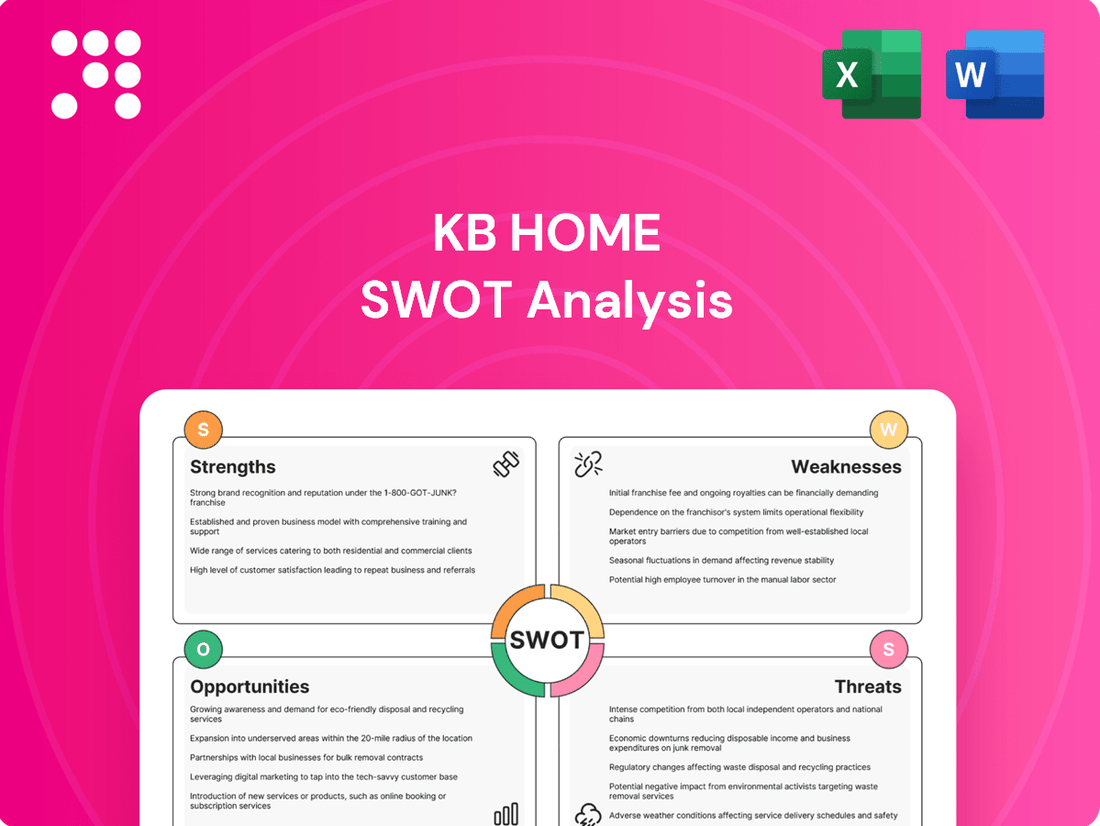

KB Home SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KB Home Bundle

KB Home, a prominent builder, navigates a dynamic housing market, facing both significant opportunities and potential challenges. Understanding their internal strengths and weaknesses, alongside external threats and opportunities, is crucial for any investor or strategist.

Want the full story behind KB Home's competitive advantages, market vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

KB Home's signature Built-to-Order model is a significant strength, allowing customers to personalize their homes extensively, from initial floor plans to interior finishes. This deep customization fosters strong customer satisfaction and creates a distinct market advantage.

This customer-focused approach translates into tangible financial benefits. For instance, in fiscal year 2023, KB Home reported a 6% increase in average selling price, partly attributed to the value customers place on personalized options, reaching $476,000.

Furthermore, the disciplined operational execution inherent in the Built-to-Order system helps manage production costs effectively, contributing to the company's competitive pricing strategy and profitability.

KB Home stands out with its strong commitment to sustainability and energy efficiency, a key differentiator in the housing market. This focus resonates with a growing segment of buyers prioritizing eco-friendly living and long-term cost savings.

The company's leadership is evident in its extensive portfolio of ENERGY STAR certified homes, exceeding 200,000. This track record, combined with an average Home Energy Rating System (HERS) Index score of 45, demonstrates tangible results in reducing energy consumption for homeowners.

