Papa John’s Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Papa John’s Bundle

Curious about Papa John's product portfolio? Our BCG Matrix analysis reveals which offerings are driving growth (Stars), generating consistent revenue (Cash Cows), lagging behind (Dogs), or hold future potential but require investment (Question Marks). Don't just wonder where Papa John's stands; gain a strategic advantage.

Purchase the full BCG Matrix report to unlock a comprehensive breakdown of each product's market share and growth rate, complete with actionable insights and recommendations for optimizing your investment strategy. Make informed decisions that can elevate your own business.

This is your opportunity to understand the dynamics behind a major player in the fast-casual dining industry. Get the full report and equip yourself with the knowledge to navigate market complexities and identify your next strategic move.

Stars

Papa John's is making significant strides in international markets, viewing them as key growth drivers. The company is expanding in established regions like Korea and Spain while also targeting new territories such as India and Saudi Arabia. This global push is a core part of their strategy to increase market share and tap into diverse consumer bases.

The company's aggressive international expansion plans are evident in their projected unit development. For 2025, Papa John's anticipates between 180 to 200 gross openings worldwide. This substantial growth in international locations underscores the perceived potential and strategic importance of these markets for the company's future performance.

By focusing on international unit development, Papa John's aims to broaden its global footprint and capitalize on the evolving pizza industry landscape outside of North America. This strategic move allows them to diversify revenue streams and leverage opportunities in markets with increasing demand for convenient, quality food options.

Digital Sales Channels are a star for Papa John's, with roughly 85% of all orders placed through these platforms. This dominance highlights a significant market share in the fast-paced Quick Service Restaurant (QSR) sector.

Papa John's continues to invest heavily in its digital infrastructure. These investments are designed to improve both the customer ordering experience and the operational efficiency for their franchisees.

This strong digital foundation is crucial for Papa John's future growth. It provides a solid base for expanding market reach and capturing more revenue in an increasingly online-centric market.

Papa John's is strategically refocusing on its core pizza offerings, acknowledging their crucial role in driving customer visits and building brand loyalty, especially as the company navigates recent sales headwinds. This re-emphasis is a cornerstone of the new leadership's 'Back to Better 2.0' plan, designed to streamline operations and guarantee the consistent quality of its fundamental menu items.

This strategic pivot aims to simplify the business and improve execution, with a particular focus on the quality and consistency of their pizzas. For instance, in 2023, Papa John's reported a 2.7% decrease in total revenue to $2.04 billion, highlighting the need for such strategic adjustments. If this renewed focus on core products proves effective in boosting sales and operational consistency, these foundational pizza items are well-positioned to recapture market share in the highly competitive and mature pizza industry.

Loyalty Program Growth

Papa John's loyalty program is a significant asset, demonstrating robust growth. In the first quarter of 2025, the program added approximately one million members, bringing the total to 37 million. This expansion is particularly notable among medium- and high-frequency customers, signaling a deepening of customer loyalty.

- Loyalty Program Membership: Reached 37 million members by Q1 2025.

- Recent Growth: Added approximately 1 million members in Q1 2025.

- Consumer Segment Growth: Expansion observed among medium- and high-frequency consumers.

- Strategic Focus: Program enhancements aim to increase customer frequency and engagement.

Strategic New Restaurant Development (North America)

Papa John's is actively pursuing strategic new restaurant development across North America, focusing on markets with untapped potential. This expansion is designed to bolster their domestic presence and capture greater market share.

To encourage franchisee participation in this growth phase, Papa John's is offering attractive incentives. For instance, waivers on national marketing fund contributions are being provided to make new unit openings more financially appealing and profitable for franchisees.

This aggressive expansion strategy directly addresses the need to increase market share in key U.S. regions, even amidst broader sales challenges. For example, Papa John's announced plans in early 2024 to open hundreds of new locations in the coming years, with a significant portion targeted for the North American market.

- Accelerated Development: Papa John's is prioritizing new restaurant openings in underserved domestic markets.

