NARI Technology Development SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NARI Technology Development Bundle

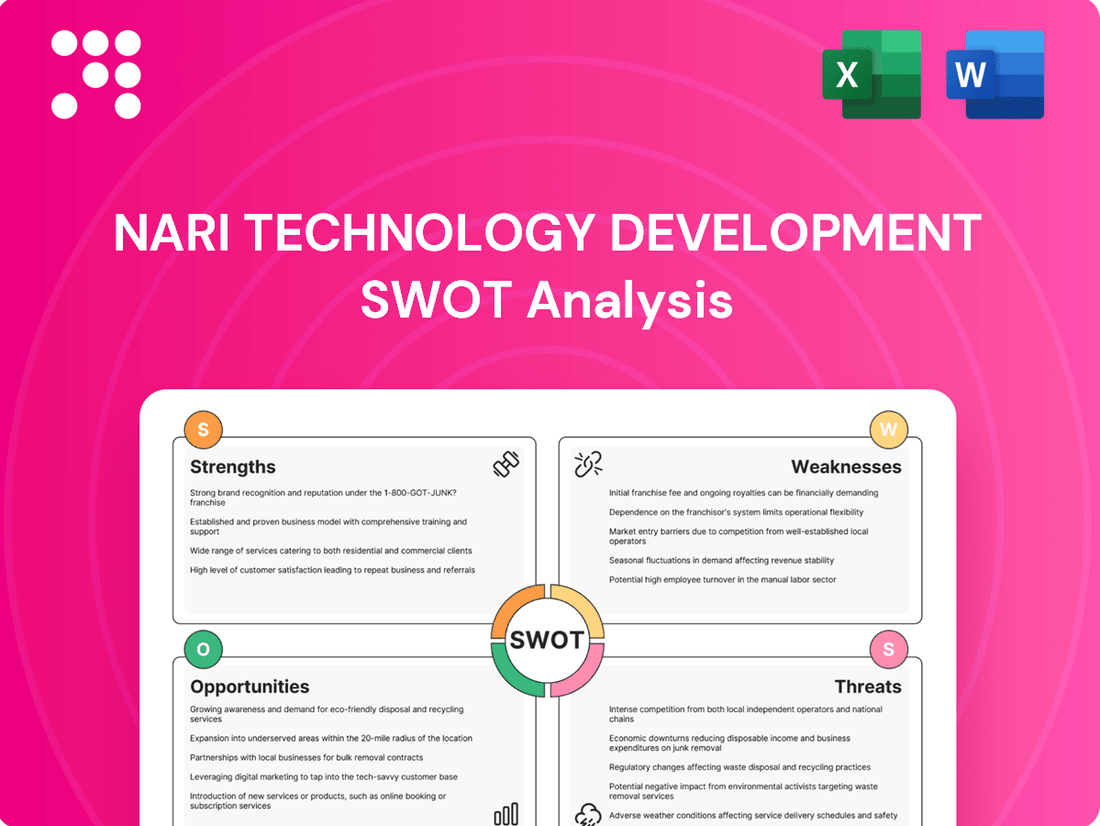

NARI Technology Development's SWOT analysis reveals critical insights into its competitive edge and potential hurdles. Understanding these dynamics is key to navigating the evolving technology landscape.

Want the full story behind NARI Technology Development's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

NARI Technology stands as a dominant force in China's electrical equipment and automation landscape, commanding a substantial market share, particularly in power automation solutions. This leadership position is a key strength, underlining its established presence and competitive advantage.

The company's robust financial performance is clearly evident in its Q1 2025 results, which showed a healthy 14% year-on-year increase in net income and a 15% surge in revenue. This financial vitality reflects strong operational execution and market demand for its offerings.

Further underscoring its financial strength, NARI Technology's trailing 12-month revenue reached an impressive $8.13 billion as of March 31, 2025. This significant revenue figure highlights the scale of its operations and its consistent ability to generate substantial income.

NARI Technology's significant investment in research and development, with approximately 9.8% of its total revenue dedicated to R&D in 2023, fuels its advanced technological capabilities. This focus has resulted in a robust portfolio of over 200 patents in recent years, showcasing a strong commitment to innovation and intellectual property creation.

