InnovAge Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InnovAge Bundle

InnovAge operates in a dynamic healthcare landscape, and understanding the forces shaping its competitive environment is crucial. Our Porter's Five Forces analysis delves into the intensity of rivalry, the power of buyers and suppliers, and the threats of substitutes and new entrants that impact InnovAge's strategic positioning.

The complete report reveals the real forces shaping InnovAge’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

InnovAge's reliance on specialized medical professionals like physicians, nurses, and therapists means these individuals possess significant bargaining power. Their unique skills can lead to demands for higher compensation or more favorable contract conditions.

The availability of these specialists in specific regions directly impacts their leverage. A shortage of certain healthcare professionals in areas where InnovAge operates can amplify their bargaining power, potentially increasing labor costs for the company.

While specialized skills grant power, the standardized nature of many medical roles within the Program of All-Inclusive Care for the Elderly (PACE) model can somewhat temper this influence. This standardization might limit the extent to which individual professionals can negotiate highly customized terms.

Suppliers of prescription drugs, particularly those with patent protections, wield considerable bargaining power. This is because their products are often essential for patient health, creating inelastic demand. For instance, in 2024, the average annual cost of specialty drugs continued its upward trend, often exceeding $50,000 per patient, highlighting the pricing leverage these suppliers possess.

InnovAge's ability to negotiate favorable pricing with pharmaceutical companies can be constrained by the industry's inherent market concentration and the critical, non-discretionary nature of many medications. However, participating in large group purchasing organizations or leveraging bulk purchasing agreements can offer some mitigation, potentially leading to discounts on high-volume prescription drug purchases.

Suppliers of specialized medical equipment and technology, like diagnostic tools and integrated healthcare systems, hold significant bargaining power. This leverage is amplified when their products are proprietary or necessitate specialized user training, making transitions difficult for InnovAge.

The switching costs involved in adopting new technology platforms or replacing integrated equipment can be substantial, granting these vendors considerable influence over pricing and terms. For instance, a major shift in electronic health record (EHR) systems could involve extensive data migration, staff retraining, and potential operational disruptions, all of which favor the incumbent supplier.

InnovAge must carefully weigh the benefits of cutting-edge technology against the financial implications of sourcing from these powerful suppliers. In 2024, the healthcare technology market saw continued consolidation, with a few key players dominating segments like AI-powered diagnostics and robotic surgery, further concentrating supplier power.

Transportation and Facility Lessors

InnovAge relies on specialized transportation providers and lessors of adult day centers and clinic spaces. In regions where these facilities and services are scarce, suppliers can exert moderate bargaining power. For instance, a lack of available specialized senior transportation fleets in a particular market could force InnovAge to accept less favorable terms.

The bargaining power of these lessors and transportation providers is influenced by the availability of alternative sites and service providers. When InnovAge has multiple options for leasing facilities or securing transportation, the suppliers' leverage diminishes. However, in markets with limited specialized real estate or transportation infrastructure tailored for senior care, these suppliers can command higher prices or stricter lease conditions.

- Limited Market Options: In areas with few suitable adult day centers or clinic spaces, lessors gain leverage.

- Specialized Transportation Needs: The requirement for senior-specific transportation can concentrate power among a limited number of providers.

- Lease Stability: Long-term lease agreements and strong existing relationships can help mitigate the bargaining power of lessors by locking in terms.

Ancillary Service Providers

InnovAge relies on a network of ancillary service providers for essential functions like lab work and medical equipment. The leverage these suppliers hold is directly tied to how specialized their offerings are, how much business InnovAge sends their way, and whether other similar providers are readily available. For instance, if a lab service is highly specialized and InnovAge needs a significant volume of tests, that supplier gains more power. Conversely, for common services where many providers exist, their bargaining power is diminished.

The bargaining power of ancillary service providers for InnovAge can be assessed by considering several factors:

- Uniqueness of Services: Suppliers offering highly specialized or proprietary services, for which few alternatives exist, can command better terms.

