Mazda Motor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mazda Motor Bundle

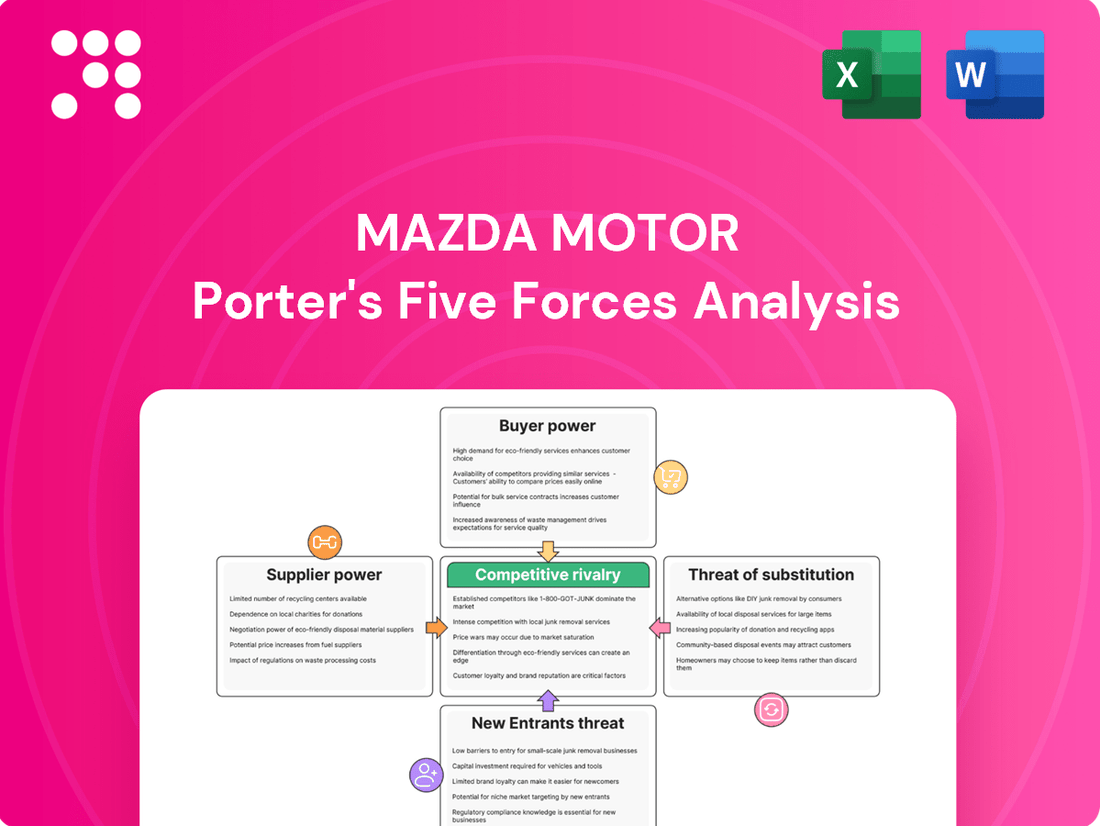

Mazda Motor faces intense competition from established automakers and emerging players, with buyer power significantly impacting pricing strategies. The threat of new entrants is moderate, while the bargaining power of suppliers is a key consideration in their supply chain management.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Mazda Motor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Mazda's reliance on suppliers for specialized components, like its Skyactiv-X engine technology or unique interior materials, can significantly impact its bargaining power. If these components are proprietary or difficult to source elsewhere, suppliers can command higher prices or dictate terms. For instance, a supplier of a critical, patented sensor technology for Mazda's advanced driver-assistance systems could hold considerable sway, especially if developing an alternative would be time-consuming and costly for Mazda.

Raw material providers, such as those supplying steel, aluminum, and semiconductors, wield significant influence over Mazda. For instance, the automotive industry in 2024 continued to grapple with semiconductor shortages, a direct consequence of increased demand and limited production capacity, leading to higher component costs for manufacturers like Mazda. These fluctuations can directly impact Mazda's production costs and profitability.