The company's leadership in smart grid research, particularly for China State Grid, is a testament to its cutting-edge solutions. A prime example is its patented 'monitoring system based on digital converter station,' which highlights NARI's ability to develop and implement sophisticated, industry-leading technologies.

NARI Technology boasts a broad and deep product and solution portfolio, covering critical areas like power grid automation, relay protection, and smart grid applications. This comprehensive offering is a significant strength, allowing them to serve diverse needs across the entire power industry value chain, from generation to distribution.

Their expertise extends to renewable energy integration and railway automation, showcasing a commitment to evolving energy and transportation sectors. This diversification not only broadens their market reach but also positions them to capitalize on emerging trends and infrastructure development.

For instance, in 2023, NARI Technology secured significant orders for smart grid projects, contributing to China's ongoing grid modernization efforts. This demonstrates the practical application and market demand for their wide-ranging technological solutions.

Strategic Alignment with National Energy Goals

NARI Technology's strategic focus on smart grids, energy conservation, and renewable energy integration is a significant strength, directly supporting China's national energy objectives. This includes the ambitious 'dual carbon' goals and the government's 14th Five-Year Plan, which specifically champions smart grid development and energy storage solutions. This strong governmental backing acts as a considerable tailwind for the company's expansion and market penetration.

This strategic alignment translates into tangible market opportunities and government support. For instance, China's State Grid Corporation, a major NARI customer, announced plans to invest approximately RMB 450 billion (around $63 billion USD) in smart grid construction during the 14th Five-Year Plan period (2021-2025). NARI's expertise in these areas positions it to capture a substantial share of this investment.

- Alignment with National Energy Strategy: NARI's core business directly supports China's 'dual carbon' targets and the 14th Five-Year Plan.

- Governmental Support and Investment: The company benefits from significant government-backed investments in smart grids, such as the State Grid's planned RMB 450 billion expenditure.

- Market Demand for Green Technologies: NARI is well-positioned to capitalize on the increasing demand for renewable energy integration and energy conservation solutions.

Strong State-Owned Enterprise Backing and International Presence

NARI Technology Development's position as a state-controlled enterprise, with the State Grid Corporation of China as its primary stakeholder, provides substantial advantages within China's vast electric utility landscape. This backing translates to preferential access and influence in a sector crucial to national infrastructure development. In 2023, NARI reported a revenue of approximately RMB 21.7 billion, underscoring its significant operational scale.

Furthermore, NARI has cultivated a robust international presence, exporting its products and services to over 30 countries and establishing agencies in key global regions. This global reach diversifies its revenue streams and mitigates reliance on any single market, a strategy that has proven beneficial as the company continues its international expansion efforts.

- State-Controlled Enterprise: Largest shareholder, State Grid Corporation of China, offers significant influence and support in the domestic electric utilities sector.

- International Reach: Exports to over 30 countries and established agencies worldwide demonstrate a broad global footprint.

- Financial Scale: Achieved revenues of approximately RMB 21.7 billion in 2023, indicating substantial market penetration and operational capacity.

NARI Technology Development's strengths are deeply rooted in its market leadership, technological innovation, and strategic alignment with national energy policies. The company's substantial investment in R&D, evidenced by its dedication of nearly 10% of revenue to innovation and a portfolio of over 200 patents, fuels its competitive edge. Its comprehensive product range, spanning power grid automation to renewable energy integration, caters to the evolving needs of the energy sector.

The company's financial health is robust, with Q1 2025 net income up 14% year-on-year and trailing 12-month revenue reaching $8.13 billion as of March 31, 2025. This financial stability supports its ambitious growth and development plans.

NARI's position as a state-controlled enterprise, primarily backed by the State Grid Corporation of China, grants it significant advantages, including preferential access and influence in the domestic market. This backing is crucial given China State Grid's planned RMB 450 billion investment in smart grids during the 14th Five-Year Plan period (2021-2025).

