IQVIA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IQVIA Bundle

IQVIA operates in a dynamic healthcare data and technology landscape, where understanding the intensity of competitive forces is crucial for strategic success. Factors like the bargaining power of buyers and the threat of new entrants significantly shape its market position.

The complete report reveals the real forces shaping IQVIA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

IQVIA's reliance on specialized data providers and technology vendors, especially for unique real-world data and advanced analytics, can grant these suppliers leverage. This is particularly true for niche data sets or proprietary software essential for IQVIA's operations.

However, IQVIA's immense scale, processing vast quantities of data, and its significant internal development capabilities help to temper supplier power. The company's ability to aggregate and analyze data from diverse sources, including its reported 150,000+ global data suppliers, reduces dependence on any single provider.

Suppliers offering unique or proprietary data, like specialized patient registries or niche technology, can exert significant influence. IQVIA's emphasis on "Healthcare-grade AI" and sophisticated analytics underscores its reliance on high-caliber, specialized data inputs. For instance, access to real-world evidence from specific disease cohorts, often held by academic institutions or specialized data aggregators, can be a critical differentiator for IQVIA's services.

The bargaining power of suppliers is significantly influenced by switching costs, and for a company like IQVIA, these costs can be substantial. If a client decides to move from IQVIA's data or technology platforms to a competitor, they often face considerable hurdles. These can include the complex process of migrating vast amounts of data, integrating new systems, and the necessary retraining of staff on different software. This makes it difficult and expensive for clients to change providers.

IQVIA's comprehensive suite of analytics and technology solutions creates an intricate ecosystem that further elevates these switching costs. Clients are often deeply embedded within IQVIA's proprietary systems, which are designed to offer specialized insights and workflows. The sheer depth and breadth of these integrated offerings mean that a client would not just be switching a single product, but rather an entire operational framework. This deep integration inherently raises the barriers to exit, thereby strengthening IQVIA's position as a supplier.

Threat of Forward Integration by Suppliers

Suppliers, especially those in the technology and data analytics sectors, could directly offer their services to life sciences companies, effectively cutting out intermediaries like IQVIA. This potential for forward integration by suppliers poses a significant threat, compelling IQVIA to continually innovate and strengthen its value proposition to retain clients. For instance, a major cloud provider with advanced AI capabilities might decide to launch its own clinical trial optimization platform, directly competing with IQVIA's offerings.

This threat encourages IQVIA to foster robust partnerships and maintain competitive pricing and service levels. Suppliers might be tempted to integrate forward if they perceive that IQVIA is capturing a disproportionate amount of value or if they believe they can serve the end market more efficiently. In 2024, the increasing commoditization of certain data processing tasks could accelerate this trend, making direct supplier offerings more attractive.

- Supplier Forward Integration Risk: Technology and data firms may offer direct analytics/research services to life sciences clients, bypassing IQVIA.

- IQVIA's Response: This necessitates strong supplier relationships and continuously competitive service offerings.

- Market Dynamics: The threat is amplified by the potential for suppliers to achieve greater efficiency or value capture by serving end-users directly.

- 2024 Context: Advancements in AI and data processing could lower barriers for suppliers looking to enter IQVIA's market space directly.

Supplier Importance to IQVIA's Business

IQVIA's reliance on key data suppliers and technology partners is significant, as these relationships are fundamental to its ability to offer advanced analytics and AI-powered solutions. The caliber and scope of the data these partners provide directly shape the quality and competitiveness of IQVIA's service portfolio.

The bargaining power of these suppliers is amplified by the specialized nature of the data and technology required for IQVIA's operations. For instance, access to real-world evidence (RWE) datasets, often sourced from healthcare providers and payers, is critical. In 2024, the demand for comprehensive and anonymized RWE continued to surge, driven by pharmaceutical companies' need for post-market surveillance and clinical trial optimization.

- Critical Data Sources: IQVIA depends on specialized data providers for anonymized patient data, electronic health records (EHRs), and claims data, which are foundational for its analytics.

- Technology Partnerships: Collaborations with cloud service providers and AI/ML platform developers are essential for IQVIA's technological infrastructure and innovation.

