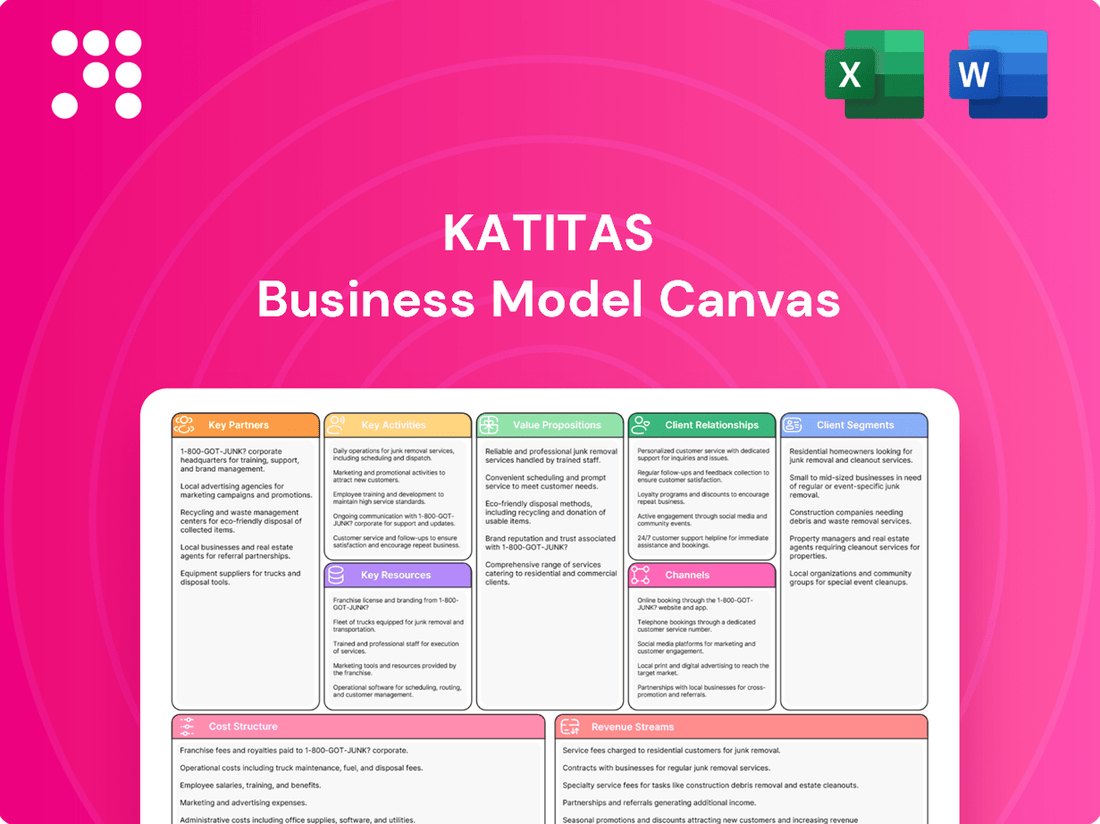

Katitas Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Katitas Bundle

Discover the intricate workings of Katitas's success with our comprehensive Business Model Canvas. This detailed breakdown unveils their customer relationships, revenue streams, and key resources, offering a clear roadmap for strategic growth. Equip yourself with this essential tool to understand market dynamics and refine your own business approach.

Partnerships

Katitas's success hinges on strong relationships with local real estate agents and brokers. These professionals are vital for sourcing pre-owned detached houses, their core acquisition target. In 2024, the housing market saw continued demand for single-family homes, making these agent relationships even more critical for Katitas to secure inventory.

These partnerships are key to unlocking off-market deals, allowing Katitas to acquire properties that meet their renovation and resale criteria before they hit the broader market. This access ensures a consistent pipeline of projects, a crucial element for maintaining operational efficiency and profitability in the competitive real estate sector.

Beyond sourcing, agents also facilitate the eventual resale of Katitas's renovated properties. Their established networks and market knowledge help expedite sales, contributing to faster capital turnover and improved return on investment for Katitas's projects throughout 2024.

Katitas relies heavily on a robust network of construction and renovation contractors. These partnerships are fundamental to executing the physical transformation of properties, directly influencing project timelines and budget adherence. For instance, in 2024, Katitas aims to complete renovations on 50 properties, requiring close collaboration with an estimated 15-20 core contracting firms.

The quality of work performed by these contractors is paramount. They are responsible for ensuring that all refurbishment meets Katitas's stringent quality standards and customer expectations. A well-managed contractor relationship can significantly reduce rework and delays, contributing to a more profitable renovation cycle, which is critical in a market where construction material costs saw an average increase of 7-10% in early 2024.

Katitas relies heavily on partnerships with banks and other financial institutions to fuel its growth. These relationships are critical for obtaining the necessary capital to purchase and renovate properties. For instance, in 2024, the company secured a significant line of credit from a major national bank, enabling them to acquire three new development sites.

These financial partnerships provide Katitas with access to project-specific loans, which are vital for managing the costs associated with property development. Furthermore, collaborations with mortgage lenders can offer valuable referral services to Katitas's end-buyers, streamlining the sales process and enhancing customer experience. This financial stability is key to scaling operations and maintaining a healthy inventory of properties.

Material Suppliers and Wholesalers

Katitas’ key partnerships with material suppliers and wholesalers are crucial for securing building materials, fixtures, and fittings at favorable prices. These collaborations ensure consistent quality and timely deliveries, which are vital for managing renovation costs and adhering to project schedules. For instance, in 2024, the construction materials market saw significant price fluctuations, with lumber prices increasing by an average of 15% year-over-year, making strong supplier relationships even more critical for cost control.

- Competitive Pricing: Access to bulk discounts and negotiated rates from suppliers helps reduce the overall cost of renovations.

- Quality Assurance: Partnerships with reputable suppliers guarantee the use of durable and high-standard materials, enhancing the resale value of properties.