The company's international footprint, with exports to over 30 countries, diversifies its revenue and reduces market dependency. NARI's 2023 revenue of approximately RMB 21.7 billion highlights its considerable operational scale and market penetration.

| Key Strength | Description | Supporting Data/Fact |

| Market Leadership | Dominant player in China's electrical equipment and automation, particularly in power automation. | Substantial market share in power automation solutions. |

| Technological Innovation | Strong R&D investment and a robust patent portfolio. | 9.8% of revenue dedicated to R&D in 2023; over 200 patents in recent years. |

| Financial Performance | Healthy revenue growth and profitability. | Q1 2025 net income up 14% YoY; Trailing 12-month revenue $8.13 billion (as of March 31, 2025). |

| Strategic Alignment | Supports national energy goals and benefits from government initiatives. | Alignment with 'dual carbon' targets and 14th Five-Year Plan; State Grid's RMB 450 billion smart grid investment. |

| Product Portfolio | Comprehensive solutions across the power industry value chain. | Expertise in power grid automation, relay protection, smart grid, renewable energy, and railway automation. |

| State Backing | Benefits from being a state-controlled enterprise. | Primary stakeholder is State Grid Corporation of China; 2023 revenue approx. RMB 21.7 billion. |

| International Reach | Diversified global presence. | Exports to over 30 countries; established agencies worldwide. |

What is included in the product

Delivers a strategic overview of NARI Technology Development’s internal and external business factors, mapping its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable roadmap for addressing technology development challenges.

Pinpoints critical areas for improvement, alleviating uncertainty in strategic planning.

Weaknesses

NARI Technology's heavy reliance on the Chinese market, with approximately 98.3% of its net sales originating from within China, presents a significant weakness. This extreme geographical concentration makes the company highly vulnerable to any adverse economic shifts or regulatory alterations that specifically impact the Chinese economy.

NARI Technology Development's stock has encountered valuation challenges, with its one-year return of 12.5% in early 2024 falling short of the SSE Composite Index's 15.2% gain during the same period. This disparity suggests potential investor apprehension or a perception of elevated risk, despite the company's underlying strengths.

The inconsistent shorter-term stock performance, characterized by periods of underperformance relative to broader market benchmarks, could signal a lack of sustained investor confidence or the presence of specific factors dampening market sentiment towards NARI.

While NARI Technology Development demonstrates strong financial performance, a closer look at its profitability reveals a potential area of concern. Specifically, the company's EBITDA margin experienced a minor decrease, settling at 19.86% in 2024, down from 19.71% in the preceding year. This slight contraction suggests that NARI may be facing increasing cost pressures that could impact its earnings before interest, taxes, depreciation, and amortization.

Intense Competition in the Smart Grid Sector

NARI Technology Development faces a significant challenge due to the highly competitive nature of the smart grid sector. The company operates within a landscape populated by approximately 110 active competitors specializing in smart distribution automation solutions. This crowded market environment can exert considerable pressure on pricing strategies and the ability to capture and maintain market share.

To navigate this intense competition, NARI must consistently prioritize and invest in ongoing innovation. Staying ahead requires not just keeping pace but actively developing next-generation technologies and solutions. Failure to do so could erode its current leading position.

- High Competitor Count: Over 110 active competitors in smart distribution automation.

- Pricing Pressure: Intense competition can lead to reduced profit margins.

- Market Share Risk: Continuous innovation is crucial to defend and grow market share.

Dependency on State Grid Corporation of China

NARI Technology's significant reliance on its parent company, State Grid Corporation of China (SGCC), presents a notable weakness. As SGCC is the majority shareholder through the NARI Group, NARI Technology's strategic direction and business opportunities can be heavily influenced by SGCC's priorities, potentially limiting its autonomy.

This dependency could translate into an over-reliance on SGCC as a primary customer. For instance, in 2023, NARI Technology's revenue from related parties, largely encompassing transactions with SGCC, represented a substantial portion of its total income, highlighting this concentrated customer risk.

- Concentrated Revenue Streams: A significant percentage of NARI Technology's revenue is derived from transactions with SGCC, making it vulnerable to changes in SGCC's investment plans or procurement strategies.

- Limited Diversification: The strong ties to SGCC may hinder NARI Technology's ability to aggressively pursue and secure business from other major utility providers or international markets independently.

