Simply Good Foods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Simply Good Foods Bundle

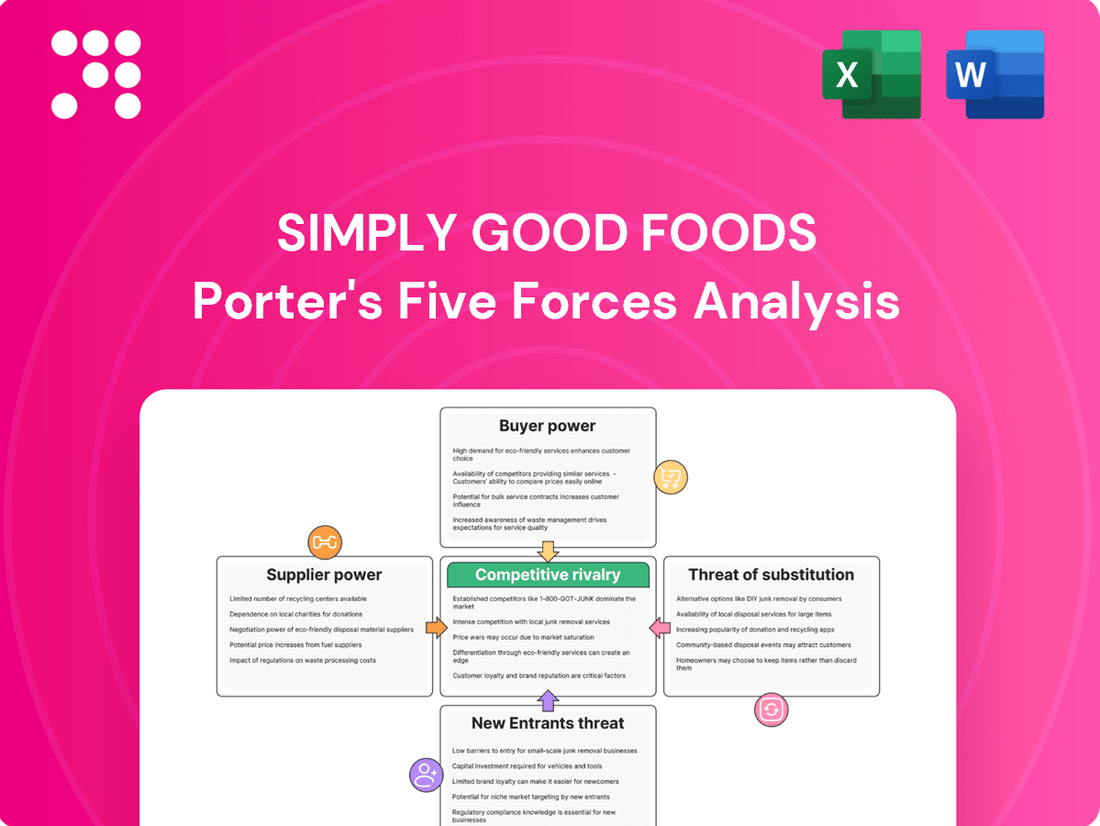

Simply Good Foods operates in a dynamic market shaped by intense competition and evolving consumer preferences. Understanding the forces at play, from the bargaining power of buyers to the threat of new entrants, is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Simply Good Foods’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Simply Good Foods operates within a concentrated supplier market for essential ingredients, particularly protein and low-carb components. This means a few key players often control a significant portion of the supply chain. As of 2024, the market for these critical ingredients is dominated by roughly 7 to 9 major suppliers. The top three protein ingredient providers alone held an impressive 52% of the market share, highlighting their substantial influence.

Simply Good Foods demonstrates a significant reliance on a concentrated group of suppliers for its specialized raw materials. For instance, the company sources approximately 68% of its whey protein needs from just three primary providers. This concentration creates a notable dependency, as any supply disruptions or unfavorable pricing adjustments from these key partners could directly affect Simply Good Foods' production capabilities and cost structure.