- Data Quality and Breadth: The bargaining power of suppliers is linked to the unique quality, granularity, and comprehensiveness of the data they offer, directly impacting IQVIA's service differentiation.

- Market Dynamics: In 2024, the increasing regulatory scrutiny around data privacy and the growing demand for integrated data solutions from healthcare stakeholders influenced the negotiating leverage of key data suppliers.

The bargaining power of IQVIA's suppliers is moderate, influenced by the specialized nature of data and technology required, yet tempered by IQVIA's scale and data aggregation capabilities. Suppliers offering unique real-world data or proprietary analytics platforms can command leverage, especially as the demand for comprehensive healthcare data, like anonymized patient records and electronic health records (EHRs), surged in 2024.

IQVIA's vast global data network, reportedly encompassing over 150,000 data suppliers, mitigates the power of any single entity. However, the critical need for high-quality, granular data for advanced analytics and AI solutions means that providers of niche datasets or specialized technology can still exert considerable influence, particularly those enabling IQVIA's focus on Healthcare-grade AI.

The threat of supplier forward integration, where these suppliers might offer services directly to life sciences companies, is a key consideration. This risk is heightened by the increasing commoditization of certain data processing tasks in 2024, potentially making direct supplier offerings more attractive and compelling IQVIA to maintain competitive service levels and foster strong partnerships.

| Supplier Factor | Impact on IQVIA | 2024 Data/Trend |

|---|---|---|

| Data Specialization & Uniqueness | High leverage for niche data providers | Continued surge in demand for comprehensive Real-World Evidence (RWE) |

| IQVIA's Scale & Aggregation | Reduces reliance on individual suppliers | Access to over 150,000 global data suppliers |

| Switching Costs for Clients | High, reinforcing IQVIA's position | Complex data migration and system integration are significant barriers |

| Supplier Forward Integration Threat | Moderate, necessitates competitive offerings | Increased commoditization of data processing tasks |