- Volume Dependence: If InnovAge represents a substantial portion of a supplier's revenue, the supplier has less incentive to push for unfavorable terms. Conversely, if InnovAge is a small client, the supplier's power increases.

- Availability of Alternatives: The presence of multiple competing providers for a given service significantly reduces the bargaining power of any single supplier. In 2024, the healthcare services market saw increased consolidation in some areas, potentially increasing supplier power for niche services.

The bargaining power of suppliers for InnovAge is a significant factor, particularly concerning specialized healthcare professionals and essential medical supplies. The demand for skilled physicians, nurses, and therapists, especially in areas with shortages, grants them considerable leverage over compensation and contract terms.

Pharmaceutical suppliers, especially those with patented drugs, hold substantial power due to the inelastic demand for medications. For example, in 2024, the average annual cost of specialty drugs often surpassed $50,000 per patient, illustrating the pricing influence these suppliers wield. Similarly, providers of proprietary medical equipment and technology can leverage high switching costs and specialized training requirements to their advantage.

| Supplier Category | Factors Influencing Bargaining Power | Impact on InnovAge |

|---|---|---|

| Healthcare Professionals | Specialized skills, regional availability, demand | Higher labor costs, potential for demanding contract terms |

| Pharmaceuticals | Patent protection, critical need for drugs, market concentration | Increased drug costs, limited negotiation flexibility |

| Medical Equipment/Technology | Proprietary nature, high switching costs, specialized training needs | Higher equipment costs, potential vendor lock-in |

| Real Estate/Transportation | Availability of specialized facilities/services, regional scarcity | Higher lease rates, less favorable transportation terms in certain markets |

| Ancillary Services | Uniqueness of services, volume dependence, availability of alternatives | Variable impact; power increases with service specialization and limited competition |

