Telit Communications Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telit Communications Bundle

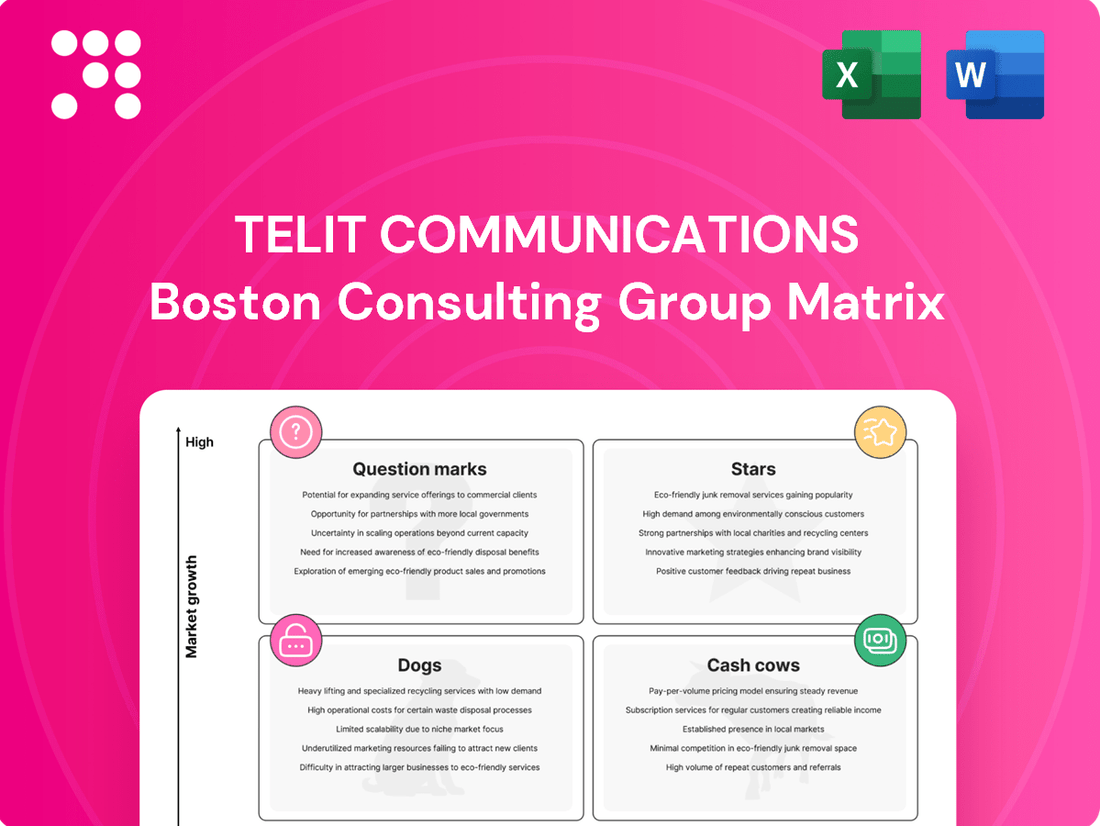

Curious about Telit Communications' strategic product positioning? Our preview offers a glimpse into their portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their market dynamics and unlock actionable strategies, dive into the full BCG Matrix.

Purchase the complete Telit Communications BCG Matrix for a comprehensive breakdown of each product's quadrant placement, backed by insightful data and strategic recommendations. This isn't just analysis; it's your roadmap to optimizing Telit's product portfolio and driving future growth.

Don't miss out on the clarity that the full Telit Communications BCG Matrix provides. Gain a competitive edge by understanding exactly where to invest, divest, or nurture their offerings. Get your copy today and transform your strategic decision-making.

Stars

Telit's 5G cellular IoT modules are considered Stars in the BCG matrix. This is driven by the explosive growth anticipated in the 5G IoT market, which is expected to surge to $17.68 billion by 2030, reflecting a compound annual growth rate of 47.6% from 2023 to 2030.