Geopolitical tensions and environmental regulations can further amplify the bargaining power of these suppliers. Disruptions in regions where key minerals are sourced, or stricter emissions standards impacting raw material processing, can create supply chain vulnerabilities. This was evident in 2024 with ongoing concerns about the sourcing of rare earth metals, crucial for electric vehicle components, where a few dominant suppliers can dictate terms.

The bargaining power of labor and talent suppliers significantly impacts Mazda's operations. Skilled engineers, designers, and manufacturing specialists are crucial, and a shortage of talent in areas like EV technology or software development can empower these workers and recruitment firms. For instance, in 2023, the automotive industry faced ongoing challenges in attracting software engineers, with demand significantly outpacing supply, leading to increased salary expectations.

Mazda must offer competitive wages, comprehensive benefits, and attractive working conditions to secure and retain this specialized workforce. These factors directly influence operational costs, as higher compensation packages are often necessary to counter the intense competition for top talent in the global automotive market.

Technology and Software Providers

The increasing sophistication of automotive technology, particularly in areas like autonomous driving and electric vehicle powertrains, significantly amplifies the bargaining power of specialized technology and software providers. These companies, often holding critical intellectual property and proprietary algorithms, become indispensable partners for automakers like Mazda.

Mazda's reliance on these suppliers for essential systems, such as advanced driver-assistance systems (ADAS) software or battery management units for its upcoming EVs, grants these providers considerable leverage. This can translate into higher licensing fees and greater influence over integration costs and future development priorities.

- Increasing Dependence: As vehicles become more software-defined, Mazda's operational efficiency and product differentiation hinge on the capabilities of these tech suppliers.

- Proprietary Technology: Companies controlling key patents for AI-driven navigation or advanced battery thermal management systems can command premium pricing and dictate terms.

- Limited Alternatives: For highly specialized functions, the number of qualified suppliers is often limited, further strengthening their negotiating position.

- Industry Trends: The global automotive software market was projected to reach over $40 billion in 2024, indicating the substantial economic clout of these providers.

Logistics and Transportation Services

The bargaining power of logistics and transportation service providers significantly impacts Mazda's global operations. For instance, in 2024, the International Monetary Fund (IMF) projected continued volatility in global shipping costs, influenced by factors like geopolitical tensions and fluctuating demand. This means companies handling Mazda's vehicle distribution and parts movement can leverage these conditions to negotiate higher rates, directly affecting Mazda's supply chain efficiency and overall cost structure.

Disruptions, such as the labor shortages experienced in the trucking industry in North America throughout 2023 and into 2024, can further empower these service providers. When there are fewer drivers or operational staff, the available providers can command premium pricing for their services. Mazda's ability to maintain cost-effective logistics is therefore directly tied to the terms negotiated with these essential partners, who are critical for getting vehicles to dealerships and components to manufacturing plants.

- Rising Fuel Costs: Global oil prices, which saw fluctuations in 2024, directly increase operating expenses for transportation companies, giving them leverage to pass these costs onto clients like Mazda.

- Labor Shortages: Persistent shortages in skilled trucking and shipping labor in key markets in 2024 allow logistics firms to demand higher wages, translating into increased service costs for Mazda.

- Supply Chain Bottlenecks: Ongoing port congestion and shipping route disruptions, which persisted in various regions through early 2024, grant greater bargaining power to the logistics companies that can navigate these challenges more effectively.

Mazda's bargaining power with suppliers is significantly influenced by the concentration of suppliers for critical components. When few suppliers can provide specialized parts, like advanced battery technology for EVs, their leverage increases, potentially leading to higher prices for Mazda. For instance, the automotive battery market in 2024 saw continued dominance by a few key players, granting them considerable pricing power.

