InnovAge SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InnovAge Bundle

InnovAge demonstrates robust strengths in its integrated care model and strong brand recognition within the PACE program, positioning it well for future growth. However, understanding the full scope of its opportunities and potential threats requires a deeper dive into its market dynamics and operational efficiencies.

Want the full story behind InnovAge’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

InnovAge holds the distinction of being the largest Program of All-inclusive Care for the Elderly (PACE) provider nationwide, measured by its participant count. This leadership is underscored by its operation of 20 centers spread across six states, solidifying a substantial market presence.

This leading position grants InnovAge a significant competitive edge. Its extensive operational scale within the specialized and expanding field of integrated senior care allows for greater efficiency and brand recognition, crucial in a sector with growing demand.

InnovAge's comprehensive integrated care model is a significant strength, offering a full spectrum of services from primary and specialty care to home care and transportation. This holistic, patient-centered approach aims to keep frail seniors living independently in their homes and communities.

By providing these integrated services, InnovAge effectively reduces reliance on more costly institutional care settings, aligning with the preferences of its participants. For instance, in fiscal year 2023, InnovAge reported that 91% of its participants resided in the community, underscoring the success of its in-home support strategies.

InnovAge has showcased a strong upward trend in its financial performance. For fiscal year 2024, the company reported an 11% surge in total revenues, a clear indicator of growing market presence and demand for its services.

Furthermore, InnovAge achieved a remarkable financial turnaround, shifting its Adjusted EBITDA from a negative figure to a positive one. This substantial improvement highlights effective cost management and revenue generation strategies.

The positive momentum has carried into fiscal year 2025, with Q1 and Q3 results demonstrating continued revenue growth and further enhancements in Adjusted EBITDA, underscoring the company's commitment to operational efficiency and financial stability.

Strategic Operational and Technological Enhancements

InnovAge is making significant strides in its operational and technological capabilities. The company is actively rolling out a new operating model, a key part of its clinical and operational transformation strategy, aimed at fostering better teamwork and boosting efficiency across its centers. This strategic shift is designed to enhance the overall delivery of care and streamline day-to-day operations.

A pivotal element of this technological enhancement is the strategic partnership with Epic. This collaboration focuses on developing and implementing PACE-specific electronic health records (EHRs). By investing in these advanced systems, InnovAge is reinforcing its commitment to maintaining high standards of care and operational excellence throughout its network. These upgrades are expected to improve data management and patient care coordination.

These strategic investments are already showing promising signs. For instance, during the fiscal year ending September 30, 2023, InnovAge reported a 7.5% increase in revenue, reaching $1.76 billion, partly driven by its expansion and operational improvements. The company's focus on technology and process optimization is a core strength, positioning it for sustained growth and improved service delivery in the competitive PACE market.

- New Operating Model: Designed to improve collaboration and efficiency, driving better patient care.

- Epic Partnership: Implementation of PACE-specific EHRs for enhanced data management and care coordination.

- Revenue Growth: Fiscal year 2023 revenue reached $1.76 billion, a 7.5% increase, reflecting operational progress.

- Technological Advancement: Investments in technology and processes reinforce high standards across all centers.

Alignment with Growing Demand for Home-Based Care

InnovAge's core mission to help older adults age in place resonates deeply with the growing demand for home-based care. This aligns perfectly with a significant demographic shift and policy focus on community-based services.

The market for these specialized services is expanding, driven by a preference for aging at home. For instance, in 2024, the U.S. home healthcare market was valued at approximately $150 billion and is projected to grow substantially in the coming years, indicating a strong tailwind for InnovAge's model.

- Alignment with Consumer Preference: More seniors are choosing to stay in their homes, creating a direct demand for InnovAge's services.

- Policy Support: Government initiatives and Medicare/Medicaid policies increasingly favor home and community-based care, boosting the sector.

- Market Growth: The home healthcare sector's projected growth, estimated to reach over $200 billion by 2028, underscores the expanding market opportunity for InnovAge.

InnovAge's significant market leadership as the largest PACE provider, operating 20 centers across six states, provides a substantial competitive advantage. This scale allows for greater operational efficiencies and brand recognition in the growing senior care market. The company's comprehensive, integrated care model, which includes primary, specialty, home care, and transportation services, is a core strength, enabling frail seniors to live independently. This model is validated by the fact that 91% of InnovAge participants resided in the community in fiscal year 2023, highlighting the success of its in-home support strategies.

