Johnson Brothers Liquor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Johnson Brothers Liquor Bundle

Understand how political shifts, economic fluctuations, and evolving social trends are impacting Johnson Brothers Liquor's market position. Our expertly crafted PESTEL analysis provides the critical intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now to gain a decisive competitive advantage.

Political factors

The alcohol industry in the U.S. operates under a stringent regulatory environment, with federal, state, and local laws dictating everything from distribution to marketing practices. Johnson Brothers, as a major national distributor, must diligently adhere to this complex legal framework, including the foundational three-tier system that separates producers, distributors, and retailers. For instance, in 2024, states continued to grapple with direct-to-consumer shipping laws, impacting how distributors like Johnson Brothers manage their product flow and market access.

Furthermore, global trade dynamics, including tariffs and ongoing trade disputes, directly influence the availability and cost of imported wines and spirits. These policies can create significant supply chain cost fluctuations and alter consumer purchasing habits. For example, the lingering effects of tariffs imposed in previous years continued to be felt in 2024, with some imported spirits seeing price increases of 10-20% depending on the origin country and specific product, directly affecting Johnson Brothers' inventory management and pricing strategies.

Johnson Brothers operates within a complex patchwork of state-level alcohol regulations, each U.S. state dictating its own rules for licensing, product availability, shipping volumes, and taxation. This decentralized approach necessitates robust compliance efforts across numerous jurisdictions, a significant operational challenge for a national distributor.

For instance, as of early 2024, the landscape of direct-to-consumer (DTC) alcohol shipping continues to evolve, with some states expanding these allowances while others maintain strict limitations, directly impacting Johnson Brothers' distribution strategies and market access.

Changes in federal and state excise taxes on alcoholic beverages directly influence the cost of goods for distributors like Johnson Brothers, ultimately affecting consumer retail prices. For instance, in 2024, several states considered or implemented adjustments to alcohol taxes, aiming to bolster state revenue. An increase in these taxes can lead to lower sales volumes, impacting Johnson Brothers' revenue and profit margins.

The alcoholic beverage industry frequently faces discussions about tax application fairness across various product categories, such as spirits, wine, and beer. In 2025, federal discussions are anticipated regarding potential shifts in tax structures, which could disproportionately affect certain segments of Johnson Brothers' product portfolio.

Health and Public Safety Initiatives

Government and public health bodies are increasingly focused on health and safety, which directly impacts the alcohol industry. For instance, in 2024, the World Health Organization continued to advocate for stronger alcohol control policies globally, pushing for higher taxes and stricter marketing regulations. These efforts can lead to changes like enhanced age verification at points of sale and more prominent health warnings on product labels, potentially affecting consumer demand and requiring Johnson Brothers to adapt its sales and promotional approaches.

Emerging regulations in 2024 and 2025 are also proposing mandatory labeling for alcoholic beverages, covering nutritional information and potential allergens. Such requirements, if implemented broadly, would necessitate significant changes in product packaging and supply chain management for Johnson Brothers. For example, the EU's ongoing discussions around mandatory nutrition labeling for alcoholic drinks illustrate this trend, with potential implementation dates looming in the near future.

- Stricter Advertising Rules: Governments may impose limitations on where and how alcohol can be advertised, impacting Johnson Brothers' marketing reach.

- Enhanced Age Verification: Increased scrutiny on preventing underage sales could mean more rigorous checks at retail and online, affecting sales processes.

- Mandatory Health Warnings: The inclusion of more explicit health warnings on packaging, similar to those seen for tobacco products, could influence consumer perception and purchasing decisions.

- Nutrition and Allergen Labeling: New labeling requirements could increase operational costs and necessitate product reformulation or updated sourcing strategies.

Political Stability and Lobbying

Political stability is a cornerstone for businesses like Johnson Brothers Liquor, as it directly influences the regulatory landscape for alcohol. Fluctuations in government stability can lead to unpredictable policy changes, impacting everything from distribution laws to taxation. For instance, in 2024, the United States saw ongoing debates around federal excise taxes on spirits, a direct result of political maneuvering and lobbying efforts. Johnson Brothers, as a significant entity in the beverage alcohol sector, must navigate these shifts. The industry's collective voice, amplified through lobbying, can significantly shape legislation, potentially creating both opportunities and challenges. The ability to effectively communicate with and influence policymakers remains a critical, ongoing political factor for the company's strategic planning and operational success.

The influence of industry lobbying groups is paramount in the alcohol sector. These organizations actively engage with lawmakers to advocate for policies favorable to their members, such as tax reductions or eased distribution requirements. In 2024, the Distilled Spirits Council of the United States (DISCUS) continued its advocacy efforts, focusing on issues like retaliatory tariffs and the promotion of free trade agreements, which directly affect companies like Johnson Brothers. The effectiveness of such lobbying can translate into tangible financial benefits or impose significant operational hurdles. Therefore, Johnson Brothers' engagement with these groups and their ability to adapt to the outcomes of legislative battles are crucial for maintaining a competitive edge.