What is included in the product

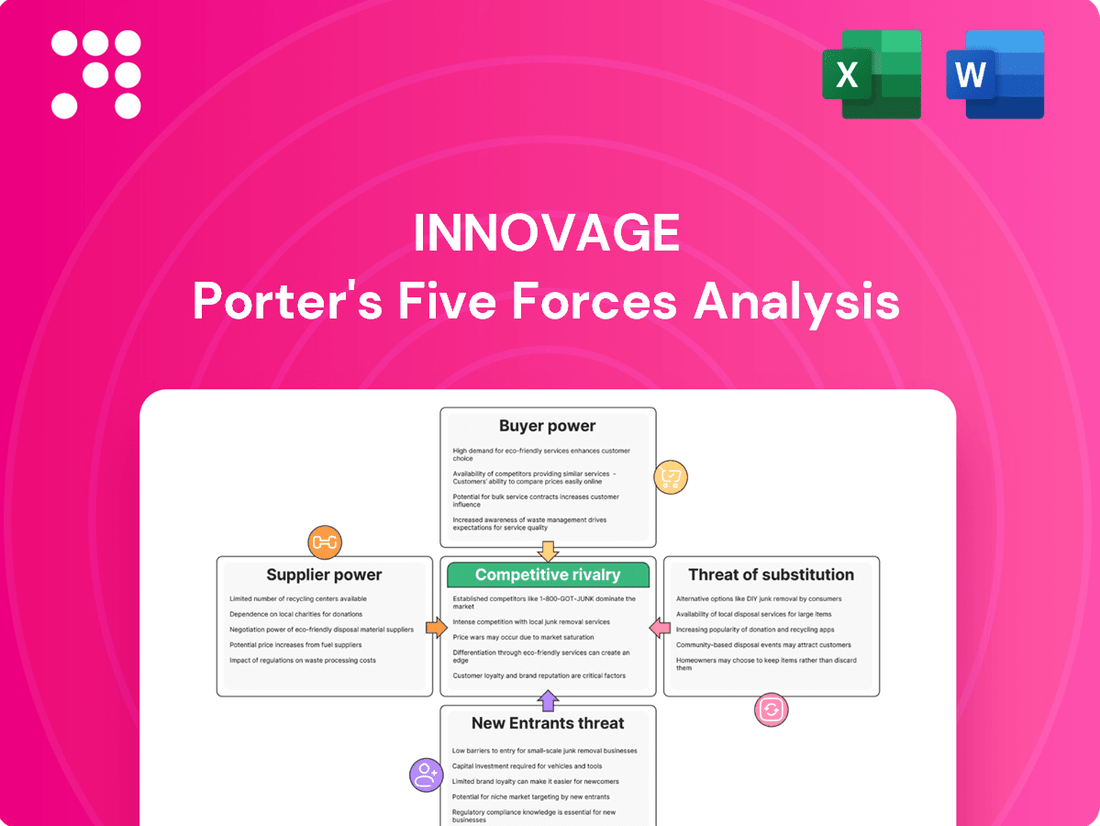

This analysis dissects the competitive forces impacting InnovAge, evaluating the intensity of rivalry, the bargaining power of suppliers and buyers, the threat of new entrants, and the availability of substitutes.

Instantly identify and address competitive threats with a clear, actionable overview of InnovAge's market landscape.

Customers Bargaining Power

InnovAge serves frail, older adults and their families, who do have choices for care, though geographic limitations can affect the availability of specific models like PACE. This ability to choose, even if restricted, gives customers some influence.

While switching from a comprehensive model like PACE, which integrates numerous services, can be challenging due to the established coordination, participants retain the theoretical option to seek alternative providers if they are unhappy. This inherent choice, even if indirect, grants them a degree of bargaining power.

Government payers like Medicare and Medicaid represent a significant portion of InnovAge's revenue, acting as powerful indirect customers. These entities have substantial bargaining power as they unilaterally set reimbursement rates and stringent regulatory requirements for PACE programs. For instance, in fiscal year 2023, InnovAge reported that approximately 90% of its revenue was derived from government programs, highlighting their critical influence.

The bargaining power of customers in the PACE (Program of All-Inclusive Care for the Elderly) market, like InnovAge, is often diminished by information asymmetry. Many frail older adults and their families may not fully grasp the intricacies of healthcare options or the nuances of long-term care, placing them in a vulnerable position.

This limited understanding means customers are frequently less price-sensitive, prioritizing the quality of care, convenience, and the provider's trustworthiness over cost. For instance, a significant portion of PACE participants rely on the program for comprehensive medical and social support, indicating a strong dependence on the provider's expertise.

InnovAge's success hinges on cultivating and maintaining exceptionally high levels of trust and service quality to address this customer dynamic effectively. In 2024, InnovAge reported serving thousands of participants, underscoring the critical importance of this trust-based relationship in a market where informed choice can be challenging.

Lack of Direct Price Negotiation

InnovAge's customers, primarily individual participants in the Program of All-Inclusive Care for the Elderly (PACE), generally do not engage in direct price negotiations. This is because PACE operates on a capitated payment model, meaning InnovAge receives a fixed monthly payment per participant, regardless of the services rendered. This structure inherently limits the direct bargaining power of individual participants, as their ability to influence pricing is minimal.

The leverage individual customers do possess stems from their choice to select an alternative PACE provider or facility if one is available and meets their needs. For instance, in 2024, the number of PACE programs across the United States continued to expand, offering more options for seniors. This increased availability of competing programs can indirectly influence InnovAge's service offerings and potentially its operational efficiency, though not through direct price haggling.

- Capitated Payment Model: InnovAge operates under a fixed per-participant monthly payment, removing direct price negotiation opportunities for individual customers.

- Limited Individual Leverage: The absence of direct price negotiation significantly diminishes the bargaining power of individual end-users.

- Choice as a Lever: Customer leverage is primarily exercised through the ability to switch to alternative PACE programs or facilities.

- Market Expansion: The growing number of PACE programs in 2024 provides more choices, indirectly influencing provider competition.