The cost of switching suppliers also plays a crucial role. If it's expensive or time-consuming for Mazda to find and integrate new suppliers for proprietary technologies, existing suppliers can maintain strong bargaining positions. This was a factor in 2024 as automakers sought to secure reliable sources for next-generation automotive chips, where switching costs were substantial.

Mazda's purchasing volume relative to a supplier's total customer base is another determinant. If Mazda represents a small portion of a supplier's business, the supplier has less incentive to accommodate Mazda's demands, thereby increasing their bargaining power.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Mazda |

|---|---|---|

| Specialized Component Providers | Proprietary technology, limited alternatives | Higher component costs, potential supply disruptions |

| Raw Material Suppliers (e.g., Steel, Semiconductors) | Market concentration, global demand/supply dynamics | Volatile input costs, production planning challenges |

| Technology & Software Providers | Intellectual property, industry growth (e.g., automotive software market projected >$40B in 2024) | Increased licensing fees, influence on development roadmaps |

| Logistics & Transportation Services | Fuel costs, labor availability, supply chain congestion | Higher shipping rates, impact on delivery times and costs |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Mazda Motor's position in the automotive industry.

Instantly identify and prioritize competitive threats with a visual breakdown of each force, empowering strategic adjustments to mitigate risks.

Customers Bargaining Power

Consumers in the automotive market often exhibit significant price sensitivity, particularly when numerous comparable models are available. For Mazda, this means that the price of its vehicles is a crucial factor influencing purchasing decisions, especially in a competitive landscape where rivals like Toyota, Honda, and Nissan offer compelling alternatives.

Economic conditions play a vital role in shaping this sensitivity. For instance, during periods of economic slowdown or rising inflation, consumers tend to scrutinize vehicle prices more closely, seeking greater value for their money. Mazda's ability to maintain competitive pricing, offer attractive financing packages, or provide compelling discounts directly impacts its sales volume and, consequently, its profit margins.

In 2024, the automotive industry continued to navigate supply chain improvements and shifting consumer preferences, with pricing remaining a key battleground. Mazda's market share, which stood at approximately 1.3% of the U.S. auto market in 2023, underscores the intense competition and the need to carefully manage pricing strategies to attract and retain customers.

The sheer volume of readily accessible information online significantly amplifies customer bargaining power. Consumers in 2024 can effortlessly compare Mazda's offerings against rivals using platforms that detail features, reliability ratings, safety scores, and pricing. This transparency means customers arrive at dealerships well-informed, armed with data that allows them to negotiate more effectively.

Websites like Consumer Reports and J.D. Power continue to provide in-depth vehicle evaluations, with J.D. Power's 2024 U.S. Vehicle Dependability Study showing a slight improvement in overall dependability across the industry. Such reports empower buyers to scrutinize Mazda's performance relative to competitors, pressuring the company to maintain competitive pricing and uphold high product quality to secure sales.

Customers generally face low costs when switching between automotive brands. For instance, in 2024, the average car buyer might consider factors like price, features, and brand reputation, but the direct financial outlay to switch from a Mazda to a competitor is usually limited to the purchase price of the new vehicle, with minimal penalties for leaving a previous brand.

Unless a buyer has invested in brand-specific infrastructure, like charging stations for electric vehicles or specialized service plans, the transition to a different manufacturer is relatively seamless. This ease of switching amplifies customer bargaining power, allowing them to readily explore alternatives if Mazda's products or pricing are not competitive.

Dealer Network Influence and Customer Experience

The strength of Mazda's dealership network significantly shapes customer bargaining power. While dealerships act as intermediaries, their sales approaches, financing packages, and the quality of their after-sales service directly influence a customer's perception of value and their overall buying journey. Customers can effectively use competitive offers from various dealerships or even different automotive brands to strengthen their negotiating position, pushing for more favorable terms or enhanced service from Mazda's authorized network.

For instance, in 2024, the automotive industry saw continued emphasis on customer experience, with dealerships offering a wider array of financing options and bundled service packages. This environment allows informed buyers to compare deals across multiple dealerships, putting pressure on individual dealers and, by extension, Mazda, to offer competitive pricing and incentives. The ability for customers to easily research and compare vehicle specifications, pricing, and financing online further amplifies their bargaining leverage.

