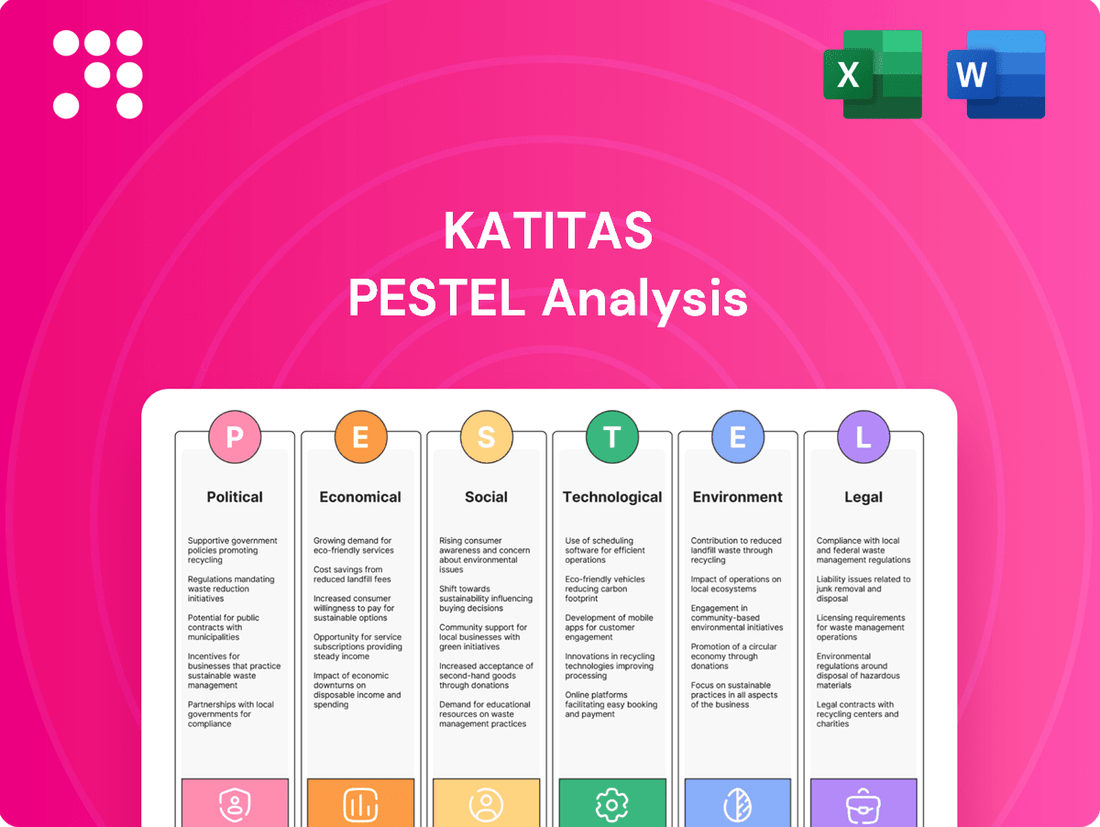

Katitas PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Katitas Bundle

Uncover the critical external factors shaping Katitas's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, understand the forces that will impact its future success. Equip yourself with actionable intelligence to refine your strategy and gain a competitive advantage. Download the full version now and unlock the insights you need to thrive.

Political factors

The Japanese government is actively promoting the renovation of existing homes, a key strategy for revitalizing the housing market. This focus on pre-owned properties aligns perfectly with Katitas's core business. For instance, the Home Energy Conservation 2025 Campaign provides financial incentives for energy-efficient upgrades, directly supporting Katitas's renovation services.

These government subsidies, such as those for improving insulation and installing high-efficiency heating and cooling systems, are designed to encourage homeowners to invest in their properties. In 2024, the government allocated an estimated ¥150 billion for such energy-saving home improvement initiatives, a significant boost for companies like Katitas engaged in this sector.

Japan's growing 'akiya' problem, particularly in rural areas, is a key political consideration. As of 2023, the number of vacant homes reached an estimated 8.49 million, a record high, representing 13.8% of all residences. This surge is prompting government intervention.

The Vacant Houses Special Measures Law, revised in 2023, empowers local governments to designate particularly dilapidated vacant homes as "specified vacant houses." This designation can lead to increased property taxes and, ultimately, forced demolition. These policy shifts aim to clear out hazardous properties, potentially unlocking opportunities for companies like Katitas to acquire land and properties at more favorable terms for renovation and resale.

