Kiliç Deniz SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kiliç Deniz Bundle

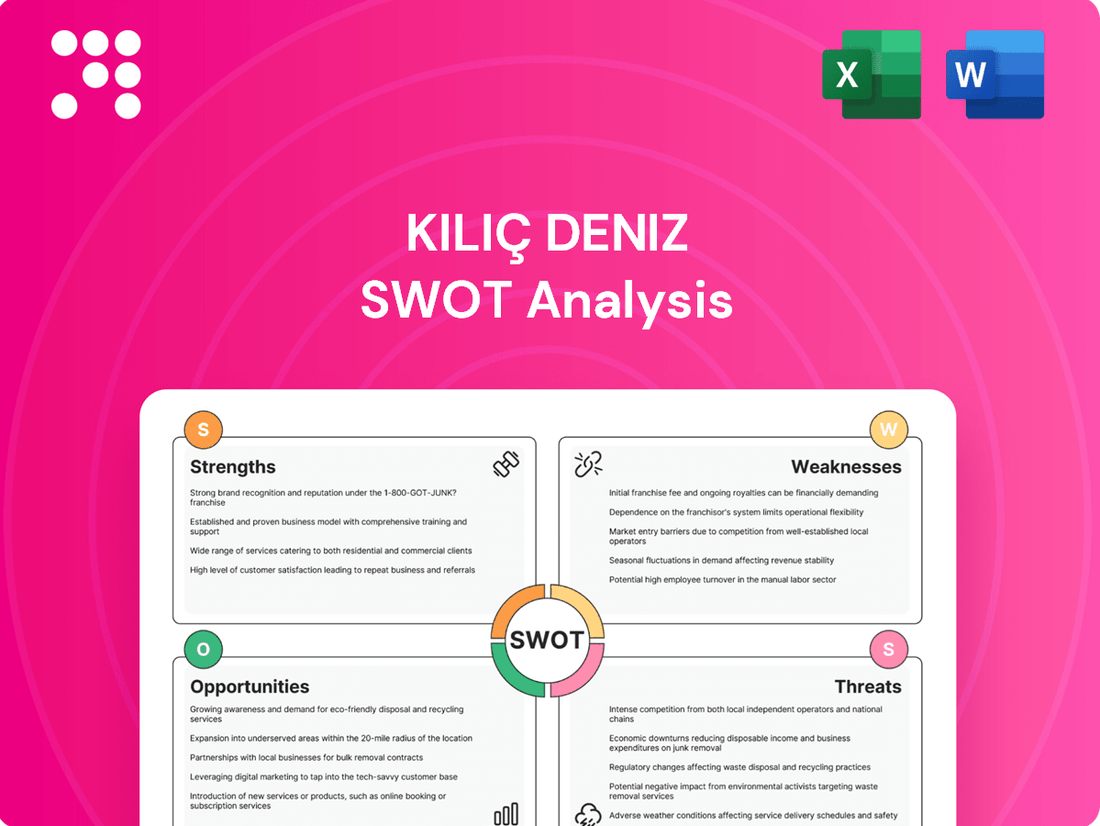

Kiliç Deniz's SWOT analysis reveals a strong market presence and established brand, but also highlights potential challenges in evolving market trends and competitive pressures. Understanding these dynamics is crucial for navigating the future.

Want the full story behind Kiliç Deniz's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Kılıç Deniz’s integrated production cycle, encompassing everything from hatcheries to farming and processing, is a significant strength. This complete vertical integration allows for meticulous quality control at every stage, ensuring a premium product. For instance, in 2023, Kılıç Deniz reported that its own hatcheries supplied 99% of the fry for its farming operations, a testament to this control.

This end-to-end management translates directly into cost efficiencies by minimizing reliance on external suppliers and their associated price fluctuations. It also guarantees a consistent and reliable supply of high-quality fish, a crucial factor for meeting market demand. This operational stability and supply chain resilience are key competitive advantages, particularly in a fluctuating global market.

