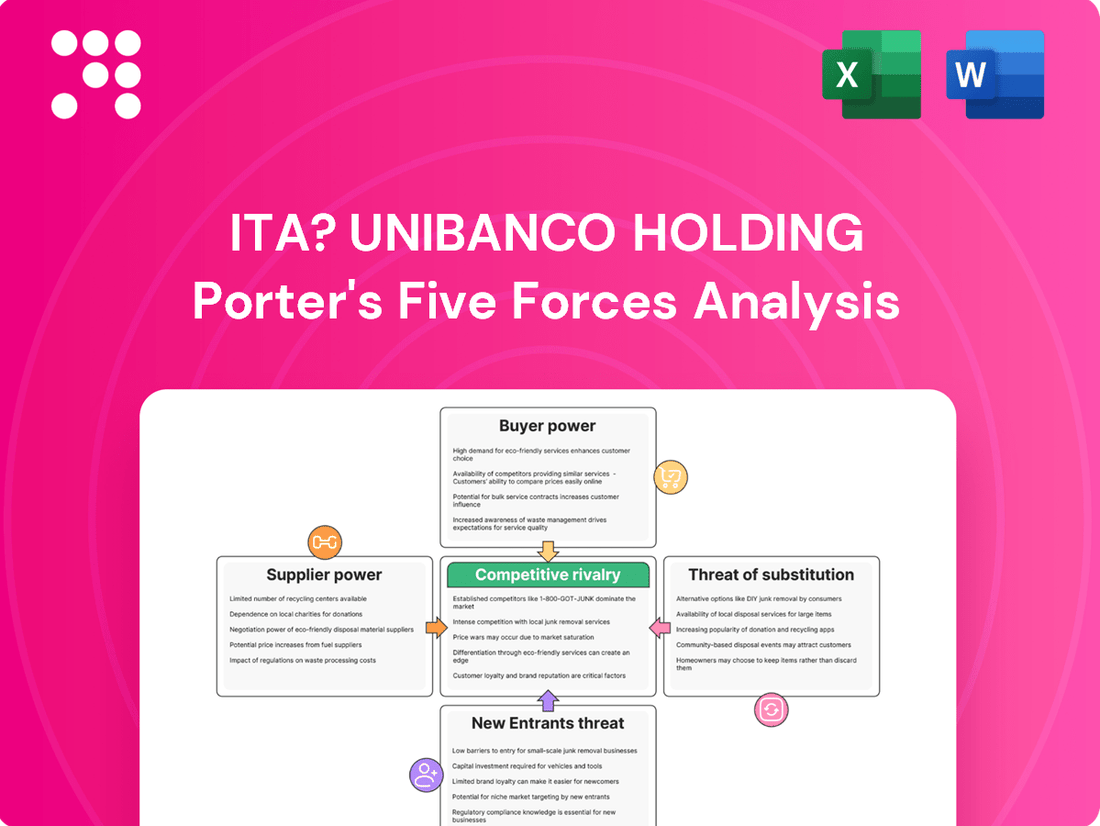

Ita? Unibanco Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ita? Unibanco Holding Bundle

Itaú Unibanco Holding faces moderate threats from new entrants due to high capital requirements and regulatory hurdles, while buyer power is significant as customers can easily switch banks. Intense rivalry among established players, including major Brazilian and international institutions, also shapes the competitive landscape.

The complete report reveals the real forces shaping Itaú Unibanco Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Itaú Unibanco's dependence on sophisticated technology and software for its digital operations, core banking infrastructure, and robust cybersecurity measures places it in a position where technology and software providers can wield significant influence. The specialized nature of these critical systems, coupled with the substantial costs and complexities associated with migrating to alternative solutions, suggests that a concentrated market of specialized tech vendors could exert moderate to high bargaining power over Itaú Unibanco.

Itaú Unibanco's reliance on capital markets means suppliers of funds, like institutional investors and international markets, wield considerable influence. This power intensifies when Brazil faces economic instability or elevated interest rates, directly impacting the bank's cost of capital.

The Central Bank of Brazil's monetary policy, particularly the Selic rate, is a critical determinant of Itaú Unibanco's funding costs. For instance, in early 2024, the Selic rate remained a key factor influencing the cost of borrowing for financial institutions across Brazil.