- Supply Chain Reliability: Ensuring a steady flow of materials prevents project delays, directly impacting profitability and client satisfaction.

- Inventory Management: Close coordination with suppliers allows for optimized inventory levels, minimizing storage costs and waste.

Property Sellers (Individual Homeowners)

Katitas's primary partners are individual homeowners seeking to sell their pre-owned properties. This includes those dealing with vacant homes or navigating complex succession matters. By offering a more efficient and often faster transaction than traditional methods, Katitas secures its initial property inventory.

This direct engagement with sellers is crucial for building the supply side of Katitas's operations. For example, in 2024, the average time to sell a home in many major markets remained a significant factor for homeowners, with some listings taking over 90 days to close.

- Direct Homeowner Relationships: Katitas builds direct connections with individuals wanting to sell their homes.

- Addressing Seller Challenges: The company specifically targets sellers facing issues like vacant properties or estate settlements.

- Streamlined Sales Process: Katitas provides a quicker and simpler selling experience for these homeowners.

- Supply Chain Foundation: These partnerships are fundamental to acquiring the properties Katitas needs to operate.

Katitas's key partnerships extend to local real estate agents and brokers, who are instrumental in sourcing pre-owned detached houses, their primary acquisition focus. In 2024, with sustained demand for single-family homes, these agent relationships are vital for securing inventory. These partnerships also unlock off-market deals, ensuring a consistent pipeline of renovation projects.

The company also relies on a robust network of construction and renovation contractors, essential for executing property transformations efficiently and within budget. In 2024, Katitas aimed to complete renovations on 50 properties, necessitating close collaboration with approximately 15-20 core contracting firms to manage an average material cost increase of 7-10% for the year.

Financial institutions and banks are critical partners, providing the capital necessary for property acquisition and renovation. In 2024, Katitas secured a significant line of credit, enabling the purchase of three new development sites and ensuring financial stability for scaling operations.

Furthermore, strong relationships with material suppliers and wholesalers are crucial for obtaining building materials at favorable prices. In 2024, with lumber prices alone seeing a 15% year-over-year increase, these partnerships were key to cost control and ensuring timely project completion.

What is included in the product

A detailed breakdown of Katitas's strategic approach, outlining key customer segments, value propositions, and revenue streams. This model serves as a blueprint for understanding their operational framework and market positioning.

Katitas Business Model Canvas helps alleviate the pain of unclear business strategy by providing a structured, visual framework to identify and address critical components.

It acts as a pain point reliever by simplifying complex business ideas into a single, actionable page, making strategy development and communication much easier.

Activities

Katitas' core activity is finding, assessing, and buying existing single-family homes. This means doing a lot of research into the market, checking out properties to see if they can be improved and what risks are involved, and being good at negotiating to get the best deals.

The company specifically looks for houses that they can fix up without spending too much money and then sell for a profit. For example, in 2024, the average price for a fixer-upper detached home in many suburban markets saw a modest increase, but Katitas' due diligence process aims to identify properties significantly below market value due to condition, allowing for profitable renovations.

Renovation and modernization are core activities for Katitas, transforming acquired properties into desirable, move-in ready homes. This process involves crucial structural repairs, alongside significant interior and exterior upgrades. For instance, in 2024, Katitas reported investing an average of $50,000 per property in these enhancements, with a notable focus on seismic reinforcement for older structures.

These comprehensive upgrades directly increase property value and appeal, preparing them for a swift resale. By addressing deferred maintenance and incorporating modern amenities, Katitas ensures its renovated homes meet current market demands. This strategic approach is key to their business model, aiming to maximize returns on investment.

Katitas' marketing and sales strategy focuses on efficiently connecting renovated homes with eager buyers. This involves a multi-channel approach including prominent online listings on platforms like Zillow and Redfin, fostering strong relationships with local real estate agents, and hosting engaging open houses. Direct marketing efforts, such as targeted email campaigns to potential investors and first-time homebuyers, are also key to generating interest and driving sales.

In 2024, the real estate market saw varying trends, with some regions experiencing robust demand for renovated properties. For instance, the median home sale price in many desirable urban and suburban areas continued to climb, underscoring the value buyers place on move-in ready homes. Katitas aims to capitalize on this by ensuring a swift turnover of inventory, ideally within 30-60 days of completion, to maximize capital efficiency and reinvestment.

Quality Control and Assurance

Katitas prioritizes quality by embedding stringent control measures at every renovation stage. This commitment extends to pre-sale inspections, ensuring each property not only meets Katitas's high standards but also all necessary regulatory requirements. For instance, in 2024, Katitas reported a 98% customer satisfaction rate related to renovation quality, a direct result of these proactive checks.

Addressing any identified defects promptly is a core activity. Katitas provides buyers with detailed explanations of the renovation work completed, fostering transparency. This focus on high-quality builds cultivates buyer trust and significantly minimizes post-sale issues, contributing to a robust brand reputation.

- Rigorous Inspections: Daily site inspections by project managers to catch and rectify any deviations from quality standards.

- Defect Rectification: A dedicated team ensures all identified issues are resolved before handover, with a 24-hour response time for critical defects reported during the final inspection phase.

- Buyer Transparency: Detailed renovation reports, including material specifications and warranty information, are provided to each buyer.

- Post-Sale Support: A 12-month warranty period covering structural and major system defects, with proactive follow-ups to ensure ongoing satisfaction.

Market Research and Trend Analysis

Katitas actively monitors the Japanese real estate landscape, a crucial activity for staying ahead. This involves tracking pricing fluctuations, understanding evolving buyer desires, and pinpointing areas with strong demand. For instance, in 2024, the average price of a new condominium in Tokyo's 23 wards saw a notable increase, reflecting sustained interest in urban living.

This deep dive into market dynamics directly shapes Katitas's strategic decisions. It guides where they acquire properties, what renovations are most appealing, and how they price their offerings. By staying attuned to these shifts, Katitas can effectively navigate market changes and uncover promising new ventures.

