Johnson Brothers Liquor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Johnson Brothers Liquor Bundle

Johnson Brothers Liquor faces intense competition and significant buyer power, impacting their pricing strategies and profit margins. Understanding these forces is crucial for navigating the dynamic beverage distribution landscape.

The complete report reveals the real forces shaping Johnson Brothers Liquor’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The beverage alcohol sector is characterized by a blend of large, established players like major breweries and distilleries, alongside a rising number of craft producers. Johnson Brothers' leverage with its suppliers naturally fluctuates based on the scale and market presence of the particular brand or producer it engages with.

For highly desirable, dominant brands, suppliers often wield greater bargaining power due to their established brand recognition and significant market share. For instance, in 2024, the top five global spirits companies commanded a substantial portion of the market, giving them considerable influence over their raw material and ingredient suppliers.

Suppliers offering highly unique or differentiated products, like exclusive craft distilleries or rare vintage wines, hold significant sway. Johnson Brothers, to maintain its appeal to retailers, must stock these sought-after items, granting these suppliers leverage in negotiations. For instance, a premium, limited-release bourbon might command higher wholesale prices due to its scarcity and brand desirability.

Switching suppliers for Johnson Brothers involves significant effort and resources. This includes renegotiating contracts, overhauling logistics and inventory systems, and retraining sales teams on new product portfolios. These transition costs can be quite high, especially for established brands demanding considerable shelf space and marketing investment, which inherently strengthens supplier leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant concern for distributors like Johnson Brothers. Major beverage alcohol producers, such as Diageo or Pernod Ricard, could potentially bypass distributors by establishing their own direct-to-consumer (D2C) sales channels or acquiring existing distribution networks. This move would allow them to capture a larger share of the profit margin and have more control over their product's journey to the end consumer.

While the alcohol industry faces stringent regulations regarding direct sales, the evolving landscape of e-commerce and D2C models is creating opportunities. For instance, in 2024, several states continued to explore or expand options for direct alcohol shipping, which could embolden larger suppliers to invest in these capabilities. This trend directly challenges the traditional role of distributors.

- Supplier Integration Risk: Large beverage alcohol producers may integrate forward into distribution, impacting Johnson Brothers' market position.

- D2C Channel Growth: The increasing viability of direct-to-consumer sales for alcohol, driven by evolving regulations and consumer preferences, empowers suppliers.

- Regulatory Landscape: While still a barrier, changes in alcohol distribution laws could facilitate supplier entry into direct sales, increasing their leverage.

- Market Dynamics: Suppliers seeking greater control and profit could view forward integration as a strategic imperative, reducing reliance on intermediaries.

Importance of Johnson Brothers to Suppliers

Johnson Brothers' expansive distribution network, spanning 17 states, is a significant asset for its suppliers. This reach allows suppliers, especially smaller or newer brands, to access a broad customer base without the considerable investment typically required for independent market penetration. In 2024, this network facilitated access to thousands of retail and on-premise accounts, a critical factor for brands aiming for wider availability.

The company's expertise in managing complex logistics, sales, and marketing efforts further enhances its value proposition to suppliers. By leveraging Johnson Brothers' established infrastructure and market knowledge, suppliers can concentrate on production and brand development, reducing their operational burden. This integrated approach streamlines the path to market, making Johnson Brothers a vital partner for brand growth.

Consequently, Johnson Brothers acts as a crucial gateway for suppliers to connect with retailers and restaurants. This dependency on Johnson Brothers to reach end consumers can, to a degree, mitigate the bargaining power of suppliers, as their ability to independently secure broad distribution is often limited.

- Extensive Distribution: Johnson Brothers operates in 17 states, providing suppliers with broad market access.

- Logistics and Sales Expertise: The company manages distribution, sales, and marketing, reducing supplier operational burdens.

- Market Penetration: Johnson Brothers is a key channel for smaller and emerging brands to reach retailers and restaurants.

- Supplier Dependency: The reliance on Johnson Brothers' network can limit suppliers' individual bargaining power.