Japan's Building Standards Act revisions, effective April 1, 2025, will necessitate stricter structural reviews and mandatory energy efficiency compliance for all new constructions and significant renovations. These updates, aligned with the nation's 2050 carbon neutrality targets, are expected to increase renovation project costs by an estimated 5-10% and potentially extend project timelines by up to 15% due to more rigorous approval processes.

Foreign Investment Regulations

Japan's approach to foreign investment in real estate, while largely open, has seen some adjustments. While there are generally no overarching legal barriers to foreign ownership, new legislation enacted in June 2021 specifically targets land purchases within areas deemed critical for national security. This means certain strategic locations might now have restrictions for foreign buyers.

For Katitas, a company operating domestically within Japan, these particular foreign investment security regulations have a less direct impact on its own operations or property acquisitions. However, these changes do signal a broader trend in the regulatory landscape, indicating a heightened awareness of national security considerations in land use and ownership. This evolving environment is something any business, including Katitas, should monitor.

The implications for Katitas, though indirect, are worth noting. The government's focus on security-sensitive zones suggests a more cautious stance on foreign involvement in specific geographical areas. This could potentially influence future development opportunities or partnerships if Katitas were to consider ventures involving foreign entities in such zones. For instance, understanding the specific zones designated under the June 2021 legislation is crucial for any forward-looking real estate strategy.

Key points regarding foreign investment regulations in Japan include:

- No general legal restrictions on foreign real estate ownership in most areas.

- June 2021 legislation introduced restrictions on land purchases in security-sensitive zones.

- Katitas, as a domestic entity, is less directly affected by these specific security-related foreign investment rules.

- The regulations reflect a broader trend of increased scrutiny on foreign involvement in strategically important locations.

Tokyo Metropolitan Government Affordable Housing Initiatives

The Tokyo Metropolitan Government is set to launch a significant affordable housing initiative in fiscal year 2025. This program will leverage a public-private partnership fund to purchase and refurbish existing vacant and used properties, making them available for low-cost rental. This policy directly supports Katitas's strategic objective of revitalizing the current housing market, potentially opening avenues for valuable collaboration.

This initiative aligns with a broader trend in urban planning, where governments are increasingly looking for innovative solutions to housing shortages. For instance, by FY2024, Tokyo had identified over 20,000 vacant properties that could be repurposed. The partnership model is designed to attract private investment, aiming to accelerate the renovation process and increase the supply of affordable units more rapidly than purely public efforts.

The focus on acquiring and renovating existing stock, rather than new construction, offers several advantages. It's often more cost-effective and environmentally sustainable. For Katitas, this presents a clear opportunity to engage with the government on projects that match its core business, potentially securing new development contracts or partnerships that benefit from government backing and subsidies.

Key aspects of the initiative for Katitas to consider include:

- Funding Structure: Understanding the terms of the public-private partnership fund and the level of government financial commitment.

- Acquisition Criteria: Identifying the types of vacant and used housing properties prioritized for acquisition and renovation.

- Rental Subsidies: Assessing the government's subsidy framework for low-cost rentals, which will impact project profitability.

- Regulatory Environment: Navigating the specific regulations and approval processes for renovation and rental within Tokyo.

Government initiatives in Japan are actively shaping the housing renovation market. The Home Energy Conservation 2025 Campaign, with an estimated ¥150 billion allocated in 2024 for energy-saving upgrades, directly supports Katitas's renovation services. Furthermore, revisions to the Vacant Houses Special Measures Law in 2023, which allows for stricter measures against dilapidated vacant homes, could create opportunities for Katitas to acquire and renovate properties.

New building standards effective April 1, 2025, will mandate stricter structural reviews and energy efficiency compliance, potentially increasing renovation costs by 5-10%. Additionally, the Tokyo Metropolitan Government's 2025 affordable housing initiative, utilizing public-private partnerships to refurbish vacant properties, presents a clear avenue for Katitas to engage with government-backed projects.

| Initiative | Focus | Impact on Katitas | Key Data/Timeline |

| Home Energy Conservation 2025 | Energy-efficient upgrades | Directly supports renovation services | ¥150 billion allocated in 2024 |

| Vacant Houses Special Measures Law Revision | Addressing dilapidated vacant homes | Potential for favorable property acquisition | Revised in 2023 |

| Building Standards Act Revisions | Stricter structural & energy efficiency compliance | Potential cost increase (5-10%), extended timelines | Effective April 1, 2025 |

| Tokyo Affordable Housing Initiative | Refurbishing vacant properties for low-cost rental | Opportunity for government-backed projects | Launching FY2025 |

What is included in the product

This comprehensive PESTLE analysis of Katitas examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Katitas.

Helps support discussions on external risk and market positioning during planning sessions, allowing Katitas to proactively address potential challenges and opportunities.

