Standard Bank Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Standard Bank Group Bundle

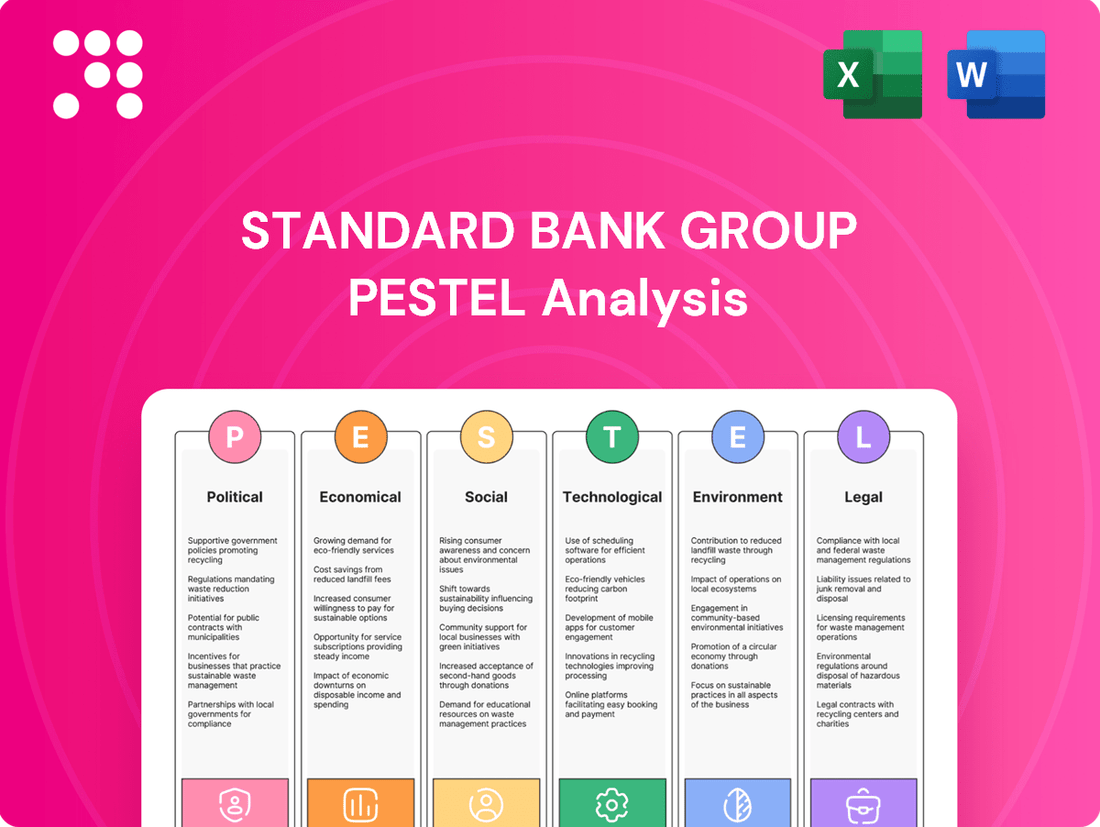

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Standard Bank Group's operations and future growth. Our meticulously researched PESTLE analysis provides the deep-dive insights you need to navigate this complex landscape effectively. Download the full version now to gain a strategic advantage and make informed decisions.

Political factors

Standard Bank Group's operations span diverse African nations, each with unique political landscapes. Political stability is paramount; for instance, the 2023 general elections in Nigeria, a key market, highlighted the importance of predictable electoral processes for business continuity. Conversely, political instability in certain regions can disrupt operations and deter investment, impacting the bank's strategic expansion plans.

The banking sector across Africa operates within a dynamic regulatory environment, with governments actively shaping rules to bolster financial stability and safeguard consumers. These evolving frameworks, encompassing shifts in banking laws, prudential requirements, and the watchful eye of central banks and financial regulators, directly impact Standard Bank's operational costs, its need for capital, and the very strategies it employs.

For instance, in 2024, several African nations intensified their focus on anti-money laundering (AML) and know-your-customer (KYC) regulations, leading to increased compliance burdens for major players like Standard Bank. These heightened requirements often translate to higher operational expenditures and necessitate robust investment in technology and personnel to ensure adherence, directly affecting profitability and strategic planning.

Pan-African trade policies, like the African Continental Free Trade Area (AfCFTA), offer significant growth potential for Standard Bank by facilitating cross-border transactions. The AfCFTA, which officially launched in 2021 and aims to create a single market for goods and services, could see intra-African trade increase by 81% by 2035, according to UNCTAD estimates, directly benefiting financial institutions involved in trade finance and payments.