Suppliers of highly sought-after or differentiated products, such as premium craft spirits or rare vintages, often hold significant bargaining power over Johnson Brothers. This is due to their unique offerings and strong brand desirability, which retailers demand. For example, in 2024, the market saw continued growth in premium and super-premium segments, where suppliers could command higher margins due to limited supply and high consumer interest.

The threat of suppliers integrating forward into distribution, or developing direct-to-consumer (D2C) channels, also amplifies their leverage. As e-commerce and D2C models evolve, particularly with some states relaxing direct shipping laws in 2024, suppliers gain potential alternatives to traditional distributors like Johnson Brothers. This could allow them to capture more profit and control, reducing their reliance on intermediaries.

However, Johnson Brothers' extensive distribution network, covering 17 states and providing access to thousands of retail and on-premise accounts in 2024, can mitigate supplier power. This broad reach is invaluable, especially for smaller or emerging brands that lack the resources for independent market penetration, making Johnson Brothers a critical partner for their growth.

| Factor | Impact on Supplier Bargaining Power | Johnson Brothers' Mitigation Strategy |

|---|---|---|

| Product Differentiation & Desirability | High for unique/premium products | Secures exclusive distribution agreements |

| Supplier Forward Integration Threat | Increasing due to D2C growth | Focuses on value-added services and strong retailer relationships |

| Johnson Brothers' Distribution Reach | Lowers supplier power for smaller brands | Leverages network to attract diverse supplier portfolios |

| Switching Costs for Johnson Brothers | High for established brands | Maintains strong supplier relationships and operational efficiency |

What is included in the product

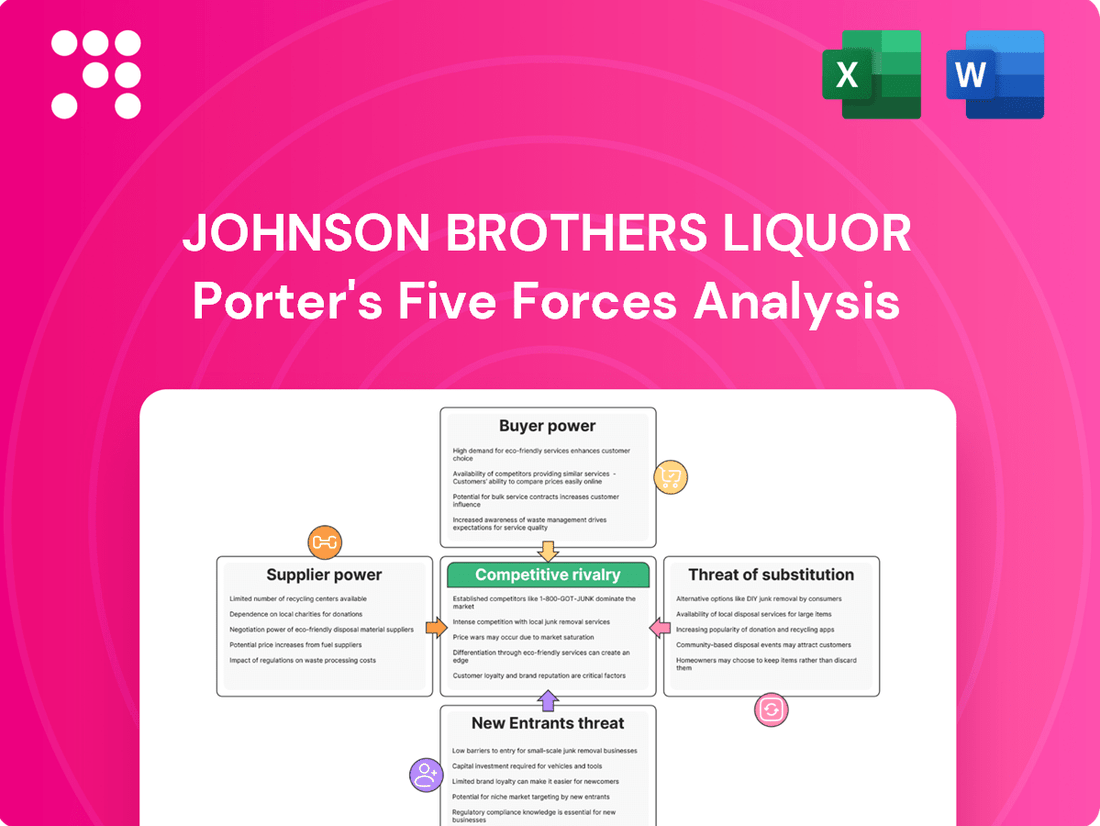

This analysis dissects the competitive landscape for Johnson Brothers Liquor, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly identify competitive threats and opportunities with a visually intuitive Porter's Five Forces chart, allowing for rapid strategic adjustments.