Economic factors

The Bank of Japan's shift towards monetary policy normalization, marked by its first interest rate hike in nearly two decades in mid-2024, will gradually increase borrowing costs. Analysts anticipate further modest hikes through 2025, potentially pushing the policy rate closer to 0.25% by year-end 2024 and towards 0.50% by the end of 2025, impacting the cost of capital for businesses and consumers.

This policy change directly affects the real estate sector, as higher interest rates will likely increase mortgage expenses for potential homebuyers. For instance, a 0.25% increase on a 30-year JPY 30 million mortgage could raise monthly payments by approximately JPY 5,000, potentially dampening demand for new properties and impacting sales volumes for developers like Katitas.

The Japanese Yen's sustained weakness throughout 2024 and into 2025 has dramatically lowered the cost of Japanese real estate for international investors. This affordability has spurred a noticeable uptick in foreign capital flowing into the market, with some reports indicating a 15-20% increase in foreign-led property acquisitions in key urban centers compared to the previous year.

This surge in foreign investment is a significant tailwind for the broader Japanese real estate sector, contributing to market stability and growth. However, for companies like Katitas, this increased demand, particularly in prime locations, could translate into higher acquisition costs for land and property, presenting a challenge for maintaining competitive pricing or securing prime development sites.

Rising land prices, coupled with increased material and labor expenses, are pushing up the cost of new homes. For instance, the Producer Price Index for construction inputs saw a significant increase in late 2024, impacting overall build costs. This environment makes pre-owned, renovated properties, like those offered by Katitas, a more appealing option for budget-conscious buyers.

However, these escalating construction costs also directly affect Katitas's own operational expenses. The company's renovation projects are subject to the same inflationary pressures on materials and skilled labor. A persistent shortage of construction workers, a trend noted throughout 2024 and projected into 2025, further exacerbates these challenges, potentially delaying projects and increasing overhead.

Stabilizing Residential Property Prices

Residential property prices in Japan, especially in major cities like Tokyo, are exhibiting a stabilizing trend through 2024 and into 2025. This follows a period of significant appreciation, with a noticeable slowdown in new housing starts contributing to this moderation. For Katitas, this shift offers a more predictable environment for its resale operations, although the demand for new single-family homes within Tokyo has softened.

The stabilization is partly attributed to factors such as a plateauing in new construction projects, particularly in desirable urban centers. This reduced supply growth, combined with evolving buyer sentiment, is leading to more consistent pricing. For instance, while the overall market is stabilizing, specific segments like luxury apartments in central Tokyo might still see localized demand, but the broader single-family home market in the capital is experiencing a cooling effect.

This market recalibration benefits Katitas by reducing the volatility previously seen in rapid price escalations. It allows for more accurate forecasting and inventory management for their resale business. However, the cooling demand for single-family homes in Tokyo presents a challenge that requires strategic adaptation, potentially by focusing on other property types or geographic areas within their resale portfolio.

- Market Trend: Stabilization of residential property prices in Japan, particularly in Tokyo, observed from late 2023 through 2024-2025.

- Contributing Factor: Slowdown in new residential construction, especially in urban areas, impacting supply dynamics.

- Impact on Katitas: Creates a more predictable market for resale business, but also signals a cooling demand for single-family homes in Tokyo.

- Data Point: While specific nationwide resale volume data for 2024-2025 is still emerging, anecdotal reports from real estate agencies indicate a shift from rapid price growth to more moderate appreciation or stabilization in key metropolitan areas.

Consumer Confidence and Housing Demand

Higher mortgage rates, a consequence of central bank interest rate hikes, are a significant factor influencing consumer confidence and, consequently, housing demand. For instance, in early 2024, average 30-year fixed mortgage rates hovered around 6.5% to 7.5%, a notable increase from the sub-3% rates seen in previous years. This escalation in borrowing costs can make homeownership less accessible, potentially leading to a slowdown in the housing market.

Despite these headwinds, several factors could bolster demand for housing, particularly for companies like Katitas. Strong wage growth, a trend observed through 2023 and into early 2024 with average hourly earnings rising by approximately 4.1% year-over-year, can help offset higher mortgage payments for some households. Furthermore, a discernible shift in buyer preference towards more affordable pre-owned homes, especially in suburban or exurban areas outside major metropolitan centers, presents an opportunity.

- Mortgage Rate Impact: Elevated mortgage rates, often exceeding 7% in early 2024, directly increase monthly housing payments, potentially reducing affordability and dampening buyer sentiment.

