Telit Communications Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telit Communications Bundle

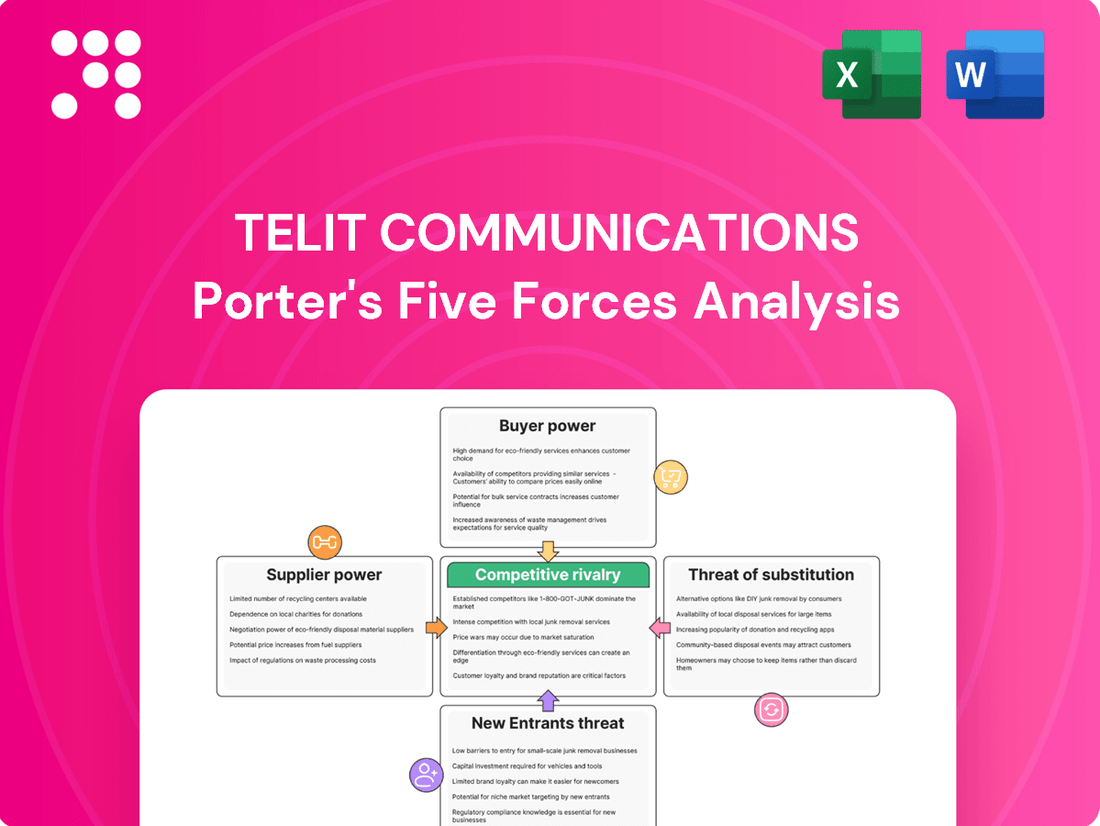

Telit Communications operates in a dynamic IoT connectivity market, facing moderate threats from new entrants and the availability of substitutes. Buyer power is significant due to the commoditization of some services, while supplier power is generally lower, though specialized component suppliers can exert influence. The intensity of rivalry among existing players is high, driving innovation and price competition.

The complete report reveals the real forces shaping Telit Communications’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Telit Communications, now part of Thales, faces significant supplier power due to its reliance on a concentrated group of semiconductor and cellular component manufacturers. The specialized nature of advanced components, particularly for emerging technologies like 5G, means few suppliers can meet these demanding specifications.

This concentration is evident in Telit Cinterion's collaborations, such as its work with Qualcomm for 5G modules. Qualcomm, a leading provider of mobile chipsets, holds substantial leverage given the critical role its technology plays in Telit's product offerings, especially as the demand for high-speed connectivity continues to grow.

The bargaining power of suppliers for Telit is influenced by switching costs. For critical components like cellular or positioning modules, these costs can be substantial for Telit. This involves expenses related to redesigning products, re-certifying devices, and establishing new supply chain logistics.