What is included in the product

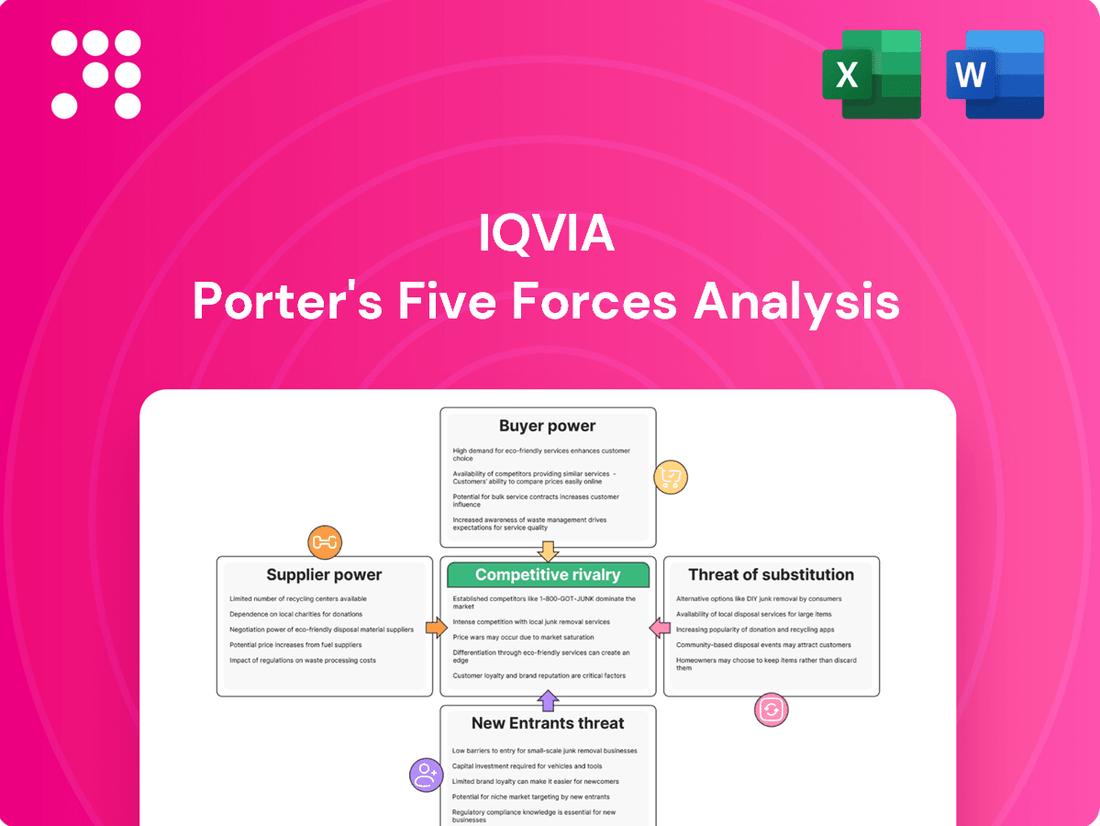

Assesses the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants and substitutes, specifically for IQVIA's market position.

Instantly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

IQVIA's extensive reach across the pharmaceutical, biotech, and medical device sectors, catering to both global giants and emerging players, significantly dilutes individual customer leverage. This broad client portfolio is a key strength.

Crucially, in 2024, no single client represented more than 10% of IQVIA's total revenue. This diversification means that the loss of any one customer would not disproportionately impact IQVIA's financial health, thereby limiting the bargaining power of any individual client.

For life sciences companies, the decision to switch from an established provider like IQVIA is fraught with complexity. Consider the disruption to ongoing clinical trials, where continuity of data and regulatory compliance are paramount. Integrating existing datasets with a new vendor can be a monumental task, often requiring significant time and resources. This inherent difficulty in transitioning, coupled with the potential loss of valuable historical insights and established workflows, effectively raises the switching costs for these customers, thereby diminishing their bargaining power.

IQVIA's comprehensive suite of services, including advanced data analytics, cutting-edge technology solutions, and expert contract research, are fundamental to the success of pharmaceutical and life sciences companies. These offerings are crucial for navigating the complexities of drug development, executing efficient clinical trials, and optimizing commercialization strategies.

The highly specialized and integrated nature of IQVIA's solutions means customers often lack viable alternatives for achieving their critical business objectives. This dependence significantly reduces the bargaining power of customers, as switching providers would incur substantial costs and disruptions to essential operations.

For instance, in 2024, IQVIA's robust data analytics capabilities, which leverage vast real-world evidence datasets, are indispensable for identifying patient populations and demonstrating drug efficacy, a process that would be prohibitively expensive and time-consuming for many clients to replicate internally.

Price Sensitivity of Customers

While IQVIA's data and analytics are crucial for pharmaceutical and biotech clients, these companies face significant pressure to control research and development expenditures. This cost consciousness can translate into increased price sensitivity for IQVIA's services, particularly those that are more standardized or have readily available alternatives.

For instance, as the pharmaceutical industry grapples with rising R&D costs, which in 2024 continued to be a major focus, clients may scrutinize contracts more closely. This heightened awareness of expenses means that IQVIA might encounter greater negotiation on pricing for services perceived as less differentiated.

- Price Sensitivity Drivers: Pharmaceutical companies' ongoing efforts to optimize R&D budgets and improve operational efficiency directly impact their willingness to pay for external services.

- Commoditization Risk: Certain IQVIA services, if not clearly differentiated by unique value or proprietary technology, could be viewed as more commoditized, increasing customer leverage in price negotiations.

- Market Pressures: The competitive landscape within the life sciences sector, including the need for rapid drug development and market access, can amplify the focus on cost management, thereby influencing customer price expectations.

Customer's Ability to Integrate Services In-House

The ability of customers to bring services in-house significantly impacts IQVIA's bargaining power. While large pharmaceutical companies possess substantial resources, fully replicating IQVIA's comprehensive data analytics and clinical research capabilities internally presents a considerable hurdle. For instance, the sheer scale and global operational footprint of IQVIA, which manages vast datasets and complex clinical trials across numerous geographies, are exceptionally difficult and costly for any single client to replicate.

This difficulty in in-house integration limits the direct threat of backward integration by customers. IQVIA's specialized expertise, proprietary technologies, and established global networks are key differentiators.

- IQVIA's extensive data repository, built over decades, offers unique insights that are challenging to replicate.