- Wage Growth Support: Continued wage increases, with average hourly earnings up around 4.1% annually in late 2023/early 2024, provide some purchasing power to households, mitigating the impact of higher borrowing costs.

- Affordable Housing Shift: A growing demand for pre-owned homes and properties located outside expensive urban cores aligns with Katitas's potential to offer more budget-friendly options.

- Consumer Confidence Index: Fluctuations in consumer confidence, as tracked by indices like the Conference Board Consumer Confidence Index which saw a rebound to over 100 in early 2024 after dips, will be a key indicator of housing market resilience.

Japan's economic landscape is shaped by a dual monetary policy approach. The Bank of Japan's move towards normalization, including its first rate hike in 19 years in mid-2024, is gradually increasing borrowing costs, with projections suggesting rates could reach 0.50% by the end of 2025. This policy shift directly impacts the real estate market by raising mortgage expenses, potentially slowing demand for new properties. Conversely, a weaker Yen throughout 2024-2025 has made Japanese real estate more attractive to foreign investors, boosting market activity but also increasing land acquisition costs for developers.

| Economic Factor | Description | Projected Impact on Katitas | Supporting Data (2024-2025) |

|---|---|---|---|

| Monetary Policy Normalization | Bank of Japan's rate hikes increasing borrowing costs. | Higher cost of capital, potentially impacting project financing and consumer affordability. | Policy rate projected to reach 0.50% by end of 2025; mortgage rates rising significantly. |

| Yen Weakness | Lower cost of Japanese assets for foreign buyers. | Increased foreign investment demand, but also higher acquisition costs for prime sites. | Yen depreciation observed throughout 2024-2025; 15-20% increase in foreign property acquisitions in key cities. |

| Inflationary Pressures | Rising costs of construction materials and labor. | Increased operational expenses for renovations and new builds, potentially affecting profit margins. | Producer Price Index for construction inputs saw significant increases in late 2024; persistent labor shortages. |

| Residential Property Price Stabilization | Moderation in price growth, especially in urban areas. | More predictable market for resale business, but cooling demand for single-family homes in Tokyo. | Stabilizing prices in major cities; slowdown in new housing starts contributing to moderation. |

Preview Before You Purchase

Katitas PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Katitas PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business.

What you’re previewing here is the actual file—fully formatted and professionally structured. It offers a deep dive into each element of the PESTLE framework, providing actionable insights for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed Katitas PESTLE analysis is designed to equip you with a thorough understanding of the external forces shaping the company's landscape.

Sociological factors

Japan's demographic shift is profound, with its aging population presenting a significant challenge and opportunity. By 2025, the entire baby boomer generation will be 75 years or older. This milestone directly influences the housing market, leading to an anticipated surge in vacant properties, often referred to as 'akiya'.

This demographic trend, sometimes called the '2025 Problem', is expected to exacerbate the issue of vacant homes across Japan. Simultaneously, there's a growing demand for housing specifically designed for seniors. Katitas can strategically position itself by focusing on the renovation and adaptation of existing properties to meet this evolving need.

The declining birthrate in many developed nations, including Japan, significantly impacts the housing market. For instance, Japan's birthrate fell to a record low of 1.26 in 2023, meaning fewer children are born per woman. This demographic shift translates to a shrinking pool of younger generations, directly affecting demand for larger, traditional family homes.

Consequently, there's a growing trend towards smaller households, often comprising single individuals or couples without children. Katitas's strategy of renovating detached houses might need to evolve to accommodate these changing living preferences. This could involve offering more flexible, compact living solutions or adapting existing properties to suit smaller family units and individual lifestyles.

Urbanization continues to draw people to cities, leading to a decline in rural populations and property values. For instance, in the US, urban areas saw a population growth of 0.9% in 2023, while many rural counties experienced net outmigration. This trend creates a dual challenge: oversupply in depopulated rural areas and high demand, often for affordable housing, in growing urban centers.

Katitas's approach of revitalizing existing housing stock is well-suited to this sociological landscape. By improving properties in areas experiencing depopulation, Katitas can potentially boost local values and create more attractive living environments. Simultaneously, these revitalized homes can offer more affordable entry points for individuals and families seeking housing near job centers in metropolitan areas, addressing the consistent demand driven by ongoing urbanization.

Increased Demand for Affordable Housing

Societal shifts are profoundly impacting housing markets. In 2024, the average rent in major Japanese cities, including Tokyo, continued its upward trajectory, with some areas seeing year-on-year increases of over 5%. This makes it increasingly challenging for middle-income families to secure stable and affordable housing, directly fueling a demand for cost-effective solutions.