These high switching costs can significantly limit Telit's flexibility in choosing alternative suppliers. Consequently, it strengthens the bargaining power of existing suppliers, as Telit may be hesitant to incur these significant expenses to switch. For instance, in 2023, the average cost for a company to migrate its core IT infrastructure to a new provider could range from tens of thousands to millions of dollars, depending on complexity.

Suppliers providing highly specialized or proprietary technologies, such as specific IoT chipsets or low-power wide-area network (LPWAN) solutions, wield significant bargaining power. Telit's reliance on these unique components to stay competitive in the rapidly evolving IoT landscape means it may be more susceptible to supplier demands.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward and offering complete IoT solutions directly to Telit's customers would significantly bolster their bargaining power. This scenario, while perhaps less frequent for pure component providers, represents a potential long-term risk if technology partners broaden their service offerings.

Consider the implications: if a key chip manufacturer, for instance, began bundling its hardware with software platforms and managed services, they could bypass Telit's value-added capabilities. This direct competition would force Telit to either lower prices or risk losing market share to its own former suppliers.

For context, the global IoT market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $2.5 trillion by 2028, indicating substantial growth potential. Suppliers with strong technological foundations could see this expansion as an opportunity to capture a larger portion of the end-customer value chain.

- Forward Integration Risk: Suppliers offering end-to-end IoT solutions directly to Telit's clientele.

- Market Dynamics: The expanding IoT market presents opportunities for suppliers to move up the value chain.

- Competitive Threat: Suppliers entering the market directly could force price reductions or market share loss for Telit.

Importance of Telit to Supplier Revenue

The bargaining power of suppliers in the telecommunications module industry, specifically concerning Telit, is significantly shaped by how crucial Telit's business is to a supplier's total revenue. If a supplier, for instance, derives only a small percentage of its income from Telit, it possesses greater leverage to dictate terms. This is a common dynamic where a large supplier serves many clients, making any single client less indispensable.

Conversely, if Telit accounts for a substantial portion of a supplier's sales, Telit's own bargaining power increases. For example, a component manufacturer heavily reliant on Telit for a significant chunk of its orders would be more inclined to offer favorable pricing or terms to retain that business. This interdependence is a key factor in supplier negotiations.

In 2024, the semiconductor and component supply chain experienced ongoing shifts. For example, while specific figures for Telit's supplier revenue dependency are not publicly detailed, industry trends indicate that suppliers focusing on niche markets or specialized components might find their customer base more concentrated. This concentration can amplify the bargaining power of key clients like Telit, especially if they are early adopters of new technologies or represent a substantial volume order.

- Supplier Dependence: The degree to which a supplier relies on Telit for its revenue directly impacts its bargaining power.

- Customer Concentration: If Telit is a major customer for a supplier, it gains more leverage in price and contract negotiations.

- Market Dynamics (2024): Fluctuations in the component market, such as shortages or oversupply, can alter the balance of power between Telit and its suppliers.

- Strategic Importance: For suppliers whose core business aligns closely with Telit's product roadmap, Telit's importance can be strategic, enhancing its negotiating position.

Telit Communications, now part of Thales, faces considerable supplier power due to its reliance on a limited number of specialized semiconductor and cellular component manufacturers. The high cost and technical complexity associated with redesigning products and re-certifying devices with new suppliers mean Telit has significant switching costs, strengthening the leverage of its current component providers.

Suppliers of proprietary technologies, such as advanced IoT chipsets, hold substantial bargaining power given Telit's need to remain competitive in the rapidly evolving IoT sector. Furthermore, the threat of these suppliers integrating forward to offer complete IoT solutions directly to Telit's customers poses a significant competitive risk.

The bargaining power of suppliers is also influenced by how critical Telit's business is to their overall revenue. In 2024, market dynamics, including potential component shortages or shifts in demand, can further amplify the leverage of key suppliers, particularly those providing essential, cutting-edge technology.

| Factor | Impact on Telit | Example Component | Supplier Leverage | Telit's Counter-Leverage |

| Component Specialization | High reliance on few suppliers | 5G Cellular Modules | High | Volume purchasing |

| Switching Costs | Significant expenses for redesign and recertification | IoT Positioning Chips | High | Long-term contracts |

| Supplier Revenue Dependence | Low dependence on Telit increases supplier power | LPWAN Solutions | High | Strategic partnerships |

| Forward Integration Threat | Suppliers offering end-to-end solutions | Integrated IoT Platforms | High | Value-added services differentiation |

What is included in the product

This analysis delves into the competitive forces impacting Telit Communications, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the IoT connectivity market.