Availability of Alternative Care Models

The availability of alternative care models significantly influences the bargaining power of customers for organizations like InnovAge. When a community offers a variety of long-term care options, such as traditional home health agencies, assisted living facilities, or skilled nursing facilities, potential participants have choices. This abundance of substitutes means customers are not locked into a single provider.

If these alternative care models are perceived as equally viable and readily accessible, it naturally strengthens the bargaining position of individuals considering long-term care. They can compare services, costs, and quality, and if they find a better fit elsewhere, they can opt out of the PACE model. This forces providers to remain competitive and responsive to customer needs.

InnovAge's strategy to counter this involves highlighting its unique integrated approach. By offering a comprehensive suite of services under one roof – including medical care, social services, and therapy – InnovAge aims to provide a value proposition that is difficult for fragmented alternative models to match. This differentiation is key to retaining participants and mitigating the bargaining power of customers seeking alternatives.

For instance, in 2024, the U.S. saw a continued demand for diverse senior living options, with the assisted living sector alone serving over 1 million residents. This broad market availability underscores the importance of specialized offerings like InnovAge's PACE model to stand out and retain its customer base.

InnovAge's individual customers, primarily frail seniors, have limited direct bargaining power due to the capitated payment model of PACE, which fixes reimbursement rates. Their leverage primarily comes from the ability to switch providers if alternatives exist, a factor amplified by the expanding PACE market in 2024.

The bargaining power of customers is also influenced by the availability of substitute care models. With a diverse senior living market, including assisted living facilities serving over 1 million residents in 2024, InnovAge must emphasize its integrated PACE model to retain participants.

Government payers, such as Medicare and Medicaid, represent a significant portion of InnovAge's revenue, holding substantial indirect bargaining power. These entities dictate reimbursement rates and regulatory standards, with government programs accounting for approximately 90% of InnovAge's revenue in fiscal year 2023.

| Customer Type | Bargaining Power Factor | Impact on InnovAge | 2024 Context |

| Individual PACE Participants | Limited by capitated payments; ability to switch providers | Minimal direct price negotiation; indirect influence through choice | Growing PACE program availability increases potential for switching |

| Government Payers (Medicare/Medicaid) | Setting reimbursement rates and regulations | Significant influence on revenue and operational standards | Continued reliance on government programs for majority of revenue |

| Availability of Substitutes | Presence of alternative care models (e.g., assisted living) | Forces providers to differentiate and offer competitive value | Diverse senior living market provides options, highlighting need for integrated care |

Preview Before You Purchase

InnovAge Porter's Five Forces Analysis

You're previewing the final, comprehensive Porter's Five Forces analysis for InnovAge. What you see is precisely the document you'll receive, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products within InnovAge's market landscape. This exact, professionally formatted analysis will be available to you instantly after purchase, ready for immediate application.

Rivalry Among Competitors

InnovAge faces direct competition from other Program of All-inclusive Care for the Elderly (PACE) organizations operating within the same service areas. The intensity of this rivalry is directly tied to the number of these co-located competitors, with some geographic markets featuring only a handful of PACE providers, while others may host multiple centers.

The competitive landscape for InnovAge is shaped by the size and established market presence of these rival PACE organizations. Larger, more established competitors can exert greater influence, potentially impacting InnovAge's market share and pricing strategies. For instance, in markets with several well-funded and experienced PACE providers, InnovAge might need to differentiate its services more aggressively.

InnovAge faces substantial indirect competition from established healthcare and long-term care providers. These include home health agencies, skilled nursing facilities, and assisted living communities, all serving a similar demographic of frail older adults.

These traditional models offer diverse care approaches, and their widespread availability directly influences InnovAge's ability to capture market share. For instance, the U.S. home healthcare market alone was valued at over $140 billion in 2023, indicating a vast and competitive landscape.