Customers Bargaining Power

Johnson Brothers' customer base is largely concentrated among retailers like liquor stores and grocery chains, along with restaurants. This concentration means that while individual customers might have limited sway, larger entities wield considerable influence.

Major retail chains, by virtue of their substantial purchase volumes, can exert significant bargaining power. For instance, in 2024, large grocery chains in the US continued to consolidate, with the top 10 retailers accounting for over 60% of grocery sales, amplifying their negotiation leverage with distributors like Johnson Brothers.

These powerful customers can therefore demand favorable pricing, extended payment terms, and enhanced promotional support, directly impacting Johnson Brothers' margins and operational flexibility.

For retailers and restaurants, switching distributors requires some administrative work and can temporarily disrupt their supply chain operations. However, if a competing distributor offers notably better pricing, superior service, or a wider product selection, these switching costs may not be substantial enough to prevent a change, thereby amplifying customer bargaining power.

Customers, particularly major retail chains, often exhibit significant price sensitivity. This is driven by the intense competition they face, compelling them to secure the most favorable pricing from distributors like Johnson Brothers to protect their own profit margins. This sensitivity directly translates into increased bargaining power.

The current economic climate, marked by persistent inflation, further amplifies this customer price sensitivity. For instance, during 2024, rising consumer prices across various goods have forced retailers to be even more vigilant about their cost of goods sold, making them less willing to absorb higher wholesale prices from their suppliers.

Availability of Substitutes for Johnson Brothers' Service

Customers of Johnson Brothers Liquor Porter face a competitive landscape with numerous alternatives. They can choose from other large national distributors, providing a broad reach, or opt for smaller, regional distributors that might offer more specialized services or local market knowledge.

This wide array of choices significantly enhances the bargaining power of Johnson Brothers' customers. If the company fails to meet their pricing expectations, service levels, or product availability demands, customers can readily switch to a competitor.

For example, in 2024, the U.S. beverage alcohol distribution market is highly fragmented, with hundreds of distributors operating across different states. This fragmentation means that for many of Johnson Brothers' clients, particularly larger retail chains or restaurant groups, switching distributors is a feasible option.

- Numerous Alternatives: Customers can select from national distributors, regional players, or even direct-from-producer options in some markets.

- Switching Costs: While some switching costs exist, the availability of comparable services often makes the transition manageable for many buyers.

- Price Sensitivity: The presence of substitutes often leads to increased price sensitivity among customers, forcing distributors to remain competitive.

Threat of Backward Integration by Customers

While the alcohol distribution sector's heavy regulation makes it less likely, major retail chains could potentially pursue backward integration. This would involve them acquiring or building their own distribution networks, bypassing distributors like Johnson Brothers.

The threat, even if it's just a possibility, gives these large customers significant bargaining power. They can use the prospect of bringing distribution in-house to negotiate more favorable terms with Johnson Brothers.

For instance, a large national retailer, which might represent a substantial portion of Johnson Brothers' revenue, could leverage its scale. If such a retailer were to hypothetically spend 10% of its annual revenue on distribution services, even a small reduction in that cost through backward integration would be significant.

- Potential for Backward Integration: Large retail chains might consider developing their own distribution infrastructure.

- Bargaining Leverage: The mere possibility of backward integration enhances customer negotiation power.

- Regulatory Hurdles: The complex regulatory landscape in alcohol distribution currently acts as a barrier to widespread backward integration.

