Kiliç Deniz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kiliç Deniz Bundle

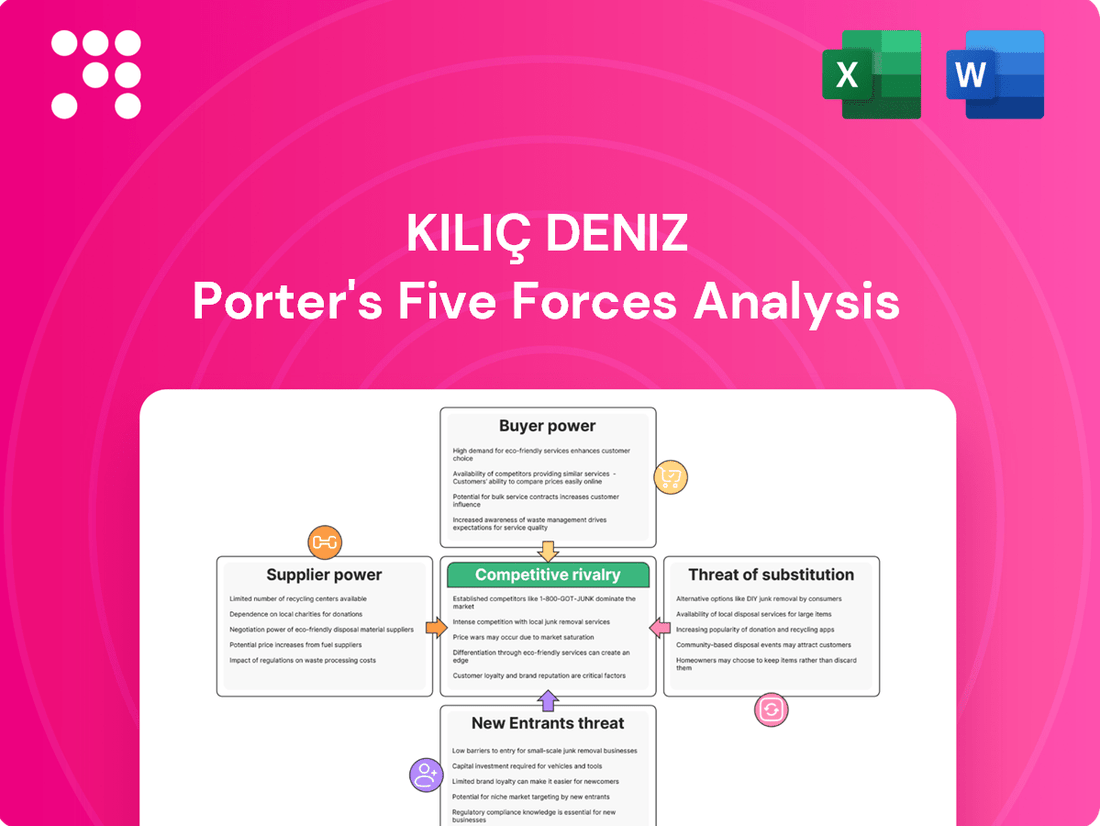

Kiliç Deniz operates within a dynamic market, where understanding the five key competitive forces is crucial for strategic success. Our analysis delves into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential impact of substitute products. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Kiliç Deniz’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The aquaculture feed industry is highly concentrated, with a few dominant companies controlling a significant portion of the market. This concentration grants these suppliers considerable power in setting prices and managing the availability of feed. For Kılıç Deniz, this means that while they are vertically integrated, their reliance on these specialized feed formulations, essential for optimal fish health and growth, makes them susceptible to supplier leverage.

In 2024, the global aquaculture feed market size was valued at approximately $220 billion, with projections indicating continued growth. The dominance of a few key players within this substantial market means Kılıç Deniz faces potential challenges in negotiating input costs. Limited alternative suppliers for highly specialized feed ingredients can create vulnerabilities in their supply chain, potentially impacting operational efficiency and profitability.

