IQVIA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IQVIA Bundle

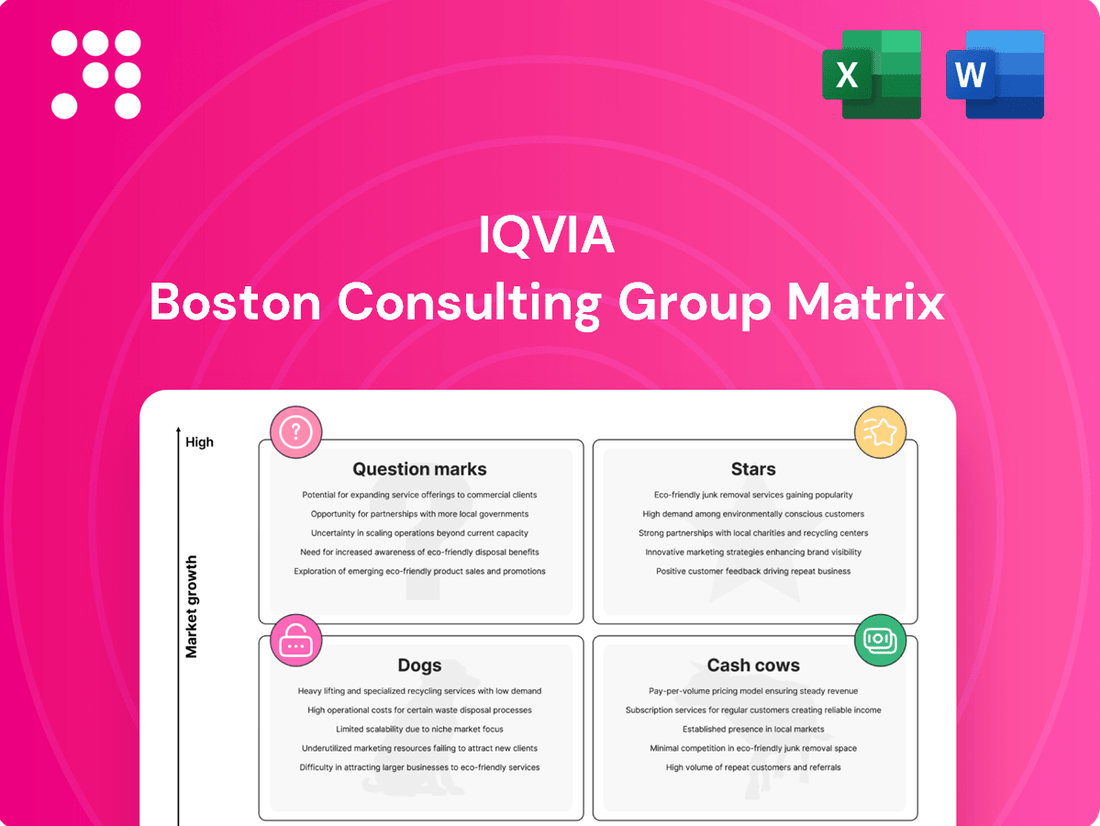

Uncover the strategic positioning of key products within the IQVIA ecosystem using the BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual of market share and growth potential. Gain the critical insights needed to optimize your portfolio and drive future success. Purchase the full IQVIA BCG Matrix for a comprehensive breakdown and actionable strategic recommendations.

Stars

IQVIA's commitment to AI and machine learning is a major catalyst for growth, with significant investments fueling advancements. The company has successfully implemented over 50 agentic AI workflows, demonstrating a practical application of these powerful technologies.

The launch of the IQVIA AI Assistant in September 2024, recognized with innovation awards, highlights the company's cutting-edge approach. These AI solutions are revolutionizing the life sciences sector by accelerating drug discovery, streamlining clinical trials, enhancing patient recruitment, and refining commercial strategies.