Johnson Brothers' customers, particularly large retail chains and restaurant groups, possess significant bargaining power due to their substantial purchasing volumes and the competitive distribution landscape. This power allows them to negotiate favorable pricing, payment terms, and promotional support, directly impacting Johnson Brothers' profitability.

| Customer Segment | Bargaining Power Factors | Impact on Johnson Brothers |

|---|---|---|

| Major Retail Chains | High purchase volume, price sensitivity, numerous distributor alternatives | Ability to demand lower prices, favorable credit terms, and enhanced marketing support |

| Restaurant Groups | Consolidation leading to increased buying power, potential for backward integration | Leverage to negotiate volume discounts and customized service agreements |

| Smaller Retailers | Lower individual purchase volume, but collective influence can be notable | May seek competitive pricing and reliable supply, but have less individual negotiation leverage |

Preview Before You Purchase

Johnson Brothers Liquor Porter's Five Forces Analysis

This preview showcases the complete Johnson Brothers Liquor Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden surprises. This professionally formatted analysis is ready for your immediate use, providing valuable insights into the industry's dynamics.

Rivalry Among Competitors

The U.S. beverage alcohol distribution landscape features a handful of dominant national distributors, including Southern Glazer's Wine & Spirits, alongside a multitude of smaller, regional competitors. Johnson Brothers, while a substantial national operator across 17 states, contends with significant rivalry from these larger, more established entities.

The U.S. alcoholic beverage market in 2024 presents a complex picture. While overall beer and wine volumes have seen a dip, the spirits segment is showing resilience, driven by popular categories like tequila and ready-to-drink (RTD) beverages. This mixed growth environment means companies are intensely focused on capturing market share.

When industry growth slows, competition naturally heats up. Johnson Brothers Liquor, like its competitors, faces increased pressure to differentiate its offerings and secure customer loyalty in a market where expansion opportunities might be limited. This dynamic can lead to more aggressive pricing and marketing strategies.

Johnson Brothers Liquor, like many distributors, faces intense competition not solely on price. They differentiate by cultivating exclusive supplier relationships and offering a broad, curated product selection. This strategy goes beyond mere availability, focusing on the unique value and appeal of the brands they represent.

Operational efficiency, including timely and reliable logistics, is another key differentiator. In 2024, the beverage distribution sector saw continued investment in advanced tracking and inventory management systems, with companies like Johnson Brothers leveraging technology to ensure product integrity and prompt delivery, a critical factor for on-premise and retail clients.

Furthermore, the quality of sales and marketing support provided to suppliers and customers plays a significant role. Johnson Brothers invests in knowledgeable sales teams and targeted marketing initiatives, helping to build brand awareness and drive demand for their portfolio, which is essential in a crowded marketplace.

Exit Barriers

Johnson Brothers Liquor Porter likely faces high exit barriers. Significant investments in specialized infrastructure like temperature-controlled warehouses and a dedicated distribution fleet represent substantial fixed assets that are difficult to liquidate without substantial loss. These assets, coupled with long-term contracts with both suppliers and customers, create a strong incentive to continue operations even when profitability dips, potentially intensifying rivalry as firms are reluctant to leave the market.

These barriers can trap capital and resources, forcing companies to compete fiercely for market share rather than exit. For instance, in the broader beverage distribution sector, the cost of maintaining a national distribution network can run into hundreds of millions of dollars, making a graceful exit challenging.

- High Fixed Asset Investment: Specialized warehouses and distribution fleets are costly to acquire and difficult to repurpose.

- Long-Term Contracts: Commitments with suppliers and major customers create ongoing obligations.

- Specialized Labor: A workforce trained in beverage logistics and compliance is not easily transferable to other industries.

- Industry-Specific Regulations: Navigating alcohol distribution often involves complex licensing and compliance that are not easily shed.

Acquisition and Consolidation Trends

The beverage distribution landscape is marked by significant acquisition and consolidation activity. Larger entities are actively absorbing smaller competitors to broaden their market presence and product offerings.

Johnson Brothers has strategically participated in this trend, notably with its 2025 acquisition of Maverick Beverage Company's operations across Texas, Arizona, Colorado, and Florida. This move not only expands Johnson Brothers' footprint but also intensifies competition by bolstering the capabilities of a major player.