Kılıç Deniz has achieved remarkable success in international markets, exporting to an impressive 68 countries. This global reach is underscored by a significant 34% increase in exports in 2024, reaching $340 million, contributing to total group exports of $443.3 million.

This consistent export growth and expansive market penetration demonstrate Kılıç Deniz's strong ability to cater to diverse international demands and solidify its global presence. Active participation in major seafood expos further reinforces its standing in the international marketplace.

Kılıç Deniz is Turkey's undisputed leader in aquaculture, consistently holding a significant majority of the nation's production and export volume. This dominance, maintained for over ten years, translates into substantial economies of scale and powerful brand recognition within the Turkish market and internationally.

Commitment to Sustainability and Innovation

Kılıç Deniz demonstrates a strong commitment to sustainability, highlighted by the release of the industry's inaugural Sustainability Report in 2024 and their adherence to certifications such as Best Aquaculture Practices (BAP). This focus on responsible operations underscores their dedication to environmental stewardship.

The company actively invests in research and development, digital transformation, and cutting-edge technologies. Initiatives include advancements in offshore farming and the integration of renewable energy sources, positioning Kılıç Deniz at the forefront of technological progress in the sector.

This dual focus on sustainability and innovation solidifies Kılıç Deniz's reputation as a forward-thinking and responsible leader within the aquaculture industry.

- 2024: Publication of the industry's first Sustainability Report.

- Adoption of Best Aquaculture Practices (BAP) certification.

- Significant investment in R&D, digital transformation, and advanced technologies.

- Focus on offshore farming and renewable energy integration.

Product Diversification and High-Value Species

Kiliç Deniz boasts a strong product portfolio, specializing in popular species like sea bass, sea bream, and trout. This breadth of offerings allows the company to tap into diverse market segments and consumer preferences.

The company's strategic investment in new products, such as Turkish sea salmon (steelhead trout), is a key strength. This forward-looking approach addresses the growing global demand for premium seafood and diversifies revenue streams, mitigating risks associated with reliance on a single product category.

The increasing global appetite for Turkish salmon presents a significant growth opportunity. For instance, in 2023, Turkey's aquaculture exports reached a record $1.3 billion, with salmon playing an increasingly vital role in this expansion, underscoring the market's potential for companies like Kiliç Deniz.

- Diverse Species Portfolio: Specializes in sea bass, sea bream, and trout, catering to broad market demand.

- Investment in New Products: Actively developing Turkish sea salmon (steelhead trout) to capture high-value market segments.

- Market Trend Alignment: Capitalizes on the rising global demand for premium and sustainably farmed fish species.

- Revenue Stream Diversification: Reduces dependence on single products, enhancing financial stability and growth potential.

Kılıç Deniz's integrated production model, from hatchery to processing, ensures stringent quality control and cost efficiencies by minimizing external supplier dependence. This end-to-end management guarantees a consistent, high-quality supply, a crucial advantage in a dynamic global market.

The company's extensive global reach, exporting to 68 countries, is a significant strength, evidenced by a 34% surge in exports in 2024, totaling $340 million. This broad market penetration and consistent growth highlight Kılıç Deniz's adaptability to diverse international demands.

As Turkey's leading aquaculture producer for over a decade, Kılıç Deniz benefits from substantial economies of scale and strong brand recognition. This market dominance provides a solid foundation for continued growth and influence.

Kılıç Deniz's commitment to sustainability, marked by its 2024 Sustainability Report and BAP certification, alongside significant investments in R&D, digital transformation, and offshore farming, positions it as an innovative and responsible industry leader.

The company's diverse product portfolio, including sea bass, sea bream, and trout, is further strengthened by strategic investments in new products like Turkish sea salmon. This diversification capitalizes on growing global demand for premium, sustainably farmed seafood.

What is included in the product

Analyzes Kiliç Deniz’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

The Kiliç Deniz SWOT Analysis offers a structured framework to identify and address critical business challenges, turning potential threats into actionable strategies.