Suppliers of advanced aquaculture technologies, like recirculating aquaculture systems (RAS) components and smart feeding systems, wield significant influence. Kılıç Deniz's reliance on these specialized providers for its technological edge, including genetic improvement solutions, underscores this power.

The proprietary nature of certain technologies creates a barrier to finding readily available alternatives, thereby increasing the costs and complexity associated with switching suppliers. This dependence can translate into less favorable terms for Kılıç Deniz.

Kılıç Deniz relies on specialized labor like veterinarians and aquaculture engineers for its integrated production. The scarcity of these skilled professionals directly impacts their bargaining power, potentially driving up operational costs and affecting efficiency.

Regulatory Compliance Inputs

Kılıç Deniz's reliance on specialized inputs for environmental compliance, such as sustainable aquaculture technologies and water treatment solutions, grants significant bargaining power to suppliers in these niche markets. The company's commitment to sustainability, highlighted in its 2024 reporting, means these suppliers are essential partners.

Suppliers offering BAP (Best Aquaculture Practices) certifications and related services also hold considerable sway. Kılıç Deniz's adherence to these rigorous standards, a key component of its operational strategy, makes these certification bodies and their associated suppliers influential.

- Environmental Regulations: Suppliers of advanced water treatment and sustainable feed technologies are critical for meeting evolving environmental standards.

- Sustainability Certifications: Companies providing BAP certification services and expertise can leverage their role in market access and brand reputation.

- Supplier Dependence: Kılıç Deniz's strategic focus on sustainability increases its dependence on suppliers who can meet and verify these high standards.

Geopolitical and Logistical Factors

Global supply chain disruptions, exacerbated by geopolitical events, have a significant impact on Kılıç Deniz's operational costs. For instance, the ongoing conflicts and trade tensions throughout 2024 have led to increased shipping expenses and delays in the delivery of essential inputs like fish feed. This volatility directly empowers suppliers who can guarantee consistent and timely access to these critical materials.

Fluctuations in energy prices, a key component of transportation and operational costs, further amplify the bargaining power of suppliers. As of mid-2024, global oil prices have remained elevated, increasing the cost of transporting raw materials and finished goods. This situation strengthens the position of energy suppliers and, consequently, those input suppliers who can absorb or mitigate these rising energy-related expenses.

- Increased Transportation Costs: Global shipping rates saw significant volatility in 2024, with some routes experiencing double-digit percentage increases due to fuel surcharges and capacity constraints.

- Geopolitical Impact on Feed Supply: Disruptions in key agricultural regions, affecting the production of fishmeal and soy, have tightened supply and increased Kılıç Deniz's reliance on a smaller pool of dependable suppliers.

- Energy Price Sensitivity: A 10% increase in crude oil prices can translate to a 2-3% rise in overall logistics costs for companies like Kılıç Deniz, highlighting the leverage of energy providers.

The concentration within the aquaculture feed industry, with a few dominant companies, grants suppliers significant leverage over pricing and availability for Kılıç Deniz. This is underscored by the global aquaculture feed market's valuation of approximately $220 billion in 2024, where a limited number of key players can dictate terms. Similarly, suppliers of specialized technologies, such as advanced recirculating aquaculture systems (RAS) components, hold considerable power due to the proprietary nature of their offerings, making alternatives costly and complex to source.

| Supplier Category | Bargaining Power Factor | Impact on Kılıç Deniz |

|---|---|---|

| Aquaculture Feed Producers | Market Concentration, Proprietary Formulations | Potential for higher input costs, supply chain vulnerability |

| Technology Providers (RAS, Smart Feeding) | Proprietary Technology, High Switching Costs | Increased reliance, less favorable terms |

| Skilled Labor (Veterinarians, Engineers) | Scarcity of Specialized Skills | Elevated operational costs, potential efficiency impacts |

| Environmental Compliance Suppliers | Niche Market, Essential for Sustainability | Increased influence due to regulatory and brand importance |

| Certification Bodies (BAP) | Market Access, Brand Reputation | Leverage through adherence to rigorous standards |

What is included in the product

This analysis meticulously examines the competitive landscape for Kiliç Deniz, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly identify and address competitive threats with a visual breakdown of each Porter's Five Force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Kılıç Deniz's extensive international customer base significantly dilutes individual customer bargaining power. By exporting to diverse markets like Russia, Italy, the Netherlands, Greece, and the UK, the company avoids dependence on any single buyer or region. This broad geographical reach, exemplified by reaching 68 countries in 2024, inherently limits the leverage any one customer can exert.

