KB Home Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KB Home Bundle

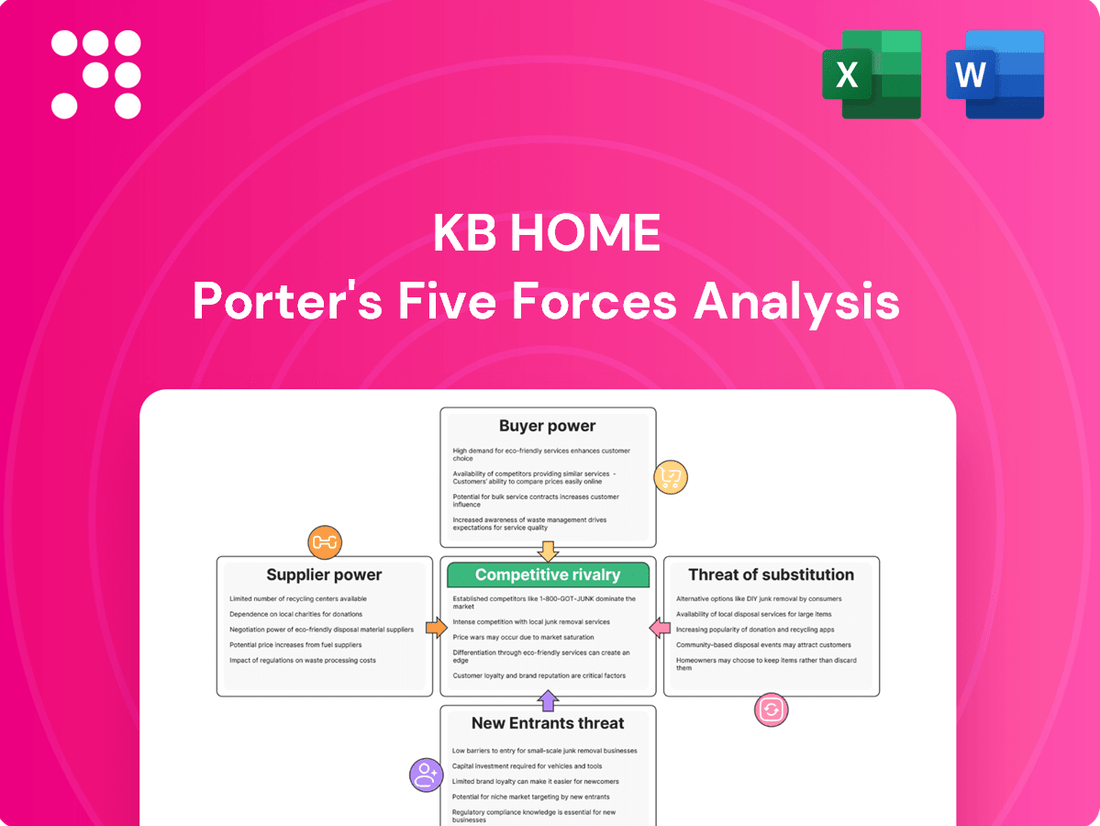

KB Home faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers playing crucial roles in shaping its market. Understanding these dynamics is key to navigating the housing industry.

The complete report reveals the real forces shaping KB Home’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for crucial building materials, such as lumber, steel, and electrical components, can be quite concentrated. This means a few key suppliers often control a large portion of the market, giving them considerable power to influence pricing and terms with companies like KB Home.

Looking ahead to 2025, material prices are anticipated to stay high. Projections indicate that overall construction material costs could increase by 5% to 7%. This rise is largely due to persistent supply chain disruptions and robust demand, which significantly strengthens the negotiating position of these suppliers.

The availability and cost of skilled labor are critical for homebuilders like KB Home, giving labor suppliers significant bargaining power. Persistent labor shortages in construction, where 42% of labor is in residential projects, mean that skilled workers are in high demand.

Rising wages directly impact construction budgets and can cause project delays. This dynamic amplifies the bargaining power of labor suppliers, as builders must compete for a limited pool of qualified workers.

KB Home, like other homebuilders, faces significant vulnerability due to its reliance on a stable supply chain. Delays in material delivery directly impact project timelines and profitability. This dependence grants suppliers considerable leverage, especially when demand outstrips supply.