- The company's global presence allows for efficient management of multi-national clinical trials, a complex undertaking for individual firms.

- Developing comparable advanced analytics platforms and specialized talent in-house would require massive investment and time, making it unfeasible for most clients.

IQVIA's broad customer base, with no single client exceeding 10% of revenue in 2024, significantly reduces individual customer bargaining power. The complexity and high switching costs associated with integrating IQVIA's specialized, data-intensive services into existing operations further limit customer leverage.

While clients are cost-conscious, the difficulty in replicating IQVIA's vast data repositories, global infrastructure, and advanced analytics platforms in-house makes backward integration unfeasible for most, thereby constraining their ability to negotiate prices downwards.

| Factor | Impact on Bargaining Power | IQVIA's Mitigation Strategy |

|---|---|---|

| Customer Concentration | Low (Diversified client base) | No single client represents over 10% of revenue (2024) |

| Switching Costs | Low (High due to data integration, regulatory continuity) | Comprehensive service suite, established workflows |

| Threat of Backward Integration | Low (Difficult and costly to replicate IQVIA's capabilities) | Proprietary technology, specialized expertise, global scale |

| Price Sensitivity | Moderate (Driven by R&D cost pressures) | Focus on value-added services, demonstrating ROI |

What You See Is What You Get

IQVIA Porter's Five Forces Analysis

This preview showcases the identical, comprehensive IQVIA Porter's Five Forces Analysis you will receive immediately upon purchase, offering a clear and unedited view of the complete document. You are looking at the actual document, ensuring that what you see is precisely what you will download, with no alterations or omissions. This detailed analysis, covering the competitive landscape of the healthcare industry, is fully formatted and ready for your immediate use after completing your transaction.

Rivalry Among Competitors

The life sciences analytics and contract research organization (CRO) market is intensely competitive. Major players like Labcorp and ICON, alongside specialized tech firms such as Medidata and IBM Watson Health, create a crowded field. This sheer number and variety of competitors significantly amplify the rivalry.

The life science analytics market is experiencing robust expansion, with projected Compound Annual Growth Rates (CAGRs) between 7.52% and a substantial 20.6% from 2025 through 2034. This rapid growth is a magnet for new entrants, intensifying the competitive landscape.

Complementing this, the Contract Research Organization (CRO) market is also set for solid growth, with an estimated CAGR of 6.85% during the same 2025-2034 period. Such favorable market dynamics, while offering opportunities, inevitably spur existing players to broaden their service offerings and market reach.

IQVIA stands out by leveraging its 'Connected Intelligence' strategy, which integrates vast datasets with sophisticated analytics, including artificial intelligence, and profound industry knowledge spanning the entire drug development process. This comprehensive approach allows them to offer unique insights and solutions to their clients.

Key to IQVIA's competitive edge are its substantial investments in AI and the utilization of real-world evidence (RWE). For instance, in 2023, IQVIA reported significant progress in its AI capabilities, aiming to enhance drug discovery and commercialization processes for pharmaceutical companies.

Exit Barriers

High capital investments are a major hurdle for companies looking to leave the IQVIA market. These investments span cutting-edge technology, robust data infrastructure, and highly specialized talent, all of which are essential for operation and innovation.

These substantial sunk costs mean that even when facing difficult market conditions, firms are often compelled to stay operational rather than incur further losses by exiting. This persistence can intensify competitive rivalry as companies fight to survive and regain profitability.

For instance, the data analytics and healthcare technology sectors, where IQVIA operates, demand continuous investment. In 2024, the global healthcare analytics market was projected to reach over $60 billion, underscoring the significant capital commitment required to remain competitive and the associated difficulty in exiting.

- High Capital Investments: Significant expenditure on technology, data infrastructure, and skilled personnel.

- Sustained Rivalry: Competitors remain in the market during downturns due to these investments, prolonging rivalry.

- Industry Example: The healthcare analytics market, valued at over $60 billion in 2024, illustrates the substantial financial commitment involved.

Industry Consolidation and Acquisitions

The Contract Research Organization (CRO) sector is witnessing significant consolidation. Larger CROs are actively acquiring smaller firms and clinical trial site networks. This strategy aims to broaden service offerings and enhance geographical reach, intensifying competition.