While consolidation can decrease the sheer number of competing firms, it often leads to the emergence of fewer, but more powerful and dominant rivals. This dynamic reshapes the competitive intensity within the industry.

- Consolidation Drivers: Expansion of geographic reach and product portfolios are key motivators for beverage distributors to acquire smaller players.

- Johnson Brothers' Growth Strategy: The acquisition of Maverick Beverage Company in 2025 exemplifies Johnson Brothers' proactive approach to market consolidation.

- Impact on Rivalry: Increased market share for acquiring firms can intensify competition among the remaining, larger distributors.

Johnson Brothers faces intense rivalry from national distributors like Southern Glazer's, and numerous regional players, especially as the U.S. spirits market shows resilience in 2024, driving a focus on market share capture.

This heightened competition intensifies pressure to differentiate through exclusive supplier relationships, curated selections, and operational efficiency, including advanced logistics and inventory management systems crucial for timely delivery.

The beverage distribution sector is undergoing significant consolidation; Johnson Brothers' 2025 acquisition of Maverick Beverage Company's operations across four states exemplifies this trend, creating fewer but more dominant rivals and intensifying competition among the remaining major players.

High exit barriers, such as substantial investments in specialized infrastructure and long-term contracts, compel firms to compete aggressively rather than withdraw, further fueling rivalry.

| Competitor | Market Share (Est. 2024) | Key Differentiators |

|---|---|---|

| Southern Glazer's Wine & Spirits | ~20-25% (National) | Extensive portfolio, national reach, strong supplier relationships |

| Republic National Distributing Company (RNDC) | ~15-20% (National) | Broad product offering, strong digital platforms, regional expertise |

| Johnson Brothers Liquor | ~3-5% (National footprint) | Exclusive supplier partnerships, operational efficiency, growing market presence |

| Regional Distributors | Varies significantly | Local market knowledge, personalized service, niche product focus |

SSubstitutes Threaten

The burgeoning market for no- and low-alcohol beverages presents a notable threat to traditional alcoholic beverage distributors like Johnson Brothers. This segment is experiencing robust growth, with market research indicating a compound annual growth rate (CAGR) of over 7% globally through 2028, reaching an estimated value of over $200 billion. Consumers are increasingly prioritizing moderation and health-conscious choices, leading them to explore these alternatives over conventional spirits, wine, and beer.

The growing acceptance and legalization of cannabis are paving the way for cannabis-infused beverages to emerge as a significant substitute. These drinks are capturing consumer attention, even finding their way into the portfolios of some established alcohol retailers and distributors in states where cannabis is legal.

By 2024, the U.S. cannabis beverage market was projected to reach approximately $2.5 billion, demonstrating a clear and growing consumer demand. This trend presents a direct challenge to traditional alcoholic beverages, as consumers increasingly explore alternative consumption methods.

The increasing adoption of direct-to-consumer (D2C) sales by beverage producers presents a significant threat. This model allows brands to bypass intermediaries like Johnson Brothers, potentially capturing higher profit margins and fostering direct customer engagement. For instance, in 2024, many craft distilleries and wineries expanded their D2C shipping capabilities, reaching consumers in states previously inaccessible through traditional three-tier systems.

While regulatory landscapes still present challenges for widespread D2C alcohol sales, the trend is undeniably growing. Producers are investing in e-commerce platforms and logistics to facilitate these sales, indicating a long-term shift that could reduce reliance on traditional distributors. This direct channel offers producers greater control over branding and customer data, making it an attractive alternative to the established distribution network.

Other Non-Alcoholic Beverages

The threat of substitutes for alcoholic beverages is significant, particularly from the expanding non-alcoholic beverage market. This includes premium sodas, specialty coffees, and a growing category of functional beverages like adaptogenic or nootropic drinks. These alternatives are increasingly being chosen for social occasions where alcohol was once the default. For instance, the global non-alcoholic beverage market was valued at approximately $1.1 trillion in 2023 and is projected to grow steadily, indicating a strong shift in consumer preferences.

