

Niche products with limited adoption, such as specialized orthopedic implants for rare deformities, can also become Dogs if market growth is negligible and surgeon uptake remains low. In 2024, the medical device market continued to see intense competition, especially in commoditized segments, where differentiation is difficult and pricing pressure is high. Treace's strategy focuses on its differentiated, minimally invasive solutions like the Lapiplasty System, moving away from products that offer little competitive advantage.

| Product Category | Market Share | Market Growth | BCG Quadrant |

| Legacy Bunionectomy Instruments | Low | Low | Dog |

| Specialized Orthopedic Implants (Rare Deformities) | Low | Low | Dog |

| Commoditized Orthopedic Implants | Low | Low | Dog |

Question Marks

Treace Medical Concepts' Micro-Lapiplasty and Mini-Adductoplasty represent innovative next-generation platforms. These advancements leverage smaller incision techniques for their core procedures, directly addressing the growing patient and surgeon preference for minimally invasive surgery. This focus on reduced invasiveness positions them for high growth potential in the evolving orthopedic market.

Despite their promising trajectory, these platforms currently hold a low market share. Their limited release and the early stages of adoption mean they are not yet established market leaders. Significant investment in surgeon education and broader market awareness campaigns will be crucial to drive wider acceptance and convert these promising innovations into successful market Stars.

The SpeedMTP Rapid Compression Implant and SpeedPlate Configurations mark Treace Medical Concepts' strategic move into the MTP (metatarsophalangeal) fusion market and other bone fusion procedures. This expansion targets new, albeit related, surgical applications, indicating a broadening of their product portfolio beyond their core offerings.

While the overall market for these fusion procedures is experiencing growth, Treace's market share within these specific implant categories is likely in its early stages. This suggests a significant opportunity for expansion but also highlights the challenge of establishing a foothold against established competitors.

Developing and commercializing these new implant systems demands considerable investment in clinical trials, regulatory approvals, and market education to demonstrate efficacy and achieve widespread adoption. For instance, the global orthopedic implants market was valued at approximately $53.4 billion in 2023 and is projected to reach $87.5 billion by 2030, with foot and ankle procedures representing a growing segment.

The IntelliGuide PSI system, leveraging AI for patient-specific bunion surgery, represents a high-growth potential product. Its personalized approach promises superior correction, positioning it as a promising innovation in orthopedic surgery.

Despite its technological advancement, IntelliGuide PSI is currently a Question Mark in the BCG matrix. The market for AI-driven surgical solutions is still nascent, and widespread adoption hinges on overcoming early-stage hurdles.

Significant investment is needed to ensure IntelliGuide PSI's success. This includes robust surgeon training programs and extensive clinical trials to validate its efficacy and demonstrate clear advantages over traditional methods.

Expansion into Broader Foot and Ankle Market Segments

Treace Medical Concepts' ambition to broaden its reach within the foot and ankle market, moving beyond its core bunion procedures, signals a pursuit of significant growth. This strategic expansion into new segments, such as midfoot and hindfoot procedures, presents substantial opportunities for revenue diversification and market penetration. For example, the total addressable market for foot and ankle surgery is projected to reach $6.2 billion by 2028, with segments beyond bunions representing a large portion of this growth.

However, these new ventures inherently begin with a low market share, placing them in the 'Question Mark' category of the BCG matrix. Treace will face formidable competition from established players who already hold significant sway in these broader segments. The company's success will hinge on its ability to innovate with new devices and procedures that offer clear advantages over existing solutions.

Significant strategic investment will be crucial for market development, clinical education, and sales force expansion to support these new product lines. Treace's 2024 investor presentations highlighted a focus on expanding its portfolio, with capital allocation plans designed to fuel these growth initiatives. The company's ability to secure market traction and achieve economies of scale will determine whether these question marks can transition into stars.

- Market Expansion: Treace aims to capture a larger share of the $6.2 billion global foot and ankle market by 2028, moving beyond bunions into midfoot and hindfoot procedures.

- Competitive Landscape: Entering new segments means competing against established companies with existing market dominance.

- Investment Requirements: Significant capital will be needed for R&D, marketing, and sales to establish a foothold in these new areas.

- Strategic Focus: Treace's 2024 strategy includes portfolio expansion, indicating a commitment to developing and launching new devices for broader foot and ankle applications.

International Market Penetration Efforts

Treace Medical Concepts' international market penetration efforts, while not its primary focus, represent a strategic avenue for future growth. The company holds a global patent portfolio, suggesting a foundational element for international expansion. However, entering new territories necessitates significant investment in navigating diverse regulatory landscapes, establishing robust distribution networks, and tailoring products to local market needs, all of which carry inherent risks regarding initial returns.

These international markets, particularly in regions with growing orthopedic surgery adoption, present a compelling opportunity for Treace's innovative solutions. For instance, the European market, with its aging population and increasing healthcare expenditure, offers substantial potential. Similarly, emerging economies in Asia Pacific are witnessing a rise in demand for advanced medical technologies.

- Global Patent Portfolio: Treace's patents extend internationally, providing a legal framework for global product protection and market entry.

- High Growth Potential Markets: Regions like Europe and Asia Pacific show increasing demand for orthopedic solutions, driven by demographics and healthcare advancements.

- Investment Requirements: Successful international expansion demands significant capital for regulatory compliance, building distribution channels, and market-specific adaptations.

- Uncertain Initial Returns: The early stages of international market penetration often involve substantial upfront costs with a delayed and uncertain return on investment.

Treace Medical Concepts' expansion into new foot and ankle segments, such as midfoot and hindfoot procedures, positions these initiatives as Question Marks. These areas represent significant growth opportunities within the broader $6.2 billion foot and ankle market projected by 2028, but Treace currently holds a minimal market share in these segments.

The company faces established competitors in these expanded markets, requiring substantial investment in product innovation, clinical education, and sales force development to gain traction. Treace's 2024 strategy explicitly targets portfolio expansion, signaling a commitment to nurturing these nascent product lines.

The success of these Question Marks hinges on Treace's ability to secure market acceptance and achieve economies of scale, thereby transitioning them into potential market Stars.

| Product/Initiative | Market Share | Market Growth | BCG Category | Strategic Focus |

|---|---|---|---|---|

| Midfoot/Hindfoot Procedures | Low | High | Question Mark | Portfolio Expansion |

| International Market Penetration | Very Low | High (in specific regions) | Question Mark | Future Growth Avenue |

BCG Matrix Data Sources

Our Treace Medical Concepts BCG Matrix is built on a foundation of robust market data, incorporating financial disclosures, competitor analysis, and industry growth projections.