- Potential for Internal Competition: Other entities within the NARI Group or under SGCC's umbrella might also compete for similar projects, potentially impacting NARI Technology's market share and profitability.

NARI Technology's significant over-reliance on the Chinese market, with approximately 98.3% of its net sales originating domestically, exposes it to considerable risk from any economic downturns or regulatory changes within China.

Furthermore, the company's stock performance in early 2024 showed a one-year return of 12.5%, lagging behind the SSE Composite Index's 15.2% gain, indicating potential investor caution or perceived risks.

The smart grid sector is intensely competitive, with NARI facing over 110 rivals in smart distribution automation, which can create pricing pressures and challenges in maintaining market share.

NARI's substantial dependence on its parent, State Grid Corporation of China (SGCC), as a majority shareholder and likely primary customer, limits its strategic autonomy and exposes it to SGCC's investment priorities.

| Weakness | Description | Impact |

|---|---|---|

| Geographic Concentration | 98.3% of net sales from China | Vulnerability to Chinese economic/regulatory shifts |

| Stock Performance Lag | 12.5% one-year return (early 2024) vs. SSE Composite's 15.2% | Potential investor apprehension or risk perception |

| Competitive Landscape | Over 110 competitors in smart distribution automation | Pricing pressure, market share risk |

| Parent Company Dependence | Majority ownership and likely primary customer (SGCC) | Limited strategic autonomy, reliance on SGCC's priorities |

Same Document Delivered

NARI Technology Development SWOT Analysis

The preview you see is the actual NARI Technology Development SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete NARI Technology Development SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual NARI Technology Development SWOT analysis file. The complete, detailed version becomes available after checkout, providing a thorough evaluation.

Opportunities

The global smart grid market is anticipated to experience robust growth, with projections indicating a compound annual growth rate (CAGR) of around 15% from 2024 to 2030, reaching an estimated value of over $100 billion by the end of the forecast period. This expansion is fueled by critical investments in enhancing grid resilience and modernization across various regions.

This significant global trend presents a substantial opportunity for NARI Technology Development. The increasing demand for integrating diverse renewable energy sources, such as solar and wind, and the growing need for sophisticated energy storage management systems directly align with NARI's advanced technological capabilities and comprehensive solutions for smart grid infrastructure.

The global push for decarbonization is a major tailwind, with countries worldwide setting ambitious emissions reduction targets. This trend directly fuels the expansion of renewable energy, with solar and wind power leading the charge. For instance, global renewable energy capacity additions reached a record 510 gigawatts (GW) in 2023, a significant increase from previous years, according to the International Energy Agency (IEA).

NARI Technology's established expertise in integrating these renewable sources into existing power grids, alongside its advancements in smart grid technologies and energy storage solutions, places it in a prime position to capture substantial market share. The electrification of transportation, a rapidly growing sector, further amplifies the demand for stable and efficient renewable energy integration, creating a symbiotic growth opportunity for NARI.

The increasing digitization of power grids, with more interconnected systems, naturally elevates the risk of cyber threats. This escalating vulnerability presents a substantial opportunity for NARI Technology Development. As critical energy infrastructure becomes a prime target, there's a growing demand for sophisticated cybersecurity solutions.

NARI can capitalize on this by developing and integrating advanced security features into its smart grid products, offering protection against these evolving threats. For instance, the global industrial cybersecurity market was valued at approximately $15.9 billion in 2023 and is projected to reach $34.4 billion by 2028, indicating a robust growth trajectory for specialized solutions in sectors like power grids.

International Market Expansion and Partnerships

NARI Technology, with its established global presence and advanced technological capabilities, is well-positioned to capitalize on opportunities for international market expansion. This growth can be particularly significant in regions actively investing in power grid upgrades and modernization. For instance, the global smart grid market was valued at approximately USD 25.5 billion in 2023 and is projected to reach USD 68.3 billion by 2030, growing at a CAGR of 15.2%.