Consumers are seeking healthier and more sophisticated options, blurring the lines between traditional beverage categories. This trend is evident in the rapid growth of the ready-to-drink (RTD) tea and coffee segments, as well as the rise of mocktails and non-alcoholic spirits. In 2024, the market for non-alcoholic beer, wine, and spirits is experiencing robust growth, with some analysts projecting double-digit annual increases.

- Growing Non-Alcoholic Market: The global non-alcoholic beverage market reached an estimated $1.1 trillion in 2023, showcasing a substantial alternative.

- Premiumization of Alternatives: Consumers are opting for higher-quality non-alcoholic options like specialty coffees and functional beverages.

- Functional Beverage Boom: Drinks infused with adaptogens or nootropics are gaining popularity as lifestyle choices, offering an alternative to alcohol for well-being.

- Social Occasion Shift: Non-alcoholic choices are becoming increasingly acceptable and even preferred in social settings, reducing reliance on alcoholic beverages.

Home Production/Brewing/Winemaking

Home production of beverages like beer, wine, and spirits, while a niche, presents a potential substitute for commercially available products. This threat is generally low for Johnson Brothers Liquor Porter because the convenience and variety offered by commercial producers are significant advantages. Consumers often prefer the ease of purchasing ready-made beverages over the time and effort required for home brewing or winemaking.

However, for a segment of consumers, particularly those seeking unique flavors or cost savings, home production remains an ultimate alternative. For instance, the craft beer movement has seen a rise in homebrewing enthusiasts, with many sharing recipes and techniques online. While specific data for home production's impact on the entire liquor market is hard to isolate, it represents a baseline for consumer choice outside of traditional retail channels.

- Niche Market: Home brewing and winemaking cater to a specific consumer segment.

- Convenience Factor: Commercial products offer superior ease of access and variety.

- Ultimate Alternative: For some, home production is the final substitute option.

- Craft Movement Influence: The rise of craft beverages has indirectly boosted interest in home production.

The threat of substitutes for Johnson Brothers Liquor Porter is substantial, primarily driven by the rapidly expanding non-alcoholic beverage market. This includes premium sodas, specialty coffees, and functional drinks, which are increasingly chosen for social occasions. The global non-alcoholic beverage market was valued at approximately $1.1 trillion in 2023, demonstrating a significant alternative for consumers seeking moderation or healthier options.

The rise of no- and low-alcohol beverages is a key substitute, with a projected global CAGR of over 7% through 2028, potentially reaching over $200 billion. Furthermore, cannabis-infused beverages are emerging as a viable alternative, with the U.S. market projected to reach $2.5 billion by 2024, indicating a clear shift in consumer preferences and spending.

Direct-to-consumer (D2C) sales by beverage producers also pose a threat, allowing brands to bypass traditional distributors like Johnson Brothers. Many craft producers expanded their D2C shipping in 2024, directly reaching consumers and capturing higher margins.

| Substitute Category | Market Size/Growth (Approximate) | Key Drivers |

|---|---|---|

| Non-Alcoholic Beverages | $1.1 Trillion (2023) | Health consciousness, moderation, premiumization |

| No/Low-Alcohol Beverages | >7% CAGR (through 2028) | Lifestyle trends, social acceptance |

| Cannabis-Infused Beverages | $2.5 Billion (U.S. projected 2024) | Legalization, evolving consumer tastes |

| Direct-to-Consumer (D2C) Sales | Growing, increased in 2024 | Higher margins, direct customer engagement |

Entrants Threaten

The alcoholic beverage distribution sector is heavily regulated. For instance, in 2024, obtaining the necessary federal permits from the Alcohol and Tobacco Tax and Trade Bureau (TTB) and state-specific liquor licenses can be a protracted and expensive process, often taking months or even years. This complexity, coupled with varying state laws governing distribution, acts as a substantial deterrent for potential new entrants seeking to enter the market.

Starting a beverage distribution business, like the one Johnson Brothers Liquor operates, demands considerable upfront capital. Think about the costs involved: building or leasing warehouses, purchasing a fleet of trucks for delivery, stocking a diverse inventory of alcoholic beverages, and investing in sophisticated technology for tracking sales and managing logistics. These aren't small sums; for instance, a modern distribution center can easily cost tens of millions of dollars to build and equip.

