Ita? Unibanco Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ita? Unibanco Holding Bundle

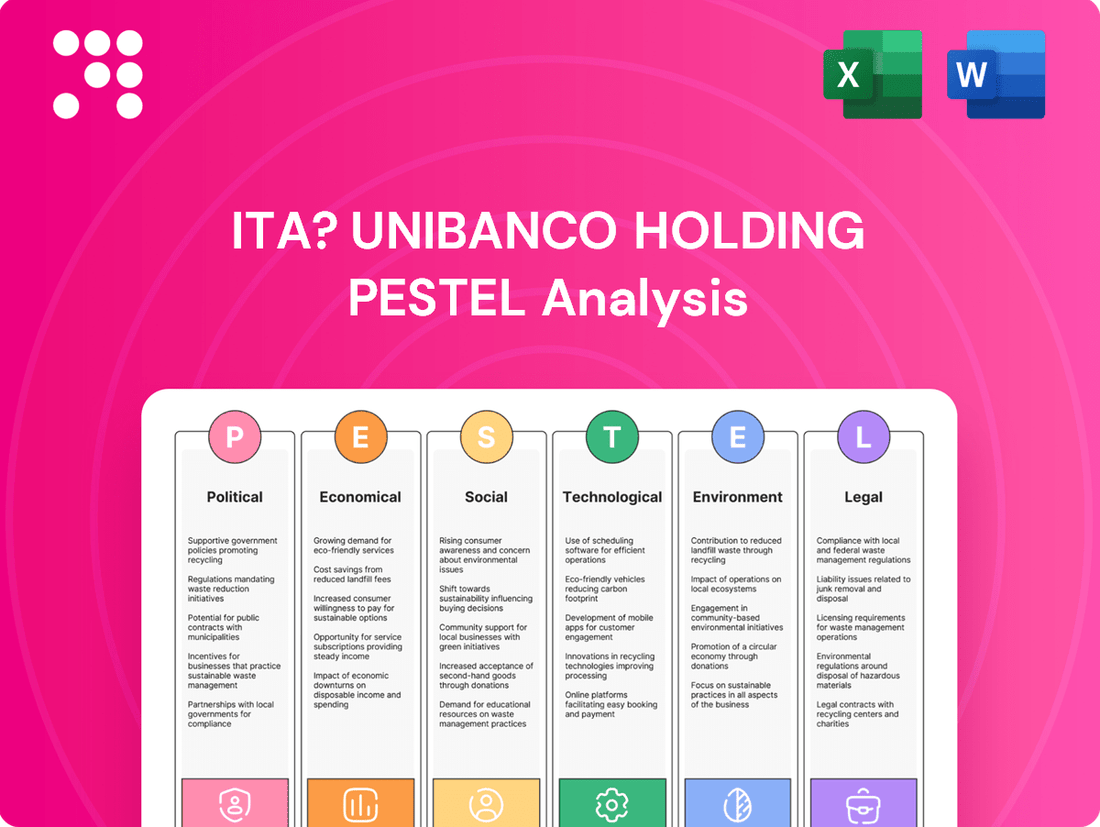

Navigate the complex external forces shaping Ita? Unibanco Holding's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends directly impact the financial giant's operations and strategic decisions. Get actionable intelligence to refine your market approach.

Unlock critical insights into the technological advancements and environmental regulations affecting Ita? Unibanco Holding. This ready-made PESTLE analysis delivers expert-level understanding, crucial for investors and strategists. Buy the full version for a complete breakdown and gain a competitive edge.

Political factors

Brazil's political environment, particularly the stability of the current administration and its economic policy direction, significantly shapes the banking sector. Itaú Unibanco, as a major financial institution, is directly affected by shifts in fiscal policy, government expenditure, and the pace of economic reforms, all of which influence consumer and business sentiment, thereby impacting the demand for banking services.

The government's approach to foreign investment and international trade agreements is also a critical consideration for Itaú Unibanco, affecting its global operations and prospects for growth. For instance, policy shifts impacting interest rates or credit availability, key determinants for bank profitability, are often driven by the government's macroeconomic management strategies.

The Central Bank of Brazil's (BCB) independence is paramount for Itaú Unibanco, influencing everything from interest rate decisions to inflation targets. For instance, the BCB's monetary policy committee, the COPOM, has maintained its benchmark Selic rate at 10.50% as of June 2024, a key factor in the bank's lending and deposit strategies.

Changes to the BCB's autonomy or its monetary policy framework directly impact Itaú's profitability and how it manages financial risks. The bank must remain agile to adapt to potential shifts in the BCB's approach to economic stability.

Furthermore, the evolving regulatory landscape, with ongoing public consultations on areas like virtual assets and Banking as a Service (BaaS), presents both opportunities and challenges for Itaú. Navigating these new rules, such as those potentially impacting digital banking operations, requires careful strategic planning.

