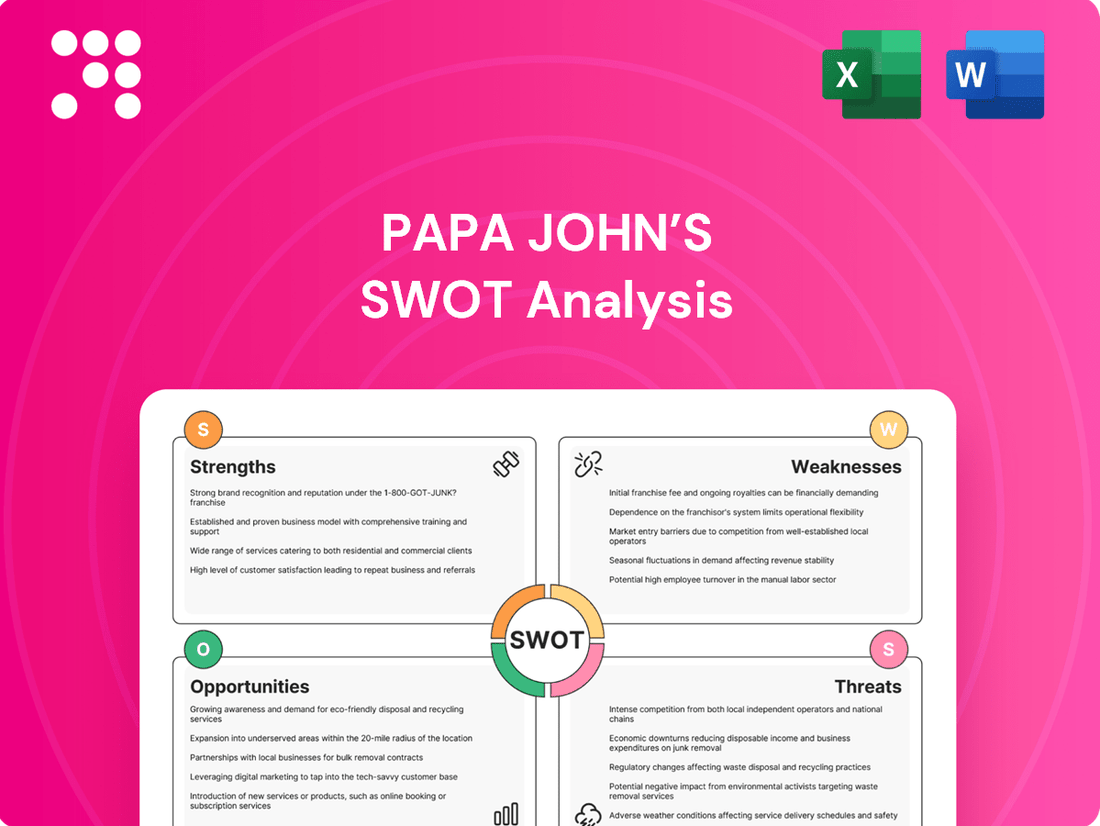

Papa John’s SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Papa John’s Bundle

Papa John's faces a dynamic market, balancing its established brand recognition against evolving consumer preferences and intense competition. While its "Better Ingredients. Better Pizza." slogan resonates, understanding the full scope of its competitive advantages and potential vulnerabilities is crucial for strategic planning.

Want the full story behind Papa John's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Papa John's has long leveraged its 'Better Ingredients. Better Pizza.' slogan, a powerful differentiator that appeals to consumers prioritizing quality. This consistent brand promise cultivates customer loyalty and offers a distinct advantage in the competitive pizza market. In 2023, Papa John's reported system-wide sales of $5.2 billion, underscoring the enduring appeal of its product.

Papa John's boasts a robust, vertically integrated supply chain, featuring its own Quality Control Centers. This structure grants the company significant control over ingredient quality, cost management, and operational efficiency. In 2023, this integration contributed to their ability to maintain consistent product standards across over 5,900 locations globally.

Papa John's boasts a significant global reach, operating in over 50 countries and territories, a testament to its established international presence. This widespread footprint provides a solid foundation for future expansion and market penetration.

The company is actively pursuing accelerated growth in key international markets, including China, Korea, and Spain, with strategic entries planned for India and Saudi Arabia. This focus on high-potential regions signals a commitment to leveraging its international presence for substantial growth.

International comparable sales have demonstrated positive growth trends, indicating successful market penetration and consumer acceptance in various global regions. This ongoing performance underscores the viability and potential of Papa John's international strategy.