- Dealer Network Impact: Dealerships, through their sales tactics and service quality, directly influence customer perception and negotiation power.

- Customer Leverage: Customers can exploit competitive offers from different dealerships and brands to secure better terms from Mazda's network.

- 2024 Market Trends: The 2024 automotive market highlighted increased customer focus on financing options and after-sales service, empowering buyers.

Impact of Fleet Buyers and Corporate Sales

Mazda's bargaining power of customers is significantly influenced by large fleet buyers. These entities, including rental car agencies and corporate fleets, often procure vehicles in substantial volumes. In 2023, rental car companies were a major segment for many automakers, and this trend is expected to continue, with fleet sales often representing a notable percentage of total vehicle deliveries for brands like Mazda.

The sheer scale of these bulk purchases allows fleet buyers considerable leverage. They can negotiate for significant discounts, request tailored vehicle specifications, and secure advantageous service contracts. This can directly impact Mazda's per-unit profitability, as meeting the demands of these high-volume customers often necessitates concessions that reduce margins.

For instance, a substantial portion of Mazda's sales volume being attributed to fleet channels could mean that a larger percentage of their revenue comes from transactions with lower profit margins compared to individual retail sales. This dynamic is a key consideration when evaluating the overall profitability and pricing strategies of the company.

- Fleet Sales Impact: Large fleet buyers can command substantial discounts, affecting per-unit profitability for Mazda.

- Customer Leverage: Bulk purchasing power enables rental car companies, government agencies, and corporate clients to negotiate favorable terms.

- Profit Margin Pressure: A high reliance on fleet sales can lead to reduced profitability on a per-vehicle basis.

The bargaining power of customers for Mazda is substantial, driven by price sensitivity and the abundance of comparable vehicles. In 2024, consumers continued to prioritize value, making pricing a critical factor. Mazda's market share, around 1.3% in the US in 2023, highlights the intense competition and the need for strategic pricing to attract buyers.

The ease with which customers can access information online further bolsters their negotiating position. Platforms detailing features, reliability, and pricing empower buyers to compare Mazda's offerings against competitors like Toyota and Honda. This transparency means customers arrive at dealerships well-informed, ready to negotiate more effectively.

Switching costs for automotive consumers remain low. In 2024, the decision to switch brands typically involves minimal financial penalties beyond the purchase of a new vehicle. This lack of significant switching costs allows customers to readily explore alternatives if Mazda's products or pricing do not meet their expectations.

Large fleet buyers, such as rental car agencies and corporate fleets, exert considerable bargaining power due to their high-volume purchases. These entities can negotiate significant discounts and customized specifications, impacting Mazda's per-unit profitability. In 2023, fleet sales represented a notable portion of overall industry deliveries, a trend likely to persist.

| Factor | Impact on Mazda | 2023/2024 Relevance |

|---|---|---|

| Price Sensitivity | High | Key differentiator in a competitive market. |

| Information Availability | High | Empowers customers for effective negotiation. |

| Switching Costs | Low | Facilitates customer mobility to competing brands. |

| Fleet Buyer Volume | Significant | Drives discounts and impacts per-unit margins. |

Same Document Delivered

Mazda Motor Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive analysis of Mazda Motor's Porter's Five Forces delves into the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the automotive industry. You'll gain actionable insights into the strategic positioning and potential challenges Mazda faces.

Rivalry Among Competitors

Mazda faces fierce competition from a vast array of global and regional automakers. Established giants like Toyota, Honda, and Volkswagen, alongside growing EV players, all vie for market share. This crowded landscape, with diverse product lines and pricing strategies, intensifies the rivalry.