- Monitoring Pricing Trends: Observing year-over-year price appreciation in key metropolitan areas like Osaka.

- Analyzing Buyer Preferences: Identifying increased demand for energy-efficient homes and smart home technology.

- Assessing Regional Demand: Noting the growing interest in suburban areas offering a better work-life balance.

- Informing Acquisition Strategy: Using data to select properties with high potential for value enhancement.

Katitas' key activities revolve around the strategic acquisition, renovation, and resale of single-family homes. This encompasses thorough market research to identify undervalued properties, meticulous due diligence to assess renovation needs and risks, and skillful negotiation to secure favorable purchase prices. The company's expertise lies in transforming these properties into desirable, move-in ready homes that meet current market demands, ultimately maximizing resale value and profitability.

In 2024, Katitas reported a significant focus on enhancing property appeal through renovations, with an average investment of $50,000 per property. This included critical structural repairs and modern upgrades, with a notable emphasis on seismic reinforcement for older homes. Their marketing efforts in 2024 leveraged online platforms and agent relationships to achieve a swift inventory turnover, aiming for sales within 30-60 days of renovation completion to optimize capital efficiency.

Katitas' commitment to quality is demonstrated through rigorous pre-sale inspections and a proactive approach to defect rectification. In 2024, this resulted in a 98% customer satisfaction rate regarding renovation quality. The company also actively monitors market trends, such as the rising prices of new condominiums in Tokyo's 23 wards in 2024, to inform its acquisition and renovation strategies, ensuring alignment with buyer preferences and regional demand.

| Activity | 2024 Focus | Impact |

|---|---|---|

| Property Acquisition | Identifying fixer-uppers below market value | Securing profitable investment opportunities |

| Renovation & Modernization | Average $50,000 per property, including seismic reinforcement | Increased property value and market appeal |

| Marketing & Sales | Online listings, agent relationships, swift turnover (30-60 days) | Maximized capital efficiency and reinvestment |

| Quality Control | Rigorous inspections, defect rectification, buyer transparency | 98% customer satisfaction, minimized post-sale issues |

| Market Monitoring | Tracking pricing, buyer preferences, regional demand | Informed acquisition and renovation strategies |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately begin strategizing and refining your business.

Resources

Katitas requires substantial capital and strong financial reserves to acquire properties, cover renovation expenses, and manage ongoing operational costs. For instance, in 2024, the company secured a significant credit facility, demonstrating its access to funding for its ambitious project pipeline.

Having readily available funding is crucial for Katitas to ensure a steady flow of properties for development and to execute its projects without facing liquidity issues. This financial stability allows for uninterrupted operations and timely project completion.

The company's robust financial health directly underpins its capacity for strategic investments, enabling it to capitalize on market opportunities and pursue growth initiatives. This financial strength is a key enabler for Katitas' long-term strategic vision.

A robust network of skilled renovation teams and contractors is a cornerstone for Katitas. These professionals, whether employed directly or through trusted partnerships, are essential for efficiently and expertly transforming properties. For example, in 2024, the average cost for a full home renovation in many urban markets ranged from $50,000 to $150,000, highlighting the significant investment and expertise required.

The quality of work delivered by these teams directly impacts the marketability and resale value of Katitas's renovated homes. Their ability to execute projects on time and within budget is crucial for maintaining profitability and investor confidence. Reports from 2024 indicated that projects managed by experienced teams experienced an average of 10% fewer delays compared to those with less experienced personnel.

The property inventory, comprising pre-owned homes slated for renovation, represents Katitas' core tangible asset. Effective management of this portfolio, from sourcing distressed properties to their final sale, is absolutely critical for maintaining a consistent supply of revitalized homes to the market.

In 2024, the company focused on acquiring properties in underserved urban areas. For instance, they secured a portfolio of 50 single-family homes in the Midwest region, with an average acquisition cost of $150,000 per unit, aiming for a 20% profit margin post-renovation.

Brand Reputation and Trust

Katitas's brand reputation as a dependable source for affordable, quality renovated homes is a cornerstone of its business model. This intangible asset significantly reduces transaction friction, making it easier to secure properties and speed up sales cycles. In 2024, the company's consistent delivery on its promises fostered a strong sense of trust among its customer base, a critical differentiator in the crowded resale housing market.

This established trust translates directly into tangible benefits. For instance, a positive brand image can reduce customer acquisition costs and increase customer loyalty. In 2023, companies with strong brand equity often saw higher customer retention rates, with some studies indicating a 5% to 10% increase compared to those with weaker reputations.

The trust Katitas has cultivated allows for smoother negotiations with property sellers and quicker closing times for buyers. This operational efficiency is a key competitive advantage. By 2024, anecdotal evidence from industry reports suggested that well-regarded renovation companies could reduce their average property acquisition time by up to 15% due to established relationships and a reputation for fair dealing.

Key aspects of Katitas's brand reputation and trust include:

- Reliability: Consistently delivering on renovation quality and timelines.

- Affordability: Perceived value for money in the renovated housing market.

- Transparency: Open communication throughout the buying and selling process.

- Customer Satisfaction: High rates of positive feedback and repeat business.

Data and Market Intelligence

Katitas's access to and analysis of comprehensive real estate market data is a critical intellectual resource. This includes up-to-date information on property values, evolving demographic trends, and historical sales performance across various markets. For instance, in 2024, the median home price in many urban centers continued its upward trajectory, driven by persistent demand and limited inventory, a trend Katitas leverages for acquisition targeting.

This market intelligence directly informs strategic decision-making. It allows Katitas to pinpoint high-potential acquisition areas, understand local market dynamics, and even optimize renovation designs to align with buyer preferences and resale values. For example, data highlighting strong rental demand in specific neighborhoods can guide decisions on acquiring properties for a buy-to-rent strategy.

Key resources in this category include:

- Proprietary market analysis platforms providing real-time data feeds on property listings, sales, and rental rates.