- Franchisee Incentives: Waivers on national marketing fund contributions are a key draw for new franchisees.

- Market Share Growth: The strategy aims to significantly increase Papa John's presence and market share in the U.S.

- Expansion Targets: Plans revealed in early 2024 indicated hundreds of new North American units in the pipeline.

Papa John's loyalty program is a clear star, boasting 37 million members by Q1 2025, with a significant addition of one million new members in that quarter alone. This rapid growth, particularly among frequent customers, indicates strong brand engagement and a solid foundation for continued success.

The company's digital sales channels also shine as stars, capturing approximately 85% of all orders and solidifying Papa John's dominant position within the quick-service restaurant sector. Continued investment in these platforms enhances customer experience and operational efficiency, crucial for future market gains.

Papa John's international expansion is another star performer, with plans for 180 to 200 gross openings worldwide in 2025. This aggressive global push into markets like India and Saudi Arabia, alongside established regions, highlights their commitment to capturing international market share and diversifying revenue.

The renewed focus on core pizza offerings, driven by the 'Back to Better 2.0' plan, positions these fundamental products as potential stars. If this strategy effectively boosts sales and operational consistency, it could lead to recaptured market share in the competitive pizza industry, especially after reporting a 2.7% decrease in total revenue to $2.04 billion in 2023.

| Category | Status | Key Metrics | Growth Driver | Strategic Importance |

|---|---|---|---|---|

| Loyalty Program | Star | 37M members (Q1 2025), +1M in Q1 2025 | Customer engagement, repeat business | Deepens customer relationships, drives frequency |

| Digital Sales Channels | Star | ~85% of orders | Convenience, market share in QSR | Enhances customer experience, operational efficiency |

| International Expansion | Star | 180-200 gross openings (2025) | Market diversification, new revenue streams | Broadens global footprint, taps into growing demand |

| Core Pizza Offerings | Potential Star | Focus of 'Back to Better 2.0' | Brand consistency, customer visits | Aims to recapture market share, improve execution |