The global automotive market, particularly in mature regions, is experiencing a relatively slow growth rate. For instance, in 2023, global light vehicle sales saw a modest increase of around 10% compared to 2022, reaching approximately 88.5 million units, indicating a market that is far from booming. This maturity intensifies competitive rivalry as companies like Mazda must fight harder for existing market share rather than capitalizing on broad market expansion.

In such a saturated environment, the pressure to differentiate becomes paramount. Mazda faces intense competition from established global players and emerging manufacturers, all vying for consumer attention and loyalty. This dynamic forces Mazda to focus on product innovation, distinctive design, and potentially more aggressive pricing strategies to secure its position and avoid losing ground to rivals.

Mazda strives to differentiate through its Kodo design language and Jinba-Ittai driving philosophy, exemplified by Skyactiv Technology. In 2024, this focus on driver engagement and distinctive styling remains a key selling point against more commoditized rivals. However, the broader automotive market is awash with innovation, with competitors rapidly introducing advanced driver-assistance systems and electrification, potentially eroding Mazda's unique advantages if they cannot maintain the pace of technological evolution.

High Fixed Costs and Exit Barriers

The automotive industry, including Mazda, is characterized by exceptionally high fixed costs. These include massive investments in research and development, the construction and maintenance of extensive manufacturing facilities, and substantial marketing budgets. For instance, developing a new vehicle platform can cost billions of dollars. These significant upfront and ongoing expenses create a powerful incentive for manufacturers to maximize production output and sales volume to spread these costs over as many units as possible. This drive for capacity utilization directly fuels intense competition among players like Mazda, as they vie for market share to achieve economies of scale and cover their fixed cost obligations.

Furthermore, the automotive sector presents considerable exit barriers, making it difficult for companies to leave the market even when facing financial difficulties. These barriers include highly specialized and costly manufacturing equipment that has limited alternative uses, substantial investments in supply chain relationships, and large, skilled workforces that are not easily redeployed. Consequently, firms that are struggling are often compelled to remain in operation, contributing to persistent overcapacity in the market. This prolonged overcapacity intensifies price competition, as companies are forced to compete aggressively on price to secure sales and avoid further losses, impacting profitability for all involved, including Mazda.

- High Fixed Costs: Automotive R&D can exceed $1 billion per new model, and global manufacturing plants represent multi-billion dollar investments.

- Capacity Utilization: Companies aim for 80-90% capacity utilization to optimize per-unit costs, leading to aggressive sales tactics.

- Exit Barriers: Specialized automotive assembly lines and tooling have low salvage value, locking companies into the industry.

- Market Overcapacity: Global auto production capacity often exceeds demand, leading to price wars and reduced margins.

Marketing and Advertising Intensity

The automotive sector demands significant marketing and advertising outlays to stand out. Mazda, alongside its competitors, must invest heavily in brand development, new model introductions, and various promotional activities to attract and retain customers. For instance, in fiscal year 2024, major automakers continued to spend billions globally on marketing to support their product portfolios and gain market share.

The intense marketing activities of rivals force Mazda to constantly enhance its promotional strategies. This continuous need for innovative campaigns and substantial media presence escalates the competitive rivalry. In 2024, digital advertising spending in the automotive industry saw a notable increase, reflecting the shift towards online channels for reaching consumers.

- High Marketing Spend: Automakers globally invested over $50 billion in advertising in 2023, a figure expected to grow in 2024.

- Brand Building Necessity: Mazda, like competitors such as Toyota and Honda, allocates a considerable portion of its revenue to marketing to maintain brand visibility and desirability.

- Product Launch Support: New vehicle launches are heavily supported by extensive advertising campaigns, often costing tens of millions of dollars per model introduction.

- Digital Transformation: The increasing reliance on digital marketing channels means companies must adapt their strategies to capture online attention, driving up overall advertising intensity.

