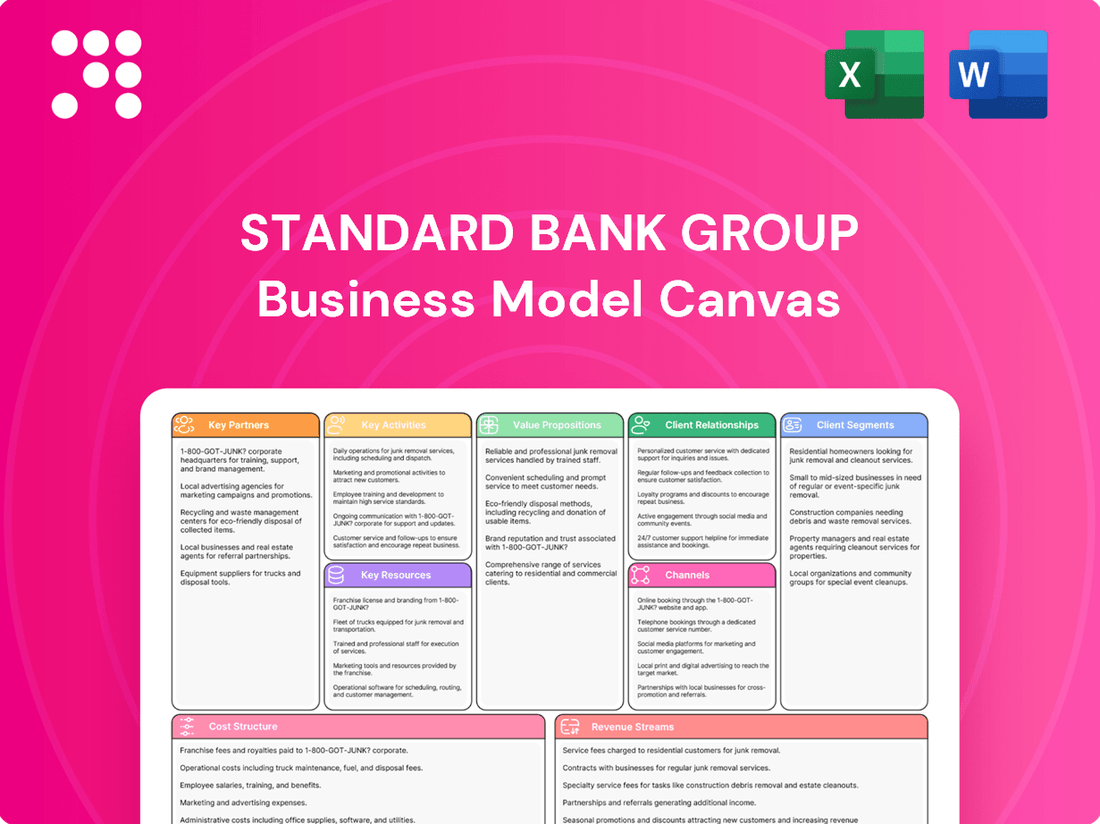

Standard Bank Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Standard Bank Group Bundle

Unlock the strategic blueprint of Standard Bank Group's success with our comprehensive Business Model Canvas. This detailed analysis dissects how they leverage key partnerships and customer relationships to deliver unique value propositions across Africa. Discover their revenue streams and cost structure, offering invaluable insights for anyone looking to understand or replicate their market dominance.

Partnerships

Standard Bank actively seeks partnerships with FinTech companies to boost its digital capabilities and introduce innovative financial solutions. These collaborations allow the bank to tap into specialized expertise, leading to improved customer experiences and more efficient operations.

For instance, in 2024, Standard Bank continued to integrate AI-powered tools and cloud-based platforms through these strategic alliances. These FinTech collaborations are crucial for staying competitive in the rapidly evolving financial landscape, offering advanced services like personalized financial advice and streamlined transaction processing.

Standard Bank's strategic alliances with governments and public sector entities across Africa are foundational to its business model, particularly for driving large-scale infrastructure and economic growth. These collaborations are vital for accessing and participating in significant development projects that are often aligned with national agendas. For instance, in 2024, Standard Bank continued to play a key role in financing projects related to renewable energy and transportation across several African nations, leveraging these partnerships to unlock substantial investment opportunities.

Standard Bank Group actively partners with International Financial Institutions (IFIs) and Development Banks, such as the African Development Bank Group (AfDB). These collaborations are crucial for channeling funding into vital sectors, particularly Small, Medium-sized, and Micro Enterprises (SMMEs), and for bolstering trade finance across the African continent.

These strategic alliances directly contribute to achieving sustainable development goals and promoting economic integration within Africa. For instance, in 2023, Standard Bank facilitated significant trade finance flows, leveraging partnerships with IFIs to support businesses and drive economic growth.

Technology and Cloud Service Providers

Standard Bank's digital ambitions are significantly bolstered by strategic alliances with major technology and cloud service providers, including Microsoft and Amazon Web Services (AWS). These partnerships are crucial for migrating core banking functions to the cloud, which is a cornerstone of their digital transformation efforts. This move is designed to enhance operational agility and pave the way for advanced digital services.

These collaborations are instrumental in unlocking the potential of artificial intelligence and data analytics, enabling Standard Bank to derive deeper insights and offer more personalized customer experiences. By leveraging cutting-edge cloud infrastructure, the bank aims to improve the reliability and performance of its digital platforms, ensuring a seamless and secure banking environment for its customers.

The impact of these partnerships is evident in the bank's ongoing efforts to modernize its IT systems. For instance, in 2024, Standard Bank continued its multi-year investment in cloud migration, aiming to reduce infrastructure costs and accelerate the deployment of new digital products and services. This strategic focus on technology partnerships underscores their commitment to innovation and efficiency in the competitive financial landscape.

- Cloud Migration: Facilitates the movement of critical workloads to scalable cloud environments, enhancing flexibility.

- AI and Data Analytics: Enables the development and deployment of advanced analytics solutions for better decision-making and customer insights.