IQVIA, a major player, has a well-documented history of strategic acquisitions. For instance, in 2023, IQVIA acquired multiple smaller entities to bolster its data analytics and real-world evidence capabilities. This demonstrates a clear trend of growth through mergers and acquisitions within the industry.

- Industry Consolidation: The CRO market is consolidating as larger companies acquire smaller ones to gain scale and expertise.

- IQVIA's Acquisition Strategy: IQVIA has a history of strategic acquisitions, exemplified by its 2023 purchases aimed at expanding its data and real-world evidence services.

- Competitive Landscape: This consolidation fuels intense rivalry, as companies seek to expand capabilities and market share through M&A activities.

The competitive rivalry within the life sciences analytics and CRO market is fierce, driven by a high number of diverse players and robust market growth. Companies like Labcorp, ICON, Medidata, and IBM Watson Health contribute to this crowded landscape, each vying for market share. This intense competition is further fueled by significant investments in technology and talent, creating high barriers to exit and encouraging firms to remain operational even during challenging periods.

The substantial capital required for advanced data infrastructure, AI capabilities, and specialized personnel acts as a deterrent for new entrants and a constraint for existing firms considering departure. For example, the global healthcare analytics market was projected to exceed $60 billion in 2024, highlighting the significant financial commitments necessary to compete effectively. This financial pressure means that companies often persist in the market, intensifying the ongoing rivalry as they strive to maintain profitability and market position.

| Factor | Description | Impact on Rivalry | Example/Data Point |

| Number of Competitors | Numerous specialized tech firms and large CROs operate in the market. | Increases intensity of competition. | Players include Labcorp, ICON, Medidata, IBM Watson Health. |

| Market Growth | Projected CAGRs of 7.52% to 20.6% (2025-2034) for life science analytics and 6.85% for CROs. | Attracts new entrants and spurs existing players to expand. | Rapid expansion signals opportunities and heightened competition. |

| Capital Investments | High expenditure on technology, data infrastructure, and talent. | Creates high barriers to exit, leading to sustained rivalry. | Healthcare analytics market valued over $60 billion in 2024. |

| Consolidation | Larger CROs acquire smaller firms and site networks. | Intensifies competition through expanded capabilities and reach. | IQVIA's 2023 acquisitions bolstered its data and RWE services. |

SSubstitutes Threaten

Large pharmaceutical and biotech firms possess the financial muscle and talent to conduct significant research, development, and data analysis internally. For instance, in 2023, the top 10 pharmaceutical companies by revenue collectively spent over $100 billion on R&D, indicating substantial in-house capacity.

However, the immense complexity, global scale, and specialized data analytics required in drug development and commercialization often make outsourcing to firms like IQVIA more cost-effective and efficient. IQVIA's extensive data platforms and expertise in areas like real-world evidence and AI-driven insights can accelerate timelines and reduce overhead for even the largest players.

While generic data providers and publicly available information exist, they often lack the specialized depth and integration crucial for sophisticated healthcare analytics. For instance, IQVIA's proprietary datasets, which include over 1.2 billion non-identified patient records as of 2024, offer a level of granularity and insight that publicly sourced data simply cannot match.

Management consulting firms are increasingly providing data-driven strategic advice, a direct challenge to IQVIA's core business. These firms leverage advanced analytics to offer insights into market trends and competitive landscapes, potentially serving as substitutes for some of IQVIA's commercial intelligence services.

While consulting firms can offer valuable strategic guidance, IQVIA's unique strength lies in its unparalleled access to proprietary real-world data and its integrated technology platforms. This deep data reservoir and integrated ecosystem are not easily replicated by standalone consulting entities, offering IQVIA a significant competitive moat.

For instance, in 2024, the global management consulting market was valued at an estimated $300 billion, with a significant portion dedicated to data analytics and digital transformation. This highlights the growing demand for such services, underscoring the competitive pressure IQVIA faces from these advisory players.

Open-Source Analytical Tools and Platforms

The rise of open-source analytical tools and platforms presents a potential threat, as it could allow some clients to develop their own in-house analytics capabilities. This might reduce their reliance on specialized providers like IQVIA for certain data processing and analysis needs.

