NARI Technology Development Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NARI Technology Development Bundle

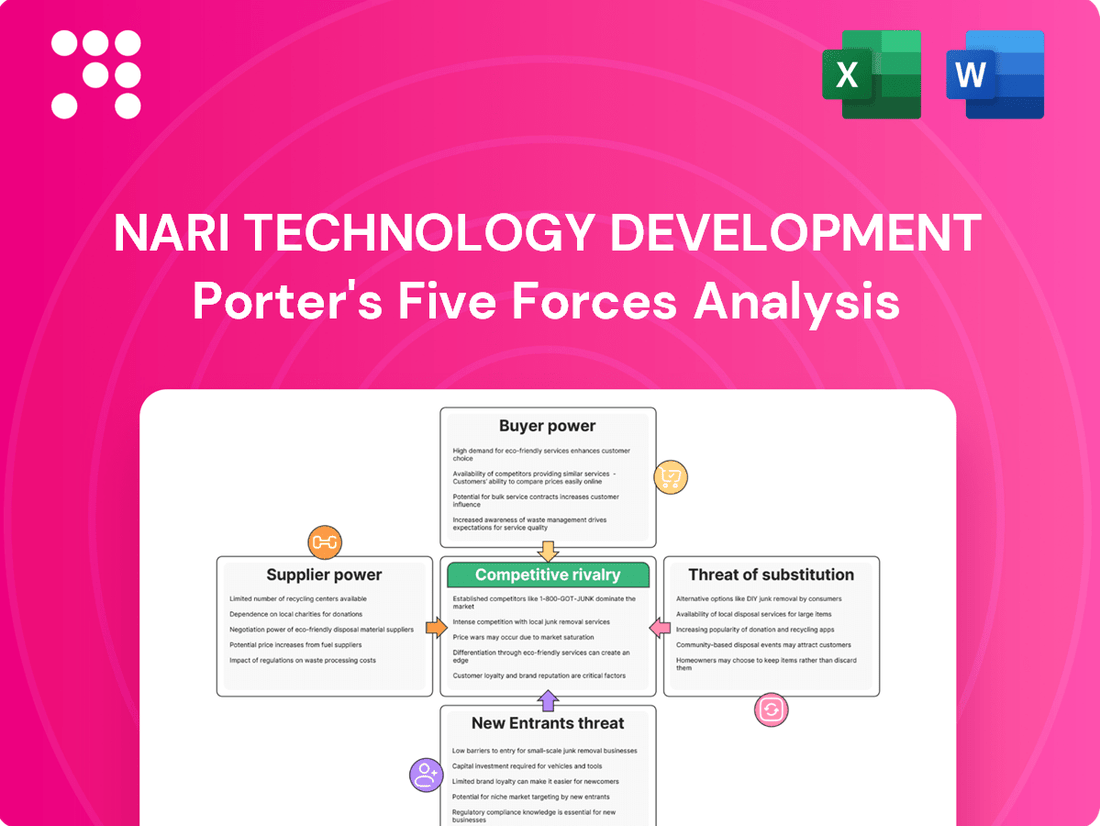

Understanding the competitive landscape for NARI Technology Development is crucial for strategic planning. Our analysis dives deep into the power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry within the industry.

The full Porter's Five Forces Analysis reveals the real forces shaping NARI Technology Development’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

NARI Technology Development's reliance on specialized components for its advanced power grid automation and smart grid solutions means it often deals with a concentrated supplier base. For instance, in the semiconductor sector, which is crucial for advanced control systems, the global market for certain high-performance chips saw supply chain constraints in early 2024, with lead times extending for some critical components. This limited availability of specialized inputs grants these few suppliers significant bargaining power, influencing pricing and delivery schedules for NARI.

For NARI Technology Development, the bargaining power of suppliers is significantly influenced by high switching costs for critical power grid components. These costs aren't just about finding a new part; they encompass the expense of redesigning existing systems, the rigorous process of re-qualifying new components to meet stringent industry standards, and the complex integration with NARI's established infrastructure. This makes changing suppliers a costly and time-consuming endeavor.