Mazda operates in an intensely competitive automotive market, characterized by numerous global and regional players. The industry's maturity, with modest growth rates like the 10% increase in global light vehicle sales in 2023 to 88.5 million units, means companies must fight for existing market share. This environment necessitates continuous innovation and differentiation, as seen in Mazda's focus on its Kodo design and Jinba-Ittai driving philosophy, to stand out against competitors rapidly advancing in electrification and driver-assistance technologies.

| Factor | Description | Impact on Mazda |

| Market Maturity | Slow global sales growth (e.g., ~10% in 2023) | Intensifies competition for existing market share. |

| Competitor Innovation | Rapid advancements in EV and ADAS by rivals | Requires Mazda to maintain pace to avoid losing differentiation. |

| High Fixed Costs | Billions in R&D and manufacturing | Drives aggressive sales tactics to maximize capacity utilization. |

| Exit Barriers | Specialized assets and supply chains | Leads to persistent overcapacity and price competition. |

| Marketing Intensity | High global ad spend (e.g., >$50 billion in 2023) | Forces significant investment in brand visibility and promotional activities. |

SSubstitutes Threaten

The threat of substitutes for Mazda's vehicles is significant, particularly in urban environments. Robust public transportation networks, including buses, trains, and subways, offer a cost-effective and often more convenient alternative for daily commuting, especially in densely populated areas. For instance, cities like Tokyo, with an extensive and highly efficient rail system, see lower personal vehicle ownership rates among residents compared to more car-dependent regions.

Furthermore, the rise of micro-mobility solutions like electric scooters and bike-sharing programs presents a growing substitute, particularly for short urban trips. These services, which saw substantial growth in 2024 with increased investment and city adoption, directly compete with Mazda's smaller, urban-focused models. As these alternatives become more accessible and integrated into city infrastructure, they can further erode the necessity of owning a personal vehicle for many urban dwellers.

The rise of ride-sharing and car-sharing services presents a significant threat of substitution for traditional car manufacturers like Mazda. Platforms such as Uber and Lyft, along with car-sharing options like Zipcar, provide convenient, on-demand transportation, directly competing with the need for personal vehicle ownership. This is especially true for individuals in urban areas or those who only require a vehicle for occasional use.

These services often prove more cost-effective for infrequent drivers, as they eliminate expenses like insurance, maintenance, depreciation, and parking. For example, a 2024 study indicated that the average cost of car ownership in major metropolitan areas can easily exceed $800 per month, a figure that ride-sharing can undercut for many users. This convenience and potential cost savings can directly influence consumer decisions away from purchasing new vehicles.

The rise of remote work and virtual connectivity presents a significant threat of substitutes for personal vehicles. As more people work from home, the daily commute, a primary driver of car usage, diminishes. This trend, amplified by advancements in video conferencing and online collaboration tools, reduces the need for physical travel for both professional and personal reasons.

In 2024, the sustained adoption of hybrid and remote work models continues to impact transportation needs. While exact figures for vehicle demand reduction solely due to remote work are complex to isolate, studies indicate a shift in commuting patterns. For instance, data from early 2024 suggested that a substantial percentage of the workforce maintained some form of remote work, directly correlating to fewer miles driven annually.

This evolving lifestyle, where virtual interactions replace many in-person engagements, could lead to a long-term decrease in the overall demand for new car purchases. Mazda, like other automakers, faces the challenge of adapting to a market where the necessity of owning a personal vehicle might be less pronounced for a growing segment of the population.

Alternative Mobility Technologies and Infrastructure

The rise of alternative mobility technologies presents a significant threat of substitutes for traditional car ownership, impacting automakers like Mazda. These alternatives range from enhanced electric bicycles and scooters to emerging autonomous shuttles and even conceptual personal aerial vehicles. The development of dedicated infrastructure, such as expanded charging networks and specialized urban transit lanes, further solidifies their viability.

These emerging options can directly address specific transportation needs currently served by Mazda's product line. For instance, micro-mobility solutions might substitute for short urban commutes, while shared autonomous vehicles could replace the need for individual car ownership in densely populated areas. By 2024, the global electric scooter market alone was projected to reach over $40 billion, indicating a substantial shift in consumer preferences for urban mobility.