Brazil's ongoing commitment to anti-corruption initiatives and corporate governance enhancements directly shapes the operational landscape for major financial entities such as Itaú Unibanco. These efforts are crucial for maintaining market integrity.

Increased scrutiny and more stringent transparency mandates can elevate compliance expenditures and necessitate more robust reputational risk mitigation strategies for banks. For instance, the Lava Jato investigation, while impacting the broader economy, highlighted the need for enhanced internal controls within financial institutions.

A well-defined and consistently applied legal framework combating corruption cultivates a more stable and reliable business climate. This predictability is a significant advantage for long-term financial planning and investment, ultimately bolstering confidence in the banking sector.

Geopolitical Tensions and International Relations

Global geopolitical tensions and Brazil's evolving international relations can create ripples affecting Itaú Unibanco. For instance, heightened trade disputes or regional conflicts might dampen foreign direct investment into Brazil, impacting the bank's lending and investment banking operations. In 2024, Brazil's active participation in BRICS and its engagement with global economic forums are crucial for navigating these complexities and attracting international capital.

Increased market volatility, often a byproduct of geopolitical instability, directly influences Itaú Unibanco's trading and asset management divisions. A less favorable global economic outlook, potentially exacerbated by international friction, could reduce cross-border capital flows. This makes Brazil's economic resilience and its ability to attract stable foreign investment, as evidenced by its foreign exchange reserves, a critical factor in Itaú Unibanco's strategic financial planning.

- Trade Friction Impact: Increased global trade tensions could reduce demand for Brazilian exports, indirectly affecting the financial sector's performance.

- Foreign Investment Flows: Geopolitical uncertainty can deter foreign investors, potentially limiting capital inflows into Brazil and impacting credit markets.

- Currency Stability: Global instability often leads to currency fluctuations, which can affect Itaú Unibanco's international operations and the value of its foreign assets.

- Brazil's Global Standing: Brazil's diplomatic efforts and trade agreements in 2024-2025 will be key to mitigating external economic shocks and supporting financial stability.

Fiscal Policy and Public Debt Management

Brazil's fiscal policy and its approach to public debt significantly shape the operating environment for Itaú Unibanco. For instance, the Brazilian government's commitment to fiscal consolidation, as seen in efforts to control spending and manage its debt-to-GDP ratio, directly impacts investor confidence and economic stability. A higher debt-to-GDP ratio, if not managed effectively, can signal fiscal risk.

Concerns regarding Brazil's public debt trajectory can trigger adverse economic reactions. For example, if markets perceive a lack of fiscal discipline, it can lead to a weaker Brazilian Real and upward pressure on interest rates. In 2024, the Central Bank of Brazil's monetary policy decisions, influenced by fiscal concerns, have kept the Selic rate at elevated levels, impacting credit demand and the cost of funding for banks like Itaú Unibanco.

- Fiscal Policy Impact: Government fiscal adjustments, such as tax reforms or spending cuts, can alter economic growth prospects and influence consumer and business confidence.

- Public Debt Dynamics: Brazil's net public debt stood at approximately 61.3% of GDP by the end of 2023, a figure that requires careful management to avoid negative market reactions.

- Interest Rate Sensitivity: Higher interest rates, often a consequence of fiscal concerns, increase the cost of borrowing for businesses and individuals, potentially slowing loan growth for Itaú Unibanco.

- Currency Volatility: Fiscal instability can lead to a depreciating Real, affecting the bank's foreign exchange exposure and the cost of imported goods and services used in its operations.

Political stability and government policy are crucial for Itaú Unibanco. Shifts in economic strategy, fiscal discipline, and regulatory frameworks directly influence the banking sector's performance and Itaú's operational landscape. The Central Bank of Brazil's monetary policy, exemplified by the Selic rate holding at 10.50% as of June 2024, significantly impacts lending and deposit strategies.

Brazil's anti-corruption efforts and corporate governance reforms are vital for market integrity, potentially increasing compliance costs for banks like Itaú. Furthermore, Brazil's international relations and participation in global forums in 2024-2025 will shape its economic resilience and ability to attract foreign investment, impacting Itaú's global operations.

Fiscal policy and public debt management are key political factors. Brazil's net public debt was around 61.3% of GDP in late 2023, requiring careful handling to maintain investor confidence. Fiscal concerns can lead to currency depreciation and higher interest rates, affecting Itaú's profitability and loan growth.

| Factor | Impact on Itaú Unibanco | 2024/2025 Relevance |

|---|---|---|

| Government Economic Policy | Influences consumer and business confidence, demand for banking services. | Stability of current administration's economic direction is key. |

| Central Bank Independence | Affects interest rate decisions, inflation targets, and monetary policy. | BCB's Selic rate at 10.50% (June 2024) is a critical benchmark. |

| Regulatory Environment | Presents opportunities and challenges in areas like digital banking and virtual assets. | Navigating new rules for BaaS and virtual assets requires strategic adaptation. |

| Fiscal Policy & Debt | Impacts investor confidence, economic stability, and interest rates. | Brazil's debt-to-GDP ratio (approx. 61.3% end-2023) needs vigilant management. |

What is included in the product

This PESTLE analysis thoroughly examines the external macro-environmental factors influencing Itaú Unibanco Holding, covering political stability, economic conditions, social trends, technological advancements, environmental regulations, and legal frameworks.