The substantial financial and operational hurdles involved in switching vendors mean that NARI's flexibility is curtailed. Suppliers of essential components for power grid technology understand this dependency. This situation grants them considerable leverage, as the cost and disruption associated with finding and implementing an alternative often far outweigh any potential savings or benefits from doing so, allowing suppliers to command more favorable terms.

Suppliers holding unique or proprietary technologies, such as advanced semiconductor designs or specialized software algorithms crucial for NARI's product development, can wield considerable bargaining power. For instance, if a supplier controls a patent for a critical component, NARI's ability to negotiate pricing or seek alternative suppliers diminishes significantly, impacting input costs and the pace of innovation.

Potential for Forward Integration by Suppliers

Suppliers possessing significant technological prowess and robust financial backing could threaten NARI Technology Development by integrating forward into the power grid solutions sector. This means they might start offering their own automation and protection systems, directly competing with NARI. For instance, a major component manufacturer with advanced R&D capabilities could leverage its existing supply chain relationships to quickly gain traction in the market.

This forward integration by suppliers can significantly alter the competitive landscape. If a critical supplier, say one providing specialized grid monitoring sensors or advanced control software components, decides to enter the market with their own integrated solutions, NARI would face a new, formidable competitor. This competitor would already have established relationships and potentially lower cost structures for the components they supply to themselves.

The potential for forward integration is a key consideration in supplier bargaining power. For example, companies like Siemens, a major player in energy automation, have demonstrated a capacity for both component supply and integrated system provision. Should such a supplier decide to focus more aggressively on offering complete grid solutions rather than just components, it would directly impact NARI’s market position. In 2024, the global grid automation market was valued at approximately $30 billion, with significant growth driven by smart grid initiatives, making it an attractive area for potential supplier expansion.

- Supplier Capability: Suppliers with advanced R&D and strong financial health are more likely to integrate forward.

- Competitive Threat: Direct competition from former suppliers can erode market share and pricing power.

- Market Dynamics: The growing smart grid market, valued at around $30 billion in 2024, incentivizes such strategic moves by suppliers.

Impact of Global Supply Chain Disruptions

The global nature of technology supply chains makes NARI Technology susceptible to disruptions. Geopolitical tensions, trade restrictions, and raw material shortages can significantly impact lead times and component prices. For instance, the semiconductor shortage that began in late 2020 and continued through much of 2023 led to extended lead times for critical components, sometimes stretching to over a year for certain chips. This environment empowers suppliers who can ensure stable delivery, thereby increasing their bargaining power.

During periods of instability, suppliers with diversified production capabilities or those controlling scarce resources gain leverage. NARI, like many tech firms, relies on a complex web of international suppliers for specialized components. When these supply chains face disruptions, such as the export controls imposed by some nations on advanced technology in 2024, the few suppliers capable of navigating these complexities or providing alternative solutions can command higher prices and more favorable terms. This dynamic directly amplifies the bargaining power of these key suppliers.

- Increased Component Costs: Disruptions can drive up the cost of essential components, impacting NARI's manufacturing expenses.

- Extended Lead Times: Delays in obtaining critical parts can hinder production schedules and product launches.

- Supplier Consolidation: Market instability may lead to fewer, more dominant suppliers, further concentrating bargaining power.

- Strategic Sourcing Importance: NARI's ability to secure stable supply agreements becomes paramount in mitigating supplier leverage.

NARI Technology Development faces significant bargaining power from its suppliers due to the specialized nature of its components and high switching costs. The concentration of suppliers for critical technologies, such as advanced semiconductors, means NARI is often beholden to the terms offered by a limited number of providers. This leverage is amplified by the substantial expenses and operational disruptions involved in qualifying and integrating new component suppliers, making it difficult for NARI to change vendors.

Suppliers who control proprietary technologies or possess unique intellectual property, like patented semiconductor designs essential for grid automation, can dictate terms to NARI. This situation limits NARI's negotiation flexibility and can directly impact input costs and the pace of its technological advancements. Furthermore, the growing global smart grid market, estimated at around $30 billion in 2024, makes it attractive for key suppliers to consider forward integration, potentially turning them into direct competitors.

