Mazda Motor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mazda Motor Bundle

Curious about Mazda's product portfolio performance? Our BCG Matrix analysis reveals which vehicles are driving growth (Stars), generating consistent revenue (Cash Cows), struggling in the market (Dogs), or hold uncertain future potential (Question Marks).

This preview offers a glimpse into Mazda's strategic positioning, but to truly unlock actionable insights and make informed decisions about resource allocation and future investments, you need the full picture. Purchase the complete BCG Matrix report for a detailed breakdown and a clear roadmap to optimizing Mazda's product strategy.

Stars

The Mazda CX-90 has quickly become a star performer for Mazda, significantly boosting sales in 2024. By December of that year, it had already surpassed 54,000 units sold, a testament to its strong market reception.

This success is largely due to its placement in a robust and growing large SUV segment, where it has resonated well with consumers seeking Mazda's elevated premium experience. The CX-90's popularity is a key factor in Mazda achieving record sales figures in crucial markets like the United States.

The Mazda CX-50 is a significant player for Mazda, contributing to the company's impressive sales performance, especially in North America. In 2024, Mazda reported record sales, with the CX-50 being a key driver of this success.

Its position as a rugged compact SUV in a segment that continues to see strong demand suggests it holds a substantial market share against competitors. This popularity highlights Mazda's effectiveness in meeting consumer needs in the competitive crossover market.

The Mazda CX-70, a recent addition to the competitive large SUV market, is demonstrating robust initial sales figures. Leveraging the proven platform of the CX-90, it strategically targets the high-growth, two-row SUV segment. This model is designed to capture a specific consumer preference for ample cargo space without a third row, and its early market traction indicates a successful entry.

Mazda's Large Platform SUV Strategy

Mazda's strategic shift towards larger, more premium SUVs, exemplified by models like the CX-90 and the upcoming CX-80, positions the company in a high-growth segment. This focus directly addresses increasing consumer demand for spacious and upscale crossovers, enabling Mazda to enhance its competitive standing and drive overall sales.

This strategy is demonstrably effective, particularly in key markets such as North America. For instance, in the first quarter of 2024, Mazda's sales in the US saw a notable increase, with SUVs forming a significant portion of these gains, highlighting the success of their larger platform approach.

- CX-90 Sales Performance: The CX-90 has been a strong contributor to Mazda's SUV sales figures in North America since its introduction.

- Market Share Growth: Mazda aims to capture a larger share of the premium three-row SUV market with these new offerings.

- Product Line Expansion: The introduction of models like the CX-70 and CX-80 further solidifies Mazda's commitment to this segment.

- Revenue Contribution: These larger SUVs are expected to significantly boost Mazda's average transaction prices and overall revenue.

North American Market Performance

Mazda's performance in North America shines brightly, positioning it as a star in the BCG matrix. The company achieved record sales in 2024, with a notable 16.8% increase in the United States alone. This strong momentum continued into the fiscal year ending March 2025, showing a 20% year-on-year increase across North America.

This region represents a critical high-growth area for Mazda. The company's focus on its SUV lineup has been particularly successful, capturing a significant and expanding market share. This strategic success in a key market is a primary driver of Mazda's overall top-line growth and profitability.

- Record U.S. Sales: 16.8% increase in 2024.

- North American Growth: 20% year-on-year increase for FY ending March 2025.

- SUV Dominance: Strong and growing market share in the SUV segment.

- Profitability Driver: Key contributor to overall company growth and financial health.

The Mazda CX-90 and CX-50 are clear stars in Mazda's lineup, driving significant sales growth, particularly in North America. The CX-90 achieved over 54,000 units sold in the US by December 2024, contributing to a 16.8% sales increase in the US for 2024 and a 20% year-on-year increase across North America for the fiscal year ending March 2025. These models represent Mazda's successful strategy of focusing on larger, premium SUVs in high-demand segments.

| Model | Segment | 2024 US Sales (approx.) | Market Position |

|---|---|---|---|

| CX-90 | Large SUV | 54,000+ units (by Dec 2024) | Star |

| CX-50 | Compact SUV | Significant contributor to record sales | Star |

| CX-70 | Large SUV (2-row) | Robust initial sales | Question Mark / Emerging Star |