In 2024 and into 2025, the construction sector grappled with persistent supply chain issues. Shortages of key components like roofing materials, transformers, and electrical equipment continued to plague the industry. While the availability of appliances saw some improvement, these ongoing bottlenecks contributed to rising costs and extended project completion times for KB Home.

High Switching Costs for Specialized Inputs

For specialized inputs crucial to KB Home's construction process, suppliers can wield significant bargaining power. When switching to a new supplier for these unique materials or components involves substantial costs and extended timelines, existing suppliers gain leverage. This is particularly true for custom-ordered elements or proprietary technologies integral to KB Home's built-to-order model, where limited alternatives or the need for extensive re-engineering can lock in customers.

KB Home's strategy to foster supply chain resilience through partnerships based on sustainability and ethical conduct can mitigate some supplier power. However, the inherent nature of specialized inputs means that even with strong relationships, the cost and complexity of changing suppliers for these critical items remain a factor. For instance, if a particular type of energy-efficient window or a custom-designed structural beam is sourced from a single or limited number of suppliers, their ability to dictate terms increases.

- High Switching Costs: Specialized inputs can lead to substantial costs and time investment when changing suppliers.

- Proprietary Technology: Custom-ordered elements or proprietary technologies in KB Home's build-to-order model can limit supplier alternatives.

- Supplier Leverage: Limited alternatives or the need for significant re-engineering enhances the bargaining power of existing suppliers.

Suppliers' Threat of Forward Integration

The threat of suppliers integrating forward into basic home construction is generally low for a company like KB Home. This is because the capital required and the complexity of managing land acquisition, design, and sales are significant barriers for material suppliers. However, the possibility, however remote, highlights the strategic value of maintaining robust relationships with key suppliers.

While not a primary concern across the entire homebuilding sector, if a major supplier were to attempt forward integration, it could theoretically shift bargaining power. For instance, a large lumber supplier potentially entering basic framing services might gain leverage. However, the integrated nature of KB Home's operations, encompassing everything from land development to final sales, makes full forward integration by a single material vendor a highly improbable scenario, especially considering the diverse needs of a national builder.

- Suppliers' Forward Integration Threat: Generally low for diversified builders like KB Home due to high capital and operational complexity.

- Industry Example: A large lumber supplier moving into basic framing services is a theoretical, though unlikely, scenario.

- KB Home's Advantage: Its comprehensive business model (land, design, sales) creates a high barrier to entry for supplier forward integration.

- Strategic Importance: Maintaining strong supplier relationships remains crucial despite the low direct threat.

The bargaining power of suppliers for KB Home is significant, particularly for specialized building materials and skilled labor, as detailed in the 2024 analysis. Concentrated markets for key components like lumber and steel, coupled with ongoing supply chain disruptions anticipated to continue into 2025, empower these suppliers. For instance, construction material costs were projected to rise by 5% to 7% in 2025 due to these factors, directly benefiting suppliers.

The scarcity of skilled labor, with 42% of labor in residential projects, further amplifies the bargaining power of labor suppliers. High demand for these workers forces builders like KB Home to compete with increased wages, impacting budgets and project timelines. This dynamic is a critical consideration for KB Home's operational costs and project execution.

KB Home's reliance on specialized inputs, where switching costs are high and proprietary technologies limit alternatives, grants existing suppliers considerable leverage. This situation is exacerbated by the general trend of rising material prices and potential delays in component delivery, which were prevalent issues in 2024 and expected to persist. The threat of suppliers integrating forward into construction is low, but strong supplier relationships remain vital.

| Factor | Impact on KB Home | Supplier Power Level | Supporting Data/Trend (2024-2025) |

|---|---|---|---|

| Concentrated Material Markets | Limited sourcing options, price sensitivity | High | Key materials like lumber, steel controlled by few suppliers. |

| Skilled Labor Shortages | Increased labor costs, project delays | High | 42% of labor in residential projects; wage competition. |

| Supply Chain Disruptions | Material unavailability, extended lead times | High | Shortages of roofing, electrical components; projected 5-7% cost increase in 2025. |

| Specialized Inputs & Switching Costs | High costs to change suppliers, reliance on existing vendors | High | Proprietary technologies, custom elements increase supplier leverage. |

| Supplier Forward Integration | Low direct threat, but strategic importance of relationships | Low | High capital/complexity barriers for suppliers to enter home construction. |

What is included in the product

This analysis of KB Home's competitive landscape examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the homebuilding industry.