Supply chain vulnerabilities, exacerbated by geopolitical factors and trade restrictions, further empower suppliers. For instance, the extended lead times for critical components experienced in 2023 due to semiconductor shortages highlighted how suppliers capable of ensuring stable delivery can command higher prices. This dynamic intensifies supplier leverage, especially when disruptions like export controls on advanced technology, seen in 2024, limit NARI's sourcing options.

What is included in the product

This analysis unpacks the competitive forces impacting NARI Technology Development, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and its strategic implications.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

NARI Technology Development's customer base is heavily concentrated among large, state-owned power utilities, particularly entities like the State Grid Corporation of China. This concentration means these utilities hold significant sway over NARI's business.

Given that the State Grid Corporation of China is also affiliated with NARI Group Corporation, this relationship further amplifies the bargaining power of these major customers. Their ability to purchase solutions on a vast scale for critical national infrastructure projects grants them substantial leverage.

The sheer volume of these procurement orders and the strategic importance of these projects mean that the purchasing decisions made by these large utilities directly and significantly impact NARI's revenue streams and overall profitability. For instance, in 2024, State Grid Corporation of China's capital expenditure plans often dictate the pace and scale of NARI's project pipeline.

The power grid infrastructure sector is characterized by large-scale, complex projects that necessitate extensive tender processes and competitive bidding. This project-based procurement approach empowers customers by allowing them to solicit bids from numerous suppliers. Consequently, NARI Technology Development faces significant pressure to compete vigorously on price, technological innovation, and service quality, directly enhancing customer bargaining power.

In 2024, major global power grid infrastructure projects often involve bidding processes where multiple vendors present detailed proposals. For instance, a significant smart grid upgrade in Europe might see over ten qualified vendors submitting bids. This intense competition means customers can readily compare offerings and negotiate for more favorable contract terms, including pricing, delivery schedules, and after-sales support, thereby tilting the scales in their favor.

Government policies significantly shape customer power in the energy sector. For instance, in 2024, many countries continued to promote renewable energy adoption through subsidies and tax credits, giving customers greater leverage to demand greener solutions from companies like NARI Technology Development. These incentives can reduce the effective cost for customers, increasing their willingness to switch or negotiate terms.

Customer's Technical Expertise and Customization Demands

Large utility clients often boast substantial internal technical knowledge, enabling them to articulate precise, customized needs for their power grid infrastructure. This expertise empowers them to set stringent specifications and insist on bespoke solutions.

Consequently, NARI faces pressure to allocate significant resources to research and development and product customization. This directly impacts NARI's ability to adjust pricing and escalates service expectations from these demanding customers.

- Customer Expertise: Utility clients frequently possess advanced in-house engineering capabilities.

- Customization Needs: Specific, tailored solutions are often mandated for grid systems.

- R&D Investment: NARI must invest heavily to meet these unique client demands.

- Pricing Pressure: Customization requirements limit NARI's pricing flexibility.

Threat of Customer Self-Provision or Vertical Integration

Major power grid operators possess significant leverage. They could develop in-house capabilities for automation and engineering services, reducing reliance on external providers like NARI Technology. This potential for self-provision or vertical integration, particularly for more standardized solutions, directly impacts NARI's market share and necessitates a strong value proposition to retain customers.

For instance, in 2024, several large utility companies announced increased investments in their internal digital transformation and grid modernization initiatives. While complete self-sufficiency in highly specialized areas like advanced AI-driven grid control remains challenging, the trend towards insourcing core competencies is evident. This means NARI must continually innovate and demonstrate superior cost-effectiveness or technological advantage to counter this customer bargaining power.

- Potential for Insourcing: Large grid operators may develop internal teams for automation and engineering, reducing their need for NARI's services.

- Vertical Integration Threat: Customers could integrate NARI's technology development functions into their own operations, limiting market opportunities.

- Value Proposition Pressure: NARI faces increased pressure to offer competitive pricing and superior technological solutions to prevent customer insourcing.