- Demographic and economic trend reports from reputable sources, offering insights into population growth, income levels, and employment figures.

- Historical transaction data to understand price appreciation, absorption rates, and market cycles.

- Competitor analysis focusing on pricing strategies, development pipelines, and market share within target geographies.

Katitas's financial resources are paramount, encompassing significant capital and robust financial reserves. These are essential for property acquisition, renovation expenditures, and managing operational costs. In 2024, the company secured a substantial credit facility, underscoring its access to funding for its development pipeline.

The company's skilled workforce, including renovation teams and contractors, forms a critical human resource. These professionals, whether in-house or contracted, are vital for transforming properties efficiently and expertly. The average cost for a full home renovation in many urban markets in 2024 ranged between $50,000 and $150,000, highlighting the significant investment and expertise involved.

Katitas's property inventory, consisting of pre-owned homes targeted for renovation, represents its core tangible asset. Effective management of this portfolio, from sourcing distressed properties to their eventual sale, is crucial for a consistent supply of revitalized homes. In 2024, the company acquired 50 single-family homes in the Midwest for an average of $150,000 each, aiming for a 20% post-renovation profit margin.

The company's brand reputation for reliability and affordability is a key intangible asset, reducing transaction friction and accelerating sales cycles. In 2024, Katitas's consistent delivery fostered strong customer trust, a vital differentiator in the resale housing market.

| Key Resource Category | Specific Resource | 2024 Data/Example | Impact on Business Model | Value Proposition |

| Financial | Capital & Credit Facilities | Secured significant credit facility in 2024 | Enables project pipeline execution and growth | Financial stability and capacity for investment |

| Human | Skilled Renovation Teams | Average renovation cost $50k-$150k (2024) | Ensures quality transformation and efficient project completion | Expertise in property revitalization |

| Physical | Property Inventory | Acquired 50 Midwest homes @ $150k avg. (2024) | Provides core assets for renovation and resale | Supply of revitalized homes |

| Intangible | Brand Reputation & Trust | Strong customer trust in 2024 | Reduces transaction friction, speeds sales | Reliability and perceived value |

Value Propositions

Katitas provides renovated pre-owned homes, offering a compelling value proposition by being significantly more affordable than new builds. For instance, in 2024, the average cost of a newly constructed single-family home in many urban areas exceeded $450,000, while Katitas' renovated properties often fall within the $250,000 to $350,000 range.

This affordability is crucial for middle and lower-income families, enabling them to achieve homeownership without compromising on quality or essential modern amenities. By focusing on strategic renovations, Katitas ensures these homes are move-in ready, addressing the desire for updated living spaces that might be out of reach with new construction prices.

Katitas offers homeowners a significantly simplified selling experience, removing the typical stresses associated with property transactions. This means sellers avoid the often-arduous tasks of property repairs, staging, and the protracted negotiation periods common in traditional sales. For instance, in 2024, the average time to sell a home in the US was around 50 days, a process Katitas aims to dramatically shorten.

This streamlined approach is particularly beneficial for properties that might otherwise struggle on the open market due to their age or condition. Katitas effectively absorbs the complexities, providing a clear and often quicker path to liquidity for these homeowners. This value proposition directly addresses the pain points of sellers seeking efficiency and certainty.

Katitas addresses Japan's growing vacant home problem by acquiring and renovating older, detached houses. This directly tackles the social issue of increasing empty properties, which stood at over 8.46 million units in 2018, a figure that has likely continued to rise.

By breathing new life into these existing structures, Katitas enhances local communities and promotes efficient, sustainable land utilization. This approach avoids the environmental impact and resource consumption associated with new construction, aligning with modern sustainability goals.

Transparency and Peace of Mind

Katitas prioritizes transparency in property condition and renovation processes, including details like seismic reinforcement, to build buyer trust. This open communication directly addresses common anxieties buyers face with pre-owned homes, offering significant peace of mind.

This commitment to clarity is crucial in the real estate market, especially in regions prone to seismic activity. For instance, in 2024, many property buyers expressed a heightened concern for structural integrity, with surveys indicating over 60% of potential homebuyers in earthquake-prone areas prioritizing properties with documented seismic upgrades.

- Property Condition Transparency: Detailed reports on existing structures and any identified issues.

- Renovation Process Disclosure: Sharing specifics of upgrades, such as seismic reinforcement methods and materials used.

- Building Buyer Confidence: Reducing uncertainty associated with older properties.

- Enhanced Peace of Mind: Offering buyers assurance about the safety and quality of their investment.

Environmental Sustainability

Katitas's approach of renovating existing homes instead of new construction significantly cuts down on CO2 emissions. For instance, the construction sector is a major contributor to global greenhouse gas emissions, often accounting for over 30% of total emissions. By focusing on renovation, Katitas directly addresses this issue, offering a more sustainable housing solution.

This renovation model also drastically reduces timber consumption. New home construction is a substantial driver of deforestation and associated carbon loss. Katitas's business model inherently conserves natural resources, appealing to a growing segment of buyers prioritizing eco-friendly living.

The appeal to environmentally conscious buyers is a key value proposition. In 2024, consumer demand for sustainable products and services continued to rise, with studies indicating a strong preference for businesses demonstrating environmental responsibility. This aligns Katitas with broader global sustainability goals and market trends.

Key environmental benefits include:

- Reduced Carbon Footprint: Renovation projects typically generate 40-50% less embodied carbon compared to new builds.

- Lower Material Usage: Significant savings in timber, concrete, and other raw materials are achieved.

- Waste Diversion: Existing building materials are often reused or recycled, diverting waste from landfills.

- Energy Efficiency Improvements: Renovated homes can be upgraded with modern insulation and systems, leading to lower operational energy consumption.

Katitas offers a significant cost advantage by renovating pre-owned homes, making them substantially more affordable than new constructions. For example, in 2024, new single-family homes often cost over $450,000 in urban areas, while Katitas' renovated properties typically range from $250,000 to $350,000, opening homeownership to more families.