- Electric Bicycles and Scooters: Offering cost-effective and environmentally friendly alternatives for short-distance travel.

- Autonomous Shuttles and Ride-Sharing: Providing on-demand transportation that can reduce reliance on personal vehicle ownership.

- Public Transportation Enhancements: Investments in faster, more reliable, and integrated public transit systems can also act as substitutes.

- Micromobility Hubs: Integrated networks of shared bikes, scooters, and other small vehicles in urban centers are increasingly common.

Improved Durability and Lifespan of Existing Vehicles

The increasing durability and extended lifespan of existing vehicles pose a significant threat to Mazda. Consumers are increasingly choosing to repair and maintain their current cars rather than purchasing new ones, especially with rising new car prices. For instance, the average age of vehicles on U.S. roads reached a record 12.5 years in 2023, up from 12.1 years in 2022, indicating a longer ownership cycle.

This trend directly impacts Mazda's sales volume by slowing down the natural replacement cycle for personal automobiles. When consumers opt to keep their vehicles longer, the demand for new car models, including those from Mazda, diminishes. This is further exacerbated by improvements in vehicle manufacturing quality and the availability of more affordable and effective maintenance and repair services.

- Extended Vehicle Lifespans: The average age of vehicles on U.S. roads hit a record 12.5 years in 2023.

- Economic Incentive: Rising new car prices make retaining older, well-maintained vehicles a more attractive option.

- Impact on Replacement Cycles: This trend directly slows down the demand for new vehicle purchases.

The threat of substitutes for Mazda vehicles is multifaceted, encompassing public transit, micro-mobility, ride-sharing, and evolving work patterns. In 2024, the continued growth of ride-sharing services and the increasing adoption of remote work models directly reduce the need for personal car ownership, particularly in urban areas. For example, the average cost of car ownership in major cities can exceed $800 monthly, making alternatives more appealing for infrequent drivers.

Furthermore, advancements in electric bicycles and scooters, coupled with enhanced public transportation, offer viable alternatives for shorter commutes. The global electric scooter market's projected growth further underscores this shift. Even the extended lifespan of existing vehicles, with the average age of cars on U.S. roads reaching 12.5 years in 2023, impacts Mazda by slowing down the traditional vehicle replacement cycle.

| Substitute Type | Key Characteristics | Impact on Mazda |

| Public Transportation | Cost-effective, convenient in dense urban areas | Reduces demand for personal vehicles in cities |

| Micro-mobility (e-scooters, bikes) | Affordable, eco-friendly for short trips | Competes for urban commute market |

| Ride-sharing/Car-sharing | On-demand, cost-effective for occasional use | Directly replaces need for car ownership |

| Remote Work | Decreases daily commuting needs | Lowers overall vehicle usage and demand |

| Extended Vehicle Lifespans | Economic savings, improved durability | Slows down new car replacement cycles |

Entrants Threaten

The automotive industry, including companies like Mazda, demands substantial upfront capital. This includes massive investments in research and development for new vehicle technologies, setting up advanced manufacturing plants, and establishing robust global supply chains. For instance, developing a new vehicle platform can cost billions of dollars, a figure that deters many aspiring entrants.

Newcomers face a significant hurdle in replicating Mazda's decades-long cultivation of brand loyalty, built on its reputation for distinctive design and engaging driving dynamics. For instance, in 2024, Mazda continued to be recognized for its premium feel and driver-centric approach, a sentiment reflected in customer satisfaction surveys and consistently strong residual values.

Establishing a comprehensive and reliable distribution and service network, akin to Mazda's existing infrastructure of dealerships and service centers, represents a monumental capital and time investment for any new entrant. This intricate web of physical locations and trained personnel is crucial for sales, maintenance, and overall customer experience, creating a substantial barrier to market entry.