KB Home demonstrates a robust financial standing, characterized by strong liquidity and a strategic emphasis on lowering its debt-to-capital ratio, even amidst fluctuating market conditions. This commitment to financial health is a significant strength.

The company's capital allocation strategy is notably shareholder-centric, evidenced by consistent share repurchase programs. This approach signals confidence in its future prospects and a dedication to enhancing shareholder value.

Established Reputation and Market Presence

KB Home benefits from an established reputation built over decades of delivering quality homes, fostering significant trust with its customer base. This strong brand recognition is a key asset in the competitive housing market.

As one of the largest homebuilders in the United States, KB Home commands a substantial market presence, operating in numerous states. This widespread operational footprint allows for diversified revenue streams and broad customer reach.

- Established Brand Trust: Decades of consistent quality have cemented KB Home's reputation, leading to strong buyer confidence.

- Significant Market Share: KB Home is recognized as one of the top homebuilders nationwide, with operations spanning multiple key U.S. markets.

- Extensive Geographic Reach: Its presence in numerous states provides a buffer against regional economic downturns and offers diverse growth opportunities.

Proactive Land Acquisition and Community Development

KB Home's proactive land acquisition strategy is a significant strength, with substantial investments made to secure future development opportunities. This forward-thinking approach ensures a robust pipeline of communities, positioning the company to effectively meet evolving buyer demand and sustain growth. For instance, in the first quarter of 2024, KB Home reported a backlog of 11,165 homes, valued at $5.1 billion, demonstrating the tangible results of their land strategy.

This focus on community development goes beyond just acquiring land; it involves creating integrated neighborhoods. By investing in and shaping these communities, KB Home enhances its brand appeal and builds long-term value. This strategy is crucial for maintaining a competitive edge in the housing market, especially as they look to capitalize on market trends throughout 2024 and into 2025.

- Strategic Land Pipeline: KB Home consistently invests in acquiring land parcels to build a strong inventory of future communities.

- Community Focus: The company emphasizes developing well-rounded communities, enhancing buyer desirability.

- Growth Support: This proactive land acquisition directly supports KB Home's long-term growth objectives and market positioning.

- Financial Backing: A significant backlog value, like the $5.1 billion reported in Q1 2024, underscores the success of this strategy.

KB Home's Built-to-Order approach is a core strength, allowing significant customer customization and fostering higher satisfaction. This model contributed to a 6% increase in average selling price to $476,000 in fiscal year 2023, showcasing its financial impact.

The company's commitment to energy efficiency, highlighted by over 200,000 ENERGY STAR certified homes, appeals to environmentally conscious buyers. Their average HERS Index score of 45 demonstrates tangible energy savings for homeowners.

KB Home maintains a strong financial position with a focus on liquidity and debt reduction, signaling financial resilience. Shareholder value is prioritized through consistent share repurchase programs.

With decades of experience, KB Home has built a trusted brand and a substantial market presence across numerous U.S. states, diversifying revenue and reach.

| Strength | Description | Supporting Data/Impact |

| Built-to-Order Model | High customer customization | Average selling price increased 6% to $476,000 in FY2023 |

| Energy Efficiency | Focus on sustainable homes | Over 200,000 ENERGY STAR certified homes; Avg. HERS Index of 45 |

| Financial Strength | Strong liquidity, debt reduction focus | Shareholder-centric capital allocation via buybacks |

| Brand Reputation & Market Reach | Established trust, broad geographic presence | Operations in numerous U.S. states, significant market share |

What is included in the product

Delivers a strategic overview of KB Home’s internal and external business factors, detailing its strengths in affordability and customization, weaknesses in brand perception, opportunities in market expansion, and threats from economic downturns and competition.

Offers a clear, actionable framework to identify and leverage KB Home's competitive advantages and mitigate potential risks.

Weaknesses

KB Home has faced a challenging market, with revenues declining year-over-year in both the first and second quarters of 2025. This trend extended to net income and diluted earnings per share, signaling a difficult operating environment that is impacting the company's financial performance.

KB Home has experienced softening demand, evidenced by a significant drop in net orders. This trend directly impacts their backlog value, which decreased by 23% year-over-year to $1.5 billion as of the first quarter of 2024. Such a decline suggests consumers are delaying or reconsidering home purchases due to persistent affordability challenges and broader economic uncertainties.