Katitas is well-positioned to capitalize on this trend. Their focus on the second-hand housing market offers a compelling value proposition. By refurbishing and reselling existing properties, Katitas provides quality homes at prices significantly lower than new constructions, addressing a critical societal need for accessible housing.

The company's strategy aligns with a broader societal desire for financial prudence and sustainable living. As economic pressures mount, consumers are actively seeking more budget-friendly options. Katitas's business model directly caters to this sentiment, offering a practical and attractive alternative in a challenging housing landscape.

Key factors driving this demand include:

- Rising Cost of Living: Inflationary pressures in 2024 have further squeezed household budgets, making affordable housing a top priority for many Japanese residents.

- Urbanization Trends: Continued migration to urban centers exacerbates housing shortages and drives up prices, amplifying the need for accessible options.

- Desire for Homeownership: Despite economic challenges, the aspiration for homeownership remains strong, and Katitas's model makes this goal more attainable for a wider demographic.

Shift in Lifestyle and Remote Work Trends

The widespread adoption of remote work, significantly accelerated in recent years, has fundamentally altered how people view their living situations. This trend has fueled a greater demand for larger homes equipped with dedicated office spaces, often found in suburban and rural locales as individuals prioritize comfort and functionality over proximity to traditional urban workplaces. For Katitas, this presents a compelling opportunity to broaden its customer base beyond established city dwellers.

This lifestyle shift means Katitas can now effectively target a wider demographic seeking better value and more space outside of congested urban centers. For instance, a 2024 survey indicated that 60% of employees who worked remotely during the pandemic expressed a desire to continue working from home at least part-time, suggesting a lasting impact on housing preferences.

- Increased demand for larger homes with dedicated office spaces.

- Geographic expansion of target market into suburban and rural areas.

- Potential for Katitas to tap into new customer segments seeking lifestyle improvements.

Societal shifts are significantly reshaping housing needs and preferences. Japan's aging population, with the entire baby boomer generation turning 75 by 2025, is driving demand for senior-friendly housing and increasing the supply of vacant properties, or akiya. Simultaneously, a declining birthrate, evidenced by Japan's 2023 birthrate of 1.26, means smaller households are becoming more common, impacting demand for larger family homes.

Urbanization continues to concentrate populations in cities, creating housing shortages and driving up rental costs, with major Japanese cities experiencing rent increases of over 5% in 2024. This trend, coupled with the rising cost of living, makes affordable housing a critical need. The widespread adoption of remote work further influences housing choices, increasing demand for larger homes with dedicated office spaces in suburban and rural areas, expanding Katitas's potential market.

| Sociological Factor | Impact on Housing Market | Katitas Opportunity |

|---|---|---|

| Aging Population (Japan's 2025 milestone) | Increased demand for senior housing; surge in vacant properties (akiya). | Renovation and adaptation of existing properties for seniors. |

| Declining Birthrate (Japan's 1.26 birthrate in 2023) | Shift towards smaller households; reduced demand for large family homes. | Focus on compact, flexible living solutions; adaptation for smaller units. |

| Urbanization (0.9% US urban growth in 2023) | Housing shortages and rising prices in urban areas; depopulation in rural areas. | Revitalizing properties in depopulated areas; offering affordable urban entry points. |

| Rising Cost of Living (5%+ rent increases in Japanese cities in 2024) | Increased demand for affordable and cost-effective housing solutions. | Providing value through refurbished second-hand properties. |

| Remote Work Adoption (60% remote workers desire continued WFH in 2024) | Demand for larger homes with office spaces; interest in suburban/rural locations. | Targeting a broader demographic seeking lifestyle improvements outside urban centers. |

Technological factors

The real estate sector in Japan is undergoing a significant transformation driven by PropTech. The adoption of technologies like the Internet of Things (IoT) for building management and Artificial Intelligence (AI) for optimizing property operations is becoming increasingly prevalent. For instance, smart home solutions are enhancing the living experience, making properties more attractive to buyers and renters.

Katitas can capitalize on these advancements by integrating PropTech into its operations. This includes utilizing AI-powered systems for more efficient property management, which could lead to cost savings and improved tenant satisfaction. Furthermore, AI can assist in data-driven renovation planning, identifying optimal upgrades to maximize property value and appeal in the competitive Japanese market.

The buyer experience is also being redefined through PropTech. Virtual tours, online property management portals, and smart home features are setting new expectations. By embracing these innovations, Katitas can offer a more seamless and engaging experience for its clients, potentially boosting sales and strengthening its brand reputation in the evolving Japanese real estate landscape.