The impact of these AI tools is quantifiable, contributing to a notable 12% improvement in the Clinical Program Productivity Index (CPPI) in 2024. This demonstrates a clear return on investment and a tangible benefit for IQVIA's clients.

The Technology & Analytics Solutions (TAS) segment is a significant growth driver for IQVIA. In the fourth quarter of 2024, this segment saw revenue climb by 8.3% as reported, and an even stronger 9.5% when currency fluctuations are removed. This indicates solid underlying demand for IQVIA's technology and data-driven offerings.

Continuing this positive trend, TAS revenue in the first quarter of 2025 grew by 6.4% on a reported basis, or 7.6% at constant currency. This segment, which encompasses innovative areas like AI-powered analytics and real-world evidence, is not only meeting but exceeding expectations, showcasing impressive momentum as we move through 2025.

IQVIA's Real-World Evidence (RWE) platforms are a powerhouse in the healthcare AI landscape, reflecting the company's substantial 33.02% share of the global health analytics market. These platforms leverage an immense data repository, encompassing over 1.2 billion health records, making them indispensable tools for navigating regulatory approvals, shaping market access, and fueling expansion within the Technology and Advanced Services (TAS) sector.

The burgeoning demand for RWE services directly underpins IQVIA's robust financial performance, highlighting the strategic importance of these data-driven solutions. For instance, the increasing reliance on RWE for drug development and post-market surveillance, a trend amplified throughout 2024, directly translates into revenue growth for IQVIA's analytics offerings.

Strategic Partnerships and Collaborations

Strategic partnerships are crucial for IQVIA's growth, particularly in the rapidly evolving life sciences sector. These collaborations allow IQVIA to integrate its vast data and analytical capabilities with cutting-edge technological platforms, enhancing its service offerings and market position.

For instance, IQVIA's expanded collaboration with Salesforce aims to accelerate the development and adoption of Life Sciences Cloud, a platform designed to revolutionize customer engagement and data management within the industry. This partnership leverages Salesforce's robust CRM infrastructure with IQVIA's deep domain expertise and data insights.

Furthermore, IQVIA's alliance with NVIDIA focuses on developing advanced AI and machine learning models. This collaboration is key to unlocking new insights from complex healthcare datasets, driving innovation in areas like drug discovery, clinical trial optimization, and personalized medicine. These strategic moves underscore IQVIA's commitment to providing next-generation solutions.

- Salesforce Collaboration: Focuses on Life Sciences Cloud for enhanced customer engagement and data management.

- NVIDIA Partnership: Drives AI and machine learning model development for advanced data analytics in life sciences.

- Industry Impact: These collaborations position IQVIA as a leader in innovative, data-driven solutions for the life sciences industry.

Decentralized Clinical Trial Technologies and Consulting Services

IQVIA stands out as a leader in decentralized clinical trial (DCT) technologies and consulting services, as highlighted by the IDC MarketScape 2024 report. Their extensive team of over 200 DCT consultants and a comprehensive suite of enabling technologies position them as a key player in this rapidly growing segment of clinical research.

The increasing adoption of DCTs signifies a fundamental shift in how clinical trials are conducted, moving towards a more patient-centric and technology-driven approach. This evolution is supported by IQVIA's commitment to providing innovative solutions that streamline trial processes and enhance data integrity.

- Market Leadership: Recognized in IDC MarketScape 2024 for DCT technologies and consulting.

- Extensive Expertise: Boasts over 200 dedicated DCT consultants.

- Technology Portfolio: Offers a broad range of technologies to support decentralized trials.

- Industry Trend: DCTs are becoming a standard practice in clinical research.

Stars in the BCG Matrix represent offerings with high market share in a rapidly growing industry. For IQVIA, their AI and analytics solutions, particularly within Real-World Evidence (RWE), fit this category. The strong revenue growth in the Technology & Analytics Solutions (TAS) segment, up 9.5% at constant currency in Q4 2024, underscores this positioning. IQVIA's substantial 33.02% share of the global health analytics market further solidifies their Star status in this dynamic field.

