Simply Good Foods SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Simply Good Foods Bundle

Simply Good Foods, a leader in the healthy snack market, boasts strong brand recognition and a loyal customer base, but also faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on their growth potential.

Want the full story behind Simply Good Foods' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Simply Good Foods possesses a powerful brand lineup, featuring established names like Atkins alongside rapidly growing brands such as Quest and the recently acquired OWYN. This diverse portfolio effectively captures various segments of the health-conscious snacking market, offering everything from low-carb solutions to high-protein and plant-based alternatives.

The Quest brand, in particular, has demonstrated impressive momentum, largely fueled by its popular salty snack offerings. Simultaneously, OWYN is experiencing significant expansion, benefiting from wider distribution channels and strong consumer demand, which translates to high sales volumes.

Simply Good Foods has shown impressive and steady revenue growth. For fiscal year 2024, net sales saw a substantial increase, and projections indicate this upward trend will continue into fiscal year 2025, driven by strong performance in key brands like Quest and OWYN.

This sustained growth is further bolstered by improving profitability. The company reported enhanced gross margins in 2024, largely due to decreased costs for ingredients and packaging, which directly contributed to a healthy net income margin and a rise in adjusted EBITDA.

Simply Good Foods leverages an extensive distribution network, ensuring their products, like Quest and Atkins, are readily available to consumers. This broad reach is complemented by strong e-commerce capabilities, allowing for seamless online purchasing and further market penetration.

Their direct-to-consumer (DTC) strategy via online platforms is a significant driver of sales growth and cultivates deeper customer relationships. This DTC focus not only boosts revenue but also enhances brand loyalty and engagement, as seen with the consistent e-commerce expansion for both key brands.

Commitment to Innovation and Product Development

Simply Good Foods demonstrates a strong commitment to innovation, consistently investing in research and development to stay ahead in the dynamic health and wellness market. This focus allows them to regularly introduce new products that align with shifting consumer tastes and demands.

Their strategic product launches, such as the Quest Bake Shop platform and the expansion of the Atkins Endulge product lines, underscore their dedication to broadening their portfolio. These initiatives are key drivers for sustained growth, fueled by a pipeline of fresh and appealing offerings.

For instance, in fiscal year 2023, Simply Good Foods reported net sales of $1.1 billion, with product innovation playing a significant role in achieving this growth. The company's ability to adapt and introduce new items, like the recently launched Quest Protein Bars with improved textures and flavors, directly contributes to their market competitiveness.

- R&D Investment: Actively channels resources into research and development to foster innovation.

- Product Launches: Regularly introduces new products to capture evolving consumer preferences in the health and wellness sector.

- Strategic Initiatives: Quest Bake Shop and new Atkins Endulge lines exemplify their commitment to expanding product offerings and driving growth through newness.

Strategic Acquisitions for Market Expansion

Simply Good Foods' strategic acquisitions are a significant strength, particularly the June 2024 purchase of OWYN. This move bolsters their presence in the booming plant-based protein sector, tapping into consumer preferences for clean-label and allergen-free products. The integration of OWYN is projected to drive substantial net sales growth and broaden the company's product offerings.

This expansion strategy is already showing promise. For the fiscal year ending August 30, 2024, Simply Good Foods reported net sales of $1.19 billion, a 7.5% increase compared to the previous year. The OWYN acquisition is anticipated to accelerate this trajectory, contributing an estimated $200 million in net sales in its first full year. This diversification is crucial for long-term resilience.

- Market Expansion: The OWYN acquisition in June 2024 directly targets the rapidly growing plant-based protein market.

- Clean Label Alignment: OWYN's allergen-free and clean-label positioning resonates with current consumer trends.

- Revenue Growth Driver: The acquisition is expected to contribute significantly to Simply Good Foods' net sales, with projections of $200 million in the first year.

- Portfolio Diversification: This strategic move diversifies the company's revenue streams beyond its core nutrition bars.