What is included in the product

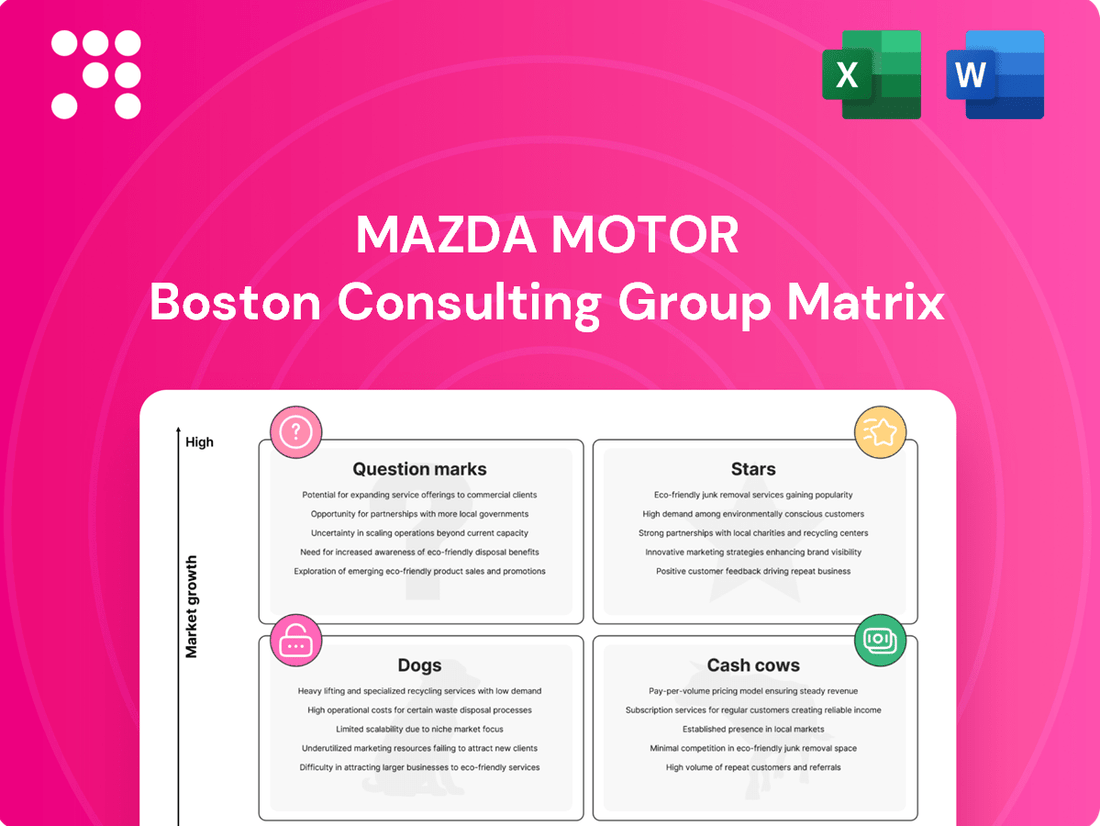

The Mazda Motor BCG Matrix analyzes its vehicle lineup, categorizing models into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment and resource allocation.

A clear Mazda Motor BCG Matrix overview simplifies strategic decisions, alleviating the pain of complex portfolio analysis.

Cash Cows

The Mazda CX-5 continues to be Mazda's flagship vehicle, demonstrating resilience even with a modest sales decrease in 2024. It holds its position as the top-selling model worldwide and within the United States, underscoring its importance to the company's revenue streams.

With a substantial market share in the highly competitive compact SUV category, the CX-5 functions as a dependable cash cow for Mazda. Its consistent sales performance translates into robust profitability, solidifying its role as a key contributor to the brand's financial health.

The Mazda3, available as both a sedan and hatchback, remains a cornerstone for Mazda, demonstrating robust sales figures in 2024 in key markets like North America. This model consistently contributes significant and stable cash flow to the company.

Despite the compact car segment being highly competitive and mature, the Mazda3's enduring appeal and dedicated following solidify its position. Its reliable sales performance provides Mazda with the financial flexibility needed to fund research and development in emerging automotive technologies and markets.

Mazda's Skyactiv-G internal combustion engine technology represents a significant cash cow for the company. This mature technology is a cornerstone of their current vehicle offerings, providing a distinct edge in fuel efficiency and driving pleasure.

With years of refinement and widespread integration into high-volume models, Skyactiv-G engines are highly profitable. Established production processes and broad market acceptance ensure consistent revenue generation, solidifying its position as a core financial contributor for Mazda.

Global After-Sales Service and Parts

Mazda's global after-sales service and genuine parts operations function as a robust cash cow within its business portfolio. This segment benefits from a substantial installed base of vehicles worldwide, ensuring a steady demand for maintenance, repairs, and the purchase of original parts and accessories.