However, navigating the diverse trade agreements and customs regulations across the continent requires Standard Bank to remain agile. While some nations have rapidly adopted AfCFTA protocols, others are still in the process, creating a patchwork of operational requirements that demand flexible product offerings and compliance frameworks.

Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF)

Global and local authorities are intensifying their focus on Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regulations. For South Africa, exiting the Financial Action Task Force (FATF) grey list is a significant priority, directly impacting financial institutions like Standard Bank. This heightened scrutiny necessitates substantial investment in advanced compliance systems and skilled personnel to detect and prevent financial crime.

Standard Bank must allocate considerable resources to enhance its AML/CTF frameworks. This includes upgrading technology for transaction monitoring, conducting thorough customer due diligence, and implementing robust reporting mechanisms. Failure to meet these evolving international and domestic standards could result in severe financial penalties and significant damage to the bank's reputation and market standing.

- Increased Regulatory Scrutiny: Global bodies like FATF and local regulators are imposing stricter AML/CTF requirements.

- South Africa's FATF Grey List Status: Efforts to be removed from the FATF grey list in 2024/2025 are driving enhanced compliance measures.

- Investment in Compliance: Banks are expected to invest heavily in technology and expertise to meet these demands.

- Risk of Penalties and Reputational Damage: Non-compliance can lead to substantial fines and a loss of trust.

Government Support and Public-Private Partnerships

Government initiatives focused on infrastructure development, such as the African Union's Agenda 2063, are projected to require trillions in investment, presenting substantial lending and advisory opportunities for Standard Bank. These programs aim to boost economic diversification across the continent, creating new markets and revenue streams for the bank.

Public-private partnerships (PPPs) are becoming increasingly crucial for financing major projects. For instance, in 2024, several African nations are actively seeking PPPs for renewable energy and transportation infrastructure, areas where Standard Bank has demonstrated strong engagement. These collaborations allow the bank to participate in large-scale development finance, aligning with its strategic goal of contributing to Africa's economic growth.

- Infrastructure Investment: Many African governments are prioritizing infrastructure, with projected spending in the hundreds of billions of dollars annually through 2030, creating significant project finance demand.

- Financial Inclusion Goals: Government policies promoting financial inclusion, such as digital banking initiatives, can expand Standard Bank's customer base and service offerings.

- Economic Diversification Support: Public sector incentives for sectors like manufacturing and technology directly benefit banking services, fostering new lending and investment avenues.

- PPP Frameworks: The establishment of clear PPP frameworks by governments streamlines the process for banks to engage in and finance public infrastructure projects.

Political stability across Standard Bank's operating regions remains a critical factor, with elections and governance shifts directly influencing market sentiment and investment flows. For example, the ongoing political transition in South Africa throughout 2024 and into 2025 necessitates careful monitoring of policy direction. Furthermore, government policies promoting financial inclusion, such as the expansion of digital banking services in countries like Kenya, present opportunities for Standard Bank to broaden its customer base.

The regulatory landscape is continuously evolving, with a strong emphasis on Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) compliance. South Africa's efforts to exit the Financial Action Task Force (FATF) grey list by mid-2025 are driving significant investment in compliance infrastructure for financial institutions. This heightened scrutiny, evident in stricter reporting requirements across the continent, directly impacts operational costs and strategic planning for Standard Bank.

Government initiatives aimed at economic diversification and infrastructure development, such as the African Continental Free Trade Area (AfCFTA), offer substantial long-term growth prospects. The AfCFTA, with its goal of boosting intra-African trade, is expected to significantly increase demand for trade finance and cross-border payment services, areas where Standard Bank is strategically positioned. However, the pace of implementation varies across member states, requiring adaptive strategies.

| Political Factor | Impact on Standard Bank | Data/Example (2024/2025 Focus) |

|---|---|---|

| Political Stability & Governance | Influences investor confidence and operational continuity. | South Africa's political landscape and policy continuity post-2024 elections are key considerations. |

| Regulatory Frameworks (AML/CTF) | Drives compliance costs and operational adjustments. | South Africa's targeted removal from FATF grey list by mid-2025 requires enhanced compliance investments. |

| Trade Policies (AfCFTA) | Creates opportunities for cross-border transactions and trade finance. | AfCFTA aims to boost intra-African trade, potentially increasing trade finance volumes for banks. |

| Government Infrastructure Spending | Generates demand for project finance and advisory services. | African governments continue to prioritize infrastructure development, creating lending opportunities. |

What is included in the product

This Standard Bank Group PESTLE analysis examines how political, economic, social, technological, environmental, and legal forces shape its operational landscape and strategic direction.