Service differentiation and quality are paramount in the senior care sector, particularly for comprehensive models like PACE. InnovAge differentiates itself by focusing on the quality of care, participant outcomes, and the integrated nature of its services. For instance, in fiscal year 2023, InnovAge reported a participant satisfaction rate of 93%, underscoring their commitment to high-quality service delivery.

InnovAge's competitive edge lies in its holistic, coordinated approach, which aims to prevent costly hospitalizations and nursing home placements. This focus on proactive care management directly impacts participant well-being and operational efficiency. Their ability to maintain a low hospitalization rate, often cited as a key metric, further solidifies their service quality advantage.

Regulatory and Geographic Constraints

The Program of All-Inclusive Care for the Elderly (PACE) model, which InnovAge operates within, is subject to stringent regulatory oversight. This includes obtaining specific approvals from both state and federal agencies, a process that can significantly restrict the number of direct competitors within any given geographic service area. For instance, in 2024, the number of approved PACE organizations continued to grow, but the barriers to entry remained substantial, effectively limiting direct competition for established players like InnovAge.

Geographic limitations inherently segment the market for PACE services. This means that InnovAge faces more intense rivalry within its existing operational regions rather than on a national scale. Expanding into new territories requires navigating a fresh set of regulatory hurdles and establishing a presence against any existing or newly emerging local competitors. This localized competition is a key characteristic of the PACE landscape.

- Regulatory Hurdles: PACE programs require extensive state and federal licensing and compliance, acting as a significant barrier to new entrants and thus moderating direct rivalry.

- Geographic Market Segmentation: Competition is primarily localized, with InnovAge facing rivals within specific service areas rather than broad national competition.

- Expansion Challenges: Entering new geographic markets means establishing operations under a different competitive dynamic, often requiring significant investment and time.

- Limited Direct Competitors: The highly regulated nature of PACE limits the number of direct, similarly structured competitors in any given market.

Market Growth and Demographics

The senior care market is experiencing significant growth, largely driven by the aging Baby Boomer generation. This demographic shift, with the number of Americans aged 65 and older projected to reach 80.8 million by 2040, could theoretically ease competitive pressures by ensuring a robust demand for services. However, within specific geographic areas, the rivalry to attract and retain participants remains intense, as providers vie for a share of this expanding, yet localized, customer base.

InnovAge, as a provider of the Program of All-Inclusive Care for the Elderly (PACE), sees its competitive landscape influenced by the expansion of PACE into new states. For instance, as of early 2024, PACE programs operate in 32 states, and the pace of new state adoption directly shapes where and how intensely InnovAge competes. Stronger growth in PACE adoption generally means more potential participants but also potentially more competitors entering these markets.

- Market Growth Driver: The U.S. population aged 65 and older is expected to nearly double from 58 million in 2022 to 80.8 million by 2040.

- Localized Competition: Despite overall market growth, competition for participants is fierce in specific local markets where multiple senior care providers operate.

- PACE Expansion Impact: The rate at which new states adopt and expand PACE programs directly influences the competitive intensity for organizations like InnovAge.

- Provider Density: In states with a high density of PACE centers, such as Pennsylvania which had 15 PACE centers as of 2023, competition is naturally more concentrated.

InnovAge faces direct competition from other PACE organizations, with rivalry intensity varying by geographic density; some areas have few, while others have multiple providers. The size and market presence of these rivals significantly influence InnovAge's market share and pricing. Indirect competition comes from established healthcare providers like home health agencies and nursing facilities, which offer alternative care models.