Gain immediate clarity on Telit's competitive landscape with a visual breakdown of each force, simplifying complex market dynamics for strategic planning.

Customers Bargaining Power

Telit Communications caters to a wide array of industries, including automotive, industrial automation, healthcare, and smart energy. This broad market reach suggests a generally diversified customer base, which typically dilutes the bargaining power of individual customers.

However, significant volume purchases by large enterprise clients or within specific high-demand industry segments can still grant these customers considerable leverage. These major buyers can negotiate for better pricing or terms due to the substantial revenue they represent.

Given Telit's strategic positioning as a provider of essential building blocks for the Internet of Things (IoT), its customer base primarily consists of other businesses. This B2B dynamic means that customers are often integrating Telit's components into their own products and services, making supply chain reliability and cost crucial factors in their purchasing decisions.

For businesses that have deeply integrated Telit's modules, connectivity, and platform services into their existing systems, the cost and effort of switching to a competitor can be substantial. This includes technical re-integration, data migration, and potential disruption to operations. For instance, a company relying on Telit's IoT platform for managing a fleet of connected devices would face significant engineering challenges and downtime to transition to a new provider. High switching costs generally reduce customer bargaining power.

The Internet of Things (IoT) market is highly competitive, offering customers a wide array of choices for modules, connectivity services, and comprehensive platforms. This abundance of alternatives, including other module manufacturers and end-to-end solution providers, significantly enhances customer bargaining power.

Customers can readily compare different offerings and their associated pricing, leveraging this knowledge to negotiate better terms. For instance, in 2024, the global IoT market was valued at approximately $1.1 trillion, with projections indicating substantial growth, further intensifying competition and empowering buyers.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Telit Communications, particularly in the rapidly expanding yet highly competitive IoT market. When products or services become commoditized, like many standard IoT modules, buyers naturally focus more on cost. This means Telit needs to work hard to show its value beyond just the price tag.

Telit can counter this by emphasizing unique selling points. Features like enhanced security protocols, superior reliability in harsh environments, or specialized software integrations can justify a higher price point. For instance, the increasing demand for secure IoT solutions means customers may be willing to pay a premium for modules with robust built-in security features.

The cellular IoT module market has indeed experienced considerable price erosion. Reports from 2023 indicated that average selling prices (ASPs) for certain types of cellular modules declined as more manufacturers entered the space. This trend is expected to continue through 2024, intensifying the need for differentiation.

- Price Sensitivity in IoT: Customers in the IoT sector, especially for standard components, are keenly aware of pricing due to market competition.

- Differentiation as a Mitigator: Telit's strategy to highlight reliability, security, and unique features helps reduce customer focus solely on price.

- Market Price Pressure: The cellular IoT module market has seen ongoing price reductions from competitors, impacting Telit's pricing power.

- 2024 Outlook: Continued price competition is anticipated for 2024, reinforcing the importance of value-added services and product innovation.

Threat of Backward Integration by Customers

Large enterprise clients, particularly those with substantial technical expertise and significant purchasing volume, possess the latent ability to integrate backward. This means they could potentially develop their own in-house IoT modules or platforms, thereby reducing their reliance on suppliers like Telit Communications.

While the investment and specialized knowledge required for such a move are considerable, it represents a tangible threat. This risk is amplified in scenarios where customers require highly specialized or mission-critical IoT solutions, making in-house development a more attractive proposition.

- Customer Capabilities: Large enterprises often have the engineering talent and financial resources to explore in-house IoT module development.

- Market Specialization: The threat is greater for niche or highly customized IoT applications where off-the-shelf solutions are less suitable.

- Cost-Benefit Analysis: Customers will weigh the cost of internal development against the ongoing expense and strategic implications of outsourcing.