It provides a comprehensive understanding of the external macro-environment, highlighting key trends and their implications for the bank's growth and risk management.

A PESTLE analysis for Standard Bank Group provides a structured framework to identify and understand external factors, acting as a pain point reliever by proactively addressing potential market shifts and regulatory changes.

This analysis offers clarity on the complex external environment, enabling Standard Bank Group to anticipate challenges and capitalize on opportunities, thereby mitigating risks and improving strategic decision-making.

Economic factors

Sub-Saharan Africa's economic growth is anticipated to strengthen, with projections suggesting a rise from approximately 3.2% in 2024 to around 3.5% in 2025. This upward trend is crucial for Standard Bank, as it directly correlates with increased lending opportunities and improved asset quality across its operating regions.

However, this positive outlook is not without its headwinds. Many nations in the region continue to grapple with elevated debt burdens, which stood at an average of over 60% of GDP for low-income countries in 2024. Persistent inflation, averaging around 7-8% across the continent in early 2025, and ongoing geopolitical tensions in select areas, could dampen consumer and business confidence, thereby limiting credit demand and potentially affecting borrowers' ability to service existing loans.

Inflation in South Africa has shown signs of moderation, with the Consumer Price Index (CPI) easing to 5.1% year-on-year in April 2024, down from 5.3% in March. This trend, coupled with expectations of potential interest rate cuts by the South African Reserve Bank (SARB) later in 2024, could alleviate financial burdens on consumers and businesses, potentially stimulating credit growth for Standard Bank.

However, global economic uncertainties and persistent inflation in some African markets where Standard Bank operates could still pose challenges. For instance, while inflation in Nigeria has been elevated, reaching 33.69% in April 2024, this presents a different risk profile compared to South Africa's moderating inflation, potentially impacting asset quality and credit demand differently across Standard Bank's diverse geographic footprint.

Improved economic conditions are expected to boost demand for credit, especially for infrastructure and green energy initiatives, creating new avenues for Standard Bank Group's lending activities. This trend is supported by forecasts indicating a rise in private sector credit growth.

Concurrently, the outlook suggests a return to more typical credit loss ratios and a decrease in non-performing loans, painting a picture of a more stable and less risky lending landscape for the bank.

Sovereign Debt and Fiscal Stability

High sovereign debt levels in several African nations present a considerable risk to financial institutions like Standard Bank. Countries with substantial debt burdens face increased costs for servicing that debt, which can strain government finances and potentially impact the banking sector through contagion effects. For instance, as of early 2024, several Sub-Saharan African countries were grappling with debt-to-GDP ratios exceeding 60%, a threshold often considered concerning.

Standard Bank's financial stability is intrinsically linked to the fiscal health of the countries where it operates. Exposure to government securities means the bank's balance sheet can be directly affected by a sovereign's ability to manage its debt. This includes the risk of default or credit rating downgrades, which would impact the value of these holdings and potentially increase the cost of borrowing for the bank itself.

The potential for contagion is a significant concern. If one country experiences a sovereign debt crisis, it can erode investor confidence across the region, making it harder for other nations and their financial institutions to access capital. This ripple effect could dampen economic activity and negatively affect Standard Bank's profitability and asset quality across its diverse African footprint.

- Sovereign Debt Concerns: Several African economies faced elevated debt-to-GDP ratios in 2023-2024, with some exceeding 70%, increasing debt servicing costs and fiscal pressure.

- Banking Sector Exposure: Banks like Standard Bank hold government bonds, making their financial health susceptible to sovereign creditworthiness and potential defaults.

- Contagion Risk: A fiscal crisis in one nation can trigger a loss of confidence across the region, impacting other markets and Standard Bank's operations.

- Fiscal Stability Impact: The overall fiscal stability of operating countries directly influences the operating environment and risk profile for Standard Bank.

Currency Volatility and Exchange Rates

Fluctuations in African currencies against major global currencies present a significant challenge for Standard Bank. For instance, a weaker Nigerian Naira or Angolan Kwanza against the South African Rand can directly reduce the reported earnings from these key markets when consolidated. This currency volatility impacts the bank's profitability, particularly within its Africa Regions operations, as translated profits shrink.

Looking ahead to 2024 and 2025, a more stable exchange rate environment is anticipated to bolster financial market stability across the continent. This stability is crucial for attracting foreign investment and fostering greater investor confidence. For Standard Bank, this translates to a more predictable operating environment and potentially improved asset valuations.

Key impacts of currency volatility on Standard Bank Group include:

- Reduced Reported Earnings: Depreciation of African currencies against the South African Rand directly lowers the Rand value of profits earned in those local markets. For example, if the Zambian Kwacha weakens by 10% against the Rand, earnings generated in Zambia will appear lower when reported in South Africa.