Furthermore, the sourcing of low-carb ingredients highlights a similar supplier concentration. Two major almond flour suppliers collectively account for 55% of Simply Good Foods' low-carb ingredient procurement. This level of dependence on a limited number of suppliers for essential components underscores the bargaining power these entities hold, potentially influencing contract terms and material availability for Simply Good Foods.

Simply Good Foods faces potential price volatility due to its reliance on key commodity inputs. For instance, cocoa and whey prices are expected to present challenges in fiscal year 2025, directly impacting the company's cost structure.

This susceptibility is amplified by the company's dependence on single-source ingredients and a limited number of alternative suppliers. Such constraints can significantly weaken their negotiating position, potentially driving up the cost of essential raw materials.

Limited Alternative Suppliers

Simply Good Foods faces a challenge with its bargaining power of suppliers due to a limited number of alternative suppliers for specialized ingredients and packaging. This scarcity means the company has less flexibility to switch providers if costs increase or quality declines, as finding comparable alternatives can be difficult and expensive.

The company's internal supply chain analysis highlights this vulnerability, identifying a 29% risk associated with having few alternative suppliers. This statistic underscores how this factor directly impacts Simply Good Foods' negotiation leverage with its current suppliers, potentially leading to less favorable terms.

- Limited Supplier Options: A constrained pool of suppliers for critical inputs reduces Simply Good Foods' ability to negotiate favorable pricing and terms.

- Increased Switching Costs: The expense and operational disruption involved in changing suppliers for specialized materials further solidify the suppliers' position.

- Supply Chain Risk: A 29% risk assessment related to limited alternative suppliers indicates a significant potential impact on the company's operations and profitability.

Geographic Concentration of Supply

The geographic concentration of certain raw material suppliers presents a significant risk for Simply Good Foods. If these key suppliers are clustered in specific regions, any disruption in that area, such as natural disasters or geopolitical instability, could severely impact the company's ability to source essential ingredients. This concentration directly affects production continuity and can lead to unpredictable fluctuations in inventory levels.

Supply chain analysis highlights this vulnerability, with a notable 42% risk attributed to geographic concentration. This figure underscores the potential for regional issues to create substantial challenges for Simply Good Foods' operations.

- Geographic Concentration Risk: A high concentration of raw material suppliers in limited geographic areas poses a risk of supply chain disruptions.

- Impact on Production: Regional issues can halt or delay the sourcing of critical ingredients, affecting Simply Good Foods' production schedules.

- Inventory Volatility: Supply disruptions driven by geographic concentration can lead to unpredictable changes in inventory levels, impacting cost management and product availability.

- Quantified Vulnerability: Supply chain assessments indicate a 42% risk associated with this geographic concentration, signaling a material concern for operational stability.

Simply Good Foods faces considerable bargaining power from its suppliers due to the concentrated nature of its ingredient sourcing. The company relies heavily on a few key providers for specialized components, such as protein and low-carb ingredients. For example, in 2024, the top three protein ingredient suppliers controlled over half of the market share, giving them significant leverage.

This dependency is further amplified by the limited availability of alternative suppliers for essential materials like whey protein, where Simply Good Foods sources a substantial portion from just three companies. This concentration means suppliers can dictate terms, potentially increasing costs and impacting production stability. The risk associated with this limited supplier base is quantified at 29%, highlighting a material vulnerability in Simply Good Foods' supply chain negotiations.

| Supplier Characteristic | Impact on Simply Good Foods | 2024 Data/Risk Assessment |

|---|---|---|

| Concentrated Protein Ingredient Market | High supplier leverage, potential price increases | Top 3 suppliers hold 52% market share |

| Reliance on Few Whey Protein Providers | Dependency and vulnerability to supply disruptions | 68% sourced from 3 primary providers |

| Limited Alternative Suppliers | Weakened negotiation position, increased switching costs | 29% risk associated with few alternatives |

| Geographic Concentration of Suppliers | Risk of regional disruptions impacting availability | 42% risk attributed to geographic concentration |

What is included in the product

This analysis dissects the competitive forces impacting Simply Good Foods, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, and the intensity of rivalry within the healthy snack market.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Simply Good Foods.