- 2024 Investment Trends: Utilities are increasing investments in internal digital transformation, signaling a growing capacity for self-provision.

NARI Technology Development's customer bargaining power is substantial, primarily due to the concentrated customer base and the significant scale of their purchases. Major state-owned utilities, like the State Grid Corporation of China, wield considerable influence, especially given their affiliation within the NARI Group. This leverage is amplified by the competitive bidding processes inherent in large-scale infrastructure projects, compelling NARI to offer competitive pricing and innovative solutions. Furthermore, government policies promoting renewable energy and customers' increasing technical expertise and potential for insourcing capabilities all contribute to this powerful customer dynamic.

| Factor | Impact on NARI | 2024 Relevance |

|---|---|---|

| Customer Concentration | High leverage for large utilities | State Grid Corporation of China's procurement volume significantly influences NARI's order book. |

| Procurement Process | Pressure on pricing and innovation | Intense competition in tenders for smart grid projects, with multiple vendors vying for contracts. |

| Customer Expertise | Demand for customized solutions | Utilities' in-house engineering teams articulate precise technical requirements. |

| Insourcing Potential | Threat to market share | Utilities increasing internal digital transformation investments, potentially reducing reliance on external providers. |

Preview Before You Purchase

NARI Technology Development Porter's Five Forces Analysis

This preview showcases the complete NARI Technology Development Porter's Five Forces Analysis, providing an in-depth examination of competitive forces shaping the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The power grid technology and smart grid sector is highly competitive, with major global players like ABB, Siemens, General Electric, and Schneider Electric vying for market dominance. These companies offer a comprehensive suite of similar products and services, intensifying the struggle for market share.

For instance, in 2023, Siemens Energy secured a significant contract worth over €2 billion for grid modernization in Germany, demonstrating the scale of investment and competition in this space. This intense rivalry means that innovation and cost-effectiveness are paramount for success.

The power grid automation and smart grid sector is characterized by a relentless pace of technological innovation. Companies like NARI Technology are deeply involved in integrating advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and renewable energy sources into their solutions. This dynamic environment demands substantial and ongoing investment in research and development to stay ahead.

This continuous innovation cycle creates an intense competition, often described as an innovation race. To maintain market relevance and avoid their products becoming outdated, firms must consistently upgrade their offerings and introduce new functionalities. For instance, the global smart grid market was valued at approximately USD 25.5 billion in 2023 and is projected to grow significantly, underscoring the importance of staying at the forefront of technological development.

The global smart grid market is a hotbed of activity, with projections indicating it could surpass USD 100 billion by 2030. This rapid expansion is a magnet for intense competition, as both established companies and newcomers vie for a piece of the lucrative pie.

This high growth environment means existing players are pushing to enhance their offerings and secure more business. Simultaneously, the attractive market size is drawing in new entrants, all eager to capture market share. This influx of competition naturally leads to increased pressure on pricing and can squeeze profit margins for all involved.

Significant Fixed Costs and Capacity Utilization Pressure

NARI Technology Development operates in an environment with significant fixed costs, particularly in research and development for advanced power grid solutions and the establishment of manufacturing facilities. These high upfront investments create a constant pressure to achieve high capacity utilization.

To offset these substantial fixed costs, companies like NARI must secure a large volume of projects. This necessity can drive aggressive pricing strategies and intensify competition during the bidding process for new grid modernization and development contracts.

- High R&D Investment: Developing cutting-edge smart grid technology requires substantial capital. For instance, in 2023, NARI's R&D expenditure represented a significant portion of its revenue, reflecting the industry's innovation demands.

- Infrastructure Costs: Building and maintaining specialized manufacturing plants for grid equipment also incurs massive fixed costs, impacting the breakeven point for production.

- Capacity Utilization Drive: To achieve profitability, NARI, like its peers, must ensure its production lines and project execution teams are consistently utilized, leading to competitive bidding.

- Pricing Pressure: The need to maintain high utilization often translates into intense price competition, especially in large-scale infrastructure projects where margins can be squeezed.