Effortlessly identify and mitigate competitive threats by visualizing KB Home Porter's Five Forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

Customers, especially first-time homebuyers, are very aware of home prices and mortgage rates. This sensitivity directly affects how much they can afford to spend, giving them considerable leverage. For instance, mortgage rates have remained around 7% since late 2024, and are expected to average 6.7% in 2025, making affordability a major hurdle.

The significant rise in home prices, with median existing home prices jumping 50% between 2019 and 2024, further amplifies this affordability challenge. Buyers facing these constraints are likely to postpone purchases or look for less expensive options, thereby increasing their bargaining power against homebuilders like KB Home.

The bargaining power of customers is on the rise for KB Home, largely due to increasing housing inventory in 2025. This uptick in available homes means buyers aren't facing the same scarcity that characterized previous years. For instance, the U.S. Census Bureau reported a rise in new housing starts and completions through early 2025, indicating a healthier supply pipeline.

With more options readily available, buyers can take their time, compare properties, and are less pressured to accept unfavorable terms. This expanded choice directly translates to greater leverage in negotiations. Buyers can now more effectively push for better pricing, concessions, or customized features, shifting the balance from a seller's market toward a more buyer-centric environment.

Today's homebuyers are incredibly well-informed, thanks to the vast amount of market data readily available online. This transparency means they can easily compare prices, features, and even builder reputations across numerous properties. For instance, in 2024, platforms like Zillow and Redfin provide detailed neighborhood statistics and recent sales data, empowering buyers to negotiate more effectively and demand better value from homebuilders like KB Home.

Desire for Personalization vs. Cost

KB Home's built-to-order model caters to a strong customer desire for personalization, which can mitigate some direct price negotiation. However, this desire is often tempered by the need for affordability, particularly as the overall cost of homeownership continues to rise.

In 2024, with ongoing inflationary pressures impacting construction materials and labor, customers are increasingly sensitive to base prices. They may leverage this by seeking concessions or opting for more cost-effective design choices to manage their budgets, thereby retaining significant bargaining power.

- Personalization Appeal: KB Home's customization options can reduce price sensitivity by meeting individual needs.

- Affordability Constraint: Rising homeownership costs in 2024 push customers to prioritize budget, influencing their willingness to negotiate on price or select less expensive features.

- Market Sensitivity: Despite customization, customers remain aware of market pricing and may exert pressure for better deals on base models or upgrades.

Availability of Substitutes (Resale Homes and Rentals)

The availability of substitutes significantly amplifies customer bargaining power for KB Home. Potential buyers can choose between newly constructed homes, existing resale properties, or rental units, all of which offer alternative housing solutions. This broad spectrum of options means customers are not solely reliant on new home builders.

The current economic climate further bolsters this customer leverage. With mortgage rates remaining elevated, many prospective homeowners are opting for rentals instead. Data from Q1 2025 indicates that renter-occupied household growth outpaced owner-occupied growth, and projections suggest rent growth will likely remain subdued. This trend directly translates to increased negotiation power for consumers who can delay purchasing a new home in favor of more affordable or flexible rental arrangements.

- Resale Market Competition: A robust resale housing market provides a direct and often more immediate alternative to new construction, giving buyers more choices and leverage.

- Rental Market Dynamics: In Q1 2025, renter-occupied households grew faster than owner-occupied households, highlighting a shift towards renting and increasing the bargaining power of those considering housing options.

- Impact of Mortgage Rates: High mortgage rates encourage potential buyers to explore renting, reducing their immediate need to purchase new homes and strengthening their negotiating position with builders.