The financial sector's drive towards digital transformation has created a significant demand for specialized talent in fields such as artificial intelligence, data science, cybersecurity, and fintech development. This intense need for expertise means that skilled professionals in these areas possess considerable bargaining power.

For Itaú Unibanco, a scarcity of these highly sought-after skills translates directly into increased labor costs. Companies must offer more competitive compensation packages, including higher salaries and enhanced benefits, to attract and retain top talent in these critical digital domains, impacting operational expenses.

Data and Information Providers

Access to robust and timely data is absolutely critical for Itaú Unibanco. It underpins everything from assessing risk and scoring creditworthiness to creating tailored financial products for their customers. Without good data, making smart decisions becomes a real challenge.

Specialized data providers, especially those with unique or very comprehensive datasets, can wield moderate bargaining power. Think of companies that offer highly specific market insights or advanced analytics. Itaú Unibanco's own vast customer data and sophisticated analytical tools do help to temper this power, but these external providers still hold some sway.

- Data Dependency: Itaú Unibanco relies on external data providers for market intelligence and specialized analytics, influencing operational efficiency and strategic planning.

- Provider Concentration: The market for specialized financial data is not overly concentrated, meaning Itaú Unibanco has some alternatives, thus limiting extreme supplier power.

- Itaú's Data Assets: Itaú Unibanco possesses a significant internal repository of customer data, enhancing its ability to perform in-house analysis and reducing reliance on external sources for core functions.

Regulatory and Compliance Services

The complex and ever-changing regulatory environment in Brazil means banks like Itaú Unibanco must engage specialized legal and consulting firms for compliance. This creates a demand for these services.

However, the market for these regulatory and compliance services in Brazil is quite fragmented. There isn't one dominant supplier that holds significant sway over Itaú Unibanco. This fragmentation generally keeps the bargaining power of individual suppliers relatively low.

For instance, in 2024, Brazil's financial sector continued to navigate new regulations from the Central Bank of Brazil (BCB) concerning open banking and data privacy, requiring diverse legal expertise. While the need for these specialized services is high, the availability of numerous law firms and consulting groups capable of providing them prevents any single entity from dictating terms to a large institution like Itaú Unibanco.

- Demand for specialized compliance services remains high due to evolving Brazilian regulations.

- The market for these services is fragmented, with many providers.

- This fragmentation limits the bargaining power of individual suppliers to Itaú Unibanco.

- No single regulatory or compliance service provider can significantly influence Itaú Unibanco's terms.

The bargaining power of suppliers for Itaú Unibanco is influenced by several factors, including technology providers, capital markets, and skilled labor. Specialized technology and software vendors can exert moderate to high influence due to the critical nature of banking systems and the high costs of switching. Similarly, suppliers of funds from capital markets hold considerable power, especially during periods of economic instability in Brazil, directly impacting the bank's cost of capital.

The demand for specialized talent in areas like AI and data science gives skilled professionals significant bargaining power, leading to increased labor costs for Itaú Unibanco as it competes to attract and retain top talent. Data providers with unique datasets also hold moderate sway, though Itaú Unibanco's own extensive customer data helps to mitigate this reliance.

In contrast, the bargaining power of suppliers in regulatory and compliance services is relatively low for Itaú Unibanco. While demand for these services is high due to Brazil's evolving regulatory landscape, the market is fragmented with numerous providers, preventing any single firm from significantly influencing terms. For example, the need for expertise in open banking and data privacy regulations in 2024, while substantial, is met by a diverse pool of legal and consulting firms.

What is included in the product

This analysis unpacks the competitive forces shaping Itaú Unibanco Holding's market, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats by visualizing Itaú Unibanco's Porter's Five Forces with a dynamic, interactive dashboard.

Customers Bargaining Power

Historically, Itaú Unibanco benefited from substantial customer switching costs. These were driven by deeply entrenched relationships, a vast physical branch network, and the intricate process of moving loans, investments, and other financial services. This situation historically granted Itaú significant leverage over its customer base.

The digital revolution and the rollout of Open Finance in Brazil have dramatically shifted power towards customers. Switching banks is now simpler and cheaper, thanks to readily available digital platforms. This increased ease of movement, coupled with greater transparency in offerings, means customers can easily shop around for the best deals on financial products and credit.