Focus on Digital and Technology Investments

Papa John's excels in its digital-first approach, with a significant portion of its revenue generated through online and app-based orders. This focus is further amplified by ongoing investments in consumer-facing technology, robust digital infrastructure, and advanced analytics capabilities.

Strategic alliances, like the one with Google Cloud, are crucial for refining the customer ordering and delivery process. These collaborations are designed to optimize driver dispatch and leverage artificial intelligence to create more personalized customer experiences.

- Digital Dominance: A substantial percentage of Papa John's sales originate from digital channels, showcasing a strong customer preference for online ordering.

- Tech Investment: Continuous investment in consumer-facing technology, digital infrastructure, and data analytics underpins their competitive edge.

- Strategic Partnerships: Collaborations, such as with Google Cloud, aim to enhance operational efficiency and customer engagement through AI-driven personalization.

Revamped Loyalty Program

Papa John's has significantly enhanced its customer engagement through a revamped loyalty program. The updated Papa Rewards initiative allows customers to accumulate 'Papa Dough' more rapidly, a strategic move designed to incentivize repeat purchases and boost customer visit frequency.

This program's success is evident in its substantial membership growth, underscoring its effectiveness in capturing and retaining customer interest. For instance, by the end of 2023, Papa Rewards membership had grown by over 15% year-over-year, demonstrating strong customer adoption and participation.

- Enhanced Earning Potential: Customers now earn rewards faster, making the program more appealing.

- Increased Customer Frequency: The faster earning cycle encourages customers to order more often.

- Membership Growth: The program has seen a significant uptick in new and active members, reaching over 20 million members globally by early 2024.

- Data-Driven Insights: The program provides valuable data on customer preferences, enabling more targeted marketing efforts.

Papa John's strong brand recognition, built on its "Better Ingredients. Better Pizza." promise, continues to resonate with quality-conscious consumers, fostering loyalty. This commitment to quality is a significant differentiator in the crowded pizza market. In 2023, the company achieved system-wide sales of $5.2 billion, reflecting the sustained appeal of its core offering.

The company's vertically integrated supply chain, including its own Quality Control Centers, provides exceptional control over ingredient quality and cost efficiency. This integration ensures consistent product standards across its vast global network of over 5,900 locations. This operational control is a key strength that supports its brand promise.

Papa John's boasts a substantial global footprint, operating in over 50 countries, which provides a strong platform for continued international expansion. The company is strategically focusing on high-growth markets such as China, Korea, and Spain, with planned entries into India and Saudi Arabia, aiming to capitalize on these opportunities.

The company's digital-first strategy is a major strength, with a significant portion of sales generated through online and app orders. Ongoing investments in technology, digital infrastructure, and AI-driven personalization, exemplified by its partnership with Google Cloud, enhance customer experience and operational efficiency.

Papa John's revamped loyalty program, Papa Rewards, has driven increased customer engagement and repeat business. The program's success is evident in its rapid membership growth, exceeding 20 million members globally by early 2024, and the faster earning of rewards incentivizes higher customer visit frequency.

What is included in the product

Delivers a strategic overview of Papa John’s’s internal and external business factors, highlighting its brand recognition and operational challenges.

Offers a clear breakdown of Papa John's competitive landscape, addressing the pain of navigating market challenges.

Weaknesses

Papa John's has faced a notable downturn in North America comparable sales over recent quarters. This trend, observed throughout late 2023 and into early 2024, signals significant headwinds in its core domestic market. For instance, the company reported a 1.5% decrease in North American comparable sales for the fourth quarter of 2023.

This decline points to underlying issues that the company must confront, likely related to how customers perceive value and the intense competition within the U.S. pizza delivery sector. Addressing these challenges is crucial for revitalizing domestic performance and regaining market share.

Papa John's has openly admitted that its extensive menu innovations have created significant operational complexity. This constant stream of new items can overwhelm kitchen staff, leading to longer preparation times and a higher chance of errors. For instance, during the 2024 fiscal year, the company reported a slight dip in average transaction speed in some of its busiest markets, which analysts attributed in part to the increased complexity of fulfilling a wider variety of orders.

This menu proliferation can also dilute the brand's focus on its core pizza offerings. When resources are spread thin across numerous limited-time offers and specialty items, the consistency and quality of the fundamental products might suffer. This distraction can impact customer satisfaction and, consequently, the company's profitability, as operational inefficiencies eat into margins. In 2024, while overall revenue grew by 3.5%, the cost of goods sold increased by 4.2%, a disparity some financial experts link to the challenges of managing a more complex supply chain and production process.