Simply Good Foods benefits from a robust brand portfolio, including established names like Atkins and high-growth brands such as Quest and OWYN. This diverse range caters to various health-conscious consumer needs, from low-carb to plant-based options.

The company exhibits strong and consistent revenue growth, with fiscal year 2024 net sales reaching $1.19 billion, a 7.5% increase year-over-year. Projections for fiscal year 2025 indicate continued upward momentum, driven by key brands.

Simply Good Foods demonstrates a strong commitment to innovation, regularly introducing new products and expanding existing lines like Quest and Atkins to meet evolving consumer demands in the health and wellness sector.

Strategic acquisitions, such as the June 2024 purchase of OWYN, are a key strength, expanding the company's reach into the growing plant-based protein market and diversifying revenue streams.

| Brand | 2024 Net Sales Contribution (Est.) | Growth Driver |

|---|---|---|

| Quest | Significant | Salty snacks, protein bars |

| Atkins | Stable | Established low-carb market |

| OWYN | ~$200 million (First Year Est.) | Plant-based, allergen-free |

What is included in the product

Delivers a strategic overview of Simply Good Foods’s internal and external business factors, highlighting its strong brand portfolio and market position while acknowledging potential challenges in evolving consumer preferences.

Offers a clear, actionable framework to address Simply Good Foods' market challenges and capitalize on growth opportunities.

Weaknesses

Simply Good Foods' significant reliance on the North American market presents a notable weakness. As of the fourth quarter of 2023, the overwhelming majority of its revenue stemmed from the United States, highlighting a limited international footprint.

This concentration in a single geographic region exposes the company to substantial risks. Regional economic downturns, changes in consumer tastes, or even regulatory shifts within the US could disproportionately impact its financial performance, making it less resilient than more globally diversified competitors.

The Atkins brand has been a persistent weak point for Simply Good Foods, showing a pattern of declining retail sales and a shrinking distribution footprint in recent quarters. For instance, in the first quarter of fiscal year 2024, Atkins experienced a net sales decrease, contributing to the company's overall revenue challenges.

Despite the company's efforts to revitalize the brand through strategic initiatives like optimizing shelf space and introducing new product innovations, the sustained underperformance of Atkins poses a significant risk. These ongoing struggles could potentially hinder Simply Good Foods' ability to achieve its broader growth objectives and impact overall profitability metrics throughout 2024 and into 2025.

Simply Good Foods is susceptible to rising costs for key ingredients such as cocoa and whey, which have previously squeezed their profit margins. For instance, in fiscal year 2023, the company noted that significant commodity price increases, particularly for dairy and cocoa, contributed to margin pressures.

While the company has implemented strategies like improving productivity and adjusting prices, persistent inflation could still hinder their ability to maintain profitability. This ongoing risk requires continuous monitoring and potential further action to offset these cost increases.

Integration Risks from Acquisitions

The acquisition of OWYN, while promising, introduces integration risks that could impact Simply Good Foods' financial performance. These risks include a potential drag on gross margins and an increase in general and administrative expenses stemming from the integration process itself. Successfully merging OWYN's operations is paramount to unlocking the expected synergies and revenue growth.

Simply Good Foods faces challenges in realizing the full potential of its acquisitions, particularly with OWYN. Key integration risks include:

- Potential Gross Margin Dilution: The integration of OWYN's cost structure could initially lead to lower overall gross margins for Simply Good Foods.

- Increased G&A Expenses: Costs associated with integrating systems, personnel, and operations for OWYN are expected to elevate general and administrative expenses in the short to medium term.

- Synergy Realization Uncertainty: The ability to achieve anticipated cost savings and revenue enhancements from the OWYN acquisition is dependent on the effectiveness of the integration plan.

Competitive Market Landscape

The nutritional snacking industry is incredibly crowded, featuring a vast array of companies, many of which possess significantly larger financial backing and a more established brand reach than Simply Good Foods. This intense fragmentation means constant pressure from competitors who can leverage greater resources for marketing and product development.