- Digital Infrastructure Enhancement: Strengthens the resilience, security, and efficiency of the bank's digital operations.

- Innovation Acceleration: Provides access to cutting-edge technologies and platforms, speeding up the introduction of new financial products and services.

Local Businesses and Corporates

Standard Bank cultivates robust relationships with a wide array of local businesses and major corporations throughout its operational regions. These partnerships are crucial, as Standard Bank offers specialized financial products, trade financing, and expert guidance designed to bolster economic development and assist clients in achieving their growth objectives.

These collaborations are vital for fostering economic activity. For instance, in 2024, Standard Bank's corporate and investment banking division reported significant growth in its trade finance offerings, supporting thousands of cross-border transactions that are fundamental to the success of these key business relationships.

- Tailored Financial Solutions: Providing customized banking, lending, and investment products to meet the specific needs of diverse corporate clients.

- Trade Finance Support: Facilitating international trade through instruments like letters of credit and guarantees, essential for businesses engaged in import/export.

- Advisory Services: Offering strategic financial advice, mergers and acquisitions support, and capital markets expertise to help businesses navigate complex financial landscapes.

- Economic Contribution: These partnerships directly contribute to job creation and economic stability within the communities where Standard Bank operates.

Standard Bank's key partnerships extend to governments and public sector entities, crucial for driving large-scale infrastructure and economic growth across Africa. These alliances, exemplified by their 2024 involvement in renewable energy and transportation projects, enable participation in significant development initiatives aligned with national agendas.

Collaborations with International Financial Institutions (IFIs) and Development Banks, such as the AfDB, are vital for channeling funds into sectors like SMMEs and bolstering trade finance. These partnerships, which facilitated significant trade finance flows in 2023, directly support sustainable development goals and economic integration.

Strategic alliances with major technology and cloud providers like Microsoft and AWS are fundamental to Standard Bank's digital transformation, enabling cloud migration and the deployment of AI and data analytics. In 2024, the bank continued its multi-year investment in cloud migration to enhance agility and accelerate digital service delivery.

Partnerships with FinTech companies are essential for enhancing digital capabilities and introducing innovative financial solutions, with 2024 seeing continued integration of AI-powered tools and cloud platforms through these collaborations.

What is included in the product

A comprehensive, pre-written business model tailored to Standard Bank Group's strategy, detailing customer segments, channels, and value propositions.

Reflects the real-world operations and plans of Standard Bank Group, organized into 9 classic BMC blocks with full narrative and insights.

The Standard Bank Group Business Model Canvas acts as a pain point reliever by offering a structured, visual representation that simplifies complex strategic thinking.

It streamlines the identification of key value propositions and customer segments, alleviating the pain of fragmented or unclear strategic direction.

Activities

Standard Bank's core activities revolve around providing a wide array of banking and financial services. This includes retail banking, offering personal accounts, loans, and credit facilities to individuals. For businesses, they provide transactional banking, lending, and specialized financial solutions.

The group also has a strong presence in corporate and investment banking, advising on mergers and acquisitions, underwriting debt and equity, and facilitating large-scale project finance. Wealth management services cater to high-net-worth individuals, offering investment advice and estate planning.

In 2023, Standard Bank reported a headline earnings growth of 27% to R20.3 billion, demonstrating the robust performance of its diverse financial service offerings across the African continent.

Standard Bank Group's digital transformation is a core activity, with substantial investments poured into enhancing mobile banking and online platforms. This includes leveraging AI and cloud technologies to streamline operations and elevate customer experiences.

In 2023, Standard Bank reported a 16% increase in digital transactions, highlighting the success of these initiatives. Their commitment to innovation aims to ensure they remain competitive in the rapidly changing financial sector.

Standard Bank Group's key activities include rigorous risk management and unwavering regulatory compliance. This dual focus is paramount for navigating the complexities of the financial sector and ensuring operational integrity.

In 2024, Standard Bank continued to invest significantly in sophisticated risk management systems. For instance, their credit risk mitigation strategies are a cornerstone, aiming to minimize potential losses from loan defaults, a critical aspect given the economic climate.

Adherence to a multitude of regulatory frameworks, including those set by the South African Reserve Bank and international bodies, is non-negotiable. This ensures the bank operates transparently and ethically, protecting both its clients and the broader financial ecosystem.

Wealth Management and Insurance Solutions

Standard Bank Group extends its financial services significantly beyond traditional banking by offering robust wealth management and insurance solutions. These offerings cater to a broad spectrum of clients, aiming to provide comprehensive financial security and growth opportunities.

The group's wealth management arm provides essential services like asset management and tailored financial planning. This ensures clients can effectively grow and preserve their wealth through expert guidance and diversified investment strategies.

In 2024, Standard Bank's wealth management segment continued to be a key contributor to its overall financial performance, reflecting strong client trust and market demand for sophisticated financial advice. The insurance solutions complement this by offering protection against various risks.

- Asset Management: Providing investment management services across various asset classes.

- Financial Planning: Offering personalized strategies for retirement, education, and estate planning.

- Insurance Products: Delivering life, health, and general insurance to protect clients and their assets.

- Diversified Revenue: These segments contribute significantly to the group's non-interest income, enhancing revenue stability.

Sustainable Finance and Development Initiatives

Standard Bank Group's key activities include mobilizing sustainable finance, with a significant focus on green energy projects and essential infrastructure development throughout Africa. This strategic allocation of capital directly supports the bank's mission to foster inclusive and sustainable economic growth across the continent.

The bank's commitment to sustainable finance is not merely aspirational; it's operationalized through concrete initiatives. For example, in 2023, Standard Bank facilitated over R20 billion in green finance, demonstrating tangible progress in channeling funds towards environmentally responsible projects. This aligns their business operations with pressing societal and environmental objectives, such as climate change mitigation and resilient infrastructure building.

- Mobilizing Sustainable Finance: Actively sourcing and deploying capital for environmentally and socially responsible projects across Africa.

- Green Energy Projects: Investing in renewable energy sources like solar and wind power to support Africa's energy transition.