Weaknesses

Kılıç Deniz's reliance on a few key species, primarily sea bass, sea bream, and trout, presents a notable weakness. This concentration, while efficient, leaves the company vulnerable to market price volatility and disease outbreaks that could disproportionately affect these specific species. For instance, a widespread outbreak of a disease affecting sea bass could severely impact a significant portion of Kılıç Deniz's revenue streams.

Kılıç Deniz, as a major exporter, faces significant risks from currency fluctuations. The Turkish Lira's volatility against currencies like the Euro and US Dollar directly impacts its profitability. For instance, if the Lira weakens considerably, while making exports cheaper for foreign buyers, it also reduces the Lira value of earnings repatriated from abroad, potentially squeezing profit margins.

This currency exposure is further complicated by the cost of imported inputs. Many of Kılıç Deniz's raw materials or machinery might be sourced internationally, and a weaker Lira would increase these import costs. In 2024, the Turkish Lira experienced significant depreciation against the US Dollar, with the USD/TRY exchange rate fluctuating around 30-33, highlighting the persistent challenge for companies like Kılıç Deniz to manage imported costs and repatriated earnings.

Kiliç Deniz faces challenges with environmental stewardship, as aquaculture inherently risks waste management issues and potential ecological disruption if not handled with extreme care. Meeting evolving environmental standards and maintaining prestigious certifications such as Best Aquaculture Practices (BAP) and Aquaculture Stewardship Council (ASC) demands ongoing financial commitment and meticulous operational oversight.

These compliance efforts can escalate operational expenses and introduce significant complexity, impacting profitability and requiring proactive adaptation to a stricter regulatory landscape. For instance, in 2023, the aquaculture sector globally saw increased scrutiny on water quality and feed sustainability, potentially translating to higher compliance costs for companies like Kiliç Deniz.

Feed and Resource Intensity

Kiliç Deniz, like much of the aquaculture sector, faces significant challenges related to its feed and resource intensity. The industry's reliance on substantial water volumes and high-quality feed inputs makes it inherently resource-demanding.

A key weakness lies in the dependence on imported fishmeal and fish oil for feed production. This reliance, a common issue in Turkish aquaculture, exposes Kiliç Deniz to the volatility of global feed prices and potential supply chain disruptions. For instance, disruptions in the supply of key ingredients could directly impact production costs and operational stability. This dependency also raises important sustainability questions regarding the long-term viability of current feed sourcing practices.

- Resource Demands: Aquaculture requires substantial water and feed resources.

- Import Dependency: Reliance on imported fishmeal and fish oil for feed.

- Price Volatility: Exposure to fluctuations in global feed ingredient prices.

- Supply Chain Risks: Vulnerability to disruptions in the global feed supply.

Domestic Consumption Limitations

While Turkey's aquaculture sector, including companies like Kiliç Deniz, has seen significant growth in production and exports, domestic fish consumption per capita remains notably lower than the global average. For instance, in 2023, per capita fish consumption in Turkey was estimated to be around 6-7 kg, significantly below the world average of approximately 20 kg. This presents a challenge for Kiliç Deniz, as it means a smaller existing domestic market, potentially limiting immediate growth opportunities within Turkey unless new strategies are implemented to boost local demand.

This lower domestic consumption can be attributed to various factors, including consumer preferences, pricing, and awareness. For Kiliç Deniz, this translates into a weakness by capping the potential for immediate, large-scale expansion within its home market. While export markets offer substantial opportunities, over-reliance on them without a robust domestic base can create vulnerabilities, especially during global economic downturns or trade disruptions.

- Lower Domestic Demand: Turkey's per capita fish consumption lags behind global averages, limiting the immediate addressable market for Kiliç Deniz within the country.

- Untapped Potential vs. Current Reality: Despite the potential to increase local consumption, the current reality limits the company's domestic growth trajectory without significant market development efforts.

- Vulnerability to Export Market Fluctuations: A weaker domestic base makes the company more susceptible to volatility in international markets, highlighting a dependency that could be a weakness.