The continuous political engagement required by Johnson Brothers Liquor involves monitoring and responding to legislative proposals. This includes staying abreast of potential changes in state-level regulations concerning direct-to-consumer shipping, advertising restrictions, and licensing requirements. For example, as of mid-2024, several states were considering legislation to expand or contract alcohol delivery services, a move that could significantly alter market access for distributors. Johnson Brothers' proactive approach to understanding and influencing these evolving political dynamics is essential for mitigating risks and capitalizing on emerging market opportunities within the complex regulatory framework of the alcohol industry.

Governmental policies significantly shape the alcohol distribution landscape. Johnson Brothers must navigate a complex web of federal, state, and local regulations, including the foundational three-tier system. For instance, ongoing debates in 2024 and 2025 regarding direct-to-consumer shipping laws across various states directly impact market access and distribution strategies.

Taxation is a critical political factor, with excise taxes on alcoholic beverages directly influencing product costs and consumer pricing. In 2024, several states considered or enacted tax adjustments, potentially affecting sales volumes and profit margins for distributors like Johnson Brothers. Anticipated federal discussions in 2025 about tax structure shifts could further alter the competitive environment for different beverage categories.

Public health advocacy and evolving regulations on marketing and labeling present ongoing challenges. Initiatives promoting stricter alcohol control policies, such as those advocated by the World Health Organization in 2024, can lead to enhanced age verification requirements and more prominent health warnings on products. Emerging regulations in 2024 and 2025 concerning mandatory nutrition and allergen labeling could also necessitate significant operational adjustments and increased supply chain costs.

Industry lobbying plays a crucial role in shaping legislation. Groups like the Distilled Spirits Council of the United States (DISCUS) actively engage with lawmakers on issues such as trade agreements and tariffs. In 2024, DISCUS's focus on retaliatory tariffs directly impacted the cost and availability of imported spirits, influencing Johnson Brothers' inventory and pricing.

What is included in the product

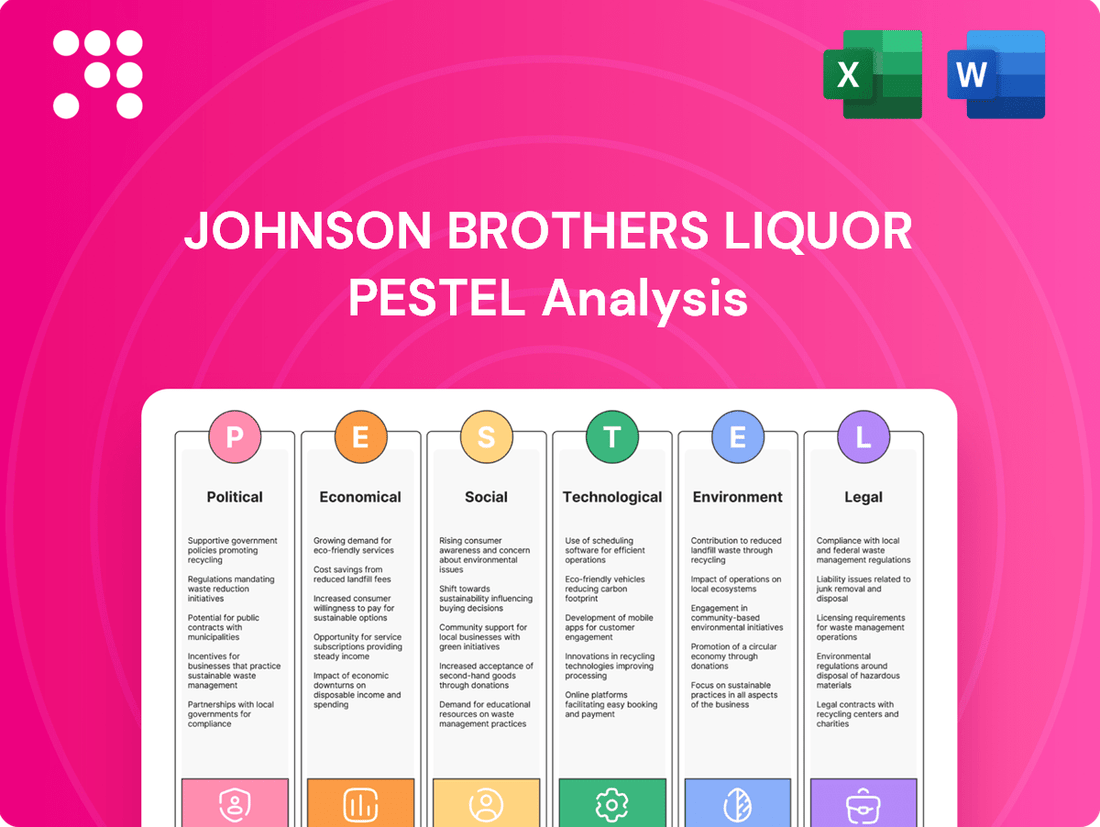

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Johnson Brothers Liquor, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within the industry and relevant geographic markets.