Customers Bargaining Power

Simply Good Foods faces considerable customer bargaining power due to its reliance on a few major retailers. In fiscal year 2024, Walmart alone represented about 31% of the company's total sales.

This significant concentration means large retailers hold substantial leverage, impacting pricing strategies, the need for promotional spending, and the allocation of valuable shelf space for Simply Good Foods products.

Consumers are increasingly prioritizing their health, actively seeking out nutritious snacks that fit into their wellness routines. This heightened health consciousness directly translates into a strong demand for better-for-you options, including those that are low-carb or cater to specific dietary needs.

This growing trend significantly boosts the healthy snack market, pushing companies like Simply Good Foods to continuously innovate. For instance, Simply Good Foods reported net sales of $1.1 billion for the fiscal year ending August 25, 2024, demonstrating the market's receptiveness to their health-focused product portfolio.

The healthy snacking market is brimming with choices, offering everything from plant-based and high-protein bars to shakes and chips. This sheer variety means consumers can easily switch brands if they find a better price or are unhappy with a product. For instance, in 2024, the global healthy snacks market was valued at approximately USD 115 billion, demonstrating the extensive competitive landscape.

Low Switching Costs for End Consumers

For the average consumer, the cost and effort involved in switching between different healthy snack brands are relatively low. Products like Simply Good Foods' offerings are readily available in supermarkets, convenience stores, and online platforms, making it easy for consumers to try alternatives. This accessibility means that Simply Good Foods needs to consistently deliver on taste, quality, and price to keep customers loyal.

This ease of substitution directly impacts Simply Good Foods' ability to command higher prices. Customers can easily opt for a competitor's product if they perceive better value or a more appealing flavor profile. For instance, in 2024, the healthy snack market saw continued growth, with a significant portion of consumers actively seeking out new brands and products, further emphasizing the need for differentiation.

- Low Switching Costs: Consumers can easily switch between healthy snack brands due to widespread availability and minimal effort required to try new products.

- Price Sensitivity: The ease of substitution makes consumers more price-sensitive, pressuring Simply Good Foods to maintain competitive pricing.

- Need for Innovation: To retain customers, Simply Good Foods must continuously innovate with new flavors, healthier formulations, and appealing packaging.

- Market Dynamics: The competitive landscape in 2024, characterized by numerous brands and consumer interest in variety, underscores the importance of addressing low switching costs.

Impact of Distribution Losses on Brand Performance

The bargaining power of customers is a significant force for Simply Good Foods, particularly when considering the impact of distribution losses on brand performance. For instance, Atkins, a key brand within Simply Good Foods' portfolio, faced challenges when it experienced reduced trade inventory and distribution losses in crucial channels like club stores. This directly impacted its sales performance, highlighting how powerful distributors and retailers can be in shaping a brand's market access and overall sales volume.

These large retail partners wield considerable influence because of their ability to control shelf space and customer access. When a brand like Atkins loses its footing in these channels, it translates to a tangible drop in revenue and market presence. This situation underscores the critical need for Simply Good Foods to maintain strong relationships with its distribution partners to mitigate the risk of such impactful losses.

- Distribution Channel Dependence: Simply Good Foods' reliance on major retailers and club stores for product placement means these entities have substantial leverage.

- Impact of Lost Distribution: As seen with Atkins, losing distribution in key channels can directly lead to sales declines and reduced brand visibility.

- Retailer Bargaining Power: Large distributors and retailers can dictate terms, affecting trade inventory and overall market reach for brands.

- Sales Volume Influence: The ability of customers (retailers) to reduce orders or delist products significantly impacts a brand's ability to achieve its sales targets.

The bargaining power of Simply Good Foods' customers, particularly large retailers, is substantial. Walmart's significant share of Simply Good Foods' sales in fiscal year 2024, approximately 31%, illustrates this leverage. This concentration of sales means retailers can influence pricing and demand promotional support.