What is included in the product

IQVIA's BCG Matrix offers a strategic framework for analyzing its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

IQVIA's BCG Matrix offers a clear, visual way to understand portfolio performance, relieving the pain of complex data analysis.

Cash Cows

The Research & Development Solutions (R&DS) segment showcases a strong future outlook despite potential short-term revenue shifts. Its significant contracted backlog is a testament to its stability and predictable revenue generation.

As of March 31, 2025, IQVIA's R&DS backlog reached an impressive $31.5 billion. This represents a healthy 4.8% increase compared to the previous year, underscoring continued demand for its services.

Of this substantial backlog, approximately $7.9 billion is anticipated to be recognized as revenue within the next twelve months, providing a clear and robust near-term financial projection for the R&DS division.

IQVIA's established CRO services are a classic cash cow within its business portfolio. Despite some market headwinds, the company's deep-rooted client relationships, including significant renewals with major pharmaceutical firms in 2024, provide a consistent and reliable revenue stream.

IQVIA's core data and analytics offerings remain powerful revenue generators, even as the company innovates with AI. These foundational services leverage IQVIA's extensive datasets, which include approximately 1.2 billion health records, to provide crucial commercial insights and healthcare intelligence to the life sciences sector.

This robust data infrastructure allows IQVIA to maintain market leadership in areas like real-world evidence and commercial analytics. For instance, in 2024, the company continued to see strong demand for its data-as-a-service solutions, which are essential for pharmaceutical companies seeking to understand market dynamics and patient journeys.

Global Presence and Diversified Client Base

IQVIA's extensive global reach, spanning over 100 countries, coupled with a diverse client portfolio, forms the bedrock of its stable revenue. This broad operational footprint ensures resilience, insulating the company from localized economic downturns.

The company serves a wide array of clients, including major players in the pharmaceutical, biotechnology, and medical device sectors. Additionally, IQVIA's engagement with payers and government agencies further diversifies its income sources, creating a robust and less volatile business model. This diversification is a key strength, as evidenced by the fact that no single client contributes more than 5% to total company revenues, significantly mitigating client-specific risks.

- Global Operations: Operates in over 100 countries, providing broad market access and revenue diversification.

- Diverse Clientele: Serves pharmaceutical, biotechnology, medical device companies, payers, and government agencies, reducing reliance on any single sector.

- Low Client Concentration: No single client accounts for more than 5% of total revenues, enhancing financial stability and reducing risk.

Post-Market Surveillance and Commercial Operations Support

IQVIA's post-market surveillance and commercial operations support services are indeed mature, acting as reliable cash cows within their business model. These offerings are crucial for pharmaceutical and life sciences companies, ensuring they meet regulatory requirements and maintain market presence after a drug's launch. The consistent demand for these services, powered by IQVIA's extensive data and analytics capabilities, translates into a stable and predictable revenue stream.

These services are vital for ongoing compliance and market access, directly impacting a client's commercial success. For instance, in 2024, IQVIA's pharmacovigilance solutions help companies manage adverse event reporting, a critical aspect of post-market surveillance. Their market access services, including health economics and outcomes research (HEOR), are also in high demand as companies navigate complex reimbursement landscapes.

- Pharmacovigilance: IQVIA supports the continuous monitoring of drug safety, a non-negotiable regulatory requirement.

- Market Access: Services help clients demonstrate the value of their products to payers, securing reimbursement and market share.

- Commercial Operations: This includes sales force effectiveness, marketing analytics, and patient support programs, all essential for sustained commercial success.

- Data and Analytics: Leveraging vast datasets, IQVIA provides insights that drive strategic decisions in the post-launch phase.