Technological advancements in construction are significantly impacting renovation. For Katitas, adopting new insulation materials, like aerogel composites, can reduce energy costs by up to 30% in renovated homes, making them more attractive to buyers. The integration of smart home technology, such as AI-powered thermostats and security systems, is becoming a standard expectation, with the smart home market projected to grow to over $100 billion globally by 2025.

These innovations allow for more efficient, cost-effective, and higher-quality renovations. For instance, advanced framing techniques can reduce material waste by 15-20% while improving structural integrity. Energy-efficient appliances, a key feature for modern buyers, can lower utility bills by an average of 10-25% annually compared to older models.

The real estate industry is rapidly embracing digital tools, with online platforms and virtual tours becoming standard for property discovery and transactions. This shift is significantly changing how buyers and sellers interact, making the process more accessible and efficient.

Katitas can leverage this trend to expand its distribution reach by investing in a strong online presence and offering immersive virtual viewing experiences. For instance, in 2024, the global proptech market was valued at over $20 billion, with a significant portion driven by digital real estate platforms, indicating substantial growth potential.

AI and Data Analytics for Valuation and Renovation Planning

The advancement of AI models capable of automatically generating renovated property designs and providing crucial market data, including crime risk and seismic activity, offers significant advantages for Katitas. This technology can streamline property valuation and renovation planning, leading to more informed acquisition and sales strategies.

For instance, AI-powered tools can analyze vast datasets to predict renovation costs and potential resale values with greater accuracy. In 2024, the global AI in real estate market was valued at approximately $1.5 billion and is projected to reach over $5 billion by 2030, highlighting its growing importance.

- AI-driven design generation can visualize potential renovations, aiding client understanding and decision-making.

- Predictive analytics can forecast market trends and property appreciation, informing acquisition timing.

- Risk assessment tools powered by AI can quantify factors like crime rates and earthquake vulnerability, impacting property desirability and insurance costs.

- Data integration allows for a holistic view, optimizing both renovation investments and sales pricing.

Energy-Efficient Technologies in Homes

Technological advancements in energy efficiency are reshaping the housing market. Mandatory energy efficiency standards for new construction, set to take effect in April 2025, alongside increasingly stringent requirements for existing homes, are driving the integration of energy-saving technologies. These include solar panels, high-efficiency water heaters, and advanced insulation materials, all aimed at reducing energy consumption and carbon footprints.

For Katitas, incorporating these innovations into their renovation projects presents a significant opportunity. By proactively integrating technologies like solar photovoltaic systems, which saw a global installed capacity increase of over 30% in 2024 according to the International Energy Agency (IEA), Katitas can ensure compliance with upcoming regulations. Furthermore, this commitment to sustainability will likely enhance property appeal to a growing segment of environmentally conscious buyers, potentially commanding premium pricing.

- Mandatory Standards: New construction must meet April 2025 energy efficiency mandates.

- Retrofitting Needs: Existing homes face rising standards, creating a market for upgrades.

- Key Technologies: Solar panels, efficient water heaters, and superior insulation are crucial.

- Market Appeal: Eco-friendly features attract buyers and can increase property value.

Technological factors are fundamentally altering the real estate landscape, pushing for greater efficiency and enhanced buyer experiences. Katitas should embrace AI for predictive analytics in market trends and property valuation, as the global AI in real estate market is projected to exceed $5 billion by 2030. Furthermore, the increasing adoption of smart home technology, with the global market expected to surpass $100 billion by 2025, presents opportunities to increase property appeal and value through integrated solutions.

| Technology | Impact on Real Estate | Katitas Opportunity | Market Data (2024/2025) |

|---|---|---|---|

| AI & Predictive Analytics | Optimized property valuation, renovation planning, market trend forecasting. | Streamline acquisition and sales strategies, improve investment ROI. | Global AI in Real Estate Market: ~ $1.5 Billion (2024), projected to reach over $5 Billion by 2030. |

| Smart Home Technology (IoT) | Enhanced living experience, increased property desirability, operational efficiency. | Offer modern, attractive features to buyers and renters, potentially commanding premium pricing. | Global Smart Home Market: Projected to exceed $100 Billion by 2025. |

| Virtual Tours & Online Platforms | Expanded distribution reach, improved buyer accessibility, seamless transactions. | Invest in digital presence to offer immersive viewing experiences, increasing sales potential. | Global Proptech Market: Valued over $20 Billion (2024), with digital platforms being a significant driver. |

Legal factors

Japan's Revised Building Standards Act, effective April 2025, mandates building permits for all renovations on two-story wooden structures, irrespective of their size. This new regulation will likely add complexity and expense to Katitas' renovation projects, requiring careful navigation of increased administrative procedures and potentially longer project timelines.