The automotive industry faces substantial regulatory hurdles that act as a significant barrier to new entrants. Meeting stringent safety standards, evolving emissions regulations, and fuel efficiency mandates across diverse global markets requires massive upfront investment in research, development, and rigorous testing. For instance, by 2024, the European Union's CO2 emission targets for new cars are becoming increasingly demanding, pushing manufacturers towards electrification and requiring extensive retooling and new technology development.

Access to Supply Chains and Specialized Technology

Newcomers face significant hurdles in accessing established automotive supply chains. These chains are built on long-standing relationships, requiring specialized components and often operating on just-in-time delivery, making it difficult for new players to integrate seamlessly. For instance, securing reliable access to critical battery components for electric vehicles, a rapidly growing segment, can be challenging due to existing long-term contracts between established automakers and suppliers.

Developing or acquiring proprietary technologies, such as advanced driver-assistance systems (ADAS) or next-generation electric powertrains, presents another substantial barrier to entry. Mazda, like other incumbents, benefits from years of investment in research and development, creating a technological moat that new entrants must overcome. In 2024, the automotive industry continued to see substantial R&D spending, with major automakers investing billions in areas like electrification and autonomous driving, further solidifying the advantage of established players.

- Supply Chain Integration: Long-term contracts and supplier loyalty create barriers for new entrants seeking critical automotive parts.

- Technological Expertise: High R&D investment by incumbents in areas like EV battery technology and ADAS creates a significant knowledge and capital gap.

- Capital Requirements: Establishing new, compliant supply chains and developing cutting-edge technology requires immense capital, often exceeding the reach of startups.

- Supplier Relationships: Mazda's entrenched relationships with suppliers provide preferential terms and guaranteed supply, which new entrants struggle to replicate.

Economies of Scale in Production and Purchasing

Mazda benefits immensely from economies of scale in production and purchasing. Their global manufacturing footprint, producing millions of vehicles annually, allows for significant cost reductions per unit. For instance, in 2023, Mazda produced approximately 1.2 million vehicles, a volume that enables them to spread fixed costs like factory overhead across a larger output. This scale also translates into substantial bargaining power with suppliers for raw materials and components, securing more favorable pricing than a new entrant could hope for.

This inherent cost advantage creates a formidable barrier to entry. New automakers would find it incredibly challenging to match Mazda's per-unit production costs without achieving similar production volumes.

- Lower Per-Unit Manufacturing Costs: Large-scale production allows Mazda to amortize fixed costs over more units, reducing the cost of each vehicle.

- Supplier Bargaining Power: High-volume purchasing gives Mazda leverage to negotiate better prices from suppliers for parts and materials.

- Cost Barrier for New Entrants: New companies lack the established scale to achieve comparable cost efficiencies, making it difficult to compete on price.

The threat of new entrants for Mazda is generally low due to the immense capital required to enter the automotive industry. Building factories, developing new vehicle technologies, and establishing global supply chains demand billions of dollars. For example, the average cost to develop a new car model can exceed $1 billion. Furthermore, regulatory compliance, including stringent emissions and safety standards that were further tightened by 2024, adds significant upfront investment and complexity for any newcomer.

New entrants also struggle to replicate Mazda's established brand loyalty and extensive distribution networks. Building a reputation for quality and driving experience, as Mazda has done, takes decades and significant marketing investment. By 2024, Mazda's consistent recognition for its design and driving dynamics continued to resonate with consumers, making it hard for new brands to gain traction. Establishing a comparable dealership and service infrastructure is a massive undertaking, requiring substantial capital and time to build trust and reach.

Economies of scale present another substantial barrier. Mazda's global production volume, around 1.2 million vehicles in 2023, allows for lower per-unit manufacturing costs and greater bargaining power with suppliers. New entrants would find it difficult to achieve similar cost efficiencies, making it challenging to compete on price against established players like Mazda.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Mazda Motor Corporation is built upon a foundation of publicly available financial reports, industry-specific market research from firms like IHS Markit, and automotive trade publications. We also incorporate data from regulatory filings and macroeconomic indicators to provide a comprehensive view of the competitive landscape.