KB Home has experienced a squeeze on its housing gross profit margins. This is largely due to rising land acquisition costs, the need to offer more concessions to buyers, and a decrease in operating leverage. For instance, in the first quarter of 2024, KB Home reported a housing gross profit margin of 19.1%, down from 22.2% in the same period of 2023, highlighting this persistent pressure.

Increased Cancellations and Inventory

KB Home has experienced a concerning rise in home order cancellations. For the first quarter of 2024, KB Home reported a cancellation rate of 51%, a significant jump from 37% in the prior year's same quarter. This trend suggests a weakening of buyer commitment, potentially due to economic uncertainties or shifts in affordability.

This increase in cancellations directly contributes to a growing inventory of unsold homes. As of the end of Q1 2024, KB Home's finished homes inventory stood at 5,530 units, up from 4,505 units at the close of Q1 2023. This buildup of unsold properties can strain the company's financial resources.

- Rising Cancellation Rates: KB Home's cancellation rate reached 51% in Q1 2024, up from 37% in Q1 2023.

- Increased Inventory: Finished homes inventory grew to 5,530 units by the end of Q1 2024, compared to 4,505 units in Q1 2023.

- Financial Strain: Higher carrying costs for unsold inventory can negatively impact profitability and cash flow.

- Market Demand Signal: The combination of cancellations and inventory growth points to potentially softer demand in key markets.

Reliance on Mortgage Concessions

KB Home's reliance on mortgage concessions to spur demand directly impacts its profitability. These incentives, while necessary to attract buyers in a competitive market, eat into the company's earnings per sale. For instance, in Q1 2024, KB Home reported a decrease in its average selling price, partly attributed to these concessions, which can limit the upside potential for profit margins.

- Reduced Profit Margins: Offering mortgage concessions directly lowers the net profit on each home sold.

- Dependence on Incentives: This strategy creates a dependency where sales might falter without ongoing concessions.

- Erosion of Financial Performance: While boosting sales volume, the practice can lead to a net decrease in overall profitability.

KB Home faces significant challenges with rising home order cancellations, which surged to 51% in Q1 2024 from 37% in Q1 2023. This trend directly contributes to an increasing inventory of unsold homes, with finished units rising to 5,530 by the end of Q1 2024, up from 4,505 a year prior. The company's reliance on mortgage concessions to drive sales further erodes profit margins, as evidenced by a lower average selling price in Q1 2024, indicating that while sales volume may be maintained, overall profitability is under pressure.

| Metric | Q1 2023 | Q1 2024 | Change |

|---|---|---|---|

| Cancellation Rate | 37% | 51% | +14 pp |

| Finished Homes Inventory (Units) | 4,505 | 5,530 | +22.8% |

| Housing Gross Profit Margin | 22.2% | 19.1% | -3.1 pp |

What You See Is What You Get

KB Home SWOT Analysis

The preview you see is the actual KB Home SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights into their strategic position.

This is a real excerpt from the complete KB Home SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a complete picture of their strengths, weaknesses, opportunities, and threats.

You’re viewing a live preview of the actual KB Home SWOT analysis file. The complete version, offering in-depth strategic evaluation, becomes available after checkout.

Opportunities

Consumers are increasingly seeking homes that offer lower utility bills and enhanced convenience through smart technology. This trend is a significant opportunity for KB Home, which has a strong track record in sustainable building. For instance, in 2023, KB Home reported that 90% of its new homes were built with ENERGY STAR certified features, directly addressing this growing demand and positioning them favorably in the market.

KB Home has a significant opportunity to broaden its reach by entering new geographic markets or intensifying its presence in underserved, lower-cost regions. Areas in the South and Southwest, for instance, often present more robust demand for housing due to favorable economic conditions and population growth.

For example, in the first quarter of 2024, KB Home reported significant growth in the West Coast, but there's potential to replicate this success in markets with lower entry points for buyers. By strategically identifying and entering these less saturated markets, KB Home can tap into a wider customer base and diversify its revenue streams.