The company's commitment to this segment is evident through its March 2025 launch of new AI-powered 5G modules and data cards. This strategic investment underscores Telit's focus on capturing a significant share of this high-growth opportunity.

Although 5G adoption in industrial IoT is still developing, its impact on automotive telematics is set to grow substantially from 2024 onwards. Telit's dedication to these advanced, high-bandwidth solutions positions them for leadership in this burgeoning market, even with current market share considerations.

Telit Cinterion's NExT Connected Module offering, unveiled at CES 2024, is a standout Star in their portfolio. It bundles hardware modules, connectivity, and management into an 'as-a-service' model, tapping into the surging demand for integrated IoT solutions and reducing upfront costs for businesses.

This service-based approach positions Telit within a rapidly expanding market focused on recurring revenue. The NExT platform's eSIM Multiprofile capabilities further enhance its appeal, offering simplified and scalable global connectivity crucial for mission-critical IoT deployments.

Telit's AI-powered IoT solutions, particularly their enhanced NVIDIA-powered AI tools announced in January 2025, position them firmly in the Star quadrant of the BCG Matrix. This strategic focus on integrating artificial intelligence into the Internet of Things is targeting the burgeoning manufacturing and industrial IoT sectors, a market experiencing rapid growth and innovation.

The company's investment in advanced AI capabilities for its IoT platforms signals a clear ambition to lead in this high-potential, evolving segment. While current market share in this specific niche is still developing, the forward-looking approach with cutting-edge AI integration is designed to capture future market dominance in industrial automation and smart factory applications.

Solutions for Smart Energy and Utilities

Telit's specialized IoT solutions for the smart energy and utilities sector are positioned as a Star within the BCG matrix. This is fueled by the smart energy market's robust expansion, with projections indicating a rise from US$199.5 billion in 2024 to US$330.6 billion by 2030.

The company's strategic approach includes active partnerships with utility broadband alliances. They offer flexible IoT modules and comprehensive edge-to-cloud solutions, directly addressing the utilities' need to modernize critical infrastructure.

This focused vertical strategy caters to the escalating demand for smart grids and real-time monitoring capabilities. Telit's expertise in this high-growth application area allows them to establish and maintain a strong market position.

- Market Growth: Smart energy market expected to reach US$330.6 billion by 2030.

- Strategic Partnerships: Collaboration with utility broadband alliances.

- Product Offerings: Flexible IoT modules and edge-to-cloud solutions.

- Industry Focus: Addressing modernization needs for smart grids and real-time monitoring.

LTE Cat 1 bis Modules

LTE Cat 1 bis modules are a clear Star for Telit Communications. Their market share within the cellular IoT module space has seen substantial growth, jumping from 32% in 2023 to an impressive 45% in 2024. This significant expansion highlights their increasing importance in the market.

Telit is actively supporting this growth by introducing new products. The launch of the LE310 and SL871K2 LTE Cat 1 bis modules in March 2025 directly addresses the market's need for cost-effective, power-efficient solutions. This strategic product development positions Telit to capitalize on the rising demand.

- Market Dominance: LTE Cat 1 bis modules are becoming the top-selling cellular IoT module type in China, indicating a strong regional and potentially global trend.

- Revenue Growth: Continued upward trends and revenue growth are projected for this technology, solidifying its role as a key revenue driver for Telit.

- Product Innovation: New module launches like the LE310 and SL871K2 cater to specific market needs for affordability and low power consumption.

- Strategic Importance: The increasing market share and demand for LTE Cat 1 bis modules make them a crucial component of Telit's growth strategy.

Telit's 5G cellular IoT modules are positioned as Stars due to the projected rapid expansion of the 5G IoT market, anticipated to reach $17.68 billion by 2030 with a 47.6% CAGR from 2023 to 2030.

The company's proactive investment, including the March 2025 launch of AI-powered 5G modules, aims to secure a substantial share in this high-growth sector, particularly in automotive telematics from 2024 onwards.

Telit Cinterion's NExT Connected Module, introduced at CES 2024, is a Star offering an integrated hardware, connectivity, and management 'as-a-service' model, addressing the rising demand for simplified, scalable IoT solutions with its eSIM Multiprofile capabilities.