What is included in the product

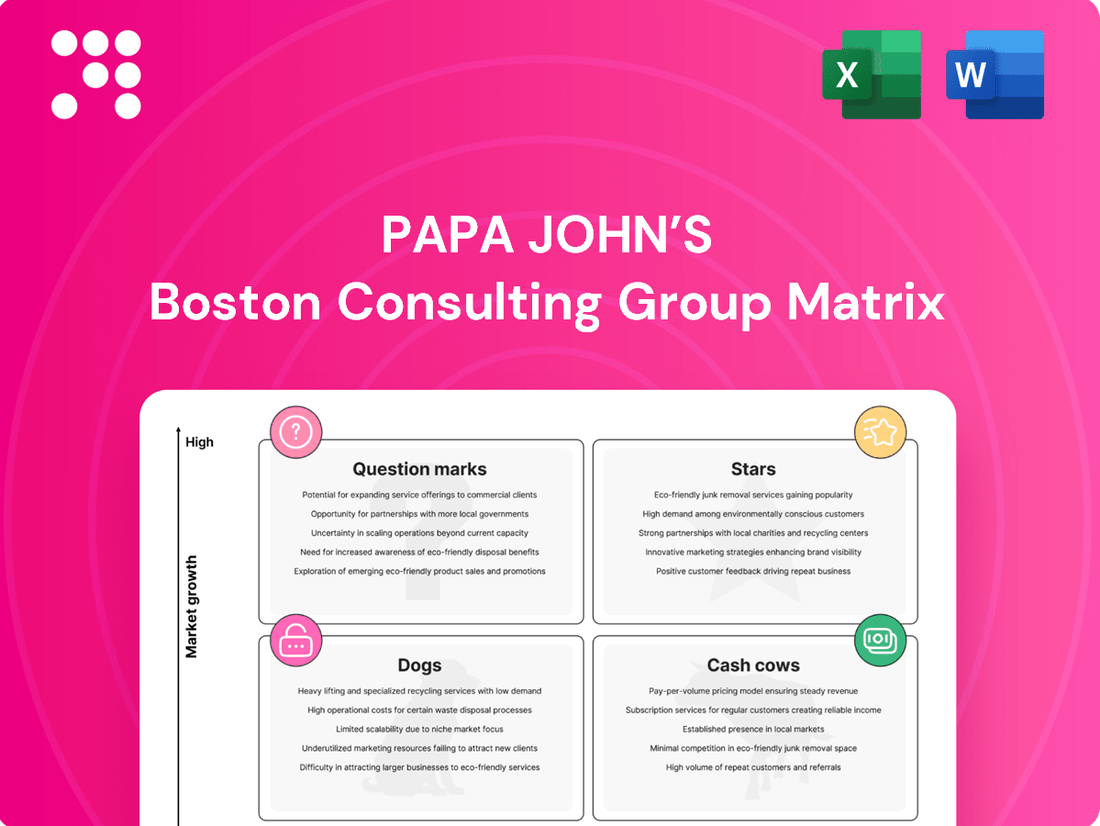

Papa John's Stars are likely new menu items, while Cash Cows are established popular pizzas. Question Marks could be international markets, and Dogs might be underperforming store locations.

A clear Papa John’s BCG Matrix overview instantly clarifies business unit performance, easing the pain of strategic uncertainty.

Cash Cows

North American franchised restaurants, numbering around 2,975 in late 2024, form Papa John's core cash cow. This extensive network, representing over 84% of its total 3,514 units, consistently generates royalty fees and supply chain revenue.

These mature locations require minimal direct capital investment from the parent company, making them a stable and significant contributor to Papa John's overall cash flow. Even with recent challenges in comparable sales, their sheer scale solidifies their position as a foundational cash generator.

Papa John's supply chain operations, essentially its internal commissary system, act as a significant cash cow. This segment is responsible for providing all the necessary ingredients and equipment to its vast network of restaurants, ensuring a consistent and high-margin revenue stream.

The company benefits from the stability and profitability of this internal supply chain, which serves both company-owned and franchised locations. Papa John's has indicated plans to boost the fixed operating margin for its U.S. commissaries, further strengthening this segment's role as a reliable source of cash.

Papa John's 'Better Ingredients. Better Pizza.' slogan has cultivated decades of strong brand equity. This enduring promise of quality, even amidst shifting customer perceptions on value, continues to draw a loyal customer base. This established reputation means less intensive, ongoing investment in brand building compared to emerging competitors.

Traditional Pizza Menu Items

Traditional pizza menu items, like the original crust pizzas, are Papa John’s cash cows. These well-established products consistently drive a significant portion of the company's revenue. Their enduring popularity means they require little in the way of new investment for research and development, making them highly profitable.

These items are the backbone of Papa John's sales, providing a stable and predictable stream of income. This consistent cash flow is crucial for funding other areas of the business, such as exploring new market opportunities or investing in innovative product lines. In 2023, Papa John's reported total revenue of $2.1 billion, with a significant portion attributed to these core offerings.

- High Sales Volume: Classic pizzas consistently sell in large quantities.

- Low R&D Costs: Minimal investment is needed to maintain and market these established items.

- Predictable Revenue: They form the stable base generating consistent cash flow.

- Brand Recognition: Long-standing items benefit from strong customer loyalty and familiarity.

Established Delivery and Carryout Model

Papa John's boasts a robust and proven delivery and carryout model, forming the bedrock of its operations. This established system, honed over years, consistently generates a significant portion of the company's revenue, reflecting strong customer reliance on these convenient ordering methods.

The company's infrastructure is optimized for these core services, ensuring efficient order fulfillment and customer satisfaction. In 2023, digital orders, which heavily leverage the delivery and carryout channels, represented a substantial percentage of total sales, underscoring the model's continued relevance and revenue generation capability.

- Revenue Generation: The delivery and carryout model remains a primary revenue driver for Papa John's.