Consumers in key markets, particularly the European Union, are showing increased price sensitivity. This is largely due to ongoing economic pressures and inflation experienced throughout 2023 and into 2024, impacting consumer spending power.

This heightened price sensitivity provides significant leverage to large retailers and food service chains. They can more effectively negotiate lower prices from suppliers like Kılıç Deniz, as consumers actively seek out more budget-friendly options.

Furthermore, a noticeable trend of consumers opting for more affordable or processed seafood products signals a potential for trading down. This shift in consumer preference further strengthens the bargaining power of customers by increasing their willingness to switch to lower-cost alternatives.

Consumers increasingly favor seafood that is sustainably sourced and carries certifications, a trend particularly strong in European markets. Kılıç Deniz's commitment to sustainability, evidenced by certifications like Best Aquaculture Practices (BAP), aligns with this preference, offering a competitive edge.

This growing demand for eco-friendly products can, however, empower customers. Large buyers, in particular, can use their purchasing power to negotiate more favorable pricing or insist on specific sustainability credentials, thereby amplifying their influence over Kılıç Deniz.

Availability of Substitutes for Customers

Customers possess significant bargaining power due to the wide array of protein alternatives available. Beyond Kılıç Deniz's farmed sea bass, sea bream, and trout, consumers can readily choose from other seafood options, such as wild-caught fish or farmed salmon, as well as poultry and red meat. This accessibility to substitutes, coupled with shifting consumer preferences, empowers buyers to seek more competitive pricing if Kılıç Deniz's offerings become less attractive. For instance, while the market for sea bass and sea bream is expanding, so too are other segments within the broader seafood industry, intensifying competitive pressures.

The availability of substitutes directly impacts Kılıç Deniz's pricing flexibility. In 2024, the global seafood market continued to see robust growth, with aquaculture playing an increasingly vital role. However, this growth is accompanied by a diversification of protein sources accessible to consumers. For example, the global poultry market, a key substitute, is projected to reach over 150 million metric tons by 2025, offering a readily available and often more economical alternative to farmed fish.

- Broad Protein Alternatives: Consumers can opt for wild-caught fish, other farmed species like salmon, poultry, or red meat, providing a wide range of choices.

- Price Sensitivity: The availability of substitutes makes customers more sensitive to price increases from Kılıç Deniz, as they can easily switch to alternatives.

- Market Diversification: While Kılıç Deniz operates in growing sea bass and sea bream markets, other seafood categories and protein sources are also expanding, increasing competitive options.

- Evolving Consumer Tastes: Changing consumer preferences for different protein types can further shift demand away from Kılıç Deniz's core products if substitutes become more appealing.

Retailer and Food Service Concentration

The concentration of buyers, particularly large supermarket chains and food service distributors, significantly amplifies their bargaining power. These entities can leverage their substantial purchasing volume to negotiate favorable pricing, stringent delivery schedules, and precise product specifications from suppliers like Kılıç Deniz. For instance, in 2024, major European grocery retailers continued to consolidate, with a few dominant players accounting for over 70% of market share in several key countries, giving them considerable leverage over their supply chains.

While Kılıç Deniz operates globally, the presence of a few dominant buyers in specific regional markets can create concentrated points of negotiation. These key customers often demand consistent, high-quality supply and are highly sensitive to competitive pricing. In 2023, the global food service market saw continued growth, with large chains like McDonald's and Starbucks representing massive procurement opportunities, but also demanding significant concessions from their seafood suppliers.

- Dominant Retailers: Large supermarket chains wield significant influence due to their market share, impacting supplier pricing and terms.

- Food Service Power: Major food service distributors and restaurant chains can dictate terms based on their extensive reach and volume.