- Infrastructure Development: Financing critical infrastructure that drives economic growth and improves quality of life, with a sustainability lens.

- Inclusive Growth Strategy: Ensuring that financial activities contribute to broad-based economic development and social well-being.

Standard Bank Group's key activities encompass a broad spectrum of financial services, from retail and corporate banking to investment and wealth management. They also focus on digital transformation and robust risk management, all while driving sustainable finance initiatives across Africa.

In 2023, Standard Bank saw significant growth, with headline earnings increasing by 27% to R20.3 billion. Their digital offerings also expanded, with a 16% rise in digital transactions, underscoring their commitment to innovation and customer experience.

The group's strategic focus on sustainable finance is evident in its 2023 green finance facilitation of over R20 billion, supporting renewable energy and infrastructure development, thereby contributing to inclusive economic growth on the continent.

| Key Activity | Description | 2023 Impact/Data |

|---|---|---|

| Banking Services | Retail, Corporate, Investment Banking | 27% headline earnings growth to R20.3 billion |

| Digital Transformation | Enhancing mobile and online platforms | 16% increase in digital transactions |

| Risk Management & Compliance | Mitigating credit risk, adhering to regulations | Continued investment in sophisticated risk systems |

| Wealth & Insurance | Asset management, financial planning, insurance products | Key contributor to overall financial performance |

| Sustainable Finance | Financing green energy and infrastructure | Facilitated over R20 billion in green finance |

Full Document Unlocks After Purchase

Business Model Canvas

The Standard Bank Group Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of their strategic operations. This is not a sample or mockup; it's a direct snapshot of the final, ready-to-use deliverable. You'll gain full access to this professionally structured document, enabling you to understand and analyze Standard Bank's core business components.

Resources

Standard Bank's extensive Pan-African network, spanning 20 countries with numerous branches and ATMs, is a cornerstone of its business model. This physical footprint ensures broad accessibility to essential banking services, including cash management and vital in-person customer support, catering to diverse digital adoption levels across the continent.

Standard Bank Group's commitment to advanced technology infrastructure is a cornerstone of its business model. Significant investments are channeled into cutting-edge areas like cloud computing, artificial intelligence, and sophisticated digital platforms. These investments are crucial for delivering seamless digital services and managing vast amounts of data efficiently.

This robust technological backbone empowers Standard Bank to offer enhanced customer experiences and rapidly introduce innovative financial solutions. For instance, in 2023, the bank continued its digital transformation journey, with a substantial portion of its IT budget allocated to enhancing its digital platforms and data analytics capabilities, aiming to improve operational efficiency and customer engagement.

Standard Bank Group's workforce, exceeding 5,000 IT specialists, financial experts, and relationship managers, forms a critical asset. This deep pool of talent is fundamental to crafting intricate financial solutions and fostering technological advancements.

Their combined expertise directly fuels the group's ability to innovate, particularly in areas like digital banking and data analytics, ensuring they remain competitive. For instance, in 2024, the bank continued to invest heavily in upskilling its employees, with a significant portion of the IT workforce undergoing training in AI and machine learning to enhance customer-facing platforms.

Strong Brand Reputation and Trust

Standard Bank's strong brand reputation, built over 160 years, is a cornerstone of its business model. This deep-seated trust is crucial for customer acquisition and retention across Africa.

This legacy translates into significant competitive advantage, enabling Standard Bank to attract and maintain a loyal customer base, which is vital for sustained growth and profitability.

- Brand Recognition: Standard Bank is a highly recognized financial institution across its operating markets.

- Customer Loyalty: The bank enjoys high levels of customer loyalty, a direct result of its long-standing reputation for reliability and service.

- Stakeholder Trust: Beyond customers, investors and partners also place significant trust in Standard Bank's management and financial stability.

- Competitive Edge: This intangible asset provides a distinct advantage over competitors, particularly in building new relationships and expanding services.

Substantial Financial Capital and Liquidity

Standard Bank Group's substantial financial capital and strong liquidity are cornerstones of its operations. This robust financial foundation, demonstrated by its consistent capital adequacy ratios, allows the bank to engage in significant lending operations across Africa. For instance, as of the first half of 2024, Standard Bank reported a Common Equity Tier 1 (CET1) ratio of 13.6%, well above regulatory requirements, underscoring its financial strength.

This financial muscle enables Standard Bank to manage substantial investment portfolios and absorb potential economic shocks. Its liquidity position, reflected in its liquidity coverage ratio (LCR), consistently remains above regulatory minimums, ensuring it can meet its short-term obligations. This capacity is critical for supporting client needs, from large corporate financing to individual banking services, and for pursuing strategic growth initiatives throughout its operating regions.

- Capital Strength: Maintained a CET1 ratio of 13.6% in H1 2024, exceeding regulatory benchmarks.

- Liquidity Management: Consistently held a strong Liquidity Coverage Ratio (LCR) above required levels.

- Lending Capacity: Enables significant credit extension to businesses and individuals across its African footprint.

- Economic Resilience: Provides a buffer to withstand economic downturns and market volatility.

Standard Bank's key resources encompass its extensive physical network, robust technology infrastructure, skilled workforce, strong brand reputation, and substantial financial capital. These elements collectively enable the bank to deliver a wide range of financial services across Africa, drive innovation, and maintain customer trust.

| Resource Category | Key Components | 2024 Data/Highlights |

|---|---|---|

| Physical Network | Branches, ATMs across 20 African countries | Continued expansion and optimization of digital and physical touchpoints. |

| Technology Infrastructure | Cloud computing, AI, digital platforms | Ongoing investment in AI and data analytics to enhance customer experience and operational efficiency. |

| Human Capital | IT specialists, financial experts, relationship managers | Significant investment in upskilling IT workforce in AI and machine learning in 2024. |

| Brand Reputation | 160+ years of trust and reliability | High customer loyalty and stakeholder trust across operating markets. |

| Financial Capital | Capital adequacy, liquidity | CET1 ratio of 13.6% in H1 2024, strong LCR above regulatory minimums. |

Value Propositions

Standard Bank Group's value proposition centers on delivering comprehensive and integrated financial solutions. This means clients can access everything from personal and business banking to sophisticated corporate and investment banking services, alongside wealth management and insurance. This all-encompassing approach streamlines financial management for individuals and businesses alike.