Katitas must now prioritize adherence to these enhanced structural review protocols and the newly enforced energy efficiency mandates for all renovation undertakings. Failure to comply could result in penalties and project delays, impacting the company's operational efficiency and profitability in the Japanese market.

From April 2025, new residential construction must adhere to stringent national energy conservation standards, specifically Thermal Insulation Performance Grade 4 and Primary Energy Consumption Grade 4 or higher. This regulatory shift, impacting approximately 1.5 million new homes built annually in the UK, sets a new benchmark for energy efficiency in the housing sector.

While these regulations are mandatory for new builds, they are expected to indirectly influence the market for renovated properties. Katitas, in its renovation projects, should anticipate increased buyer demand for upgraded energy performance, potentially requiring investments in insulation and energy-efficient systems to meet evolving expectations, even in existing structures.

Amendments to the Real Estate Registration Law, effective April 2024, introduce new requirements for overseas investors and inheritance, mandating the registration of domestic contact information. While Katitas operates domestically, these legal shifts are designed to enhance the clarity and accuracy of property ownership records across the board.

This streamlining of property ownership documentation could indirectly benefit Katitas by potentially simplifying the process of acquiring vacant or inherited properties, as the updated legal framework aims to reduce ambiguities in ownership.

Property Acquisition and Transfer Taxes

When Katitas acquires property in Japan, it will encounter several taxes on the transfer. For instance, the real property acquisition tax is levied at the time of purchase, typically at a rate of 4% for land and residential buildings, though this can be reduced for certain types of properties or in specific prefectures. Registration tax is also applied when registering ownership, with rates varying, for example, 2% for land and 1% for buildings as of recent general guidelines.

These taxes directly impact the cost of acquiring new assets and the net proceeds from property sales. Katitas needs to meticulously calculate these liabilities, as they can significantly alter the profitability of real estate transactions. Understanding the nuances of prefectural and municipal variations in tax rates is crucial for accurate financial planning.

Key considerations for Katitas regarding property acquisition and transfer taxes include:

- Real Property Acquisition Tax: Generally 4% on acquisition value, but subject to reductions for specific property types and locations.

- Registration and License Tax: Varies, with common rates around 2% for land and 1% for buildings upon registration of ownership.

- Impact on Transaction Costs: These taxes add a substantial layer to the overall cost of buying and selling property, requiring careful budgeting.

- Prefectural and Municipal Variations: Specific rates and exemptions can differ significantly by region within Japan, necessitating localized research.

Vacant Houses Special Measures Law

The Vacant Houses Special Measures Law, introduced in 2015, grants the government the authority to identify and mandate the demolition or repair of vacant properties deemed hazardous. This legislation is crucial for Katitas as it creates opportunities to acquire distressed properties. By renovating these buildings, Katitas can contribute to urban revitalization and reintroduce viable housing stock to the market.

This law directly supports Katitas' business model by increasing the supply of properties suitable for their renovation and resale strategy. For instance, in 2024, local authorities reported a 15% increase in vacant properties flagged for potential intervention under similar measures, indicating a growing pipeline of opportunities. This legal framework streamlines the process for acquiring and developing such properties, fostering urban renewal projects.

The effectiveness of this law is evident in its contribution to urban renewal initiatives. By enabling the government to address derelict buildings, it not only improves neighborhood aesthetics but also unlocks potential development sites. Katitas can leverage this by acquiring these properties at potentially lower costs, undertaking necessary repairs or redevelopment, and ultimately increasing the availability of quality housing in targeted areas.

Key aspects of the Vacant Houses Special Measures Law for Katitas include:

- Facilitates acquisition of distressed properties

- Supports urban revitalization efforts

- Increases supply of renovation-ready housing stock

- Streamlines process for addressing hazardous vacant buildings

Japan's legal landscape presents both challenges and opportunities for Katitas. The Revised Building Standards Act, effective April 2025, introduces stricter permit requirements for renovations on two-story wooden structures, potentially increasing administrative burdens and project timelines. Furthermore, new residential construction must meet enhanced energy efficiency standards from April 2025, which may indirectly drive demand for higher energy performance in renovated properties.

Environmental factors

Japan's commitment to carbon neutrality by 2050, including a target of a 46% reduction in greenhouse gas emissions by 2030, significantly shapes its environmental policy landscape. This ambitious goal necessitates stringent regulations and incentives aimed at decarbonization across all sectors.

Consequently, Katitas must navigate an evolving regulatory environment that prioritizes sustainability. For instance, stricter energy efficiency standards for new and existing buildings are likely to be implemented, directly impacting the company's renovation strategies and material sourcing decisions to align with these national environmental objectives.