Strategic partnerships with international entities can significantly accelerate NARI's global reach and market penetration. These collaborations can provide access to local expertise, distribution networks, and regulatory insights, thereby reducing market entry barriers. By leveraging these alliances, NARI can effectively tap into burgeoning markets such as Southeast Asia and Africa, where demand for advanced grid solutions is rapidly increasing.

- Global Smart Grid Market Growth: The smart grid market is expected to grow substantially, presenting a significant opportunity for NARI's solutions.

- Emerging Market Potential: Regions like Southeast Asia and Africa show strong demand for power infrastructure development, offering expansion avenues.

- Partnership Benefits: Collaborations can provide crucial local market knowledge and distribution channels for NARI.

Development of New Technologies like Grid-Forming and Energy Storage

The global push towards low-carbon, safe, and intelligent power systems is a significant opportunity. NARI can leverage this trend by developing advanced grid-forming technologies and expanding its energy storage solutions. For instance, the International Energy Agency (IEA) reported that global renewable energy capacity additions reached a record 510 gigawatts (GW) in 2023, highlighting the growing demand for grid modernization.

The increasing deployment of battery energy storage systems (BESS) worldwide offers a direct avenue for NARI's growth. By 2030, the global BESS market is projected to reach over $200 billion, according to various market research firms. This expansion necessitates innovative solutions for grid integration and stability, areas where NARI's expertise in grid-forming technology can be applied.

- Innovation in Grid-Forming Inverters: NARI can develop advanced inverters that actively control grid voltage and frequency, crucial for integrating high levels of renewables.

- Expansion of Energy Storage Solutions: The company has an opportunity to offer comprehensive energy storage packages, from utility-scale batteries to distributed storage systems.

- Smart Grid Integration: Developing technologies that seamlessly integrate distributed energy resources (DERs) and storage with the main grid presents a key growth area.

- Digitalization of Power Systems: Enhancing intelligent control and monitoring capabilities for new energy technologies will be vital for grid reliability and efficiency.

NARI Technology Development is strategically positioned to capitalize on the global shift towards smart grids, with the market projected to exceed $100 billion by 2030, driven by modernization efforts and renewable energy integration. The increasing demand for stable grid integration of renewable sources like solar and wind, coupled with the rapid growth in electric vehicle adoption, creates a significant market for NARI's advanced solutions. Furthermore, the escalating cybersecurity threats to critical energy infrastructure present a substantial opportunity for NARI to offer robust security features, tapping into a growing industrial cybersecurity market valued at nearly $16 billion in 2023.

| Opportunity Area | Market Projection/Data Point | NARI's Strategic Advantage |

|---|---|---|

| Smart Grid Expansion | Global smart grid market to exceed $100 billion by 2030 (CAGR ~15%). | Leveraging expertise in grid modernization and renewable integration. |

| Renewable Energy Integration | Record 510 GW renewable capacity added globally in 2023. | Advanced solutions for integrating diverse renewable sources and storage. |

| Cybersecurity for Grids | Industrial cybersecurity market ~ $15.9 billion in 2023, growing to $34.4 billion by 2028. | Developing and integrating advanced security features into smart grid products. |

| Energy Storage Solutions | Global BESS market projected to exceed $200 billion by 2030. | Offering comprehensive energy storage packages and grid integration technologies. |

Threats

NARI Technology operates in the intensely competitive global electrical equipment and automation markets. This heightened competition, especially from international companies, poses a significant threat by potentially driving down prices and squeezing profit margins for NARI.

Geopolitical risks pose a significant threat to NARI Technology Development. As a Chinese state-controlled entity operating globally, the company is vulnerable to trade disputes and political tensions between China and other nations. For instance, in 2023, several international projects faced scrutiny due to these tensions, impacting market access and potentially leading to contract cancellations, mirroring past disruptions.

The power technology sector is a hotbed of rapid advancements, meaning NARI, like many in this field, faces a significant threat from its own technologies becoming outdated. If the company doesn't keep pace with emerging trends, such as the integration of advanced AI for smarter grid management or the constant evolution of cybersecurity protocols, its current offerings could quickly lose their competitive edge.

For instance, the increasing demand for AI-driven solutions in grid optimization, projected to grow substantially in the coming years, highlights the need for continuous R&D investment. Failure to adapt to these shifts could render NARI's existing technologies obsolete, impacting its market share and revenue streams as newer, more advanced solutions emerge.