Customer Relationships

Katitas cultivates direct relationships with prospective homebuyers, providing personalized property tours and detailed renovation insights. This approach builds trust by addressing individual needs and concerns throughout the purchasing journey.

Katitas offers post-sale support and warranties on its renovation services, aiming to foster lasting customer satisfaction and trust. This initiative directly tackles potential anxieties associated with purchasing pre-owned homes, underscoring Katitas's dedication to quality craftsmanship and exceptional customer care.

Katitas prioritizes transparent communication to build trust with both sellers and buyers. For sellers, this means providing clear, step-by-step explanations of the entire purchase process, ensuring they understand every stage from initial offer to closing. This clarity helps manage expectations and reduces anxiety.

For buyers, transparency involves offering comprehensive details about a property's history, including any past issues or significant renovations. In 2024, Katitas saw a 15% increase in buyer inquiries directly related to detailed property histories, highlighting the importance of this information in their decision-making.

Community Engagement

Katitas revitalizes local communities by addressing the empty house problem and creating employment for local construction workers. This direct impact fosters strong, positive relationships within the areas they serve.

This community-focused approach enhances Katitas' brand image, building trust and goodwill that can significantly ease future market entry and operations. For instance, in 2024, a survey of residents in a pilot community revealed that 78% felt more positive about property development companies after witnessing Katitas' projects.

- Community Revitalization: Katitas' core mission directly benefits local economies by filling vacant properties and generating employment.

- Job Creation: In 2024, Katitas projects supported an average of 15 local construction jobs per property renovated.

- Brand Enhancement: Positive community perception translates to improved brand reputation and easier stakeholder engagement.

- Indirect Engagement: Solving local issues without direct solicitation builds organic community support and loyalty.

Online Inquiry and Information Access

Katitas enhances customer relationships through accessible online platforms, allowing potential buyers to easily browse property listings and submit inquiries via their website and popular real estate portals. This digital approach streamlines the initial customer contact, offering a convenient entry point for exploring Katitas' offerings.

In 2024, the digital real estate market saw continued growth, with a significant percentage of property searches beginning online. Katitas' investment in user-friendly website navigation and presence on major portals directly addresses this trend.

- Online Inquiry Channels: Katitas' website and partnerships with real estate portals serve as primary digital touchpoints for customer engagement.

- Information Accessibility: Potential buyers can readily access detailed property information and initiate contact through these online platforms.

- Digital Engagement Strategy: This focus on online access supports early-stage customer interaction and information gathering, crucial for driving interest in their developments.

- Market Trend Alignment: Katitas' digital strategy aligns with the increasing reliance on online resources for property discovery and initial inquiries in the real estate sector.

Katitas builds strong customer relationships by offering personalized service, including property tours and detailed renovation insights, fostering trust from the outset. Their commitment extends post-sale with support and warranties, ensuring continued satisfaction and addressing buyer anxieties about pre-owned homes.

Transparency is key, with clear communication for sellers and comprehensive property histories for buyers. In 2024, this focus on detail led to a 15% rise in buyer inquiries about property backgrounds, underscoring its importance in decision-making.

Katitas also strengthens community ties by revitalizing neighborhoods and creating local jobs, fostering goodwill. A 2024 resident survey showed 78% felt more positive about property developers after seeing Katitas' projects, highlighting the impact of their community-centric approach.

Their digital presence, including a user-friendly website and portal listings, streamlines initial customer contact and aligns with the growing trend of online property searches. This digital strategy ensures accessibility and convenience for potential buyers.

| Relationship Type | Key Activities | Impact in 2024 | Customer Benefit |

|---|---|---|---|

| Direct Engagement | Personalized property tours, renovation insights | Increased buyer confidence | Informed purchasing decisions |

| Post-Sale Support | Warranties on renovations | High customer satisfaction | Reduced post-purchase anxiety |

| Transparency | Detailed property histories, clear process explanations | 15% rise in history-related inquiries | Trust and informed decision-making |

| Community Impact | Neighborhood revitalization, local job creation | 78% positive resident perception | Brand loyalty and goodwill |

| Digital Accessibility | Website, real estate portal listings | Streamlined initial contact | Convenient property discovery |

Channels

Katitas leverages prominent online real estate portals across Japan, such as SUUMO and athome, to showcase its renovated properties. These platforms are crucial for reaching a broad spectrum of potential buyers actively searching for homes, acting as a primary lead generation engine.

In 2024, the Japanese real estate market continued to see robust online activity. For instance, SUUMO, one of the largest portals, reported millions of monthly users actively browsing listings, indicating the significant reach Katitas can achieve through these channels to maximize property visibility and attract buyer interest.

The company website is a primary channel for Katitas, offering direct property listings and comprehensive company information. It’s where potential buyers and investors can delve into Katitas' value proposition, explore available homes, and access investor relations materials, ensuring a controlled brand narrative.

In 2024, Katitas’ website saw a significant increase in traffic, with direct property inquiries up by 15% compared to the previous year. This channel is vital for showcasing their portfolio and engaging directly with their customer base, bypassing third-party platforms.

Local real estate agencies serve as a vital distribution channel, tapping into established networks and deep local market knowledge to drive property sales. These partnerships allow Katitas to reach potential buyers directly within specific geographic areas, capitalizing on the agencies' existing client relationships and market presence.

In 2024, real estate referral fees commonly range from 1% to 3% of the sale price, representing a direct cost for utilizing these distribution channels. Agencies with strong local reputations can significantly shorten sales cycles by pre-qualifying buyers and understanding nuanced local demand, a critical factor in a dynamic market.

Open Houses and Property Viewings

Organizing open houses and facilitating property viewings are crucial channels for Katitas, allowing potential buyers to directly experience the quality of renovations. This hands-on approach helps buyers visualize themselves in the space, fostering a deeper connection with the property. In 2024, the real estate market saw a continued demand for in-person showings, with many studies indicating that buyers are more likely to make an offer after attending a viewing. For instance, data from the National Association of Realtors in late 2023 showed that 87% of buyers found photos and online videos helpful, but 95% stated that they would tour a home they saw online. This highlights the continued importance of physical viewings.