The bargaining power of customers for KB Home is substantial and growing, driven by increased housing inventory and buyer awareness of market conditions. With mortgage rates hovering around 7% through late 2024 and expected to average 6.7% in 2025, affordability remains a key concern for buyers. This financial pressure, coupled with a 50% rise in median existing home prices between 2019 and 2024, forces consumers to be more discerning and exert greater negotiation leverage.

| Factor | 2024/2025 Data Point | Impact on KB Home Customer Bargaining Power |

|---|---|---|

| Mortgage Rates | ~7% (late 2024), projected 6.7% (2025 average) | Increases affordability concerns, strengthening buyer negotiation. |

| Median Existing Home Price Increase | 50% (2019-2024) | Amplifies affordability challenge, leading to more price-sensitive buyers. |

| Housing Inventory | Rising (early 2025) | Reduces buyer urgency, allowing for more comparison and negotiation. |

| Rental Market Growth | Renter-occupied households outpacing owner-occupied (Q1 2025) | Provides a strong alternative, reducing reliance on new home purchases and boosting buyer leverage. |

What You See Is What You Get

KB Home Porter's Five Forces Analysis

This preview shows the exact KB Home Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual document, which details KB Home's competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the homebuilding industry. Once you complete your purchase, you’ll get instant access to this exact file, fully formatted and ready for your strategic planning.

Rivalry Among Competitors

The U.S. homebuilding landscape is a crowded arena, featuring a mix of large national builders and a multitude of regional and local firms. This dynamic creates significant competitive rivalry for KB Home.

Key national competitors like D.R. Horton, Lennar Corporation, and PulteGroup actively compete for market share, employing aggressive pricing and diverse product offerings. For instance, in 2023, D.R. Horton reported revenues of $35.8 billion, and Lennar's revenue reached $30.4 billion, demonstrating their substantial scale and market presence.

While larger public builders have consolidated some market share, the sheer volume of regional and local builders ensures that competition remains intense across various geographic markets. This fragmentation means KB Home must constantly adapt to localized market conditions and competitor strategies.

While the U.S. residential construction market is projected to expand by USD 242.9 million with a compound annual growth rate of 4.5% from 2024 to 2029, it's also facing significant short-term turbulence. This environment fosters intense competition as companies like KB Home navigate a landscape where immediate demand can fluctuate considerably.

The industry anticipates a dip in single-family housing starts during 2025, followed by a recovery. Compounding this, overall home sales are tracking towards a thirty-year low. Such a blend of sustained growth potential and immediate uncertainty escalates rivalry, forcing builders to vie more aggressively for the available buyers in the present market.

While KB Home’s built-to-order model allows for customization, the fundamental product, a new single-family home, often exhibits limited differentiation among competitors, particularly within similar price ranges. This homogeneity intensifies competition, often driving it towards price, incentives, and delivery timelines.

In 2024, the housing market continues to see builders vying for market share, with differentiation becoming crucial. KB Home, for instance, emphasizes features like its Energy Star certified homes and its SmartGuide digital platform to create perceived value beyond the basic structure, aiming to capture buyers seeking modern conveniences and cost savings.

High Exit Barriers for Homebuilders

The homebuilding sector is characterized by substantial fixed asset investments, especially in land acquisition and development. These significant upfront costs create high exit barriers, making it financially challenging for companies to leave the market easily, even when facing economic headwinds.

Because exiting is difficult, homebuilders often feel compelled to continue operations, even in slower markets. This can lead to intensified competition, with companies engaging in price wars or employing aggressive sales strategies to clear their existing inventory, thereby increasing rivalry.

KB Home's strategic decisions highlight this dynamic. The company significantly increased its land investments in 2024, signaling a commitment to future development. Furthermore, KB Home has indicated plans to continue this trend of increased land investment throughout 2025, reinforcing the high capital commitment inherent in the industry.

- High Fixed Asset Investment: Homebuilders commit substantial capital to land acquisition and development, creating significant barriers to exiting the industry.

- Incentive to Continue Operations: Due to high exit barriers, builders are often motivated to keep building and selling, even in challenging market conditions.

- Intensified Rivalry: The pressure to sell inventory can lead to price competition and aggressive sales tactics among builders, heightening competitive rivalry.

- KB Home's Land Strategy: KB Home's increased land investments in 2024 and planned further increases in 2025 underscore the long-term capital commitments typical in this sector.

Emphasis on Customer Satisfaction and Sustainability as Differentiators

In the highly competitive homebuilding sector, companies are increasingly distinguishing themselves through superior customer satisfaction and a commitment to sustainability, moving beyond just price as a competitive lever. KB Home, for instance, highlights its position as the #1 customer-ranked national homebuilder, a testament to its focus on client experience. This emphasis on non-price factors is crucial for building brand loyalty and carving out a unique market position.