It provides actionable insights for strategic decision-making by identifying emerging threats and opportunities pertinent to Itaú Unibanco Holding's operations and future growth.

This PESTLE analysis for Itaú Unibanco Holding acts as a pain point reliever by providing a clear, summarized version of complex external factors, enabling quick referencing and informed decision-making during strategic planning and risk assessment.

Economic factors

Inflationary pressures in Brazil remain a significant concern for Itaú Unibanco. While inflation has shown some moderation, persistent price increases can erode consumer purchasing power, potentially impacting loan demand and increasing the risk of defaults across various loan portfolios.

The Central Bank of Brazil's (BCB) monetary policy, particularly its benchmark Selic rate, directly affects Itaú Unibanco's profitability. As of mid-2025, the BCB has been navigating a complex environment, balancing inflation control with economic growth. Anticipated interest rate adjustments by the BCB in 2025 will directly influence the bank's funding costs and its ability to generate income from lending activities.

Brazil's Gross Domestic Product (GDP) growth is a key driver for Itaú Unibanco. When the economy expands, people and businesses tend to spend more, which directly translates to increased demand for banking services like loans and credit. For instance, Brazil's GDP growth was projected to be around 2.3% in 2024, indicating a generally positive, albeit moderate, economic climate.

This moderate growth forecast for 2024 and into 2025 suggests a stable operating environment for Itaú Unibanco. A healthy GDP typically means higher consumer confidence and increased business investment, both of which are beneficial for a large financial institution like Itaú. The bank can expect steady demand for its diverse range of financial products and services.

The Brazilian Real (BRL) experienced significant volatility in 2024. For instance, the BRL depreciated by approximately 5% against the US Dollar in the first half of 2024, impacting Itaú Unibanco's international operations and its balance sheet, which holds foreign currency assets and liabilities. This depreciation also contributed to inflationary pressures, influencing the Central Bank of Brazil's decisions on interest rates.

Consumer Spending and Credit Demand

Consumer spending is a cornerstone for Itaú Unibanco's retail operations, directly impacting credit demand. In 2024, Brazil's economic recovery is expected to bolster consumer confidence, leading to increased borrowing. For instance, retail sales in Brazil saw a notable increase of 4.2% in the first quarter of 2024 compared to the same period in 2023, indicating a positive trend for credit products.

The demand for credit is intrinsically linked to employment and income levels. As job creation continues, and disposable income rises, consumers are more likely to engage with credit facilities such as personal loans and credit cards. Itaú Unibanco's loan portfolio, particularly in the consumer segment, benefits from this increased willingness to spend and borrow. The bank's growth is therefore a reflection of a robust consumer market.

- Consumer Confidence: Expected to rise in Brazil throughout 2024, encouraging greater spending.

- Retail Sales Growth: Q1 2024 saw a 4.2% year-on-year increase in Brazilian retail sales.

- Loan Portfolio Expansion: Directly correlated with a healthy consumer market and increased credit uptake.

- Employment and Income: Key drivers for individuals' capacity and willingness to take on new credit.

Investment Climate and Capital Flows

The investment climate in Brazil significantly influences Itaú Unibanco's operations, particularly its investment banking and asset management arms. For instance, in the first quarter of 2024, Brazil saw a notable increase in foreign direct investment (FDI), reaching approximately $20 billion, which directly benefits banks like Itaú by boosting deal flow and asset under management.

Policies aimed at simplifying non-resident access to Brazil's financial markets are vital. When regulations ease, such as the Central Bank of Brazil's ongoing efforts to modernize foreign exchange rules, Itaú's capacity to attract international capital for its clients and its own balance sheet grows. This directly impacts the bank's ability to offer a wider range of investment products and services to a global clientele.

Stable capital flows are the bedrock of Itaú Unibanco's liquidity and market operations. In 2024, Brazil has experienced more consistent capital inflows compared to previous years, partly due to a more predictable interest rate environment. This stability supports the bank's trading desks and its ability to manage risk effectively.

- FDI Inflows: Brazil's FDI in Q1 2024 reached around $20 billion, a positive signal for Itaú's investment banking divisions.

- Regulatory Modernization: Central Bank initiatives to simplify foreign exchange access are key to attracting foreign investment to Itaú's platforms.