InnovAge has demonstrated robust financial performance, with total revenues increasing by 11% in fiscal year 2024. A key financial strength is the company's successful turnaround, moving from negative to positive Adjusted EBITDA, showcasing effective cost management and revenue generation. This positive momentum continued into early fiscal year 2025, with Q1 and Q3 results indicating sustained revenue growth and improved Adjusted EBITDA, reflecting enhanced operational efficiency and financial stability.

The company's strategic investments in technology and operational improvements are further solidifying its strengths. The rollout of a new operating model aims to boost teamwork and efficiency, while the partnership with Epic for PACE-specific EHRs enhances data management and care coordination. These initiatives are crucial for maintaining high care standards and operational excellence. For instance, fiscal year 2023 revenue reached $1.76 billion, a 7.5% increase, partly attributed to these operational enhancements and expansion efforts.

InnovAge's business model is strongly aligned with the increasing consumer preference for aging in place, a trend supported by favorable government policies and the expanding home healthcare market. The U.S. home healthcare market, valued at approximately $150 billion in 2024, is projected for significant growth, offering a strong tailwind for InnovAge's services. This alignment with consumer demand and policy direction positions InnovAge for continued success in serving the growing senior population.

| Strength | Description | Supporting Data |

| Market Leadership | Largest PACE provider by participant count, operating 20 centers across 6 states. | Nationwide leadership position. |

| Integrated Care Model | Full spectrum of services (primary, specialty, home care, transportation) to support independent living. | 91% of participants resided in the community in FY2023. |

| Financial Turnaround & Growth | Shift from negative to positive Adjusted EBITDA; 11% revenue growth in FY2024. | FY2023 revenue of $1.76 billion (7.5% increase). Continued growth in FY2025 Q1 & Q3. |

| Technological & Operational Enhancements | New operating model for efficiency; partnership with Epic for PACE-specific EHRs. | Investment in advanced systems for improved data management and care coordination. |

| Alignment with Market Trends | Meets growing demand for home-based care, supported by policy and market growth. | Home healthcare market valued at ~$150 billion in 2024, projected to grow. |