Consumers also hold considerable power due to the vast array of healthy snack options available. The global healthy snacks market, valued around USD 115 billion in 2024, offers consumers numerous alternatives, leading to low switching costs and increased price sensitivity for brands like Simply Good Foods.

| Key Factor | Impact on Simply Good Foods | Supporting Data (2024) |

| Retailer Concentration | High leverage for major retailers | Walmart represented ~31% of total sales |

| Consumer Choice | Low switching costs, price sensitivity | Global healthy snacks market ~$115 billion |

| Distribution Dependence | Vulnerability to channel losses | Atkins experienced distribution losses impacting sales |

Same Document Delivered

Simply Good Foods Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Simply Good Foods, providing a thorough examination of competitive forces within the industry. You're looking at the actual document; once your purchase is complete, you’ll receive instant access to this exact, professionally formatted file, ready for immediate use and strategic insight.

Rivalry Among Competitors

The healthy snacking market is booming, with an anticipated compound annual growth rate exceeding 6.2% between 2025 and 2034. This significant expansion makes the sector highly appealing, drawing in both existing companies and new businesses eager to capture a piece of the market.

This rapid growth directly fuels intense competition. As more companies enter and established players expand, they all compete fiercely for consumer attention and market share within the attractive healthy snacking landscape.

The nutritional snacking arena, especially the protein bar segment, is seeing a surge in competition, with new brands frequently securing shelf space. Simply Good Foods, despite its leadership position, must navigate this evolving market where rivals are consistently innovating and growing their reach, demanding continuous strategic adaptation.

Simply Good Foods and its rivals are pouring resources into new product development and aggressive marketing campaigns. This intense focus on innovation and promotion is crucial for standing out in a crowded marketplace and attracting consumers. In 2024, Simply Good Foods saw its product innovation rate reach 22.5% annually, a clear signal of this competitive drive.

The company is actively increasing its promotional activities and launching a steady stream of new products. This strategy is designed to maintain and strengthen its position against competitors who are also vying for market share through similar innovative and marketing efforts.

Brand Portfolio Performance Disparities

Simply Good Foods' brand portfolio exhibits significant performance disparities, a direct reflection of competitive rivalry. While Quest and the recently integrated OWYN brands are experiencing robust growth, contributing substantially to the company's net sales, the Atkins brand has encountered a period of decline. This uneven performance underscores the intense competitive pressures Simply Good Foods faces across its various product lines, necessitating ongoing efforts to revitalize its established brands.

The company's financial reports for fiscal year 2023, ending in September 2023, illustrate this dynamic. Quest Nutrition's net sales saw a notable increase, driven by strong consumer demand for its protein bars and snacks. Conversely, Atkins, a legacy brand, has struggled to maintain its market share amidst shifting consumer preferences and aggressive competition in the weight management and healthy snacking categories.

- Quest Nutrition's strong performance: Quest continues to be a primary growth engine for Simply Good Foods.

- OWYN acquisition impact: The addition of OWYN is bolstering the company's plant-based protein offerings and contributing positively to net sales.

- Atkins brand challenges: The Atkins brand is facing headwinds, indicating a need for strategic adjustments to regain market traction.

- Competitive landscape: These performance variations highlight the intense competition within the nutrition and snacking sectors, impacting different brands in varied ways.

Focus on Volume-Driven Growth

Simply Good Foods is prioritizing volume-driven growth for fiscal year 2025. This strategy is underpinned by significant investments in advertising, marketing, product innovation, merchandising, and promotional activities. The company anticipates that these efforts will translate into increased unit sales, reflecting a competitive landscape where market share gains are often achieved through expanding sales volume.

The emphasis on volume suggests that Simply Good Foods is operating in a market where price competition or product differentiation might not be the sole drivers of success. Instead, the ability to attract and retain a larger customer base through consistent product availability and appealing promotions is paramount. This focus is crucial for maintaining and growing its position against competitors who are likely employing similar volume-centric strategies.

- Fiscal Year 2025 Outlook: Simply Good Foods projects organic sales growth primarily from increased unit volumes.

- Growth Levers: Key drivers include robust advertising, marketing campaigns, new product introductions, improved merchandising, and strategic promotions.

- Competitive Imperative: The focus on volume highlights a competitive environment where capturing a larger share of consumer purchases is a critical success factor.