For instance, in 2024, Standard Bank continued to enhance its digital platforms, aiming to provide seamless access to its diverse product offerings. This integration is crucial for clients managing multiple financial aspects, reducing complexity and saving valuable time. The bank's commitment to a single point of access for all financial needs underscores its strategy to be a lifelong financial partner.

Standard Bank's extensive footprint across 20 African nations, including significant operations in South Africa and Nigeria, grants it unparalleled market expertise. This deep connectivity allows the bank to navigate complex local economic nuances and regulatory frameworks, offering tailored financial solutions that foster growth. For instance, in 2023, Standard Bank reported a headline earnings growth of 27% in its Africa Regions segment, underscoring the effectiveness of its localized approach.

Standard Bank Group's dedication to digital transformation is evident in its advanced mobile applications and online platforms, offering clients a highly convenient and innovative banking experience. This focus ensures seamless digital transactions and improved accessibility, meeting the growing need for efficient digital interactions.

In 2024, Standard Bank continued to bolster its digital offerings, with mobile banking users growing by 15% year-on-year, showcasing the increasing adoption of these convenient channels. AI-powered services are also being integrated, aiming to personalize customer interactions and streamline processes, further enhancing the user experience.

Commitment to Sustainable and Inclusive Growth

Standard Bank Group is deeply committed to fostering sustainable and inclusive growth across Africa. This commitment is more than just rhetoric; it's woven into their business model, differentiating them in a competitive landscape. They actively finance projects that drive positive change, such as renewable energy installations and essential infrastructure development, which are crucial for economic advancement.

This focus on impactful development isn't just about corporate responsibility; it's a strategic advantage. Clients and investors increasingly seek financial partners who demonstrate a genuine commitment to environmental and social governance (ESG) principles. By prioritizing these areas, Standard Bank attracts capital and builds stronger relationships with stakeholders who share their vision for a more prosperous and equitable continent.

In 2024, Standard Bank continued to channel significant resources into these growth areas. For instance, their financing for renewable energy projects played a vital role in expanding access to clean power. Furthermore, their support for Small and Medium-sized Enterprises (SMMEs) is a cornerstone of their inclusive growth strategy. SMMEs are the backbone of African economies, and by providing them with access to finance and advisory services, Standard Bank empowers job creation and local economic development.

Key initiatives and their impact include:

- Financing Renewable Energy: Standard Bank has been a leading financier of renewable energy projects across Africa, contributing to a greener energy mix and reducing carbon emissions. Their portfolio in this sector saw significant growth in 2024.

- Critical Infrastructure Development: The bank actively supports the development of essential infrastructure such as transportation, water, and telecommunications, which are vital for economic connectivity and growth.

- Support for SMMEs: Through various lending programs and business support services, Standard Bank empowers small and medium-sized businesses, recognizing their critical role in employment generation and economic diversification. In 2024, their SMME lending book expanded by a notable percentage.

- Impact Investing: Standard Bank is increasingly involved in impact investing, aligning financial returns with measurable social and environmental benefits, attracting a growing pool of ESG-conscious investors.

Trusted and Resilient Financial Partner

Standard Bank Group's value proposition as a Trusted and Resilient Financial Partner is underpinned by its extensive history and robust governance. This translates into a deep sense of security and reliability for its diverse clientele. For instance, as of the first half of 2024, Standard Bank reported a strong Common Equity Tier 1 (CET1) ratio of 14.3%, demonstrating its solid capital base and ability to withstand economic fluctuations.

This enduring stability, combined with a strategically diversified business model, provides clients with the confidence of uninterrupted service and support. The bank's operations span across various sectors and geographies, mitigating risks and ensuring operational continuity. In 2023, Standard Bank Group's headline earnings reached R11.9 billion, showcasing its consistent performance and resilience.

- Long-standing history provides a foundation of trust and experience.

- Strong governance framework ensures accountability and ethical operations.

- Diversified business model offers stability and continuity across economic cycles.

- Robust capital ratios, such as a CET1 ratio of 14.3% in H1 2024, signal financial strength.

Standard Bank Group offers integrated financial solutions, providing clients with a single access point for diverse banking needs, from personal to corporate and wealth management. This comprehensive approach simplifies financial management and positions the bank as a lifelong partner.

The bank's extensive African footprint, spanning 20 countries, allows for deep market understanding and tailored solutions, driving growth. In 2023, their Africa Regions segment saw a 27% headline earnings growth, highlighting the success of this localized strategy.

Standard Bank is committed to sustainable and inclusive growth, actively financing renewable energy and infrastructure projects, and supporting Small and Medium-sized Enterprises (SMMEs). This focus on ESG principles attracts capital and builds stronger stakeholder relationships.

The bank's value proposition is also built on being a trusted and resilient financial partner, evidenced by its strong capital base. As of H1 2024, Standard Bank reported a CET1 ratio of 14.3%, demonstrating its financial strength and ability to navigate economic challenges.

| Value Proposition Element | Description | Key Supporting Fact (2023/2024 Data) |

|---|---|---|

| Integrated Financial Solutions | Comprehensive access to personal, business, corporate, investment banking, wealth management, and insurance services. | Continued enhancement of digital platforms in 2024 for seamless access. |

| Deep African Market Expertise | Extensive presence across 20 African nations enabling tailored financial solutions. | Africa Regions segment headline earnings grew 27% in 2023. |

| Commitment to Sustainable Growth | Financing of renewable energy, infrastructure, and support for SMMEs. | Mobile banking users grew 15% year-on-year in 2024, indicating digital adoption for these services. |

| Trusted and Resilient Partner | Strong governance, diversified business model, and robust capital position. | CET1 ratio of 14.3% reported in H1 2024. |

Customer Relationships

For its corporate, institutional, and high-net-worth clientele, Standard Bank Group deploys dedicated relationship managers and specialized teams. This high-touch strategy is designed to deliver precisely tailored financial advice and bespoke solutions.