- Operational Efficiency: The company's infrastructure is well-suited for these established channels.

- Customer Preference: A significant portion of sales continues to come through delivery and carryout.

- Market Position: Despite competition, this model secures a steady stream of transactions.

Papa John's North American franchised restaurants, numbering approximately 2,975 in late 2024, represent its primary cash cow. This extensive network, making up over 84% of its 3,514 global units, reliably generates royalty fees and supply chain revenue with minimal direct capital investment from the parent company.

The company's internal supply chain, a robust commissary system providing ingredients and equipment, is another significant cash cow. Papa John's aims to boost the fixed operating margin for its U.S. commissaries, further solidifying this segment's role as a consistent cash generator.

Traditional menu items, particularly original crust pizzas, are enduring cash cows for Papa John's, driving substantial revenue with low research and development costs. These established products, supported by strong brand equity from the 'Better Ingredients. Better Pizza.' slogan, provide a stable income stream, contributing significantly to the company's $2.1 billion in total revenue reported for 2023.

The proven delivery and carryout model remains a foundational cash cow, optimized for efficient order fulfillment and customer satisfaction. Digital orders, which heavily utilize these channels, represented a substantial portion of sales in 2023, highlighting their continued importance in generating consistent revenue.

| Segment | Description | Revenue Contribution | Investment Need | Cash Flow Generation |

| North American Franchised Restaurants | Extensive network, primary royalty and supply chain revenue source. | High (over 84% of units) | Low | High & Stable |

| Supply Chain Operations (Commissaries) | Internal provision of ingredients and equipment. | Significant & Growing (margin improvement planned) | Low | High & Stable |

| Traditional Pizza Menu Items | Core products like original crust pizzas. | Substantial (key driver of $2.1B 2023 revenue) | Very Low (R&D minimal) | High & Predictable |

| Delivery & Carryout Model | Established operational channels for customer orders. | Primary Revenue Driver (significant digital order share) | Low (infrastructure optimized) | High & Consistent |

What You’re Viewing Is Included

Papa John’s BCG Matrix

The Papa John's BCG Matrix you're previewing is the complete, unwatermarked document you'll receive immediately after purchase. This comprehensive analysis, detailing Papa John's product portfolio, is ready for immediate strategic application. You're seeing the final, professionally formatted report, ensuring no surprises or additional edits are needed before you can leverage its insights for your business planning.

Dogs

Domestic company-owned Papa John's restaurants have been a significant drag on performance, with comparable sales falling 6% in the fourth quarter of 2024 and another 5% in the first quarter of 2025.

These locations are consuming valuable resources but are not yielding adequate returns, effectively acting as cash traps within the company's portfolio.

To bolster overall profitability, Papa John's is likely evaluating strategic options such as closing these underperforming units or refranchising them to more effective operators.

Papa John's is strategically reducing its presence in the UK, a market that has proven challenging due to persistent inflation and broader economic headwinds. This 'right-sizing' effort involves closing stores that are not contributing to profitability, a move designed to streamline operations and improve financial performance.

The UK operations currently fall into the 'Dogs' category of the BCG Matrix, characterized by a low market share within a low-growth industry. This segment has been a drag on Papa John's overall international sales figures, highlighting the need for decisive action to improve the company's global financial standing.

By divesting from these underperforming units, Papa John's aims to create a more robust and profitable foundation for its international business. This strategic pivot is crucial for reallocating resources to markets with higher growth potential and better returns, ultimately strengthening the company's overall market position.

Papa John's recognized that its past strategy of introducing too many menu innovations was actually disrupting kitchen operations, a concept the CEO termed 'rhythm breakers'. This complexity didn't consistently lead to customers ordering more often.

While some of these new items attracted new customers for a short period, those that complicated operations without proving profitable long-term or building lasting loyalty were essentially question marks in the company's strategic portfolio. For example, in 2023, Papa John's reported a slight decrease in comparable sales for certain periods, partly attributed to operational inefficiencies.