Telit's AI-enhanced IoT solutions, especially the NVIDIA-powered tools announced in January 2025, are Stars targeting the booming manufacturing and industrial IoT sectors, aiming for leadership in industrial automation.

Specialized IoT solutions for smart energy and utilities are Stars, driven by the market's growth from US$199.5 billion in 2024 to an estimated US$330.6 billion by 2030, supported by strategic partnerships and comprehensive edge-to-cloud offerings.

LTE Cat 1 bis modules are Stars for Telit, with market share increasing from 32% in 2023 to 45% in 2024, bolstered by cost-effective and power-efficient new products like the LE310 and SL871K2 launched in March 2025.

| Product Category | BCG Quadrant | Key Growth Drivers | Strategic Actions | Market Data Point |

|---|---|---|---|---|

| 5G Cellular IoT Modules | Star | 5G IoT market growth to $17.68B by 2030 (47.6% CAGR) | Launch of AI-powered 5G modules (March 2025) | Automotive telematics impact growing from 2024 |

| NExT Connected Module | Star | Demand for integrated IoT solutions, recurring revenue models | 'As-a-service' bundling, eSIM Multiprofile | CES 2024 unveiling |

| AI-Powered IoT Solutions | Star | Growth in manufacturing & industrial IoT sectors | Enhanced NVIDIA-powered AI tools (Jan 2025) | Focus on industrial automation & smart factories |

| Smart Energy & Utilities IoT | Star | Smart energy market growth to $330.6B by 2030 | Partnerships with utility broadband alliances | Modernization of critical infrastructure |

| LTE Cat 1 bis Modules | Star | Demand for cost-effective, power-efficient solutions | Launch of LE310 & SL871K2 (March 2025) | Market share increased to 45% in 2024 (from 32% in 2023) |

What is included in the product

This BCG Matrix overview provides a tailored analysis of Telit's product portfolio, highlighting which units to invest in, hold, or divest.

The Telit Communications BCG Matrix offers a clear, one-page overview of its business units, simplifying strategic decisions and relieving the pain of complex portfolio analysis.

Cash Cows

Telit's well-established portfolio of cellular IoT modules, especially those for traditional Machine-to-Machine (M2M) applications, function as cash cows within its BCG Matrix. These modules are integral to mature segments such as point-of-sale terminals, smart meters, and vehicle telematics, where connectivity demands are stable. For instance, in 2023, the M2M communication segment represented a significant portion of the IoT connectivity market, demonstrating consistent demand for these reliable solutions.

Telit's core IoT connectivity services are firmly positioned as a Cash Cow. These services consistently generate stable, recurring revenue from a substantial base of established customer deployments. Businesses rely on these fundamental offerings to connect and manage their devices across a wide array of industries, leveraging Telit's extensive global network and reliable infrastructure.

The recurring revenue stream from these core services is a significant strength. In 2024, the IoT connectivity market continued its robust expansion, with analysts projecting continued growth driven by the increasing adoption of connected devices in sectors like manufacturing, healthcare, and logistics. Telit's established position in this market allows it to capture a significant portion of this stable demand.

Telit's GNSS Positioning Modules, exemplified by offerings like the SE868K5-DR, are firmly positioned as Cash Cows within their product portfolio. These modules are vital for applications demanding precise location data, such as asset tracking and telematics, sectors where Telit has cultivated a robust market presence and a loyal customer base over time.

While the overall market for GNSS modules may not be experiencing explosive growth compared to newer IoT technologies, Telit's segment within this space demonstrates stability and profitability. The company enjoys a significant market share in its specialized niche, allowing these modules to generate consistent revenue with a comparatively modest need for ongoing, substantial investment in research and development.

Legacy LTE Modules (excluding Cat 1 bis)

Telit's legacy LTE modules, excluding the rapidly growing Cat 1 bis, represent a significant cash cow. These modules, particularly within the LTE and LTE-Advanced categories, have achieved widespread adoption and are a cornerstone for numerous existing IoT deployments.