- Capital Flow Stability: A more stable inflow of capital in 2024 enhances Itaú's liquidity and market operational capacity.

Brazil's economic trajectory significantly impacts Itaú Unibanco. While projected GDP growth around 2.3% for 2024 suggests a stable environment, persistent inflation remains a concern, potentially affecting consumer spending and loan demand. The Central Bank of Brazil's monetary policy, particularly the Selic rate, directly influences the bank's funding costs and lending income, with anticipated adjustments in 2025 being a key factor.

The volatility of the Brazilian Real, which depreciated around 5% against the US Dollar in the first half of 2024, impacts Itaú's international operations and contributes to inflationary pressures. Despite this, consumer spending shows resilience, with retail sales up 4.2% year-on-year in Q1 2024, signaling a positive trend for credit products. This, coupled with job creation and rising incomes, supports the expansion of Itaú's loan portfolio.

| Economic Factor | 2024/2025 Projection/Data | Impact on Itaú Unibanco |

|---|---|---|

| GDP Growth | Projected ~2.3% for 2024 | Stable operating environment, steady demand for services. |

| Inflation | Persistent concern, moderating but impacting purchasing power. | Potential for reduced loan demand, increased default risk. |

| Selic Rate | Central Bank policy to manage inflation and growth. | Directly affects funding costs and lending profitability. |

| Brazilian Real (BRL) | Depreciated ~5% vs USD in H1 2024. | Impacts international operations, contributes to inflation. |

| Retail Sales | +4.2% YoY in Q1 2024. | Positive trend for credit products and consumer lending. |

Same Document Delivered

Ita? Unibanco Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Itaú Unibanco Holding delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides crucial insights into the dynamic Brazilian financial landscape and its implications for Itaú Unibanco's strategic positioning and future growth.

Sociological factors

Brazil's population is projected to reach around 219 million by 2025, with a growing urban concentration. This demographic trend directly impacts Itaú Unibanco by increasing the demand for accessible financial services in metropolitan areas and for digital banking solutions catering to a younger, tech-savvy demographic.

The bank's strategy involves optimizing its physical footprint while expanding digital offerings to meet the needs of an increasingly urbanized and diverse customer base. For instance, Itaú Unibanco has been investing heavily in its digital platforms, aiming to serve the growing number of Brazilians living in cities who expect seamless online and mobile banking experiences.

Brazil's push for financial inclusion, exemplified by the rapid adoption of Pix, is reshaping banking. By the end of 2023, Pix had facilitated over 21 billion transactions, demonstrating a significant shift towards digital payments and opening avenues for Itaú Unibanco to reach previously unbanked segments. This expansion necessitates the creation of simplified, accessible banking solutions tailored for diverse socioeconomic groups.

Alongside inclusion, enhancing financial literacy remains a critical societal goal. A more financially educated populace is better equipped to manage credit responsibly and engage in informed investment decisions, which directly impacts the stability and growth of Itaú Unibanco's customer base and loan portfolios. Efforts to boost literacy are therefore crucial for sustainable financial sector development.

Consumer preferences are rapidly evolving, largely due to digitalization and the growing influence of fintech companies. This shift means Itaú Unibanco must constantly update its services to keep up. For instance, by the end of 2024, a significant portion of Itaú's customer base is expected to be actively using digital channels, reflecting a strong preference for online banking.

Customers now demand seamless digital banking experiences, including easy online payments and highly personalized services. Itaú's strategic investment in its 'Superapp' and the implementation of AI for personalized recommendations directly address these changing behaviors, aiming to provide a more integrated and user-friendly banking journey.

Wealth Distribution and Income Inequality

Brazil's persistent wealth distribution and income inequality profoundly shape the financial landscape. In 2023, the Gini coefficient, a common measure of inequality, remained high, indicating a significant gap between the rich and the poor. This disparity directly influences the demand for financial products, with lower-income segments often seeking basic banking, credit, and insurance, while higher-income groups focus on investment, wealth management, and sophisticated financial planning.

Itaú Unibanco strategically navigates this environment by offering a broad spectrum of financial solutions. From microfinance initiatives designed to support small businesses and low-income individuals to premium wealth management services for affluent clients, the bank caters to the diverse needs arising from Brazil's economic stratification. This inclusive approach is crucial for capturing market share across various socioeconomic strata.

Furthermore, addressing income inequality through targeted financial inclusion programs presents a significant opportunity for Itaú Unibanco to enhance its social impact and build long-term customer loyalty. Initiatives promoting financial literacy and access to affordable credit for underserved populations can foster economic mobility and create a more stable, growing customer base for the bank.

- Gini Coefficient: Brazil's Gini coefficient remained a concern in 2023, reflecting substantial income disparities.

- Product Demand: Inequality drives varied demand for financial services, from microcredit to wealth management.