- Regional Concentration: Even in a global business, a few key buyers in a particular region can exert disproportionate pressure.

- Demand for Consistency: Large buyers prioritize reliable supply and competitive pricing, often using this as a negotiation tool.

The bargaining power of customers for Kılıç Deniz is multifaceted, influenced by price sensitivity, the availability of substitutes, and buyer concentration. While Kılıç Deniz's global reach in 2024, serving 68 countries, mitigates individual customer leverage, broader market trends such as inflation and a consumer shift towards more affordable protein options empower buyers. The presence of numerous substitutes, from other seafood species to poultry, further limits Kılıç Deniz's pricing flexibility, especially as these alternative markets also expand. Moreover, the consolidation of major buyers, particularly large supermarket chains and food service providers, grants them significant negotiation power due to their substantial purchasing volumes.

| Factor | Impact on Kılıç Deniz | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Price Sensitivity | Increases customer leverage | Consumers in EU markets show heightened sensitivity due to inflation. |

| Availability of Substitutes | Limits pricing flexibility | Global poultry market projected to exceed 150 million metric tons by 2025. |

| Buyer Concentration | Amplifies negotiation power | Major European retailers hold over 70% market share in key countries. |

Preview Before You Purchase

Kiliç Deniz Porter's Five Forces Analysis

This preview shows the exact Kiliç Deniz Porter's Five Forces Analysis document you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This is the complete, ready-to-use analysis file, professionally formatted for your immediate needs.

Rivalry Among Competitors

The Turkish aquaculture industry is characterized by intense competition, with many firms actively seeking market dominance. Kılıç Deniz, despite its leading position, faces significant rivalry from other prominent companies within Turkey, such as Gümüşdoğa Fish. The sector's consolidation is also evident, with Kılıç Holding recently acquiring Agromey, further concentrating market power among fewer, larger entities.

Globally, Kılıç Deniz's competitive landscape is further amplified by major producers in Greece and Spain, particularly in the sea bass and sea bream markets. These international players represent a substantial challenge, impacting pricing and market access for Turkish exporters. For instance, in 2023, Greece remained a top European producer of sea bass and sea bream, underscoring the strength of its industry.

The Turkish aquaculture sector has seen robust growth, with production volumes expanding considerably over the past twenty years, alongside a notable increase in exports. This expansion creates opportunities for new entrants and existing players to grow their operations without necessarily engaging in intense direct competition for market share.

However, this burgeoning market also attracts new competitors, intensifying the rivalry. Leading companies are pursuing consolidation strategies to achieve greater economies of scale and solidify their market positions. A prime example of this trend is Kılıç Deniz's acquisition of Agromey in 2024, a move signaling a strategic push towards consolidation among key industry participants.

Kılıç Deniz operates in a market where its core products, sea bass, sea bream, and trout, are largely seen as commodities. This makes it difficult to stand out, as competitors often offer very similar species, intensifying price-based competition. For instance, the global aquaculture market, while growing, sees many players focusing on these staple fish, meaning consumers can easily switch suppliers based on cost.

To counter this, Kılıç Deniz actively pursues differentiation strategies. They emphasize product quality, often backed by sustainability certifications, which can appeal to a growing segment of environmentally conscious consumers. Furthermore, the company develops value-added products, such as pre-portioned Turkish salmon fillets, offering convenience and a perceived higher quality that moves beyond basic commodity pricing.

High Fixed Costs and Exit Barriers

The aquaculture industry, like Kiliç Deniz operates within, is characterized by substantial fixed costs. These include significant investments in hatcheries, specialized farming equipment, and processing facilities. For example, establishing a modern salmon farm can require millions of dollars in initial capital outlay.

These high capital requirements act as considerable exit barriers. Companies are often compelled to continue operations, even when facing reduced profitability, to avoid abandoning their sunk costs. This persistence can fuel aggressive competition and contribute to market oversupply.

- High Capital Investment: Aquaculture requires significant upfront capital for facilities and technology.

- Exit Barriers: Substantial sunk costs make it difficult and costly for firms to leave the market.