- Impact on Asset Valuations: Volatile exchange rates can also affect the perceived value of Standard Bank's assets held in foreign currencies, influencing capital adequacy ratios and overall balance sheet strength.

- Increased Hedging Costs: To mitigate these risks, the bank may incur higher costs for currency hedging strategies, impacting operational efficiency.

- Investor Confidence: Greater exchange rate stability is expected to enhance investor confidence in African markets, potentially leading to increased capital flows and improved economic conditions that benefit banking sector performance.

Sub-Saharan Africa's economic growth is projected to improve, with forecasts suggesting a rise from approximately 3.2% in 2024 to around 3.5% in 2025, which directly benefits Standard Bank through increased lending opportunities. However, high debt burdens, averaging over 60% of GDP for low-income countries in 2024, and persistent inflation, around 7-8% continent-wide in early 2025, pose risks by potentially dampening credit demand and affecting loan repayment capabilities.

Inflation in South Africa has moderated, with CPI at 5.1% in April 2024, and anticipated interest rate cuts by the SARB later in 2024 could stimulate credit growth for Standard Bank. Conversely, elevated inflation in other markets, such as Nigeria's 33.69% in April 2024, presents different risk profiles affecting asset quality and credit demand across the bank's operations.

The bank's financial health is closely tied to the fiscal stability of its operating countries, with high sovereign debt levels in several nations, some exceeding 70% of GDP in 2023-2024, posing a significant risk. Exposure to government bonds makes Standard Bank susceptible to sovereign creditworthiness, and a fiscal crisis in one nation could trigger a loss of investor confidence across the region, impacting other markets and the bank's operations.

Currency fluctuations are a key challenge, as depreciation of African currencies against the South African Rand can reduce reported earnings; for example, a weaker Zambian Kwacha directly lowers the Rand value of profits earned there. A more stable exchange rate environment anticipated for 2024-2025 is crucial for attracting foreign investment and fostering investor confidence, leading to a more predictable operating environment for Standard Bank.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Standard Bank | Key Considerations |

| Sub-Saharan Africa GDP Growth | ~3.2% | ~3.5% | Increased lending opportunities, improved asset quality | Growth drivers, sector-specific performance |

| Inflation (Continent Average) | ~7-8% (early 2025) | Moderating | Potential impact on credit demand and borrower capacity | Country-specific inflation rates, monetary policy responses |

| South Africa Inflation | 5.1% (April 2024) | Further moderation expected | Potential for interest rate cuts, stimulating credit growth | SARB policy decisions, consumer spending |

| Sovereign Debt-to-GDP (select countries) | Exceeding 60-70% (2023-2024) | Continued monitoring | Risk of fiscal pressure, potential impact on bank's holdings | Debt servicing costs, fiscal sustainability |

| Currency Volatility (e.g., ZMW vs ZAR) | Significant fluctuations | Anticipated stability | Impact on reported earnings, asset valuations, hedging costs | Exchange rate policy, foreign investment flows |

Full Version Awaits

Standard Bank Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Standard Bank Group's PESTLE analysis. This comprehensive report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the group's operations. You'll gain valuable insights into the strategic landscape Standard Bank navigates.

Sociological factors

Standard Bank is deeply invested in financial inclusion, working to bring banking services to millions across Africa who are currently unbanked or underbanked. This commitment translates into creating simpler, more affordable products and leveraging digital platforms to reach these communities.

By bringing more individuals and small businesses into the formal financial system, Standard Bank aims to foster economic growth and development. For instance, in 2024, they reported a significant increase in their customer base through these initiatives, particularly in mobile banking solutions which saw a 15% year-on-year growth in active users.

Consumer behavior in Africa is rapidly evolving, driven by a significant surge in digital adoption. Many more Africans are now turning to digital platforms for their banking needs, reflecting a shift in preferences. For instance, by the end of 2024, mobile banking penetration across the continent is projected to reach over 60% in key markets, a substantial increase from previous years.

Standard Bank is actively responding to this trend by making substantial investments in its digital services and upgrading client platforms. This includes enhancing mobile apps and online banking portals to offer a seamless user experience. Simultaneously, the bank recognizes that a portion of its customer base still values traditional banking, and thus it is strategically maintaining a physical branch network to cater to these diverse needs.

Standard Bank actively addresses the critical issue of high youth unemployment across Africa, a persistent societal challenge. Through targeted skills development programs and graduate recruitment initiatives, the bank invests in nurturing young talent. For instance, in 2023, Standard Bank's various youth empowerment programs reached over 100,000 young people across its African operations, aiming to equip them with employable skills.