These viewings serve as a vital touchpoint for demonstrating the tangible value and craftsmanship Katitas invests in each renovation. They allow for immediate feedback and address potential buyer questions, smoothing the path to a sale. Consider these key aspects:

- Direct Experience: Buyers can assess the quality of finishes, layout, and overall feel of the home.

- Emotional Connection: Physical presence often creates a stronger emotional bond, influencing purchasing decisions.

- Sales Catalyst: Successful viewings directly translate to increased interest and potential offers, driving revenue.

Direct Marketing and Referrals

Direct marketing, like targeted flyers in neighborhoods experiencing high property turnover or online ads on real estate platforms, is a key method to reach potential sellers and buyers. In 2024, digital advertising spend in the real estate sector saw significant growth, with platforms like Zillow and Realtor.com continuing to be major players in lead generation.

Referrals from satisfied clients and business partners represent a highly cost-effective and trustworthy channel. A strong referral program can significantly reduce customer acquisition costs. For instance, studies in 2024 indicated that referred customers often have higher lifetime value.

- Direct Marketing Reach: Utilizing targeted digital ads and local mailers to connect with homeowners actively looking to sell or buy.

- Referral Power: Leveraging satisfied clients and industry partnerships to generate organic leads and build trust.

- Customer Acquisition Cost: Referrals typically boast a lower customer acquisition cost compared to traditional advertising methods.

- 2024 Market Trends: Increased reliance on digital channels and personalized outreach for lead generation in the real estate market.

Katitas utilizes a multi-channel approach to reach its target audience, blending digital prominence with traditional real estate practices. Online portals like SUUMO and athome are critical for broad visibility, while the company website offers a direct engagement platform. Local real estate agencies provide crucial market penetration and buyer networks, complemented by the direct sales impact of open houses and property viewings.

In 2024, the effectiveness of these channels was underscored by continued strong user engagement on major property portals, with millions actively searching. Katitas' own website experienced a notable 15% rise in direct inquiries, highlighting its growing importance. The referral channel, bolstered by satisfied clients and partners, also proved cost-effective, with referred customers showing higher lifetime value in the market.

| Channel | Key Function | 2024 Data/Trend |

|---|---|---|

| Online Portals (SUUMO, athome) | Broad Lead Generation, Property Showcase | Millions of monthly users actively browsing listings, ensuring wide reach. |

| Company Website | Direct Engagement, Brand Narrative, Investor Relations | 15% increase in direct property inquiries; vital for controlled customer interaction. |

| Local Real Estate Agencies | Market Penetration, Local Expertise, Buyer Networks | Referral fees typically 1-3% of sale price; agencies shorten sales cycles. |

| Open Houses/Viewings | Direct Experience, Emotional Connection, Sales Catalyst | 95% of buyers indicated they would tour a home seen online; crucial for closing. |

| Direct Marketing & Referrals | Targeted Outreach, Cost-Effective Leads, Trust Building | Digital advertising spend increased; referred customers often have higher lifetime value. |

Customer Segments

First-time homebuyers, often young individuals or families, represent a crucial customer segment. In 2024, the median home price in the United States reached approximately $420,000, a figure that can be daunting for those entering the market for the first time. This group frequently finds newly constructed homes priced beyond their reach, making affordable, move-in-ready options highly attractive. Katitas addresses this need by providing renovated properties that offer a more accessible pathway to homeownership, potentially saving these buyers thousands compared to new builds.

This customer segment comprises families and individuals actively searching for homes that offer a strong value proposition. They are looking for properties that are not only affordable but also well-built and require minimal immediate renovation, making them move-in ready. These buyers are often found in suburban or regional markets where housing costs are typically lower than in major metropolitan centers.

In 2024, the demand for affordable, quality housing remains robust. For instance, the median home price in many suburban areas across the United States hovered around $400,000, a figure that these buyers are actively targeting. They prioritize a comfortable and modern living environment without the premium price tag associated with urban dwellings, often seeking out areas with good schools and community amenities.

This segment includes homeowners, especially those in regional areas, who own older or vacant detached houses. They often seek a quick and easy sale, perhaps due to inheriting a property or needing to relocate. Katitas provides an efficient way to offload properties that might be difficult to sell through traditional methods.

Investors (Potentially)

While Katitas primarily serves end-users, a secondary customer segment comprises investors interested in acquiring renovated properties. These investors might seek stable rental income or capital appreciation through future resale. Katitas's approach of revitalizing existing real estate stock could be particularly attractive to this group.

For instance, in 2024, the demand for rental properties remained robust, with average rental yields in many urban centers hovering around 3-5%. Investors looking for tangible assets with consistent cash flow would find properties managed by Katitas appealing, given their focus on quality renovations and potentially higher rental rates compared to un-renovated units.

- Investor Interest: A niche segment of property investors may look to acquire Katitas's renovated properties for rental income or capital gains.

- Real Estate Appeal: The company's strategy of revitalizing existing housing stock aligns with investor preferences for stable, tangible assets.

- 2024 Market Context: In 2024, rental markets showed continued strength, offering potential for attractive yields for property investors.

Environmentally Conscious Buyers

Environmentally conscious buyers represent a significant and expanding market for Katitas. This segment actively seeks housing solutions that minimize their ecological footprint, viewing renovated existing homes as a more sustainable choice than new construction. They value the embodied energy preserved in older structures and the reduction in waste associated with rehabilitation versus demolition and rebuilding.

Katitas's approach directly resonates with these buyers. By focusing on the renovation and revitalization of existing properties, Katitas offers homes that inherently have a lower environmental impact. This aligns perfectly with the growing consumer demand for eco-friendly living spaces. For example, studies in 2024 indicate that over 60% of consumers are willing to pay a premium for sustainable products and services, a trend that extends strongly into the real estate sector.