The bargaining power of customers for Telit Communications is moderate to high, driven by intense market competition and increasing customer price sensitivity in the IoT sector.

In 2024, the global IoT market, valued at approximately $1.1 trillion, features numerous suppliers, allowing customers to readily compare pricing and features, thereby increasing their leverage.

While Telit benefits from high switching costs for deeply integrated clients, the availability of alternative solutions and the potential for backward integration by large enterprises temper this advantage.

Price erosion in the cellular IoT module market, with reports of declining average selling prices in 2023 expected to continue through 2024, further empowers customers to negotiate favorable terms.

| Factor | Impact on Telit | Customer Leverage | 2024 Context |

| Market Competition | High | Strong | $1.1 trillion global IoT market, many suppliers |

| Price Sensitivity | High | Strong | Commoditized modules, focus on cost |

| Switching Costs | Moderate | Weak | High integration effort for existing clients |

| Backward Integration Potential | Moderate Threat | Moderate | Large enterprises may develop in-house solutions |

Same Document Delivered

Telit Communications Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Telit Communications, offering a comprehensive examination of competitive forces within its industry. You are viewing the exact document you will receive immediately after purchase, ensuring no surprises and full transparency regarding the depth of insights provided. This detailed analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, equipping you with a thorough understanding of Telit's competitive landscape.

Rivalry Among Competitors

The Internet of Things (IoT) and Machine-to-Machine (M2M) sectors are teeming with a wide array of competitors. These range from module makers like Quectel and Fibocom to connectivity specialists such as KORE Wireless and Aeris, alongside major mobile network operators. Telit Cinterion, while a prominent name, navigates a fiercely competitive global landscape, particularly challenged by the strong presence of Asian manufacturers.

The global Internet of Things (IoT) and Machine-to-Machine (M2M) communications market is a dynamic space, with significant expansion anticipated. For instance, industry analysts projected the IoT market to reach over $1.1 trillion by 2025, a substantial increase from previous years. This robust growth offers ample room for various companies to carve out their niches, potentially easing intense competitive pressures by expanding the overall pie.

However, this growth isn't uniform across all segments. While the broader market thrives, certain specialized areas, such as cellular Low Power Wide Area (LPWA) modules, have encountered headwinds, with some reports indicating a contraction in specific sub-segments during 2023-2024. This divergence means that while overall market expansion might temper rivalry, intense competition can still persist or even escalate within shrinking or slower-growing segments.

Telit Communications strives to stand out by offering a complete IoT ecosystem, encompassing cellular, short-range, and positioning modules, plus connectivity and platform services. This integrated approach aims to provide a seamless, end-to-end solution for customers.

The company's ability to differentiate through cutting-edge features, such as AI-enhanced 5G modules, advanced security protocols, or tailored solutions for specific industries, is key to mitigating intense price competition. For instance, the growing demand for secure and efficient IoT deployments in sectors like automotive and industrial automation creates opportunities for specialized product offerings.

Exit Barriers

High fixed costs associated with developing and maintaining IoT platforms and infrastructure can trap companies in the market. For instance, substantial investments in research and development for specialized connectivity solutions or data analytics software are not easily recouped if a company decides to exit. This can lead to continued competition even in low-profitability scenarios as firms strive to recover their sunk costs, thereby intensifying rivalry.

Specialized assets, such as proprietary hardware for specific IoT applications or unique network infrastructure, also present considerable exit barriers. If these assets lack alternative uses in other industries, companies are reluctant to abandon them, preferring to keep them operational, even at reduced efficiency. This makes it difficult for firms to divest or repurpose their investments, prolonging competitive engagement.

Long-term contracts with customers for IoT services further cement companies in the market. These agreements often span several years, obligating providers to deliver services and support. Breaking these contracts can incur significant penalties, making an orderly exit challenging. Consequently, companies may feel compelled to continue operations to fulfill contractual obligations, even when facing declining market share or profitability, thus sustaining competitive pressure.

The IoT sector, in general, saw significant investment in 2024. For example, global IoT spending was projected to reach over $1.1 trillion in 2024, indicating substantial capital tied up in the industry. This large financial commitment amplifies the impact of exit barriers.