The number of approved PACE organizations, which grew to over 270 nationwide by early 2024, is limited by substantial regulatory barriers to entry, moderating direct competition for established players. Geographic segmentation means rivalry is localized, with InnovAge competing intensely within its service areas rather than nationally. The aging population, with over 58 million Americans aged 65+ in 2022, fuels demand but also intensifies local competition for participants.

| Metric | 2023 Data | 2024 Outlook |

| Total PACE Organizations | ~260 | ~270+ (early 2024) |

| U.S. Population 65+ | ~58 million (2022) | Projected growth |

| InnovAge Participant Satisfaction | 93% (FY23) | Focus on maintaining high satisfaction |

| U.S. Home Healthcare Market Value | >$140 billion (2023) | Continued growth expected |

SSubstitutes Threaten

Traditional home health services, offering piecemeal care like nursing or therapy from separate providers, represent a significant substitute for InnovAge's integrated PACE model. While these standalone services might seem more flexible or less demanding initially, they lack the comprehensive coordination that PACE provides. InnovAge needs to emphasize how its unified approach delivers superior outcomes compared to these fragmented options.

Frail older adults often face the option of uncoordinated medical care, seeking out individual appointments with primary care physicians and various specialists. They may also rely on family members or community groups for essential support like transportation and social engagement. This fragmented approach acts as a direct substitute for the comprehensive, integrated care management that programs like PACE provide.

The appeal of this substitute is directly tied to how individuals perceive the effort required to manage their own care versus the perceived benefits of having more control over their choices. For instance, while PACE programs aim to streamline care, some seniors might prefer the autonomy of selecting their own doctors, even if it means more personal coordination effort.

Assisted living and skilled nursing facilities represent significant substitutes for the comprehensive care offered by PACE programs, particularly for individuals requiring more intensive supervision or round-the-clock medical attention. These facilities provide a structured residential setting as an alternative to remaining in a participant's home, which is PACE's primary goal. For instance, in 2024, the demand for skilled nursing care continued to rise, with approximately 1.3 million individuals residing in nursing homes across the United States, highlighting the strong market for these substitute services.

The choice between PACE and these substitute facilities often depends on a participant's evolving functional status and the preferences of their family. When a participant's needs exceed the scope of home-based care that PACE can effectively manage, or if families seek a more contained residential environment, assisted living or skilled nursing becomes a more suitable option. This dynamic is reflected in the growing market for assisted living, which, as of 2024, served over 800,000 residents nationwide, indicating a substantial segment of the senior care market that may opt for these alternatives.

Informal Caregiving by Family and Friends

Informal caregiving by family and friends presents a significant threat of substitutes for formal senior care services like those offered by InnovAge. This unpaid care, often provided for activities of daily living, can substantially reduce or even eliminate the demand for professional assistance. For instance, a 2023 AARP report indicated that 11.5 million Americans provided unpaid care to someone aged 65 or older, highlighting the widespread nature of this substitute.

While informal care is prevalent, the growing burden on family caregivers frequently prompts a search for structured programs. The strain, both emotional and physical, often leads to seeking out solutions such as InnovAge's PACE program. However, the initial reliance on this informal support can sometimes delay an individual's enrollment in formal care, impacting the market penetration for service providers.

The effectiveness of informal care can vary greatly, depending on the family's capacity and the senior's specific needs. When informal care becomes insufficient or unsustainable, the demand for professional services increases. This dynamic means that while informal care is a constant substitute, its limitations can also create opportunities for formal care providers.

- Prevalence of Unpaid Care: Millions of Americans provide unpaid care to seniors, acting as a direct substitute for paid services.

- Caregiver Strain: The increasing demands on informal caregivers can lead them to seek professional care solutions.

- Delayed Enrollment: Initial reliance on family support might postpone an individual's entry into formal care programs.

Community-Based Senior Programs

Various community-based senior programs can act as substitutes for parts of InnovAge's comprehensive care model. These can include senior centers offering social activities, meal delivery services like Meals on Wheels addressing nutritional needs, and local transportation programs helping with mobility. While these don't replicate the full medical integration of PACE, they fulfill critical social, nutritional, and logistical requirements for seniors.

The increasing availability and perceived quality of these fragmented community services can impact the demand for a complete Program of All-Inclusive Care for the Elderly (PACE). For instance, in 2024, the Administration for Community Living reported continued growth in senior center participation and meal delivery programs, indicating a strong existing infrastructure that seniors can leverage.