However, the complexity of healthcare data and the stringent requirements for 'Healthcare-grade AI' solutions remain significant barriers. IQVIA's established expertise in integrating diverse healthcare datasets and developing these advanced AI solutions provides a strong competitive advantage.

- Specialized Expertise: Building robust healthcare analytics requires deep domain knowledge and technical skill, areas where IQVIA excels.

- Data Integration Challenges: Seamlessly combining fragmented healthcare data is a complex undertaking that IQVIA has mastered.

- Regulatory Compliance: Developing AI solutions that meet healthcare industry regulations demands specialized understanding and infrastructure.

- IQVIA's Investment: In 2023, IQVIA continued to invest heavily in its technology platforms and AI capabilities, enhancing its ability to deliver sophisticated solutions.

Emerging Technologies and AI Solutions from Niche Players

Niche players leveraging cutting-edge AI and specialized technologies pose a threat of substitution for specific IQVIA services. These entrants can offer highly focused solutions that may outperform broader offerings in certain areas. For instance, a startup developing advanced predictive analytics for clinical trial site selection could present a substitute to IQVIA's traditional data analysis services in that domain.

IQVIA is proactively addressing this by heavily investing in its own AI capabilities. By mid-2024, the company was deploying over 50 NVIDIA-built AI agents, demonstrating a commitment to integrating advanced technologies. This strategic investment aims to ensure IQVIA's comprehensive platforms remain competitive and incorporate these emerging solutions, rather than being entirely replaced by them.

- Niche AI/Tech Solutions: New entrants focusing on specialized AI or technology can offer substitutes for specific IQVIA services.

- IQVIA's AI Investment: IQVIA is actively investing in AI, including over 50 NVIDIA-built AI agents, to maintain its competitive edge.

- Integration Strategy: IQVIA aims to integrate these advanced AI capabilities into its existing comprehensive offerings.

While clients could theoretically develop in-house analytics, the specialized nature of healthcare data and the significant investment required for sophisticated AI solutions make this challenging. IQVIA's proprietary datasets, including over 1.2 billion non-identified patient records as of 2024, offer a depth of insight not easily replicated. Furthermore, the complexity of integrating diverse healthcare data and ensuring regulatory compliance for AI solutions remain substantial barriers for many organizations.

Management consulting firms, with the global market valued at approximately $300 billion in 2024, also present a substitute threat by offering data-driven strategic advice. However, IQVIA's unique access to integrated, real-world data and its specialized technology platforms provide a distinct advantage that standalone consulting firms often lack. For instance, IQVIA's continued investment in its technology and AI capabilities, including the deployment of over 50 NVIDIA-built AI agents by mid-2024, further solidifies its position against these advisory substitutes.

Entrants Threaten

Entering the life sciences analytics and contract research organization (CRO) market demands immense capital. Companies need to invest heavily in robust data infrastructure, cutting-edge technology, and establishing a widespread global presence. For instance, building the sophisticated data repositories and analytical platforms that IQVIA utilizes can easily run into hundreds of millions of dollars.

The life sciences sector presents a formidable challenge for newcomers due to its inherent complexity. Navigating intricate regulatory landscapes and requiring profound domain knowledge in areas such as clinical trials and real-world evidence development creates substantial barriers to entry.

IQVIA, a leader in this space, fields a workforce of over 88,000 employees, a testament to the vast and specialized expertise required. This deep bench of talent, encompassing scientific, clinical, and data analytics professionals, acts as a significant deterrent to potential competitors who lack comparable resources and accumulated knowledge.

IQVIA's competitive edge is built on its immense and proprietary data, including over 1.2 billion non-identified patient records and connections with more than 150,000 data sources. This extensive data ecosystem and supplier network represents a significant hurdle for any new entrant aiming to replicate its scale and depth.

Regulatory Hurdles and Compliance

The life sciences and healthcare sectors present significant regulatory barriers for new entrants. Companies must meticulously navigate a complex web of compliance requirements, including stringent data privacy laws like GDPR and HIPAA, alongside critical ethical considerations. IQVIA's deep-rooted expertise and established operational frameworks in these areas create a formidable advantage, making it challenging for newcomers to match their compliance capabilities and scale.