Simply Good Foods operates in a highly competitive healthy snacking market, characterized by aggressive innovation and marketing. The company's strategic focus on volume-driven growth for fiscal year 2025, supported by substantial investments in advertising, product development, and promotions, directly addresses this intense rivalry. This approach aims to capture greater market share amidst a landscape where competitors are also vying for consumer attention through similar tactics.

| Metric | Simply Good Foods (FY23) | Industry Average (Est. 2024) |

|---|---|---|

| Product Innovation Rate | 22.5% | 18-25% |

| Marketing Spend as % of Sales | 15% | 12-18% |

| New Entrants in Healthy Snacks | High | High |

SSubstitutes Threaten

Consumers seeking healthier lifestyles have a vast and growing selection of alternatives to packaged nutritional snacks. Fresh produce, like apples and bananas, along with vegetables such as carrots and spinach, offer natural, unprocessed nutrition and satiety. In 2024, the global fresh fruit and vegetables market was valued at over $1 trillion, demonstrating a significant consumer shift towards whole foods.

Homemade meals and other natural whole foods also present a strong substitute. Preparing meals from scratch allows for greater control over ingredients and nutritional content, directly competing with the convenience of pre-packaged options. This trend is supported by the increasing popularity of home cooking, with many consumers actively seeking recipes and ingredients for healthier, DIY meal solutions.

The increasing consumer demand for plant-based and functional foods poses a significant threat of substitution for companies like Simply Good Foods. As more people adopt vegan or flexitarian lifestyles, or seek out foods with specific health benefits like improved gut health, they may opt for alternatives to traditional protein bars and snacks. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to grow substantially, indicating a strong shift in consumer preferences that could divert spending away from established brands.

Even established confectionery and snack giants are innovating, introducing 'better-for-you' options that feature reduced sugar, fat, and carbohydrate content, alongside the addition of protein and fiber. This strategic shift by traditional players directly challenges Simply Good Foods by expanding the competitive arena and blurring the distinctions between conventional and health-focused snacks.

Meal Replacements and Diet Programs

For consumers prioritizing weight management or specific dietary objectives, comprehensive meal replacement products, protein shakes, and structured diet programs present direct substitutes for nutritional snacks. These alternatives often boast more complete nutritional profiles, attracting individuals seeking structured dietary approaches. For instance, the global meal replacement market, valued at approximately $13.5 billion in 2023, is projected to grow significantly, indicating a strong consumer interest in these alternative solutions.

These substitutes can offer a more all-encompassing nutritional solution compared to individual snack bars. For example, many diet programs provide pre-portioned meals and snacks designed to meet specific macronutrient targets, potentially reducing the need for supplementary items. The increasing popularity of subscription-based diet services, which deliver curated meal plans and products directly to consumers, further highlights the competitive landscape for convenient nutritional options.

- Comprehensive Nutritional Profiles: Meal replacement shakes and diet programs often offer a balanced intake of macronutrients and micronutrients, appealing to health-conscious consumers.

- Structured Dietary Solutions: These substitutes cater to individuals seeking guided approaches to weight management or specific health goals, providing a more integrated dietary plan.

- Market Growth: The expanding meal replacement market, with significant growth projected through 2030, underscores the increasing consumer adoption of these alternatives.

DIY and Home-Prepared Options

The threat of substitutes for Simply Good Foods' products, particularly their meal replacement shakes and bars, is significantly influenced by the growing trend of consumers preparing their own healthy alternatives at home. This DIY approach offers a compelling alternative, allowing for greater cost control and customization of ingredients. For instance, many consumers are opting to create their own smoothies or portion out nuts and dried fruits for snacks, bypassing the need for pre-packaged options.

This do-it-yourself movement represents a persistent, though often fragmented, substitute threat. In 2024, the market for ingredients used in homemade healthy snacks, such as nuts, seeds, and dried fruits, continued to see robust growth, indicating a consumer shift towards more personalized nutrition. This trend directly impacts the demand for convenience-focused, pre-packaged health foods by offering a more economical and tailored solution.