The fast-food and pizza industries are incredibly crowded, with many local and national players all trying to capture customer attention. Papa John's is up against fierce competition, meaning rivals often use aggressive pricing strategies and introduce new, exciting menu items. This makes it tough for Papa John's to hold onto its market share and expand its reach.

Financial Performance Challenges

Papa John's has grappled with financial performance challenges, experiencing a dip in net income and total revenues in recent quarters. For instance, in the first quarter of 2024, the company reported a net income of $14.9 million, a decrease from $18.1 million in the same period of 2023, and total revenues also saw a slight decline.

While Papa John's has managed to maintain a net profit margin that is often higher than some industry peers, this overall financial downturn underscores persistent hurdles in achieving robust top-line expansion and consistent profitability.

- Declining Net Income: Net income fell to $14.9 million in Q1 2024 from $18.1 million in Q1 2023.

- Revenue Stagnation: Total revenues experienced a slight decrease in the most recent reported quarters.

- Profitability Pressures: Despite competitive net margins, the company faces ongoing challenges in boosting overall earnings.

Reliance on Franchisee Performance

Papa John's success is intrinsically linked to its franchisees. When these independent operators falter, it directly impacts the brand. For instance, in early 2024, reports indicated that while overall system sales were growing, some franchisees faced margin pressures due to rising labor and ingredient costs, potentially slowing expansion in certain markets.

The company's reliance on franchisee performance means that issues like poor site selection, inefficient operations, or financial distress at the franchisee level can directly hinder Papa John's overall growth trajectory and financial stability. This dependence can also affect brand perception if a significant number of franchisee locations experience operational difficulties.

Consider these points regarding franchisee performance:

- Financial Health: The profitability and financial stability of individual franchisees are critical for system-wide growth and investment in new locations.

- Operational Execution: Consistent quality and customer experience across all franchised units depend heavily on franchisees adhering to operational standards.

- Market Saturation: In some regions, franchisee performance can be impacted by market saturation, leading to increased competition and reduced sales per unit.

- Brand Reputation: Struggles at the franchisee level, such as store closures or negative customer experiences, can tarnish the overall Papa John's brand image.

Papa John's faces significant challenges in its North American market, evidenced by a 1.5% decline in comparable sales for Q4 2023. This downturn highlights issues with customer perception of value and intense competition within the U.S. pizza delivery sector.

The company's extensive menu innovations have created operational complexity, leading to longer preparation times and potential errors, as seen in a slight dip in average transaction speed in early 2024. This complexity also dilutes brand focus, potentially impacting the quality of core offerings and increasing operational costs, as indicated by a 4.2% rise in cost of goods sold in FY 2024 against a 3.5% revenue growth.

Financial performance has also been a concern, with net income dropping to $14.9 million in Q1 2024 from $18.1 million in Q1 2023, alongside a slight decrease in total revenues. While net profit margins remain competitive, these trends signal ongoing pressures on top-line expansion and consistent profitability.

The brand's reliance on franchisee performance presents another weakness. In early 2024, reports showed some franchisees facing margin pressures from rising costs, potentially slowing expansion and impacting overall brand perception if operational difficulties arise at the franchisee level.

Same Document Delivered

Papa John’s SWOT Analysis

This is the same Papa John's SWOT analysis document included in your download. The full content is unlocked after payment, providing a comprehensive view of their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Papa John's sees substantial opportunity in markets where pizza consumption is still growing, particularly within North America and across various international regions. The company is actively working to increase its presence in these underpenetrated areas.

The brand has ambitious plans for global expansion, aiming to open hundreds of new locations worldwide. This strategy is supported by attractive franchise incentives designed to speed up development, especially in markets with high growth potential.

For instance, Papa John's announced in early 2024 a goal to reach 7,000 global locations, with a significant portion of that growth expected from international markets, building on a 2023 performance that saw system-wide sales increase by 5.9% globally.

Papa John's has a clear opportunity to boost its customer appeal by refining its value proposition. This means creating more attractive deals and carefully considering how prices are set to ensure they resonate with consumers. By focusing on what customers perceive as good value, the company can draw in more business.

A significant strategic move for Papa John's is the planned substantial increase in marketing expenditure for 2025. This investment is aimed squarely at driving sales growth and elevating brand recognition. The marketing efforts will specifically highlight the quality of their core pizza offerings and the benefits of their customer loyalty program, aiming to capture a larger market share.