IQVIA's established CRO services, along with its core data and analytics offerings, represent significant cash cows. These mature business segments benefit from deep client relationships and extensive data, ensuring consistent revenue. The company's global reach and diverse client base further solidify these positions, mitigating risks and providing a stable financial foundation.

| Segment | BCG Category | Key Strengths | Revenue Driver |

|---|---|---|---|

| Contract Research Organization (CRO) Services | Cash Cow | Long-standing client relationships, deep industry expertise | Consistent demand for clinical trial support |

| Data & Analytics | Cash Cow | Vast datasets (approx. 1.2 billion health records), market leadership in RWE | Commercial insights, real-world evidence generation |

| Post-Market Surveillance & Commercial Operations | Cash Cow | Regulatory compliance needs, ongoing market support | Pharmacovigilance, market access, commercial analytics |

What You’re Viewing Is Included

IQVIA BCG Matrix

The IQVIA BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report ready for your strategic planning. You can be confident that what you see is precisely what you'll download, allowing you to make an informed decision about this valuable business intelligence tool.

Dogs

The Contract Sales & Medical Solutions (CSMS) segment is showing signs of being a 'dog' in the BCG matrix, with a noticeable downturn in its financial performance.

In the fourth quarter of 2024, CSMS revenue experienced a reported decrease of 4.8%, translating to a 3.2% decline when adjusted for currency fluctuations. This trend continued into the first quarter of 2025, where the segment saw a reported revenue drop of 4.2%, or 2.1% at constant currency.

This consistent revenue decline suggests that CSMS is operating within a market characterized by low growth and potentially declining profitability, fitting the profile of a 'dog' in strategic portfolio analysis.

Legacy IT systems and outdated infrastructure at IQVIA, while not traditional products, could be classified as Dogs in a BCG-like analysis. These systems often incur significant maintenance costs, offering little in terms of competitive edge and hindering the company's strategic pivot towards AI and advanced analytics.

For instance, if IQVIA continues to heavily invest in maintaining older data warehousing solutions that are not cloud-native or easily integrated with modern AI platforms, these would qualify as Dogs. Such systems consume valuable IT budgets and personnel time, diverting resources from innovation and growth areas.

The financial drain from these legacy systems is substantial; in 2024, IT spending on maintaining such infrastructure globally often represents a significant portion of overall IT budgets, sometimes exceeding 60% for older enterprises, according to industry reports.

Services that were heavily reliant on COVID-19 related work have experienced a notable decline in revenue. For example, IQVIA reported virtually no COVID-related revenue in Q1 2025, a stark contrast to the over $40 million generated in Q1 2024. This significant drop directly impacted the revenue growth of the R&DS segment.

Underperforming Niche Acquisitions

Some of IQVIA's past acquisitions, particularly those that haven't been fully integrated or haven't delivered the anticipated synergies, might be classified as 'dogs' in the BCG matrix. These ventures, while not explicitly detailed, could be tying up valuable capital without making a substantial contribution to the company's overall growth trajectory. For example, if an acquisition was made in a niche market that subsequently declined, it would fit this category.

Underperforming niche acquisitions can drain resources and management attention. In 2024, companies are increasingly scrutinizing their portfolios for such assets. If IQVIA had an acquisition from a few years ago in a specialized data analytics segment that saw reduced demand, it would likely fall into this 'dog' quadrant, demanding a strategic review.

- Underperforming Acquisitions: Identify acquisitions that haven't met financial or strategic targets post-integration.

- Capital Tie-up: Recognize that these 'dogs' consume capital without generating commensurate returns.

- Strategic Review: Highlight the need for a clear strategy, whether it's divestment, turnaround, or continued investment, for these underperforming units.

- Market Dynamics: Consider how shifts in niche markets can turn previously promising acquisitions into 'dogs'.

Services with High Pricing Pressure and Intense Competition

Within IQVIA's extensive service offerings, those operating in highly commoditized segments of the life sciences market are likely candidates for the 'dog' category in a BCG matrix analysis. These services often face significant pricing pressure due to a large number of competitors, leading to squeezed profit margins and limited opportunities for substantial growth. Maintaining market share in these areas demands considerable effort and resources, often yielding low profitability.