Differentiation Challenges in a Highly Technical Market

Competitive rivalry within the power grid technology sector, particularly for companies like NARI, presents a significant challenge. While NARI offers advanced solutions, differentiating solely on technological sophistication is difficult. Many competitors also possess robust research and development capabilities, leading to a crowded innovation landscape.

To effectively compete, NARI must move beyond just technical features. This means focusing on superior service quality, seamless integration of their solutions with existing infrastructure, and demonstrating excellence in project execution. Building and maintaining strong customer relationships is also paramount for standing out in this highly technical market.

- Technological Parity: Competitors in the power grid sector often match or exceed NARI's technological advancements, making pure tech differentiation a tough strategy.

- Service as a Differentiator: Companies that excel in customer support, implementation, and ongoing maintenance can gain a significant competitive edge.

- Integration Expertise: The ability to smoothly integrate new technologies with legacy systems is a key factor for utilities, creating opportunities for differentiation.

- Project Execution: A proven track record of successful, on-time, and on-budget project delivery builds trust and sets companies apart.

Competitive rivalry in the smart grid sector is intense, driven by substantial market growth and high R&D investment. Companies like NARI Technology face pressure from established giants and emerging players, necessitating a focus beyond just technology to include service and integration expertise. This dynamic environment means that differentiation through project execution and customer relationships is crucial for sustained success.

The global smart grid market, valued at approximately USD 25.5 billion in 2023, is projected for significant expansion, attracting fierce competition. This growth fuels an innovation race, where companies must continuously invest in R&D to avoid obsolescence, as seen with major players like Siemens and GE securing multi-billion euro contracts for grid modernization.

| Key Competitor | 2023 Revenue (approx. USD billions) | Smart Grid Focus Areas |

| ABB | 32.2 | Grid automation, electrification, digital solutions |

| Siemens | 77.8 (Energy sector) | Grid control, smart metering, distributed energy systems |

| General Electric | 68.3 (Grid segment) | Grid modernization, renewable integration, digital grid solutions |

| Schneider Electric | 35.5 | Energy management, automation, smart grid infrastructure |

SSubstitutes Threaten

The rise of decentralized energy resources (DERs) like rooftop solar and microgrids presents a growing threat of substitution for traditional grid infrastructure. These distributed systems can lessen demand for centralized grid automation and protection, as seen with the projected 15% growth in global solar PV capacity in 2024, according to the International Energy Agency.

As more consumers and communities adopt localized power generation, their reliance on large, centralized utilities diminishes. This shift directly impacts the market for NARI Technology's core offerings in grid automation and protection, as power becomes more self-contained and less dependent on the traditional grid's reach.

Rapid advancements in energy storage technologies, particularly battery energy storage systems (BESS), present a significant threat of substitution for grid automation services. These technologies are increasingly capable of performing functions like grid stability and load balancing, which were once core offerings of companies like NARI Technology Development.

As BESS become more efficient and cost-effective, their ability to mitigate grid fluctuations and manage demand peaks grows. For instance, by mid-2024, the global BESS market was projected to reach over $150 billion, demonstrating substantial investment and rapid technological progress. This trend could directly reduce the demand for NARI’s grid optimization and dispatching solutions as utilities increasingly rely on stored energy to manage grid operations.

Aggressive adoption of demand-side management (DSM) and energy efficiency programs by utilities and consumers is a significant threat. These initiatives aim to reduce overall electricity demand and optimize consumption, potentially diminishing the market need for NARI's grid modernization solutions. For instance, in 2024, many utilities reported substantial reductions in peak demand through DSM, with some programs achieving savings of 5-10% of total energy consumption.

Evolution of Non-Traditional Grid Management Approaches

Emerging concepts like virtual power plants (VPPs) and advanced peer-to-peer energy trading platforms present a significant threat of substitution for traditional grid management solutions. These decentralized approaches, which aggregate distributed energy resources, can offer greater flexibility and efficiency in balancing supply and demand. For instance, by 2024, the global VPP market was projected to reach over $6 billion, indicating substantial growth and potential to disrupt established grid control models.