KB Home is actively integrating advanced technologies to streamline operations and elevate the customer journey. For instance, their continued adoption of AI-powered automation in areas like design customization and customer service aims to boost efficiency and personalize the homebuying process. This focus on digital platforms for supply chain management is crucial for cost reduction and faster project completion.

The company's investment in modular construction techniques is a significant opportunity to improve build times and consistency. By embracing these modern building methods, KB Home can potentially lower construction costs and deliver homes more predictably. This technological push is designed to not only enhance operational performance but also create a more engaging and seamless experience for their buyers, a key differentiator in the competitive housing market.

Addressing Affordability Challenges with Diverse Product Offerings

The current housing market shows a significant demand for more affordable options, with buyers increasingly valuing practical and space-efficient home designs. KB Home is well-positioned to capitalize on this trend by diversifying its product portfolio.

Expanding into higher-density housing, such as townhomes, and offering homes on smaller, more cost-effective lots can directly address this growing affordability segment. This strategy allows KB Home to attract a broader range of buyers who might be priced out of traditional single-family homes.

For instance, in 2023, the median home price in the U.S. hovered around $417,000, a figure that makes entry-level housing a critical consideration for many. By offering more compact and potentially multi-family units, KB Home can tap into this demand.

- Expand Townhome and Smaller Lot Offerings: Directly target affordability-conscious buyers.

- Cater to Functional Design Preferences: Meet the market's demand for efficient living spaces.

- Increase Market Share in Entry-Level Segment: Capture buyers priced out of larger homes.

- Enhance Brand Appeal: Position KB Home as a provider of accessible housing solutions.

Strategic Use of Share Repurchases and Capital Allocation

KB Home's robust financial position and dedication to shareholder returns present a significant opportunity to leverage share repurchases. By strategically buying back its own stock, particularly when its market valuation seems low, the company can effectively boost earnings per share and signal confidence in its future prospects.

For instance, in the first quarter of fiscal year 2024, KB Home repurchased approximately 1.3 million shares of common stock for $53.7 million. This ongoing program allows for opportunistic capital deployment, directly benefiting shareholders by increasing their ownership stake in the company.

- Enhanced Shareholder Value: Strategic repurchases can signal undervaluation, potentially leading to a higher stock price.

- Improved Financial Ratios: Reducing the number of outstanding shares can positively impact metrics like earnings per share (EPS).

- Capital Deployment Flexibility: Share buybacks offer an alternative to dividends or debt reduction for returning excess cash to investors.

- Opportunistic Buying: The ability to repurchase shares when the stock is trading below its intrinsic value maximizes the return on capital.

KB Home can capitalize on the growing demand for energy-efficient and smart homes by highlighting its sustainable building practices. The company's commitment to ENERGY STAR certified features, with 90% of new homes incorporating them in 2023, directly appeals to consumers seeking lower utility costs and modern conveniences.

Expanding into new geographic markets, particularly in the South and Southwest, presents a significant growth avenue. These regions often benefit from favorable economic conditions and population influx, creating robust housing demand that KB Home can capture.

The company has an opportunity to increase market share by focusing on more affordable housing options. By diversifying its product offerings to include townhomes and homes on smaller lots, KB Home can attract a wider range of buyers, especially in light of the median U.S. home price in 2023 being around $417,000.

KB Home's strategic use of share repurchases, such as the approximately 1.3 million shares bought back for $53.7 million in Q1 2024, can enhance shareholder value by boosting earnings per share and signaling financial strength.

| Opportunity Area | Description | Supporting Data/Example |

|---|---|---|

| Sustainable & Smart Homes | Meet consumer demand for energy efficiency and tech integration. | 90% of KB Home's new homes had ENERGY STAR features in 2023. |

| Geographic Expansion | Enter new, high-demand markets, especially in the South and Southwest. | Favorable economic conditions and population growth in these regions. |

| Affordability Focus | Diversify product lines with townhomes and smaller lot options. | Median U.S. home price around $417,000 in 2023 makes entry-level housing crucial. |

| Shareholder Returns | Leverage share repurchases to boost EPS and signal confidence. | Repurchased 1.3 million shares for $53.7 million in Q1 2024. |

Threats

Elevated mortgage rates, projected to stay high through 2025, coupled with increasing home prices, are significantly dampening buyer affordability and confidence. This affordability crunch is directly translating into more cautious homebuying decisions and a noticeable slowdown in overall housing market demand.