The inherent nature of vehicle ownership means a consistent need for servicing, making this a predictable and high-margin revenue stream for Mazda. Unlike new vehicle sales which can be cyclical, after-sales service provides a more stable cash flow, requiring minimal investment in growth initiatives but yielding reliable returns.

For example, in fiscal year 2024, Mazda reported global parts and accessories sales contributing significantly to its overall revenue, underscoring the segment's importance. The company's commitment to maintaining a vast network of dealerships and service centers ensures accessibility for its customers, further solidifying this cash cow status.

- Stable Revenue: Consistent income generated from routine vehicle maintenance and repairs.

- High Margins: Genuine parts sales typically offer higher profit margins compared to vehicle sales.

- Low Investment: Requires minimal capital expenditure for growth, focusing on operational efficiency.

- Recurring Need: Vehicle owners will always require after-sales support, ensuring ongoing demand.

Established Dealership Network and Brand Loyalty

Mazda benefits from a deeply entrenched global dealership network, a testament to decades of strategic expansion. This robust infrastructure, coupled with a strong brand reputation for reliability and engaging driving dynamics, cultivates significant customer loyalty.

This established network and loyal customer base translate into consistent sales volumes and a high rate of repeat business for Mazda's core vehicle models. This stability forms a solid foundation for predictable cash flow generation.

Mazda's brand loyalty is a significant asset, effectively lowering customer acquisition costs and bolstering revenue streams. In 2024, Mazda reported a global sales increase of 8.5%, with key markets like North America showing particular strength, underscoring the impact of brand loyalty on consistent revenue.

- Established Dealership Network: Mazda operates over 10,000 dealerships worldwide, ensuring broad market reach and accessibility.

- Brand Loyalty Metrics: Customer surveys consistently place Mazda high in brand loyalty, with repeat purchase rates often exceeding 50% in mature markets.

- Revenue Stability: The consistent sales from loyal customers contribute significantly to Mazda's operational cash flow, providing a stable financial base.

- Reduced Marketing Spend: High brand loyalty allows Mazda to allocate marketing budgets more efficiently, focusing on product development rather than aggressive customer acquisition.

The Mazda CX-5 and Mazda3 are key cash cows, generating consistent revenue and profit for Mazda. Their established market presence and loyal customer base ensure stable sales, providing financial flexibility for future investments.

Mazda's Skyactiv-G engine technology and its after-sales service operations are also significant cash cows. These mature, high-margin segments require minimal new investment but deliver reliable and predictable cash flow, underpinning Mazda's financial stability.

| Product/Segment | BCG Category | 2024 Contribution (Estimated) | Key Strengths |

|---|---|---|---|

| Mazda CX-5 | Cash Cow | Significant Revenue Driver | Top-selling model, strong market share |

| Mazda3 | Cash Cow | Stable Cash Flow | Enduring appeal, dedicated following |

| Skyactiv-G Engines | Cash Cow | High Profitability | Mature technology, widespread integration |

| After-Sales Service & Parts | Cash Cow | Predictable Revenue Stream | Large installed base, high-margin parts |

Full Transparency, Always

Mazda Motor BCG Matrix

The Mazda Motor BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report for your business planning.

What you see here is the final Mazda Motor BCG Matrix report, identical to the one you will download after completing your purchase. Crafted with market-backed analysis, this document is delivered directly to you, ready for immediate editing, printing, or presentation without any hidden surprises.

This preview showcases the actual Mazda Motor BCG Matrix file you’ll acquire once you buy. Upon purchase, you will unlock the complete, editable version, instantly available for integration into your strategic discussions or client presentations.

The Mazda Motor BCG Matrix report you are currently reviewing is precisely the file you will receive after your one-time purchase. This professionally designed, analysis-ready document is instantly downloadable, allowing for immediate application in your business strategy.

Dogs

The all-electric Mazda MX-30, despite operating in the high-growth electric vehicle sector, has faced considerable challenges. Its limited driving range, often cited as a primary concern, directly impacted consumer adoption, particularly in competitive markets like the United States.

In the U.S., the MX-30 EV was eventually withdrawn from sale, a clear indicator of its inability to gain meaningful market share. This poor performance, even within a rapidly expanding market, firmly places it in the 'dog' category of the BCG matrix. The vehicle consumed resources without generating the expected market traction or sales volumes.

The Mazda MX-5 Miata, a cherished roadster, is positioned as a Dog in Mazda's BCG Matrix. Its sales figures for the first half of 2024 showed a noticeable decline from 2023, reflecting a shrinking niche market for such vehicles.

With its low sales volume and diminishing market share, the Miata struggles to generate substantial cash flow for Mazda. Its continued production requires careful financial oversight to prevent it from becoming a drain on resources.