Specifically within popular categories like protein bars, Simply Good Foods faces heightened competition. This can translate into more aggressive pricing strategies and promotional campaigns from rivals, potentially impacting Simply Good Foods' market share and profitability. For instance, the protein bar market alone was valued at over $7 billion globally in 2023 and is projected to grow, attracting new entrants and intensifying existing rivalries.

- Fragmented Market: Numerous small and large players compete, diluting market share.

- Resource Disparity: Larger competitors often have greater financial resources for marketing and R&D.

- Promotional Pressure: Intense competition, particularly in protein bars, drives aggressive promotional activities.

- Market Share Risk: Increased competition can lead to a squeeze on Simply Good Foods' existing market share.

Simply Good Foods' heavy dependence on the North American market, particularly the United States, remains a significant vulnerability. This geographic concentration exposes the company to substantial risks from regional economic fluctuations and evolving consumer preferences, limiting its resilience compared to more diversified global players.

The Atkins brand continues to be a persistent weak point, exhibiting declining retail sales and a shrinking distribution footprint. For example, in Q1 FY2024, Atkins experienced a net sales decrease, underscoring ongoing challenges in revitalizing this core brand despite strategic efforts.

Rising costs for key ingredients such as cocoa and whey present a consistent threat to Simply Good Foods' profit margins. In fiscal year 2023, the company noted that commodity price increases, especially for dairy and cocoa, directly pressured its profitability, requiring ongoing cost management and potential price adjustments.

The acquisition of OWYN introduces integration risks, potentially diluting gross margins and increasing general and administrative expenses. The success of this integration is critical for realizing expected synergies and preventing a drag on overall financial performance through 2024 and into 2025.