If these non-traditional methods achieve widespread adoption, they could directly substitute for certain aspects of NARI's conventional grid automation and dispatching services. This shift could reduce the demand for centralized control systems as more energy management functions are handled at the local or distributed level. The increasing integration of renewable energy sources further fuels the adoption of these flexible, non-traditional grid management strategies.

- Virtual Power Plants (VPPs): Aggregate distributed energy resources (DERs) like solar panels and battery storage to provide grid services.

- Peer-to-Peer (P2P) Energy Trading: Platforms enabling direct energy transactions between consumers and producers, bypassing traditional utility structures.

- Market Growth: The global VPP market was anticipated to exceed $6 billion by 2024, highlighting increasing investment and adoption.

- Impact on Traditional Grid: These alternatives offer flexibility and efficiency, potentially reducing reliance on centralized grid automation and dispatching.

Direct Power Solutions for Large Consumers

Large industrial consumers, data centers, and commercial entities are increasingly investigating on-site power generation and direct power purchase agreements. This strategy allows them to bypass traditional grid infrastructure for a portion of their energy requirements. For instance, in 2024, the global corporate power purchase agreement (PPA) market saw significant growth, with companies like Microsoft and Google continuing to invest heavily in renewable energy projects to secure their own power supply.

This shift, fueled by a desire for greater energy resilience and the achievement of sustainability targets, poses a threat to NARI Technology Development. Such self-contained power ecosystems can diminish the demand for NARI's grid-centric solutions. By 2023, the installed capacity of distributed generation in some key markets had already reached substantial levels, indicating a growing trend of energy independence.

- Growing Corporate PPA Market: The global corporate PPA market continued its upward trajectory in 2024, with major tech companies leading the charge in securing direct energy supplies.

- On-Site Generation Trend: An increasing number of large consumers are adopting on-site generation, reducing reliance on traditional utility providers.

- Energy Resilience and Sustainability Drivers: These adoption trends are primarily driven by the dual goals of enhancing energy security and meeting corporate environmental, social, and governance (ESG) objectives.

- Impact on Grid-Centric Solutions: The rise of alternative power ecosystems directly challenges the market share of companies focused on traditional grid infrastructure and services.

The increasing adoption of decentralized energy resources (DERs) like rooftop solar and microgrids directly substitutes for traditional grid infrastructure, reducing reliance on centralized systems. For instance, global solar PV capacity was projected to grow by 15% in 2024, according to the International Energy Agency.

Advancements in battery energy storage systems (BESS) are also a significant threat, as they increasingly perform grid stability and load balancing functions. The global BESS market was projected to exceed $150 billion by mid-2024, showcasing rapid technological progress and investment.

Virtual power plants (VPPs) and peer-to-peer energy trading platforms offer flexible, decentralized grid management, potentially replacing traditional grid automation services. The global VPP market was expected to surpass $6 billion in 2024, indicating a growing trend towards alternative energy management models.

Large industrial consumers pursuing on-site generation and direct power purchase agreements create self-contained power ecosystems, diminishing demand for grid-centric solutions. The corporate power purchase agreement (PPA) market saw significant growth in 2024, with major corporations actively securing their own energy supplies.

Entrants Threaten

Entering the power grid technology sector, particularly for companies like NARI Technology Development, necessitates massive capital outlays. This includes significant investment in cutting-edge research and development, the construction of advanced manufacturing plants, and the creation of robust deployment and service infrastructure. For instance, the global smart grid market was valued at approximately USD 35 billion in 2023 and is projected to grow substantially, indicating the scale of investment needed to compete.

These substantial upfront capital requirements act as a formidable barrier, effectively deterring a large number of potential new entrants. The sheer magnitude of the investment, coupled with potentially extended payback periods for new technologies, makes the power grid technology market inherently less accessible to smaller or less capitalized firms, thereby reducing the immediate threat of new competition.

The power industry is exceptionally regulated, demanding adherence to rigorous safety and reliability standards. New entrants must navigate these complex frameworks and secure necessary certifications, a process that can be both time-consuming and costly, acting as a significant barrier.