- Itaú's Strategy: The bank offers a comprehensive product suite to serve diverse socioeconomic segments.

- Social Impact: Financial inclusion programs can improve social outcomes and bank-customer relationships.

Corporate Social Responsibility and ESG Expectations

Societal pressure for companies to act responsibly, particularly concerning environmental, social, and governance (ESG) factors, significantly shapes Itaú Unibanco's public image and attractiveness to investors. As of early 2024, Itaú Unibanco continues to emphasize its dedication to sustainable practices, aiming to attract a growing segment of socially conscious capital.

The bank's proactive approach to sustainable finance, including its investments in renewable energy and its commitment to diversity within its workforce, directly impacts its ability to secure funding and retain customers. For instance, Itaú Unibanco's 2023 ESG report highlighted a 15% increase in its sustainable loan portfolio compared to the previous year, demonstrating tangible progress in this area.

- ESG Integration: Itaú Unibanco's strategy increasingly incorporates ESG criteria into its lending and investment decisions, reflecting a broader market trend.

- Climate Transition: The bank has set ambitious targets for reducing its financed emissions, aligning with global climate goals and investor expectations for 2024-2025.

- Social Impact: Initiatives focused on financial inclusion and community development are key components of Itaú Unibanco's social responsibility efforts, enhancing its brand value.

- Investor Demand: There's a clear upward trend in assets managed under ESG mandates, with global ESG assets projected to surpass $50 trillion by 2025, making Itaú Unibanco's performance in this area critical.

Brazil's evolving demographics, with a growing urban population and increasing digital adoption, directly influence Itaú Unibanco's service delivery. The bank's focus on digital platforms and financial inclusion initiatives, such as the widespread use of Pix, aims to capture new customer segments and cater to changing consumer preferences for seamless online experiences.

Income inequality in Brazil creates a diverse demand for financial products, from basic banking for lower-income groups to sophisticated wealth management for the affluent. Itaú Unibanco strategically addresses this by offering a broad product suite, including microfinance and premium services, to serve various socioeconomic strata and foster financial inclusion.

Societal expectations for corporate responsibility, particularly in Environmental, Social, and Governance (ESG) factors, are shaping Itaú Unibanco's strategy and investor appeal. The bank's commitment to sustainable finance and social impact initiatives, like financial literacy programs, is crucial for attracting capital and enhancing its brand value in 2024-2025.

Consumer preferences are rapidly shifting towards digital and personalized banking solutions, driven by technological advancements and fintech competition. Itaú Unibanco's investment in its Superapp and AI-driven recommendations directly addresses these evolving behaviors, aiming to provide an integrated and user-friendly banking journey.

Technological factors

Itaú Unibanco is aggressively pursuing digital transformation, notably through its Superapp initiative, aiming to integrate a comprehensive suite of banking services for an improved customer experience. This strategic pivot involves transitioning millions of users onto a singular, streamlined platform, leveraging artificial intelligence and vast datasets to deliver highly personalized financial interactions.

By offering agile and self-directed financial management capabilities directly through mobile channels, Itaú Unibanco is positioning itself to effectively compete and retain customers in an increasingly digital banking environment. In 2023, Itaú Unibanco reported that over 60% of its customer interactions occurred through digital channels, underscoring the critical importance of its mobile-first strategy.

The burgeoning fintech landscape in Brazil presents a dual challenge and opportunity for Itaú Unibanco. Digital banks, with their agile, technology-driven models and focus on financial inclusion, are increasingly capturing market share. For instance, Nubank, a prominent Brazilian digital bank, reported over 100 million customers globally by early 2024, demonstrating the significant shift in consumer preference towards digital financial services.

Itaú Unibanco is actively navigating this competitive environment by making substantial investments in its own digital transformation, including the development of advanced mobile banking platforms and the strategic acquisition of innovative fintech companies. The bank's commitment to AI integration, as seen in its ongoing efforts to enhance customer service and operational efficiency, underscores its strategy to not only compete but also to lead in the evolving financial sector.

Itaú Unibanco is at the forefront of integrating Artificial Intelligence (AI) and Machine Learning (ML) into its operations, boasting hundreds of generative AI projects and thousands of active AI models. This strategic adoption is key to driving efficiency and innovation across the bank.

The bank leverages AI and ML to significantly lower transaction costs and elevate the customer experience through personalized recommendations and streamlined processes. For instance, AI models are actively used to detect and prevent fraudulent activities, a critical component of risk management.

In 2024, Itaú Unibanco reported that its AI initiatives are projected to generate substantial cost savings and revenue growth. The bank's commitment to AI is evident in its continuous investment in research and development, aiming to further enhance operational efficiency and competitive advantage in the financial sector.