Furthermore, KB Home's leadership in sustainability, evidenced by its status as the builder of more ENERGY STAR certified homes than any other in the nation, directly addresses growing consumer demand for environmentally conscious housing. These strategies are not merely about corporate social responsibility; they are vital differentiators in a crowded marketplace, appealing to a segment of buyers prioritizing long-term value and environmental impact.

- Customer Satisfaction: KB Home's claim as the #1 customer-ranked national homebuilder underscores the importance of this metric in competitive strategy.

- Sustainability Leadership: Building more ENERGY STAR certified homes than any competitor positions KB Home as an environmental frontrunner.

- Differentiation Beyond Price: These non-price competitive factors are essential for standing out in a saturated industry.

- Market Appeal: Focusing on customer satisfaction and sustainability attracts and retains buyers who value these attributes.

The competitive rivalry within the homebuilding industry is intense, driven by numerous national, regional, and local players. This saturation forces companies like KB Home to constantly innovate and differentiate their offerings, often through price, incentives, and product features. The market's inherent capital intensity and high exit barriers also contribute to sustained rivalry, as builders are incentivized to remain active even in softer economic periods.

In 2024, builders are focusing on non-price differentiators like customer satisfaction and sustainability. KB Home's emphasis on being the #1 customer-ranked national homebuilder and its leadership in ENERGY STAR certified homes are key strategies to capture market share. These efforts are crucial as overall home sales are projected to be at a thirty-year low in 2024, intensifying the competition for available buyers.

| Competitor | 2023 Revenue (USD Billions) | Key Differentiators |

|---|---|---|

| D.R. Horton | 35.8 | Scale, diverse product lines |

| Lennar Corporation | 30.4 | Scale, integrated homebuilding services |

| PulteGroup | 14.7 | Brand recognition, various home types |

| KB Home | 6.4 | Built-to-order, ENERGY STAR certified, digital platform |

SSubstitutes Threaten

The vast inventory of existing homes on the market acts as a significant substitute for KB Home's new constructions. Their relative affordability often presents a compelling alternative for potential buyers, directly influencing demand for new builds.

While the rate lock-in effect has historically constrained the resale market, available data indicates that existing home inventory is on the rise. This growing supply of resale homes intensifies the competitive landscape for new home builders.

The median sales price for existing homes saw a substantial 50% surge between 2019 and 2024. However, current trends suggest a cooling of price growth, making these resale properties an increasingly competitive and attractive substitute for new homes.

The rental housing market, encompassing apartments and single-family homes, stands as a significant substitute for KB Home, especially when the cost of owning a home becomes prohibitive. This is particularly relevant in the current economic climate where affordability is a key concern for many potential buyers.

Data from Q1 2025 indicates that the number of renter-occupied households grew faster than owner-occupied households. This trend is largely attributed to ongoing affordability challenges in the homeownership market, pushing more individuals towards renting as a viable alternative.

Looking ahead to 2025, projections suggest a period of soft rent growth. This moderation in rental price increases further bolsters the appeal of renting, making it a more attractive and accessible option compared to the upfront costs and ongoing expenses associated with purchasing a new home.

Homeowners often consider renovating or expanding their existing homes as a viable alternative to purchasing a new one. This is particularly true when current mortgage rates are favorable, making it more cost-effective to stay put and upgrade. For example, in early 2024, many homeowners were locked into lower mortgage rates compared to prevailing market rates, incentivizing renovations over new home purchases.

The attractiveness of renovation as a substitute for new home buying intensifies when new home prices surge or when the inventory of available homes is scarce. In 2024, persistent supply chain issues and labor shortages continued to impact new home construction, leading to higher prices and longer wait times for buyers, thus bolstering the appeal of renovations.

Furthermore, the evolving needs of homeowners, such as the desire for more flexible, multipurpose living spaces or the integration of eco-friendly features, can be readily addressed through renovations. This allows homeowners to customize their current residences to meet modern demands, presenting a compelling alternative to the often standardized offerings in new construction projects.