By providing these crucial employment opportunities and fostering talent development, Standard Bank directly contributes to human capital growth and the creation of a more skilled workforce essential for future economic progress. This focus on youth employment is not just a social responsibility but a strategic imperative for sustainable development in the regions where it operates.

Urbanization and Demographic Shifts

Africa's rapid urbanization, with projections indicating that by 2050, 60% of its population will reside in cities, significantly impacts Standard Bank. This trend fuels demand for a broad spectrum of financial services, from mortgages and savings accounts to digital payment solutions. The growing urban middle class, particularly the youth, represents a key demographic for expansion.

Catering to this evolving landscape requires Standard Bank to adapt its strategies. This includes developing innovative, mobile-first financial products and expanding digital and agent banking networks to reach diverse urban and peri-urban populations. For instance, in 2024, Standard Bank reported a substantial increase in digital transactions across its African operations, highlighting the growing reliance on these channels.

- Urban Population Growth: Africa's urban population is expected to reach 1.3 billion by 2050, creating a larger customer base for financial services.

- Youth Demographic: A significant portion of Africa's population is under 25, representing a key segment for long-term banking relationships and digital adoption.

- Demand for Financial Services: Urbanization drives increased need for credit, insurance, and investment products among a growing middle class.

- Digital Adoption: The young, urban population is highly receptive to digital banking solutions, pushing Standard Bank to enhance its mobile and online offerings.

Corporate Social Investment and Community Impact

Standard Bank Group's commitment to corporate social investment (CSI) is a cornerstone of its strategy to foster sustainable development and positive societal impact. The bank actively engages in initiatives designed to enhance financial literacy, support small and medium-sized enterprises (SMEs), and drive job creation across its operating regions.

In 2023, Standard Bank reported significant contributions through its CSI programs. For instance, its financial inclusion efforts reached over 2 million individuals, providing access to banking services and financial education. The bank also channeled substantial investment into SME development, directly supporting over 5,000 businesses and contributing to an estimated 15,000 new jobs created through these partnerships.

These efforts underscore Standard Bank's role as a responsible corporate citizen, aiming to build shared value. Key areas of focus include:

- Financial Health: Initiatives promoting financial literacy and access to affordable financial products.

- Business Growth: Support for SMEs through funding, mentorship, and market access programs.

- Job Creation: Direct and indirect employment generation through business development and infrastructure projects.

- Infrastructure Development: Investments in projects that improve community access to essential services and economic opportunities.

Standard Bank's operations are significantly shaped by the diverse sociological landscape across Africa, particularly concerning financial inclusion and evolving consumer behaviors. The bank's strategy actively addresses the continent's high youth population and rapid urbanization, recognizing these as key drivers for future growth and service demand.

The bank's commitment to financial inclusion is evident in its efforts to bank the unbanked, with a notable 15% year-on-year growth in active mobile banking users reported by the end of 2024. This digital shift is further underscored by projections that mobile banking penetration will exceed 60% in key African markets by the close of 2024, reflecting a significant change in how consumers interact with financial services.

Furthermore, Standard Bank's focus on youth employment, through skills development and graduate programs, aims to combat high unemployment rates. In 2023 alone, these initiatives positively impacted over 100,000 young people, enhancing human capital and fostering economic participation.

| Sociological Factor | Impact on Standard Bank | Key Data/Initiatives (2023-2024) |

|---|---|---|

| Financial Inclusion | Expands customer base and drives digital adoption. | 15% YoY growth in active mobile banking users (2024). 2 million individuals reached through financial inclusion efforts (2023). |

| Youth Demographic | Represents a significant future customer segment and workforce. | Over 100,000 young people engaged in skills development programs (2023). |

| Urbanization | Increases demand for diverse financial products and services. | Urban population projected to reach 1.3 billion by 2050. |

| Digital Adoption | Requires enhanced digital platforms and mobile-first solutions. | Mobile banking penetration projected over 60% in key markets (2024). |

Technological factors

Standard Bank is actively driving digital transformation, reallocating its technology investments from traditional hardware to software and cloud-based services. This strategic pivot is crucial for staying competitive in the rapidly evolving financial landscape.

The bank's cloud-first strategy is designed to boost agility and resilience, allowing for quicker service deployment. For instance, by the end of 2024, Standard Bank aimed to increase its cloud-native application development by 25%, directly supporting its goal of faster innovation.

This focus on cloud adoption enhances operational efficiency and enables Standard Bank to better respond to changing customer demands. By mid-2025, the bank expects to see a 15% improvement in system uptime due to these cloud initiatives, ensuring more reliable customer access to services.