Despite the rise of newer technologies, the broader LTE market segment held a 22.5% share in 2024. This indicates a mature, yet remarkably stable, market position. These modules continue to be indispensable, delivering dependable performance for a substantial installed base, requiring minimal investment in new market penetration.

- Cash Cow Status: Telit's established LTE modules are generating consistent revenue with low investment needs.

- Market Maturity: The broader LTE market, at 22.5% in 2024, signifies a stable, mature segment.

- Installed Base Reliance: These modules are crucial for a large existing customer base, ensuring ongoing demand.

- Performance Reliability: They offer proven and reliable connectivity for a wide range of IoT applications.

Device Management Platform (deviceWISE)

The deviceWISE IoT Platform, a core component of Telit's IoT offerings, functions as a Cash Cow. Its established market position and critical role in managing a vast number of IoT devices and their data flow ensure consistent revenue generation. In 2024, Telit reported significant growth in its IoT solutions segment, with platforms like deviceWISE underpinning this expansion by providing a secure and scalable infrastructure for numerous client projects.

deviceWISE's mature functionality and broad customer adoption mean it requires minimal aggressive investment for market expansion. Instead, Telit focuses on maintaining strong relationships with its existing client base, ensuring continued subscription revenue. This strategic focus on retention rather than aggressive acquisition is characteristic of a Cash Cow, allowing for efficient resource allocation.

- Established Market Presence: deviceWISE has a proven track record in the IoT device management space.

- Steady Revenue Generation: Subscription-based models for the platform ensure predictable income.

- Low Investment Needs: Focus is on maintenance and customer retention, not aggressive market penetration.

- Scalable and Secure Foundation: Supports a wide range of IoT projects, driving ongoing customer value.

Telit's established cellular IoT modules, particularly those for traditional M2M, serve as cash cows. These modules are critical for stable segments like smart meters and vehicle telematics, where demand remains consistent. The M2M communication market, a significant part of the broader IoT landscape, continued to show steady demand for these reliable solutions in 2023.

Telit's core IoT connectivity services are also strong cash cows, consistently generating stable, recurring revenue from a large, established customer base. These fundamental offerings are essential for businesses managing connected devices across various industries, utilizing Telit's global network. The IoT connectivity market saw robust expansion in 2024, with Telit's established position capturing a significant portion of this stable demand.

Telit's GNSS Positioning Modules, like the SE868K5-DR, are cash cows due to their vital role in precise location applications such as asset tracking. While the GNSS market isn't experiencing explosive growth, Telit's niche offers stability and profitability with a significant market share, requiring minimal R&D investment.

Legacy LTE modules, excluding Cat 1 bis, are also cash cows, forming a cornerstone for many existing IoT deployments. The broader LTE market, holding a 22.5% share in 2024, remains a stable, mature segment where these modules deliver dependable performance to a substantial installed base with minimal new investment needs.

The deviceWISE IoT Platform is a cash cow, leveraging its established market position and critical role in managing numerous IoT devices for consistent revenue. Telit's IoT solutions segment experienced significant growth in 2024, with deviceWISE providing the necessary secure and scalable infrastructure. This mature platform requires minimal aggressive investment, allowing Telit to focus on customer retention for continued subscription revenue.

| Product Category | BCG Matrix Position | Key Characteristics | 2024 Market Insight |

|---|---|---|---|

| M2M Cellular IoT Modules | Cash Cow | Mature, stable demand, reliable performance | Significant portion of IoT connectivity market, consistent demand |

| Core IoT Connectivity Services | Cash Cow | Recurring revenue, large customer base, essential infrastructure | Robust expansion in IoT connectivity market |

| GNSS Positioning Modules | Cash Cow | Precise location, niche stability, market share | Stable profitability in specialized GNSS segment |

| Legacy LTE Modules | Cash Cow | Wide adoption, dependable performance, large installed base | 22.5% share in mature LTE market |

| deviceWISE IoT Platform | Cash Cow | Established management, subscription revenue, low investment | Underpins growth in IoT solutions segment |

What You See Is What You Get

Telit Communications BCG Matrix

The Telit Communications BCG Matrix preview you are viewing is the identical, fully-formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no alterations—just the complete, professionally designed analysis ready for your strategic decision-making.