- Intensified Rivalry: Persistent firms may engage in price wars or overproduction to maintain market share.

Export-Driven Competition

Turkey is a significant player in the global aquaculture market, particularly for sea bass and sea bream. Kılıç Deniz, as a major exporter, faces intense competition from other producing nations that also supply these popular species to international buyers. Global demand and pricing are thus heavily influenced by the aggregate supply from all key exporting countries, creating a dynamic and often price-sensitive environment.

Kılıç Deniz's robust export strategy places it in direct contention with non-Turkish producers within its primary target markets. This export-driven rivalry means that the company’s success is not only dependent on its operational efficiency but also on its ability to navigate and outperform international competitors in terms of quality, price, and market access.

- Global Aquaculture Market Share: In 2024, Turkey's contribution to the European sea bass and sea bream market remained substantial, with exports often exceeding 50,000 tonnes annually for these species.

- Key Export Competitors: Major international competitors for Turkish aquaculture products include Greece, Spain, and Italy, each with established export channels and significant production volumes.

- Price Sensitivity: Fluctuations in global supply, driven by major exporters, can lead to price volatility in international markets, impacting Kılıç Deniz's revenue and profit margins.

- Market Access Challenges: Gaining and maintaining access to key import markets often involves navigating complex regulatory environments and meeting diverse consumer preferences, areas where competitors also vie for dominance.

The competitive rivalry for Kılıç Deniz is intense, both domestically and internationally, primarily due to the commoditized nature of its core products like sea bass and sea bream. This similarity among offerings from various producers forces a strong emphasis on price competition. The Turkish market itself sees significant competition, with companies like Gümüşdoğa Fish being key rivals, and consolidation, such as Kılıç Holding's 2024 acquisition of Agromey, is reshaping the competitive landscape by concentrating market power among fewer, larger entities.

Internationally, Kılıç Deniz faces formidable competition from established aquaculture powerhouses in Greece and Spain, particularly in the lucrative sea bass and sea bream segments. These nations are significant global suppliers, influencing international pricing and market access for Turkish exporters. For example, Greece consistently ranks as a top European producer of these species, demonstrating the competitive pressure Kılıç Deniz must contend with in export markets.

| Competitor Type | Key Players/Regions | Impact on Kılıç Deniz |

|---|---|---|

| Domestic | Gümüşdoğa Fish, Other Turkish Producers | Price competition, market share battles |

| International | Greece, Spain, Italy | Global pricing influence, market access challenges, quality benchmarks |

SSubstitutes Threaten

The most direct substitutes for Kılıç Deniz's farmed sea bass, sea bream, and trout are other readily available seafood options. This includes wild-caught fish, as well as farmed species like salmon, shrimp, and cod, which are popular in key markets. For instance, in 2024, the global salmon market alone was valued at over $50 billion, indicating a significant alternative for consumers.

Consumer preferences for specific tastes, textures, and price points can drive shifts between these seafood categories. For example, if the price of farmed sea bass increases significantly, consumers might opt for more affordable wild-caught mackerel or farmed tilapia, which can be substantially cheaper per kilogram.

Poultry, beef, and pork are significant substitutes for consumers seeking protein, often competing with seafood on factors like price, convenience, and ingrained cultural preferences. For instance, in 2024, the average retail price for boneless, skinless chicken breast remained considerably lower than many fish varieties, making it an attractive alternative during periods of economic uncertainty or elevated seafood costs.

The burgeoning trend of plant-based diets presents a significant emerging threat to the seafood industry. As more consumers prioritize health and environmental concerns, the demand for plant-based meat and seafood alternatives is on the rise. For instance, the global plant-based food market was valued at approximately $22.6 billion in 2023 and is projected to grow substantially, potentially impacting seafood consumption.

Processed and Canned Seafood

Processed and canned seafood, including options beyond sea bass and sea bream, represent a significant threat of substitutes for Kiliç Deniz. These alternatives offer consumers greater convenience and extended shelf life, often at a more accessible price point and with minimal preparation required, directly competing with fresh seafood offerings.