In 2023, Brazil's Open Finance initiative saw significant growth, with over 15 million customer consents for data sharing by the end of the year, according to the Central Bank of Brazil. This data sharing empowers customers by allowing them to compare financial products and services from various institutions more effectively, directly impacting Itaú Unibanco's ability to retain customers without competitive pricing and superior service.

Customers, especially in Itaú Unibanco's retail sector, are increasingly sensitive to pricing due to a surge in competition from fintech companies. These digital disruptors often provide services with significantly lower fees and greater accessibility, directly impacting customer loyalty and forcing traditional banks to reconsider their own fee structures.

In 2024, this trend is particularly evident as consumers actively seek value. For instance, a significant portion of Brazilian banking customers have expressed a willingness to switch providers for better rates or reduced charges, putting pressure on institutions like Itaú Unibanco to innovate and offer more competitive pricing to maintain market share.

Access to Diverse Financial Products

Customers now have an unprecedented variety of financial products and services at their fingertips. This includes offerings from nimble fintech startups, digital-only banks, and niche lenders, all competing for their business. This broad access means customers are less dependent on any single institution, significantly boosting their ability to negotiate terms and seek better value.

The proliferation of choice directly enhances customer bargaining power. For instance, in 2024, the global fintech market continued its rapid expansion, with transaction volumes in digital payments alone reaching trillions of dollars, demonstrating the widespread adoption of alternative financial channels. This competitive landscape forces traditional banks like Itaú Unibanco to offer more attractive rates and services to retain their customer base.

- Increased Competition: The rise of fintechs and digital banks provides customers with more alternatives to traditional banking services.

- Price Sensitivity: Customers can easily compare rates and fees across different providers, driving down prices for financial products.

- Demand for Customization: A wider product range allows customers to find solutions tailored to their specific needs, increasing their leverage.

- Digital Accessibility: Online platforms and mobile apps make it easier for customers to switch providers or negotiate terms, further empowering them.

Large Corporate and High-Net-Worth Clients

Large corporations and high-net-worth individuals wield considerable bargaining power with Itaú Unibanco. These clients represent significant revenue streams, allowing them to negotiate for customized services, preferential interest rates, and bespoke financial products. Their substantial business volume means they can often secure more advantageous terms compared to smaller clients.

- Client Concentration: Itaú Unibanco's reliance on a few large corporate clients can amplify their negotiation leverage.

- Demand for Customization: High-net-worth and corporate clients often require specialized wealth management, investment banking, and treasury services, which can be costly to provide and thus subject to negotiation.

- Rate Sensitivity: For these clients, even small differences in interest rates or fees on large sums can translate into significant financial gains, incentivizing them to seek the best possible terms.

- Competitive Landscape: The presence of other major financial institutions willing to cater to these lucrative clients means Itaú Unibanco must remain competitive in its offerings and pricing to retain them.

The bargaining power of Itaú Unibanco's customers has significantly increased due to the digital transformation and the implementation of Open Finance in Brazil. This shift grants customers greater ease in comparing and switching financial providers, forcing institutions to offer more competitive pricing and superior services to retain their business.

In 2024, customer price sensitivity is heightened by the competitive landscape, with fintechs offering lower fees and greater accessibility. This environment compels traditional banks like Itaú Unibanco to continuously innovate and provide more attractive terms to maintain market share and customer loyalty.

The availability of diverse financial products from numerous fintech startups and digital banks reduces customer dependence on any single institution. This broadens customer choice, significantly enhancing their ability to negotiate favorable terms and secure better value from their banking relationships.

| Factor | Impact on Itaú Unibanco | 2024 Data/Trend |

|---|---|---|

| Digitalization & Open Finance | Increased customer ability to compare and switch | Over 15 million customer consents for data sharing in Brazil (end of 2023) |

| Fintech Competition | Pressure on pricing and fees | Continued rapid expansion of the global fintech market |

| Customer Choice | Reduced dependence on single institutions | Trillions of dollars in global digital payment transaction volumes |

| Price Sensitivity | Demand for better rates and reduced charges | Growing willingness among Brazilian banking customers to switch for better value |

Full Version Awaits

Ita? Unibanco Holding Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Ita? Unibanco Holding details the intense competitive rivalry within Brazil's banking sector, highlighting the significant threat of new entrants due to high capital requirements and regulatory hurdles. It also thoroughly examines the bargaining power of buyers, who have increasing access to digital alternatives, and the moderate bargaining power of suppliers, primarily IT and data providers. Furthermore, the analysis evaluates the threat of substitute products, such as fintech solutions and peer-to-peer lending platforms, and the overall industry attractiveness based on these forces.