Rest assured, the BCG Matrix for Telit Communications you see here is the exact document that will be delivered to you upon completing your purchase. This comprehensive report is crafted for immediate use, allowing you to seamlessly integrate its insights into your business planning and competitive strategies without any further editing or revisions.

Dogs

Telit's older 2G and 3G cellular modules are considered Dogs in the BCG Matrix. The market is rapidly migrating away from these legacy technologies, with industry trends showing a significant shift towards LTE Cat 1 bis as a replacement.

These segments represent low-growth areas for Telit, likely resulting in low market share as newer technologies gain traction. Maintaining these products incurs costs without substantial revenue generation or future growth prospects.

Consequently, Telit's 2G/3G modules are candidates for divestiture or a phased discontinuation strategy to reallocate resources to more promising product lines. For instance, the global 2G and 3G network shutdowns are accelerating, with many operators planning to complete these by 2025, further diminishing the viability of these modules.

Certain highly commoditized, very low-margin cellular IoT modules, where Telit faces intense price competition particularly from Chinese vendors, can be classified as Dogs within the BCG Matrix. These Chinese companies often sell modules at lower prices, putting significant pressure on Western suppliers' margins, impacting Telit's profitability in this segment.

If Telit cannot effectively differentiate these offerings or achieve substantial economies of scale, these products risk becoming cash traps. This means they could consume valuable resources without generating adequate returns, hindering the company's overall financial health and strategic flexibility.

Telit's NB-IoT and LTE-M modules in regions experiencing declining adoption, like NB-IoT in China, could be categorized as question marks or potentially dogs if market share is not growing. The overall LPWA market share saw a dip from 27% in 2023 to 21% in 2024, indicating a challenging environment for these technologies.

If Telit's specific product lines within these declining segments are not capturing significant market share, they may face difficulties achieving profitability. This scenario suggests a need for strategic evaluation, potentially leading to divestment or a significant pivot in product development for these particular offerings.

Non-Strategic, Niche Legacy Hardware

Non-strategic, niche legacy hardware products within Telit Communications' portfolio are those with limited market demand, not aligning with their core IoT and M2M strategies. These products typically hold a small market share in stagnant or shrinking markets. For instance, if Telit still offered older cellular modem modules for specific, outdated industrial applications, these would likely fit this category. Such offerings consume valuable resources and management focus that could be better directed towards growth areas.

- Low Market Share: These products often represent a minimal percentage of Telit's overall revenue.

- Declining or Stagnant Markets: The demand for these legacy hardware solutions is not growing, and may even be decreasing due to technological advancements.

- Resource Drain: Continued support, maintenance, and potential inventory management for these items divert resources from more promising investments.

- Strategic Misalignment: They do not contribute to Telit's primary objective of leading in the IoT and M2M connectivity space.

Unsuccessful Pilot Programs/Discontinued Ventures

Telit Communications has experienced unsuccessful pilot programs and discontinued ventures that represent investments failing to gain traction. These initiatives, while not always explicitly named as products, have been relegated to minimal support or effectively ceased operations. For instance, certain niche IoT connectivity solutions developed in the early 2020s, aimed at specific industrial applications, did not achieve the anticipated market adoption. By 2023, these ventures were consuming residual resources with little prospect of significant return.

These discontinued efforts highlight a strategic challenge in translating innovative concepts into market-leading products. For example, a pilot program focused on a specialized low-power wide-area network (LPWAN) technology for smart agriculture faced significant competition and slower than expected deployment cycles. By the end of 2024, it was clear that this venture would not achieve the necessary scale to justify continued investment, leading to its discontinuation.

- Discontinued Ventures: Specific IoT pilot programs that failed to scale or gain market adoption.

- Resource Consumption: These ventures continue to consume residual resources, impacting overall efficiency.

- Divestment Potential: They are prime candidates for complete divestment to reallocate capital to more promising areas.