- Cost Savings: Homemade snacks can be significantly cheaper per serving than their pre-packaged counterparts. For example, a large bag of almonds can yield numerous snack portions at a fraction of the cost of individual snack bars.

- Ingredient Control: Consumers preparing their own food have complete control over ingredients, avoiding added sugars, artificial preservatives, or allergens, which is a major driver for health-conscious individuals.

- Customization: DIY options allow for perfect tailoring to individual dietary needs, preferences, and macronutrient targets, something pre-packaged products struggle to achieve for a broad audience.

- Perceived Healthiness: Many consumers perceive homemade food as inherently healthier due to the transparency of ingredients and preparation methods, even if nutritional profiles are comparable.

The threat of substitutes for Simply Good Foods is substantial, encompassing a wide array of healthier alternatives. Consumers increasingly turn to unprocessed options like fresh fruits and vegetables, with the global fresh produce market exceeding $1 trillion in 2024. Homemade snacks and meals also present a strong challenge, offering cost savings and ingredient control, evidenced by the robust growth in ingredients like nuts and seeds used for DIY snacks.

Furthermore, the burgeoning plant-based and functional foods sector, valued at nearly $30 billion in 2023, diverts consumers seeking specific health benefits. Even traditional snack manufacturers are introducing 'better-for-you' options, intensifying competition. Meal replacement products and structured diet programs, representing a market worth over $13 billion in 2023, offer comprehensive nutritional solutions that directly compete with nutritional bars and snacks.

| Substitute Category | Key Characteristics | 2023/2024 Market Data | Implication for Simply Good Foods |

|---|---|---|---|

| Fresh Produce | Natural, unprocessed, high satiety | Global market > $1 trillion (2024) | Direct competition for everyday snacking occasions. |

| Homemade Snacks | Cost-effective, customizable, ingredient control | Growth in ingredients like nuts, seeds | Undercuts convenience premium, appeals to budget-conscious and health-focused consumers. |

| Plant-Based/Functional Foods | Dietary trends, specific health benefits | Global market ~$29.7 billion (2023) | Captures consumers prioritizing specific lifestyle or wellness goals. |

| Meal Replacements/Diet Programs | Comprehensive nutrition, structured dieting | Global market ~$13.5 billion (2023) | Offers a more complete solution for weight management and dietary goals. |

Entrants Threaten

The healthy snacking market's robust growth, anticipated to climb at a compound annual growth rate exceeding 5% between 2024 and 2029, significantly heightens its appeal to potential new entrants. This expanding market size and consumer demand create a fertile ground for both startups and established food corporations to introduce innovative products.

Simply Good Foods enjoys a significant advantage due to the strong brand loyalty and recognition of its key products, Atkins and Quest. These brands have cultivated deep consumer trust and awareness over many years, making it difficult for newcomers to gain traction.

New entrants must overcome the considerable hurdle of establishing their own brand identity and building consumer trust in a highly competitive market. This typically necessitates substantial investment in marketing and advertising, a barrier that can deter many potential competitors.

Entering the consumer packaged goods food sector, especially with products like Simply Good Foods', demands massive upfront capital. This is to build out efficient manufacturing capabilities, establish robust supply chains, and secure widespread distribution channels. For instance, a new entrant would need to invest heavily in co-packing agreements or their own production facilities, alongside the logistics to get products onto store shelves across the nation.

New companies must therefore raise substantial funding to even begin challenging established players. Simply Good Foods, with its established brands like Atkins and Simply Protein, already benefits from significant economies of scale and a deeply entrenched relationship with major retailers. A newcomer would need to match this reach, which necessitates a large financial war chest to compete on price, product availability, and marketing presence.

Access to Retail Distribution Channels

Securing shelf space in major retail outlets like supermarkets, hypermarkets, and prominent online marketplaces presents a significant hurdle for new entrants. Established players, such as Simply Good Foods, have cultivated deep-seated relationships with these retailers, often holding prime shelf real estate that is difficult for newcomers to penetrate.

For instance, in 2023, major grocery chains continued to consolidate their supplier relationships, favoring brands with proven sales volume and marketing support. This trend makes it challenging for emerging brands to gain initial distribution, as retailers often require significant upfront investment or guaranteed sales performance to allocate valuable space.