This personalized approach allows for a deep understanding of intricate client requirements, thereby cultivating robust and long-lasting partnerships. For instance, in 2023, Standard Bank reported a significant increase in its wealth management segment, reflecting the success of these relationship-driven strategies.

Standard Bank Group prioritizes digital channels for customer engagement, offering robust self-service functionalities via its mobile application and online banking. This digital-first approach aims to provide clients with immediate access to a wide array of banking services and information.

The bank leverages AI-powered contact centers to deliver efficient and accessible customer support. These advanced systems empower clients to resolve inquiries and access services seamlessly, enhancing overall customer satisfaction and operational efficiency.

In 2024, Standard Bank reported a significant increase in digital transaction volumes, with over 80% of customer interactions occurring through digital channels. This highlights the success of their strategy in promoting digital self-service and support.

Standard Bank actively fosters community engagement through programs designed to boost financial literacy and inclusion. For instance, in 2024, their financial education workshops reached over 150,000 individuals across various African nations, aiming to equip them with essential money management skills.

These initiatives go beyond typical banking services, building deep trust and showcasing Standard Bank's dedication to the economic well-being of the communities they serve. By empowering individuals and small businesses with knowledge, the bank cultivates stronger, more resilient economies.

Proactive Advisory and Market Insights

Standard Bank Group aims to be a proactive financial advisor, offering clients timely market insights and economic analyses. This proactive stance allows them to provide strategic guidance, helping clients navigate complex financial landscapes and identify emerging opportunities. For instance, in 2024, the bank intensified its digital advisory services, with a reported 15% increase in client engagement through personalized market updates and investment recommendations.

This approach goes beyond routine banking, fostering deeper advisory relationships. By delivering valuable information and strategic input, Standard Bank helps clients make more informed decisions, ultimately strengthening loyalty and expanding the scope of services provided. Their focus on delivering actionable intelligence was evident in their Q3 2024 performance, where advisory-led client acquisition grew by 10% year-on-year.

- Proactive Guidance: Providing timely market insights and economic analyses to clients.

- Informed Decision-Making: Empowering clients with strategic guidance for better financial choices.

- Opportunity Identification: Helping clients discover and capitalize on new market opportunities.

- Deepened Relationships: Moving beyond basic banking to build stronger, advisory-focused partnerships.

Client-Centric Product and Service Development

Standard Bank Group places a strong emphasis on client-centric product and service development. This means the bank actively listens to its customers and monitors market trends to shape its offerings. For instance, in 2024, Standard Bank continued to invest in digital platforms, responding to the growing demand for seamless online banking experiences.

This commitment ensures that Standard Bank's solutions stay current and competitive. By directly addressing the changing financial needs of its varied customer base, the bank aims to foster stronger, long-lasting relationships.

- Client Feedback Integration: Standard Bank actively incorporates client feedback gathered through surveys, digital channels, and direct engagement to refine existing products and conceptualize new ones.

- Market Needs Responsiveness: The bank monitors economic shifts, technological advancements, and evolving customer behaviors to proactively develop financial solutions that meet emerging demands.

- Digital Transformation Focus: In 2024, a significant portion of new product development centered on enhancing digital capabilities, including improved mobile banking features and streamlined online account opening processes.

- Personalized Solutions: Standard Bank strives to offer tailored financial products and services, recognizing that the needs of individual customers, small businesses, and large corporations differ significantly.

Standard Bank Group cultivates customer loyalty through a multi-faceted approach, blending personalized relationship management with robust digital self-service options. Their commitment to community engagement and proactive financial advisory further solidifies these bonds, ensuring clients feel supported and informed. This strategy is reflected in their strong performance and increasing digital adoption.

| Customer Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Personalized Support | Dedicated relationship managers for corporate and high-net-worth clients. | Increased wealth management segment growth in 2023, indicating success of tailored advice. |

| Digital Engagement | Mobile app and online banking with self-service functionalities. | Over 80% of customer interactions occurred digitally in 2024; AI-powered contact centers enhance efficiency. |

| Community & Education | Financial literacy and inclusion programs. | Financial education workshops reached over 150,000 individuals in 2024. |

| Proactive Advisory | Timely market insights and economic analyses. | 15% increase in client engagement via personalized market updates in 2024; advisory-led acquisition grew 10% year-on-year (Q3 2024). |

Channels

Digital Banking Platforms represent Standard Bank Group's primary and fastest-growing channel. These include the Standard Bank Mobile App and online banking portals, offering a full spectrum of services from simple transactions to in-depth account management. This digital ecosystem caters to an increasingly digitally active client base, providing them with unmatched convenience and accessibility.

In 2023, Standard Bank reported a significant increase in digital engagement, with over 12 million active digital users across its African operations. This highlights the critical role these platforms play in reaching and serving a broad customer base, facilitating seamless financial interactions and reinforcing customer loyalty through user-friendly interfaces and a wide array of self-service options.

Despite the rise of digital banking, Standard Bank Group's extensive branch and ATM network remains a cornerstone of its business model. In 2024, this physical presence across Africa continued to be vital, particularly for customers needing cash services, complex financial advice, or those in regions with less developed digital connectivity. This hybrid approach ensures accessibility for a broad customer base.

Standard Bank Group's dedicated contact centers are evolving into sophisticated, multi-channel hubs. These centers are increasingly integrating AI to handle customer inquiries, provide technical support, and manage service requests efficiently. This ensures customers receive comprehensive assistance, effectively bridging the gap between digital self-service options and more traditional interaction methods.

Relationship Managers and Sales Force

Standard Bank Group leverages specialized relationship managers and dedicated sales forces to cater to its corporate, institutional, and high-net-worth client base. This direct, human-centric approach is fundamental for fostering deep client relationships and understanding intricate financial needs.

These teams are instrumental in originating complex deals and crafting tailored financial solutions, which are vital for securing and growing business within these high-value segments. For instance, in 2024, Standard Bank reported significant growth in its corporate and investment banking division, underscoring the effectiveness of these relationship-driven channels.