What You See Is What You Get

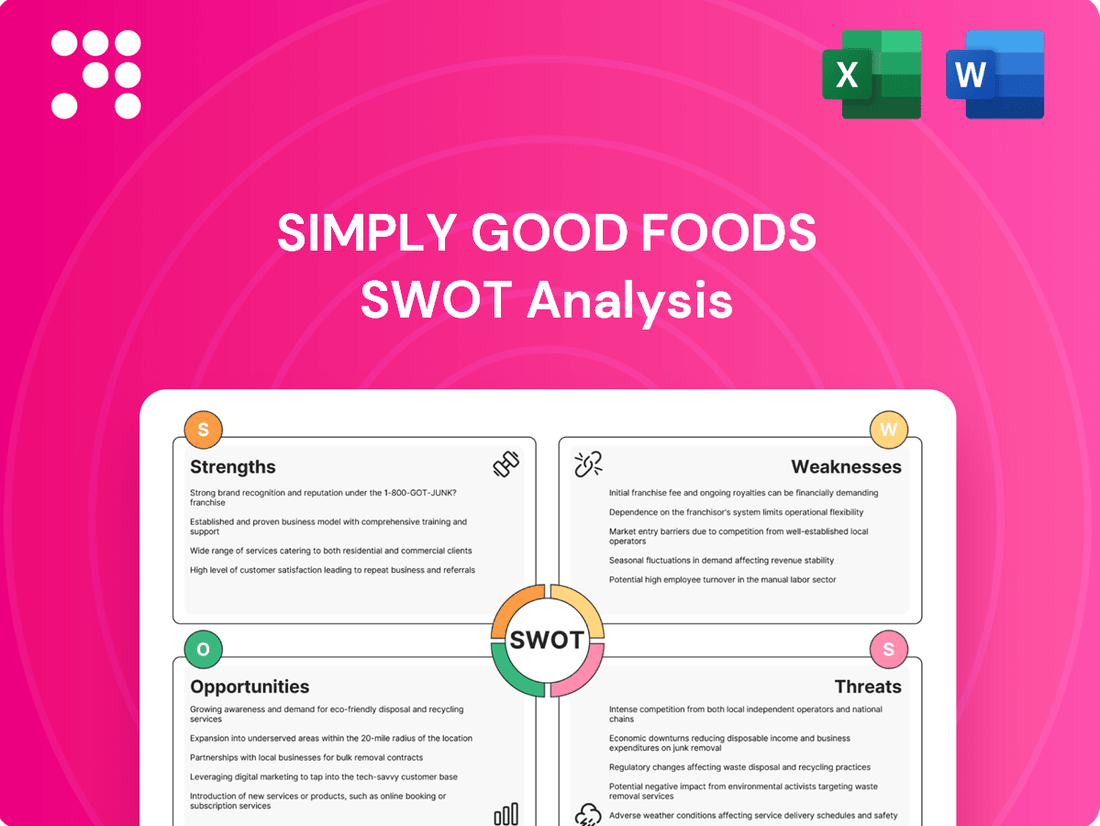

Simply Good Foods SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine snapshot of the comprehensive Simply Good Foods analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. Unlock the full, in-depth report to gain complete strategic insights.

Opportunities

The nutritional snacking category is booming, with consumers increasingly prioritizing healthy lifestyles and seeking out products that are high in protein, low in sugar, and low in carbohydrates. This trend is a significant tailwind for companies like Simply Good Foods.

Simply Good Foods is strategically positioned to leverage this growing demand. Its portfolio of 'better-for-you' brands, including Quest Nutrition and Atkins, directly addresses these consumer preferences, allowing the company to capture a larger share of this expanding market.

For instance, the global healthy snacks market was valued at over $100 billion in 2023 and is projected to grow at a compound annual growth rate of around 6% through 2030, indicating substantial room for expansion for companies aligned with these consumer values.

Simply Good Foods' acquisition of OWYN directly taps into the rapidly expanding plant-based and allergen-friendly food markets. This strategic move allows the company to cater to a growing segment of consumers actively seeking specialized dietary solutions, diversifying its product portfolio.

The plant-based food market is projected to reach $74.2 billion by 2030, with allergen-friendly products showing similar robust growth. By integrating OWYN, Simply Good Foods is well-positioned to capture a significant share of this expanding market, appealing to a wider demographic.

Simply Good Foods can significantly boost its direct-to-consumer (DTC) sales by continuing to invest in and refine its e-commerce platforms. This strategy not only drives revenue but also cultivates deeper brand loyalty and customer relationships.

The robust e-commerce performance for both Quest and Atkins brands highlights a substantial opportunity for expansion in this sales channel. This is particularly true in markets where securing prime physical retail shelf space presents a challenge.

Strategic Partnerships and International Expansion

Simply Good Foods can significantly boost its growth by forging new retail partnerships within the U.S. and venturing into international markets. This dual approach offers a pathway to substantial new revenue, especially considering the company's current U.S.-centric market presence.

Expanding internationally can diversify revenue streams, lessening dependence on the domestic market. For instance, the global healthy snacks market, valued at over $100 billion in 2023, presents a vast opportunity for brands like Simply Good Foods to establish a foothold.

- Explore partnerships with emerging grocery chains and online retailers to broaden U.S. distribution.

- Target key international markets with high consumer demand for healthy and convenient food options, such as Western Europe and Australia.

- Leverage existing product appeal to adapt and introduce offerings that resonate with local tastes and dietary preferences abroad.

- Analyze the competitive landscape in potential international markets to identify unique selling propositions and market entry strategies.

Product Innovation in Emerging Categories

Simply Good Foods can expand beyond its established snack bars and confectionery by venturing into exciting new 'better-for-you' food sectors. This includes developing and launching products in areas like healthy baked goods, mirroring the success of its Quest Bake Shop line, and entering the growing market for ready-to-drink nutritional beverages.

By consistently innovating and introducing new product formats, Simply Good Foods can ensure its brands remain appealing to evolving consumer preferences and attract entirely new customer bases. This strategic move into adjacent categories is crucial for sustained long-term growth and market share expansion.