Rivalry Among Competitors

The Brazilian banking landscape is fiercely competitive, with digital banks and fintechs like Nubank and Banco Inter rapidly gaining market share. These agile players challenge established institutions such as Itaú Unibanco by offering streamlined digital services and often lower costs, forcing traditional banks to innovate and adapt to retain customers.

The Brazilian banking sector is characterized by intense competition among a few major players, with Itaú Unibanco, Bradesco, Banco do Brasil, and Santander Brasil holding significant market share. This oligopolistic structure fuels aggressive competition for customers and profitability.

In 2024, these large incumbent banks continue to exert considerable influence, leveraging their established customer bases and extensive branch networks. For instance, Itaú Unibanco reported a net income of R$33.4 billion in 2023, showcasing its strong financial standing amidst this rivalry.

Itaú Unibanco, like its peers, is in a fierce digital race, pouring significant resources into developing superapps and bolstering online services. This isn't just about keeping up; it's a direct response to the nimble fintech sector that has disrupted traditional banking models. The bank’s digital investments are crucial for maintaining market share.

In 2023, Itaú Unibanco reported a substantial increase in digital transactions, highlighting the growing customer preference for online channels. This trend is expected to accelerate, pushing banks to continuously innovate their offerings, from AI-powered customer service to seamless payment solutions, to remain competitive.

Regulatory Initiatives Fostering Competition

Regulatory initiatives spearheaded by the Central Bank of Brazil, such as the instant payment system Pix and the Open Finance framework, are actively designed to inject more competition and enhance efficiency across the financial sector. These forward-thinking measures facilitate seamless data sharing and payment portability, intensifying the competitive landscape for all participants, including Ita? Unibanco.

The impact of these regulations is already evident. For instance, Pix, launched in late 2020, has seen exponential growth. By the end of 2023, Pix transactions surpassed 16 billion, representing a significant shift in payment habits and directly challenging traditional banking services. Open Finance, still in its developmental stages, aims to further democratize access to financial services by allowing consumers to share their data securely with third-party providers, thereby fostering innovation and new competitive pressures.

- Pix adoption continues to surge, with over 137 million users by early 2024, indicating a substantial migration from traditional payment methods.

- Open Finance aims to increase competition by enabling consumers to aggregate their financial data and access new services, potentially reducing customer stickiness for established banks.

- These initiatives directly lower barriers to entry for fintechs and other new players, forcing incumbent institutions like Ita? Unibanco to innovate and compete more aggressively on price and service.

Product and Service Diversification

Competitive rivalry within Itaú Unibanco Holding is intense, stemming from the broad spectrum of financial products and services offered. This includes everything from basic checking and savings accounts to complex investment products, wealth management, and insurance. Itaú competes not just on price but on the breadth and depth of its diversified portfolio.

Banks vie for customer loyalty by providing personalized services tailored to different client segments. This diversification allows institutions like Itaú to capture a larger share of a customer's financial life, fostering stickier relationships. For instance, a customer using Itaú for a mortgage might also be drawn to their credit card offerings or investment platforms.

- Product Breadth: Itaú offers a full suite of banking, investment, insurance, and credit products.

- Service Personalization: Tailored services are key to attracting and retaining diverse customer segments.

- Cross-Selling Opportunities: Diversification enables effective cross-selling, deepening customer relationships.

The competitive rivalry for Itaú Unibanco is shaped by both traditional banking giants and agile digital disruptors. Established players like Bradesco and Santander Brasil are also vying for market share, leading to an intense battle for customers and profitability. This dynamic forces all participants to continually enhance their offerings and service delivery.