Declining Self-Delivery and Carryout Business (due to aggregator shift)

Papa John's has observed a decline in its own delivery and carryout services. This trend is happening even as growth from third-party delivery aggregators hasn't fully compensated for these losses.

The company's market share in direct customer channels appears to be shrinking. This situation could lead to these segments becoming question marks in the BCG matrix if the shift to aggregators isn't managed effectively.

- Shrinking Direct Channels: Papa John's self-delivery and carryout business is experiencing a downturn.

- Aggregator Dependency: Growth from third-party aggregators has not offset the decline in direct business.

- Market Share Erosion: This indicates a potential loss of market share in traditional service models.

- Strategic Re-evaluation Needed: The company must find ways to re-engage customers directly to counter this trend.

Non-Strategic Physical Footprint (Dine-in Focus)

Papa John's core strength lies in its delivery and carryout model. Any significant investment in traditional dine-in spaces, which don't leverage this core competency, would likely fall into the 'Dog' category of the BCG matrix. These would be underperforming locations in a slow-growth market, draining resources without generating substantial returns. For instance, a recent analysis of the quick-service restaurant industry in 2024 shows a continued consumer preference for convenience and digital ordering, making traditional dine-in less of a priority for brands like Papa John's.

If Papa John's were to operate dine-in locations that are not contributing to their primary delivery and carryout business, these would represent a low-market-share segment within a potentially stagnant or declining market for that specific format. Such units would tie up capital and operational resources, yielding low returns compared to their more successful delivery-focused counterparts. Data from 2024 indicates that while some casual dining experiences are recovering, the QSR sector continues to see growth primarily driven by off-premise dining solutions.

- Non-Strategic Dine-in Formats: Locations that do not align with Papa John's delivery and carryout focus.

- Low Growth, Low Share: These units would operate in a market segment with limited expansion potential and a small customer base.

- Capital Tie-up: Investment in these locations represents capital that could be better allocated to core business strengths.

- 2024 Market Trends: Consumer preference in 2024 heavily favors digital ordering and delivery, underscoring the risk of investing in non-aligned formats.

Papa John's domestic company-owned restaurants, with comparable sales down 6% in Q4 2024 and 5% in Q1 2025, are acting as cash traps. Similarly, the UK operations, facing inflation and economic headwinds, are classified as Dogs due to low market share in a low-growth sector. These underperforming segments are being streamlined through closures or refranchising to improve overall financial health.

| Segment | Market Growth | Market Share | Performance | BCG Category |

| Domestic Company-Owned Stores | Low | Low | Declining Sales (-6% Q4 2024, -5% Q1 2025) | Dog |

| UK Operations | Low | Low | Underperforming due to inflation/headwinds | Dog |

Question Marks

Papa John's is strategically innovating its menu with items like the Croissant Pizza and reintroducing fan favorites such as the Cheesy Burger Pizza. These offerings are designed to attract new demographics and reignite interest among its current customer base in a highly competitive landscape. For instance, Papa John's reported a 3.4% increase in North American comparable sales for the first quarter of 2024, indicating a market receptive to new product introductions.

Papa John's is actively enhancing its digital presence and loyalty program, focusing on personalized customer interactions and tailored promotions. This strategic investment aims to boost customer frequency and average order values through their own channels.

While these digital initiatives hold significant growth potential, their ultimate effect on market share and long-term customer loyalty is still unfolding. Consequently, this area represents a 'Question Mark' within the BCG matrix, necessitating ongoing investment and refinement to realize its full promise.

Papa John's partnership with Google Cloud, announced in 2023, is a strategic move to integrate AI and advanced data analytics into their delivery operations. This aims to refine driver dispatch, optimize routes, and boost delivery time accuracy, directly addressing the demands of the booming delivery market. For instance, by mid-2024, many quick-service restaurants reported that AI-driven route optimization led to an average reduction of 10-15% in delivery times.