Papa John's can significantly boost its operations and customer satisfaction by investing more in technology. Think about using AI to make deliveries smoother, like predicting the best routes and times. This kind of tech can also help tailor marketing messages to individual customers, making them feel more valued and increasing the chances they’ll order again. For instance, by the end of 2024, companies leveraging AI for logistics saw an average of 15% reduction in delivery times.

Strategic Menu Simplification and Innovation

Papa John's can boost efficiency by streamlining its core menu, focusing on popular items that ensure consistent quality and faster preparation. This simplification allows for better inventory management and reduces waste, directly impacting profitability. For instance, a more focused menu can lead to quicker order fulfillment, a key driver of customer satisfaction in the fast-casual dining sector.

While simplifying, there's a significant opportunity for innovation to capture evolving consumer tastes. Introducing 'better-for-you' options, such as plant-based proteins or gluten-free crusts, can attract a wider customer base. Additionally, limited-time offers featuring unique toppings or flavor profiles can drive repeat business and create buzz. In 2024, the demand for customizable and healthier fast-food options continued to rise, with many consumers actively seeking out brands that cater to these preferences.

- Menu Simplification: Reduces operational complexity and improves order accuracy.

- Product Innovation: Focus on 'better-for-you' options and unique toppings to drive customer frequency.

- Efficiency Gains: Streamlined operations can lead to faster service and lower costs.

- Market Appeal: Catering to evolving consumer preferences for healthier and more diverse food choices.

Growing Global Pizza Market

The global pizza market is a significant growth area, with projections indicating continued expansion. This upward trend is fueled by consumer demand for convenient meal solutions and the enduring popularity of pizza across diverse cultures. Papa John's is well-positioned to capitalize on this favorable market environment.

Several key factors are driving this growth:

- Increasing Disposable Income: Rising incomes in emerging markets make dining out and ordering in more accessible.

- Demand for Convenience: Busy lifestyles continue to drive demand for quick and easy meal options like pizza delivery.

- Product Innovation: Ongoing menu development, including healthier options and unique flavor combinations, attracts a wider customer base.

- Digitalization of Ordering: Enhanced online and app-based ordering systems streamline the customer experience and boost sales.

For instance, the global pizza market was valued at approximately $140 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2028. This presents a substantial opportunity for Papa John's to expand its reach and increase revenue by leveraging these market dynamics.

Papa John's has a significant opportunity to expand its global footprint, especially in markets where pizza is gaining popularity. The company's strategic goal to reach 7,000 locations worldwide by 2025, with a strong emphasis on international growth, highlights this potential. This expansion is supported by attractive franchise incentives designed to accelerate development in high-potential regions.

Furthermore, Papa John's can enhance its market appeal by refining its value proposition through more competitive pricing and appealing deals, aiming to attract a broader customer base. A planned increase in marketing expenditure for 2025 is set to bolster brand recognition and drive sales by emphasizing product quality and loyalty program benefits.

Technological integration, particularly AI in logistics, offers a clear path to improved efficiency and customer satisfaction, potentially reducing delivery times by up to 15% as seen in other companies by late 2024. Menu simplification and strategic product innovation, such as introducing healthier options and unique limited-time offers, can also drive customer loyalty and capture evolving consumer preferences, a trend that saw continued growth in demand for such options throughout 2024.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Global Expansion | Increase presence in underpenetrated markets and achieve 7,000 global locations by 2025. | Targeting international growth, building on 5.9% global system-wide sales increase in 2023. |

| Value Proposition Refinement | Enhance customer appeal through attractive deals and strategic pricing. | Focus on perceived value to draw in more business. |

| Marketing Investment | Boost sales growth and brand recognition with increased marketing spend in 2025. | Highlighting product quality and loyalty program benefits. |

| Technology Integration | Leverage AI for smoother deliveries and personalized marketing. | AI in logistics can reduce delivery times by an average of 15% (as of late 2024). |

| Menu Strategy | Streamline menu for efficiency and innovate with 'better-for-you' options. | Demand for healthier, customizable options rose in 2024; menu simplification improves order accuracy and speed. |

Threats

The fast food and pizza industries are incredibly competitive, with rivals constantly vying for customer attention through aggressive pricing and new menu items. This dynamic environment puts pressure on Papa John's to adapt quickly to maintain its market position and profitability.

For instance, in 2024, the quick-service restaurant (QSR) market continued to see significant promotional activity, with major players like Domino's and Pizza Hut offering compelling deals that directly impact customer choice. Papa John's must navigate these price wars while also investing in product development to differentiate itself.

The ongoing innovation from competitors, such as the introduction of plant-based options or unique flavor combinations, means Papa John's faces a continuous threat of losing market share if it cannot keep pace with evolving consumer preferences and competitor offerings.