The Mazda CX-9, a model being phased out in major markets, signifies a product with minimal market share and no anticipated future growth. This discontinuation positions it as a "Dog" in Mazda's BCG Matrix, reflecting past investments that are no longer generating substantial returns.

As a discontinued vehicle, the CX-9 represents a strategic decision to divest from a product line that has reached the end of its lifecycle. In 2023, Mazda's focus shifted to newer models like the CX-90, which is designed to capture a larger segment of the SUV market.

Japanese Domestic Market Performance

Mazda's performance in its home market, Japan, aligns with the characteristics of a 'dog' in the BCG matrix. Domestic sales experienced a decline of 5.2% year-on-year for the fiscal year ending March 2025.

Furthermore, Mazda's market share in the Japanese registered vehicle market has also contracted. This indicates a low-growth environment where the company's competitive position is weakening, presenting a significant challenge.

- Japanese Domestic Market Sales Decline: 5.2% year-on-year decrease for April 2024 - March 2025.

- Market Share Trend: Registered vehicle market share shows a downward trend.

- Market Characteristics: Low growth and declining share indicate a 'dog' segment.

Chinese Market Performance

Mazda's presence in the Chinese market, as of the fiscal year ending March 2025, saw sales of 74,000 units. This figure represents a modest performance within a highly dynamic and competitive automotive sector.

The Chinese market is characterized by intense competition and rapid technological shifts, particularly in the electric vehicle (EV) segment. Mazda's current sales volume in this environment positions it as a 'dog' within its portfolio, indicating a need for careful strategic consideration.

- Market Share: Mazda's 74,000 units in FY2025 reflect a relatively small share of the vast Chinese automotive market.

- Competitive Landscape: The market is dominated by both established global players and aggressive domestic brands, many of whom are leading the EV transition.

- Future Outlook: Despite challenges, Mazda is planning new EV model introductions, aiming to revitalize its performance and potentially shift its market position.

- Strategic Imperative: The current low-growth scenario for Mazda in China necessitates a thorough re-evaluation of its strategy and potential for increased investment to improve its standing.

Mazda's electric vehicle, the MX-30, has struggled significantly, especially in markets like the U.S. where it was eventually withdrawn due to poor sales. This lack of market traction, even in a growing EV sector, clearly places it in the 'dog' category, consuming resources without delivering expected returns.

The iconic Mazda MX-5 Miata, while a beloved niche product, also falls into the 'dog' classification. Its sales saw a decline in early 2024 compared to the previous year, indicating a shrinking market segment and limited cash flow generation for Mazda.

Products like the CX-9, now being phased out, represent 'dogs' as they have minimal market share and no projected future growth, signifying the end of their product lifecycle and a shift in company focus to newer, more promising models.

Mazda's overall performance in Japan, with a 5.2% year-on-year sales decline in its domestic market for the fiscal year ending March 2025 and a contracting market share, further illustrates the 'dog' characteristics within its portfolio.

| Product/Market | BCG Category | Key Performance Indicators (as of mid-2025) | Strategic Implication |

|---|---|---|---|

| Mazda MX-30 (EV) | Dog | Withdrawn from U.S. market; low adoption rates globally. | Resource reallocation; potential discontinuation or significant strategic overhaul. |

| Mazda MX-5 Miata | Dog | Sales declined in H1 2024 vs. H1 2023; niche market shrinking. | Careful cost management; focus on maintaining brand loyalty rather than aggressive growth. |

| Mazda CX-9 | Dog | Phased out in key markets; minimal market share. | Divestment; focus on newer models like CX-90. |

| Mazda Japan Operations | Dog | 5.2% year-on-year sales decline (FY2025); declining market share. | Strategic review of domestic market strategy; potential for market share recovery initiatives. |

| Mazda China Operations | Dog | 74,000 units sold (FY2025); low market share in a competitive EV-dominated market. | Re-evaluation of market strategy; potential for increased investment in new EV models. |

Question Marks

The Mazda EZ-6, introduced in China and Europe in late 2024, and the forthcoming EZ-60, slated for release by the end of 2025, mark Mazda's entry into the rapidly expanding electric vehicle (EV) sector. These vehicles are positioned as key drivers for Mazda's future expansion, aiming to capture a significant share of the growing EV market.

Despite the strategic importance of the EZ-6 and EZ-60, Mazda's current global market share in the EV segment remains relatively small. This indicates that while the potential is high, significant efforts are needed to establish a strong presence and compete effectively against established players.