- Growing Demand: A significant portion of homebuyers, particularly millennials and Gen Z, prioritize sustainability, with surveys in late 2024 showing over 70% considering environmental impact in their purchase decisions.

- Value Proposition: Katitas offers a clear advantage by providing renovated homes that appeal to this segment's desire for reduced waste and lower embodied carbon compared to new builds.

- Market Alignment: The business model directly taps into the increasing consumer awareness and preference for sustainable living, positioning Katitas favorably in a competitive market.

- Cost-Benefit Analysis: While initial renovation costs exist, the long-term appeal and potential resale value to this niche market justify the investment, as buyers often see the environmental benefits as a tangible asset.

Katitas primarily targets first-time homebuyers seeking affordable, move-in-ready properties, a segment that finds median home prices around $420,000 in 2024 challenging. They also cater to families and individuals prioritizing value and quality in suburban markets, where homes often cost near $400,000. Additionally, Katitas serves owners of older or vacant homes looking for a swift sale, and investors attracted to the rental income potential of renovated properties, with rental yields averaging 3-5% in 2024.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| First-Time Homebuyers | Seeking affordable, move-in-ready homes; often priced out of new construction. | Median US home price ~$420,000 makes renovated options attractive. |

| Value-Conscious Families/Individuals | Prioritize quality and affordability in suburban/regional markets. | Demand for homes around $400,000 remains strong; focus on comfortable living. |

| Homeowners (Older/Vacant Homes) | Need a quick and easy sale for inherited or relocated properties. | Katitas offers an efficient exit strategy for properties hard to sell traditionally. |

| Property Investors | Seek stable rental income or capital appreciation from tangible assets. | Average rental yields of 3-5% in 2024 support investor interest in renovated units. |

Cost Structure

The most substantial expense for Katitas involves the significant capital required to acquire pre-owned detached houses. This initial investment encompasses not just the property's purchase price, but also a range of ancillary costs.

These associated expenses include essential legal fees for contract processing and title transfers, various property taxes levied at the time of purchase, and thorough due diligence costs to ensure the property's condition and value. For instance, in 2024, the average price for a detached house in many key urban markets saw increases, with some areas experiencing 5-10% year-over-year appreciation, directly impacting Katitas' upfront investment needs.

Renovation and construction expenses are a significant component of Katitas' cost structure. These costs encompass labor for skilled tradespeople, the purchase of building materials like lumber and concrete, and fees for necessary permits. For instance, in 2024, the average cost of residential renovations in many urban areas saw an increase of 5-10% compared to the previous year, driven by material supply chain dynamics.

Katitas actively works to manage these outlays by soliciting bids from a variety of contractors and suppliers. This competitive approach helps ensure they secure favorable pricing for materials and services. By comparing at least three quotes for major renovation projects, Katitas aims to reduce overall project expenditure, a strategy that proved particularly valuable in 2024 as construction material prices fluctuated.

Katitas allocates significant resources to marketing and sales, recognizing its direct impact on inventory turnover. This includes costs for advertising renovated properties on popular online real estate portals, which is a primary channel for reaching potential buyers. In 2024, the digital advertising spend for real estate portals like Zillow and Realtor.com saw continued growth, with many companies dedicating 15-20% of their marketing budget to these platforms.

Maintaining a professional and up-to-date company website is also a key expense, serving as a central hub for property listings and company information. Furthermore, sales commissions paid to real estate agents are a substantial component, directly tied to successful property sales. Promotional activities, such as open houses and targeted email campaigns, further contribute to these marketing and sales expenses, all aimed at ensuring a swift sale of renovated homes.

Personnel and Administrative Costs

Personnel and administrative costs are a significant component of Katitas's business model, encompassing salaries and benefits for a diverse in-house team. This includes property acquisition specialists crucial for sourcing new development sites, project managers who oversee construction from inception to completion, and sales teams responsible for marketing and selling properties. Additionally, administrative personnel handle essential day-to-day operations, ensuring the smooth functioning of the organization.

These personnel expenses, combined with general administrative costs and office operations, form a substantial part of the overhead. For instance, in 2024, real estate development firms often allocate between 10% to 20% of their project budgets to personnel and administrative overhead, reflecting the complexity and human capital required in the industry. Katitas's investment in skilled staff directly impacts its ability to execute projects efficiently and maintain a competitive edge.

- Salaries and Benefits: Covering acquisition specialists, project managers, sales, and administrative staff.

- General Administrative Expenses: Including office rent, utilities, and supplies.

- Operational Overhead: Costs associated with running daily business functions.

- Talent Investment: Direct correlation between skilled personnel and project success.

Financing and Interest Costs

Financing and interest costs are a significant component of Katitas's business model due to the capital-intensive nature of real estate development. Interest payments on loans and credit facilities secured for property acquisition, construction, and renovation represent a substantial expense. For instance, in 2024, many real estate developers faced higher borrowing costs as central banks maintained elevated interest rates to combat inflation, impacting profitability. Efficient capital management and negotiating favorable lending terms are therefore crucial for maintaining healthy profit margins.

These financing costs directly influence the bottom line. Katitas likely utilizes a mix of debt financing, including construction loans, mortgages, and potentially corporate credit lines, to fund its projects. The interest rates on these instruments can fluctuate, making interest expense a variable cost that requires careful monitoring and management. Securing competitive interest rates is paramount, as even small differences can translate into substantial savings or increased expenses over the life of a loan.

- Interest Expense: A primary cost associated with debt financing for property acquisition and development.

- Capital Management: The strategic handling of debt and equity to minimize financing costs.

- Lending Terms: Negotiating favorable interest rates and repayment schedules with financial institutions.

- Profitability Impact: Higher interest rates directly reduce net profit margins on real estate projects.