For instance, the company's 2024 fiscal year saw continued strength in its protein bar segment, with net sales for the Quest brand growing year-over-year. This existing brand equity provides a solid foundation for introducing new product innovations.

- Expansion into healthy baked goods: Leveraging the Quest brand's success in this niche.

- Entry into ready-to-drink beverages: Tapping into a rapidly growing segment of the health and wellness market.

- Cross-category appeal: Attracting consumers seeking convenient, nutritious options across multiple meal occasions.

- Brand extension: Utilizing established brand recognition to drive adoption of new product lines.

Simply Good Foods is well-positioned to capitalize on the expanding healthy snacking trend, with its strong portfolio of brands like Quest Nutrition and Atkins directly aligning with consumer demand for protein-rich, low-sugar options. The global healthy snacks market, valued at over $100 billion in 2023, offers significant growth potential. Furthermore, the strategic acquisition of OWYN allows the company to tap into the rapidly growing plant-based and allergen-friendly food markets, projected to reach $74.2 billion by 2030, diversifying its offerings and customer base.

Expanding its direct-to-consumer (DTC) channels presents a substantial opportunity for Simply Good Foods to enhance sales and build deeper customer loyalty, especially where physical shelf space is competitive. The company can also drive significant growth by forging new retail partnerships within the U.S. and expanding into international markets, leveraging the global healthy snacks market's vast potential. Finally, innovating into adjacent 'better-for-you' categories, such as healthy baked goods and ready-to-drink nutritional beverages, can attract new customers and ensure sustained long-term growth, building on existing brand equity like the Quest brand's success in protein bars.

| Opportunity Area | Market Trend | Key Brands/Products | Projected Market Growth (CAGR) | Simply Good Foods' Position |

|---|---|---|---|---|

| Healthy Snacking | Increasing consumer focus on health and wellness | Quest Nutrition (protein bars), Atkins (low-carb snacks) | Global healthy snacks market >$100B (2023), 6% through 2030 | Strong brand recognition and product alignment |

| Plant-Based & Allergen-Friendly | Growing demand for specialized dietary solutions | OWYN (plant-based, allergen-friendly) | Plant-based food market $74.2B by 2030 | Strategic acquisition to capture niche market share |

| Direct-to-Consumer (DTC) Expansion | Rise of e-commerce and desire for direct brand engagement | Quest and Atkins e-commerce platforms | N/A (channel-specific growth) | Leveraging existing DTC success for further investment |

| International Market Entry | Global demand for convenient, healthy food options | All Simply Good Foods brands | Global healthy snacks market >$100B (2023) | Untapped potential for revenue diversification |

| Product Innovation & Diversification | Consumer desire for variety and new healthy formats | Quest Bake Shop, potential for RTD beverages | N/A (category-specific growth) | Expanding into adjacent categories to capture new segments |

Threats

Consumer tastes are changing fast, and new diet fads, like the rise of GLP-1 medications, could really affect how much people want Simply Good Foods' current products, especially Atkins. For instance, in early 2024, the weight-loss drug market was projected to reach tens of billions of dollars, a significant shift in how people approach health.

Simply Good Foods needs to be quick to adjust its product offerings to match these evolving preferences, or its current items might become less popular. Staying ahead of these trends is crucial to avoid being left behind in a competitive market.

The nutritional snacking arena is incredibly crowded, with many players vying for consumer attention. This intense competition, particularly in popular segments, risks market saturation. For Simply Good Foods, this could translate into price wars as companies try to undercut each other, and a significant increase in marketing and promotional expenses just to hold onto their existing customer base.

Larger, well-funded competitors represent a substantial threat. These companies often have the financial muscle to launch new products rapidly and secure broader distribution channels, potentially squeezing out smaller or less agile brands. For instance, in 2024, major food conglomerates continued to invest heavily in their snack portfolios, often acquiring smaller, innovative brands to quickly gain market share and access new consumer trends.