- High fixed costs in R&D and infrastructure development deter exits.

- Specialized assets, lacking alternative uses, create a need to continue operations.

- Long-term contracts obligate companies to remain active in the market.

- Substantial industry investment, like the over $1.1 trillion projected global IoT spending in 2024, increases the impact of these barriers.

Strategic Stakes

The Internet of Things (IoT) market is a hotbed of strategic importance, drawing in major technology firms eager to capture significant market share and technological dominance. This intense rivalry fuels aggressive competition, pushing companies to innovate rapidly.

Companies are channeling substantial resources into research and development and forging strategic partnerships. For instance, in 2024, major players continued to announce significant R&D investments and collaborations aimed at advancing IoT capabilities, particularly in areas like edge computing and AI integration within IoT solutions.

- Intense Competition: The IoT sector is characterized by fierce competition among numerous technology companies, from established giants to emerging specialists, all vying for leadership.

- Strategic Importance: IoT is considered a critical growth area, driving significant investment and strategic maneuvering by companies aiming to secure future revenue streams.

- R&D and Collaboration Focus: Companies are heavily investing in innovation and forming alliances to develop cutting-edge IoT technologies and expand their market reach.

- Market Share and Technological Leadership: The primary goal for many firms is to gain a dominant position in the market and be recognized as leaders in IoT technology development and deployment.

Competitive rivalry within the IoT and M2M sectors is intense, driven by a crowded market with numerous module makers, connectivity providers, and mobile network operators, particularly with strong Asian manufacturers challenging established players like Telit Cinterion.

Despite the overall market growth, with global IoT spending projected to exceed $1.1 trillion in 2024, certain segments like cellular LPWA modules have faced contraction, intensifying competition in these specific niches.

High fixed costs in R&D and infrastructure, coupled with specialized assets and long-term customer contracts, create significant exit barriers, compelling companies to remain active and sustain competitive pressure even in challenging conditions.

Companies like Telit Communications differentiate themselves through integrated IoT ecosystems and advanced features such as AI-enhanced 5G modules, aiming to mitigate price wars driven by aggressive innovation and strategic partnerships.

| Key Competitors | Market Segment | 2024 Market Projection (USD Trillions) | Competitive Focus |

| Quectel, Fibocom | IoT Modules | 1.1+ (Overall IoT) | Price, Performance, Asian Manufacturing Strength |

| KORE Wireless, Aeris | IoT Connectivity | 1.1+ (Overall IoT) | Connectivity Management, Platform Services |

| Major Mobile Network Operators | Cellular IoT Connectivity | 1.1+ (Overall IoT) | Network Coverage, Data Plans, Enterprise Solutions |

| Telit Cinterion | End-to-End IoT Solutions | 1.1+ (Overall IoT) | Integrated Ecosystem, AI/5G Modules, Security |

SSubstitutes Threaten

While Telit excels in cellular, short-range, and positioning modules, a range of alternative connectivity technologies poses a threat. Satellite communication offers global coverage, Wi-Fi and Bluetooth provide robust short-range options, and emerging Low Power Wide Area Network (LPWAN) technologies like mioty® are gaining traction, particularly for low-power, long-range applications. The selection among these hinges on specific use cases, considering factors like required range, energy efficiency, and data transmission speeds.

For certain data collection needs, businesses may bypass full IoT solutions in favor of established methods. These can range from manual data input processes to localized, wired network setups or other less automated systems that don't require the extensive connectivity of IoT.

For instance, a small retail store might use a point-of-sale system with manual inventory tracking instead of IoT sensors, representing a significant cost saving. In 2024, the global market for traditional data collection hardware, excluding advanced IoT devices, still represents a substantial segment, particularly in sectors with legacy systems or lower data volume requirements.

Large enterprises with significant R&D budgets, such as those in the automotive or industrial sectors, may opt to build their own IoT solutions. For instance, in 2024, many Fortune 500 companies continued to invest heavily in internal technology development, with some allocating billions to R&D. This in-house capability can directly substitute for the need for external module providers like Telit, particularly for core functionalities.