These substitute services, while not a direct replacement for InnovAge's integrated medical and social support, can siphon off participants who prioritize specific needs or find these community options more accessible or affordable. The challenge for InnovAge lies in demonstrating the unique value proposition of its all-encompassing approach compared to these more piecemeal solutions.

- Senior Centers: Provide social engagement and activities, mitigating isolation.

- Meal Delivery Services: Ensure nutritional support for homebound seniors.

- Transportation Programs: Offer essential mobility for appointments and errands.

- Community Health Clinics: Address specific medical needs outside of a comprehensive program.

The threat of substitutes for InnovAge's integrated PACE model is significant, encompassing traditional healthcare services, informal care, and residential facilities. These alternatives, while often less comprehensive, can fulfill specific needs or offer perceived advantages like greater autonomy. For instance, in 2024, the continued demand for skilled nursing facilities, serving over 1.3 million individuals, underscores the market for more intensive residential care options that substitute for home-based PACE services.

The appeal of substitutes like assisted living facilities, which housed over 800,000 residents nationwide in 2024, is often tied to evolving participant needs and family preferences for structured environments. Similarly, the prevalence of informal caregiving, with 11.5 million Americans providing unpaid care in 2023, highlights a substantial segment of the market that may initially opt for family support over formal programs.

Furthermore, various community-based programs, such as senior centers and meal delivery services, offer fragmented support that can partially substitute for PACE's comprehensive approach. The growing participation in these programs, as reported by the Administration for Community Living in 2024, indicates their role in fulfilling specific social, nutritional, or logistical needs, potentially diverting individuals from fully integrated care models.

Entrants Threaten

The Program of All-inclusive Care for the Elderly (PACE) model, which InnovAge operates within, faces substantial regulatory hurdles. Both federal and state governments impose stringent licensing, certification, and operational compliance requirements. These extensive regulations demand significant investment in time, capital, and specialized knowledge, effectively deterring potential new entrants.

Establishing a Program of All-Inclusive Care for the Elderly (PACE) demands significant upfront capital. This includes costs for physical facilities like adult day centers and clinics, specialized medical equipment, and essential transportation fleets to serve participants. For instance, in 2024, the average startup cost for a new PACE center can range from $5 million to $15 million, depending on the scale and services offered.

This substantial financial barrier effectively limits the number of new organizations that can enter the market. Only entities with considerable financial resources or robust backing can realistically consider launching a PACE program, thereby reducing the immediate threat of widespread new competition.

Operating a Programs of All-Inclusive Care for the Elderly (PACE) requires a deeply specialized interdisciplinary team. This includes physicians, nurses, therapists, social workers, and other allied health professionals with specific experience in geriatric care coordination. Without this expertise, a new entrant would struggle to provide the comprehensive services PACE mandates.

The challenge of recruiting and retaining such a skilled workforce is significant. Building the necessary operational expertise within a new organization takes considerable time and investment. For instance, in 2024, the demand for geriatric specialists continued to outpace supply, making talent acquisition a persistent hurdle for any new player in this niche market.

This substantial human capital barrier effectively limits the threat of new entrants. It's not simply about capital; it's about having the right people with the right skills. This makes it incredibly difficult for newcomers to quickly establish themselves and compete effectively against established PACE providers who have already cultivated their specialized teams.

Brand Recognition and Trust

In the senior care sector, brand recognition and trust are incredibly important, acting as a significant barrier to new entrants. InnovAge, for instance, has cultivated strong relationships over many years with its participants, their families, and healthcare referral sources. Building this level of trust and a recognizable brand in healthcare is a lengthy and resource-intensive undertaking for any new competitor.

Newcomers must commit substantial resources to marketing and community engagement to achieve a similar standing. This process is inherently slow in the healthcare industry, where reputation is built on consistent quality and patient outcomes. For example, in 2024, healthcare providers often cited patient testimonials and long-standing community ties as key differentiators, highlighting the non-financial investment required to establish credibility.