For instance, certain data aggregation and basic analytics services, particularly those that are easily replicated by numerous vendors, could fall into this classification. The intense competition means that differentiation is difficult, forcing providers to compete primarily on price. This dynamic can significantly impact revenue and profitability, making these services a challenge to manage effectively.

In 2024, the market for standard clinical data management, for example, has seen a proliferation of providers, intensifying competition. Companies in this space often report gross margins in the low to mid-teens, a stark contrast to higher-margin areas like advanced analytics or specialized consulting. This pressure on pricing directly limits the potential for high growth and necessitates a strategic focus on efficiency to preserve any profitability.

- Commoditized Data Services: Basic data collection and standardization services face intense competition from a wide array of vendors, driving down prices.

- Standard Clinical Trial Support: Routine administrative and operational support for clinical trials, often offered by multiple players, experience significant pricing pressure.

- Legacy Technology Integration: Services focused on integrating older healthcare IT systems can be labor-intensive and face competition from newer, more efficient solutions.

- Low-Value Market Research: Generic market sizing and basic competitive intelligence reports, lacking deep insight or proprietary data, often struggle with pricing power.

The Contract Sales & Medical Solutions (CSMS) segment is exhibiting characteristics of a 'dog' within IQVIA's portfolio, marked by a decline in revenue. This segment experienced a reported revenue decrease of 4.8% in Q4 2024, and a further 4.2% drop in Q1 2025, indicating a low-growth, potentially low-profitability market. Legacy IT systems also function as 'dogs', consuming significant IT budgets, sometimes over 60% in 2024, without offering a competitive advantage. Services heavily reliant on COVID-19 work, like the over $40 million in Q1 2024 COVID-related revenue that vanished by Q1 2025, are also effectively 'dogs' due to the sharp decline. Underperforming acquisitions in declining niche markets, which tie up capital without substantial returns, also fit this classification, requiring strategic review.

Question Marks

Emerging AI-driven drug discovery initiatives represent the question mark quadrant of the IQVIA BCG Matrix. These ventures, while holding immense promise for revolutionizing pharmaceutical research, are currently in their nascent stages, characterized by high growth potential but a low market share.

The challenge lies in their early development and adoption phase, demanding substantial investment to validate their efficacy and secure a competitive foothold. For instance, while AI in drug discovery is projected to grow significantly, specific applications like AI-powered patient stratification for clinical trials are still gaining traction, with adoption rates varying across the industry.

Companies in this space are investing heavily in R&D, aiming to demonstrate tangible value propositions that can disrupt traditional, often lengthy and costly, drug development processes. The potential for these initiatives to become stars is substantial, but they require careful nurturing and strategic resource allocation to overcome current market uncertainties.

Venturing into new geographic markets, especially those that are rapidly changing or present unique challenges, can be seen as a strategic move for companies like IQVIA. Consider their partnership with Alibaba Cloud to offer solutions in China. This taps into a massive, high-growth potential market. However, entering such markets typically means starting with a very small initial market share and facing considerable risks.

These types of expansions demand significant investment and careful strategic planning to build a solid presence. For instance, in 2024, many technology firms are increasing their R&D spending in emerging markets, with some allocating over 15% of their budget to these regions to capture future growth, despite the inherent uncertainties.

IQVIA's specialized patient registry solutions for rare diseases, bolstered by acquisitions like OpenApp, address a burgeoning market. These offerings, while innovative, likely represent a nascent market share, demanding substantial investment for broader adoption and market penetration.

Innovative Digital Health Solutions

Innovative digital health solutions often land in the question mark category of the BCG matrix. These are typically new platforms or services that are just starting to gain traction with healthcare providers and patients. Think of early-stage remote patient monitoring systems or AI-powered diagnostic tools that are still proving their value and seeking wider adoption.