Cybersecurity and Data Privacy

As Itaú Unibanco increasingly relies on digital platforms, cybersecurity and data privacy are critical concerns. Protecting sensitive customer information and ensuring the integrity of online transactions are paramount for maintaining client trust and adhering to Brazil's Lei Geral de Proteção de Dados (LGPD). The bank's commitment to robust security measures directly impacts its reputation and operational resilience in the face of evolving cyber threats.

Itaú Unibanco's proactive approach to cybersecurity is essential. In 2023, the financial sector globally saw a significant rise in sophisticated cyberattacks, with reports indicating billions of dollars in losses. For Itaú Unibanco, this translates to a continuous need for investment in advanced security infrastructure, threat detection systems, and employee training to safeguard against potential breaches and maintain regulatory compliance.

Key aspects of Itaú Unibanco's technological strategy regarding cybersecurity and data privacy include:

- Enhanced Data Encryption: Implementing state-of-the-art encryption protocols for all customer data, both in transit and at rest.

- Advanced Threat Detection: Utilizing AI-powered systems to monitor for and respond to suspicious activities in real-time, minimizing the window of opportunity for attackers.

- Regulatory Adherence: Ensuring strict compliance with LGPD and other relevant data protection laws, with potential fines for non-compliance reaching up to 2% of revenue in Brazil.

- Customer Education: Providing resources and guidance to customers on safe online banking practices to collectively strengthen the security posture.

Cloud Computing and Infrastructure Modernization

Itaú Unibanco is actively migrating its core systems to cloud computing, a strategic move to modernize its IT infrastructure. The bank aims to process 75% of its digital transactions via Microsoft Azure by 2025, with a complete cloud migration targeted for 2028. This transition is expected to significantly decrease high-impact IT incidents and accelerate the pace of new feature deployments.

This technological shift is crucial for enhancing Itaú Unibanco's operational efficiency and supporting its ambitious digital transformation goals. By leveraging cloud infrastructure, the bank anticipates improved scalability and greater resilience, ensuring its systems can handle increasing demand and adapt quickly to market changes. This modernization underpins the bank's strategy to remain competitive in the evolving financial landscape.

Key benefits anticipated from this cloud adoption include:

- Reduced IT operational costs: Cloud services often offer a more cost-effective model compared to maintaining on-premises data centers.

- Enhanced agility and innovation: Faster deployment cycles and access to advanced cloud services enable quicker development of new products and services.

- Improved system reliability and security: Cloud providers typically offer robust security measures and high availability, reducing downtime and protecting sensitive data.

Itaú Unibanco's aggressive digital transformation, particularly its Superapp, is reshaping customer interactions, with over 60% of interactions occurring digitally in 2023. The bank is heavily investing in AI, with hundreds of generative AI projects underway to boost efficiency and personalize services, aiming for substantial cost savings and revenue growth in 2024. This digital focus necessitates robust cybersecurity, especially given Brazil's LGPD, and a strategic migration to cloud computing, targeting 75% of digital transactions on Microsoft Azure by 2025 to enhance agility and reduce IT incidents.

| Technological Factor | Itaú Unibanco's Action/Impact | Key Data/Metric |

|---|---|---|

| Digital Transformation | Superapp initiative for integrated services | Over 60% of customer interactions digital (2023) |

| Artificial Intelligence (AI) | Hundreds of generative AI projects, AI for fraud detection | Projected cost savings and revenue growth from AI (2024) |

| Cloud Computing Migration | Migrating core systems to cloud, targeting Microsoft Azure | 75% of digital transactions via Azure by 2025; full migration by 2028 |

| Cybersecurity & Data Privacy | Enhanced encryption, AI threat detection, LGPD compliance | LGPD fines up to 2% of revenue; global financial sector cyber losses in billions (2023) |

Legal factors

Itaú Unibanco's operations are strictly governed by Brazil's National Monetary Council (CMN) and the Central Bank of Brazil (BCB). These bodies set the rules for everything from getting a banking license to how the bank manages its money and risks. For instance, as of late 2024, the BCB continues to emphasize robust capital adequacy ratios, with major banks like Itaú maintaining levels well above the Basel III minimums, ensuring their resilience against economic shocks.

Adherence to these banking and financial regulations is crucial for Itaú Unibanco to maintain its license and operate smoothly. These rules are designed to protect customers and ensure the overall stability of Brazil's financial system. The BCB's ongoing focus on digital security and consumer data protection, particularly in light of the Pix instant payment system's widespread adoption, means Itaú must continuously invest in compliance and cybersecurity measures.

Brazil's Lei Geral de Proteção de Dados (LGPD), enacted in 2020, imposes strict regulations on how Itaú Unibanco handles personal data. This law mandates transparency and security in data processing, directly affecting the bank's operations and customer interactions.