- Trust is paramount in senior care.

- InnovAge has years of built relationships.

- New entrants need heavy investment in marketing.

- Brand recognition is a slow and arduous process in healthcare.

Economies of Scale and Experience

Established Programs of All-Inclusive Care for the Elderly (PACE) providers leverage significant economies of scale. This advantage translates to lower per-participant costs in areas like procurement of medical supplies and administrative overhead, as demonstrated by the extensive operational networks of leading organizations. For instance, in 2024, larger PACE organizations often reported administrative costs that were a smaller percentage of revenue compared to newer, smaller entities. This cost efficiency is a direct result of their established presence and the volume of services they provide.

Furthermore, the experience curve offers a substantial barrier to entry. Incumbent PACE providers have honed their operational processes over years, leading to greater efficiency in care delivery and management. This accumulated knowledge allows them to navigate complex regulations and optimize resource allocation more effectively. New entrants, conversely, face a steeper learning curve, which can lead to higher initial operating expenses and potential service delivery challenges as they build their expertise.

- Economies of Scale: Established PACE providers benefit from lower per-participant costs due to their larger operational footprint and purchasing power.

- Experience Curve Advantage: Years of operational experience allow incumbents to optimize processes, reduce inefficiencies, and better manage the complexities of the PACE model.

- Cost Disadvantage for New Entrants: New organizations will likely incur higher initial costs and face operational hurdles as they develop expertise and scale.

- Competitive Pricing Potential: Incumbents' cost efficiencies can enable them to offer more competitive pricing or reinvest in service enhancements.

The threat of new entrants into the Program of All-inclusive Care for the Elderly (PACE) market, where InnovAge operates, is significantly mitigated by a confluence of substantial barriers. These include demanding regulatory landscapes, considerable capital requirements for facilities and equipment, and the necessity of assembling highly specialized interdisciplinary healthcare teams. For instance, in 2024, the average startup cost for a new PACE center was estimated between $5 million and $15 million, a figure that immediately filters out many potential competitors.

Furthermore, the established reputation and trust that incumbents like InnovAge have built over years represent a formidable non-financial barrier. New players must invest heavily in marketing and community outreach, a process that is inherently slow in the healthcare sector, where credibility is earned through consistent quality and patient outcomes. The experience curve also favors existing providers, who have optimized their operations and can achieve greater economies of scale, leading to lower per-participant costs. For example, in 2024, larger PACE organizations generally reported lower administrative costs as a percentage of revenue than smaller, newer entities, underscoring this advantage.

| Barrier Type | Description | Impact on New Entrants | Supporting Data (2024) |

| Regulatory Hurdles | Stringent federal and state licensing, certification, and compliance requirements. | High; demands significant investment in time, capital, and specialized knowledge. | No specific numerical data available for regulatory burden, but compliance is universally cited as complex. |

| Capital Requirements | Investment in facilities, medical equipment, and transportation. | High; limits entry to well-funded organizations. | Startup costs range from $5M to $15M for a new PACE center. |

| Specialized Workforce | Need for physicians, nurses, therapists, social workers with geriatric expertise. | High; recruitment and retention of specialized talent is challenging due to demand exceeding supply. | Demand for geriatric specialists continued to outpace supply. |

| Brand Recognition & Trust | Cultivating strong relationships and reputation in senior care. | High; requires lengthy and resource-intensive marketing and community engagement. | Patient testimonials and long-standing community ties are key differentiators. |

| Economies of Scale & Experience Curve | Lower per-unit costs and optimized operational processes for incumbents. | High; new entrants face higher initial operating expenses and a steeper learning curve. | Larger PACE organizations had lower administrative costs as a % of revenue compared to smaller entities. |

Porter's Five Forces Analysis Data Sources

Our InnovAge Porter's Five Forces analysis leverages a comprehensive data strategy, drawing from InnovAge's investor relations materials, industry-specific market research reports, and government healthcare databases to understand competitive dynamics.