This PESTLE analysis for Johnson Brothers Liquor acts as a pain point reliever by offering a clear, summarized version of external factors, enabling efficient strategic discussions and risk mitigation during planning sessions.

Economic factors

Inflation continues to be a significant headwind for the food and beverage sector, directly impacting Johnson Brothers Liquor. Rising costs for essential inputs like grains, sugar, and glass bottles, coupled with increased transportation expenses and higher wages for warehouse and delivery staff, are squeezing operational budgets. For instance, the U.S. Producer Price Index for food and beverages saw an increase of 4.5% year-over-year in Q1 2024, reflecting these widespread cost pressures.

As a distributor, Johnson Brothers must navigate these escalating costs. If these increased expenses cannot be fully passed on to consumers through price adjustments, profit margins will inevitably shrink. The company's ability to implement effective pricing strategies, perhaps by focusing on premium products with higher margins or negotiating better terms with suppliers, will be crucial for maintaining profitability through 2024 and beyond. Supply chain efficiencies, such as optimizing delivery routes and inventory management, also offer avenues to mitigate these inflationary impacts.

Looking ahead, while overall inflation might show signs of moderation, persistent pressures on agricultural inputs and labor are anticipated to continue through 2024. Reports from the USDA indicate that fertilizer costs, a key component in grain production, remained elevated in early 2024, and the tight labor market is expected to keep wage growth strong. These factors suggest that Johnson Brothers will likely face ongoing cost challenges, necessitating continuous adaptation in its operational and pricing strategies.

Economic conditions, including the persistent inflation seen through 2024, directly impact consumer disposable income. As the cost of essential goods rises, households have less discretionary income available for purchases like alcoholic beverages. For instance, the U.S. Consumer Price Index (CPI) showed a 3.3% increase in May 2024 year-over-year, meaning more of consumers' budgets are allocated to necessities.

Potential recessionary concerns also weigh on consumer confidence and spending habits. Should economic growth falter in late 2024 or into 2025, individuals are likely to become more cautious with their spending on non-essential items. This could lead to a noticeable shift towards lower-priced brands or a general reduction in the volume of alcoholic beverages purchased by consumers, directly affecting Johnson Brothers' sales performance.

The U.S. alcoholic beverage market in early 2025 shows a notable trend: while the total market value is climbing, largely due to price hikes and a shift towards premium products, the actual volume of beverages consumed is shrinking. This presents a complex landscape for companies like Johnson Brothers Liquor, especially those whose traditional growth models rely on increasing sales volume.

Specifically, the spirits and wine segments have reported volume declines in the early part of 2025. This is a significant challenge for distributors and suppliers who have historically measured success by the sheer quantity of products sold. The focus is clearly shifting from volume to value, driven by consumer preferences for higher-end offerings.

Amidst these declines, the ready-to-drink (RTD) beverage category continues to be a bright spot, demonstrating robust growth. RTDs are attracting consumers, particularly younger demographics, and represent a key area where Johnson Brothers Liquor can potentially offset volume losses in other categories.

Supply Chain Stability and Logistics Costs

While global supply chain disruptions have shown signs of easing, they continue to pose risks to product availability and pricing for Johnson Brothers. For instance, the average cost to ship a 40-foot container globally saw a significant drop from its 2022 peaks, but remained elevated compared to pre-pandemic levels throughout much of 2023 and into early 2024, impacting import costs.

Inflationary pressures and fluctuating fuel prices directly influence transportation and warehousing expenses, which are critical components of Johnson Brothers' distribution network. The US Consumer Price Index (CPI) for transportation services, which includes freight and logistics, continued to show year-over-year increases in late 2023 and early 2024, impacting overall operational costs.

Johnson Brothers' ability to navigate these economic factors hinges on robust supply chain management. Companies that can optimize inventory, secure reliable shipping partners, and adapt to changing logistics costs are better positioned to maintain profitability and product flow.

- Global container shipping rates, while down from 2022 highs, remained above pre-pandemic averages in early 2024.

- US transportation services CPI showed continued year-over-year inflation in late 2023 and early 2024.

- Efficient logistics and inventory management are key to mitigating rising operational expenses.