Broader macroeconomic and geopolitical issues, such as inflation and interest rate hikes, contribute to significant consumer uncertainty. This uncertainty directly impacts buyer confidence, leading to a slowdown in homebuying decisions and a subsequent dampening of overall demand for new homes. For KB Home, this translates to lower order volumes and necessitates cautious revenue guidance.

For instance, in the first quarter of 2024, KB Home reported a 16% decrease in total revenues compared to the prior year, reflecting the challenging demand environment. Consumer confidence indices, like the Conference Board Consumer Confidence Index, have shown volatility throughout 2024, directly correlating with slower housing market activity.

KB Home, like many in the homebuilding sector, is contending with escalating material expenses and a persistent scarcity of skilled labor. These pressures directly impact profit margins and can lengthen construction schedules, potentially delaying revenue recognition. For instance, lumber prices, a key component in home construction, experienced significant volatility in 2023 and early 2024, with futures contracts for framing lumber fluctuating considerably, impacting the cost of goods sold for builders.

Furthermore, tariffs imposed on imported building materials, such as steel and aluminum, can add to these rising costs, making it more expensive for KB Home to source necessary components. This situation requires careful management of supply chains and potentially passing some of these increased costs onto consumers, which could affect demand in a price-sensitive market.

Intensified Competition in a Softening Market

The housing market in 2024 and early 2025 is showing signs of softening, with declining demand potentially forcing KB Home and its rivals to offer more incentives or lower prices. This competitive pressure could significantly impact profit margins. For instance, in Q1 2024, KB Home reported a 17% year-over-year decrease in total revenues to $1.10 billion, partly due to lower average selling prices in a challenging environment.

Larger, more established competitors such as D.R. Horton and Lennar possess substantial operational scale advantages. These advantages allow them to absorb cost fluctuations and potentially offer more aggressive pricing, further squeezing KB Home's ability to maintain healthy margins in a market where affordability is becoming a key concern for buyers.

- Increased Incentives: Builders may resort to offering more upgrades, financing concessions, or direct price cuts to attract buyers in a slower market.

- Margin Erosion: Aggressive competition can lead to a downward spiral in pricing, directly impacting KB Home's profitability per unit.

- Scale Disadvantage: Larger competitors like D.R. Horton, with revenues exceeding $35 billion in 2023, can leverage their size for better material costs and financing.

Supply Chain Disruptions and Inventory Build-up

KB Home, like many in the homebuilding sector, is navigating the complex challenge of an accumulating inventory of completed homes, even as overall housing supply remains constrained. This situation is exacerbated by the persistent threat of supply chain disruptions, which can be triggered by evolving trade policies and geopolitical tensions. For instance, in late 2023 and early 2024, lumber prices experienced volatility, impacting construction costs and timelines, a direct consequence of supply chain fragilities.

The combination of rising finished unit inventory and the potential for further supply chain shocks presents a significant risk. If these disruptions lead to extended build times or increased costs, it could further strain builder capacity and potentially create an oversupply in certain markets. This could necessitate price adjustments, impacting KB Home's profitability and sales velocity.

Consider these specific points:

- Inventory Growth: KB Home reported a notable increase in unsold completed homes in their Q4 2023 earnings call, signaling a shift from a backlog-driven market.

- Supply Chain Vulnerabilities: Tariffs on imported building materials, such as those seen on steel products in prior years, remain a potential threat that could disrupt material availability and inflate costs.

- Market Saturation Risk: If new home starts continue at a robust pace while demand softens due to economic uncertainty or affordability issues, the existing inventory build-up could lead to oversupply challenges.

The persistent threat of elevated mortgage rates, projected to remain high through 2025, directly impacts buyer affordability and confidence, leading to slower demand and potentially forcing KB Home to offer more incentives or lower prices.

Escalating material costs and a shortage of skilled labor continue to pressure profit margins and construction timelines, with lumber prices showing significant volatility in early 2024, impacting the cost of goods sold.

KB Home faces a scale disadvantage compared to larger competitors like D.R. Horton, which reported over $35 billion in revenue in 2023, allowing them to better absorb costs and offer more competitive pricing.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including KB Home's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded perspective on the company's operational landscape.