Fintechs and digital banks, such as Nubank and Banco Inter, are a significant competitive force, leveraging technology to offer streamlined services and often lower fees. Their rapid growth, fueled by customer demand for digital solutions, pressures traditional banks like Itaú to accelerate their own digital transformation strategies. By early 2024, Pix, Brazil's instant payment system, had over 137 million users, demonstrating a clear shift away from traditional payment methods and intensifying competition.

Itaú Unibanco's broad product portfolio, encompassing banking, investments, insurance, and credit, allows for extensive cross-selling opportunities. This diversification is a key strategy to deepen customer relationships and build loyalty in a highly competitive market. For instance, a customer utilizing Itaú for a mortgage may be more inclined to use their credit card or investment platforms, reinforcing their engagement with the bank.

| Competitor | Market Share (approx. 2023/2024) | Key Competitive Factors |

|---|---|---|

| Bradesco | Significant | Extensive branch network, diverse product offerings |

| Santander Brasil | Significant | International brand recognition, digital innovation |

| Nubank | Rapidly growing | Digital-first approach, low fees, customer experience |

| Banco Inter | Rapidly growing | Digital banking, investment platform, marketplace integration |

SSubstitutes Threaten

The threat of substitutes for Itaú Unibanco Holding, particularly in payments and lending, is substantial and growing, primarily driven by agile fintech companies. These disruptors often provide more specialized and cost-effective solutions for specific financial needs. For instance, Brazil's Pix instant payment system, launched in late 2020, has rapidly gained traction, processing over 42 billion transactions in 2023, significantly impacting traditional fee-based payment methods used by banks.

Digital wallets and peer-to-peer (P2P) lending platforms further intensify this threat. Companies like Nubank, which has over 100 million customers as of early 2024, offer seamless digital payment experiences and competitive lending rates, directly challenging Itaú's market share in these segments. The ease of use and lower overheads of these fintechs allow them to undercut traditional banking fees and interest rates, making them attractive alternatives for consumers and small businesses alike.

Customers are increasingly bypassing traditional bank offerings for direct investment platforms. These platforms, often featuring lower fees, provide access to a broader spectrum of financial instruments, directly impacting wealth management and investment services. For instance, by mid-2024, the growth of fintech investment apps has seen a significant surge, with many reporting double-digit percentage increases in user acquisition year-over-year, indicating a clear shift in consumer behavior away from conventional banking channels for investment needs.

The rise of cryptocurrencies and blockchain technology presents a potential long-term threat to Itaú Unibanco Holding. Brazil's regulatory landscape for digital assets is evolving, with a significant milestone being the Central Bank of Brazil's framework for stablecoins and digital asset service providers, enacted in 2023, which aims to provide clarity and foster innovation. While still in its nascent stages, the increasing adoption of these technologies could eventually offer alternative financial services, bypassing traditional banking infrastructure.

Embedded Finance

Embedded finance presents a significant threat by seamlessly integrating financial services into non-financial platforms. This means customers can access credit or payment options directly on e-commerce sites, bypassing traditional banking interactions. For instance, by mid-2024, many fintech companies are offering buy-now-pay-later solutions directly at checkout, making them a convenient alternative to personal loans or credit cards from established banks like Ita? Unibanco.

This trend allows consumers to manage financial needs within their existing purchasing journeys, reducing the perceived need for a direct relationship with a bank. The convenience factor is high, as it simplifies transactions. For example, a consumer buying electronics might be offered financing directly by the retailer's platform, a service that might have previously required a separate application with their bank.

The growing adoption of these embedded solutions can erode traditional banks' customer base and transaction volumes. By early 2024, reports indicated a substantial increase in the volume of transactions processed through embedded finance channels, particularly in retail and e-commerce sectors. This shift indicates a growing preference for integrated, on-demand financial solutions.

- Convenience: Financial services are offered at the point of need, simplifying transactions for consumers.

- Reduced Friction: Eliminates the need for separate applications or interactions with traditional financial institutions.

- Market Reach: Non-financial companies can leverage their existing customer bases to offer financial products.

- Competitive Pressure: Forces traditional banks to innovate and adapt to retain market share.