- Client Engagement: Direct interaction allows for in-depth needs assessment and personalized service.

- Deal Origination: Relationship managers are key to identifying and structuring complex transactions.

- Solution Customization: Bespoke financial products are developed based on detailed client discussions.

- Revenue Generation: This channel is a primary driver of revenue from high-value client segments.

Strategic Partnership Networks

Standard Bank actively cultivates strategic partnerships, notably with FinTech innovators, payment gateways, and other financial service providers. These collaborations are crucial for expanding the bank's service delivery beyond its traditional channels, enabling access to new customer segments and offering specialized, integrated financial solutions. For instance, in 2024, Standard Bank continued to bolster its digital offerings by integrating with several emerging FinTech platforms, enhancing customer onboarding and transaction capabilities.

These networks allow Standard Bank to achieve broader market penetration by leveraging the established customer bases and specialized technologies of its partners. This ecosystem approach enables the bank to offer a more comprehensive suite of financial products and services, often through third-party platforms, thereby increasing customer convenience and engagement. By collaborating with over 50 FinTechs across Africa by the end of 2023, Standard Bank demonstrated a clear commitment to this strategy.

The benefits of these strategic partnerships extend to enhanced operational efficiency and the co-creation of innovative financial products. By tapping into partner expertise and infrastructure, Standard Bank can accelerate the development and deployment of new services, such as digital lending or cross-border payment solutions, more rapidly and cost-effectively. This collaborative model is a cornerstone of their strategy to remain competitive in the evolving African financial landscape.

- FinTech Integrations: Standard Bank's partnerships with FinTechs in 2024 focused on enhancing digital onboarding and payment processing.

- Expanded Reach: Collaborations with payment service providers allowed access to new customer segments and markets.

- Integrated Solutions: The bank leveraged partner channels to offer combined financial services, increasing customer value.

- Ecosystem Growth: By the close of 2023, Standard Bank had partnered with over 50 FinTechs across the African continent.

Standard Bank Group employs a multi-channel approach, blending digital innovation with traditional touchpoints. Digital platforms, including their mobile app and online banking, are central, evident in over 12 million active digital users in 2023. Their extensive branch and ATM network remains crucial for accessibility, especially in 2024, supporting cash services and complex advice. Contact centers are evolving into AI-enhanced hubs, managing inquiries and support efficiently. Specialized relationship managers cater to corporate and high-net-worth clients, driving complex deal origination and tailored solutions, a strategy that saw growth in their corporate and investment banking division in 2024. Strategic partnerships, particularly with over 50 FinTechs by the end of 2023, expand service delivery and reach, integrating new capabilities like digital lending.

| Channel Type | Key Features | 2023/2024 Data Point | Strategic Importance |

|---|---|---|---|

| Digital Platforms | Mobile App, Online Banking | 12M+ active digital users (2023) | Primary, fastest-growing, convenience |

| Physical Network | Branches, ATMs | Continued vital presence (2024) | Accessibility for cash, advice, low connectivity areas |

| Contact Centers | AI-enhanced support | Evolving into multi-channel hubs | Efficient customer assistance |

| Relationship Managers | Direct client interaction | Growth in CIB division (2024) | High-value client relationships, deal origination |

| Strategic Partnerships | FinTechs, payment gateways | 50+ FinTechs partnered (end 2023) | Expanded reach, integrated solutions |

Customer Segments

Standard Bank Group’s Personal and Private Banking clients encompass a broad spectrum, from everyday consumers needing basic accounts and loans to affluent individuals requiring in-depth wealth management. In 2024, the bank continued to focus on digital channels to serve its mass-market base, while offering bespoke advisory services for its high-net-worth segment.

This segment is crucial for Standard Bank’s retail operations, driving transaction volumes and deposit growth. The bank aims to cater to the evolving financial needs of these diverse customers through a range of tailored products, including savings accounts, mortgages, and investment solutions, reflecting a commitment to client-centricity.

Small, Medium-sized, and Micro Enterprises (SMMEs) are a cornerstone of economic activity, and Standard Bank Group actively supports this diverse segment. These businesses, ranging from sole proprietorships to growing mid-sized firms, are crucial for job creation and innovation across various economies. In 2024, Standard Bank continued to offer tailored financial solutions designed to foster their growth and sustainability.

Standard Bank provides SMMEs with essential financial tools, including accessible credit facilities, robust transactional banking services, and valuable business advisory support. These offerings are designed to help SMMEs manage their day-to-day operations, invest in expansion, and navigate the complexities of the business landscape. For instance, in South Africa alone, SMMEs contribute significantly to employment, and Standard Bank's commitment aims to bolster this contribution.

Standard Bank Group serves a robust Corporate and Institutional Clients segment, which includes major corporations, multinational enterprises, and government bodies. These clients rely on the bank for sophisticated corporate and investment banking solutions tailored to their large-scale financial needs.

For these clients, Standard Bank provides critical services such as project finance for infrastructure development, comprehensive trade finance solutions to facilitate international commerce, and expert capital markets advisory. In 2023, Standard Bank reported significant growth in its Corporate and Investment Banking division, reflecting strong engagement with this client base, particularly in areas like syndicated lending and cross-border transactions.

Clients Across Africa's Diverse Regions

Standard Bank Group operates across 20 African countries, acknowledging the distinct economic, regulatory, and cultural environments within each. This broad reach necessitates a tailored approach to serving diverse client needs.

The bank's strategy focuses on understanding and adapting to these regional specificities. For instance, in 2023, Standard Bank reported a headline earnings growth of 20% in its South Africa operations, while its Rest of Africa segment saw a 26% increase, highlighting varied performance across its footprint.

- South Africa: A mature market with sophisticated financial needs, including corporate banking, wealth management, and retail services.

- East Africa (e.g., Kenya, Uganda): Growing economies with increasing demand for trade finance, digital banking solutions, and SME lending.

- West Africa (e.g., Nigeria, Ghana): Dynamic markets with significant opportunities in infrastructure financing, foreign exchange services, and digital payment adoption.