Failure to comply with LGPD can result in significant fines, with penalties reaching up to 2% of a company's revenue in Brazil, capped at R$50 million per infraction. Itaú Unibanco's commitment to robust data governance and advanced cybersecurity measures is therefore paramount to avoid these penalties and safeguard its reputation.

The bank's investment in data protection technology and employee training is essential for meeting LGPD requirements, ensuring customer data is collected, processed, and stored securely, thereby maintaining trust and operational integrity.

Itaú Unibanco operates under stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, requiring robust internal controls and customer due diligence processes. Failure to comply can result in significant penalties and reputational damage.

Consumer Protection Laws

Brazilian consumer protection laws, particularly the Consumer Defense Code (CDC), significantly shape Itaú Unibanco's operations. These regulations govern everything from how the bank advertises its products and services to how it handles customer complaints and manages contractual terms. Failure to comply can result in hefty fines and reputational damage, impacting customer trust. For instance, in 2023, the Central Bank of Brazil continued to emphasize robust consumer protection measures, with banks like Itaú investing in enhanced complaint resolution channels.

Itaú Unibanco's commitment to transparency and customer-centricity is a strategic response to these legal mandates. By proactively aligning its practices with consumer protection requirements, the bank aims to foster stronger customer relationships and mitigate the risk of costly litigation. This proactive approach is crucial in a market where consumer rights are increasingly asserted, as evidenced by the growing volume of consumer protection cases filed annually in Brazilian courts.

- Consumer Defense Code (CDC): Mandates fair practices in advertising, contracts, and customer service.

- Complaint Resolution: Banks must have accessible and effective channels for addressing customer grievances.

- Transparency: Requirements for clear disclosure of fees, interest rates, and product terms.

- Enforcement: Potential for significant fines and sanctions for non-compliance by regulatory bodies.

Competition and Antitrust Legislation

Competition and antitrust laws in Brazil significantly shape the banking sector's dynamics, ensuring fair play and deterring monopolistic practices. Itaú Unibanco, as a dominant financial institution, must meticulously adhere to these regulations, especially concerning its strategic moves in mergers, acquisitions, and collaborations with emerging fintech firms.

Brazil's Administrative Council for Economic Defense (CADE) actively monitors market concentration and anti-competitive behavior. For instance, in 2023, CADE reviewed numerous transactions within the financial services industry, including those involving digital banks and payment processors, to safeguard consumer interests and market integrity.

- Antitrust Oversight: CADE's scrutiny ensures Itaú Unibanco's growth strategies do not stifle competition.

- Fintech Partnerships: Regulations govern how established banks can partner with or acquire fintechs to prevent undue market control.

- Market Share Limits: Antitrust laws can impose limits on market share to maintain a diverse financial services landscape.

- Consumer Protection: Compliance with these laws ultimately protects consumers from potential price gouging or reduced service quality resulting from a lack of competition.

Itaú Unibanco navigates a complex web of Brazilian legal frameworks, with the Central Bank of Brazil (BCB) and the National Monetary Council (CMN) setting stringent operational and capital requirements. The Lei Geral de Proteção de Dados (LGPD) imposes significant obligations on data handling, with penalties up to 2% of revenue, capped at R$50 million, underscoring the need for robust data governance. Furthermore, adherence to Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, alongside consumer protection mandates like the Consumer Defense Code (CDC), is critical for maintaining operational integrity and customer trust.

| Legal Area | Key Regulations/Bodies | Impact on Itaú Unibanco | Example (2023/2024 Focus) |

|---|---|---|---|

| Banking Regulation | CMN, BCB | Capital adequacy, risk management, licensing | Maintaining capital ratios well above Basel III minimums |

| Data Protection | LGPD | Strict data handling, security, transparency | Investment in cybersecurity and data governance to avoid fines |

| Consumer Protection | CDC | Fair advertising, contract terms, complaint resolution | Enhanced complaint resolution channels, transparency in fees |

| Antitrust | CADE | Market competition, M&A oversight | Scrutiny of fintech partnerships and market share |

Environmental factors

Climate change poses significant physical risks to Itaú Unibanco, such as potential damage to properties or disruptions to business operations due to extreme weather events, which are becoming more frequent. For instance, Brazil has experienced severe droughts and floods in recent years, impacting various sectors the bank finances.

Transition risks are also a key concern as global policies shift towards a low-carbon economy. Itaú Unibanco is proactively addressing this by integrating climate considerations into its risk management frameworks, aiming to identify and mitigate potential financial exposures arising from this transition.

Simultaneously, climate change creates substantial opportunities for sustainable finance. Itaú Unibanco is actively exploring these by financing projects that promote environmental sustainability and social well-being, aligning with the growing demand for green investments and contributing to a more resilient economy.

Itaú Unibanco faces growing demands from investors, regulators, and the public to demonstrate robust Environmental, Social, and Governance (ESG) performance. This impetus is shaping the bank's strategic direction, pushing it to prioritize sustainability across its operations.