Competition and Market Consolidation

The beverage distribution sector is a dynamic arena marked by intense competition and a persistent trend toward consolidation. This ongoing consolidation among distributors directly impacts Johnson Brothers' ability to secure market share, negotiate pricing, and nurture vital relationships with both producers and retailers. For instance, in 2023, the U.S. beverage alcohol distribution market saw significant M&A activity, with major players acquiring smaller regional distributors, aiming to expand their geographic reach and product portfolios.

Navigating this evolving landscape requires Johnson Brothers to excel in offering robust supply chain solutions and cultivating enduring partnerships. The ability to provide efficient logistics, manage inventory effectively, and offer value-added services becomes paramount. As of early 2024, distributors focusing on technology integration for supply chain visibility and data analytics are gaining a competitive edge, allowing them to better serve producer and retailer needs.

- Market Share Impact: Consolidation can lead to fewer, larger competitors, potentially diminishing Johnson Brothers' independent market share if they cannot adapt or participate in consolidation.

- Pricing Power: Increased consolidation among distributors can shift pricing leverage towards these larger entities, potentially squeezing margins for distributors like Johnson Brothers.

- Producer & Retailer Relationships: Distributors that can offer broader networks and more integrated services due to consolidation may become more attractive partners for producers and retailers.

- Strategic Alliances: To counter consolidation, Johnson Brothers may need to explore strategic alliances or targeted acquisitions to maintain or enhance its competitive position.

Economic factors present a dual challenge for Johnson Brothers Liquor. Persistent inflation, seen in a 3.3% CPI increase for transportation services in May 2024, drives up operational costs for distribution, impacting profit margins if these costs cannot be fully passed on. Simultaneously, reduced consumer disposable income due to inflation and potential recessionary fears could curb demand for alcoholic beverages.

Preview Before You Purchase

Johnson Brothers Liquor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Johnson Brothers Liquor details Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. It provides actionable insights for strategic planning.

Sociological factors

The increasing emphasis on health and wellness is significantly reshaping the beverage industry. Consumers are actively seeking healthier alternatives, driving a notable rise in demand for low-alcohol, no-alcohol, and reduced-calorie drinks. This trend is particularly pronounced among younger demographics like millennials and Gen Z, who are embracing mindful consumption and the 'sober curious' movement.

In 2024, the global non-alcoholic beverage market was valued at over $1.1 trillion, with a projected compound annual growth rate (CAGR) of 5.2% through 2030, indicating a strong consumer shift. This necessitates that Johnson Brothers Liquor strategically adapt its product offerings to cater to these evolving preferences, potentially expanding its portfolio to include more innovative and health-conscious options to remain competitive.

While the trend of premiumization has been a significant driver, its pace has moderated in certain beverage categories. Consumers are increasingly gravitating towards what's termed 'affordable luxury,' seeking quality without overspending. This indicates a strategic need for Johnson Brothers to refine its product offerings and pricing to align with this more discerning consumer mindset.

Consumers are also demonstrating a more mindful approach to consumption, often opting for higher-quality beverages but reducing their overall volume intake. This shift underscores the importance for Johnson Brothers to adapt its sales and marketing efforts to resonate with these evolving tastes. The growing appeal of agave-based spirits and ready-to-drink (RTD) beverages are prime examples of these changing preferences that require strategic attention.

Generational differences significantly shape consumer behavior in the beverage alcohol industry. For example, Gen Z, born between 1997 and 2012, is demonstrating a keen interest in exploring novel beverage options and is a driving force behind the growth of low- and no-alcohol (LNA) products. In 2024, the global LNA market was valued at over $11 billion, with projections indicating continued robust growth, suggesting a substantial opportunity for brands that cater to this preference.

Millennials, often characterized by their emphasis on experiences and authenticity, continue to influence premiumization trends and craft beverage demand. Their purchasing decisions are frequently informed by brand story and ethical sourcing. Johnson Brothers must recognize these evolving preferences across the demographic spectrum to refine its product portfolio and marketing strategies for maximum market penetration.

Social Consumption Patterns and On-Premise vs. Off-Premise Sales

Consumer socialization heavily influences how alcohol is distributed. The preference for socializing at home versus in public venues directly affects Johnson Brothers' sales channels. For instance, a shift towards more at-home entertainment, potentially driven by economic factors, would favor off-premise sales.

While on-premise consumption, like enjoying cocktails at a bar, remains a significant revenue stream for spirits, off-premise sales through retailers have experienced shifts. For example, Nielsen data from late 2023 indicated continued growth in certain ready-to-drink (RTD) categories sold off-premise, while traditional spirit categories saw more modest gains.

Johnson Brothers needs to be agile in its distribution. This means adapting to:

- Shifting Social Habits: Understanding where consumers choose to drink and socialize is crucial for optimizing inventory and marketing efforts.

- Economic Influences on Consumption: Increased at-home consumption, often a response to economic pressures, necessitates a strong focus on off-premise channels and potentially different product offerings.