The digital health market itself is experiencing rapid expansion, with global spending projected to reach over $660 billion by 2025. However, these nascent digital health solutions require significant investment in marketing, sales, and further development to carve out a substantial market share. Without this strategic backing, they risk remaining niche products despite operating in a high-growth sector.

- Early Market Penetration: Solutions like personalized telehealth platforms or blockchain-based health record systems are in the initial phases of adoption, facing the challenge of educating users and integrating into existing workflows.

- High Market Growth Potential: The overall digital health market is booming, with a compound annual growth rate (CAGR) of approximately 15-20% expected in the coming years, offering substantial upside for successful question marks.

- Significant Investment Needs: Companies behind these innovations typically need substantial capital for research and development, regulatory approvals, and go-to-market strategies to compete effectively.

- Uncertain Future Success: While promising, the ultimate success of these digital health solutions is not guaranteed, as they must overcome adoption barriers and demonstrate clear clinical and economic benefits to become stars.

Integration of Generative AI Tools in New Applications

IQVIA's strategic question marks revolve around the integration of generative AI into new applications, extending beyond their existing IQVIA AI Assistant. This move into novel generative AI tools for future applications, slated for 2025 and beyond, signifies a high-growth potential area. However, these initiatives are currently in early adoption stages, necessitating continued investment to achieve scalability and measurable impact across the market.

This strategic direction places these generative AI integrations in the "question mark" quadrant of the BCG matrix. While the potential for market disruption and significant revenue generation is high, the current adoption rates and the need for further development mean their future market share and growth rate are uncertain. For instance, while specific investment figures for these nascent generative AI projects are not publicly disclosed, the broader AI market is experiencing substantial growth, with some estimates projecting the global AI market to reach over $1.5 trillion by 2030, indicating the significant opportunity IQVIA is targeting.

- High Growth Potential: Novel generative AI tools offer transformative capabilities for new applications within the life sciences sector.

- Early Adoption Phase: Widespread market acceptance and proven use cases for these specific generative AI integrations are still developing.

- Investment Requirement: Significant capital will be needed to refine these technologies, build out new applications, and drive market adoption.

- Uncertain Future: The ultimate success and market dominance of these generative AI-powered applications remain to be seen, classifying them as question marks.

Question marks in the IQVIA BCG Matrix represent initiatives with high growth potential but currently low market share. These are often new technologies or market entries that require significant investment to prove their value and gain traction. Their future success is uncertain, but they hold the promise of becoming future stars if managed strategically.

For example, emerging AI-driven drug discovery platforms fit this description. While the AI in drug discovery market is projected for substantial growth, specific AI applications are still in early adoption. Companies invest heavily in R&D for these, aiming to disrupt traditional methods. The potential is high, but they need careful nurturing to overcome current market uncertainties and achieve scalability.

Similarly, innovative digital health solutions often start as question marks. The digital health market is expanding rapidly, with global spending expected to exceed $660 billion by 2025. However, these new platforms need considerable investment in marketing and development to secure a significant market share and avoid remaining niche products.

IQVIA's exploration of generative AI for new applications beyond its existing AI Assistant also falls into this category. While the broader AI market is set to reach over $1.5 trillion by 2030, these specific generative AI integrations are in early adoption stages. Significant capital is required to refine these technologies, build new applications, and drive market acceptance, making their future market dominance uncertain.

| Initiative Type | Market Growth Potential | Current Market Share | Investment Needs | Future Outlook |

|---|---|---|---|---|

| AI-driven Drug Discovery | High | Low | High (R&D, validation) | Uncertain, potential to become Star |

| Digital Health Solutions | High (Market CAGR 15-20%) | Low | High (Marketing, development) | Uncertain, depends on adoption |

| Generative AI Applications | High (AI Market > $1.5T by 2030) | Low | High (Refinement, new apps) | Uncertain, needs market acceptance |

| Expansion into New Markets (e.g., China) | High | Low | High (Strategic planning, presence building) | Uncertain, depends on execution |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.