Standard Bank is actively integrating artificial intelligence and robotics to sharpen its competitive edge, aiming to boost customer satisfaction and streamline internal processes. This technological push is central to their strategic vision for enhanced operational performance.

The bank is deploying AI in customer-facing applications, such as personalized financial advice and fraud detection, while also utilizing AI-powered tools in its contact centers to manage inquiries more efficiently. For instance, in 2023, Standard Bank reported a significant increase in digital customer engagement, with AI playing a role in personalizing interactions and offering faster query resolution.

These advancements are designed to create superior client platforms and optimize back-office functions, leading to cost savings and improved service delivery. The bank's commitment to innovation in AI and automation is expected to yield further efficiency gains and a more responsive banking experience throughout 2024 and into 2025.

As Standard Bank Group increasingly relies on digital channels, with over 10 million digital customers as of early 2024, cybersecurity and data resilience are critical. The surge in digital transactions necessitates robust core infrastructure and system stability to safeguard client data.

Standard Bank is actively investing in advanced cybersecurity measures to counter evolving cyber threats. This focus is essential for maintaining customer trust and ensuring the uninterrupted operation of its digital platforms, a key priority given the growing digital footprint.

Fintech Partnerships and Innovation

Standard Bank is actively forging partnerships with technology firms and fintech companies to accelerate its digital transformation and develop innovative financial solutions. These collaborations are crucial for staying competitive in a rapidly evolving financial sector, particularly with the rise of non-traditional market players.

By teaming up with fintechs, Standard Bank gains access to faster innovation cycles, more adaptable resources, and specialized expertise. This allows them to leverage data more effectively, fostering deeper customer relationships and creating tailored offerings that meet evolving consumer demands. For instance, in 2024, Standard Bank announced a strategic partnership with a leading African fintech to enhance its digital payment capabilities, aiming to process an additional 20% of transactions through this new channel by the end of 2025.

- Digital Innovation: Collaborations focus on co-creating unique digital products and services.

- Customer Intimacy: Leveraging data analytics from partnerships to understand and serve customers better.

- Market Adaptation: Responding to the changing financial landscape and new entrants through technology.

- Efficiency Gains: Fintech partnerships are projected to reduce transaction processing times by up to 15% in key markets by 2025.

Modernization of Core Banking Systems

Standard Bank is actively modernizing its core banking systems, alongside its client relationship management (CRM) and other enabling platforms. This strategic move is designed to bolster the bank's underlying technology infrastructure, ensuring it can handle growing transaction volumes efficiently. For instance, in 2023, Standard Bank reported a significant increase in digital transaction volumes, underscoring the need for robust and scalable systems.

These technological upgrades are vital for supporting the rapid rollout of new digital features and services. By investing in modernization, Standard Bank aims to enhance customer experience and operational efficiency across its diverse client segments, from retail banking to corporate and investment banking. This focus on foundational technology is a key enabler for future growth and innovation in a competitive financial landscape.

- Core System Modernization: Enhancing scalability and processing power to meet increasing transaction demands.

- CRM Integration: Improving client data management for personalized service delivery.

- Enabling Platforms: Building flexible infrastructure for faster new product development and deployment.

- Digital Transaction Growth: Supporting the surge in digital banking activities reported by the bank.

Technological factors are shaping Standard Bank Group's strategy, with a significant shift towards digital transformation and cloud-first initiatives. By the end of 2024, the bank targeted a 25% increase in cloud-native application development, aiming for a 15% improvement in system uptime by mid-2025 due to these efforts.

Artificial intelligence and robotics are being integrated to enhance customer satisfaction and streamline operations, with AI playing a role in personalized advice and fraud detection. Digital engagement saw a notable increase in 2023, partly attributed to AI-driven personalization.

Cybersecurity and data resilience are paramount, especially with over 10 million digital customers by early 2024, necessitating robust infrastructure to protect client data.

Partnerships with fintech companies are accelerating innovation, with a goal to process an additional 20% of transactions through new digital channels by the end of 2025 via strategic alliances.

| Technology Focus | Key Initiative | Target/Metric | Year |

|---|---|---|---|

| Digital Transformation | Cloud-first strategy | 25% increase in cloud-native app development | 2024 |

| Operational Efficiency | Cloud adoption | 15% improvement in system uptime | Mid-2025 |

| Customer Engagement | AI integration | Increased digital customer engagement | 2023 |

| Market Expansion | Fintech partnerships | 20% additional transactions via new channels | End of 2025 |

Legal factors

South African banks, including Standard Bank, are navigating the ongoing implementation of Basel III and the forthcoming Basel IV (often referred to as Basel 3.1) risk-based capital regulations, with key phases extending through 2025. These global reforms significantly influence capital requirements, demanding higher quality and quantity of capital, and necessitate a continuous evolution of risk management frameworks and internal control systems to ensure compliance and maintain robust capital buffers.