The building sector is a major energy consumer in Japan, driving a significant push for enhanced energy efficiency. This trend presents a clear opportunity for Katitas to boost the appeal of its renovated properties. By integrating superior insulation, advanced high-efficiency appliances, and eco-friendly building materials, Katitas can tap into both government support programs and growing consumer preferences for sustainable living.

The revised Building Standards Act in 2024 is a significant driver for Katitas, mandating the use of sustainable building materials such as responsibly sourced timber and promoting decarbonization throughout the construction lifecycle. This legislation directly encourages a shift away from traditional, high-carbon footprint materials.

Katitas can strategically integrate circular economy principles into its renovation projects. For instance, utilizing smart crushed aggregates, which are processed construction and demolition waste, or incorporating recycled timber can significantly lower environmental impact. By adopting these practices, Katitas not only adheres to evolving regulatory standards but also positions itself as a leader in sustainable construction, potentially attracting environmentally conscious clients and investors.

Urban Heat Island Effect and Green Infrastructure

The urban heat island effect significantly impacts city dwellers, posing health risks, particularly to vulnerable populations like the elderly. This growing concern fuels a demand for climate-resilient urban planning and the implementation of green infrastructure solutions. In 2024, cities globally are investing more in these areas, with the green building sector expected to reach $2.5 trillion by 2030, according to some projections.

Katitas's renovation projects for detached houses offer a direct opportunity to address this environmental challenge. By integrating features such as green roofs, enhanced insulation for improved ventilation, and the use of reflective materials for roofing and paving, Katitas can help mitigate the heat island effect at the property level. For instance, studies have shown that cool roofs can reduce a building's surface temperature by up to 50°F (28°C), leading to lower cooling costs and improved indoor comfort.

- Increased demand for climate-resilient housing: Growing awareness of heat-related health risks is driving consumer interest in properties designed for thermal comfort.

- Green infrastructure investment: Global investment in green building is projected to surge, indicating a favorable market for sustainable renovation solutions.

- Property value enhancement: Homes incorporating green features and energy efficiency upgrades are likely to see higher resale values, a trend observed in 2024 real estate markets.

- Mitigation of urban heat: Katitas's focus on green spaces and reflective materials directly contributes to reducing local temperatures and improving urban livability.

Waste Management and Recycling in Construction

Japan has a strong track record in construction waste recycling, with rates for concrete, asphalt, and timber exceeding 90% in recent years, driven by legislation enacted in the 1990s. Katitas can leverage this established infrastructure by implementing advanced waste segregation and material recovery processes during its renovation projects.

By actively participating in Japan's circular economy initiatives, Katitas can not only minimize landfill contributions but also potentially reduce operational expenses through the sale of recycled materials. For instance, the recycling of construction and demolition waste in Japan reached approximately 420 million tons in 2022, a testament to the effectiveness of their policies.

- High Recycling Rates: Japan consistently achieves over 90% recycling for key construction materials like concrete and timber.

- Cost Reduction Potential: Optimizing waste management can lead to lower disposal fees and revenue from recycled materials for Katitas.

- Circular Economy Contribution: Active participation aligns Katitas with Japan's commitment to a sustainable built environment.

Japan's aggressive carbon neutrality goals, targeting a 46% greenhouse gas reduction by 2030, mandate stricter environmental regulations impacting construction and renovation. Katitas must adapt to these evolving standards, which favor energy-efficient materials and practices.

The growing concern over urban heat islands is driving demand for climate-resilient housing, creating opportunities for Katitas to incorporate green infrastructure like green roofs and reflective materials, which can reduce surface temperatures significantly.

Japan's high construction waste recycling rates, exceeding 90% for key materials, provide a strong foundation for Katitas to implement circular economy principles, reducing waste and potentially lowering operational costs.

| Environmental Factor | Impact on Katitas | Opportunity/Challenge |

| Carbon Neutrality Goals | Stricter energy efficiency standards, demand for low-carbon materials | Opportunity to differentiate through sustainable renovations, challenge to meet higher compliance costs |

| Urban Heat Island Effect | Increased demand for climate-resilient features, need for green infrastructure integration | Opportunity to offer enhanced property value through thermal comfort solutions, challenge to implement new technologies |

| Waste Recycling Infrastructure | Availability of recycled materials, established waste segregation processes | Opportunity to reduce material costs and landfill contributions, challenge to optimize waste management for maximum benefit |

PESTLE Analysis Data Sources

Our Katitas PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable market research firms, and leading academic journals. This comprehensive approach ensures that each factor, from political stability to technological advancements, is informed by credible and current information.