Alternative Housing Types (e.g., Manufactured Homes)

Alternative housing solutions like manufactured homes and modular construction present a tangible threat of substitutes for KB Home. These options often come with a lower price point and faster completion times, directly appealing to budget-conscious buyers or those needing housing quickly. For instance, the manufactured housing sector, which includes mobile homes, has seen consistent demand. In 2023, shipments of manufactured homes reached approximately 96,000 units, indicating a significant market segment that might opt for these alternatives over traditional site-built homes.

While KB Home specializes in traditional site-built residences, the existence of these lower-cost alternatives can cap the pricing power for KB Home's offerings, especially in certain market segments. Buyers prioritizing affordability might choose a manufactured home, which could cost significantly less than a comparable new site-built house. This dynamic forces KB Home to remain competitive on price and value proposition to attract and retain customers who have these other viable housing options.

The threat is amplified as these alternative construction methods become more sophisticated and accepted. Innovations in modular construction, for example, are leading to higher quality and more customizable homes, blurring the lines between factory-built and traditional housing. This continuous improvement in substitutes means KB Home must constantly innovate and demonstrate the superior value of its site-built homes to mitigate the impact of these alternatives.

- Lower Cost: Manufactured homes can offer substantial savings compared to site-built homes, with average prices often tens of thousands of dollars lower.

- Faster Delivery: The off-site construction process for manufactured and modular homes typically results in quicker occupancy for buyers.

- Market Segmentation: These alternatives cater to specific buyer needs, such as first-time homebuyers or those in high-cost-of-living areas seeking more accessible entry points into homeownership.

- Technological Advancements: Improvements in building techniques and materials for off-site construction are enhancing the appeal and quality of substitute housing options.

Economic Headwinds Impacting Homeownership Desire

Macroeconomic factors significantly influence the appeal of homeownership, acting as a potent threat of substitutes. When economic conditions are challenging, potential buyers may reconsider purchasing a new home.

For instance, elevated mortgage rates, which are projected to hover around 6.7% in 2025, coupled with general economic uncertainty and concerns about job security, can make the substantial financial commitment of buying a home seem less attractive. This environment often pushes individuals toward alternative housing solutions.

Consequently, the desire for homeownership can be dampened, leading more consumers to explore options such as renting apartments or continuing to reside in their current rental properties. These alternatives offer greater flexibility and lower upfront costs, becoming more appealing substitutes during periods of economic strain.

- High Interest Rates: Mortgage rates around 6.7% in 2025 make buying less affordable.

- Economic Uncertainty: Fears about employment and the broader economy deter long-term commitments.

- Rental Market Appeal: Renting offers flexibility and lower immediate financial burdens.

- Existing Home Retention: Many opt to stay in their current homes rather than upgrade.

The threat of substitutes for KB Home is substantial, primarily stemming from the existing housing market, rentals, and alternative construction methods. The sheer volume of resale homes, often more affordable due to cooling price growth, directly competes with new builds. For example, while existing home prices saw a 50% surge between 2019 and early 2024, the pace is slowing, making them more attractive. Similarly, the rental market, bolstered by faster growth in renter-occupied households in Q1 2025 and projected soft rent growth for 2025, presents a flexible and lower-cost alternative, especially when homeownership affordability is a concern.

| Substitute Type | Key Advantage | Impact on KB Home | Relevant Data Point (2024-2025) |

|---|---|---|---|

| Existing Homes | Affordability, faster move-in | Reduces demand for new builds, caps pricing power | Median existing home price growth cooling; inventory rising |

| Rental Market | Flexibility, lower upfront cost | Deters new buyers, especially during economic uncertainty | Renter-occupied households growing faster than owner-occupied (Q1 2025); soft rent growth projected for 2025 |

| Manufactured/Modular Homes | Lower cost, faster construction | Appeals to budget-conscious buyers, limits KB Home's price ceiling | Manufactured home shipments ~96,000 units (2023); lower price points |

Entrants Threaten

The homebuilding sector presents a substantial hurdle for newcomers due to the immense capital needed for land acquisition and development. This financial barrier is a critical factor in the threat of new entrants.

Consider KB Home: they allocated more than $2.8 billion to land acquisition and development in 2024. Their strategic plans indicate a further increase in this investment for 2025, underscoring the significant financial commitment necessary to compete effectively in this industry.