The Conduct of Financial Institutions (COFI) Bill represents a significant shift in South Africa's financial regulatory landscape, aiming to embed customer-centricity into the core of financial services. This legislation will likely impose greater oversight and accountability on Standard Bank, demanding a more proactive approach to customer protection and ethical conduct.

For Standard Bank, the COFI Bill translates into increased compliance costs and potentially more rigorous governance structures. The emphasis on treating customers fairly will necessitate robust internal processes and a demonstrable commitment to acting in customers' best interests, impacting everything from product design to customer complaint resolution.

New joint standards for cybersecurity and cyber resilience, effective from June 2025, will require financial institutions like Standard Bank to continuously update their cybersecurity strategies. These regulations emphasize the implementation of robust preventative practices and the development of comprehensive data loss prevention policies to safeguard sensitive information.

Compliance with these evolving legal frameworks is paramount for Standard Bank to effectively mitigate sophisticated cyber threats and protect customer data. Failure to adhere to these standards could result in significant regulatory penalties and reputational damage, underscoring the critical need for proactive cyber defense measures.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Compliance

Standard Bank faces significant obligations stemming from ongoing regulatory reforms designed to bolster Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) capabilities. The potential exit of South Africa from the Financial Action Task Force (FATF) grey list in 2024 underscores the urgency and stringency of these requirements.

Adherence to strict legislation and directives is paramount for Standard Bank to prevent illicit financial activities. This compliance directly influences operational workflows, data management, and external reporting mandates, impacting overall business efficiency and risk management frameworks.

- Regulatory Scrutiny: Banks like Standard Bank are under increased pressure to enhance their AML/CTF systems, with regulators focusing on transaction monitoring and suspicious activity reporting.

- FATF Grey List Impact: South Africa's position on the FATF grey list (as of early 2024) necessitates robust compliance measures to improve international financial standing.

- Operational Adjustments: Implementing advanced analytics and artificial intelligence for transaction screening is becoming a necessity, impacting IT infrastructure and staffing.

- Reporting Obligations: Stricter reporting requirements to financial intelligence units demand greater accuracy and timeliness in data submissions.

Deposit Insurance Scheme (CoDI) Membership

The introduction of South Africa's Corporation for Deposit Insurance (CoDI) in April 2024 mandates membership for all licensed banks, including Standard Bank. This new deposit protection regime introduces annual levies and monthly premiums, directly impacting Standard Bank's operational costs and compliance obligations.

CoDI membership signifies a shift in the regulatory landscape, necessitating adherence to new premium structures and potential capital contributions. For Standard Bank, this means integrating these new financial commitments into its budgeting and risk management strategies. The exact figures for levies and premiums are still being finalized by CoDI, but they are expected to be based on a bank's deposit base.

- Mandatory Membership: All South African banks must join CoDI from April 2024.

- New Cost Structure: Annual levies and monthly premiums will be introduced.

- Regulatory Impact: CoDI membership affects compliance and financial planning.

- Data Dependency: Specific financial implications are contingent on CoDI's finalized premium calculations.

Standard Bank, like other South African financial institutions, is adapting to the evolving regulatory environment shaped by Basel III and the upcoming Basel IV reforms, with capital requirements and risk management frameworks continuously being updated through 2025. The new Conduct of Financial Institutions (COFI) Bill is also a significant factor, pushing for greater customer-centricity and increasing accountability for banks.

New cybersecurity standards, effective mid-2025, will mandate enhanced data protection policies and preventative practices for Standard Bank. Furthermore, the bank must bolster its Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) systems, especially given South Africa's efforts to exit the FATF grey list in 2024, which requires stringent compliance measures.

The introduction of the Corporation for Deposit Insurance (CoDI) in April 2024 means Standard Bank must now pay annual levies and monthly premiums, adding to its operational costs and compliance duties. These legal and regulatory shifts demand ongoing investment in compliance, technology, and robust governance to ensure stability and trust.

Environmental factors

Standard Bank is actively pursuing its net-zero emissions goal by 2050, a commitment that directly influences its operational strategies and investment decisions, especially concerning Africa's energy transition. This involves a dual focus on mitigating climate-related risks, such as physical damage to assets, and adapting business models to capitalize on emerging green opportunities.

The group's strategy emphasizes maximizing positive environmental impact, demonstrated by its significant investments in renewable energy projects across Africa. For instance, in 2024, Standard Bank financed a substantial portion of a new solar farm in South Africa, contributing to a cleaner energy mix. This proactive approach to climate change positions them to navigate evolving regulatory landscapes and growing investor demand for sustainable finance.