- Category Performance: Monitoring which categories are thriving in on-premise versus off-premise environments allows for targeted strategies. For example, while premium spirits might do well in restaurants, value-oriented or convenient options could be key for off-premise growth.

E-commerce and Convenience Culture

The pervasive demand for convenience is profoundly shaping consumer behavior, particularly in the alcohol sector. This shift is fueling the expansion of e-commerce for beverage alcohol, with consumers increasingly expecting seamless online ordering and rapid delivery. In 2024, online alcohol sales in the US are projected to reach over $30 billion, a testament to this evolving convenience culture.

Johnson Brothers Liquor must actively adapt to this trend by strengthening its digital presence and exploring avenues for enhanced e-commerce capabilities. This includes investing in user-friendly online platforms and potentially expanding direct-to-consumer (DTC) or online retail channels. Navigating the intricate and varied legal frameworks governing online alcohol sales across different states remains a critical challenge and opportunity.

- Growing Online Alcohol Market: The US online alcohol market is expected to surpass $30 billion in 2024, highlighting significant consumer adoption of e-commerce for beverage purchases.

- Consumer Expectation for Convenience: Modern consumers prioritize ease of access and personalized shopping experiences, driving demand for online alcohol sales with efficient delivery.

- Strategic E-commerce Investment: Johnson Brothers should consider strategic investments in digital marketing and e-commerce infrastructure to meet evolving consumer preferences and expand market reach.

- Navigating Regulatory Complexities: Successfully expanding online sales requires careful attention to and compliance with the diverse and often changing regulations surrounding alcohol distribution and sales.

Societal attitudes towards alcohol consumption are evolving, with a growing segment of the population embracing mindful drinking and seeking healthier alternatives. This is evidenced by the significant growth in the low- and no-alcohol (LNA) market, which was valued at over $11 billion globally in 2024 and is projected to continue its upward trajectory. Johnson Brothers Liquor must acknowledge this shift by potentially expanding its portfolio to include more LNA options to cater to these changing consumer preferences.

Generational differences play a crucial role, with Gen Z actively exploring new beverage categories, including LNA products, and millennials driving demand for premiumization and ethically sourced options. This necessitates a nuanced marketing approach that resonates with the values and preferences of different age groups. For instance, in 2024, the global non-alcoholic beverage market exceeded $1.1 trillion, underscoring the broad appeal of healthier choices across demographics.

The emphasis on health and wellness is a dominant sociological factor, pushing consumers towards reduced-calorie and lower-alcohol options. This trend is not limited to specific age groups but represents a broader societal movement towards more conscious consumption. Understanding these underlying social dynamics is key for Johnson Brothers Liquor to adapt its product development and marketing strategies effectively.

Technological factors

Advanced technologies like Enterprise Resource Planning (ERP) systems are vital for streamlining operations, managing inventory, and optimizing distribution logistics within the beverage alcohol industry. Johnson Brothers can leverage these systems to enhance efficiency and reduce costs.

By integrating modern ERP solutions, Johnson Brothers can achieve greater visibility across their entire supply chain, from procurement to final delivery. For instance, in 2024, companies that invested in advanced supply chain technology reported an average of 15% reduction in inventory holding costs and a 10% improvement in on-time delivery rates.

The beverage sector is seeing a significant shift due to AI and ML, impacting everything from what products get made to how companies connect with customers. Johnson Brothers can leverage these advanced tools to pinpoint emerging market trends, forecast what consumers will want next, and refine their sales and marketing strategies with much sharper accuracy.

For instance, by analyzing vast datasets, Johnson Brothers could identify a growing demand for low-alcohol or non-alcoholic craft beverages, a trend that saw the global low/no-alcohol market reach an estimated USD 11 billion in 2023 and is projected to grow significantly. This data-driven approach allows for more informed inventory management and targeted promotional campaigns, potentially boosting sales by an estimated 10-15% for specific product lines identified through predictive analytics.

The continued expansion of e-commerce in the beverage sector demands sophisticated digital platforms. Johnson Brothers must prioritize investments in user-friendly online ordering systems and efficient logistics to support digital sales channels. For instance, the global e-commerce market for alcoholic beverages saw significant growth, with projections indicating it will reach over $100 billion by 2025, highlighting the critical need for robust online infrastructure.

Adapting to digital sales requires a strong focus on technology that ensures regulatory compliance, particularly for age verification and responsible alcohol sales online. This includes implementing secure payment gateways and transparent tracking mechanisms for deliveries. The increasing consumer preference for online purchasing, with a notable surge in alcohol e-commerce during recent years, underscores the urgency for distributors to enhance their digital capabilities to remain competitive.