- Established Retail Relationships: Simply Good Foods benefits from existing partnerships with key retailers, providing consistent access to consumers.

- Shelf Space Competition: New entrants face intense competition for limited and valuable shelf space, often requiring substantial marketing investment to gain visibility.

- Online Platform Barriers: Gaining prominence on major e-commerce platforms also requires significant investment in digital marketing and logistics, mirroring physical retail challenges.

Need for Continuous Innovation and R&D

The 'better-for-you' snacking market is a dynamic space where consumer tastes and nutritional demands shift rapidly. Simply Good Foods, known for brands like Quest Nutrition and Atkins, must consistently invest in research and development to stay ahead. This commitment to innovation is crucial for introducing new products that align with emerging health trends, such as plant-based options or reduced sugar formulations, to maintain market share.

New companies entering this sector face a significant barrier due to the substantial capital required for ongoing research and development. To effectively compete with established players like Simply Good Foods, these entrants need to allocate considerable resources towards creating unique and appealing products. For instance, in 2024, the global healthy snacks market was valued at approximately $127.2 billion, underscoring the scale of investment needed to carve out a niche.

- High R&D Investment: New entrants must commit significant capital to research and development to create innovative products that meet evolving consumer preferences for nutrition and taste.

- Consumer Preference Evolution: The demand for healthier snack options, including those with specific dietary benefits like low sugar or plant-based ingredients, necessitates continuous product pipeline development.

- Competitive Landscape: Companies like Simply Good Foods have established innovation pipelines, meaning new entrants must offer truly differentiated products to gain traction in the market.

- Market Growth Potential: The substantial growth in the healthy snacks market, projected to reach over $200 billion by 2030, incentivizes new entrants but also demands robust R&D to compete effectively.

The threat of new entrants for Simply Good Foods is moderate, primarily due to high capital requirements and established brand loyalty. While the healthy snacking market's growth, projected to exceed 5% annually through 2029, attracts new players, significant investment in manufacturing, distribution, and marketing is essential. Existing players like Simply Good Foods benefit from strong brand recognition with Atkins and Quest, creating a substantial barrier for newcomers seeking to build trust and secure prime retail shelf space.

New entrants must overcome substantial hurdles in capital investment and brand building. The cost of establishing manufacturing, securing supply chains, and gaining retail distribution is immense. Simply Good Foods' established relationships with major retailers and its economies of scale, derived from brands like Atkins and Simply Protein, mean new competitors need considerable financial backing to compete effectively on price, availability, and marketing presence.

Securing shelf space remains a critical challenge. In 2023, retailers continued to consolidate, favoring brands with proven sales and marketing support, making it difficult for emerging brands to gain initial distribution. This trend necessitates significant upfront investment or guaranteed sales performance from newcomers to secure valuable shelf real estate, whether in physical stores or on major e-commerce platforms.

The need for continuous innovation in the dynamic 'better-for-you' snacking market also poses a barrier. Simply Good Foods invests heavily in R&D to stay ahead of evolving consumer tastes and nutritional demands, such as plant-based options. New entrants must allocate considerable resources to product development to compete, especially given the global healthy snacks market was valued around $127.2 billion in 2024.

| Barrier | Impact on New Entrants | Simply Good Foods' Advantage |

|---|---|---|

| Capital Requirements (Manufacturing, Distribution, Marketing) | High; requires significant upfront investment. | Benefits from established infrastructure and economies of scale. |

| Brand Loyalty and Recognition | Challenging to build; requires substantial marketing to gain trust. | Strong, established brands like Atkins and Quest. |

| Retail Shelf Space Access | Difficult to secure; requires investment and proven sales. | Established relationships with major retailers. |

| Research and Development Investment | High; essential for product innovation and differentiation. | Continuous investment in R&D for evolving consumer trends. |

Porter's Five Forces Analysis Data Sources

Our Simply Good Foods Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the company's annual reports, SEC filings, and investor relations materials. We also incorporate insights from reputable industry research firms and market intelligence platforms.