New entrants in the homebuilding sector, like KB Home, encounter significant barriers due to complex and lengthy regulatory requirements. These include navigating intricate zoning laws, adhering to stringent environmental regulations, and obtaining a multitude of necessary permits before any construction can begin.

The process is further complicated by declining national permitting rates, which, as of recent data, have seen a slowdown, and a general lengthening of construction timelines. These factors collectively create substantial hurdles for new companies aiming to enter the market and establish operations efficiently.

Established brand reputation and customer loyalty represent a significant barrier to entry for new homebuilders. Companies like KB Home have cultivated decades of trust and recognition, making it challenging for newcomers to quickly establish credibility. In 2024, KB Home continued to leverage its strong brand, having been recognized as the #1 customer-ranked national homebuilder, a testament to its focus on customer satisfaction and proven track record.

Challenges in Securing Supply Chains and Skilled Labor

New entrants would face significant hurdles in building robust supply chains and accessing a skilled workforce, both vital for efficient home construction. The existing market, already grappling with volatile building material prices and labor shortages, provides established players like KB Home with a distinct advantage due to their pre-existing supplier relationships and workforce networks.

For instance, in 2024, the U.S. construction industry continued to experience elevated material costs, with lumber prices fluctuating significantly throughout the year, impacting project budgets. Furthermore, the shortage of skilled construction workers remained a persistent issue, with industry reports indicating a deficit of hundreds of thousands of workers needed to meet demand.

- Supply Chain Dependence: New entrants would need to invest heavily to establish reliable sourcing for key materials, a process that takes time and proven relationships.

- Skilled Labor Scarcity: The limited pool of experienced construction professionals makes it difficult for newcomers to assemble competent teams quickly.

- Economies of Scale: Established builders often secure better pricing and terms from suppliers due to higher volume purchasing, a benefit not readily available to new entrants.

- Operational Expertise: Navigating complex permitting processes and managing construction timelines requires specialized knowledge and experience that new firms would lack.

Economies of Scale Enjoyed by Large Homebuilders

Large national homebuilders, including KB Home, leverage significant economies of scale. This translates to lower per-unit costs in areas like material procurement, financing, and marketing, presenting a substantial cost barrier for smaller or new competitors. For instance, in 2024, publicly traded homebuilders continued to consolidate market share, demonstrating the inherent advantages of scale in this industry.

These scale advantages create a notable cost disadvantage for potential new entrants. Smaller builders often struggle to match the purchasing power and efficient financing terms secured by larger, established companies. This disparity makes it challenging for newcomers to compete on price and profitability from the outset.

The increasing market share held by public homebuilders is a clear indicator of this trend. Their ability to absorb market fluctuations and invest in technology and land acquisition, fueled by their scale, further solidifies their competitive position. This dominance makes the threat of new entrants relatively low, as overcoming these entrenched economies of scale is a significant hurdle.

The threat of new entrants in the homebuilding industry, particularly for companies like KB Home, remains relatively low due to substantial barriers. These include immense capital requirements for land and development, which KB Home demonstrated with over $2.8 billion invested in 2024, complex regulatory landscapes, and established brand loyalty. Furthermore, the difficulty in replicating existing supply chains, securing skilled labor, and achieving economies of scale presents significant challenges for newcomers aiming to compete effectively.

| Barrier | Description | KB Home Relevance (2024 Data) |

|---|---|---|

| Capital Requirements | High costs for land acquisition and development. | Over $2.8 billion allocated to land acquisition and development. |

| Regulatory Hurdles | Complex zoning, environmental laws, and permitting processes. | Navigating these is a time-consuming and costly endeavor for new firms. |

| Brand Reputation & Loyalty | Established trust and customer recognition. | Recognized as #1 customer-ranked national homebuilder. |

| Supply Chain & Labor | Difficulty in establishing reliable sourcing and skilled workforce. | Industry-wide labor shortages and volatile material costs persist. |

| Economies of Scale | Lower per-unit costs for established players. | Public homebuilders continue to consolidate market share, benefiting from scale. |

Porter's Five Forces Analysis Data Sources

Our KB Home Porter's Five Forces analysis is built upon a foundation of comprehensive data, including KB Home's annual reports and SEC filings, alongside industry-specific market research from sources like IBISWorld and Builder Magazine. We also incorporate macroeconomic data from government agencies to understand broader economic influences.