This significant financial barrier makes it tough for new companies to enter the market. A new entrant would need to secure substantial funding to even begin competing, which can be a major hurdle. For example, securing a loan for millions to cover initial operational costs and inventory is a prerequisite, a challenge many aspiring businesses cannot overcome.

Johnson Brothers Liquor Portfolio benefits from deeply entrenched relationships with a vast network of beverage producers. These long-standing partnerships are crucial, as new entrants would struggle to replicate this access to desirable brands and secure distribution agreements. For instance, in 2024, the beverage distribution market continued to consolidate, making it even harder for newcomers to gain a foothold against established players with extensive brand portfolios.

Economies of Scale

Economies of scale present a significant barrier for new entrants in the liquor distribution industry, including for companies like Johnson Brothers Liquor. Large, established distributors leverage their sheer volume to secure better pricing from suppliers and optimize their logistics networks, leading to lower per-unit costs.

For instance, in 2024, major beverage distributors often operate fleets of thousands of trucks and manage vast warehouse spaces, allowing them to spread fixed costs over a much larger volume of goods. This scale translates into a substantial cost advantage. A new entrant would find it incredibly difficult to match these operational efficiencies and purchasing power immediately. Without achieving comparable scale, new players would struggle to compete on price, making it challenging to gain market share against incumbents who can offer more attractive terms to retailers.

- Lower Per-Unit Costs: Established players benefit from bulk purchasing discounts, reducing the cost of goods sold.

- Logistical Efficiency: Large-scale operations allow for optimized delivery routes and warehousing, cutting transportation and storage expenses.

- Pricing Disadvantage for Newcomers: Entrants without significant volume are forced to accept higher costs, limiting their ability to offer competitive pricing.

Retaliation by Incumbents

Established players like Johnson Brothers Liquor Company possess significant financial muscle and market influence. This allows them to retaliate against newcomers through tactics such as aggressive price cuts, extensive advertising campaigns, or by leveraging their long-standing ties with distributors and retail partners. For instance, in the competitive beverage alcohol distribution sector, incumbents often control prime shelf space and favorable payment terms, making it difficult for new entrants to secure comparable arrangements.

The potential for such robust incumbent reactions acts as a powerful deterrent, discouraging new companies from entering the market. In 2024, the U.S. beverage alcohol market, valued at over $350 billion, continues to see consolidation, further strengthening the position of major distributors who can absorb initial losses from price wars or outspend smaller competitors on marketing initiatives.

- Incumbent Retaliation: Established firms can engage in price wars, increase marketing spend, and leverage existing distribution networks.

- Market Power: Companies like Johnson Brothers have the resources to absorb short-term losses and outspend new entrants.

- Deterrent Effect: The credible threat of retaliation discourages new companies from entering the market.

- 2024 Market Dynamics: The U.S. beverage alcohol market's size and ongoing consolidation favor established players.

The threat of new entrants for Johnson Brothers Liquor is significantly low due to substantial barriers. Stringent regulatory hurdles, such as obtaining federal and state liquor licenses in 2024, demand considerable time and financial investment, deterring many potential competitors. The capital-intensive nature of the business, requiring millions for warehouses, fleets, and inventory, further solidifies this. Established relationships with producers and the advantage of economies of scale also make it difficult for newcomers to gain traction.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Requirements | Complex licensing and compliance processes (e.g., TTB permits in 2024). | High; protracted and costly to navigate. |

| Capital Intensity | Significant upfront investment in infrastructure, inventory, and technology. | High; requires substantial funding, often in the tens of millions. |

| Supplier Relationships | Established, long-standing partnerships with beverage producers. | High; difficult for new entrants to replicate access to desirable brands. |

| Economies of Scale | Cost advantages derived from large-volume operations and optimized logistics. | High; new entrants face higher per-unit costs and logistical inefficiencies. |

| Incumbent Retaliation | Potential for aggressive pricing, marketing, and leveraging existing networks. | High; credible threat of price wars and market power discourages entry. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Johnson Brothers Liquor leverages data from industry-specific market research reports, financial filings of publicly traded competitors, and trade association publications to provide a comprehensive view of the competitive landscape.