Kılıç Deniz's concentrated product portfolio, heavily reliant on sea bass, sea bream, and trout, exposes it to significant risks. A disease outbreak or a sharp decline in market prices for these specific species could disproportionately impact its overall revenue. For example, a widespread disease affecting sea bass in 2024 could severely damage a large portion of the company's earnings.

The company's substantial export operations make it highly susceptible to currency fluctuations, particularly the volatility of the Turkish Lira against major currencies like the Euro and US Dollar. This exposure can significantly erode profitability when earnings are repatriated. In 2024, the USD/TRY rate often hovered between 30 and 33, illustrating the ongoing challenge of managing this risk.

Kılıç Deniz faces the challenge of managing the environmental impact inherent in aquaculture. Meeting stringent environmental standards and maintaining certifications like Best Aquaculture Practices (BAP) requires continuous investment and meticulous operational control, potentially increasing costs. Global scrutiny on water quality and feed sustainability in 2023 indicates a trend towards higher compliance burdens.

A key weakness is the company's reliance on imported fishmeal and fish oil for feed production, a common issue in Turkish aquaculture. This dependency exposes Kılıç Deniz to volatile global feed prices and potential supply chain disruptions, impacting both costs and operational stability.

Preview the Actual Deliverable

Kiliç Deniz SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Kiliç Deniz SWOT analysis, complete with all its strategic insights. Once purchased, you'll gain access to the full, detailed report.

Opportunities

The global appetite for healthy, sustainably sourced seafood is on the rise, creating a prime opportunity for Kılıç Deniz. As the world's population expands and more people prioritize nutritious diets, the demand for farmed fish, like sea bass and sea bream which Kılıç Deniz specializes in, is projected to climb significantly. This trend allows Kılıç Deniz to tap into new markets and boost its sales volumes.

Kılıç Deniz is strategically broadening its reach into new international markets, with a significant focus on North America and Asia. This global expansion is further evidenced by their active participation in international seafood expos, a key avenue for showcasing products and forging new partnerships.

This geographical diversification is designed to unlock access to new consumer segments, thereby strengthening revenue streams and mitigating risks associated with over-reliance on any single market. The establishment of a production facility in the Dominican Republic is a crucial element of this strategy, facilitating more efficient and timely access to the lucrative US market.

Kılıç Deniz can leverage ongoing advancements in aquaculture technology, such as offshore farming and Recirculation Aquaculture Systems (RAS), to boost efficiency and cut costs. For instance, the global RAS market is projected to reach $3.5 billion by 2028, indicating significant growth potential for early adopters.

The integration of artificial intelligence and automation presents a key opportunity to optimize production processes and improve fish health monitoring. Companies adopting AI in aquaculture have reported up to a 15% reduction in mortality rates, a crucial factor for profitability.

Investing in these cutting-edge technologies will allow Kılıç Deniz to gain a substantial competitive edge, enhance product quality, and potentially reduce its environmental footprint.

Value-Added Products and Product Diversification

Kiliç Deniz can significantly boost its revenue by developing and marketing more value-added seafood items. Think about offering pre-portioned, filleted, or even smoked fish. This caters to consumer convenience and can command higher prices, increasing profit margins. For instance, the global market for value-added seafood is projected to grow substantially, with some reports indicating a compound annual growth rate of over 5% leading up to 2025.

Expanding the product range is another key opportunity. Continued investment in promising species, such as Turkish sea salmon, allows Kiliç Deniz to tap into new and growing market segments. This diversification not only broadens their customer base but also mitigates risks associated with relying on a single product line. The demand for sustainably farmed fish, like sea salmon, is on the rise, presenting a clear avenue for increased sales and market penetration.

- Develop and market value-added seafood products like filleted and smoked fish to increase profitability and consumer appeal.

- Diversify the product portfolio, including continued investment in species like Turkish sea salmon, to capture new market segments.

- Capitalize on the growing global demand for convenient, ready-to-cook seafood options.