Vulnerability to Cyberattacks

NARI Technology Development, despite its cybersecurity offerings, faces significant threats from cyberattacks due to its own reliance on interconnected digital systems. The company’s extensive use of smart grid technology and data transmission networks creates numerous potential entry points for malicious actors. For instance, the global cybersecurity market is projected to reach $376 billion by 2027, indicating a growing threat landscape that NARI must navigate.

A successful cyberattack could have severe repercussions for NARI. This could include the theft of sensitive intellectual property related to its advanced grid solutions, disruption of critical infrastructure operations if its systems are compromised, and significant damage to its hard-earned reputation. In 2023, the average cost of a data breach reached $4.45 million globally, highlighting the substantial financial impact such incidents can have.

- Operational Disruption: Interruption of NARI's internal systems and client-facing services.

- Intellectual Property Theft: Loss of proprietary technology and research data.

- Reputational Damage: Erosion of customer trust and market confidence.

- Financial Losses: Costs associated with remediation, legal fees, and potential regulatory fines.

Supply Chain Disruptions and Component Shortages

The global push for power grid modernization, a key driver for NARI's business, is simultaneously creating significant supply chain bottlenecks. The demand for critical components, such as transformers, is outstripping supply, leading to extended lead times and increased costs. For instance, in 2024, lead times for high-voltage transformers in some regions extended to over 24 months, a substantial increase from pre-pandemic levels.

NARI, along with its competitors, is susceptible to these disruptions, which can directly impact its ability to fulfill orders and meet project deadlines. These component shortages can lead to production delays and potentially affect the financial performance of ongoing projects. The International Energy Agency (IEA) has highlighted that these supply chain issues could slow down the pace of grid upgrades worldwide.

- Component Scarcity: Shortages of essential grid modernization components like transformers and specialized switchgear are a persistent threat.

- Extended Lead Times: The time required to procure critical parts has significantly increased, impacting project scheduling and delivery.

- Cost Volatility: Supply chain pressures contribute to price fluctuations for key materials and manufactured goods, affecting project budgets.

NARI Technology faces intense global competition, particularly from international players, which can pressure pricing and profit margins. Furthermore, geopolitical tensions, especially those involving China, create significant risks for market access and project stability, as seen with international project scrutiny in 2023.

Rapid technological advancements in the power sector present a constant threat of obsolescence for NARI's existing technologies. The growing demand for AI-driven grid solutions, a market expected to expand significantly, necessitates continuous R&D investment to maintain a competitive edge.

Cybersecurity threats are a major concern for NARI due to its reliance on interconnected digital systems for smart grid operations. A successful cyberattack could lead to intellectual property theft, operational disruptions, and substantial financial losses, with global data breach costs averaging $4.45 million in 2023.

Supply chain bottlenecks for critical components, such as transformers, are a significant threat, leading to extended lead times and increased costs. In 2024, transformer lead times reached over 24 months in some areas, impacting NARI's ability to fulfill orders and meet project deadlines.

| Threat Category | Specific Threat | Impact | Example/Data Point (2023-2025) |

|---|---|---|---|

| Market Competition | Intensified Global Competition | Price pressure, reduced profit margins | Increased market share by international competitors in key regions. |

| Geopolitical Risks | Trade disputes and political tensions | Market access restrictions, contract cancellations | Scrutiny of Chinese state-controlled entities in international projects (2023). |

| Technological Obsolescence | Rapid advancements in power technology | Loss of competitive edge, outdated offerings | Growing demand for AI in grid optimization, requiring continuous R&D. |

| Cybersecurity | Cyberattacks on interconnected systems | IP theft, operational disruption, reputational damage | Average data breach cost globally: $4.45 million (2023). |

| Supply Chain Issues | Component scarcity and extended lead times | Production delays, increased costs, inability to meet deadlines | Transformer lead times exceeding 24 months (2024). |

SWOT Analysis Data Sources

This NARI Technology Development SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market intelligence, and expert industry forecasts to provide a clear and actionable strategic overview.