In response, the bank has rolled out a new ESG strategy. This plan emphasizes sustainable finance, fostering diversity, and actively participating in the climate transition. A key element is the establishment of ambitious goals for sustainable financing, aiming to channel significant capital towards environmentally and socially responsible projects.

Furthermore, Itaú Unibanco is integrating ESG considerations directly into its core governance structures and risk management frameworks. This ensures that sustainability factors are systematically evaluated and managed, reflecting a deeper commitment to responsible business practices. For instance, by the end of 2023, Itaú Unibanco had already disbursed R$200 billion in credit for sustainable business, with a target to reach R$1 trillion by 2030.

Itaú Unibanco is aggressively pursuing sustainable finance, aiming to mobilize R$1 trillion by the end of 2030. This ambitious goal builds on their achievement of a R$400 billion target in 2024.

The bank's strategy includes financing clients involved in activities compliant with green taxonomies and developing innovative financial products for areas like degraded land restoration and eco-friendly construction.

Furthermore, Itaú Unibanco is actively structuring ESG (Environmental, Social, and Governance) debt operations, solidifying its position as a key player in driving the transition towards a more sustainable economic landscape.

Carbon Footprint and Emissions Reduction

Itaú Unibanco is actively addressing its environmental impact by setting ambitious goals for carbon footprint reduction. The bank aims to cut its Scope 1 and Scope 2 emissions by half by 2030, with a long-term vision of achieving net-zero emissions by 2050.

Key initiatives include transitioning to 100% renewable energy sources for its operations and implementing emission offsetting strategies. Itaú Unibanco also leverages carbon credit trading as a mechanism to further its climate objectives and contribute to broader emission reduction efforts.

- Emission Reduction Targets: 50% reduction in Scope 1 & 2 emissions by 2030; Net-zero by 2050.

- Renewable Energy: Commitment to sourcing 100% of energy from renewable sources.

- Offsetting Strategies: Utilization of emission offsetting to meet climate goals.

- Carbon Credit Trading: Active participation in carbon credit markets to support climate strategy.

Resource Management and Circular Economy

Itaú Unibanco Holding's approach to resource management emphasizes operational efficiency, aiming to reduce energy and water consumption. This focus is crucial for managing operational costs and minimizing environmental impact, particularly in a sector increasingly scrutinized for its sustainability practices.

While explicit, detailed circular economy initiatives from Itaú Unibanco Holding are not extensively publicized, the bank's overarching commitment to sustainable development suggests an underlying strategy to minimize waste and foster responsible practices throughout its operations and value chain. This aligns with global trends pushing financial institutions to integrate circularity principles.

For instance, in 2023, Itaú Unibanco reported a 5.1% reduction in energy consumption per employee compared to 2022, reaching 1,650 kWh/employee. Water consumption also saw a decrease of 3.2% per employee, totaling 0.15 m³/employee. These figures reflect a tangible effort in resource efficiency.

- Energy Efficiency: Itaú Unibanco's 2023 report highlights a 5.1% reduction in energy consumption per employee year-on-year.

- Water Conservation: The bank achieved a 3.2% decrease in water consumption per employee in 2023 compared to the previous year.

- Sustainable Practices: The bank's broader sustainability goals imply a focus on waste reduction and promoting responsible practices across its value chain.

Itaú Unibanco is actively managing climate-related risks and opportunities, with a significant focus on sustainable finance. The bank has set ambitious targets, aiming to mobilize R$1 trillion by 2030, building on its R$400 billion achievement in 2024.

The bank is also committed to reducing its environmental footprint, targeting a 50% cut in Scope 1 and 2 emissions by 2030 and net-zero by 2050, supported by a transition to 100% renewable energy sources.

Operational efficiency is a key environmental strategy, demonstrated by a 5.1% reduction in energy consumption per employee and a 3.2% decrease in water consumption per employee in 2023 compared to 2022.

| Metric | 2023 Value | Year-on-Year Change | Target |

|---|---|---|---|

| Sustainable Finance Mobilization | N/A | N/A | R$1 trillion by 2030 (R$400 billion achieved in 2024) |

| Scope 1 & 2 Emissions Reduction | N/A | N/A | 50% by 2030 |

| Renewable Energy Usage | N/A | N/A | 100% of operations |

| Energy Consumption per Employee | 1,650 kWh/employee | -5.1% | N/A |

| Water Consumption per Employee | 0.15 m³/employee | -3.2% | N/A |

PESTLE Analysis Data Sources

Our Itaú Unibanco Holding PESTLE Analysis is built on data from official regulatory bodies, economic indicators from institutions like the IMF and World Bank, and reputable financial news outlets. We incorporate market research reports and analyses of technological advancements to provide a comprehensive view.