The European Union market, for instance, has shown a trend towards reduced at-home consumption of fresh seafood, with a noticeable uptick in the purchase and consumption of frozen and tinned seafood products. This shift indicates a growing consumer preference for the convenience and cost-effectiveness associated with processed seafood options.

- Price Sensitivity: Canned tuna, sardines, and mackerel are often priced considerably lower than fresh sea bass or sea bream, making them an attractive option for budget-conscious consumers.

- Convenience Factor: Ready-to-eat canned seafood requires no thawing or extensive preparation, appealing to busy consumers seeking quick meal solutions.

- Market Trends: In 2023, the global canned seafood market was valued at approximately USD 27.5 billion, demonstrating its substantial presence and consumer demand.

Geographical and Culinary Substitutes

Different regions boast unique culinary traditions and preferences for fish species, influencing the threat of substitutes. In markets where sea bass, sea bream, and trout are not traditional staples, consumers readily turn to local fish varieties or alternative protein sources. For instance, in many Asian markets, freshwater fish like tilapia or carp are more commonly consumed than sea bass, presenting a direct substitute. Similarly, in regions with strong red meat or poultry consumption, these proteins serve as significant substitutes for farmed fish.

Kılıç Deniz must continuously adapt its product offerings and marketing strategies to remain competitive across these diverse international palates. This involves understanding local tastes and potentially introducing or promoting species that align with regional preferences. For example, while Kılıç Deniz is a major producer of sea bass and sea bream, which are popular in Europe, expanding into markets where these are less established requires a different approach. The global aquaculture market is projected to reach approximately $294 billion by 2027, indicating significant growth, but also highlighting the need for market-specific strategies to counter substitution threats.

- Regional Preferences: Culinary traditions dictate the acceptance of specific fish species, with local varieties often preferred over imported or farmed options in many markets.

- Protein Alternatives: The availability and affordability of other protein sources like poultry, beef, pork, and even plant-based alternatives pose a significant competitive threat to farmed fish.

- Market Adaptation: Kılıç Deniz's success in international markets hinges on its ability to tailor its product portfolio and marketing messages to resonate with diverse consumer preferences and existing dietary habits.

- Data Point: In 2023, global per capita fish consumption reached an estimated 20.7 kilograms, but the specific species consumed varied dramatically by region, underscoring the importance of understanding local demand.

The threat of substitutes for Kılıç Deniz's farmed fish is substantial, encompassing a wide range of alternatives from other seafood to entirely different protein sources. Consumers can easily switch to wild-caught fish, other farmed species like salmon or shrimp, or even non-seafood proteins such as chicken, beef, and pork, especially if price or availability shifts. The growing plant-based food market also presents an increasing substitution challenge.

These substitutes compete on price, convenience, taste, and ingrained consumer habits. For example, the affordability of chicken, which in 2024 remained significantly lower per kilogram than many farmed fish varieties, makes it a strong alternative. Similarly, processed and canned seafood offers convenience and a longer shelf life, appealing to consumers seeking quick meal solutions and contributing to a global canned seafood market valued at approximately USD 27.5 billion in 2023.

| Substitute Category | Key Examples | Competitive Factors | Market Relevance (2024 Data/Trends) |

|---|---|---|---|

| Other Seafood | Wild-caught fish (mackerel, tilapia), Salmon, Shrimp, Cod | Price, Taste, Texture, Availability | Global salmon market valued over $50 billion; regional preferences for local species. |

| Other Proteins | Chicken, Beef, Pork | Price, Convenience, Cultural Preference | Chicken remains considerably cheaper than many fish varieties. |

| Plant-Based Alternatives | Plant-based meat and seafood | Health, Environmental Concerns, Novelty | Global plant-based food market projected for substantial growth from its 2023 valuation of ~$22.6 billion. |

| Processed/Canned Seafood | Canned tuna, sardines, mackerel | Price, Convenience, Shelf Life | Global canned seafood market valued at ~$27.5 billion in 2023; growing at-home consumption of frozen/tinned products in EU. |

Entrants Threaten

The threat of new entrants in the aquaculture sector, particularly for a company like Kılıç Deniz, is significantly mitigated by the substantial capital investment required. Establishing a complete aquaculture operation, encompassing everything from hatcheries to sophisticated processing plants, demands a massive upfront financial commitment. This high barrier to entry naturally deters many potential new players from even considering the market.