Navigating these regulatory landscapes requires substantial investment in legal, compliance, and data security infrastructure. For instance, the cost of achieving and maintaining compliance with data privacy regulations can be a significant deterrent. In 2024, reports indicated that companies across various industries spent billions annually on regulatory compliance, with healthcare and life sciences being among the highest.

- High Compliance Costs: New entrants face substantial upfront and ongoing expenses to meet regulatory standards.

- Data Privacy Laws: Strict adherence to GDPR, HIPAA, and similar regulations is mandatory and resource-intensive.

- Ethical Considerations: Maintaining high ethical standards in data handling and research is paramount and adds complexity.

- IQVIA's Established Expertise: IQVIA's long-standing experience and proven track record in regulatory compliance offer a significant competitive moat.

Brand Recognition and Customer Trust

IQVIA benefits from a deeply ingrained brand recognition and a high level of customer trust within the life sciences sector, a trust meticulously cultivated over decades of providing essential data, analytics, and services. This established reputation acts as a formidable barrier for any potential new entrant aiming to gain traction.

New companies entering the market would struggle immensely to replicate IQVIA's credibility and the strong, long-standing relationships it holds with its clientele. Building this level of trust and recognition typically requires substantial time and consistent delivery of high-quality, reliable services.

- Brand Equity: IQVIA's brand is synonymous with industry expertise and data integrity, making it a preferred partner for many life science organizations.

- Customer Loyalty: Existing clients often exhibit strong loyalty due to IQVIA's proven track record and deep understanding of their complex needs.

- Switching Costs: The significant investment in integrating IQVIA's systems and data into their operations creates high switching costs for customers, further deterring new entrants.

- Reputational Barrier: A new entrant would need to overcome the perception that only established players like IQVIA can reliably handle sensitive and critical life science data.

The threat of new entrants into the life sciences analytics and CRO market is significantly mitigated by the immense capital requirements. Building the sophisticated data infrastructure and global presence akin to IQVIA's can easily cost hundreds of millions of dollars, a substantial hurdle for any newcomer. Furthermore, the sector's inherent complexity, demanding deep domain knowledge in areas like clinical trials and real-world evidence, alongside navigating intricate regulatory landscapes, presents a formidable challenge.

IQVIA's vast talent pool, exceeding 88,000 employees with specialized scientific, clinical, and data analytics expertise, acts as a significant deterrent. This deep bench of human capital is difficult and time-consuming for new entrants to replicate. The company's proprietary data ecosystem, boasting over 1.2 billion non-identified patient records and connections to more than 150,000 data sources, creates another substantial barrier, making it exceptionally challenging for new players to match its scale and depth.

Regulatory hurdles are also substantial, requiring new entrants to invest heavily in legal, compliance, and data security infrastructure to adhere to strict data privacy laws like GDPR and HIPAA, as well as ethical considerations. In 2024, regulatory compliance costs across industries were in the billions annually, with life sciences being a major contributor. IQVIA's established expertise and operational frameworks in these areas provide a significant advantage, making it difficult for newcomers to match their compliance capabilities.

| Barrier | Description | IQVIA's Advantage |

|---|---|---|

| Capital Requirements | Building data infrastructure and global presence requires hundreds of millions of dollars. | Established infrastructure and scale. |

| Industry Complexity & Domain Knowledge | Navigating clinical trials, real-world evidence, and regulatory landscapes demands specialized expertise. | Vast talent pool (88,000+ employees) with deep scientific and clinical knowledge. |

| Proprietary Data & Networks | Access to and management of extensive, high-quality data is crucial. | 1.2 billion+ patient records, 150,000+ data sources. |

| Regulatory Compliance | Meeting stringent data privacy (GDPR, HIPAA) and ethical standards is resource-intensive. | Proven expertise and established compliance frameworks. |

| Brand Recognition & Trust | Cultivating decades of trust and strong client relationships is vital. | High brand equity and customer loyalty due to consistent delivery. |

Porter's Five Forces Analysis Data Sources

Our IQVIA Porter's Five Forces analysis is built upon a robust foundation of data, drawing from IQVIA's proprietary market intelligence, pharmaceutical company annual reports, regulatory filings, and extensive industry research databases to provide comprehensive competitive insights.