Automation in Warehousing and Distribution

Automation in warehousing and distribution is significantly reshaping the logistics landscape. Robotic systems for tasks like sorting and picking are becoming increasingly sophisticated, promising to boost efficiency and accuracy. For a major distributor like Johnson Brothers, embracing these advancements could unlock substantial operational benefits.

The integration of automation can directly impact the bottom line. For instance, a report from Interact Analysis in 2024 projected that the warehouse automation market would reach $11.5 billion by 2028, driven by the need for faster order fulfillment and reduced labor expenses. This suggests a strong trend towards technological adoption in the sector.

- Increased Efficiency: Automated systems can operate 24/7, leading to faster processing times and higher throughput.

- Reduced Labor Costs: Automation can decrease reliance on manual labor for repetitive tasks, lowering overall labor expenditure.

- Improved Accuracy: Robotic picking and sorting minimize human error, leading to fewer incorrect orders and returns.

- Scalability: Automated solutions can be scaled more easily to meet fluctuating demand compared to manual operations.

Age Verification and Compliance Technology

Technological advancements in age verification are crucial for Johnson Brothers, especially with evolving regulations for online and delivery alcohol sales. The company can leverage electronic scanning devices and biometric systems to enhance compliance and reduce the risk of underage purchases. For instance, by 2024, the global identity verification market was projected to reach $33.4 billion, indicating a significant investment in such technologies across industries.

Implementing these solutions can streamline the sales process while ensuring adherence to legal requirements. Johnson Brothers could explore partnerships with tech providers offering AI-powered facial recognition or digital ID verification platforms. These technologies are vital as penalties for non-compliance, such as fines and license suspension, can be substantial.

- Electronic ID Scanners: Devices that read driver's licenses and other government-issued IDs to verify age and authenticity.

- Biometric Systems: Technologies like facial recognition or fingerprint scanning for more robust age verification, particularly in digital environments.

- Compliance Software: Platforms that integrate with sales systems to automatically flag or prevent sales to underage individuals.

- Data Security Protocols: Ensuring that customer data collected during verification is handled securely and in compliance with privacy regulations.

Johnson Brothers must embrace technological advancements to maintain a competitive edge in the beverage alcohol distribution sector. Leveraging AI and machine learning can provide critical insights into consumer preferences and market trends, as seen with the growing demand for low-alcohol options, a market that reached an estimated USD 11 billion in 2023. Furthermore, the expansion of e-commerce necessitates robust digital platforms and efficient logistics, with the global alcoholic beverage e-commerce market projected to exceed $100 billion by 2025.

Automation in warehousing, including robotic systems for picking and sorting, is becoming essential for boosting efficiency and reducing labor costs. The warehouse automation market was projected to reach $11.5 billion by 2028, indicating a significant industry shift. Additionally, implementing advanced age verification technologies, such as electronic ID scanners and biometric systems, is crucial for regulatory compliance in online sales, with the global identity verification market projected to reach $33.4 billion by 2024.

| Technology Area | Impact on Johnson Brothers | Relevant Data/Projections (2023-2025) |

|---|---|---|

| AI & Machine Learning | Market trend analysis, demand forecasting, personalized marketing | Low/No-Alcohol Market: ~$11 billion (2023) |

| E-commerce Platforms | Online sales channel expansion, customer accessibility | Global Alcohol E-commerce Market: Projected >$100 billion (by 2025) |

| Automation (Warehousing) | Increased efficiency, reduced labor costs, improved accuracy | Warehouse Automation Market: Projected $11.5 billion (by 2028) |

| Age Verification Systems | Regulatory compliance, risk reduction for online sales | Identity Verification Market: Projected $33.4 billion (by 2024) |

Legal factors

The U.S. alcohol distribution landscape is anchored by a post-Prohibition, three-tier system: producer, distributor, and retailer. As a distributor, Johnson Brothers is intrinsically linked to this structure, meaning any regulatory shifts or varied state enforcement of these tiers directly shape their operational strategies and business viability.

Changes in these regulations, such as alterations to direct shipping laws or franchise laws governing distributor-retailer relationships, can significantly affect Johnson Brothers' market access and competitive positioning. For instance, states that have recently reformed their alcohol distribution laws, like Texas in 2021 with changes to its self-distribution thresholds, illustrate the dynamic nature of these legal frameworks.

Navigating the intricate web of state-specific licensing and permitting is a critical legal hurdle for Johnson Brothers Liquor. Each state maintains its own unique set of rules for alcohol distribution, and these regulations are in a constant state of flux, demanding vigilant oversight. For instance, in 2024, states like California continued to refine their direct-to-consumer (DTC) shipping laws for alcoholic beverages, impacting how distributors can reach customers.