- Leverage the increasing consumer preference for sustainably farmed and premium fish species.

Strategic Acquisitions and Partnerships

Kiliç Deniz's strategic acquisition of Agromey in 2024 is a prime example of how targeted M&A can accelerate growth and bolster vertical integration. This move is projected to significantly increase sales and streamline operations, showcasing the power of strategic acquisitions in the aquaculture sector.

By actively seeking additional partnerships and acquisitions, Kiliç Deniz can further solidify its market standing. These opportunities are key to expanding production capabilities and securing access to cutting-edge technologies or more robust distribution channels, vital for sustained competitive advantage.

- Strategic Acquisitions: The 2024 Agromey acquisition is expected to boost sales and enhance vertical integration, demonstrating a successful growth strategy.

- Market Expansion: Further partnerships and acquisitions can strengthen Kiliç Deniz's market position and broaden its operational reach.

- Capacity Growth: These strategic moves are crucial for increasing production capacity to meet growing demand.

- Technological Advancement: Accessing new technologies through acquisitions or partnerships can drive innovation and efficiency.

Kılıç Deniz is well-positioned to capitalize on the increasing global demand for high-quality, sustainably farmed seafood. The company can further enhance its market penetration by developing and promoting value-added products, such as pre-portioned fillets, which cater to evolving consumer preferences for convenience and higher margins. Expanding its product line to include niche species like Turkish sea salmon also presents a significant opportunity to attract new customer segments and diversify revenue streams. Furthermore, strategic acquisitions, like the 2024 Agromey deal, offer a clear path to accelerated growth, improved vertical integration, and enhanced market standing.

| Opportunity Area | Description | Potential Impact |

|---|---|---|

| Value-Added Products | Develop and market convenient, ready-to-cook seafood items. | Increased profitability, enhanced consumer appeal. |

| Product Diversification | Invest in and promote species like Turkish sea salmon. | Access to new markets, reduced reliance on single products. |

| Strategic Acquisitions | Continue targeted M&A for growth and integration. | Expanded production, technological access, stronger market position. |

| Global Market Expansion | Leverage existing international presence and new facilities. | Increased sales volume, diversified revenue streams. |

Threats

Disease outbreaks in aquaculture farms present a significant threat to Kiliç Deniz, with the potential to cause substantial economic losses and reduced production. For instance, the global aquaculture industry, which includes species Kiliç Deniz cultivates, has faced challenges with viral and bacterial infections impacting yields. Maintaining robust biosecurity protocols and investing in proactive fish health research are therefore critical to mitigating these ongoing risks and protecting the company's operational stability and market reputation.

Kılıç Deniz faces a crowded global aquaculture arena, where both long-standing companies and emerging businesses vie for dominance. Many rivals boast well-developed distribution channels and established brand loyalty, presenting hurdles for Kılıç Deniz in expanding its market presence and offering competitive prices.

For instance, the global farmed shrimp market, a significant segment for aquaculture, is projected to reach approximately $57.5 billion by 2027, indicating substantial growth but also intense competition. Companies like Charoen Pokphand Foods (CPF) and Thai Union Group are major players with extensive global reach and integrated supply chains, setting a high bar for market entry and share acquisition.

To navigate this landscape effectively, Kılıç Deniz must prioritize ongoing innovation in farming techniques, product development, and sustainable practices. Strategic partnerships and a focus on niche markets or premium product offerings could also provide a competitive edge against larger, more diversified competitors.

Warming sea waters, a direct consequence of climate change, pose a significant threat to Kiliç Deniz by endangering sensitive fish species. This necessitates substantial investment in costly mitigation measures, such as advanced cooling systems for aquaculture facilities, impacting operational budgets. For instance, studies in the Mediterranean, a key region for aquaculture, indicate rising sea surface temperatures by over 1.5°C in some areas over the past few decades, directly affecting species like sea bream and sea bass.