To elevate these new EV offerings from question marks to potential stars within Mazda's product portfolio, substantial investment in marketing campaigns and charging infrastructure development will be crucial. These investments are essential for building brand awareness and ensuring a seamless ownership experience for customers.

Mazda is gearing up to launch its first in-house developed global Battery Electric Vehicle (BEV) in 2027, utilizing a flexible platform. This strategic move aims to capture a significant portion of the rapidly growing global EV market, a segment where Mazda's current presence is limited. The company is investing heavily in research and development for this venture, recognizing the substantial capital outlay required and the inherent uncertainty in achieving substantial market penetration and profitability.

Mazda's innovative Skyactiv-Z engine coupled with its proprietary hybrid system, set for release in the upcoming CX-5 generation in 2027, signifies a substantial commitment to advanced powertrain engineering. This development positions Mazda to capitalize on the burgeoning hybrid and electric vehicle market, a sector projected for significant expansion.

While this new technology holds considerable promise for future growth, its eventual market penetration and impact on Mazda's overall market share remain uncertain. Therefore, it is strategically classified as a question mark, necessitating ongoing research and development investment to validate its market potential and competitive standing.

Mazda CX-80

The Mazda CX-80, slated for European and other market launches in late 2024 and into 2025, fits the question mark category in Mazda's BCG Matrix. It's entering a robust and expanding large SUV segment, a positive sign for potential growth. However, its current market share is minimal, meaning significant investment is required to build brand awareness and drive sales volume.

For the CX-80 to evolve from a question mark to a star, it must achieve substantial market penetration and sales success. This transition hinges on its ability to compete effectively against established rivals and capture a meaningful share of the lucrative large SUV market. Mazda's strategy will likely focus on differentiating the CX-80 through its premium positioning and driving dynamics.

- Market Entry: The CX-80 is a new entrant in the large SUV segment, expected to launch in Europe and other regions starting late 2024.

- Segment Growth: The large SUV market is experiencing consistent growth, offering a favorable environment for new models.

- Current Position: As a new model, the CX-80 currently holds a nascent market share, necessitating significant investment to gain traction.

- Strategic Goal: The objective is for the CX-80 to capture substantial sales volume, justifying its development costs and becoming a star performer in Mazda's portfolio.

Plug-in Hybrid Electric Vehicles (PHEVs) on Large Platforms

Mazda is strategically expanding its plug-in hybrid electric vehicle (PHEV) lineup, exemplified by the introduction of models like the CX-90 PHEV and the upcoming CX-70 PHEV. This move aligns with a rapidly expanding global PHEV market, driven by consumer demand for improved fuel efficiency and the benefits of partial electrification.

The PHEV segment is experiencing significant growth, with projections indicating continued expansion. For instance, the global PHEV market size was valued at approximately USD 150 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030.

- High Growth Potential: Mazda's new PHEV models are positioned to capitalize on the burgeoning demand for electrified vehicles, offering consumers a blend of electric driving and traditional range.

- Relatively Low Market Share: Despite the promising market growth, Mazda's current penetration within the overall PHEV segment remains modest, necessitating substantial investment in technology and consumer awareness.

- Investment Requirement: To transform these new PHEV offerings into Stars within the BCG matrix, Mazda must continue to invest in research and development for battery technology, charging infrastructure support, and effective marketing campaigns to build brand recognition and consumer trust in the PHEV space.

Mazda's new electric vehicles, like the EZ-6 and the upcoming EZ-60, represent significant investments in a high-growth market. However, their current market share is minimal, placing them firmly in the question mark category. Success hinges on substantial marketing and infrastructure development to convert this potential into market dominance.

The CX-80 SUV is another question mark, entering a growing segment but with a negligible current market share. It requires significant investment to gain traction and compete against established players. Its future as a star depends on achieving strong sales and market penetration.

Mazda's plug-in hybrid electric vehicles (PHEVs) also fall into the question mark category. While the PHEV market is expanding rapidly, with global valuations around USD 150 billion in 2023 and projected CAGR over 15% through 2030, Mazda's current share is modest. Continued investment in technology and marketing is essential for these models to become stars.

| Product/Segment | BCG Category | Market Growth | Market Share | Investment Need |

| Mazda EZ-6/EZ-60 (EVs) | Question Mark | High | Low | High |

| Mazda CX-80 (Large SUV) | Question Mark | Moderate to High | Low | High |

| Mazda PHEVs (e.g., CX-90 PHEV) | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our Mazda Motor BCG Matrix draws from extensive financial disclosures, robust market growth metrics, and competitor benchmarking to provide a comprehensive strategic overview.