Johnson Brothers must maintain unwavering compliance across all operating states, a task complicated by the need for distinct licenses for various product categories such as wine, spirits, and beer. Furthermore, regulations differ significantly based on sales channels, encompassing on-premise consumption, off-premise retail, and the increasingly complex DTC models. The Alcohol and Tobacco Tax and Trade Bureau (TTB) reported in late 2023 that the number of permits issued for alcoholic beverage businesses continues to grow, underscoring the dynamic regulatory landscape.

The legal framework governing direct-to-consumer (DTC) alcohol shipments is incredibly intricate and differs dramatically from state to state, with laws constantly being updated. While certain states are opening up to DTC sales, others continue to enforce strict limitations or complete prohibitions.

This evolving legal environment directly impacts Johnson Brothers' capacity to support producers and retailers exploring DTC avenues. For instance, as of early 2024, states like New York have seen continued debate around expanding DTC wine shipping, but progress remains incremental, highlighting the ongoing legislative challenges.

Alcohol Labeling and Marketing Regulations

Alcohol labeling regulations are tightening, with proposed rules in 2024 and 2025 mandating nutritional information, calorie counts, and allergen disclosures on alcoholic beverages. Johnson Brothers must meticulously ensure all distributed products meet these evolving federal and state standards. Their marketing strategies also face scrutiny, requiring strict adherence to advertising guidelines and restrictions to avoid penalties.

Compliance with these legal factors is critical for Johnson Brothers. For instance, the Alcohol and Tobacco Tax and Trade Bureau (TTT) actively enforces labeling and advertising rules. Failure to comply can result in significant fines, product recalls, and damage to brand reputation. Staying ahead of these regulatory shifts is paramount for smooth operations and continued market access.

- Nutritional Labeling Mandates: Expect increased requirements for calorie and ingredient information on alcohol products, with potential implementation phases starting in late 2024.

- Advertising Restrictions: Johnson Brothers must navigate varying state-specific regulations on alcohol advertising, including digital and social media campaigns, to ensure compliance.

- Allergen Disclosures: Emerging regulations may require clear identification of common allergens present in alcoholic beverages, impacting product formulation and labeling.

Labor Laws and Employment Regulations

As a significant employer, Johnson Brothers Liquor navigates a complex web of labor laws, impacting everything from minimum wage requirements to workplace safety standards. For instance, in 2024, the federal minimum wage remains at $7.25 per hour, but many states and cities have enacted higher minimums, directly affecting Johnson Brothers' payroll expenses.

Shifts in employment regulations, such as new rules on overtime pay or independent contractor classification, can necessitate costly adjustments to HR practices. The potential for increased unionization efforts also presents a factor, as collective bargaining agreements can alter wage structures and operational flexibility.

- Wage and Hour Laws: Compliance with federal, state, and local minimum wage and overtime regulations is paramount, with varying state minimums (e.g., California at $16.00/hour in 2024) directly influencing labor costs.

- Workplace Safety: Adherence to Occupational Safety and Health Administration (OSHA) standards is critical to prevent accidents and associated penalties, with workplace injuries costing businesses billions annually.

- Unionization and Collective Bargaining: The possibility of unionization can lead to increased labor costs and altered employment terms through negotiated contracts.

- Anti-Discrimination Laws: Strict compliance with laws prohibiting discrimination in hiring and employment practices is essential to avoid legal challenges and reputational damage.

Johnson Brothers must navigate a complex and evolving legal landscape, particularly concerning the three-tier alcohol distribution system. State-specific licensing and compliance remain critical, with ongoing updates to direct-to-consumer (DTC) shipping laws, as seen in ongoing debates in states like New York as of early 2024. Furthermore, impending regulations for nutritional labeling and allergen disclosures on alcoholic beverages, expected to see implementation phases starting in late 2024, will require meticulous adherence to federal and state standards, alongside strict oversight of advertising practices to avoid penalties.

Environmental factors

The beverage sector is seeing a significant shift towards sustainable packaging, with companies exploring biodegradable materials, reusable options, and a sharp reduction in single-use plastics. For instance, by early 2024, major beverage companies reported that over 60% of their packaging materials were either recyclable, reusable, or compostable, a notable increase from previous years.

Johnson Brothers, as a key distributor, has an opportunity to influence this trend by actively championing and enabling the adoption of these eco-conscious packaging choices throughout its network. This could involve prioritizing suppliers who utilize sustainable materials and offering incentives to retail partners for stocking products with greener packaging.

Water is essential for beverage production, and Johnson Brothers faces increasing pressure to manage its water footprint. In 2024, the beverage industry globally faced scrutiny over water consumption, with some regions experiencing significant water stress. Optimizing water use in logistics, like efficient cleaning of transport vehicles, and partnering with producers who prioritize water stewardship are key strategies for Johnson Brothers.

The beverage industry, including alcohol distribution, faces scrutiny for its environmental impact, particularly concerning greenhouse gas emissions. Production, packaging, and the extensive transportation networks required for distribution all contribute to a significant carbon footprint. For instance, the global beverage sector's emissions are a notable component of industrial greenhouse gas output, with transportation alone accounting for a substantial portion of this environmental burden.