Informal Lending and Alternative Credit Models

The threat of substitutes for Ita? Unibanco Holding's traditional banking services is amplified by the rise of informal lending and alternative credit models. In specific market segments, particularly for small businesses and individuals who find it challenging to secure traditional bank financing, these alternative avenues present a viable substitute.

Fintech companies, for instance, are increasingly leveraging innovative credit scoring methodologies, often incorporating non-traditional data points, to offer loans. This directly competes with Ita? Unibanco's loan portfolio. As of early 2024, the Brazilian fintech lending sector has seen significant growth, with some estimates suggesting a substantial portion of credit being extended outside of traditional banking channels, particularly for micro and small enterprises.

- Informal Lending Networks: These operate outside regulatory frameworks, offering quick access to capital but often at higher costs or with less transparency.

- Fintech Lending Platforms: Utilize alternative data and technology for faster approvals and potentially more inclusive credit access.

- Peer-to-Peer (P2P) Lending: Connects individual borrowers directly with investors, bypassing traditional financial institutions.

- Digital Wallets and Payment Providers: Some are expanding into offering short-term credit facilities or installment plans, acting as substitutes for small, immediate credit needs.

The threat of substitutes for Itaú Unibanco Holding is significant, driven by fintech innovations and evolving consumer preferences. Digital payment systems like Pix, with over 42 billion transactions in 2023, directly challenge traditional banking fees. Fintechs such as Nubank, serving over 100 million customers by early 2024, offer competitive rates and seamless digital experiences, eroding market share in payments and lending.

Alternative investment platforms with lower fees are also drawing customers away from traditional wealth management services. Embedded finance, integrating financial services into non-financial platforms, further simplifies transactions and reduces reliance on banks. For instance, buy-now-pay-later options at e-commerce checkouts, prevalent by mid-2024, offer a convenient substitute for traditional credit products.

| Substitute Type | Key Characteristics | Impact on Itaú Unibanco | Growth Indicator (2023/Early 2024) |

| Digital Payments (e.g., Pix) | Instant, low-cost transactions | Reduced fee income from traditional payments | 42+ billion transactions processed (2023) |

| Fintech Lenders | Alternative data, faster approvals | Competition for loan portfolio, potentially lower margins | Significant growth in fintech lending sector |

| Investment Platforms | Lower fees, broader instrument access | Loss of wealth management and investment clients | Double-digit user acquisition growth for fintech apps |

| Embedded Finance | Seamless integration, point-of-need solutions | Decreased direct customer interaction and transaction volume | Substantial increase in embedded finance transactions |

Entrants Threaten

The threat of new entrants in Brazil's banking sector, specifically for Ita? Unibanco Holding, is significantly mitigated by high regulatory barriers and substantial capital requirements. The Central Bank of Brazil (BCB) enforces rigorous licensing procedures and ongoing compliance standards, creating a formidable hurdle for aspiring banks.

These stringent regulations, coupled with the need for considerable initial capital investments, effectively deter many potential new competitors. For instance, establishing a new bank in Brazil often requires a minimum capital base that can run into hundreds of millions of Brazilian Reais, a figure that presents a significant challenge for startups.

Established financial institutions like Itaú Unibanco have cultivated deep brand loyalty and trust over many years. This loyalty, often built through consistent service and robust relationships, makes it difficult for new players to attract customers. For example, in 2023, Itaú Unibanco maintained a strong market presence, reflecting this ingrained customer trust.

Itaú Unibanco's massive scale offers significant cost advantages. For instance, in 2024, its operational efficiency allowed it to maintain a cost-to-income ratio of around 37%, a benchmark difficult for smaller, newer banks to match. This scale translates into lower per-unit costs for everything from IT infrastructure to customer service, creating a formidable barrier for potential new entrants.

Newcomers find it incredibly challenging to replicate Itaú's economies of scope, which span a broad range of financial products and services. Competing on price across this entire spectrum, from basic checking accounts to complex investment banking, requires substantial upfront investment and market penetration that is hard to achieve quickly. This makes it difficult for new entrants to offer a compelling value proposition that can truly disrupt Itaú's established customer base.