Standard Bank Group is actively pursuing ambitious sustainable finance goals, targeting the mobilization of over R450 billion from 2022 to 2028. A significant portion of this funding is earmarked for renewable energy initiatives, demonstrating a clear strategic focus on climate transition.

This commitment is central to Standard Bank's strategy of supporting its clients' sustainability objectives. By facilitating green, social, and sustainability-linked transactions, the bank aims to be a key partner in driving climate action and enabling a more sustainable economic future.

Standard Bank Group actively embeds environmental, social, and governance (ESG) factors into its core risk management and operational strategies. This commitment is demonstrated through rigorous materiality assessments, ensuring the bank focuses on the most impactful ESG issues for its stakeholders.

The bank's dedication to transparency is evident in its comprehensive sustainability disclosures. By aligning with international benchmarks such as the UN Sustainable Development Goals and the Paris Agreement, Standard Bank provides clear reporting on its ESG performance, allowing for informed evaluation by investors and other interested parties.

Fossil Fuel Exposure and Transition Policy

Standard Bank Group is actively managing its exposure to fossil fuels as part of its commitment to a low-carbon future. While the bank continues to finance new oil and gas projects in Africa, these are subject to stringent environmental and social risk controls.

The bank has set clear targets to manage its energy portfolio responsibly. Specifically, Standard Bank aims to limit its exposure to upstream oil and gas to less than 30% of its total energy book and less than 3% of its overall loans and advances by the year 2030.

- Energy Transition Strategy: Standard Bank is navigating the global energy transition by balancing current energy needs with future sustainability goals.

- Fossil Fuel Financing: The bank continues to finance oil and gas projects in Africa, albeit under strict environmental and social risk management frameworks.

- Exposure Limits: By 2030, upstream oil and gas exposure is targeted to be under 30% of the energy book and below 3% of total loans and advances.

Financing Renewable Energy Projects

Standard Bank is making substantial strides in financing renewable energy projects across Africa, demonstrating a strong commitment to the continent's energy transition. In 2023, the bank reported a significant increase in its financing for renewable power, with a substantial portion of its energy portfolio now directed towards green initiatives. This focus is crucial for Africa's development, aiming to bridge energy gaps and foster sustainable economic growth.

The bank's energy supply ratio, a key indicator of its commitment, reflects a growing emphasis on renewables over traditional fossil fuels. For instance, by the end of 2024, Standard Bank aims to have over 60% of its new energy financing allocated to renewable sources, a notable increase from the 45% recorded in 2022. This strategic shift supports the development of vital infrastructure like solar farms and wind power plants.

- Financing Green Energy: Standard Bank has mobilized over $2 billion in funding for renewable energy projects in Africa as of early 2025.

- Energy Supply Ratio: The bank's ratio of renewable to non-renewable energy financing has improved, targeting a 60% allocation to green projects by the end of 2024.

- Project Support: This financing directly supports the construction and expansion of solar, wind, and hydropower facilities across key African markets.

- Africa's Energy Transition: Standard Bank's efforts are instrumental in helping African nations achieve their clean energy goals and reduce reliance on fossil fuels.

Standard Bank Group is actively managing its environmental footprint, aiming for net-zero emissions by 2050. This strategy involves significant investment in renewable energy across Africa, with over R450 billion targeted for sustainable finance between 2022 and 2028.

The bank is increasing its allocation to green energy projects, with over 60% of new energy financing earmarked for renewables by the end of 2024, up from 45% in 2022. This commitment is crucial for Africa's energy transition, supporting projects like solar and wind farms.

While continuing to finance oil and gas projects in Africa, Standard Bank is implementing strict environmental controls and aims to limit upstream oil and gas exposure to under 30% of its energy book and below 3% of total loans by 2030.

| Environmental Factor | Standard Bank Group's Action/Target | Timeline/Data Point |

|---|---|---|

| Net-Zero Emissions Goal | Commitment to achieving net-zero emissions | By 2050 |

| Renewable Energy Financing | Mobilized over $2 billion for renewable projects in Africa | As of early 2025 |

| Energy Financing Allocation | Targeting over 60% of new energy financing for renewables | By end of 2024 |

| Fossil Fuel Exposure Limit | Limit upstream oil and gas exposure to < 30% of energy book | By 2030 |

| Fossil Fuel Exposure Limit | Limit upstream oil and gas exposure to < 3% of total loans | By 2030 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Standard Bank Group is built on a robust foundation of data from official government publications, international financial institutions like the IMF and World Bank, and reputable market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the banking sector.