Value Perception Initiatives

Papa John's recognizes that consumers perceive less value, impacting sales. They're launching a five-step initiative to counter this, emphasizing competitive pricing and reinforcing their quality message. This strategy aims to attract budget-conscious customers and boost market share, a significant growth avenue. Success hinges on how well these initiatives resonate with consumers.

The company's focus on value perception is critical for regaining market traction. By highlighting both affordability and quality, Papa John's seeks to recalibrate consumer sentiment. This approach is particularly important in the current economic climate where price sensitivity is high.

- Value Perception Initiatives: Papa John's is actively addressing consumer perceptions of value, a key factor in recent sales trends.

- Five-Step Plan: The company has outlined a structured approach to improve its value proposition, focusing on attractive offers and quality communication.

- Market Opportunity: Winning back price-sensitive customers presents a significant growth opportunity to increase market share.

- Execution Dependency: The ultimate success of these value perception initiatives relies heavily on their effective implementation and consumer reception.

International Market Restructuring and New Entries

Papa John's international operations are a dynamic area. While overall international expansion is often viewed as a Star due to its high growth trajectory, specific strategic moves within this segment can be classified as Question Marks. This is particularly true when considering the 'right-sizing' of established markets, such as the UK, and the company's deliberate entry into new, untapped territories.

These new market entries and strategic reconfigurations are classic Question Marks. They possess considerable potential for future growth, reflecting the company's ambition to expand its global footprint. However, at their inception, these ventures typically start with a very small market share. This necessitates substantial investment and meticulous strategic planning to nurture them into profitable operations and secure a solid market position.

- UK Market Right-Sizing: Papa John's has been actively managing its UK presence, which involves strategic adjustments rather than pure expansion. This could mean consolidating operations or focusing on more profitable locations, a move that requires careful investment to yield future returns.

- New Country Entries: The company's entry into new international markets, such as recent expansions in regions like Southeast Asia or Africa, represents significant investment in underdeveloped markets. These new ventures carry high growth potential but begin with minimal market share, requiring substantial capital and strategic focus to succeed.

- Investment and Management Needs: Both right-sizing and new entries demand significant financial resources and skilled management. The success of these Question Marks hinges on Papa John's ability to effectively allocate capital and implement robust operational strategies to build market share and achieve profitability.

- Potential for Future Stars: If these strategic international initiatives are managed effectively, they have the potential to transition from Question Marks into Stars, contributing significantly to Papa John's overall global growth and market dominance in the coming years.

Papa John's digital transformation and AI integration, exemplified by its Google Cloud partnership, represent significant investments with uncertain returns. While these initiatives aim to optimize operations and enhance customer experience, their impact on market share and profitability is still developing, classifying them as Question Marks. The company's focus on improving value perception through a five-step plan also falls into this category, as its success is contingent on consumer reception and effective execution. New international market entries, while holding high growth potential, begin with low market share, requiring substantial investment and strategic management to evolve into Stars.

| BCG Category | Papa John's Initiatives | Rationale | Potential Impact | 2024 Data/Context |

|---|---|---|---|---|

| Question Mark | Digital Transformation & AI Integration (e.g., Google Cloud Partnership) | High investment, uncertain market share gain, evolving customer adoption. | Improved operational efficiency, enhanced customer loyalty, potential market share growth. | Partnership announced in 2023, with ongoing implementation throughout 2024. AI-driven route optimization reported to reduce delivery times by 10-15% in the QSR sector by mid-2024. |

| Question Mark | Value Perception Initiatives (Five-Step Plan) | Addresses price sensitivity, aims to increase market share, success depends on consumer response. | Regained customer trust, increased sales volume, improved brand perception. | Launched to counter perceived lack of value, critical in a price-sensitive economic climate. |

| Question Mark | New International Market Entries | Low initial market share, high growth potential, requires significant investment and strategic management. | Global market share expansion, diversification of revenue streams, future Star potential. | Ongoing strategic entries into underdeveloped regions, requiring substantial capital allocation. |

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary sales data, customer feedback, and market share analysis to accurately position Papa John's offerings.