Simply Good Foods faces significant risks from supply chain disruptions and fluctuating commodity prices. For instance, the cost of key ingredients like whey and cocoa can swing dramatically, directly impacting production expenses and squeezing gross profit margins. This vulnerability was highlighted in their Q1 2024 earnings, where they noted increased input costs impacting their outlook.

Global economic instability and geopolitical tensions, such as ongoing trade disputes or conflicts, can further worsen these issues. These events can disrupt the availability of essential raw materials and drive up their prices, creating a challenging operating environment for the company and potentially affecting their ability to meet demand consistently.

Regulatory Changes and Health Scrutiny

Increased regulatory scrutiny over nutritional claims, ingredient sourcing, or food labeling could necessitate costly product reformulations or marketing adjustments for Simply Good Foods. For instance, evolving FDA guidelines on health claims or ingredient transparency could directly impact their product development pipeline and marketing strategies, potentially adding significant operational costs.

Public perception shifts regarding artificial ingredients or specific dietary approaches could also negatively impact brand reputation and sales. A growing consumer preference away from artificial sweeteners or a surge in popularity for keto-specific products not aligned with Simply Good Foods' current offerings could present a challenge. In 2024, the global functional foods market, which Simply Good Foods operates within, was valued at approximately $280 billion and is projected to grow, but this growth is highly sensitive to consumer sentiment and regulatory environments.

- Regulatory Risk: Potential for new regulations on sugar content or artificial ingredients impacting product formulations.

- Consumer Perception: Shifting dietary trends and concerns about specific ingredients can affect brand appeal.

- Compliance Costs: Reformulations and updated labeling can lead to increased operational expenses.

Economic Downturns and Discretionary Spending

Potential economic downturns or periods of high inflation could significantly impact consumer discretionary spending, directly affecting demand for premium-priced nutritional snacks like those offered by Simply Good Foods. As consumers tighten their budgets and focus on essential goods, 'better-for-you' options may be perceived as non-essential luxuries, potentially leading to reduced sales volumes. For instance, during periods of economic uncertainty, consumers often cut back on items not deemed critical for survival.

The company's reliance on a consumer base that can afford premium products makes it vulnerable. If inflation continues to rise, as seen with CPI figures potentially remaining elevated in 2024 and 2025, consumers may trade down to less expensive alternatives. This shift in purchasing behavior poses a direct threat to Simply Good Foods' market share and revenue streams.

- Inflationary Pressures: Persistent inflation in 2024-2025 could erode consumer purchasing power for non-essential items.

- Discretionary Spending Cuts: Economic uncertainty often leads consumers to prioritize essential goods over premium snacks.

- Competitive Landscape: Lower-priced competitors could gain an advantage if consumers seek more budget-friendly options.

- Brand Perception: 'Better-for-you' products might be reclassified as discretionary, impacting sales volume.

The rise of GLP-1 medications presents a significant threat, potentially altering consumer approaches to weight management and reducing demand for traditional diet products like Atkins. With the weight-loss drug market projected to reach tens of billions of dollars by early 2024, Simply Good Foods must adapt its offerings quickly to stay relevant.

Intense competition in the nutritional snacking market, characterized by numerous brands vying for consumer attention, risks market saturation and price wars. This crowded landscape could force Simply Good Foods into increased marketing spending simply to maintain its current customer base.

Simply Good Foods faces threats from supply chain volatility and fluctuating commodity prices, impacting production costs and profit margins. For instance, increased input costs were noted in their Q1 2024 earnings, affecting their financial outlook.

Economic downturns and persistent inflation, as seen with elevated CPI figures in 2024-2025, can curb consumer discretionary spending, making premium snacks less of a priority. This vulnerability is amplified by the company's reliance on consumers who can afford its higher-priced products.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verifiable financial statements, comprehensive market research reports, and expert industry analyses. These diverse data streams provide a robust understanding of Simply Good Foods' operational landscape and competitive positioning.