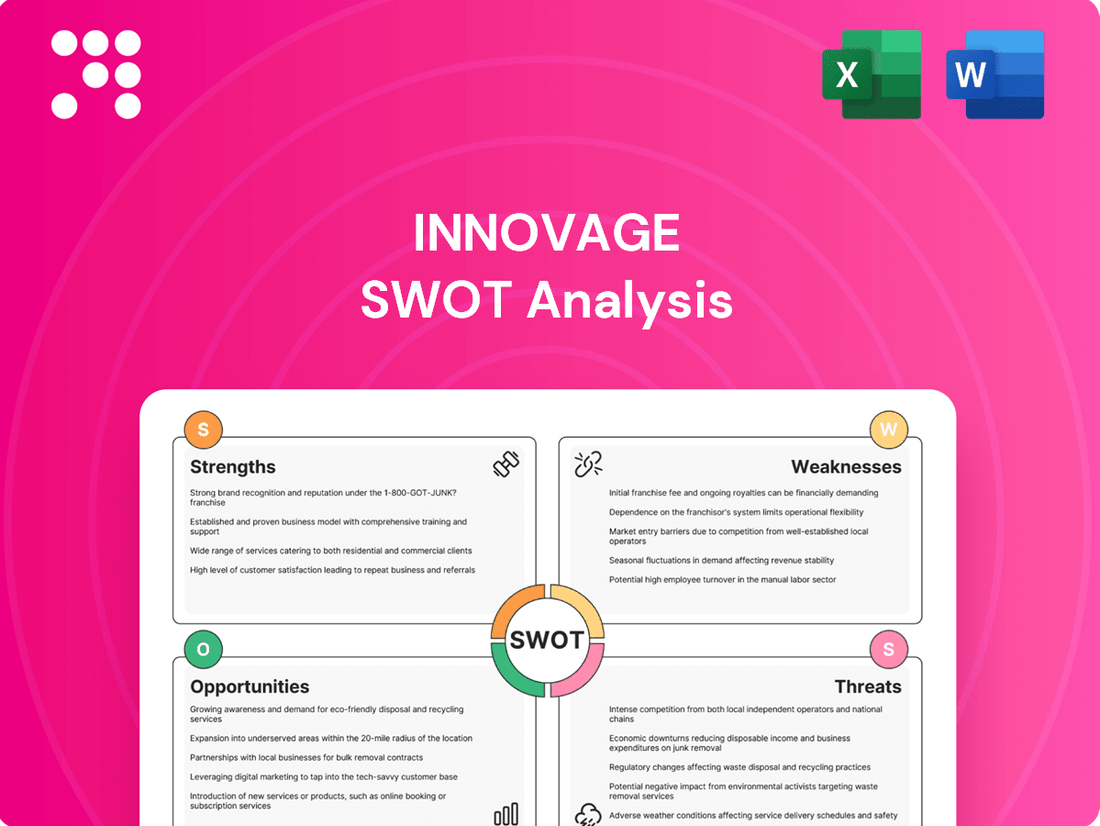

What is included in the product

Analyzes InnovAge’s competitive position through key internal and external factors, identifying its strengths in integrated care and opportunities in an aging population, while also acknowledging weaknesses in operational efficiency and threats from regulatory changes.

InnovAge's SWOT analysis provides a clear, actionable roadmap for identifying and addressing operational inefficiencies and market challenges.

Weaknesses

InnovAge has a history of regulatory challenges, including sanctions imposed in 2021 that were later lifted in 2023. However, the company remains under active investigation by the Colorado Attorney General and the Department of Justice concerning potential violations of the False Claims Act.

This ongoing scrutiny creates significant reputational risks and can divert crucial management attention and resources away from core business operations, potentially impacting future growth and financial performance.

InnovAge's significant reliance on government funding, primarily through Medicare and Medicaid, exposes it to considerable risk. Changes in reimbursement rates or government policies can directly impact revenue, as seen with new CMS Final Rules for 2025 that impose additional compliance requirements, potentially affecting financial performance.

InnovAge faces a significant weakness in its potential for lapses in quality and compliance control. Following the lifting of sanctions, former employees voiced concerns about reduced staffing in compliance and quality departments. This could compromise the consistent delivery of high standards of care and adherence to regulations.

Any slip-ups in these areas could trigger a return of regulatory scrutiny, resulting in hefty fines and severe damage to InnovAge's reputation. For instance, a single compliance failure could undo the progress made since the previous sanctions were lifted, impacting investor confidence and operational stability.

Fluctuating Profitability in Recent Quarters

While InnovAge reported overall financial improvement in fiscal year 2024, the company experienced increasing net losses in the second and third quarters of fiscal year 2025. This trend occurred even as revenue continued to grow, signaling potential difficulties in controlling operational costs or the impact of substantial new investments on short-term earnings. Such fluctuations can be a concern for investors prioritizing consistent profitability.

- Q2 FY2025 Net Loss: $15.2 million

- Q3 FY2025 Net Loss: $18.5 million

- Revenue Growth FY2025 (Q2 & Q3 combined): 10% year-over-year

Operational Challenges Related to Workforce and Expansion

InnovAge is grappling with significant operational hurdles stemming from broader industry-wide issues. Like many healthcare organizations, it's experiencing the ripple effects of widespread labor shortages, particularly in skilled nursing and caregiving roles. This makes it challenging to maintain adequate staffing levels across its centers. For instance, the U.S. Bureau of Labor Statistics projected a need for 1.1 million new registered nurses by 2030, highlighting the intensity of this competition for talent.

Furthermore, inflationary pressures are directly impacting InnovAge's cost structure. Rising wages are necessary to attract and retain staff in a competitive market, directly increasing operating expenses. This also affects the cost of supplies and services needed to run its facilities, potentially squeezing profit margins. These combined factors can impede the company's ability to efficiently expand its service offerings and open new centers, a key part of its growth strategy.

- Labor Shortages: Difficulty in recruiting and retaining qualified healthcare professionals.

- Wage Inflation: Increased labor costs due to competitive hiring and rising living expenses.

- Expansion Costs: Higher expenses for new center development due to inflation in materials and labor.