- Market Adoption Failure: Investments did not yield significant market share or growth as initially projected.

Telit's older 2G and 3G cellular modules are considered Dogs due to the industry's rapid migration to newer technologies like LTE Cat 1 bis. These legacy products face declining market demand and low market share, representing low-growth segments for Telit. Resources spent on maintaining these modules offer minimal revenue and limited future growth prospects.

The ongoing global shutdown of 2G and 3G networks, with many operators aiming for completion by 2025, further diminishes the viability of these modules. Telit's commoditized, low-margin modules, especially those facing intense price competition from Chinese vendors, are also classified as Dogs. These products risk becoming cash traps if differentiation or economies of scale are not achieved, hindering financial health.

Telit's NB-IoT and LTE-M modules in regions with declining adoption, such as NB-IoT in China, could also be categorized as Dogs if market share isn't growing. The overall LPWA market share saw a dip from 27% in 2023 to 21% in 2024, indicating a challenging environment. Non-strategic, niche legacy hardware products with limited market demand and small market share in stagnant or shrinking markets also fall into this category.

Discontinued ventures and unsuccessful pilot programs, which failed to gain market traction or scale, also represent Dogs. These initiatives consume residual resources with little prospect of significant return, and by the end of 2024, it was clear some ventures would not achieve the necessary scale, leading to discontinuation.

| Category | Telit Product Example | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Dogs | 2G/3G Cellular Modules | Declining | Low | Divestment/Discontinuation |

| Dogs | Commoditized Low-Margin IoT Modules | Stagnant/Declining | Low to Moderate | Resource Drain/Cash Trap |

| Dogs | Legacy Niche Hardware | Declining | Very Low | Resource Diversion |

| Dogs | Failed Pilot Programs/Discontinued Ventures | N/A (Ceased Operations) | N/A | Divestment/Capital Reallocation |

Question Marks

Telit's new LPWA NTN-IoT (Satellite IoT) modules, launched in November 2024 via a strategic partnership, are positioned as Question Marks within the BCG matrix. These modules are specifically designed for rural applications, tapping into a market with significant untapped potential.

The global market for IoT nanosatellite services is experiencing rapid expansion, with projections indicating it could reach $5.9 billion by 2025. This forecast highlights the substantial growth prospects for NTN-IoT technologies, making it an attractive area for development.

Despite the promising market outlook, Telit's current market share in this nascent satellite IoT segment is likely minimal. Consequently, substantial investment will be necessary to transform this potential into a dominant market position, moving the modules from Question Mark to Star.

Telit's 5G RedCap modules are categorized as Question Marks within the BCG Matrix. These modules are appearing in early 5G rollouts, especially in places like China and North America. While the broader 5G market is expanding rapidly, RedCap is a more specialized area focusing on devices such as surveillance cameras and smart glasses.

Telit is making a concerted effort in the 5G RedCap space, but its market position is still being established. This segment requires significant investment to grow its market share and capitalize on future opportunities. For instance, as of early 2024, the global 5G IoT market is projected to reach hundreds of billions of dollars by the end of the decade, with RedCap expected to carve out a notable niche within that growth.

Specialized AI tools for niche industrial verticals are a prime example of a Question Mark within Telit's portfolio. These are AI solutions tailored for very specific applications, like predictive maintenance in a particular type of turbine or quality control in a unique semiconductor manufacturing process. While the broader AI in IoT market is booming, Telit's penetration into these highly specialized segments is likely to be minimal at the outset.

The investment required to develop and market these highly focused AI tools is significant, as is the effort to gain traction in these niche markets. For instance, a recent report from Mordor Intelligence projected the global AI in manufacturing market to reach $16.5 billion by 2026, but the sub-segments for hyper-specialized AI are still emerging and fragmented. Telit would need to demonstrate clear ROI and build strong partnerships to carve out a market share.

New Regional Market Expansions (e.g., specific emerging markets)

Telit's strategic push into new regional markets, particularly in emerging economies like India, positions them as a potential 'Question Mark' in the BCG matrix. The Indian IoT market is experiencing robust expansion, projected to reach $15 billion by 2027, driven by sectors such as smart metering and the burgeoning e-bike industry.