Rise of Fintechs and Digital-First Models

The banking sector, including institutions like Itaú Unibanco, faces a growing threat from new entrants, particularly fintechs and digital-first banks. These agile competitors often sidestep traditional regulatory hurdles by initially focusing on specific financial services or operating under less stringent licenses before scaling their offerings. For instance, by mid-2024, the global fintech market was projected to reach over $300 billion, demonstrating significant investment and growth potential for new players. This trend allows them to offer competitive pricing and innovative user experiences, directly challenging established players.

- Fintechs leverage technology to reduce operational costs, allowing them to undercut traditional banks on fees and interest rates.

- Digital-first models bypass the need for extensive physical branch networks, significantly lowering capital expenditure and overhead.

- Regulatory arbitrage allows some fintechs to enter the market with lighter compliance burdens, enabling faster innovation and customer acquisition.

- The increasing adoption of open banking initiatives further lowers barriers to entry, as new players can integrate with existing financial infrastructure.

Open Banking and BaaS Lowering Entry Hurdles

Initiatives like Open Banking and Banking as a Service (BaaS) are indeed lowering some traditional barriers to entry in the financial sector. BaaS platforms allow non-financial companies, often tech-focused, to integrate banking functionalities into their offerings by partnering with licensed banks. This significantly reduces the capital expenditure and regulatory burden typically associated with launching banking services. For instance, by 2024, the global BaaS market was projected to reach tens of billions of dollars, indicating substantial growth and adoption.

Open Banking further democratizes access by mandating secure data sharing between banks and authorized third-party providers (TPPs). This enables new fintech companies to develop innovative products and services, such as personalized financial management tools or streamlined payment solutions, without needing to build their own extensive banking infrastructure. In 2024, adoption rates for Open Banking services were steadily increasing across major economies, with a significant percentage of consumers in regions like the UK and Europe actively using or open to using such services.

- BaaS enables non-banks to offer financial services, reducing infrastructure costs.

- Open Banking facilitates data sharing, fostering innovation by fintechs.

- These trends lower capital requirements and regulatory hurdles for new entrants.

- The BaaS market growth by 2024 highlights its impact on market accessibility.

While regulatory and capital barriers remain high, the threat of new entrants for Itaú Unibanco is evolving due to technological advancements. Fintechs and digital banks, often leveraging lighter regulatory frameworks initially, pose a growing challenge by offering innovative services and competitive pricing. By mid-2024, the global fintech market was projected to exceed $300 billion, underscoring the significant investment and growth potential for these agile competitors.

These new players can significantly reduce operational costs through technology, allowing them to undercut traditional banks on fees. Their digital-first models bypass the need for extensive physical branch networks, a major capital expenditure advantage. Furthermore, regulatory arbitrage and the increasing adoption of open banking initiatives lower entry barriers, enabling faster innovation and customer acquisition for newcomers.

Banking as a Service (BaaS) platforms are a prime example, allowing non-financial companies to offer banking functions by partnering with licensed institutions, drastically cutting capital needs and compliance burdens. The global BaaS market's projected growth into the tens of billions of dollars by 2024 highlights its role in increasing market accessibility. Open Banking further aids this by mandating secure data sharing, empowering fintechs to build new services without extensive infrastructure investment.

| Factor | Impact on Itaú Unibanco | 2024 Relevance |

|---|---|---|

| Regulatory Barriers | High, significant deterrent | Ongoing stringent licensing and compliance |

| Capital Requirements | Substantial, discourages new entrants | Minimum capital in hundreds of millions of BRL |

| Brand Loyalty & Trust | Strong, established customer base | Reflected in Itaú's consistent market presence |

| Economies of Scale & Scope | Significant cost advantages, broad product offering | Cost-to-income ratio around 37% in 2024 |

| Fintech & Digital Banks | Emerging threat, agile competitors | Global fintech market projected >$300B by mid-2024 |

| BaaS & Open Banking | Enabling new entrants, lowering barriers | BaaS market projected tens of billions by 2024 |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Itaú Unibanco Holding is built upon a foundation of reliable data, including the bank's annual and quarterly financial reports, investor presentations, and regulatory filings with the Brazilian Securities and Exchange Commission (CVM). We also incorporate insights from reputable financial news outlets, industry analysis reports from firms like Fitch Ratings and Moody's, and macroeconomic data from sources like the Central Bank of Brazil.