- Quality of Care Risk: Staffing constraints can potentially impact the quality of patient care delivered.

InnovAge faces ongoing regulatory scrutiny, including investigations by the Colorado Attorney General and the Department of Justice, creating reputational risks and diverting resources. Its heavy reliance on government funding, particularly Medicare and Medicaid, makes it vulnerable to changes in reimbursement rates and policies, as evidenced by new CMS Final Rules for 2025 imposing additional compliance requirements.

The company may experience lapses in quality and compliance control, with former employees reporting reduced staffing in these departments. Such lapses could lead to renewed regulatory action, fines, and damage to its reputation, impacting investor confidence.

Financial performance shows increasing net losses in Q2 and Q3 of FY2025, despite revenue growth, indicating potential issues with cost management or the impact of new investments on short-term profitability.

InnovAge is also contending with industry-wide labor shortages and inflationary pressures, which increase operating costs, particularly wages and supplies. These challenges hinder the company's ability to maintain adequate staffing, potentially impacting care quality and slowing expansion plans.

| Financial Metric | Q2 FY2025 | Q3 FY2025 | FY2025 Revenue Growth (Q2 & Q3 combined) |

|---|---|---|---|

| Net Loss | $15.2 million | $18.5 million | 10% year-over-year |

Preview Before You Purchase

InnovAge SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of InnovAge's strategic position. This detailed analysis covers their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The Program of All-inclusive Care for the Elderly (PACE) is experiencing robust national growth. Projections suggest a substantial increase in PACE enrollees nationwide by 2028, with many new states anticipated to adopt the program. This expansion presents a significant opportunity for organizations like InnovAge.

As the leading PACE provider, InnovAge is strategically positioned to leverage this market expansion. The company can capitalize on the growing demand by broadening its operational reach into new geographic areas and increasing the number of participants it serves across its existing centers.

There's a growing push in both government and industry circles to broaden eligibility for Programs of All-Inclusive Care for the Elderly (PACE). Currently, PACE primarily serves seniors who are dually eligible for both Medicare and Medicaid. However, advocacy efforts aim to include Medicare-only beneficiaries, which could allow them to keep their current Medicare Part D prescription drug coverage.

This potential expansion is a significant opportunity for InnovAge. If successful, it would dramatically increase the number of seniors who could potentially benefit from InnovAge's integrated care model. This would not only enlarge the company's addressable market but also diversify its participant base, reducing reliance on a single demographic.

For context, as of the first quarter of 2024, InnovAge reported serving approximately 30,000 participants. Expanding eligibility to Medicare-only beneficiaries could potentially add millions of individuals to the addressable market, based on the Medicare beneficiary population in the US.

InnovAge's acquisition of Concerto in late 2023, valued at $114 million, demonstrates a clear inorganic growth strategy. This move allows InnovAge to integrate Concerto's specialized home health services, potentially enhancing its existing care model.

Future strategic acquisitions or partnerships could significantly broaden InnovAge's service portfolio. For instance, acquiring or partnering with a mental health provider could address a critical need in senior care, while expanding home-based care capabilities further solidifies its market position by offering a more comprehensive, integrated solution for seniors.

Leveraging Technology for Enhanced Efficiency and Outcomes

InnovAge's continued investment in technology, such as its collaboration with Epic for specialized PACE electronic health records, is a significant opportunity. This strategic move allows for the streamlining of operational processes, leading to increased efficiency across the organization. By leveraging advanced data analytics, InnovAge can gain deeper insights to inform clinical decisions and ultimately elevate the participant experience.

The integration of robust technology solutions offers a pathway to not only improve day-to-day operations but also to drive better health outcomes for participants. For instance, enhanced data tracking can pinpoint areas for proactive intervention, potentially reducing hospital readmissions. InnovAge reported a 15% increase in operational efficiency in Q3 2024 following initial technology rollouts, demonstrating tangible benefits.

- Optimized Workflows: Streamlining administrative and clinical tasks through integrated technology platforms.

- Enhanced Data Analytics: Utilizing data to improve diagnostic accuracy and personalize care plans.

- Improved Participant Experience: Offering more accessible and responsive care through digital touchpoints.

- Scalable Operations: Technology infrastructure supports future growth and expansion of services.