Kılıç Deniz benefits from considerable economies of scale due to its existing size and vertical integration. This means they can produce at a lower cost per unit than a smaller, less established competitor. New entrants would need to secure enormous funding to match these production efficiencies and achieve cost competitiveness from the outset, which is a formidable challenge.

Stringent regulatory requirements pose a significant threat to new entrants in the aquaculture sector. The industry faces a complex web of evolving environmental regulations, licensing mandates, and rigorous food safety standards. These rules are crucial for promoting sustainability and ensuring product quality, but they create substantial hurdles for newcomers. For instance, Türkiye's fisheries regulations are frequently updated to safeguard resource utilization, adding another layer of complexity for potential investors.

Kılıç Deniz boasts a formidable presence with established international distribution networks spanning 68 countries. New entrants would find it incredibly difficult to replicate these extensive relationships with retailers, distributors, and importers, which are vital for securing market access and achieving significant sales volumes. The company’s long-standing trade partnerships and strong brand recognition further solidify this barrier.

Technological Advancements and Expertise

Technological advancements are a significant barrier to entry in modern aquaculture. Kılıç Deniz leverages sophisticated technologies like precision aquaculture, smart feeding systems, and advanced genetic improvement programs. These innovations, which Kılıç Deniz actively invests in through R&D and digital transformation, demand substantial expertise and capital, making it difficult for new entrants to compete effectively.

The adoption of these cutting-edge technologies not only enhances operational efficiency but also plays a crucial role in minimizing environmental impact, a factor increasingly important for market acceptance and regulatory compliance. For instance, precision feeding systems can reduce feed waste by up to 10%, directly impacting cost-effectiveness and sustainability.

- High Capital Investment: Acquiring and implementing advanced aquaculture technologies requires significant upfront capital, deterring smaller or less-funded new entrants.

- Specialized Expertise: Operating and maintaining these sophisticated systems necessitates a skilled workforce with specialized knowledge in areas like data analytics and biological sciences.

- R&D Intensity: Companies like Kılıç Deniz that continuously invest in research and development to refine these technologies create an ongoing technological gap that new players struggle to bridge.

- Efficiency and Sustainability Gains: The operational efficiencies and improved sustainability profiles achieved through these technologies offer a competitive advantage that is hard for newcomers to replicate without similar investment.

Brand Loyalty and Established Reputation

Kılıç Deniz has cultivated a robust brand loyalty over decades as Turkey's premier aquaculture producer, recognized for unwavering quality and dependability. New competitors face a steep challenge, requiring substantial investment in marketing and considerable time to foster comparable customer trust, particularly within the demanding global seafood sector. In 2023, Kılıç Deniz maintained its status as a leading exporter, underscoring its deeply entrenched market presence.

- Decades of operation

- Strong brand recognition for quality

- Significant marketing investment required for new entrants

- Established export leadership

The threat of new entrants for Kılıç Deniz is considerably low due to multiple significant barriers. High capital requirements for establishing operations, coupled with the need for specialized technological expertise and ongoing R&D investment, deter potential competitors. Furthermore, stringent regulatory environments and the established brand loyalty and extensive distribution networks of Kılıç Deniz create formidable challenges for any new player seeking to enter the market.

| Barrier | Impact on New Entrants | Kılıç Deniz Advantage |

|---|---|---|

| Capital Investment | Very High | Established infrastructure, economies of scale |

| Technology & Expertise | High | Advanced R&D, skilled workforce |

| Regulations | High | Experienced in compliance, established licenses |

| Brand & Distribution | Very High | Global reach (68 countries), strong customer trust |

Porter's Five Forces Analysis Data Sources

Our Kiliç Deniz Porter's Five Forces analysis is built upon a foundation of industry-specific market research reports, financial statements from key players, and regulatory filings to provide a comprehensive view of the competitive landscape.