The development of sophisticated power grid automation, relay protection, and smart grid solutions demands a deep bench of highly specialized engineering and technical talent, often cultivated over many years. This significant knowledge barrier makes it difficult for new entrants to rapidly acquire or cultivate the necessary expertise, thereby safeguarding established players like NARI Technology.

Established Relationships and Brand Trust with Utilities

Established power utilities, inherently cautious about grid stability and security, often prioritize long-term partnerships with proven vendors. NARI Technology, like other incumbents, has spent years building deep trust and a reliable track record with these critical infrastructure operators. This makes it exceptionally difficult for newcomers to gain a foothold, as they must first overcome significant hurdles in demonstrating their capability and trustworthiness for large-scale, high-stakes projects.

The challenge for new entrants is compounded by the fact that utilities typically have established procurement processes and vendor qualification requirements that favor those with a history of successful delivery. For instance, in 2024, major grid modernization projects often require vendors to demonstrate decades of experience and a proven ability to integrate complex systems seamlessly. New companies struggle to meet these stringent criteria without prior engagement and a recognized brand reputation in the sector.

- Incumbent Advantage: Utilities favor vendors with a proven history of reliability and security for critical infrastructure.

- Trust and Credibility: New entrants face significant challenges in building the necessary trust and brand reputation with risk-averse utilities.

- Procurement Barriers: Established procurement processes and vendor qualification requirements favor companies with extensive experience, making market entry difficult for new players.

Economies of Scale and Experience Curve Advantages

Existing players in the technology development sector, including NARI Technology, possess significant advantages due to economies of scale. This allows them to achieve lower per-unit costs in manufacturing, procurement of components, and the delivery of complex technological solutions, making their pricing more competitive. For instance, in 2024, major players often reported gross margins in the high 30s to low 40s, a feat difficult for newcomers to match without substantial initial investment.

NARI's deep operational experience translates into a powerful learning curve. This accumulated knowledge enables more efficient project execution, faster problem-solving, and the development of refined processes that reduce waste and improve quality. New entrants would struggle to replicate this operational efficiency and risk mitigation, which is crucial in a sector with long project cycles and high technical demands.

- Economies of Scale: Lower per-unit costs in manufacturing and procurement.

- Experience Curve: Improved efficiency and reduced risk through accumulated operational knowledge.

- Competitive Pricing: Established players can offer more attractive pricing structures.

- Integrated Solutions: Ability to bundle services and products due to scale and experience.

The threat of new entrants for NARI Technology Development is significantly mitigated by substantial capital requirements, stringent regulatory hurdles, and the need for specialized technical expertise. Established players benefit from economies of scale and deep-seated relationships with utilities, making it difficult for newcomers to compete on price or gain trust.

Utilities' preference for proven vendors with extensive experience, as seen in 2024 grid modernization projects requiring decades of proven delivery, creates a considerable barrier. New entrants struggle to meet these stringent qualification criteria without a strong track record.

The accumulated operational knowledge of incumbents like NARI translates into greater efficiency and reduced risk, further deterring new competition. This experience curve allows for more competitive pricing and integrated solutions, which are difficult for new firms to replicate.

| Barrier Type | Impact on New Entrants | Supporting Factor |

|---|---|---|

| Capital Requirements | High | Massive R&D, manufacturing, and infrastructure investment needed. |

| Regulation & Certification | High | Complex safety and reliability standards require time and cost to meet. |

| Technical Expertise | High | Demand for highly specialized engineering talent is a significant hurdle. |

| Customer Relationships | High | Utilities prioritize trust and proven track records, favoring incumbents. |

| Economies of Scale | Moderate | Lower per-unit costs for established players impact pricing competitiveness. |

Porter's Five Forces Analysis Data Sources

Our NARI Technology Development Porter's Five Forces analysis is built upon a foundation of comprehensive data, including industry-specific market research reports, financial statements of key players, and patent filings. We also leverage government databases and regulatory filings to understand the landscape of new entrants and substitute products.