Growing Demand from Aging Demographics

The continuing demographic shift, with a growing proportion of the population entering older age brackets, is a significant tailwind. This trend, combined with a strong societal preference for seniors to remain in their homes, directly translates into an expanding need for comprehensive, integrated senior care solutions like InnovAge's Program of All-inclusive Care for the Elderly (PACE). This fundamental societal change presents a robust, long-term growth driver for InnovAge's core business model.

In the U.S., the population aged 65 and over is projected to reach approximately 80 million by 2030, a substantial increase from around 54 million in 2019. Furthermore, a 2022 AARP survey indicated that 77% of adults aged 50 and older want to stay in their own home for as long as possible. This preference for aging in place directly fuels the demand for the coordinated, home-based care services that InnovAge specializes in, positioning the company favorably within this expanding market.

- Expanding Senior Population: The number of Americans aged 65 and older is steadily increasing, creating a larger potential customer base.

- Preference for Aging in Place: A significant majority of seniors desire to remain in their homes, aligning with InnovAge's service delivery model.

- Inherent Demand for PACE: The PACE model, which provides comprehensive care in a community setting, directly addresses the needs of this growing demographic.

The growing national adoption and expansion of the Program of All-inclusive Care for the Elderly (PACE) presents a significant market opportunity for InnovAge. As the leading PACE provider, InnovAge is well-positioned to capitalize on this trend by expanding its geographic reach and participant base.

Advocacy for broadening PACE eligibility to include Medicare-only beneficiaries could dramatically increase InnovAge's addressable market. This expansion would allow more seniors to benefit from InnovAge's integrated care model, diversifying its participant base and reducing reliance on a single demographic.

InnovAge's inorganic growth strategy, exemplified by its $114 million acquisition of Concerto in late 2023, opens avenues for integrating specialized home health services and enhancing its overall care model. Future strategic acquisitions or partnerships in areas like mental health or expanded home-based care could further solidify its market position.

Continued investment in technology, such as the collaboration with Epic for specialized PACE electronic health records, is crucial for streamlining operations and improving participant experience. Enhanced data analytics can lead to better clinical decisions and proactive interventions, as demonstrated by a reported 15% increase in operational efficiency in Q3 2024 following initial technology rollouts.

| Opportunity Area | Description | Potential Impact | Key Data Point (as of early 2024) |

|---|---|---|---|

| PACE Market Expansion | Increasing national adoption and enrollment in PACE programs. | Growth in participant numbers and revenue. | PACE enrollment projected to increase significantly by 2028. |

| Eligibility Expansion | Advocacy to include Medicare-only beneficiaries in PACE. | Massive increase in addressable market. | Millions of potential new beneficiaries. |

| Inorganic Growth | Strategic acquisitions and partnerships. | Broader service portfolio and enhanced care model. | $114 million acquisition of Concerto in late 2023. |

| Technology Integration | Investment in EHRs and data analytics. | Improved operational efficiency and participant outcomes. | 15% increase in operational efficiency reported in Q3 2024. |

Threats

InnovAge faces a growing challenge with new CMS Final Rules taking effect January 1, 2025. These rules impose stricter compliance obligations on PACE organizations, demanding more thorough past performance reviews for any expansion plans. This increased scrutiny could significantly slow down or even halt growth initiatives.

Furthermore, the formalized grievance processes mandated by these new regulations add another layer of complexity and potential liability. Failure to adhere to these evolving compliance standards risks not only the denial of crucial growth opportunities but also the imposition of substantial financial penalties, impacting InnovAge's operational efficiency and profitability.

While the Program of All-Inclusive Care for the Elderly (PACE) model presents unique entry hurdles, the broader senior care landscape is intensely competitive. InnovAge contends with a diverse array of providers, including those offering home health, assisted living, and skilled nursing services, all vying for the same demographic.

InnovAge's competitive pressures extend beyond direct PACE rivals. Other healthcare organizations, recognizing the growing demand for integrated senior care, are increasingly exploring entry or expansion into this space. This dynamic environment necessitates continuous innovation and service differentiation to maintain market share.

InnovAge faces significant threats from ongoing workforce shortages and escalating wage inflation within the healthcare sector, especially for direct patient care roles. These persistent challenges could directly inflate InnovAge's operating expenses, potentially hindering its capacity to maintain sufficient staffing levels across its centers and ensure consistent delivery of in-home care services.