Despite this immense potential, Telit is in the early stages of establishing its footprint in India, indicating a low current market share. This necessitates substantial investment in building brand awareness, developing localized solutions, and expanding sales and distribution networks to capture a significant portion of this high-growth market.

- High Growth Potential: India's IoT market is a key growth engine.

- Low Market Share: Telit is building its presence, implying a nascent position.

- Investment Required: Significant capital is needed for market penetration.

- Strategic Importance: Expansion into India aligns with global IoT trends.

Cutting-Edge IoT Security Solutions

Telit's focus on developing and commercializing advanced IoT security solutions, particularly those aligning with upcoming regulations like the EU RED directive slated for August 2025, places it in the Question Mark category of the BCG matrix. The increasing demand for secure connected devices, driven by rising cyber threats, creates a substantial market opportunity. For instance, the global IoT security market was valued at approximately USD 10.5 billion in 2023 and is projected to reach USD 37.2 billion by 2028, growing at a CAGR of 28.7% according to MarketsandMarkets.

However, this high-growth sector is characterized by intense competition and a fragmented landscape, with numerous players offering a range of security protocols and platforms. Telit's success hinges on its capacity to innovate rapidly and secure substantial market penetration in this specialized, yet rapidly expanding, domain. Continued strategic investment in research and development, alongside aggressive go-to-market strategies, will be critical for Telit to transform its IoT security offerings from a Question Mark into a Star.

- Market Growth: The IoT security market is experiencing rapid expansion, projected to grow significantly in the coming years.

- Regulatory Tailwinds: Upcoming regulations, such as the EU RED directive, are creating a demand for compliant IoT security solutions.

- Competitive Landscape: The market is highly competitive and fragmented, requiring strong differentiation for success.

- Strategic Imperative: Sustained investment and rapid market adoption are crucial for Telit to capitalize on this opportunity.

Telit's new LPWA NTN-IoT (Satellite IoT) modules, launched in November 2024, are positioned as Question Marks. These modules target rural applications, a market with significant untapped potential, and the global nanosatellite IoT market is projected to reach $5.9 billion by 2025, underscoring the growth prospects.

Telit's 5G RedCap modules are also Question Marks, appearing in early 5G rollouts. While the broader 5G IoT market is expected to reach hundreds of billions of dollars by 2030, RedCap's niche focus requires substantial investment for Telit to establish its market share.

Specialized AI tools for niche industrial verticals represent another Question Mark. The global AI in manufacturing market is projected to reach $16.5 billion by 2026, but Telit's penetration into hyper-specialized AI segments is minimal, demanding significant investment and partnerships.

Telit's expansion into new regional markets, such as India, where the IoT market is projected to reach $15 billion by 2027, also places them as Question Marks due to their early stage presence and low market share, necessitating considerable investment.

Telit's advanced IoT security solutions, especially those aligning with the August 2025 EU RED directive, are Question Marks. The IoT security market was valued at $10.5 billion in 2023 and is expected to reach $37.2 billion by 2028, but Telit needs sustained investment to compete effectively.

| Product/Initiative | BCG Category | Market Growth | Market Share | Investment Need |

| LPWA NTN-IoT Modules | Question Mark | High (Global nanosatellite IoT market $5.9B by 2025) | Low | High |

| 5G RedCap Modules | Question Mark | High (Global 5G IoT market hundreds of billions by 2030) | Low | High |

| Specialized AI Tools | Question Mark | Moderate-High (AI in Manufacturing $16.5B by 2026) | Very Low | Very High |

| India Market Expansion | Question Mark | High (India IoT market $15B by 2027) | Low | High |

| IoT Security Solutions | Question Mark | Very High ($10.5B in 2023 to $37.2B by 2028) | Low | High |

BCG Matrix Data Sources

Our Telit Communications BCG Matrix is informed by a blend of financial disclosures, market research reports, and competitive analysis. This ensures a comprehensive view of each business unit's market share and growth potential.