When major players develop proprietary IoT platforms, they bypass the market for off-the-shelf modules and connectivity services. This trend is evident as companies like Amazon with AWS IoT and Microsoft with Azure IoT continue to expand their end-to-end offerings, providing integrated hardware and software solutions. Such comprehensive internal ecosystems can reduce reliance on specialized third-party vendors, thereby increasing the threat of substitution.

Cloud-Native or Software-Only Approaches

The rise of cloud-native or software-only IoT platforms presents a significant threat of substitution for Telit Communications. Instead of relying on Telit's integrated hardware and software modules, customers increasingly favor flexible, cloud-based solutions that can connect with a wider range of generic hardware. This trend shifts the competitive landscape from hardware-centric offerings to a software-defined approach.

This shift means that the value proposition moves from the physical module to the platform's capabilities, such as data analytics, device management, and application enablement. For instance, the global IoT platforms market was valued at approximately $25 billion in 2023 and is projected to grow substantially, indicating a strong customer preference for these software-centric solutions.

- Shift in Value Proposition: Customers are increasingly prioritizing the software and cloud services of IoT platforms over the underlying hardware modules.

- Market Growth: The global IoT platforms market is expanding rapidly, with projections indicating continued strong growth through 2025 and beyond.

- Integration Flexibility: Cloud-native solutions offer greater flexibility, allowing customers to integrate with diverse hardware, bypassing the need for specialized modules.

Cost-Performance Trade-off of Substitutes

The threat of substitutes for Telit Communications' IoT solutions is significantly shaped by the cost-performance trade-off. If alternative technologies or services can deliver comparable results at a substantially lower price point or with greater ease of implementation, they represent a more potent competitive pressure.

For instance, while Telit offers advanced cellular IoT modules, simpler, lower-cost connectivity options like LoRaWAN or even Wi-Fi might suffice for certain applications where high bandwidth or extreme mobility isn't critical. This presents a direct substitution threat, especially for cost-sensitive deployments.

- Lower Cost Alternatives: For applications requiring less data throughput or lower mobility, cheaper connectivity solutions can be viable substitutes.

- Simplicity of Implementation: Easier-to-deploy or manage substitute technologies can attract customers seeking to reduce integration complexity and time-to-market.

- Perceived Value: If the perceived value of a substitute solution, considering its total cost of ownership, is higher for a specific use case, it directly impacts Telit's market position.

- Technological Advancements: Emerging technologies that offer similar functionality at a reduced cost or improved performance can rapidly become attractive substitutes.

The threat of substitutes for Telit Communications is substantial, encompassing alternative connectivity technologies and entirely different approaches to data collection. For example, while Telit specializes in cellular IoT, technologies like satellite communication offer global reach, and Wi-Fi/Bluetooth provide robust short-range alternatives. Furthermore, some applications may bypass IoT altogether, opting for manual data entry or wired systems, especially in cost-sensitive environments.

In 2024, the market for traditional data collection hardware, separate from advanced IoT, remained a significant segment, particularly for businesses with existing infrastructure or lower data needs. Large enterprises also increasingly develop proprietary IoT solutions, reducing reliance on external module providers, a trend supported by significant R&D investments from major corporations.

The increasing prevalence of cloud-native, software-only IoT platforms presents a direct substitution threat. These platforms allow customers to integrate with a wider array of generic hardware, shifting the value proposition from the physical module to software capabilities. The global IoT platforms market, valued around $25 billion in 2023 and projected for strong growth, underscores this customer preference for flexible, software-centric solutions.

Entrants Threaten

Entering the IoT and M2M solutions market, especially for hardware modules and integrated platforms, demands substantial capital. Companies need significant investment for research and development, establishing robust manufacturing capabilities, and securing vital intellectual property. For instance, in 2024, the global IoT market was valued at over $1.1 trillion, with hardware modules being a foundational component, indicating the scale of investment required to compete.

Telit Communications, a key player in the Internet of Things (IoT) module market, benefits from deeply entrenched relationships with a global network of solution providers, device manufacturers, and system integrators. These established partnerships are crucial for market access, as new entrants would struggle to replicate this extensive network and build the necessary trust within a highly competitive landscape. For instance, in 2024, the IoT market continued its rapid expansion, with module shipments reaching hundreds of millions annually, underscoring the importance of established distribution channels for any new competitor aiming to gain traction.