Beyond temperature shifts, other environmental factors and the growing imperative for sustainable practices present ongoing challenges. Kiliç Deniz must continually adapt strategies to minimize its ecological footprint, which can involve adopting new feed formulations, improving waste management, and exploring renewable energy sources for its operations. Failure to do so could lead to reputational damage and potential regulatory penalties, especially as consumer demand for sustainably sourced seafood intensifies.

Changes in Regulatory Landscape and Trade Policies

Changes in the regulatory landscape, particularly concerning environmental impact and food safety, pose a significant threat to Kılıç Deniz. For instance, stricter EU regulations on aquaculture, which came into effect in 2024, could necessitate substantial upgrades to their farming and processing facilities. These changes might also impact export capabilities, as non-compliance could lead to market access restrictions.

Evolving international trade policies, including potential tariffs or quotas on seafood imports, present another challenge. For example, if key export markets implement new trade barriers in 2025, Kılıç Deniz's profitability could be directly affected. Adapting to these shifts may require costly adjustments to supply chains and market strategies.

- Environmental Regulations: Increased compliance costs due to evolving EU environmental standards for aquaculture operations.

- Food Safety Standards: Potential for market rejection or increased testing requirements for products failing to meet updated international food safety protocols.

- Trade Policy Shifts: Risk of higher tariffs or quotas on Turkish seafood exports in key markets, impacting Kılıç Deniz's competitive pricing and sales volumes.

- Investment Needs: Requirement for significant capital expenditure to upgrade facilities and processes to meet new regulatory demands.

Fluctuations in Feed Prices and Supply Chain Disruptions

The aquaculture sector, including companies like Kiliç Deniz, faces significant threats from volatile feed prices. Key ingredients like fishmeal and fish oil are subject to global market forces, and their costs can surge unexpectedly. For instance, in early 2024, the price of fishmeal saw a notable uptick due to reduced catches in major producing regions, directly impacting feed formulation expenses.

Supply chain disruptions further exacerbate these cost pressures. Issues ranging from shipping delays to geopolitical instability can impede the timely and cost-effective delivery of essential feed components and other operational inputs. This unpredictability makes it challenging for Kiliç Deniz to maintain stable production costs and predictable profit margins.

These price fluctuations and supply chain vulnerabilities can significantly erode profitability. For example, a 10% increase in fishmeal prices, a common occurrence in recent years, can translate to a substantial rise in overall production costs for an aquaculture operation. Kiliç Deniz, like its peers, must navigate these external economic and logistical challenges.

- Feed Cost Volatility: Raw material prices for fish feed, such as fishmeal and fish oil, are inherently unstable.

- Supply Chain Risks: Global disruptions can lead to increased costs and delays in acquiring feed and other vital inputs.

- Profitability Impact: Fluctuations in input costs directly affect production expenses and Kiliç Deniz's bottom line.

- Operational Input Dependence: Beyond feed, other operational necessities are also vulnerable to price spikes and availability issues.

Kiliç Deniz faces considerable threats from evolving environmental regulations and stringent food safety standards, particularly within its key export markets like the European Union. For instance, new EU directives implemented in 2024 mandate enhanced traceability and sustainability reporting, potentially increasing compliance costs and requiring facility upgrades. Failure to meet these evolving international food safety protocols could lead to market access restrictions or product rejections, impacting sales volumes and profitability.

Shifting international trade policies, including the potential for new tariffs or quotas on seafood imports in 2025, also pose a significant risk. These trade barriers could directly affect Kiliç Deniz's competitive pricing and overall export revenue, necessitating agile adjustments to supply chain management and market strategies.

The company is also vulnerable to volatile feed prices, with key inputs like fishmeal and fish oil subject to global market fluctuations. For example, early 2024 saw a notable increase in fishmeal prices due to reduced catches, directly impacting feed formulation costs. Coupled with supply chain disruptions that can delay essential inputs, these factors create unpredictability in production expenses and challenge profit margin stability.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including Kiliç Deniz's official financial reports, comprehensive market research on the aquaculture sector, and expert opinions from industry analysts.