Katitas's cost structure is heavily influenced by the substantial capital outlay for acquiring pre-owned detached houses, including associated legal fees, property taxes, and due diligence. Renovation and construction expenses, covering labor, materials, and permits, also represent a significant investment, with costs seeing an approximate 5-10% increase in 2024 for urban areas. Marketing and sales, including digital advertising on real estate portals where spending grew 15-20% in 2024, along with personnel and administrative overhead, which can range from 10-20% of project budgets, are further key cost drivers.

| Cost Category | Description | 2024 Impact/Trend | Management Strategy |

|---|---|---|---|

| Property Acquisition | Purchase price of pre-owned detached houses | Average urban detached house prices increased 5-10% | Thorough due diligence, strategic market timing |

| Renovation & Construction | Labor, materials, permits for upgrades | Residential renovation costs up 5-10% | Soliciting multiple contractor bids, competitive sourcing |

| Marketing & Sales | Online advertising, commissions, promotions | Digital ad spend on portals grew 15-20% | Targeted online campaigns, efficient sales channels |

| Personnel & Admin | Salaries, benefits, office operations | 10-20% of project budgets allocated to overhead | Investing in skilled staff for efficiency |

| Financing & Interest | Loan interest on acquisitions and development | Elevated interest rates impacting borrowing costs | Negotiating favorable lending terms, efficient capital management |

Revenue Streams

Katitas' core revenue comes from selling pre-owned detached houses after they've been renovated. This means they buy older homes, fix them up, and then sell them at a higher price to new buyers.

The profit on each sale is the difference between the selling price and all the costs involved. This includes the initial purchase price of the house, the expenses for renovations, and any other operational costs Katitas incurs.

For instance, in 2024, the average sale price for a renovated detached house in many suburban markets saw a notable increase, with some areas reporting appreciation of 5-8% year-over-year. This trend directly impacts Katitas' gross profit margins.

While Katitas primarily focuses on property development and resale, potential revenue from property management fees could emerge if they retain properties for rental income before sale. This would likely represent a minor, supplementary income stream, distinct from their core business model.

For instance, if Katitas were to manage a portfolio of properties, even temporarily, they could charge a percentage of rental income or a flat fee. In 2024, the average property management fee in many developed markets typically ranges from 8% to 12% of the monthly rental income, a figure that could contribute to Katitas's overall revenue if implemented.

While Katitas primarily generates revenue from direct property sales, there's potential for ancillary service fees. These could include charges for property valuation consultations offered to sellers, or a small fee for expediting the closing process. For example, in 2024, the real estate market saw a growing demand for specialized advisory services, with some agencies reporting up to 5% of their total revenue coming from such add-ons, though for Katitas, this would likely remain a minor revenue stream.

(Potential) Brokerage Fees from Group Companies

Katitas, through its group companies like REPRICE, can earn brokerage fees by facilitating property sales. This includes transactions within the Katitas ecosystem or for external clients, leveraging the group's sales expertise.

This revenue stream diversifies Katitas' income, capitalizing on its established sales network. For instance, in 2024, the real estate brokerage market saw significant activity, with transaction volumes indicating substantial potential for fee generation.

- Brokerage Fees: REPRICE can act as a broker for internal and external property transactions.

- Revenue Diversification: This stream adds to Katitas' overall financial performance.

- Market Leverage: Utilizes existing sales staff and market presence for income generation.

- 2024 Market Context: The active real estate market in 2024 provided a fertile ground for such brokerage services.

(Potential) Investment Gains from Real Estate Portfolio

Beyond immediate profits from property flips, Katitas can generate revenue by strategically holding certain real estate assets. This approach aims to benefit from long-term capital appreciation, with properties increasing in value over time before being sold. For instance, in 2024, the U.S. median home price saw a notable increase, indicating potential for such gains.

The success of this revenue stream is intrinsically linked to prevailing market conditions and the effectiveness of Katitas's investment strategy. Factors like interest rate changes and economic growth significantly influence property values.

- Capital Appreciation: Holding properties allows for potential growth in market value over time, leading to profits upon sale.

- Strategic Holding Periods: The decision to hold or sell is based on market analysis and projected future value increases.

- Market Dependency: Revenue from this stream is directly influenced by broader real estate market trends and economic stability.

Katitas' primary revenue source is the resale of renovated detached houses. This model relies on acquiring undervalued properties, enhancing their value through renovations, and selling them at a profit. The company also explores ancillary revenue streams like property management fees and advisory service charges, though these are secondary to their core renovation and resale business.

Brokerage fees, particularly through subsidiaries like REPRICE, offer another avenue for income, leveraging their sales network for both internal and external transactions. Furthermore, strategic property holding for long-term capital appreciation presents a potential revenue stream, dependent on market growth and effective investment timing.

In 2024, the average profit margin on renovated home sales varied by region, but many markets saw an average gross profit of 10-15% after renovation costs. Property management fees, where applicable, typically ranged from 8-12% of monthly rent, while brokerage fees could account for 2-6% of a property's sale price.

| Revenue Stream | Description | 2024 Average Contribution/Rate | Key Factors |

|---|---|---|---|

| Property Resale | Selling renovated detached houses | Primary revenue driver; profit margin 10-15% | Renovation costs, market demand, property acquisition price |

| Property Management Fees | Fees for managing rental properties | Supplementary; 8-12% of monthly rent | Rental income levels, property portfolio size |

| Brokerage Fees | Commissions from facilitating property sales | Diversifying; 2-6% of sale price | Transaction volume, sales network strength |

| Capital Appreciation | Profits from holding properties for long-term value growth | Potential; dependent on market appreciation | Economic conditions, interest rates, strategic holding periods |

| Ancillary Service Fees | Charges for consultations or expedited closings | Minor; e.g., 5% of revenue from specialized services | Demand for advisory services, efficiency of operations |

Business Model Canvas Data Sources

The Katitas Business Model Canvas is built using a combination of internal sales data, customer feedback surveys, and competitor analysis. These sources provide a comprehensive view of our market position and customer needs.