Johnson Brothers Liquor can proactively address this by implementing strategies to lower its carbon footprint. Optimizing delivery routes, a common practice in logistics, can directly reduce fuel consumption and associated emissions. Investing in energy-efficient fleets, such as electric or hybrid vehicles, represents a tangible step towards decarbonization. Furthermore, exploring renewable energy sources like solar power for their warehouses and distribution centers can significantly cut reliance on fossil fuels, aligning with broader sustainability goals and potentially leading to cost savings in the long run.

Waste Management and Recycling Programs

The beverage industry faces significant environmental scrutiny regarding waste, particularly from disposable containers. Johnson Brothers can proactively address this by engaging in or championing advanced recycling initiatives and closed-loop systems. For instance, in 2024, the U.S. Environmental Protection Agency reported that recycling and composting prevented 94 million tons of material from being disposed of, highlighting the growing importance of these programs.

Johnson Brothers can integrate waste reduction into its operational strategy by collaborating with suppliers and logistics partners to optimize packaging and minimize material use throughout the supply chain. This could involve exploring reusable packaging options and improving the efficiency of their distribution networks to cut down on single-use materials. By 2025, many states are expected to have expanded bottle deposit laws, further incentivizing container return and recycling.

- Promote and participate in beverage container recycling programs.

- Collaborate with partners to implement closed-loop systems for packaging.

- Investigate and adopt sustainable packaging materials.

- Optimize distribution to reduce waste generation.

Ethical Sourcing and Sustainable Agriculture

Consumers are increasingly scrutinizing supply chains, demanding transparency and products derived from sustainable and ethical agricultural practices. This trend directly impacts the beverage industry, pushing companies to adopt more responsible sourcing. For instance, a 2024 Nielsen report indicated that 60% of consumers are willing to pay more for products from brands committed to sustainability.

Johnson Brothers can bolster its environmental standing by forging partnerships with producers who champion low-impact farming techniques. This includes supporting those who utilize upcycled ingredients, thereby reducing waste and resource consumption. Such collaborations align with growing market expectations for environmental stewardship.

The company's commitment to these practices can be highlighted through initiatives like:

- Partnering with vineyards employing water-saving irrigation methods.

- Sourcing spirits from distilleries using renewable energy sources.

- Developing product lines featuring ingredients grown with organic or regenerative farming.

- Ensuring traceability for key raw materials back to their origin farms.

Environmental regulations are becoming more stringent, particularly concerning emissions and waste management. Johnson Brothers must navigate these evolving rules, which can impact operational costs and supply chain practices. For example, by 2025, many jurisdictions are expected to implement stricter carbon pricing mechanisms, directly affecting transportation and warehousing expenses.

The beverage industry's environmental footprint, especially concerning greenhouse gas emissions from production and distribution, is under increasing scrutiny. By 2024, the sector's carbon intensity remained a key concern, with transportation alone contributing significantly to its environmental burden. Johnson Brothers can mitigate this by optimizing delivery routes and investing in fuel-efficient fleets, potentially reducing fuel costs by 5-10% annually through efficient logistics.

Water scarcity and responsible water management are critical environmental factors for beverage production. In 2024, several regions experienced significant water stress, impacting the availability and cost of water for production. Johnson Brothers can address this by partnering with producers who prioritize water stewardship, which is becoming a key differentiator for environmentally conscious consumers.

Consumer demand for sustainable products and transparent supply chains is a powerful environmental driver. A 2024 Nielsen report found that 60% of consumers are willing to pay more for sustainable brands. Johnson Brothers can capitalize on this by sourcing from producers employing eco-friendly farming and production methods, such as those using renewable energy or water-saving irrigation.

| Environmental Factor | Impact on Johnson Brothers | Actionable Insights for Johnson Brothers |

|---|---|---|

| Sustainable Packaging | Increased demand for eco-friendly materials, potential cost implications. | Prioritize suppliers with biodegradable or recyclable packaging; incentivize retailers for stocking greener products. |

| Carbon Emissions | Regulatory pressure and reputational risk from distribution footprint. | Optimize delivery routes; invest in electric or hybrid fleets; explore renewable energy for facilities. |

| Water Management | Operational risks in water-stressed regions; consumer expectations for responsible sourcing. | Partner with producers focused on water stewardship; promote efficient water use in logistics. |

| Consumer Demand for Sustainability | Opportunity to differentiate and capture market share. | Source from producers using low-impact farming; highlight sustainable practices in marketing. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Johnson Brothers Liquor is built upon a comprehensive review of industry-specific market research reports, government regulatory filings, and economic data from reputable financial institutions. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in factual, current information.