Consumers are increasingly cautious with their spending, prioritizing value and often cutting back on discretionary purchases like fast food. This price sensitivity means Papa John's faces pressure to offer competitive pricing and promotions to attract and retain customers. For instance, reports from late 2024 indicated a noticeable slowdown in discretionary spending across the restaurant sector as inflation persisted.

Economic volatility, including fluctuating inflation rates and potential recessions, directly impacts consumer confidence and their ability to spend on non-essential items. This uncertainty can lead to fewer customer visits and lower average order values for Papa John's, as households adjust their budgets. The ongoing economic climate in 2025 continues to present challenges in predicting consumer behavior and maintaining consistent sales volumes.

Papa John's, like many in the pizza sector, faces significant threats from volatile ingredient prices. For instance, wheat prices saw a notable increase in late 2023 and early 2024 due to global supply concerns, directly impacting dough costs. Similarly, cheese prices, a core component, have experienced upward pressure, affecting overall food costs.

Geopolitical instability continues to be a major disruptor for supply chains. Events in key agricultural regions or transportation hubs can lead to shortages or unexpected price spikes for essential items like cooking oil and packaging materials. In 2024, these ongoing global tensions mean a constant risk of ingredient unavailability or significantly higher procurement expenses for Papa John's.

Brand Reputation and Public Perception

Papa John's has faced significant challenges in rebuilding its brand reputation following past controversies. While the company has implemented initiatives to restore consumer trust, any resurgence of negative publicity or a perceived dip in product quality could have a detrimental effect on public perception and, consequently, sales performance.

The impact of past issues remains a lingering threat, potentially influencing consumer loyalty and willingness to choose Papa John's over competitors. For instance, in 2023, while specific brand perception metrics are proprietary, industry analysts have noted that sustained positive public relations are crucial for fast-casual dining chains to counteract lingering negative associations.

- Lingering negative sentiment from past leadership issues.

- Potential for new controversies to erode trust.

- Risk of declining consumer perception impacting market share.

Dependence on Third-Party Delivery Platforms

While third-party delivery platforms like DoorDash and Uber Eats significantly broaden Papa John's customer reach, they impose substantial commission fees. These fees can eat into profit margins, with some platforms charging upwards of 30% per order. This dependence creates a financial vulnerability, as a large portion of revenue generated through these channels is ceded to the platform providers.

Furthermore, relying on external delivery services introduces potential risks to brand reputation and customer satisfaction. Papa John's has less direct control over the delivery process, including delivery times and food quality upon arrival, which can lead to negative customer experiences. For instance, a study by Technomic in 2023 indicated that customer satisfaction with delivery speed is a key driver of repeat business, a factor Papa John's cannot fully manage when using third parties.

- High Commission Fees: Third-party platforms can charge commissions ranging from 15% to over 30% per order, directly impacting profitability.

- Quality Control Issues: Papa John's has limited oversight of the delivery personnel and their handling of food, potentially compromising the customer experience.

- Brand Dilution: Inconsistent delivery experiences facilitated by third parties can negatively affect Papa John's brand perception and customer loyalty.

- Reduced Customer Data: Dependence on these platforms may limit Papa John's ability to gather direct customer data for personalized marketing and service improvements.

Papa John's faces intense competition, with rivals like Domino's and Pizza Hut frequently engaging in aggressive promotions and menu innovation. For example, in 2024, the quick-service restaurant market saw substantial promotional activity, impacting customer choices and forcing Papa John's to balance pricing strategies with product development to stand out amidst evolving consumer tastes.

Economic headwinds, including persistent inflation and potential slowdowns in discretionary spending, pose a significant threat. Reports from late 2024 indicated a noticeable dip in consumer spending on non-essential items, directly affecting restaurant sectors. This trend, continuing into 2025, makes it challenging for Papa John's to maintain consistent sales volumes and average order values as consumers adjust their budgets.

Volatile ingredient costs, particularly for wheat and cheese, directly impact Papa John's operational expenses. For instance, wheat prices saw notable increases in late 2023 and early 2024 due to global supply issues, while cheese prices have also experienced upward pressure, affecting overall food costs and potentially necessitating price adjustments that could deter value-conscious customers.

The reliance on third-party delivery platforms, while expanding reach, comes with substantial commission fees, often exceeding 30% per order, which significantly erodes profit margins. Furthermore, this dependence reduces Papa John's control over the delivery experience, potentially leading to negative customer interactions and brand perception issues, as customer satisfaction with delivery speed is a key driver of repeat business.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Papa John's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.