The creation of sophisticated cellular, short-range, and positioning modules, coupled with secure connectivity and platform services, necessitates significant technological know-how and robust intellectual property. This inherent complexity acts as a considerable barrier, making it challenging for nascent companies to swiftly duplicate Telit's existing product portfolio and service ecosystem.

Regulatory Hurdles and Certifications

The Internet of Things (IoT) sector, particularly for cellular modules, faces substantial regulatory hurdles and certification requirements. These often include approvals from mobile network operators and various government bodies, creating a significant barrier for new entrants attempting to establish a foothold in the market. For instance, in 2024, the global IoT market was valued at approximately $1.1 trillion, with a significant portion attributed to connectivity solutions like cellular modules, underscoring the importance of regulatory compliance for market access.

Navigating these complex and often country-specific regulations demands considerable investment in time and resources. New companies must invest in testing, documentation, and compliance processes, which can be prohibitively expensive.

- Regulatory Approvals: Obtaining certifications from bodies like the FCC in the US or CE in Europe is mandatory for selling IoT devices.

- Operator Certifications: Mobile network operators require specific testing and certification for modules to ensure compatibility and performance on their networks.

- Industry Standards: Adherence to evolving industry standards, such as those set by 3GPP for cellular technologies, is crucial for market acceptance.

- Compliance Costs: The cost of achieving and maintaining these certifications can run into tens of thousands of dollars per product, a significant deterrent for startups.

Economies of Scale and Experience Curve

Established players in the IoT module market, including Telit Communications, leverage significant economies of scale in their manufacturing and research and development processes. This allows them to achieve lower per-unit production costs, a crucial advantage. For instance, in 2024, major module manufacturers were operating at production volumes that enabled substantial cost reductions per unit compared to smaller operations.

New entrants face a considerable hurdle in matching these cost efficiencies. Without the established volume and the associated learning curve benefits, new companies would find it difficult to compete on price. This experience curve effect, where costs decrease with cumulative production, means that newcomers are inherently at a disadvantage from the outset.

- Economies of Scale: Telit and established competitors benefit from lower production costs due to high-volume manufacturing, a barrier for new entrants.

- Experience Curve: Cumulative production experience leads to ongoing cost reductions, which new companies lack.

- R&D Investment: Significant R&D spending by incumbents is amortized over larger sales volumes, making it harder for new players to invest comparably.

- Market Penetration: Achieving the scale necessary to offset initial R&D and manufacturing setup costs requires substantial market penetration, which is difficult for new entrants to achieve quickly.

The threat of new entrants in the IoT module market, where Telit Communications operates, is moderate. Significant capital investment is required for R&D, manufacturing, and intellectual property, with the global IoT market exceeding $1.1 trillion in 2024. Established relationships with solution providers and manufacturers also present a barrier, as replicating Telit's extensive network is challenging. The complexity of developing advanced modules and securing regulatory approvals, which can cost tens of thousands of dollars per product in 2024, further deters new players.

| Barrier to Entry | Description | 2024 Relevance |

| Capital Requirements | High investment needed for R&D, manufacturing, and IP. | Global IoT market valued over $1.1 trillion, demanding substantial upfront capital. |

| Established Relationships | Entrenched partnerships with solution providers and manufacturers. | Crucial for market access in a competitive landscape with hundreds of millions of module shipments annually. |

| Technological Complexity & IP | Need for advanced technological know-how and intellectual property. | Replicating Telit's product portfolio and service ecosystem is difficult for new companies. |

| Regulatory Hurdles | Navigating certifications from network operators and government bodies. | Compliance costs can be prohibitive, impacting market entry for startups. |

| Economies of Scale | Lower per-unit costs due to high-volume manufacturing. | New entrants struggle to match cost efficiencies achieved by established players. |

Porter's Five Forces Analysis Data Sources

Our Telit Communications Porter's Five Forces analysis is built upon a foundation of robust data, including Telit's official annual reports, investor presentations, and SEC filings. We also incorporate insights from reputable industry analysis firms and market research reports to provide a comprehensive view of the competitive landscape.