- Southern Africa (e.g., Angola, Mozambique): Resource-rich regions where the bank supports mining, energy, and agricultural sectors, alongside growing consumer banking needs.

Digitally-Inclined Customers

Digitally-inclined customers are a rapidly growing and crucial segment for Standard Bank Group. This group actively engages with the bank through its digital platforms, demonstrating a clear preference for self-service and convenient online interactions. For instance, in 2024, Standard Bank reported a significant uptick in mobile banking transactions, with over 70% of customer interactions occurring via digital channels.

This segment's preference fuels the bank's strategic investments in its digital ecosystem. Standard Bank is continuously enhancing its mobile application and online banking portals, incorporating features like AI-powered chatbots for instant customer support and personalized financial advice. By mid-2025, the bank aims to have over 80% of its customer service inquiries resolved digitally.

- Digital Adoption: In 2024, Standard Bank saw a 25% year-over-year increase in active digital users.

- Mobile-First Strategy: The bank's mobile app accounts for 65% of all digital transactions.

- AI Integration: By the end of 2025, Standard Bank plans to deploy AI across 90% of its customer-facing digital touchpoints.

- Customer Preference: Surveys indicate that over 75% of customers under 40 prefer digital banking channels.

Standard Bank Group’s customer segments are diverse, catering to individuals, businesses, and institutions across Africa. The bank prioritizes understanding the unique needs of each group, from mass-market consumers to large corporations and government entities.

In 2024, the bank continued its digital transformation, enhancing online and mobile platforms to serve digitally-inclined customers better. This focus aims to improve accessibility and convenience for a growing segment that prefers self-service interactions.

The bank's commitment extends to Small, Medium-sized, and Micro Enterprises (SMMEs), recognizing their vital role in economic development. Tailored financial solutions, including credit and advisory services, are provided to foster their growth and sustainability.

Corporate and Institutional Clients rely on Standard Bank for sophisticated financial solutions, such as project finance and capital markets advisory. The bank’s extensive reach across 20 African countries allows it to serve these clients effectively in varied economic landscapes.

| Customer Segment | Key Characteristics | 2024 Focus/Data Point |

|---|---|---|

| Personal & Private Banking | Mass-market consumers to affluent individuals requiring wealth management. | Continued focus on digital channels for mass market; bespoke advisory for high-net-worth. |

| SMMEs | Small to medium-sized businesses crucial for job creation. | Offering tailored credit, transactional banking, and advisory support. |

| Corporate & Institutional Clients | Major corporations, multinational enterprises, government bodies. | Providing project finance, trade finance, and capital markets advisory. Reported strong engagement in syndicated lending and cross-border transactions in 2023. |

| Digitally-Inclined Customers | Prefer self-service and online interactions. | Significant uptick in mobile banking transactions; over 70% of customer interactions via digital channels. |

Cost Structure

Standard Bank Group allocates a substantial portion of its budget to technology and digital investments. This includes significant outlays for cloud infrastructure, essential software licenses, robust cybersecurity measures to protect client data, and the ongoing development of artificial intelligence capabilities. These expenditures are vital for staying competitive in the digital financial landscape and ensuring smooth, efficient operations across the group.

Standard Bank Group's cost structure is significantly impacted by personnel expenses, a critical component for its extensive and specialized workforce. In 2024, the bank continued to invest heavily in competitive salaries and comprehensive benefits packages to attract and retain top talent across its diverse operations.

The bank also allocates substantial resources to training and development programs. These initiatives are vital for equipping employees with the skills needed to navigate evolving financial markets, implement new technologies, and deliver innovative solutions, thereby ensuring high-quality service delivery and fostering a culture of continuous improvement.

Standard Bank Group's extensive branch network and physical infrastructure across Africa represent a significant cost driver. Even with increasing digital adoption, these brick-and-mortar locations, including ATMs, require substantial investment in rent, property upkeep, utilities, and security. For instance, in 2023, Standard Bank reported operating expenses that include costs associated with its widespread physical presence, underscoring the ongoing financial commitment to maintaining these traditional touchpoints for customers.

Regulatory Compliance and Risk Management Costs

Standard Bank Group invests heavily in regulatory compliance and risk management to uphold its integrity and avoid significant penalties. These essential functions require substantial operational and technological resources.

Adhering to evolving financial regulations, such as those from the Prudential Regulation Authority and the Financial Conduct Authority in the UK, and the South African Reserve Bank, necessitates continuous investment in compliance systems and personnel. For instance, in 2023, global financial institutions reported significant expenditures on compliance, with many allocating over 10% of their IT budgets to regulatory initiatives.

- Regulatory Compliance: Ongoing investment in systems and expertise to meet diverse international and local financial regulations.

- Risk Management Frameworks: Development and maintenance of robust frameworks to identify, assess, and mitigate various financial, operational, and reputational risks.

- Anti-Money Laundering (AML): Significant expenditure on technology and processes to ensure strict adherence to AML and counter-terrorist financing (CTF) requirements.

- Operational and Technological Investment: Substantial allocation of resources for the implementation and upkeep of advanced technological solutions supporting compliance and risk management.

Marketing, Sales, and Customer Acquisition Costs

Standard Bank Group dedicates significant resources to marketing, sales, and customer acquisition. This expenditure is crucial for expanding their reach and strengthening their brand across diverse markets. These costs encompass a wide array of activities, from broad advertising campaigns to targeted digital outreach.

In 2023, Standard Bank Group reported operating expenses of R53.5 billion, a portion of which is allocated to these critical growth drivers. Their strategy involves both traditional media and increasingly sophisticated digital marketing to attract new clients and retain existing ones.

- Brand Building: Investment in advertising and public relations to enhance brand recognition and trust.

- Digital Marketing: Spend on online advertising, social media engagement, and search engine optimization to reach a wider audience.

- Sales Initiatives: Costs associated with sales teams, relationship managers, and promotional offers to drive product uptake.

- Customer Acquisition: Expenses related to onboarding new customers, including digital account opening processes and introductory incentives.