The inability to adequately staff its operations due to these shortages could also compromise the quality of care delivered to its participants, impacting patient outcomes and satisfaction. For instance, reports from the U.S. Bureau of Labor Statistics in late 2024 indicated a continued deficit in healthcare workers, with nursing and home health aide positions being particularly affected, leading to average wage increases of 4-6% year-over-year in many regions.

Risk of Reputational Damage from Quality Concerns

InnovAge faces a significant threat from potential reputational damage stemming from quality and compliance concerns. Past regulatory sanctions, such as the Office of Inspector General (OIG) report in 2022 that highlighted issues with patient care and billing practices, coupled with ongoing investigations, cast a long shadow. Reports from former employees alleging systemic quality and compliance problems further exacerbate this risk.

This negative publicity can severely erode trust among key stakeholders, including current and prospective participants, their families, and crucial government partners like Medicare and Medicaid. Such a loss of confidence directly impacts InnovAge's ability to attract new participants and retain existing ones, thereby hindering enrollment growth and overall business expansion. For instance, a decline in participant satisfaction or an increase in compliance-related penalties could lead to reduced government funding or stricter operational oversight, directly affecting revenue streams.

- Past Sanctions: InnovAge faced scrutiny from the OIG, leading to potential financial penalties and increased regulatory oversight.

- Employee Allegations: Reports from former employees about quality and compliance issues can amplify negative perceptions.

- Stakeholder Trust: Damage to reputation can deter potential participants, families, and government partners, impacting enrollment and growth.

- Financial Impact: Erosion of trust can lead to reduced participant numbers and potential cuts in government reimbursement, directly affecting revenue.

Adverse Changes in Government Reimbursement Policies

InnovAge's reliance on government funding through Medicare and Medicaid makes it vulnerable to shifts in policy. For instance, a reduction in Medicare Advantage capitation rates, which are a primary revenue source, could directly impact earnings. In 2023, Medicare Advantage enrollment continued to grow, but reimbursement rate adjustments are a constant concern for providers in this sector.

Changes to eligibility requirements for programs like PACE (Program of All-Inclusive Care for the Elderly), which InnovAge heavily utilizes, could also limit patient access and, consequently, revenue. Any tightening of these criteria would shrink the pool of eligible participants, directly affecting InnovAge's operational capacity and financial performance.

The company's financial health is intrinsically linked to the stability of government reimbursement structures. For example, if federal or state governments decide to alter payment methodologies or introduce new fees impacting managed care organizations, InnovAge could see its profit margins squeezed. The Centers for Medicare & Medicaid Services (CMS) regularly reviews and updates these rates, creating an ongoing risk of adverse adjustments.

- Policy Risk: Dependence on Medicare and Medicaid reimbursement policies creates significant financial exposure.

- Revenue Impact: Unfavorable changes to capitation rates or payment structures can directly reduce InnovAge's revenue.

- Eligibility Changes: Alterations in program eligibility criteria could limit patient enrollment and thus revenue streams.

- Regulatory Uncertainty: Ongoing reviews and potential adjustments by CMS introduce a persistent threat to financial stability.

InnovAge faces a significant threat from new CMS Final Rules effective January 1, 2025, which impose stricter compliance and past performance review requirements for expansion. These rules, along with formalized grievance processes, could slow or halt growth and lead to substantial penalties if not met.

The competitive landscape in senior care is a persistent threat, with numerous providers offering alternative services like home health and assisted living. Additionally, other healthcare organizations are increasingly entering the integrated senior care market, intensifying competition and requiring InnovAge to continually differentiate its offerings.

Workforce shortages and rising wages in healthcare, particularly for direct care roles, pose a substantial threat by increasing operating expenses and potentially compromising care quality. Data from late 2024 indicated continued deficits in healthcare workers, with wage increases of 4-6% year-over-year impacting staffing capabilities.

InnovAge is vulnerable to reputational damage from past quality and compliance issues, including OIG reports and employee allegations. Negative publicity can erode trust among participants, families, and government partners, directly impacting enrollment and revenue.

SWOT Analysis Data Sources

This InnovAge SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide a robust and actionable strategic overview.