Standard Bank Group's cost structure is heavily influenced by its extensive physical footprint across Africa. Maintaining a vast network of branches and ATMs, including rent, utilities, and security, represents a significant ongoing expense. In 2023, operating expenses reflected these substantial commitments to physical infrastructure, even as digital channels grow.

| Cost Category | Description | 2023 Impact (Illustrative) |

|---|---|---|

| Technology & Digital | Cloud, software, AI development, cybersecurity | Significant investment for competitive edge |

| Personnel | Salaries, benefits, training for skilled workforce | Key driver for talent acquisition and retention |

| Physical Infrastructure | Branch network, ATMs, property upkeep | Substantial costs for maintaining physical presence |

| Regulatory Compliance & Risk | Systems, expertise for adherence to financial laws | Essential for integrity and avoiding penalties |

| Marketing & Sales | Brand building, digital outreach, customer acquisition | Crucial for market expansion and client growth |

Revenue Streams

Net Interest Income (NII) is Standard Bank Group's core revenue generator. It arises from the spread between the interest received on its lending activities and investments, and the interest paid out on customer deposits and wholesale funding. This fundamental banking operation is highly sensitive to changes in interest rates and the overall volume of the bank's interest-earning assets.

For the first half of 2024, Standard Bank Group reported a significant NII of R27.8 billion, demonstrating its continued reliance on this income stream. This figure represents a substantial portion of the bank's overall earnings, highlighting the importance of effective asset and liability management in navigating the prevailing interest rate environment.

Net fee and commission income for Standard Bank Group is a significant contributor, stemming from a broad spectrum of banking services. This includes income generated from account maintenance, various transaction charges, credit and debit card usage, and advisory services. Furthermore, commissions earned from wealth management and insurance products play a crucial role in this revenue stream.

In 2024, Standard Bank Group reported substantial growth in its non-interest revenue, with fee and commission income showing resilience. For instance, the group's interim results for the six months ended June 30, 2024, highlighted a notable increase in transaction-based fees, driven by higher client activity and the ongoing shift towards digital banking channels across its African operations.

Standard Bank Group generates significant revenue from its trading and investment income. This includes profits from actively trading in financial markets, such as foreign exchange, derivatives, and fixed-income securities. For instance, in 2023, the bank reported substantial gains from its trading desks, reflecting its ability to navigate volatile market conditions and capitalize on opportunities.

Furthermore, returns on strategic investments contribute to this revenue stream. Standard Bank Group holds stakes in various businesses and financial instruments, and the performance of these investments directly impacts its overall income. Market volatility, while posing risks, can also create opportunities for enhanced returns on these holdings, as seen in the bank's diversified investment portfolio.

Insurance Premiums and Asset Management Fees

Standard Bank Group's revenue streams are significantly bolstered by insurance premiums and asset management fees. The bank generates income from selling a variety of insurance products, including life, short-term, and funeral policies, catering to diverse customer needs. This diversification not only broadens the bank's income base but also allows it to offer more comprehensive financial solutions to its clientele.

Furthermore, Standard Bank earns substantial fees from its wealth management division, where it manages client assets. This dual approach, combining insurance and asset management, provides a stable and recurring revenue stream, reducing reliance on traditional lending activities. For instance, in 2024, the group's insurance businesses continued to demonstrate resilience, contributing positively to overall earnings through premium growth and effective claims management.

- Income from Insurance: Premiums collected from the sale of life, short-term, and funeral insurance policies.

- Asset Management Fees: Earnings derived from managing client investments and assets within the wealth management segment.

- Diversified Revenue: These streams reduce the bank's dependence on interest income from loans.

- Holistic Solutions: Enables Standard Bank to offer integrated financial planning and protection services.

Digital and Ecosystem-Based Revenue

Standard Bank is actively cultivating new revenue streams through its digital transformation and ecosystem development. This includes revenue generated from innovative digital products and services designed to meet evolving customer needs.

The bank is also leveraging platform-based services, creating opportunities for third-party integration and monetization. For instance, collaborations within integrated ecosystems, such as the OneFarm initiative which connects farmers to markets and financial services, are becoming significant revenue contributors.

- Digital Products: Expanding offerings beyond traditional banking to include value-added digital solutions.

- Platform Services: Monetizing its digital infrastructure through partnerships and API integrations.

- Ecosystem Initiatives: Generating revenue from services and transactions facilitated within strategic partnerships like OneFarm.

- Data Monetization: Exploring opportunities to leverage aggregated, anonymized data insights within regulatory frameworks.

Standard Bank Group's revenue streams are diverse, encompassing net interest income, fees and commissions, trading and investment income, and income from insurance and asset management. The bank is also actively developing new revenue streams through digital initiatives and ecosystem partnerships.

For the first half of 2024, Net Interest Income (NII) was R27.8 billion, underscoring its importance. Fee and commission income also showed resilience, with notable growth in transaction-based fees driven by increased client activity and digital channel adoption.

Insurance premiums and asset management fees provide stable, recurring income, reducing reliance on traditional lending. Digital products and platform services are emerging as key growth areas, with initiatives like OneFarm demonstrating the potential of ecosystem monetization.

| Revenue Stream | 2023 Performance (Illustrative) | H1 2024 Performance | Key Drivers |

|---|---|---|---|

| Net Interest Income (NII) | Significant contributor | R27.8 billion | Interest rate environment, loan volumes |

| Net Fee and Commission Income | Strong performance | Growth in transaction fees | Digital banking adoption, client activity |

| Trading and Investment Income | Substantial gains | Market volatility, investment performance | Financial market trading, strategic investments |

| Insurance & Asset Management | Positive contribution | Resilient premium growth | Insurance product sales, wealth management fees |

| Digital & Ecosystem Revenue | Emerging contributor | Growth in digital services | Digital product innovation, platform partnerships |

Business Model Canvas Data Sources

The Standard Bank Group Business Model Canvas is constructed using a blend of internal financial disclosures, extensive market research reports, and strategic insights derived from industry analysis. These diverse data sources ensure a comprehensive and accurate representation of the bank's operations and market positioning.